Global Inorganic Coagulants Market by Product Type (Aluminum Sulphate, Polyaluminium Chloride, Ferric Chloride Ferrous Sulphate, & Other Types), By Application (Papermaking, sewage system, Municipal water treatment, & Industry water treatment), and by Region – Global Forecast to 2030

- Published date: Feb 2024

- Report ID: 69810

- Number of Pages: 265

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

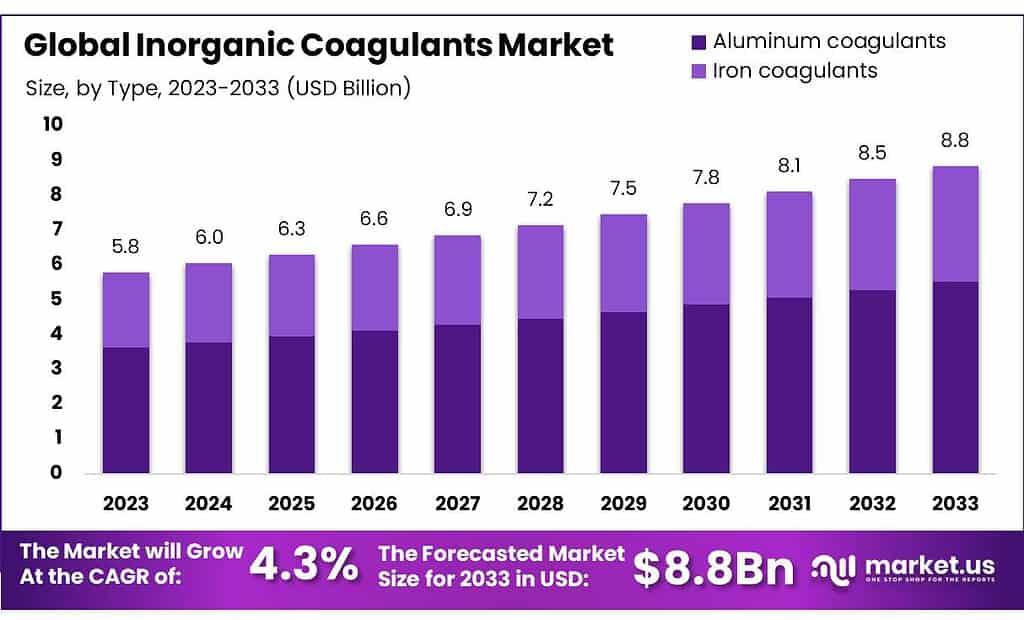

The global Inorganic Coagulants market size is expected to be worth around USD 8.8 billion by 2033, from USD 5.8 billion in 2023, growing at a CAGR of 4.3% during the forecast period from 2023 to 2033.

Inorganic coagulants refer to chemical substances, typically metal salts, used in water and wastewater treatment processes. These coagulants play a crucial role in destabilizing and aggregating particles suspended in water, facilitating their removal through precipitation or sedimentation.

Common inorganic coagulants include aluminum sulfate (alum), ferric chloride, and poly aluminum chloride. Their application aids in the clarification and purification of water by promoting the formation of larger, settleable flocs that can be easily separated, leading to improved water quality and reduced turbidity.

Key Takeaways

- Market Growth: The Inorganic Coagulants market is set to grow at a CAGR of 4.3%, reaching USD 8.8 billion by 2033 from USD 5.8 billion in 2023.

- Aluminum Coagulants Dominance: Aluminum coagulants, including sulfate and chloride, held over 62.4% market share in 2023, favored for water and wastewater treatment.

- Liquid Form Preference: Liquid inorganic coagulants secured 56.2% market share in 2023, known for ease of use and efficient water treatment application.

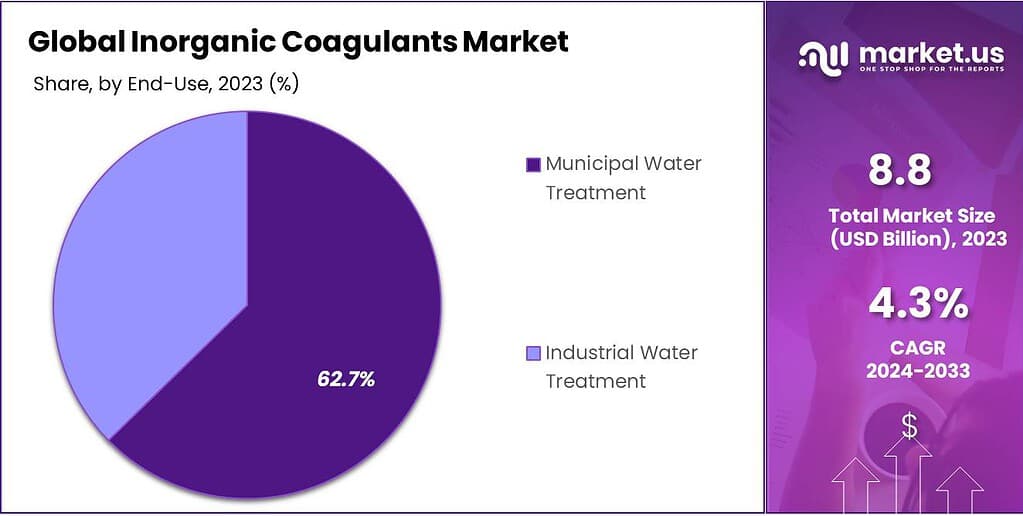

- Municipal Water Treatment Leadership: Municipal Water Treatment claimed a dominant 62.7% market share in 2023, showcasing inorganic coagulants’ crucial role in ensuring clean drinking water.

By Type

In 2023, Aluminum coagulants asserted dominance, securing over 62.4% of the market share in the inorganic coagulants segment. This category encompasses various crucial subtypes such as Aluminum sulfate, Polyaluminum sulfate, Aluminum chloride, Polyaluminum chloride, Aluminum chlorohydrate, and Sodium aluminate. Aluminum coagulants play a pivotal role in water and wastewater treatment, aiding in the effective removal of impurities through coagulation processes.

Their widespread usage is attributed to their efficiency in destabilizing particles and facilitating the formation of larger flocs for improved water quality. Among these, Aluminum sulfate and polyaluminum chloride stand out for their significant contributions to the market, offering versatility and effectiveness in water treatment applications.

By Form

In 2023, Liquid emerged as the dominant form in the inorganic coagulants market, commanding over 56.2% of the market share. The liquid form of inorganic coagulants, known for its ease of use and efficient application, is extensively preferred in water treatment processes.

Its popularity is attributed to the convenience it offers in handling and dosing, contributing to the effectiveness of coagulation for the removal of impurities from water and wastewater. The liquid form provides flexibility in application across diverse treatment scenarios, making it a key choice for industries and municipalities seeking reliable and efficient water purification solutions.

End-Use

In 2023, Municipal Water Treatment secured a dominant market position, commanding over 62.7% of the inorganic coagulants segment. This reflects the critical role of inorganic coagulants in addressing water treatment needs for municipalities. The efficient and reliable coagulation properties of inorganic coagulants play a pivotal role in the clarification and purification of water for public consumption.

The Municipal Water Treatment sector relies significantly on inorganic coagulants to enhance the removal of impurities, ensuring the delivery of clean and safe drinking water to communities. Beyond municipal applications, inorganic coagulants also find substantial usage in Industrial Water Treatment, Textile, Food & Beverage, Pulp & Paper, Chemicals & Fertilizers, Oil & Gas, Mining & Mineral Processing, and various other sectors, contributing to diverse water treatment requirements across industries.

Key Маrkеt Ѕеgmеntѕ

By Type

- Aluminum coagulants

- Aluminum sulfate

- Polyaluminum sulfate

- Aluminum chloride

- Polyaluminum chloride

- Aluminum chlorohydrate

- Sodium aluminate

- Iron coagulants

- Ferric chloride

- Ferrous chloride

- Ferric sulfate

- Ferrous sulfate

- Ferric chloro sulfate

By Form

- Liquid

- Dry

End-Use

- Municipal Water Treatment

- Industrial Water Treatment

- Textile

- Food & Beverage

- Pulp & Paper

- Chemicals & Fertilizers

- Oil & Gas

- Mining & Mineral Processing

- Others

Market Drivers

Increasing Demand for Water Treatment:

The primary driver propelling the rapid growth of the inorganic coagulants market is the escalating demand for water treatment solutions across various industries and municipal sectors. With growing concerns about water pollution and the need for efficient purification, inorganic coagulants, such as aluminum sulfate and poly aluminum chloride, play a pivotal role in the removal of suspended particles and impurities. The rising global population and industrial activities contribute to heightened water contamination, making inorganic coagulants a critical component in addressing water treatment challenges.

Stringent Regulatory Standards:

Stringent environmental regulations and water quality standards imposed by regulatory bodies worldwide act as a catalyst for the adoption of inorganic coagulants. Municipalities and industries are compelled to adhere to strict guidelines regarding the quality of discharged water. Inorganic coagulants offer an effective and reliable solution to meet these standards by aiding in the coagulation and flocculation processes, ensuring compliance with environmental norms. This regulatory push further stimulates the demand for rapid inorganic coagulants.

Market Restraints

High Initial Investment and Operating Costs:

One of the primary challenges restraining the rapid growth of the inorganic coagulants market is the substantial upfront investment required for manufacturing facilities and specialized equipment. The production of inorganic coagulants involves intricate processes, demanding sophisticated technologies that contribute to significant initial costs. Moreover, operating expenses, including maintenance and skilled personnel, pose financial challenges, particularly for small and medium-sized enterprises (SMEs). This high entry barrier may limit the market participation of smaller players, hindering the overall market expansion.

Technical Limitations and Material Challenges:

Despite the effectiveness of inorganic coagulants in water treatment, the market faces restraints related to technical limitations and material challenges. The current range of materials that can be effectively treated by inorganic coagulants is subject to restrictions. Ongoing research endeavors aim to broaden the scope of coagulant applications, but limitations persist. Factors such as the durability of coagulants under diverse conditions and compatibility with different chemicals present hurdles to widespread adoption. Overcoming these technical limitations is essential for the broader acceptance of inorganic coagulants in various industries and applications.

Market Opportunities

Expansion into Emerging Markets:

The rapid inorganic coagulants market presents significant opportunities for expansion into emerging markets beyond traditional applications. As developing regions witness increased industrialization and urbanization, the demand for effective water treatment solutions rises. Manufacturers can capitalize on these opportunities by introducing and promoting their inorganic coagulant products in emerging markets, addressing the growing need for water purification infrastructure.

Technological Advancements and Automation:

An exciting opportunity lies in the integration of technological advancements and automation in the production and application of inorganic coagulants. Automation can enhance the precision and efficiency of coagulant dosing, ensuring optimal performance in water treatment processes. Continuous research in technology can lead to the development of smart coagulation systems that adapt to real-time water quality variations, providing a futuristic solution for improved water treatment efficiency.

Market Trends

Innovations in Coagulant Formulations:

A prominent trend in the rapid inorganic coagulants market is the continuous innovation in coagulant formulations to enhance efficiency and address specific water treatment challenges. Manufacturers are investing in research and development to create advanced coagulant formulations that exhibit superior coagulation properties, stability, and adaptability to diverse water treatment scenarios. These innovations cater to the evolving needs of industries and municipalities seeking optimized coagulant solutions for efficient water purification.

Shift towards Sustainable Water Treatment Practices:

The market is witnessing a noticeable trend towards sustainable water treatment practices, with a focus on minimizing the environmental impact of coagulant usage. Manufacturers are developing eco-friendly inorganic coagulants that reduce the generation of sludge and exhibit enhanced biodegradability. This sustainable approach aligns with global initiatives for environmental conservation and resonates with end-users seeking greener alternatives for water treatment processes.

Geopolitical and Recession Impact Analysis

Geopolitical Impact:

- Trade Import and Tariff Restrictions: Strained international relations may result in tariffs and import restrictions on inorganic coagulants. This could disrupt the supply chain, elevate production costs, and subsequently increase prices for consumers.

- Supply Chain Disruptions: Political instability in major inorganic coagulant-producing regions may disrupt the global supply chain. Interruptions in raw material flow or manufacturing processes could cause production delays, impacting the availability of inorganic coagulant products.

- Market Access Challenges: Geopolitical tensions can create barriers for inorganic coagulant manufacturers seeking entry into new markets. Restrictions on market access or unfavorable trade policies might hinder expansion efforts, limiting growth prospects in specific regions.

- Currency Exchange Rate Fluctuations: Geopolitical events can induce fluctuations in currency exchange rates, impacting the cost of inorganic coagulant raw materials. These shifts may affect the competitiveness of inorganic coagulant exports globally, influencing both domestic sales and international trade dynamics.

Recession Impact:

- Reduced Demand in End-User Industries: Economic downturns could lead to reduced demand for inorganic coagulants in industries like municipal water treatment and pulp & paper. Declines in construction and industrial activities may affect the demand for coagulants used in water treatment and manufacturing processes.

- Constraints on Industrial Spending: During recessions, industries may limit spending, impacting projects involving inorganic coagulants. Cutbacks in municipal water treatment or industrial projects might result in delayed or reduced demand for coagulants in various applications.

- Cost-Reduction Strategies: Inorganic coagulant manufacturers might implement cost-cutting measures in response to economic downturns. Workforce reductions or scaled-down production could impact the availability and variety of inorganic coagulant products in the market.

- Emphasis on Innovation: Recessions may drive innovation within the inorganic coagulants market. Manufacturers may focus on developing more cost-effective and sustainable coagulant solutions to align with changing preferences. This innovation drive may lead to the introduction of novel coagulant formulations or applications to remain competitive in a challenging market environment.

Regional Analysis

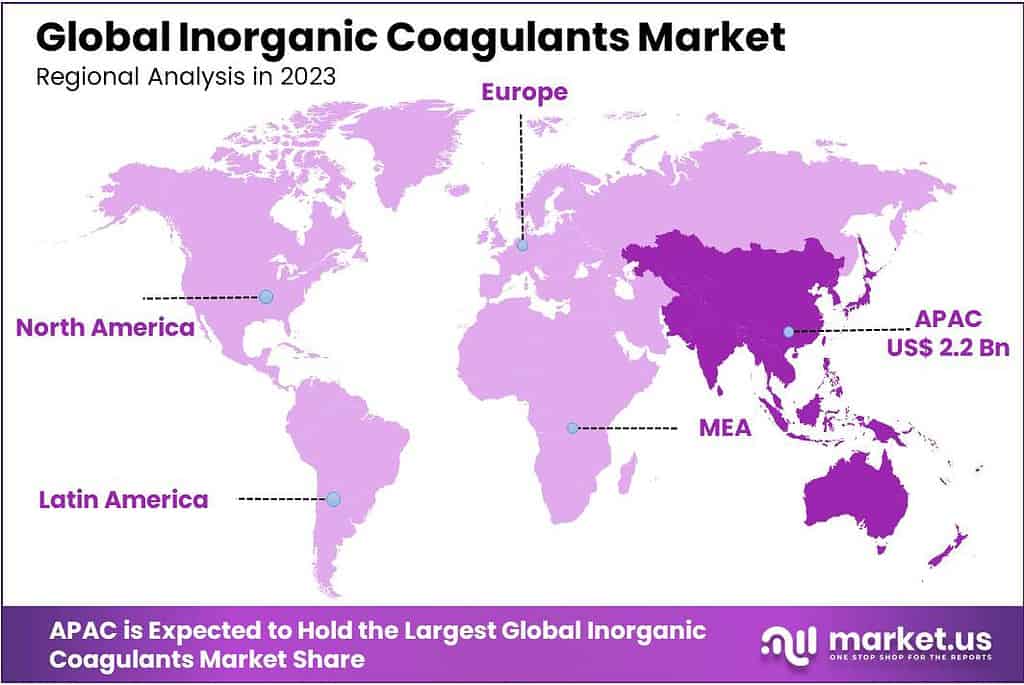

In 2023, the Asia-Pacific (APAC) region emerged as a dominant force in the Inorganic Coagulants Market, securing a substantial market share of over 38.5%. The market’s valuation reached USD 2.03 billion, indicating significant growth driven by the region’s robust demand for inorganic coagulants.

This dominance underscores the considerable interest and utilization of inorganic coagulants across diverse industries in the APAC region. The thriving industrial sector, especially in segments like water treatment, textiles, and chemicals, played a pivotal role in propelling the notable demand for inorganic coagulants, contributing significantly to the market’s expansion.

The region’s economic prosperity, coupled with extensive infrastructural development and a surge in manufacturing activities, propelled the consumption of inorganic coagulants. Moreover, the rising population and the expanding middle-class demographic further fueled the demand for water treatment, industrial processes, and chemical applications—all of which extensively incorporate inorganic coagulants in their operational processes.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

In the competitive landscape of the Inorganic Coagulants Market, key players play pivotal roles in driving innovation, ensuring global reach, and maintaining industry leadership. One such major player is Kemira Oyj, renowned for its substantial market share and diversified product portfolio.

Kemira’s commitment to continuous innovation is evident in its development of advanced inorganic coagulants tailored for diverse industrial applications. Strategic collaborations with water treatment facilities and industrial manufacturers further enhance Kemira’s influence in the market.

Ecolab Inc., another key player, stands out as an industry leader, providing comprehensive water and process solutions. Its global presence and emphasis on sustainable coagulant practices align with the industry’s growing focus on eco-friendly products.

BASF SE, a chemical giant, holds a strong position with its diversified product portfolio catering to various sectors, including chemicals, textiles, and water treatment. The company’s continuous investment in research and development ensures a steady stream of innovative coagulant products.

Top Key Рlауеrѕ

- BASF SE

- Kemira OYJ

- Solenis, LLC

- Ecolab, Inc.

- SNF S.A.S.

- Danaher Corporation

- Evonik Industries AG

- Suez SA

- Nouryon

- Lonza Group Ltd

- Kurita Water Industries, Ltd.

- Huntsman Corporation

- GEO Specialty Chemicals, Inc.

- Ixom Operations Pty., Ltd.

- Feralco AB

Recent Developments

2023 BASF SE: Announced partnership with Kurita Water Industries for joint development of water treatment solutions.

Solenis, LLC: Focused on digitalization and data-driven solutions for water treatment.

Report Scope

Report Features Description Market Value (2023) USD 5.8 Bn Forecast Revenue (2033) USD 8.8 Bn CAGR (2024-2033) 4.3% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Derivative(Acrylic Esters, Butyl Acrylate, Ethyl Acrylate, Methyl Acrylate, 2-Ethylhexyl Acrylate, Others), Acrylic Polymer(Superabsorbent Polymers, Water Treatment Polymers, Others, Others), By Application(Paint and Coatings, Adhesives & Sealants, Detergents, Textiles, Diapers and Feminine Hygien Product, Water Treatment, Personal Care Products, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape BASF SE, Kemira OYJ, Solenis, LLC, Ecolab, Inc., SNF S.A.S., Danaher Corporation, Evonik Industries AG, Suez SA, Nouryon, Lonza Group Ltd, Kurita Water Industries, Ltd., Huntsman Corporation, GEO Specialty Chemicals, Inc., Ixom Operations Pty., Ltd., Feralco AB Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Inorganic Coagulants market?Inorganic Coagulants market size is expected to be worth around USD 8.8 billion by 2033, from USD 5.8 billion in 2023

What is the Inorganic Coagulants Market growth?The global Inorganic Coagulants Market Market is expected to grow at a compound annual growth rate of 4.3%. From 2024 to 2033.Who are the key players in the Inorganic Coagulants Market?BASF SE, Kemira OYJ, Solenis, LLC, Ecolab, Inc., SNF S.A.S., Danaher Corporation, Evonik Industries AG, Suez SA, Nouryon, Lonza Group Ltd, Kurita Water Industries, Ltd., Huntsman Corporation, GEO Specialty Chemicals, Inc., Ixom Operations Pty., Ltd., Feralco AB

Inorganic Coagulants MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample

Inorganic Coagulants MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- Kemira OYJ

- Solenis, LLC

- Ecolab, Inc.

- SNF S.A.S.

- Danaher Corporation

- Evonik Industries AG

- Suez SA

- Nouryon

- Lonza Group Ltd

- Kurita Water Industries, Ltd.

- Huntsman Corporation

- GEO Specialty Chemicals, Inc.

- Ixom Operations Pty., Ltd.

- Feralco AB