IV Flush Syringe Market By Product Type (Saline IV Flush Syringes and Heparin IV Flush Syringes), By Capacity (3 mL Syringes, 5 mL Syringes, 10 mL Syringes and Others), By End User (Hospitals and Clinics, Home-care Settings, and Ambulatory Surgical Centers and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153564

- Number of Pages: 319

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

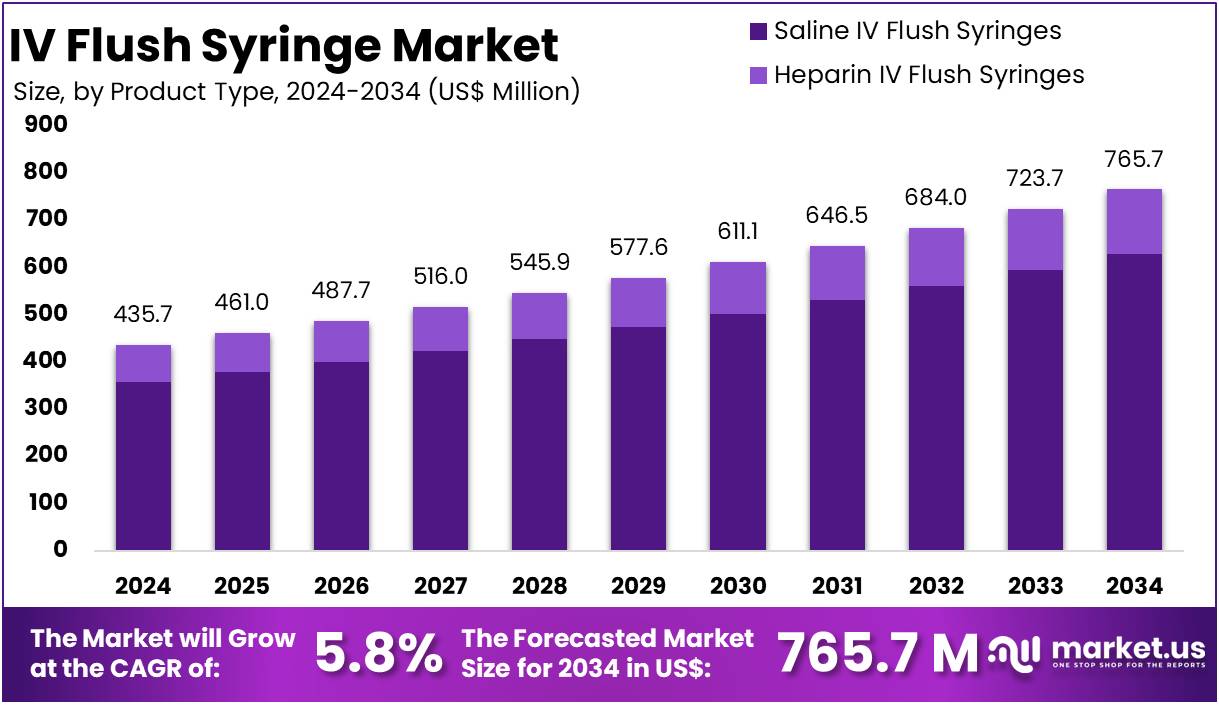

The IV Flush Syringe Market size is expected to be worth around US$ 765.7 million by 2034 from US$ 435.7 million in 2024, growing at a CAGR of 5.8% during the forecast period 2025 to 2034.

The global IV flush syringe market is experiencing steady growth, driven by increasing healthcare needs and advancements in medical technology. The increasing prevalence of chronic conditions such as asthma, diabetes, cancer, and others is driving a rise in hospital inpatient admissions. For example, according to the American Hospital Association’s annual survey, U.S. hospitals recorded 36.2 million total admissions in 2024. This surge in hospital admissions is contributing to a higher demand for IV catheters used to administer various medications, subsequently boosting the need for IV flush syringes to maintain clear lines.

The demand for prefilled IV flush syringes is also rising, as healthcare providers seek to minimize cross-contamination risks. Additionally, investments by major industry players in advanced manufacturing facilities are supporting market growth. For instance, in December 2020, BD (Becton, Dickinson, and Company) announced a USD 1.2 million investment over four years to enhance its production capacity and technology for prefillable syringes. The development of such facilities and innovative products is expected to further propel market expansion.

Key Takeaways

- In 2024, the market for IV Flush Syringe generated a revenue of US$ 435.7 million, with a CAGR of 5.8%, and is expected to reach US$ 765.7 million by the year 2034.

- The product type segment is divided into Saline IV Flush Syringes and Heparin IV Flush Syringes with Saline IV Flush Syringes taking the lead in 2023 with a market share of 82.1%.

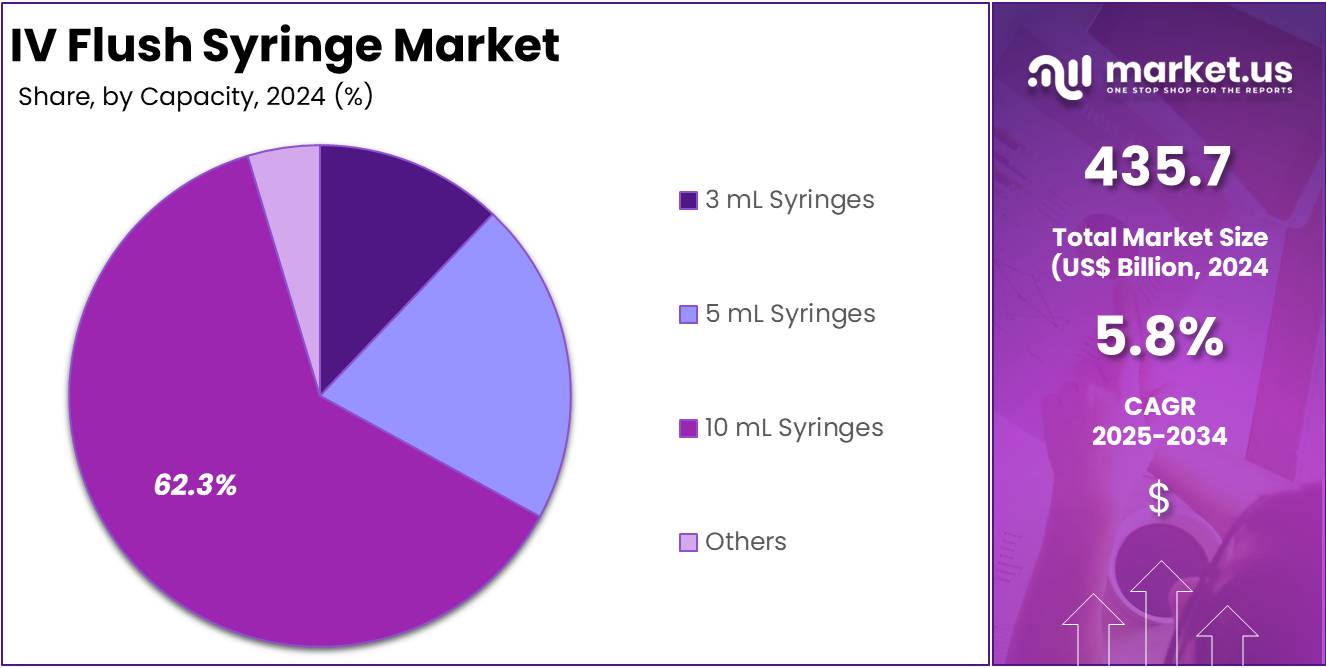

- By Capacity, the market is bifurcated into 3 mL Syringes, 5 mL Syringes, 10 mL Syringes and Others, with 10 mL Syringes leading the market with 62.3% of market share.

- Furthermore, concerning the End-User segment, the market is segregated into Hospitals and Clinics, Home-care Settings, and Ambulatory Surgical Centers and Others. The Hospitals and Clinics stands out as the dominant segment, holding the largest revenue share of 55.6% in the IV Flush Syringe market.

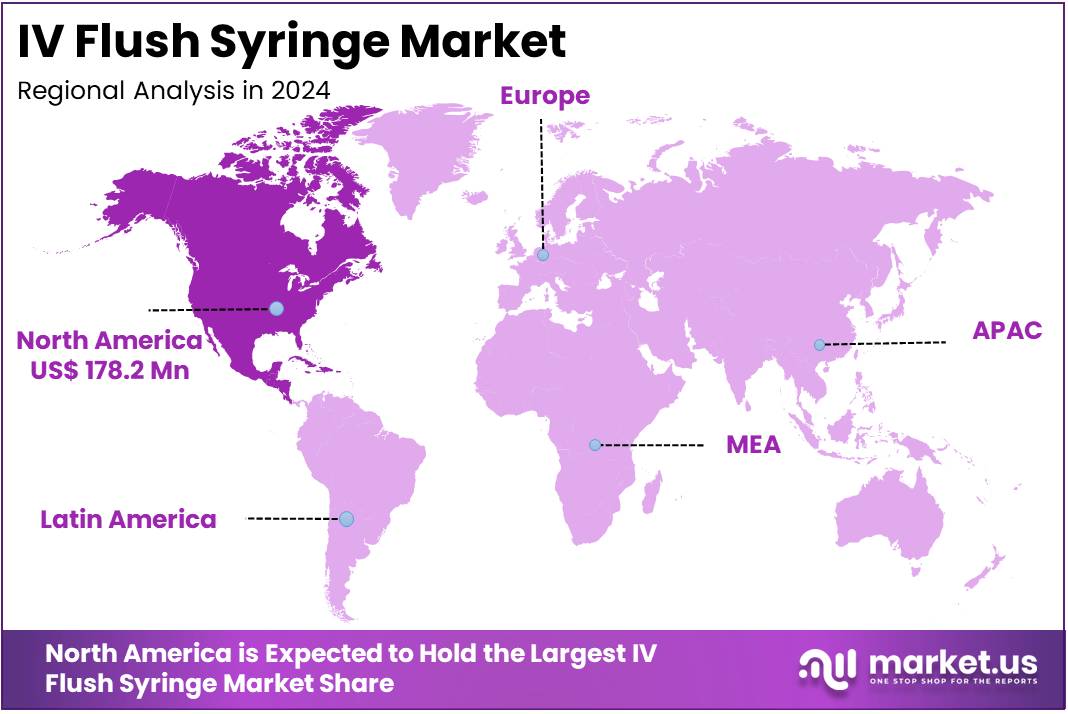

- North America led the market by securing a market share of 40.9% in 2023.

Product Type Analysis

Saline IV flush syringes dominated the IV flush syringe market with a 82.1% market share due to their broad and versatile application across healthcare settings. These syringes are commonly used to flush IV lines, ensuring the patency of the catheter and preventing the formation of clots. Saline flush syringes are favored because they are non-invasive and have a lower risk of complications compared to heparin flush syringes. They are commonly used in hospitals, outpatient clinics, and home care settings as part of routine patient care for those undergoing intravenous medication.

One of the key advantages of saline syringes is their safety profile; they do not pose the risks associated with heparin, such as heparin-induced thrombocytopenia (HIT). Moreover, saline syringes are cost-effective and widely available, contributing to their dominance in the market. Heparin IV flush syringes, while critical in specialized settings such as intensive care units or for patients with higher risks of clot formation, hold a smaller market share due to their specific use cases. Their application requires careful monitoring, making saline flush syringes the preferred choice for general use in medical environments.

Capacity Analysis

In the IV flush syringe market, 10 mL syringes are the dominant capacity segment which accounted for 62.3% market share in 2024 due to their versatility and wider range of clinical applications. These syringes are often used in medical settings where larger volumes of fluid need to be administered, such as for intravenous medications, hydration therapies, and blood transfusions. Their larger size is ideal for patients who require more intensive or prolonged treatments, including those in intensive care units or undergoing complex surgeries. For example, BD offers PosiFlush™ Prefilled Normal Saline Flush Syringe, 10 mL Syringe 10 mL Saline Fill which is a popular product in the market.

Additionally, the 10 mL syringes are suitable for pediatric and geriatric patients, who often require fluid management in higher volumes than smaller syringes can offer. Their widespread use in critical care settings and during various procedures contributes significantly to their market dominance. While 3 mL and 5 mL syringes are still in demand, particularly in less intensive settings or for routine procedures, the larger 10 mL syringe ensures optimal fluid management during more complicated interventions.

End-User Analysis

Hospitals and clinics represent the largest segment in the IV flush syringe market with a 55.6% market share, driven by the high volume of intravenous procedures conducted daily. These healthcare settings are the primary users of IV flush syringes, as IV catheterization is a standard procedure in patient care. Hospitals, particularly those with emergency departments, intensive care units (ICUs), and surgical centers, see a constant need for IV flush syringes for maintaining catheter patency, preventing blockages, and administering medications.

Clinics that provide outpatient services also require IV flush syringes for routine treatments such as IV hydration or medication infusions. The high patient turnover in these facilities, combined with the need for effective fluid management, has made hospitals and clinics the leading end-users of IV flush syringes. While home-care settings are increasingly adopting these syringes due to the growing trend of at-home intravenous therapies, they still represent a smaller portion of the market.

Key Market Segments

By Product Type

- Saline IV Flush Syringes

- Heparin IV Flush Syringes

By Capacity

- 3 mL Syringes

- 5 mL Syringes

- 10 mL Syringes

- Others

By End-User

- Hospitals and Clinics

- Home-care Settings

- Ambulatory Surgical Centers and Others

Drivers

Increasing Prevalence of Chronic Diseases

The increasing prevalence of chronic diseases, including diabetes, heart disease, and kidney disorders, is a key driver for the IV flush syringe market. As these conditions often require long-term treatments that involve intravenous therapies, there is a rising need for effective tools like IV flush syringes to maintain catheter patency and prevent complications like clotting. For example, patients with diabetes often require IV access for administering insulin or fluids, and patients with kidney failure may need regular dialysis, which also involves catheter maintenance. The World Health Organization (WHO) reports that chronic diseases account for a significant portion of healthcare costs globally.

As the global population ages and more individuals develop chronic conditions, the demand for medical devices, including IV flush syringes, will continue to grow. This trend is particularly significant in outpatient care settings and at-home care, where regular maintenance of intravenous access is essential for patient health management. For instance, as per the statistics by OECD, on average, 43% of those with the lowest income say they have a long-lasting health problem, while only 27% of those with the highest income say the same. This gap is largest in Lithuania, Belgium, Estonia and Ireland, where those with the lowest income are at least twice as likely to have a health problem.

Restraints

Stringent Regulatory Requirements

Stringent regulatory requirements act as a major restraint in the IV flush syringe market. Regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) impose strict guidelines on the manufacturing, sterilization, and distribution of medical devices, including syringes. These regulations ensure product safety and efficacy, but they also create significant barriers for manufacturers.

For instance, each batch of IV flush syringes must undergo thorough testing for sterility and quality assurance to meet these standards, adding time and cost to the production process. The process for securing approval for new products can be lengthy, especially for manufacturers introducing innovative designs or materials. Compliance with these regulations is essential, but it can slow product launches and increase operational costs, thereby limiting market expansion.

Opportunities

Expansion in Home Healthcare Settings

The growing shift toward home healthcare represents a significant opportunity for the IV flush syringe market. With the rising cost of hospital stays and advancements in telemedicine, patients are increasingly receiving care at home for chronic conditions such as cancer, diabetes, and kidney failure. Home healthcare solutions, such as home dialysis, require medical devices like IV flush syringes to maintain catheter patency and administer treatments. For example, patients undergoing peritoneal dialysis at home regularly use IV flush syringes to ensure their catheters are functioning properly. As more patients receive intravenous therapy in home settings, the demand for convenient, safe, and easy-to-use IV flush syringes will grow.

Manufacturers have an opportunity to design syringes tailored for home use, with innovations like prefilled syringes and more portable packaging, to meet the needs of patients and caregivers. This trend is expected to expand the market and drive growth in the coming years. In August 2024, the National Home Infusion Association (NHIA) introduced a reference list of medications to guide site-of-care decisions for patients in need of intravenous (IV) or subcutaneous (SC) infusions.

The list, which aligns with current U.S. prescribing practices, was compiled using medication dispensing reports from home infusion providers and reviewed by NHIA’s Quality and Standards Committee. Home infusion therapy is experiencing rapid growth. According to NHIA’s 2020 Trends Report, around 3.2 million patients are annually served by nearly 1,000 pharmacy-based providers.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic factors such as inflation, healthcare spending, and economic downturns can have a considerable impact on the production and consumption of medical devices, including IV flush syringes. In times of economic uncertainty, healthcare budgets may be constrained, limiting the ability of hospitals and healthcare providers to purchase new equipment, thus potentially slowing the growth of the IV flush syringe market. Additionally, rising costs of raw materials and labor due to inflation can increase the manufacturing cost of syringes, thereby impacting pricing strategies and market accessibility.

Geopolitical factors, such as international trade policies and tariffs, also play a crucial role in the IV flush syringe market. For example, tariffs on raw materials like plastics or medical-grade components can increase the cost of manufacturing, which may lead to higher prices for end users. In contrast, free trade agreements between countries can facilitate the global distribution of syringes, expanding market reach and reducing costs. Furthermore, political instability in key manufacturing regions or major healthcare markets can disrupt the supply chain and delay production or delivery, thereby affecting market stability.

Latest Trends

Technological Advancements in Syringe Design

Technological advancements in syringe design are significantly influencing the IV flush syringe market. Manufacturers are integrating new technologies to improve syringe functionality, safety, and user experience. For example, the development of smart syringes with built-in sensors to monitor the volume of flush fluid being administered is enhancing patient safety and accuracy in fluid delivery. These syringes can alert healthcare providers when the correct amount of fluid has been delivered, reducing the risk of over- or under-infusion.

Additionally, there is a growing trend toward the use of prefilled syringes, which are more convenient and ensure sterility, reducing the time and complexity involved in preparing and administering the flush. Advances in materials, such as the use of high-quality, biocompatible polymers, are also enhancing the durability and safety of syringes. These innovations are improving the overall efficiency of intravenous treatments and driving the adoption of IV flush syringes in hospitals, outpatient clinics, and home care settings.

Automated IV flushing is receiving growing recognition in clinical environments, particularly in areas where precise medication dosing is essential. For instance, in June 2025, Droplet IV announced the successful closure of a US$2 million funding round, which will support the launch of its first automatic IV-line flushing device in both the EU and US markets. This innovative device aims to solve a significant challenge for nurses, who currently dedicate considerable time to manually flushing IV lines to remove residual medication.

Regional Analysis

North America is leading the IV Flush Syringe Market

North American IV flush syringe market is poised for steady growth accounting for over 40.9% market share in 2024, driven by technological advancements, an aging population, and a shift towards home-based care. Stakeholders must navigate regulatory landscapes and market dynamics to capitalize on emerging opportunities.

The presence of strong healthcare infrastructure and key players making innovations with readily available funding is a major factor for the region’s dominance in the global market. For instance, in April 2025, Sharps Technology, Inc., an innovative medical device and pharmaceutical packaging company known for its patented, top-tier smart-safety syringe products, today announced receiving a US$400,000 purchase order from a U.S. leader in IV flushing solutions. This order represents the first under the previously disclosed US$50 million supply agreement announced in July 2024.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the IV Flush Syringe market include Becton, Dickinson and Company (BD), B. Braun Melsungen AG, Cardinal Health, Medline Industries, LP, Medefil, Inc., Nipro Corporation, Polymedicure, Aquabiliti, SteriCare Solutions, ICU Medical, Inc., Terumo Corporation, Halyard Health (now part of Owens & Minor), McKesson Corporation, Weigao Group, Amsino International, Inc., and Others.

Becton, Dickinson and Company (BD) is a leading player in the medical device industry, providing a wide range of products, including IV flush syringes. BD’s IV flush syringes are known for their safety, precision, and innovation, catering to hospitals and clinics globally with a focus on patient care and infection control. B. Braun Melsungen AG offers an extensive range of medical products, including IV flush syringes. The company’s syringes are designed to ensure safe and effective intravenous access, widely used in healthcare facilities.

B. Braun is known for its commitment to high-quality manufacturing standards and regulatory compliance in the medical device sector. Cardinal Health is a prominent healthcare services and products provider, offering IV flush syringes as part of its extensive portfolio. The company’s syringes are designed to meet the needs of hospitals, clinics, and home-care settings, focusing on ease of use, sterility, and patient safety.

Top Key Players in the IV Flush Syringe Market

- Becton, Dickinson and Company (BD)

- Braun Melsungen AG

- Cardinal Health

- Medline Industries, LP

- Medefil, Inc.

- Nipro Corporation

- Polymedicure

- Aquabiliti

- SteriCare Solutions

- ICU Medical, Inc.

- Terumo Corporation

- Halyard Health (now part of Owens & Minor)

- McKesson Corporation

- Weigao Group

- Amsino International, Inc.

- Other Prominent Players

Recent Developments

- In May 2023: BD (Becton, Dickinson and Company), a leading global medical technology company, announced the expanded customer availability of an all-in-one prefilled flush syringe. The syringe features an integrated disinfection unit, designed to enhance compliance with infection prevention guidelines and streamline nursing workflows.

- In September 2022: Heron Therapeutics, Inc., a commercial-stage biotechnology company dedicated to enhancing patient outcomes through the development of best-in-class treatments for significant unmet needs, announced that the U.S. Food and Drug Administration (FDA) approved APONVIE (aprepitant) injectable emulsion for intravenous use. The drug is approved for the prevention of postoperative nausea and vomiting (PONV) in adults.

Report Scope

Report Features Description Market Value (2024) US$ 435.7 million Forecast Revenue (2034) US$ 765.7 million CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Saline IV Flush Syringes and Heparin IV Flush Syringes), By Capacity (3 mL Syringes, 5 mL Syringes, 10 mL Syringes and Others), By End User (Hospitals and Clinics, Home-care Settings, and Ambulatory Surgical Centers and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Becton, Dickinson and Company (BD), B. Braun Melsungen AG, Cardinal Health, Medline Industries, LP, Medefil, Inc., Nipro Corporation, Polymedicure, Aquabiliti, SteriCare Solutions, ICU Medical, Inc., Terumo Corporation, Halyard Health (now part of Owens & Minor), McKesson Corporation, Weigao Group, Amsino International, Inc., and Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Becton, Dickinson and Company (BD)

- Braun Melsungen AG

- Cardinal Health

- Medline Industries, LP

- Medefil, Inc.

- Nipro Corporation

- Polymedicure

- Aquabiliti

- SteriCare Solutions

- ICU Medical, Inc.

- Terumo Corporation

- Halyard Health (now part of Owens & Minor)

- McKesson Corporation

- Weigao Group

- Amsino International, Inc.

- Other Prominent Players