Global Isobutylbenzene Market Size, Share, And Business Benefits By Purity (Less Than 98%, Greater Than 99%), By Application (Surfactant, Analgesic, Ibuprofen, Anti-inflammatory, Painkillers, Feedstock, Fragrance, Others), By End-Use (Pharmaceutical, Personal Care, Chemical, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152152

- Number of Pages: 324

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

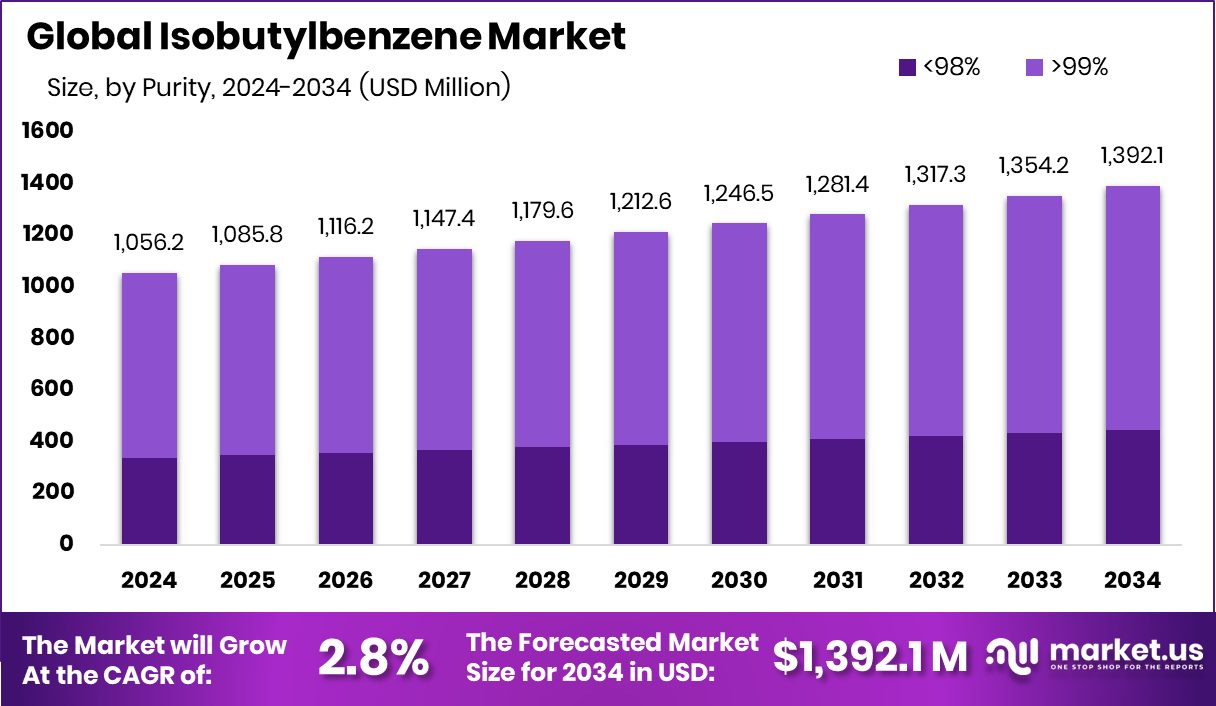

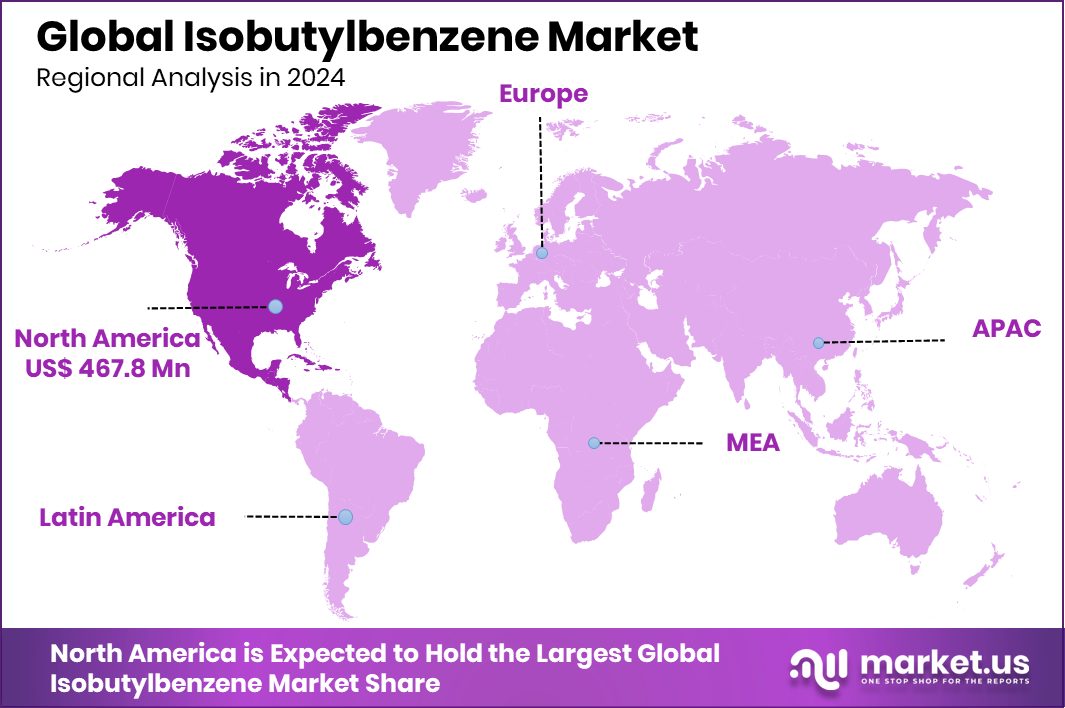

Global Isobutylbenzene Market is expected to be worth around USD 1,392.1 Million by 2034, up from USD 1056.2 Million in 2024, and grow at a CAGR of 2.8% from 2025 to 2034. With a 44.3% share, North America remained a leading regional consumer in 2024.

Isobutylbenzene is an organic compound classified as an aromatic hydrocarbon, composed of a benzene ring bonded with an isobutyl group. It appears as a colorless liquid with a characteristic aromatic odor and is primarily used as an intermediate in the synthesis of various chemical products. One of its most notable applications is in the production of ibuprofen, where it serves as a key building block during the initial stages of synthesis.

The isobutylbenzene market comprises the global production, distribution, and consumption of isobutylbenzene across different industrial applications. Its demand is largely concentrated in the pharmaceutical sector, where it plays a vital role in drug formulation. The market structure includes manufacturers, distributors, and end-use industries that rely on consistent quality and chemical purity.

The growth of the isobutylbenzene market can be attributed to its critical function in pharmaceutical manufacturing, particularly for nonsteroidal anti-inflammatory drugs. Increasing healthcare awareness and the rising global demand for generic medicines have led to an expanded requirement for pharmaceutical intermediates, thus positively influencing isobutylbenzene consumption.

Demand for isobutylbenzene is primarily driven by its role in bulk drug production and its versatility in industrial synthesis. Emerging economies have shown increased investment in pharmaceutical infrastructure, which has resulted in higher import and usage volumes of chemical intermediates. Additionally, the growth in population and aging demographics are contributing to the long-term demand in the healthcare segment.

Key Takeaways

- Global Isobutylbenzene Market is expected to be worth around USD 1,392.1 Million by 2034, up from USD 1056.2 Million in 2024, and grow at a CAGR of 2.8% from 2025 to 2034.

- In 2024, >99% purity dominated the Isobutylbenzene market, accounting for 68.1% global share.

- Ibuprofen synthesis held the largest application share in 2024, contributing 44.2% of market consumption.

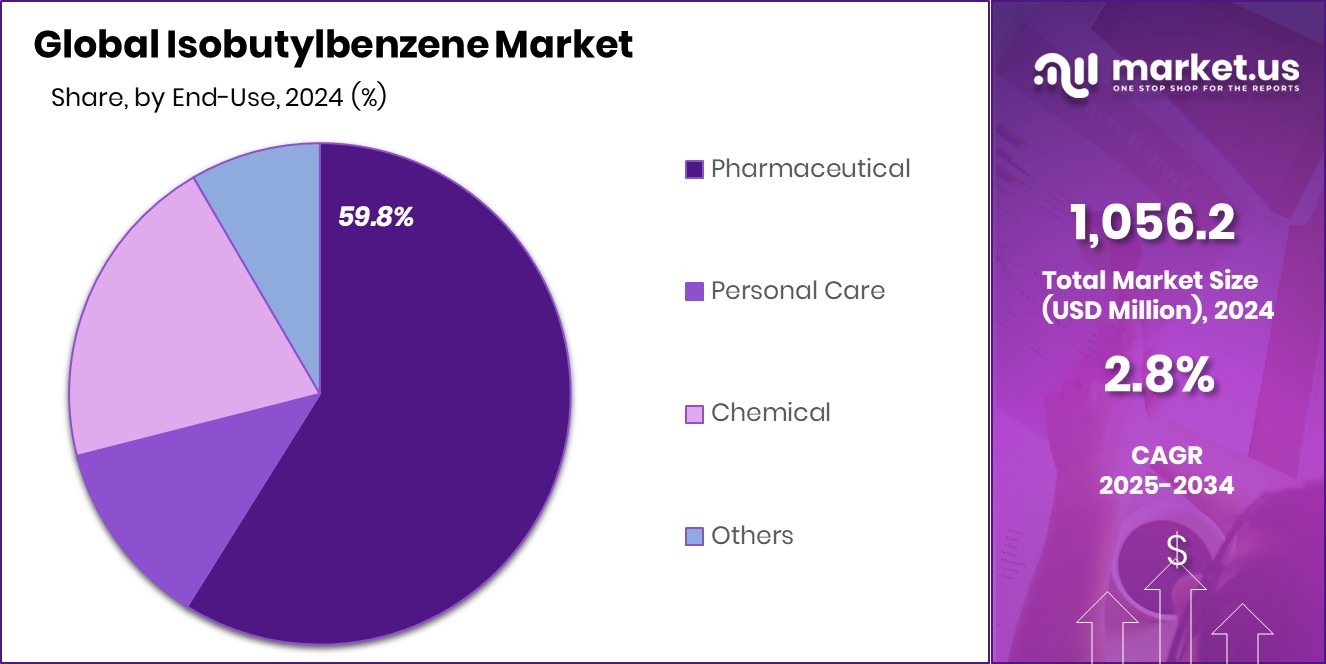

- The pharmaceutical sector led with a 59.8% share, highlighting healthcare’s reliance on isobutylbenzene intermediates.

- North America’s strong pharmaceutical manufacturing supported USD 467.8 million in isobutylbenzene market growth.

By Purity Analysis

Isobutylbenzene with >99% purity dominates with a 68.1% share.

In 2024, >99% held a dominant market position in the By Purity segment of the Isobutylbenzene Market, with a 68.1% share. This high-purity grade is primarily favored due to its critical application in pharmaceutical synthesis, particularly where precision and consistency in chemical composition are essential.

The >99% purity level ensures minimal presence of impurities, which is vital in processes where product integrity and safety are non-negotiable. Its dominance can be attributed to the increasing demand for high-quality intermediates in the production of active pharmaceutical ingredients (APIs), where stringent regulatory standards mandate the use of high-purity input materials.

The preference for >99% purity is further supported by the robust expansion of pharmaceutical manufacturing units, especially in regions investing heavily in health infrastructure and drug production capabilities. High-purity isobutylbenzene also demonstrates improved performance in controlled reactions, enhancing process reliability and output efficiency.

As the pharmaceutical and fine chemical sectors prioritize quality and compliance, the >99% purity segment continues to be the most relied-upon standard across major end-use industries. Given its established role and consistent demand in precision-driven sectors, this segment is expected to maintain its lead in the coming years, reinforcing its position as the market benchmark for isobutylbenzene purity.

By Application Analysis

Ibuprofen production drives 44.2% of the isobutylbenzene market applications.

In 2024, Ibuprofen held a dominant market position in the By Application segment of the Isobutylbenzene Market, with a 44.2% share. This leadership is driven by isobutylbenzene’s essential role as a key intermediate in the industrial synthesis of ibuprofen, a widely used over-the-counter nonsteroidal anti-inflammatory drug (NSAID). The pharmaceutical industry’s reliance on isobutylbenzene for this specific application has solidified its position, especially amid rising global demand for effective pain relief and anti-inflammatory medications.

The 44.2% share reflects the sustained consumption of ibuprofen worldwide, supported by growing healthcare needs, an aging population, and increased access to generic medications in emerging economies. The production processes for ibuprofen require high-purity isobutylbenzene to ensure product safety, efficacy, and regulatory compliance, further anchoring this application’s dominance.

Moreover, the scalability and cost-effectiveness of ibuprofen manufacturing have made it one of the most commercially viable end uses for isobutylbenzene. As public health systems and private pharmaceutical players continue to expand their offerings to meet chronic and acute medical demands, the use of isobutylbenzene in ibuprofen production remains a critical market pillar.

By End-Use Analysis

The pharmaceutical sector leads with a 59.8% isobutylbenzene market share.

In 2024, Pharmaceutical held a dominant market position in the By End-Use segment of the Isobutylbenzene Market, with a 59.8% share. This substantial market share is attributed to the widespread use of isobutylbenzene as a crucial intermediate in pharmaceutical manufacturing, particularly in the synthesis of widely consumed medications such as ibuprofen. The pharmaceutical industry’s strict emphasis on chemical purity and process consistency has elevated the demand for isobutylbenzene of high standard, making it indispensable in large-scale drug production.

The 59.8% share indicates the deep integration of isobutylbenzene into pharmaceutical supply chains, especially as healthcare systems worldwide continue to prioritize access to essential drugs. Growth in pharmaceutical research, rising generic drug production, and the need for efficient, cost-effective synthesis routes have further solidified the role of isobutylbenzene in this sector.

Regulatory compliance and the need for batch reproducibility in drug manufacturing reinforce the use of high-quality chemical intermediates, contributing to the strong preference within the pharmaceutical end-use segment. With expanding therapeutic demands and global emphasis on medicine availability, especially in emerging markets, the pharmaceutical sector is expected to maintain its leading position in driving isobutylbenzene demand, securing its 59.8% share in the market.

Key Market Segments

By Purity

- <98%

- >99%

By Application

- Surfactant

- Analgesic

- Ibuprofen

- Anti-inflammatory

- Painkillers

- Feedstock

- Fragrance

- Others

By End-Use

- Pharmaceutical

- Personal Care

- Chemical

- Others

Driving Factors

Pharmaceutical Expansion Boosts Isobutylbenzene Demand Globally

One of the main driving factors for the isobutylbenzene market is the strong growth of the pharmaceutical industry, especially due to the increasing demand for ibuprofen. Isobutylbenzene is a key raw material used in making ibuprofen, which is widely used to treat pain, fever, and inflammation. As more people around the world require affordable and effective healthcare, especially in developing countries, the production of ibuprofen is growing steadily.

This directly increases the need for isobutylbenzene. In addition, with aging populations and rising healthcare access in countries like India, China, and Brazil, pharmaceutical manufacturers are scaling up production, further boosting the use of isobutylbenzene. As a result, this sector continues to lead demand and fuel steady market growth.

Restraining Factors

Environmental Concerns Limit Isobutylbenzene Market Expansion

A major restraining factor for the isobutylbenzene market is the increasing concern over its environmental and health impact. Isobutylbenzene is a petroleum-derived chemical, and its production involves processes that may release volatile organic compounds (VOCs) and other hazardous substances. These emissions can contribute to air pollution and pose risks to workers and surrounding communities.

As a result, governments and regulatory bodies in many regions are enforcing stricter environmental and safety regulations on chemical manufacturing. Compliance with these rules increases production costs and may discourage new investments. Moreover, industries are now shifting toward greener alternatives, which could reduce the long-term use of isobutylbenzene.

Growth Opportunity

Cleaner Production Methods Offer Growth Opportunities

One significant growth opportunity in the isobutylbenzene market lies in the adoption of cleaner and more sustainable production methods. Manufacturers can improve environmental performance and reduce regulatory risks by switching to greener synthesis routes, such as using bio-based feedstocks or implementing advanced catalytic processes that minimize waste and emissions. These innovations would not only enhance compliance with tightening environmental regulations but also reduce production costs through energy and resource efficiency gains.

Additionally, companies that invest in eco‑friendly technologies may find new partnerships, gain favorable public perception, and access green financing options. As companies and regulators increasingly prioritize sustainability, producers of isobutylbenzene can strengthen their market position by offering high‑quality products made through responsible, low‑impact manufacturing processes, adding both economic and reputational value.

Latest Trends

Shift Toward Bio‑Based Isobutylbenzene Alternatives Emerging

A notable recent trend in the isobutylbenzene market is the growing exploration of bio‑based alternatives. Chemical manufacturers are increasingly investigating renewable feedstocks, such as plant‑derived oils or sugars, as starting materials instead of traditional petroleum sources. This shift is motivated by a desire to reduce reliance on fossil fuels, lower greenhouse gas emissions, and improve sustainability credentials. Research efforts have led to the development of catalytic processes that convert biomass into isobutylbenzene‑like compounds with comparable purity and performance.

Companies adopting these green approaches are positioned to meet evolving regulatory standards and satisfy environmentally conscious customers. As sustainability becomes a key decision factor in procurement and production, bio‑based routes are likely to gain traction, potentially reshaping supply chains and creating a more eco‑responsible isobutylbenzene value chain in the years to come.

Regional Analysis

In 2024, North America held a 44.3% share, valued at USD 467.8 million.

In 2024, North America emerged as the dominant region in the global isobutylbenzene market, accounting for a substantial 44.3% share, which translated to a market value of USD 467.8 million. This leading position is primarily supported by the well-established pharmaceutical sector in the United States and Canada, where isobutylbenzene is extensively used as a key intermediate in the synthesis of ibuprofen.

High healthcare spending, advanced chemical manufacturing infrastructure, and strong demand for over-the-counter medications continue to drive consumption in the region. Europe also remains an important market, benefiting from its mature pharmaceutical base and compliance-focused production practices. Meanwhile, Asia Pacific is witnessing a gradual uptake, supported by growing pharmaceutical capabilities and industrial expansion in countries such as India and China.

The Middle East & Africa, along with Latin America, represent smaller markets but show emerging potential due to improving healthcare access and localized production initiatives. However, North America’s dominance is sustained by its advanced processing capabilities and demand stability, keeping it ahead of other regions in 2024.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

INEOS, a major name in the global chemical industry, maintained its presence through the consistent supply of aromatic hydrocarbons, with isobutylbenzene forming part of its broader petrochemical portfolio. The company’s operational scale and integration across chemical value chains enabled stable output to meet industrial-grade requirements, especially in pharmaceutical applications.

IOL Chemicals & Pharmaceuticals Limited continued to focus on the pharmaceutical segment, leveraging its expertise in producing active pharmaceutical ingredients (APIs) and intermediates. Its backward integration strategy supported the consistent availability of high-purity isobutylbenzene for internal consumption and external supply. This alignment with ibuprofen production strengthened its position in the pharmaceutical vertical of the isobutylbenzene market.

Leonid Chemicals, with its specialized product lines in laboratory and fine chemicals, served a niche segment where small- to medium-scale users required high-quality isobutylbenzene for research and synthesis purposes. Meanwhile, LGC Standards GmbH remained active through its supply of certified reference materials, ensuring quality control and analytical accuracy in laboratories dealing with isobutylbenzene testing.

Top Key Players in the Market

- INEOS

- IOL Chemicals & Pharmaceuticals Limited

- Leonid Chemicals

- LGC Standards GmbH

- Reliance Industries

- Santa Cruz Biotechnology Inc.

- Shandong Xinhua Pharmaceuticals CO., Ltd.

- SI Group

- Vinati Organics Limited

Recent Developments

- In May 2025, IOL invested INR 155 crore (approximately USD 18 million) from internal accruals to expand its chemical operations. This investment is expected to enhance capacity for chemicals, including isobutylbenzene, enabling higher production volumes and improved supply chain stability.

- In May 2024, INEOS Oxide completed the acquisition of LyondellBasell’s Ethylene Oxide & Derivatives (EO&D) business located in Bayport, Texas. This move expanded INEOS’s footprint in high-purity oxide chemicals, enhancing its capacity to supply intermediates that share similar downstream processing importance with compounds like isobutylbenzene.

Report Scope

Report Features Description Market Value (2024) USD 1056.2 Million Forecast Revenue (2034) USD 1,392.1 Million CAGR (2025-2034) 2.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Purity (<98%, >99%), By Application (Surfactant, Analgesic, Ibuprofen, Anti-inflammatory, Painkillers, Feedstock, Fragrance, Others), By End-Use (Pharmaceutical, Personal Care, Chemical, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape INEOS, IOL Chemicals & Pharmaceuticals Limited, Leonid Chemicals, LGC Standards GmbH, Reliance Industries, Santa Cruz Biotechnology Inc., Shandong Xinhua Pharmaceuticals CO., Ltd., SI Group, Vinati Organics Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- INEOS

- IOL Chemicals & Pharmaceuticals Limited

- Leonid Chemicals

- LGC Standards GmbH

- Reliance Industries

- Santa Cruz Biotechnology Inc.

- Shandong Xinhua Pharmaceuticals CO., Ltd.

- SI Group

- Vinati Organics Limited