Global Intravenous Iron Drugs Market By Product Type (Ferric carboxymaltose, Iron sucrose, Iron dextran, Iron derisomaltose, Sodium ferric gluconate, Others) By Application (Chronic kidney disease (CKD), Inflammatory bowel disease (IBD), Cancer- and chemotherapy-induced anemia, Obstetrics & gynaecology, Iron deficiency with heart failure, Others, By Patient Type (Adult, Pediatric, Geriatric) By End-User (Hospitals, Ambulatory care, Homecare settings, Specialty centers, Others) Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 168113

- Number of Pages: 322

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

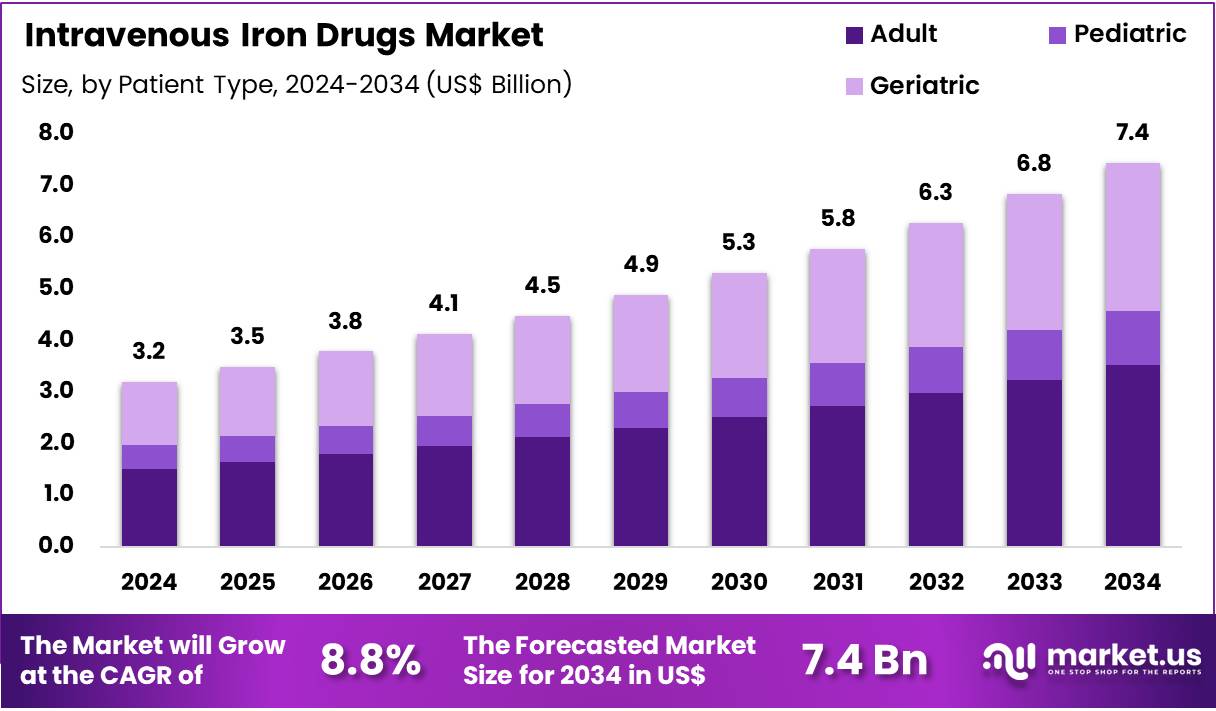

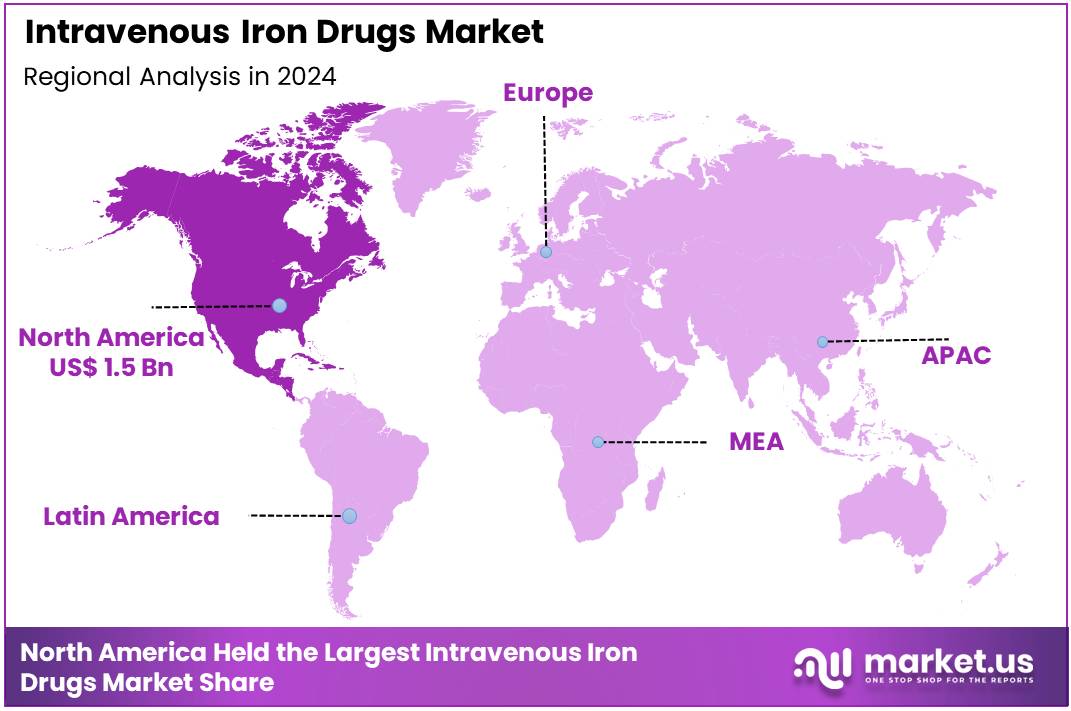

Global Intravenous Iron Drugs Market size is expected to be worth around US$ 7.4 Billion by 2034 from US$ 3.2 Billion in 2024, growing at a CAGR of 8.8% during the forecast period from 2025 to 2034. In 2024, North America led the market, achieving over 45.4% share with a revenue of US$ 1.5 Billion.

The market has been experiencing sustained growth, supported by the high and persistent burden of anaemia worldwide. The World Health Organization (WHO) reported that in 2019 approximately half a billion women aged 15–49 years and 269 million children aged 6–59 months were living with anaemia.

Recent WHO updates indicate that anaemia among women of reproductive age reached 30.7% in 2023, only marginally above the 27.6% baseline in 2012, demonstrating that global reduction targets are not progressing as planned. Because iron deficiency remains the leading cause of anaemia, the large unmet medical need continues to support strong uptake of IV iron therapy, particularly when oral iron treatments are ineffective or poorly tolerated.

Global health policy commitments further reinforce market expansion. The World Health Assembly has set a target to reduce anaemia in women of reproductive age by 50%, extended through 2030 under WHO’s updated nutrition agenda. As more countries scale up screening and treatment programmes, IV iron use is increasing in high-risk groups, especially during late pregnancy, severe anaemia, and situations requiring rapid correction.

Rising chronic disease prevalence provides another significant driver. Chronic kidney disease (CKD) affects more than 10% of the global population, equivalent to over 800 million individuals, with 674 million estimated cases in 2021. In the United States, the CDC reports that 14% of adults, or 35.5 million people, have CKD. IV iron is firmly established in CKD management, particularly in dialysis, generating stable and recurring treatment demand.

Heart failure also contributes to expanding utilization. Clinical evidence over the past two decades demonstrates that modern IV iron formulations such as ferric carboxymaltose improve exercise capacity, symptoms, and hospitalization rates in iron-deficient heart failure patients, driving broader adoption in cardiology.

Additional pressure stems from worsening dietary patterns. In England, NHS data show that hospital admissions for iron deficiency rose to 191,927 in 2023–24, almost ten times higher than in 1998–99. Maternal and child health programmes further increase need, as anaemia affects 40% of children, 37% of pregnant women, and 30% of women aged 15–49 years globally.

Market growth is further supported by improvements in infusion infrastructure, regulatory clarity from EMA and FDA, and the ageing global population. As chronic diseases rise and countries intensify anaemia-reduction strategies, demand for IV iron drugs is expected to remain strong, particularly for newer formulations offering high dosing efficiency and favourable safety profiles.

Key Takeaways

- Market Size: Global Intravenous Iron Drugs Market size is expected to be worth around US$ 7.4 Billion by 2034 from US$ 3.2 Billion in 2024.

- Market Growth: The market growing at a CAGR of 8.8% during the forecast period from 2025 to 2034.

- Product Type Analysis: Ferric carboxymaltose accounted for 44.1% of the global market share in 2024, and its dominance has been attributed to favourable dosing advantages, lower infusion time, and reduced requirement for repeat visits.

- Application Analysis: Chronic kidney disease (CKD) accounted for 38.5% of the global market share in 2024, making it the leading application segment.

- Patient Type Analysis: The adult segment accounted for 47.4% of the global market share in 2024, emerging as the dominant category.

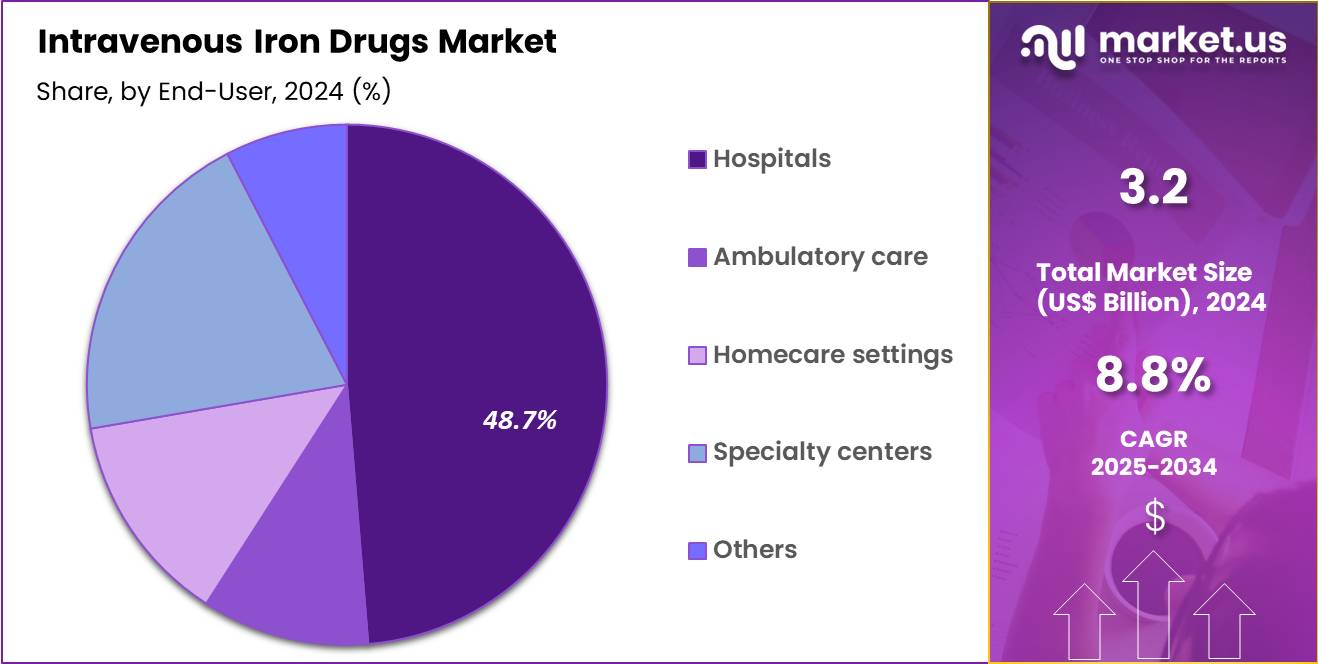

- End-Use Analysis: Hospitals accounted for 48.7% of the global market share in 2024, positioning them as the dominant end-user segment.

- Regional Analysis: In 2024, North America led the market, achieving over 45.4% share with a revenue of US$ 1.5 Billion.

Product Type Analysis

The market has been segmented based on major intravenous iron formulations, and clear differentiation has been observed in terms of adoption, safety profile, dosage convenience, and clinical efficacy. Ferric carboxymaltose accounted for 44.1% of the global market share in 2024, and its dominance has been attributed to favourable dosing advantages, lower infusion time, and reduced requirement for repeat visits. High bioavailability and improved tolerability have also supported its widespread use in hospital and outpatient settings.

Iron sucrose represented one of the significant segments, supported by its established clinical use, particularly in chronic kidney disease patients. Its growth has been driven by cost-effectiveness and broad therapeutic familiarity. Iron dextran continued to capture demand owing to its capability to deliver large replacement doses, although usage has been moderated due to hypersensitivity concerns.

Iron derisomaltose experienced increasing adoption because of its ability to provide high-dose single infusions, resulting in improved patient compliance. Sodium ferric gluconate contributed to steady market penetration due to its established role in dialysis centers. The “Others” category included emerging formulations that have been adopted gradually due to specific clinical or regional preferences.

Application Analysis

The market has been segmented based on key therapeutic applications, and significant variations in usage patterns have been observed across clinical settings. Chronic kidney disease (CKD) accounted for 38.5% of the global market share in 2024, making it the leading application segment. This dominance has been attributed to the high prevalence of anemia among CKD patients, the routine use of IV iron in dialysis centers, and clinical guidelines that recommend parenteral iron as the preferred therapy for advanced renal impairment.

Inflammatory bowel disease (IBD) represented a major segment, supported by increasing diagnosis of Crohn’s disease and ulcerative colitis, where oral iron is often poorly tolerated. Cancer- and chemotherapy-induced anemia continued to drive substantial demand due to the frequent need for rapid hemoglobin correction in oncology patients.

Obstetrics and gynaecology applications experienced rising adoption as IV iron became widely accepted for treating moderate to severe anemia during pregnancy. Iron deficiency associated with heart failure emerged as a growing segment, influenced by evidence linking IV iron therapy with improved functional outcomes. The “Others” category included applications in perioperative care and general iron deficiency that contributed steadily to the market landscape.

Patient Type Analysis

The market has been segmented based on patient type, and utilisation patterns reflect disease prevalence, treatment guidelines, and tolerance to oral iron supplements. The adult segment accounted for 47.4% of the global market share in 2024, emerging as the dominant category. This leadership has been supported by the high incidence of iron deficiency anemia among adults with chronic kidney disease, inflammatory disorders, cancer, and postpartum conditions. The growing preference for rapid iron repletion and the increasing availability of advanced formulations further reinforced demand within this segment.

The paediatric segment represented a smaller but steadily expanding share, driven by rising screening efforts for nutritional deficiencies and improvements in the safety profile of IV iron formulations suitable for children. Increased awareness of iron deficiency in premature infants and adolescents further supported the uptake of intravenous therapy when oral supplementation proved insufficient.

The geriatric segment continued to show considerable utilisation due to the higher prevalence of anemia associated with chronic illnesses, malabsorption, and polypharmacy. The need for fast correction of iron levels in elderly patients, particularly those undergoing renal or cardiac treatment, contributed to consistent market growth in this category.

End User Analysis

The market has been categorized based on major end-users, and clear differentiation has been observed in terms of treatment volume, infrastructure, and patient management capabilities. “Hospitals accounted for 48.7% of the global market share in 2024″, positioning them as the dominant end-user segment. This leadership has been supported by the high concentration of complex cases requiring close monitoring, the availability of advanced infusion setups, and the routine management of anemia associated with chronic kidney disease, cancer, and gastrointestinal disorders within hospital systems.

The pediatric end-user segment captured a moderate share, driven by the rising prevalence of iron deficiency among infants, children, and adolescents. Increased referrals to specialized pediatric units for controlled IV iron administration and improved clinical protocols contributed to segment expansion.

The geriatric end-user segment demonstrated sustained growth, supported by the high burden of age-related anemia, chronic diseases, and malabsorption disorders in older adults. Demand within this segment has been supported by the need for rapid iron restoration and the preference for supervised settings to manage comorbidities. Together, these segments contributed to the structured and diversified utilisation of IV iron therapies across healthcare facilities.

Key Market Segments

By Product Type

- Ferric carboxymaltose

- Iron sucrose

- Iron dextran

- Iron derisomaltose

- Sodium ferric gluconate

- Others

By Application

- Chronic kidney disease (CKD)

- Inflammatory bowel disease (IBD)

- Cancer- and chemotherapy-induced anemia

- Obstetrics & gynaecology

- Iron deficiency with heart failure

- Others

By Patient Type

- Adult

- Pediatric

- Geriatric

By End-User

- Hospitals

- Ambulatory care

- Homecare settings

- Specialty centers

- Others

Driving Factors

The increasing global burden of iron deficiency anemia (IDA), particularly among patients with chronic diseases such as Chronic Kidney Disease (CKD), cancer, and inflammatory disorders, constitutes a principal driver for the intravenous iron drugs market. Oral iron supplementation often proves inadequate in such cases, especially when malabsorption, gastrointestinal intolerance, or rapid correction of iron stores is needed. Intravenous (IV) iron therapy offers a more direct and efficient route for replenishing iron stores and raising hemoglobin levels.

Clinical evidence supports this. For instance, IV iron sucrose has been shown to be safe and effective in raising hemoglobin for patients with iron-deficiency anemia. In addition, a meta-analysis concluded that IV iron therapy significantly reduces the need for allogeneic red blood cell transfusion, an important benefit in patients with severe anemia or those undergoing surgery or chronic therapy.

Consequently, as the prevalence of conditions leading to iron deficiency continues to rise including CKD, cancer, and chronic inflammatory diseases demand for IV iron formulations is expected to grow. This drives adoption in hospitals, dialysis centers, and oncology clinics where rapid and reliable iron repletion is often required.

Trending Factors

A salient trend in the intravenous iron drugs market is the increasing adoption of newer, improved IV iron formulations that offer greater safety, higher dosing flexibility, and convenience relative to older preparations. Clinical practice guidelines and growing evidence encourage use of such formulations especially in patients for whom oral iron therapy is insufficient or contraindicated.

Specifically, modern formulations such as Iron Sucrose are widely used in patients with CKD undergoing dialysis, since they allow relatively frequent administration (e.g., weekly infusions) and have demonstrated favorable safety and efficacy profiles.

Further, IV iron is becoming a standard component of anemia management protocols in oncology (for chemotherapy-induced anemia) and in other chronic disease settings where oral iron is not optimal.

The shift toward more proactive iron repletion (rather than episodic correction) is supported by growing recognition of long-term risks associated with untreated or sub-optimally treated iron deficiency. This has encouraged broader acceptance of IV iron therapy across diverse patient populations a trend that is expected to support market expansion.

Restraining Factors

Despite the clinical advantages, the use of intravenous iron drugs is constrained by safety concerns and regulatory scrutiny. Historically, certain IV iron formulations have been associated with adverse reactions including hypersensitivity, infusion reactions, and risk of iron overload when dosing is not appropriately controlled.

For example, in the context of pregnancy, some guidelines continue to favour intramuscular or oral iron over IV therapy for moderate anemia, citing uncertainty around safety of IV iron in that population.

Moreover, long-term or indiscriminate iron infusion in patients with renal disease or on dialysis has been linked to haemosiderosis (iron overload in organs such as the liver), especially when MRI-based liver iron quantification demonstrated elevated iron accumulation.

These safety concerns necessitate careful patient selection, dosing protocols, and monitoring, which in turn may limit widespread adoption particularly in regions with weak healthcare infrastructure or low monitoring capacity.

Thus, regulatory caution and the need for rigorous pharmacovigilance represent a significant restraint on the broader expansion of the IV iron drugs market.

Opportunity

A significant opportunity for growth lies in expanding use of intravenous iron therapy in underserved populations and clinical settings where oral iron is inadequate or poorly tolerated including patients with chronic diseases (CKD, cancer, inflammatory diseases), pregnant women with moderate to severe iron deficiency anemia, and others with malabsorption or intolerance to oral iron. As diagnostic screening and awareness improve globally, the identified treatment gap is likely to widen, creating greater demand for effective IV iron solutions.

Further, ongoing research and development of novel IV iron formulations with improved safety profiles, better tolerability, and optimized pharmacokinetics can broaden the applicability and acceptance of IV iron therapy. Advances such as high-dose, low-frequency iron infusions or newer iron complexes may enhance patient convenience and adherence, especially in resource-limited settings.

Additionally, public health efforts and government or institutional guidelines supporting proactive management of iron deficiency and anemia in high-risk groups could stimulate demand. For instance, as prenatal care, CKD management, and oncology supportive care become more accessible globally, IV iron therapy may gain traction as a preferred approach.

Therefore, expansion into new therapeutic segments and geographies combined with improved formulations and growing clinical awareness presents a substantial opportunity for the intravenous iron drugs market.

If desired, I can also supply recent regulatory updates and clinical guideline influence on the IV iron drugs market (with references to WHO or national health-authority guidelines) to illustrate how policy drives adoption. Do you want me to prepare that for you?

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 45.4% share and holds US$ 1.5 Billion market value for the year. The region continued to lead due to strong clinical adoption, advanced healthcare systems, and rising awareness of iron deficiency disorders. Demand growth was supported by broad access to specialty treatments and well-established reimbursement structures. The overall environment created a favourable setting for the expansion of intravenous iron therapies.

The growth of the market in North America was driven by a high prevalence of chronic kidney disease, anemia associated with chronic diseases, and gastrointestinal disorders. These conditions increased the need for parenteral iron administration. Clinical preference for rapid iron repletion also supported the uptake of advanced intravenous formulations.

The presence of specialized healthcare facilities improved the rate of diagnosis and treatment. A well-developed hospital network ensured strong product accessibility. Treatment guidelines encouraged the use of intravenous iron when oral iron was ineffective or poorly tolerated. This reinforced the shift toward injectable iron therapies in both outpatient and hospital settings.

Patient awareness programs increased screening rates for iron deficiency. This supported early intervention and strengthened market demand. The adoption of modern diagnostic tools improved clinical decision-making, which also supported therapy uptake.

Key Factors Strengthening Dominance

Favourable reimbursement policies reduced patient costs and encouraged therapy acceptance. High healthcare expenditure enabled wider use of premium formulations. Pharmaceutical innovation remained strong in the region. This promoted the availability of safer and more efficient iron complexes.

The region also benefited from continuous medical education and strong clinician engagement. These activities increased confidence in new intravenous iron products. Broader insurance coverage further expanded the eligible patient base.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The competitive landscape of intravenous iron drugs is characterized by a concentrated group of global manufacturers and specialized pharmaceutical developers. Competition has been shaped by continuous innovation in formulations with improved safety profiles, particularly those designed to reduce hypersensitivity risks and shorten infusion times. Strong market positioning has been achieved through extensive clinical trial data, expanded regulatory approvals, and well-established distribution networks.

Focus on lifecycle management strategies, including patent protection and incremental product enhancements, has strengthened market presence. Strategic collaborations with healthcare providers and hospital networks have supported wider adoption in both chronic kidney disease and obstetric care segments.

Pricing strategies remain closely influenced by reimbursement policies, while emerging participants are investing in differentiated delivery systems to gain share. Overall, market dominance is maintained by firms with robust R&D capabilities, global outreach, and diversified portfolios across parenteral hematology therapies.

Market Key Players

- Vifor Pharma Management Ltd.

- Pharmacosmos A/S

- AMAG Pharmaceuticals, Inc.

- Sanofi S.A.

- Daiichi Sankyo Company, Ltd.

- AbbVie Inc.

- Fresenius Kabi AG

- Baxter International Inc.

- Zydus Group

- Rockwell Medical, Inc.

- Viatris

- Emcure Pharmaceuticals Ltd.

- Nichi-Iko Pharmaceutical Co. Ltd.

- Lupin Ltd.

Recent Developments

- Vifor Pharma Management Ltd.: In March 2024, its IV iron product Ferinject was approved by Health Canada for treatment of iron-deficiency anemia in adult and pediatric patients and for iron deficiency in adults with heart failure.

- AMAG Pharmaceuticals, Inc: As noted in industry reporting (2025), AMAG remains listed among key intravenous iron drugs market players, reflecting its continuing stake in IV & oral iron therapy market despite its earlier acquisition.

- Sanofi S.A.: Recent market analyses (2024) include Sanofi among the significant participants in the global IV & oral iron drugs market, underscoring its ongoing involvement in iron therapy supply and regional market penetration.

- Rockwell Medical, Inc.: The 2025 global IV & oral iron drugs market report includes Rockwell Medical in its vendor list, indicating its active participation in the intravenous iron segment amidst increasing demand for renal-anemia treatments.

Report Scope

Report Features Description Market Value (2024) US$ 3.2 Billion Forecast Revenue (2034) US$ 7.4 Billion CAGR (2025-2034) 8.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Ferric carboxymaltose, Iron sucrose, Iron dextran, Iron derisomaltose, Sodium ferric gluconate, Others) By Application (Chronic kidney disease (CKD), Inflammatory bowel disease (IBD), Cancer- and chemotherapy-induced anemia, Obstetrics & gynaecology, Iron deficiency with heart failure, Others, By Patient Type (Adult, Pediatric, Geriatric) By End-User (Hospitals, Ambulatory care, Homecare settings, Specialty centers, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Vifor Pharma Management Ltd., Pharmacosmos A/S, AMAG Pharmaceuticals, Inc., Sanofi S.A., Daiichi Sankyo Company, Ltd., AbbVie Inc., Fresenius Kabi AG, Baxter International Inc., Zydus Group, Rockwell Medical, Inc., Viatris, Emcure Pharmaceuticals Ltd., Nichi-Iko Pharmaceutical Co. Ltd., Lupin Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Intravenous Iron Drugs MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Intravenous Iron Drugs MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Vifor Pharma Management Ltd.

- Pharmacosmos A/S

- AMAG Pharmaceuticals, Inc.

- Sanofi S.A.

- Daiichi Sankyo Company, Ltd.

- AbbVie Inc.

- Fresenius Kabi AG

- Baxter International Inc.

- Zydus Group

- Rockwell Medical, Inc.

- Viatris

- Emcure Pharmaceuticals Ltd.

- Nichi-Iko Pharmaceutical Co. Ltd.

- Lupin Ltd.