Global Isoflavones Market Size, Share, And Business Benefits By Form (Capsules, Wax, Liquid, Powder), By Source (Soybeans, Chickpeas, Clover, Others), By Type (Agtycone Isoflavones, Glycoside Isoflavones, Malonyl Isoflavones, Acetyl Isoflavones), By Application (Nutraceuticals, Pharmaceuticals, Food and Beverages, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 156969

- Number of Pages: 374

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

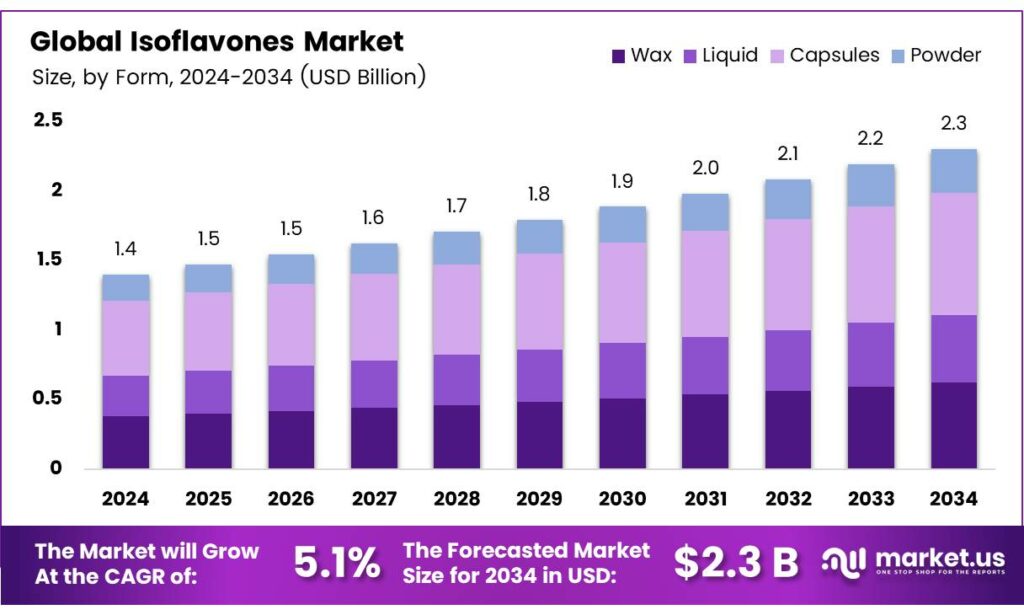

The Global Isoflavones Market size is expected to be worth around USD 2.3 billion by 2034, from USD 1.4 billion in 2024, growing at a CAGR of 5.1% during the forecast period from 2025 to 2034.

Phytoestrogens, particularly isoflavones like daidzein and genistein found in soybeans and soy products, are plant compounds resembling vertebrate estrogens. They exhibit estrogenic or antiestrogenic effects and are considered chemoprotective, potentially aiding in treating hormonal disorders such as breast and prostate cancers, cardiovascular diseases, osteoporosis, and menopausal symptoms.

Isoflavones may also act as endocrine disruptors, posing potential health and environmental risks. Soy isoflavone aglycones (IFAs) have low water solubility. This study optimized Deinococcus geothermalis amylosucrase-mediated α-1,4 glycosylation of IFA-rich soybean extract to enhance bioaccessibility. Optimal conditions used 5 U enzyme with donor: acceptor ratios of 1000:1 for glycitein and 400:1 for daidzein and genistein, achieving an average 95.7% conversion yield, with genistein showing the highest conversion, followed by daidzein and glycitein.

These conditions enable the production of transglycosylated IFA-rich functional ingredients from soybeans. Soybean (Glycine max) is a major global crop alongside corn, wheat, and rice. Isoflavones, secondary metabolites found mainly in legumes like soybeans, exist primarily in conjugated forms, classified as acetylisoflavones, malonylisoflavones, non-acylated glucosides, and isoflavone aglycones (IFAs) such as daidzein, glycitein, and genistein.

Isoflavones, phytoestrogens found in plants and processed or fermented foods, vary widely in concentration. Among plants, soybeans contain the highest isoflavone levels (1.2–4.2 mg/g), followed by red clover (21 mg/100 g), while alfalfa, flaxseed, and broccoli have lower amounts (0.02–0.07 mg/100 g). Processed foods like tofu (5.1–64 mg/100 g) and soy milk (1–33 mg/100 g) are significant sources, while red wine has minimal isoflavones (0.01 mg/100 g). Fermented foods, including miso, doenjang, and natto (20–126 mg/100 g), also provide substantial isoflavone content.

Key Takeaways

- The Global Isoflavones Market is expected to grow from USD 1.4 billion in 2024 to USD 2.3 billion by 2034, with a 5.1% CAGR.

- Capsules held a 38.3% market share in 2024 due to convenience, precise dosage, and long shelf life.

- Soybeans dominated with a 71.2% share in 2024 as the richest isoflavone source for supplements and foods.

- Aglycone isoflavones led with a 44.7% share in 2024, driven by higher bioavailability for better absorption.

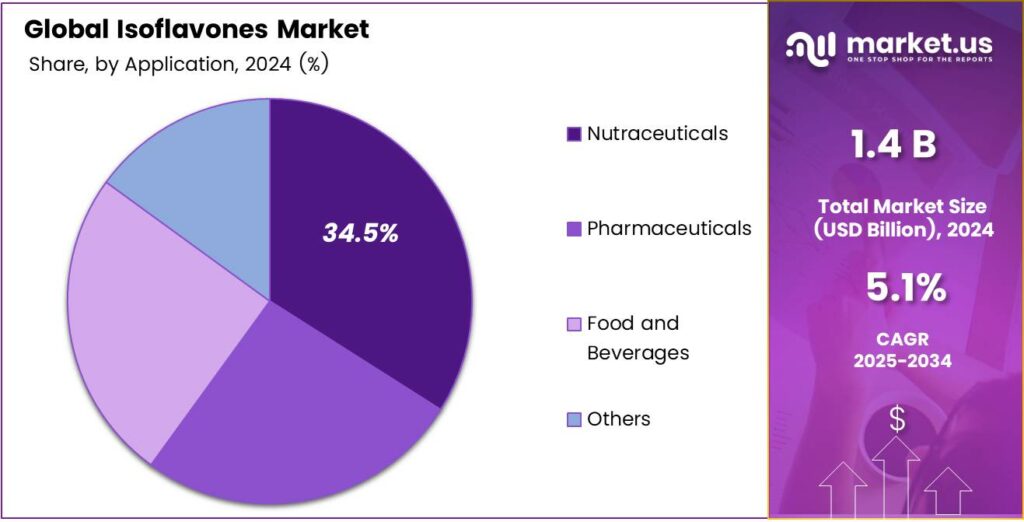

- Nutraceuticals captured a 34.5% share in 2024, fueled by benefits for menopause, heart, and bone health.

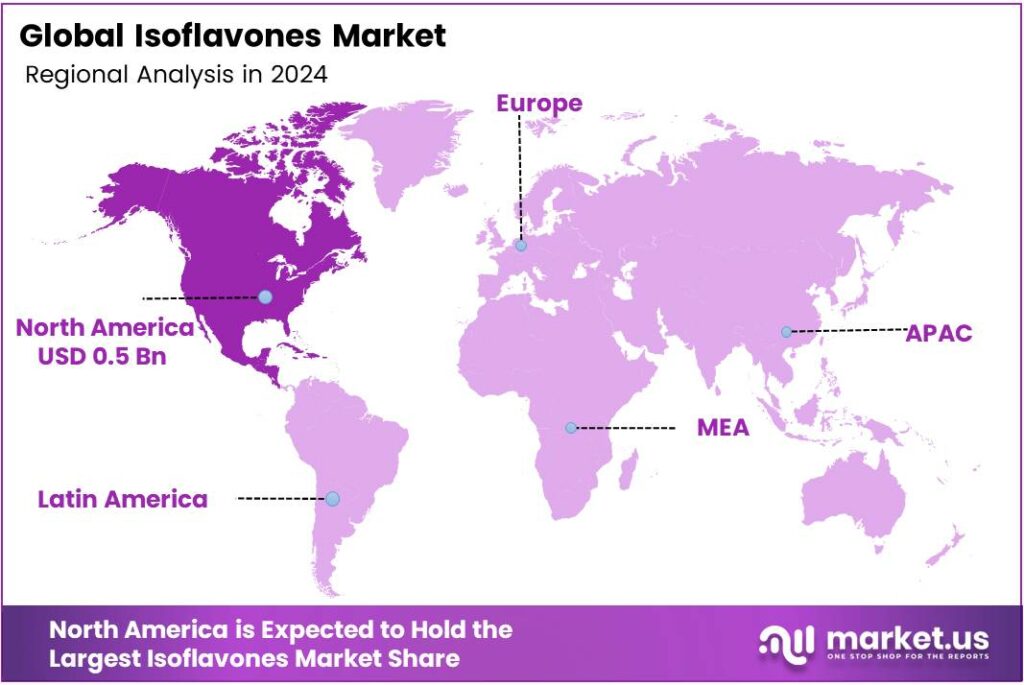

- North America led with a 42.8% share (USD 0.5 Billion) in 2024, driven by strong nutraceutical demand and awareness.

Analyst Viewpoint

The Isoflavones Market is ripe with potential for investors, driven by a surge in consumer interest in natural health products. Isoflavones, found primarily in soybeans, are gaining traction for their role in addressing menopausal symptoms, heart health, and potential cancer prevention.

This creates opportunities in nutraceuticals, where demand for supplements is rising, and in functional foods like soy-based beverages or snacks, especially in health-conscious markets like North America and Europe. Despite its promise, the isoflavones market carries notable risks. Regulatory scrutiny is a major hurdle, with strict rules on health claims and allergen labeling in regions like the EU and the U.S., which can raise costs and slow market entry.

Consumers are increasingly drawn to isoflavones for their natural, plant-based appeal, particularly women seeking relief from menopausal symptoms and health-conscious individuals focused on preventive care. The rise in plant-based diets has boosted demand for soy-based products, with younger demographics prioritizing sustainability and non-GMO options.

By Form

Capsules Lead with 38.3% Share

In 2024, Capsules held a dominant market position, capturing more than a 38.3% share in the global isoflavones market. Their popularity stems from convenience, precise dosage, and longer shelf life compared to other forms. Consumers often prefer capsules as an easy-to-use supplement format, making them suitable for daily nutritional routines.

The year 2025 is expected to see continued demand for capsule-based isoflavones, supported by rising awareness of plant-based health products and their benefits in managing hormonal balance and supporting bone health. As more people opt for natural supplements, capsules are likely to maintain their strong share and remain the most trusted form of isoflavones in the market.

By Source

Soybeans Dominate with 71.2% Share

In 2024, Soybeans held a dominant market position, capturing more than a 71.2% share in the global isoflavones market. Soybeans are the richest natural source of isoflavones, making them the primary choice for extraction and product development. Their wide use in dietary supplements, functional foods, and pharmaceuticals has strongly reinforced this leadership.

The dominance of soybeans is expected to remain steady as demand for plant-based and natural health products grows worldwide. The nutritional profile of soy, coupled with its role in supporting heart health and managing menopausal symptoms, ensures its strong acceptance among consumers. This continued reliance on soybeans highlights their central role in shaping the future of the isoflavones market.

By Type

Aglycone Isoflavones Lead with 44.7% Share

In 2024, Aglycone Isoflavones held a dominant market position, capturing more than a 44.7% share in the global isoflavones market. Their higher bioavailability compared to other forms makes them more effective for absorption in the human body, which increases their demand in dietary supplements and functional food products.

Consumers prefer this type for its quick action in supporting hormonal balance, bone strength, and overall wellness. The prominence of aglycone isoflavones is expected to continue as awareness of their health benefits rises. With growing focus on preventive healthcare and plant-based nutrition, this type is likely to sustain its leadership, supported by its effectiveness and wider acceptance among health-conscious populations.

By Application

Nutraceuticals Hold 34.5% Share

In 2024, Nutraceuticals held a dominant market position, capturing more than a 34.5% share in the global isoflavones market. Isoflavones are widely used in nutraceutical formulations due to their proven benefits in managing menopause symptoms, supporting cardiovascular health, and maintaining bone density. Consumers seeking natural and preventive health solutions increasingly rely on nutraceutical products, which has strengthened this segment’s growth.

The demand for isoflavone-based nutraceuticals is expected to rise further as awareness about plant-derived supplements expands. With lifestyles becoming more health-conscious and the preference for natural remedies growing, nutraceuticals are set to remain a strong application area, ensuring steady growth for this segment in the isoflavones market.

Key Market Segments

By Form

- Capsules

- Wax

- Liquid

- Powder

By Source

- Soybeans

- Chickpeas

- Clover

- Others

By Type

- Agtycone Isoflavones

- Glycoside Isoflavones

- Malonyl Isoflavones

- Acetyl Isoflavones

By Application

- Nutraceuticals

- Pharmaceuticals

- Food and Beverages

- Others

Drivers

Growing Health Awareness and FDA-Backed Recognition

In 2025, awareness among U.S. health professionals about the FDA‑authorized health claim for soy protein climbed to 54%, up from 49% in 2023. This steady rise shows that more experts are paying attention to soy’s recognized benefits. That shift matters for how people choose what to consume.

As healthcare providers grow more confident in soy’s heart-health properties, they share that assurance with their patients. People naturally trust what their doctors and nutritionists believe is backed by the FDA. In turn, everyday consumers start looking for isoflavone-rich options, whether it’s a fortified cereal, supplement, or beverage.

Soy isoflavones are often celebrated for their potential to support heart health, bone density, and menopausal comfort. That’s why this FDA recognition is so impactful; it reinforces trust in a product that comes from a natural source (soy) and is increasingly promoted by professionals.

Restraints

Hormonal Safety Concerns and Regulatory Caution

One key restraint holding back the isoflavones market is the lingering concern about their hormonal effects, especially among vulnerable groups. A notable example comes from the French Agency for Food, Environmental and Occupational Health & Safety (ANSES).

They found there was a significant risk that certain people, particularly children before puberty, pregnant women, and women of reproductive age, could exceed the tolerable upper intake levels (TRVs) of isoflavones when consuming soy-based foods. ANSES even went so far as to halve the TRV to 0.01 mg per kg of body weight per day for those vulnerable groups, signaling real caution about overconsumption.

That kind of regulatory alarm naturally makes health professionals and consumers think twice. When people hear that certain populations might unintentionally exceed safety thresholds from everyday intake, they become more hesitant. Manufacturers and retailers feel the tension too how much they should advertise the isoflavone content? Do they need special labels or dosage recommendations? All of this adds layers of complexity and slows down the market’s growth.

Opportunity

Strong FDA Health Claim Spurs Consumer Trust

A powerful growth booster for the isoflavones market comes from the long‑standing, FDA‑authorized health claim that links soy protein to heart health. In simple terms, the FDA allows products containing 25 grams of soy protein per day, as part of a diet low in saturated fat and cholesterol, to carry a claim that they may reduce the risk of heart disease.

That rule might sound technical, but it speaks volumes when you imagine a person scanning labels at the grocery store. Seeing that heart‑healthy note on soy milk, tofu, or other soy‑based products offers real reassurance. In fact, a meta‑analysis of 46 randomized clinical trials found that consuming around 25 grams of soy protein daily can lead to a modest but meaningful 3.2% drop in LDL cholesterol and a 2.8% decrease in total cholesterol.

Trends

Rising Role of Soy Isoflavones in Plant-Based Food Innovation

A quiet yet powerful shift is underway as soy isoflavones increasingly find their place within the booming plant-based ingredients landscape. Soy isoflavones made up approximately 8–10% of the nutraceutical ingredients market, and 3–5% of the functional food and beverage ingredients sector numbers, which highlight how much they’re being woven into everyday healthy foods and supplements.

This trend is more than just numbers; it’s about how food companies are responding to what people want: natural, effective, and plant-derived solutions. Isoflavones aren’t just an add-on; they’re emerging as key players in product innovation. Brands are even investing in sophisticated extraction and delivery methods like nanoemulsification and liposomal encapsulation to make these ingredients even more effective and appealing.

Behind the scenes, this isn’t being driven by hype. Rising consumer focus on hormone balance, bone strength, and a preference for natural alternatives to synthetic options are real motivators. Engineers and food scientists are listening and crafting ingredients that both deliver benefits and fit neatly into wellness-driven trends.

Regional Analysis

North America leads with a 42.8% share and a USD 0.5 Billion market value.

In 2024, North America dominated the global isoflavones landscape, contributing 42.8% of market revenue, about USD 0.5 billion. The region’s outperformance stems from a mature nutraceuticals ecosystem, high consumer awareness of women’s health and cardiometabolic wellness, and deep retail penetration across pharmacies, specialty nutrition chains, and fast-growing ecommerce.

Isoflavones are primarily consumed through dietary supplements and functional foods, supported by an innovation pipeline focused on improved bioavailability, clean-label formats, and plant-based positioning. The United States anchors demand, with Canada a fast follower as brands leverage cross-border regulatory alignment and bilingual packaging efficiencies.

North America benefits from reliable soy ingredient processing, traceability programs, and increasing availability of non-GMO inputs, which help brands meet retailer standards and consumer preferences. Clinical education initiatives by healthcare practitioners and broader preventive health spending also support steady repeat purchases among peri and postmenopausal consumers.

Category growth will be reinforced by expanded applications in ready-to-drink beverages, fortified dairy alternatives. North America’s scale advantages in formulation, marketing, and omnichannel distributioncombined with stable raw material accessposition the region to sustain its leadership and act as the launchpad for next-generation isoflavone products.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Indena S.p.A is a renowned Italian leader in the production of high-quality botanical derivatives, including isoflavones. With a century of expertise in phytochemistry, the company specializes in developing standardized, patented plant extracts like its SoySelect. Its focus on rigorous scientific research, clinical studies, and intellectual property protection makes it a preferred partner for the pharmaceutical and nutraceutical industries seeking premium, efficacious, and reliable ingredients.

ADM (Archer-Daniels-Midland Company) is a powerhouse in the isoflavones market. The company leverages its massive, integrated soybean supply chain to produce and market a wide portfolio of plant-based ingredients. ADM provides isoflavones from non-GMO and organic soy sources, supplying major brands in the food, beverage, and supplement sectors. Its scale, sustainability initiatives, and focus on innovation make it a fundamental supplier in the industry.

DSM (Firmenich), now DSM-Firmenich following its merger, is a major science-based innovator in health and nutrition. The company offers high-purity isoflavones as part of its extensive nutritional ingredients portfolio, targeting solutions for women’s health and menopause support. Its strong emphasis on clinical substantiation, sustainability (via its non-GMO SoyLife brand), and global market reach positions it as a key partner for developing evidence-based, targeted health products.

Top Key Players in the Market

- Glanbia plc

- Indena S.p.A

- ADM

- DSM

- International Flavors and Fragrances

- Nexira Inc.

- Bio-gen Extracts

- Avestia Pharma

- Herbo Nutra

Recent Developments

- In 2024, Glanbia acquired Flavor Producers, a provider of natural, organic, and plant-based flavors and extracts. This move strengthens Glanbia’s portfolio in plant-based nutritional solutions, which could include isoflavone-related applications for functional foods and beverages, as isoflavones are plant-derived compounds.

- In 2024, Indena invested in sustainable sourcing for soy-based ingredients, ensuring GMO-free and traceable supply chains. Their 2024 sustainability report details efforts to reduce environmental impact in botanical extract production, which includes isoflavone-containing products.

Report Scope

Report Features Description Market Value (2024) USD 1.4 Billion Forecast Revenue (2034) USD 2.3 Billion CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Capsules, Wax, Liquid, Powder), By Source (Soybeans, Chickpeas, Clover, Others), By Type (Agtycone Isoflavones, Glycoside Isoflavones, Malonyl Isoflavones, Acetyl Isoflavones), By Application (Nutraceuticals, Pharmaceuticals, Food and Beverages, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Glanbia plc, Indena S.p.A., ADM, DSM, International Flavors and Fragrances, Nexira Inc., Bio-gen Extracts, Avestia Pharma, Herbo Nutra Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Glanbia plc

- Indena S.p.A

- ADM

- DSM

- International Flavors and Fragrances

- Nexira Inc.

- Bio-gen Extracts

- Avestia Pharma

- Herbo Nutra