Global Isononyl Alcohol Market By Purity (Up to 98%, and Above 98%), By Application (Plasticizers, Surfactants, Lubricants, Emollient and Fragrance, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034.

- Published date: September 2025

- Report ID: 158795

- Number of Pages: 223

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overviews

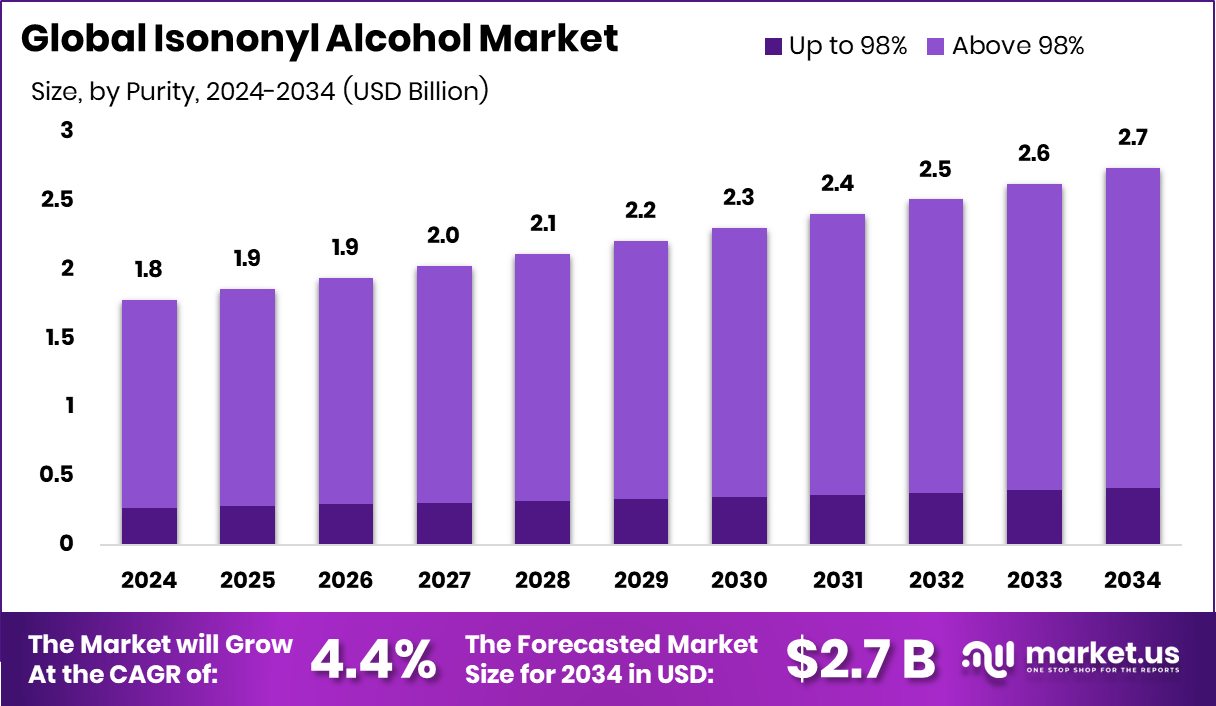

In 2024, the Global Isononyl Alcohol Market was valued at US$1.8 billion, and between 2025 and 2034, this market is estimated to register a CAGR of 4.4%, reaching about US$2.7 billion by 2034.

Isononyl alcohol (INA) is a colorless, slightly floral-scented, and flammable liquid that functions as a crucial raw material in various industries. It is typically produced by hydroformylation of octenes, which are produced from the dimerization of butenes, which are olefins, making the isononyl alcohol market vulnerable to geopolitical tensions. The major driver of the chemical is the plasticizer industry, where it is a precursor to plasticizers such as diisononyl phthalate (DINP) that are used to make plastics like polyvinyl chloride (PVC) flexible.

As it is mostly used in the plasticizer industry to produce DINP, the market faces challenges such as environmental and regulatory concerns regarding phthalates. As these concerns gain momentum and awareness grows, the market is shifting towards sustainable plasticizers such as DINCH (Diisononyl Cyclohexane Dicarboxylate), which is again an isononyl alcohol based plasticizer. In addition, due to its chemical properties, the chemical is gaining traction from the fragrance, lubricants, and surfactants industries.

Key Takeaways

- The global isononyl alcohol market was valued at US$1.8 billion in 2024.

- The global isononyl alcohol market is projected to grow at a CAGR of 4.4% and is estimated to reach US$2.7 billion by 2034.

- Based on purity, isononyl alcohol that is more than 98% pure dominated the market in 2024, comprising about 84.9% share of the total global market.

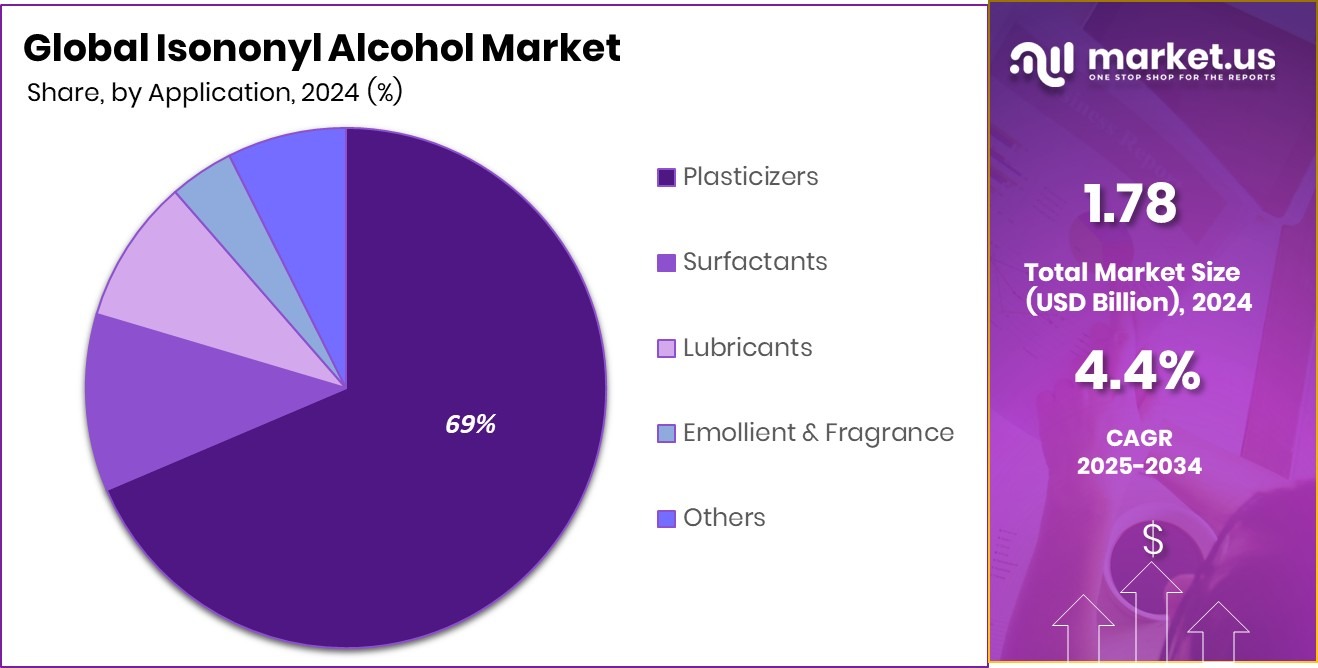

- Based on the applications of isononyl alcohol, in 2024, plasticizers led the market, encompassing about 68.6% share of the total global market.

- Asia Pacific was at the forefront in the isononyl alcohol in 2024, comprising roughly 44.8% of the total global consumption.

Type Analysis

In 2024, Isononyl Alcohol with a Purity Exceeding 98% Held the Dominant Position in the Market.

Based on purity, the isononyl alcohol market is segmented into up to 98% and above 98%. The isononyl alcohol that is more than 98% pure dominated the market in 2024 with a market share of 84.9%. Isononyl alcohol with a purity above 98% is more widely used than its lower-purity counterparts due to its superior performance, consistency, and suitability for high-quality applications. High-purity isononyl alcohol ensures better chemical stability and fewer impurities, which is critical in sensitive industries, such as plasticizers, lubricants, and cosmetics.

For instance, in the production of isononyl phthalate (DINP) plasticizers, higher purity alcohol leads to improved plasticizer performance, including better flexibility, lower volatility, and enhanced durability. In lubricants and personal care products, impurities can compromise product quality, shelf life, and safety. Manufacturers prefer using isononyl alcohol that is more than 98% pure to meet stringent performance and regulatory requirements across various end-use sectors.

Application Analysis

One of the Major Applications of the Isononyl Alcohol is in the Manufacturing of Plasticizers.

Based on the application of the isononyl alcohol, the market is divided into plasticizers, surfactants, lubricants, emollients & fragrance, and others. The plasticizers sector dominated the isononyl alcohol market in 2024 with a market share of 68.6%. Most of the isononyl alcohol produced is used in the plasticizer industry, as it serves as a key raw material in the production of isononyl phthalate (DINP), one of the most widely used plasticizers for flexible PVC applications.

The plasticizer industry demands large volumes of isononyl alcohol due to the extensive use of flexible PVC in construction, automotive, electrical cables, and consumer goods. In contrast, applications in surfactants, lubricants, emollients, and fragrances require significantly smaller quantities and more specialized formulations. These sectors focus on performance-specific uses where isononyl alcohol acts as an additive or intermediate, not a bulk raw material.

Key Market Segments

By Purity

- Up to 98%

- Above 98%

By Application

- Plasticizers

- Di-isononyl Phthalate (DINP)

- Di-isononyl Cyclohexanoate (DINCH)

- Di-isononyl Adipate (DINA)

- Tri-isononyl Trimellitate (TINTM)

- Others

- Surfactants

- Lubricants

- Emollient & Fragrance

- Others

Drivers

Applications of the Isononyl Alcohol in the Plasticizer Industry Drive the Market.

Isononyl alcohol plays a critical role in the plasticizer industry, serving as a key raw material in the production of isononyl phthalate (DINP), a widely used plasticizer for polyvinyl chloride (PVC) and other polymers. Its high compatibility with PVC resins, combined with low volatility and excellent weather resistance, makes it ideal for applications such as wire and cable insulation, flooring, automotive interiors, and construction materials. Over 80% of isononyl alcohol produced globally is utilized in plasticizer manufacturing, reflecting its significance in the sector.

For instance, in the automotive industry, flexible PVC components containing DINP provide both durability and flexibility, essential for interior trims and under-the-hood applications. Additionally, its use in vinyl flooring contributes to enhanced product longevity and safety through improved thermal stability and low migration properties. The continued demand for durable, flexible, and cost-effective plastic products across construction and automotive sectors sustains the high consumption of isononyl alcohol in the plasticizer industry.

Restraints

Environmental Concerns Might Hamper the Growth of the Isononyl Alcohol Market.

Environmental concerns present a significant challenge to the growth of the isononyl alcohol market, primarily due to its use in producing phthalate-based plasticizers such as DINP, which have been under scrutiny for their potential health and environmental risks. Regulatory agencies, including the European Chemicals Agency (ECHA), have raised concerns about phthalates’ potential endocrine-disrupting effects, leading to stricter regulations on their usage in consumer goods.

For instance, several phthalates have already been restricted under REACH regulations in Europe, prompting manufacturers to seek safer, bio-based alternatives. Additionally, improper disposal and degradation of plastic products containing isononyl alcohol-derived plasticizers contribute to environmental pollution, especially in aquatic ecosystems.

A study by the United Nations Environment Programme (UNEP) found that plastic additives, including certain phthalates, were present in over 90% of sampled marine litter, raising concerns about long-term ecological impacts. As sustainability becomes a global priority, these environmental and regulatory pressures could hinder demand for isononyl alcohol in traditional applications.

Opportunity

Demand for Isononyl Alcohol from the Lubricants and Fragrance Industry Boosts the Market.

The demand for isononyl alcohol is steadily increasing from the lubricants and fragrance industries, contributing notably to the growth of the overall market. In the lubricants sector, isononyl alcohol is used in the synthesis of esters that enhance the performance of synthetic lubricants by improving their thermal stability, viscosity, and biodegradability. These properties are essential for applications in automotive engines and industrial machinery, where high-performance lubricants are critical.

According to industry usage patterns, synthetic esters derived from C9 alcohols, including isononyl alcohol, are preferred in formulating biodegradable lubricants for environmentally sensitive areas such as marine and forestry operations. Additionally, in the fragrance industry, isononyl alcohol serves as a key intermediate in producing aroma compounds due to its pleasant, mild odor and good solvency. It is commonly used in the formulation of personal care products, perfumes, and cosmetics. Its low volatility and compatibility with other fragrance ingredients make it a desirable component in scent formulations.

Trends

Shift Towards Non-Phthalate Plasticizers.

The shift towards non-phthalate plasticizers is a significant trend in the isononyl alcohol market, driven by increasing regulatory pressure and consumer demand for safer, more sustainable products. Traditional phthalate-based plasticizers, such as DINP (Diisononyl Phthalate), have faced scrutiny due to potential health concerns, prompting manufacturers to explore alternatives. Isononyl alcohol is now increasingly being used in the production of non-phthalate plasticizers like DINCH (Diisononyl Cyclohexane Dicarboxylate), which offer similar performance without the associated health risks. For instance, DINCH is widely used in medical devices, children’s toys, and food packaging, where safety is paramount.

According to BASF, manufacturer of Hexamoll DINCH, the chemical has lower migration and toxicity levels compared to traditional phthalates, making it a preferred substitute. As regulatory frameworks such as REACH in the EU and stricter FDA guidelines in the U.S. push for phthalate-free formulations, demand for isononyl alcohol in the production of non-phthalate plasticizers continues to grow steadily.

Geopolitical Impact Analysis

Geopolitical Tensions Leading to Supply Chain Disruptions in the Isononyl Alcohol Market.

Geopolitical tensions have a substantial impact on the isononyl alcohol market, particularly due to the globalized nature of its supply chain and the petrochemical industry. Isononyl alcohol is derived from oxo alcohols, which are in turn synthesized from feedstock, such as butane or propylene, petrochemicals that are heavily influenced by crude oil prices and availability. Since early 2022, conflicts in oil-producing regions such as the Middle East or trade disruptions involving major producers such as Russia have led to supply shortages and price volatility in raw materials.

For instance, during the Russia-Ukraine conflict, supply chains for several petrochemical intermediates were disrupted, leading to increased costs for downstream products, including plasticizers and lubricants derived from isononyl alcohol. Additionally, export restrictions, sanctions, and logistical delays at ports due to regional conflicts can slow the delivery of isononyl alcohol and its derivatives, affecting manufacturers globally. These uncertainties compel producers to seek alternative supply routes or regionalize production to reduce dependency on geopolitically sensitive areas.

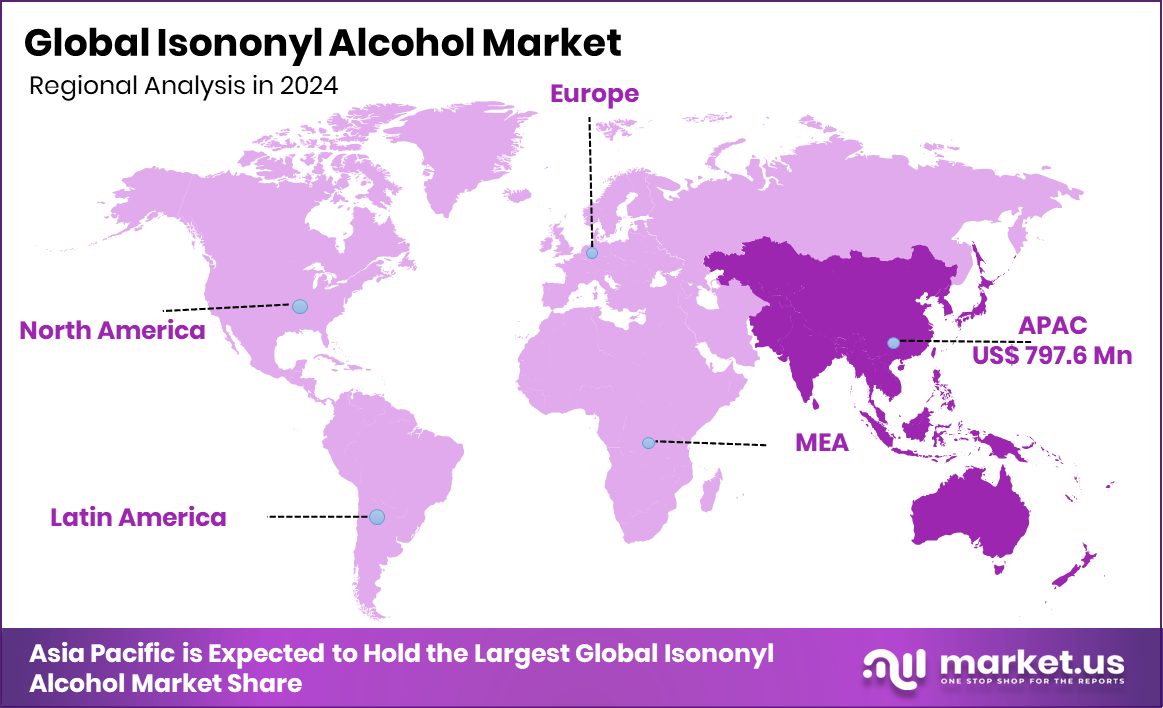

Regional Analysis

Asia Pacific was at the Forefront in the Global Isononyl Alcohol Market in 2024.

Asia Pacific held the major share of the global isononyl alcohol market, valued at around US$797.6 million, commanding an estimated 44.8% of total revenue share. The dominance of the region is primarily characterized by its robust manufacturing base, high demand for plasticizers, and rapid industrialization. Countries such as China, India, South Korea, Japan, Taiwan, and Vietnam are major consumers due to their expansive plastics, automotive, construction, and electronics industries.

In particular, China alone accounts for a significant share of global PVC production, much of which uses isononyl phthalate (DINP) as a plasticizer. For instance, PVC products such as wires, cables, synthetic leather, and flooring are heavily manufactured and consumed in the region.

Additionally, the region’s growing middle class and urbanization are fueling demand for consumer goods and vehicles, further boosting the use of isononyl alcohol in lubricants and packaging materials. Asia Pacific’s access to raw materials, competitive production costs, and increasing domestic consumption position it at the forefront of the global isononyl alcohol market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The major participants in the isononyl alcohol market are Evonik Industries AG, KH Neochem, Unilong Industry, Nan Ya Plastics Corporation, Petronas Chemicals Group Berhad, ChemicalBull, Alfa Chemical, Ensince Industry, Haihang Industry, and Exxon Mobil Corporation.

Evonik Industries is a global specialty chemicals company from Germany that is a major producer of isononyl alcohol (INA) and other oxo alcohols. Its large production capacity for INA, including the world’s largest single INA plant at its Marl site, positions it as a leading global supplier in this market segment.

Petronas Chemicals Group Berhad (PCG) is a leading integrated chemicals producer in Malaysia and Southeast Asia, which produces and markets a diverse range of chemicals, including isononyl alcohol. The company operates numerous world-class production sites in Malaysia and internationally, including in the Netherlands, Sweden, Singapore, Germany, Italy, China, the USA, and Canada.

ChemicalBull is an Indian chemical manufacturer, distributor, and supplier that offers high-purity isononyl alcohol. The company aims to provide cost-effective, high-quality chemicals with reliable delivery and flexible packaging to domestic and international clients.

Ensince Industry is a Chinese chemical manufacturer specializing in fine chemicals, cosmetic raw materials, and pharma intermediates, including isononyl alcohol, which serves as a raw material for plasticizers and surfactants. The company operates internationally, adheres to ISO quality management standards, and offers customized solutions and services to its customers.

Top Key Players in the Market

- Evonik Industries AG

- KH Neochem Co., Ltd.

- Unilong Industry Co., Ltd.

- NAN YA PLASTICS CORPORATION

- PETRONAS Chemicals Group Berhad

- ChemicalBull

- Alfa Chemical Co., Ltd.

- Ensince Industry Co., Ltd.

- Haihang Industry Co., Ltd.

- Exxon Mobil Corporation

- Other Key Players

Recent Developments

- In October 2023, BASF and Ningbo Refining and Chemical (NZRCC) signed a technology license agreement to produce isononyl alcohol utilizing BASF’s proprietary oxo-technology. NZRCC is a joint venture between the City of Ningbo and Zhenhai Refining and Chemical (ZRCC), an affiliate of China Petroleum & Chemical Corporation (SINOPEC).

Report Scope

Report Features Description Market Value (2024) USD 1.8 Billion Forecast Revenue (2034) USD 2.7 Billion CAGR (2025-2034) 4.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Purity (Up to 98%, and Above 98%), By Application (Plasticizers, Surfactants, Lubricants, Emollient & Fragrance, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Evonik Industries AG, KH Neochem Co., Ltd., Unilong Industry Co., Ltd., NAN YA PLASTICS CORPORATION, PETRONAS Chemicals Group Berhad, ChemicalBull, Alfa Chemical Co., Ltd., Ensince Industry Co., Ltd., Haihang Industry Co., Ltd., Exxon Mobil Corporation, Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Isononyl Alcohol MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample

Isononyl Alcohol MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Evonik Industries AG

- KH Neochem Co., Ltd.

- Unilong Industry Co., Ltd.

- NAN YA PLASTICS CORPORATION

- PETRONAS Chemicals Group Berhad

- ChemicalBull

- Alfa Chemical Co., Ltd.

- Ensince Industry Co., Ltd.

- Haihang Industry Co., Ltd.

- Exxon Mobil Corporation

- Other Key Players