Global Inductor Market By Inductance (Fixed Inductors, Variable Inductors), By Type (Film Type, Multilayered, Wire Wound, Molded), By Core Type (Air Core, Ferromagnetic/Ferrite Core, Iron Core), By Shield Type (Shielded, Unshielded), By Mounting Technique(Surface Mount, Through Hole), By End-user(Automotive, Industrial, RF & Telecommunication, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 167866

- Number of Pages: 269

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Main Factors Driving Adoption

- By Inductance: Fixed Inductors

- By Type: Multilayered

- By Core Type: Ferromagnetic/Ferrite Core

- By Shield Type: Shielded

- By Mounting Technique: Surface Mount

- By End-User: Consumer Electronics

- Emerging Trends

- Growth Factors

- Benefits

- Usage

- Key Market Segments

- Regional Analysis

- Driver

- Restraint

- Opportunity

- Challenge

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

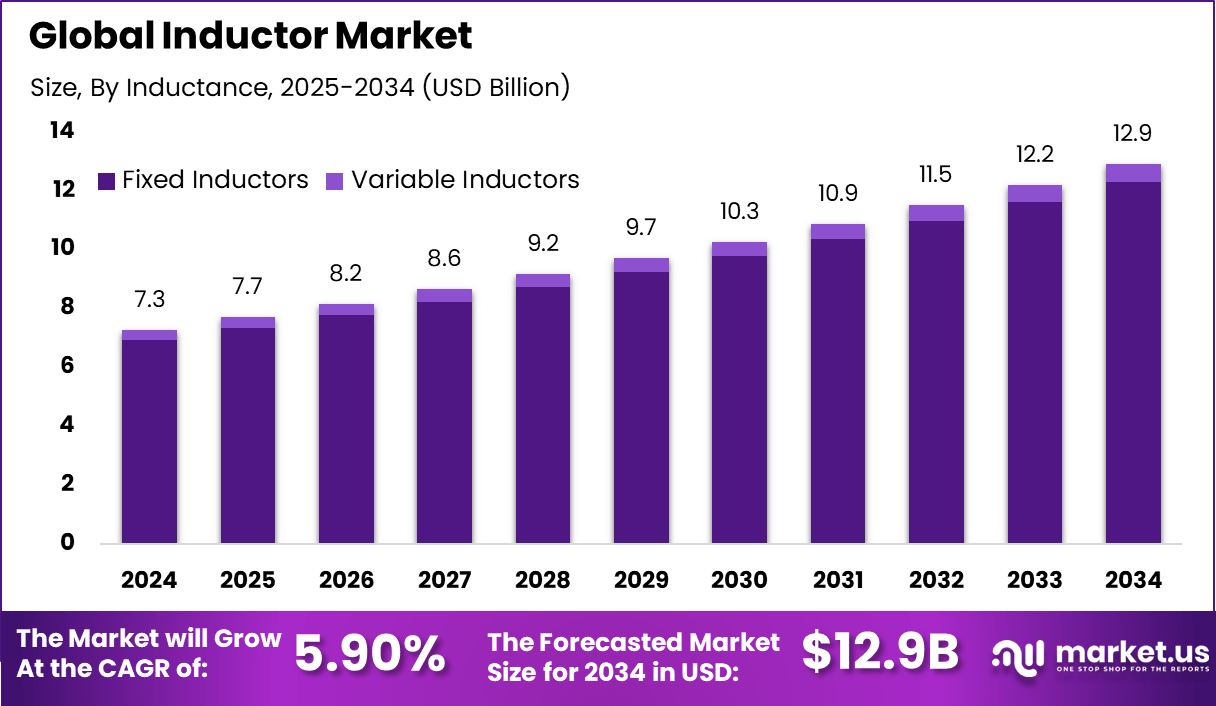

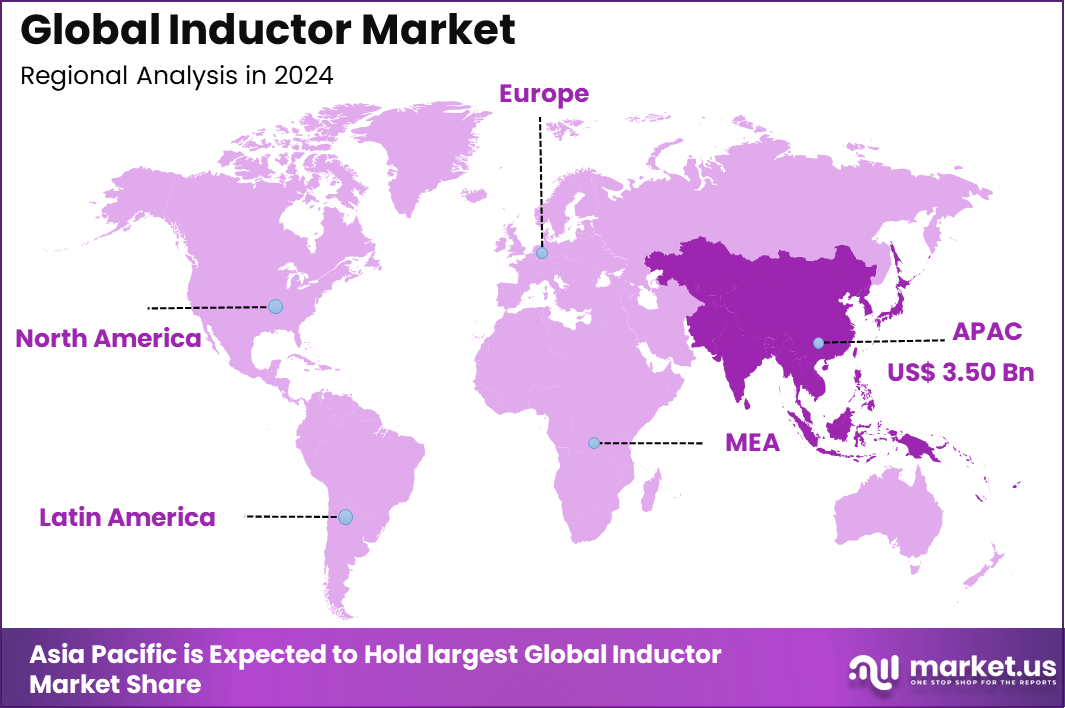

The Global Inductor Market generated USD 7.3 billion in 2024 and is predicted to register growth from USD 7.7 billion in 2025 to about USD 12.9 billion by 2034, recording a CAGR of 5.90% throughout the forecast span. In 2024, Asia Pacific held a dominan market position, capturing more than a 48.2% share, holding USD 3.50 Billion revenue.

The inductor market is experiencing steady growth driven by the rising demand for energy-efficient and compact electronic components. Inductors are crucial in power regulation, signal filtering, and energy storage across various applications, especially in consumer electronics, automotive, telecommunications, and industrial sectors.

With the rise of electric vehicles (EVs), 5G technology, and IoT devices, the requirement for high-performance inductors has become indispensable. The market growth is further fueled by technological advancements such as miniaturization and the integration of advanced materials allowing for smaller and more efficient inductors without compromising performance.

Top driving factors include the rapid electrification of automotive fleets, increasing adoption of consumer electronics, and expanding telecommunications infrastructure. The rise in electric vehicle sales, growing use of smart devices, and deployment of 5G networks have all significantly propelled inductor demand. The trend towards miniaturized devices necessitates inductors that support compact and high-frequency circuit designs, further boosting their adoption.

The increasing adoption of technologies such as electric vehicles, 5G connectivity, IoT devices, and smart home systems are key reasons for expanding inductor usage. EVs rely on inductors for managing power conversion and battery efficiency, while 5G technology demands inductors that ensure high-speed signal processing and electromagnetic interference control. IoT expansion and industrial automation require inductors that maintain stable power delivery and signal filtering in sensor networks and embedded systems.

Top Market Takeaways

- By inductance, fixed inductors dominate the market with 95.2% share. These are preferred for their reliability and stable inductance in consumer electronics and automotive applications.

- By type, multilayered inductors hold 41.6% share, driven by their compact size, superior inductance, and suitability for integration with surface-mount technology in advanced communication and consumer devices.

- By core type, ferromagnetic/ferrite cores dominate with 66.8% share, valued for high magnetic permeability, efficiency, and low losses in power supplies and RF circuits.

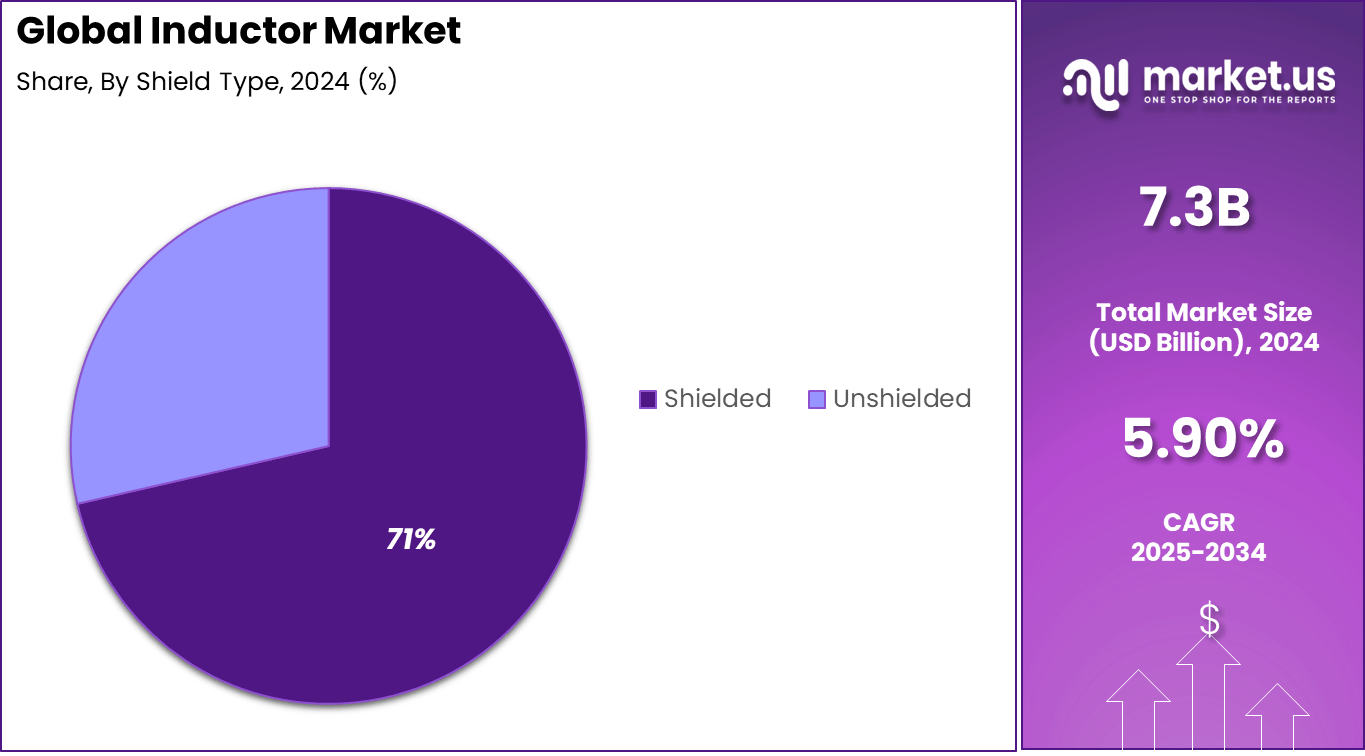

- By shield type, shielded inductors account for 71.4% share, driven by rising EMI concerns in compact electronics such as smartphones and automotive ECUs requiring electromagnetic interference suppression.

- By mounting technique, surface mount technology (SMT) dominates with 85.2% share, favored for compact PCB design, automated manufacturing, and reliability.

- By end-user, consumer electronics lead with 30.3% share, fueled by smartphone, tablet, wearable, and smart home device growth accelerating inductor demand for power regulation and signal filtering.

- Regionally, Asia Pacific holds about 48.2% of the market.

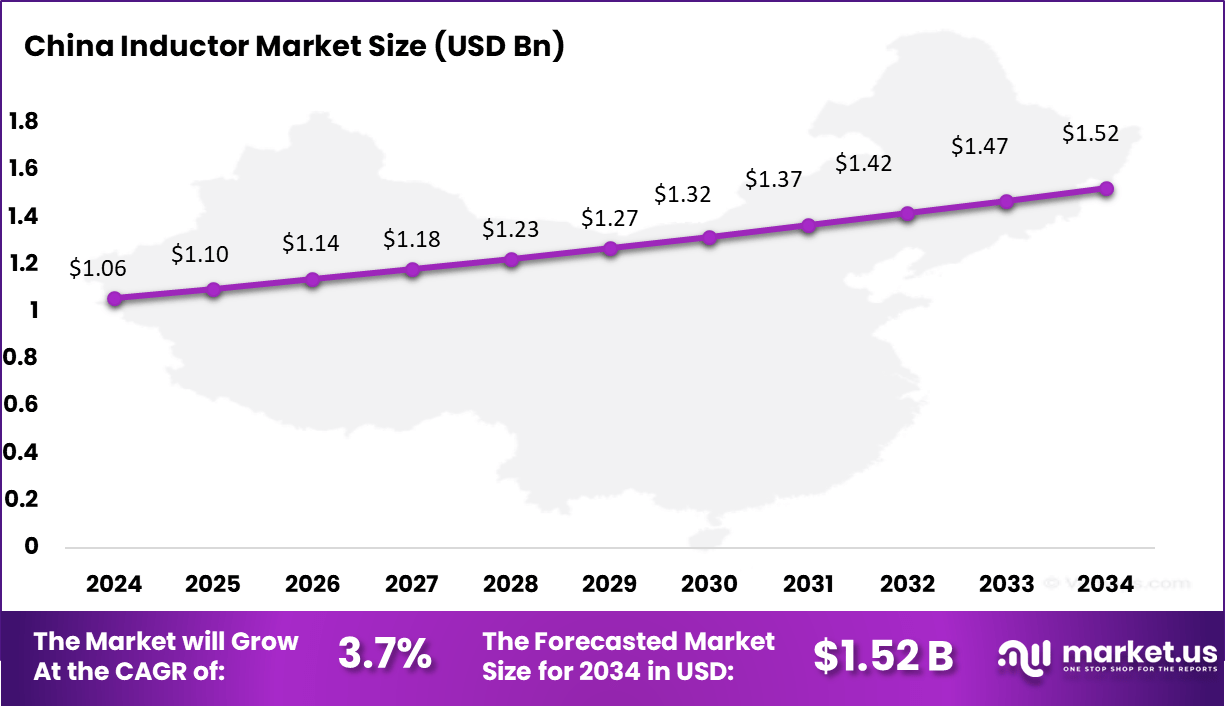

- The China inductor market size is approximately USD 1.06 billion in 2025.

- The market is growing at a CAGR of around 3.7%, challenged by material and supply chain dynamics but supported by consumer demand, industrialization, and the growth of EV and 5G deployments.

Main Factors Driving Adoption

- Energy storage: Inductors store energy in magnetic fields, essential for power supply stabilization and smooth current flow in circuits.

- Noise filtering: They help filter out high-frequency noise in electronic signals, ensuring signal clarity and device performance.

- Miniaturization support: Advances enable smaller inductors that fit into compact devices without compromising performance, meeting the demand for portable electronics.

- Durability and reliability: Inductors provide consistent performance under various environmental stresses, important for automotive, aerospace, and industrial applications.

- Versatility: They serve in diverse applications, from power supplies and filters to sensors and transformers, adapting to different industry needs.

By Inductance: Fixed Inductors

Fixed inductors dominate the market with a commanding 95.2% share, confirming their fundamental role in electrical and electronic circuits. Their consistent inductance values provide stability, making them indispensable in power management, noise suppression, and signal filtering.

The high demand comes from their extensive application across various industries such as consumer electronics, automotive systems, and telecommunications, where reliable and predictable performance is critical. The preference for fixed inductors is also driven by their simple design and ease of integration into complex circuit boards.

Unlike variable inductors, fixed inductors offer greater mechanical robustness and less susceptibility to performance variation, which is vital for mass production environments. Their broad use in devices ranging from smartphones to industrial power supplies ensures they remain the backbone of the global inductor market.

By Type: Multilayered

Multilayer inductors account for about 41.6% of the market, reflecting strong growth in compact and high-frequency electronic applications. These inductors feature multiple layers of coils and materials stacked to maximize inductance within a small footprint.

Their ability to operate efficiently at high frequencies makes them essential for consumer electronics, telecommunications, and automotive sectors, especially as devices continue to shrink in size without sacrificing performance. The multilayer design enhances inductance density and thermal management, supporting modern miniaturization trends.

Innovations such as ceramic or ferrite cores in multilayer inductors further improve durability and magnetic efficiency. As electronics demand more compact and energy-efficient components, multilayer inductors offer a strategic advantage in integrating power and signal management seamlessly in tight circuit spaces.

By Core Type: Ferromagnetic/Ferrite Core

Ferromagnetic or ferrite core inductors represent the largest segment at around 66.8%, thanks to their excellent magnetic properties and cost-effectiveness. Ferrite cores provide high magnetic permeability, which enables steady inductance and low core losses, crucial for power supplies, RF circuits, and signal processing modules.

Their lightweight and compact form contribute to widespread application in consumer devices and telecommunications infrastructure. The dominance of ferrite cores is due to their ability to perform well across a wide frequency range and temperature stability.

They help reduce electromagnetic interference and support energy-efficient operation, which is increasingly demanded in electric and hybrid vehicles, portable electronics, and industrial controls. Innovations in ferrite material formulations continue to boost performance while keeping production costs competitive.

By Shield Type: Shielded

Shielded inductors lead with a 71.4% share, driven by the critical need to minimize electromagnetic interference (EMI) in dense electronic assemblies. The magnetic shielding around the core reduces noise emissions and signal distortion, ensuring device reliability in smartphones, automotive ECUs, and industrial control systems.

Shielded inductors are especially favored in environments with strict EMI compliance requirements, supporting high-density circuit boards and sensitive signal processing. The market demand for shielded inductors is reinforced by the trend toward smaller, feature-rich devices where space is limited, and performance cannot be compromised.

Shielded inductors prevent crosstalk between components and improve overall circuit stability. While unshielded types grow in more cost-sensitive applications, shielded inductors maintain dominance in high-performance and regulated sectors.

By Mounting Technique: Surface Mount

Surface mount technology (SMT) dominates with 85.2% of the market, reflecting its efficiency in high-volume, automated production. SMT inductors enable smaller and lighter printed circuit boards (PCBs), allowing more components to fit within compact device designs.

This technique reduces assembly time and cost by eliminating the need for drilled holes, which also improves manufacturing yields in consumer electronics, automotive modules, and industrial electronics. The miniaturization of modern electronics heavily depends on surface mount inductors for their reduced size and enhanced thermal management.

This mounting method supports the trend for portable and wearable devices, where every millimeter counts. Despite the advantages of SMT components, through-hole inductors remain relevant in applications requiring mechanical robustness and vibration resistance, such as aerospace and heavy machinery.

By End-User: Consumer Electronics

Consumer electronics account for 30.3% of inductor market consumption, driven by rapid growth in smartphones, tablets, laptops, wearables, and smart home appliances. Inductors play a crucial role in power regulation, noise suppression, and signal integrity in these devices, enabling efficient and reliable performance.

Consumer demand for smaller, energy-efficient gadgets fuels continuous innovation in inductor miniaturization and enhanced frequency capabilities. The consumer electronics sector’s lead is supported by the adoption of smart and connected devices, increasing reliance on inductors to manage high-speed data and power efficiency.

As technologies like 5G and IoT expand, inductors are critical for ensuring device stability and user experience. This end-user segment is expected to remain a major driver for the inductor market, with ongoing investments in better materials and designs aligned to evolving consumer needs.

Emerging Trends

Key Trends Description Miniaturization and High-Density Designs Increasing demand for smaller, compact inductors suitable for mobile devices and wearables. Integration of AI and Predictive Analytics Use of AI for optimizing inductor performance and predictive maintenance in applications like automotive systems. Expansion of 5G and High-Frequency Inductors Rising deployment of 5G networks driving demand for inductors supporting high-frequency and millimeter-wave bands. Focus on Energy Efficiency Development of inductors with lower core losses and higher power density to improve system efficiency. Adoption of Advanced Materials Utilization of new magnetic core materials and innovative manufacturing processes to enhance performance. Growth Factors

Key Factors Description Growing Demand from Consumer Electronics Surge in smartphones, tablets, wearables, and IoT devices demanding advanced inductors for power management. Rising Electric Vehicle (EV) Production Expansion of EVs and hybrid vehicles driving the need for robust inductors in battery management and power systems. Increasing Deployment in Telecommunication Infrastructure Growth in telecom infrastructure including 5G supports market expansion. Government Initiatives and Investments Policies promoting local manufacturing and R&D boosting inductor production capacity and innovation. Technological Advancements and R&D Ongoing innovation in design and material science facilitating new applications and improved inductor performance. Benefits

- Reduced electronic interference: By filtering out electrical noise, inductors improve device reliability and user experience.

- Cost efficiency: Inductors help prevent circuit damage from voltage spikes, saving on expensive repairs and replacements.

- Enhanced energy efficiency: They optimize power flow and reduce energy loss, supporting longer battery life in portable devices and EVs.

- Scalability: Inductors enable manufacturers to meet diverse market demands efficiently, from consumer electronics to industrial machinery.

- Facilitates innovation: Advanced inductors support cutting-edge technologies like IoT, 5G, and electric vehicles, giving businesses a competitive edge.

Usage

- Tuning circuits in radios and communication devices

- Energy storage and transfer in power supplies and converters

- Noise filtering and electromagnetic interference (EMI) suppression

- Components in electric motors and induction heating systems

- Transformers and relays in various electrical and electronic applications

Key Market Segments

By Inductance

- Fixed Inductors

- Variable Inductors

By Type

- Film Type

- Multilayered

- Wire Wound

- Molded

By Core Type

- Air Core

- Ferromagnetic/Ferrite Core

- Iron Core

By Shield Type

- Shielded

- Unshielded

By Mounting Technique

- Surface Mount

- Through Hole

By End-User

- Automotive

- Industrial

- RF & Telecommunication

- Military & Defense

- Consumer Electronics

- Transmission & Distribution

- Healthcare

- Others

Regional Analysis

Asia Pacific dominated the inductor market with a significant 48.2% share, underpinned by rapid industrial growth and a robust electronics manufacturing base, particularly in countries like China, Japan, South Korea, and India.

The increasing demand for consumer electronics, such as smartphones, tablets, and wearable devices, as well as the growth of the electric vehicle (EV) market and expanding 5G infrastructure, drives the need for advanced inductors in this region. The Asia Pacific market benefits from cost-effective manufacturing, widespread supplier networks, and continuous innovation in miniaturized and high-performance inductors.

China stands out as the largest contributor, with a market value of approximately USD 1.06 billion in 2024. The country’s dominance is fueled by its vast consumer electronics sector, growing automotive industry, and increasing investments in semiconductor manufacturing.

Chinese manufacturers focus on enhancing the quality and efficiency of inductors to meet stringent industry standards. Government initiatives promoting domestic production and technological self-reliance also support market expansion. This strong industrial ecosystem positions China as the key growth engine for the Asia Pacific inductor market, reinforcing the region’s leading role globally.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Rising Demand in Consumer Electronics and Automotive

The inductor market is chiefly driven by growing demand for consumer electronics such as smartphones, tablets, laptops, and wearables. These devices require inductors for signal filtering, power management, and energy storage, pushing manufacturers to develop compact, high-efficiency components.

Additionally, the expanding electric vehicle (EV) market and advanced driver assistance systems in automotive sectors significantly contribute to demand, as inductors help in power regulation and energy efficiency.

Technological advances such as 5G deployment and smart device integration further accelerate the consumption of inductors. The focus on sustainable, energy-efficient solutions also pushes innovation, growing opportunities across multiple industries.

Restraint

Fluctuating Raw Material Prices and Miniaturization Challenges

Growth in the inductor market is restrained by fluctuating prices of raw materials like copper and ferrite, which increase production costs and affect profit margins. The volatile supply chain, impacted by geopolitical tensions and global economic shifts, leads to uncertain pricing environments for manufacturers.

Moreover, the trend towards miniaturization in electronic devices introduces design complexities. Producing tiny inductors with consistent performance and thermal stability demands advanced manufacturing processes, driving up costs and limiting adoption in budget-focused segments.

Opportunity

Expansion in Renewable Energy and Industrial Automation

India and other rapidly developing markets present key opportunities, driven by investment in renewable energy infrastructure and smart grid technologies. Inductors with low core loss and high efficiency are essential for power conversion and storage in solar and wind power systems, fueling demand for advanced inductors.

Industrial automation and IoT adoption also offer growth prospects, as inductors form critical components in sensors, actuators, and power supplies for automated manufacturing. Emerging markets’ government support and environmental initiatives further accelerate these applications, opening new revenue streams for industry players.

Challenge

Intense Market Competition and Lifecycle Pressures

The inductor market faces fierce competition, especially from low-cost manufacturers in Asia, exerting downward pressure on prices. Established companies must continuously innovate to maintain their market share, balancing cost, quality, and technological advancement.

Rapid technological changes shorten product lifecycles, requiring frequent updates and new product development. Keeping pace with evolving standards and managing this innovation cycle increases R&D costs while demanding agility from manufacturers to stay ahead of competitors.

Competitive Analysis

TDK Corporation, Murata Manufacturing, Vishay Intertechnology, Panasonic, and Taiyo Yuden lead the inductor market with strong portfolios of power inductors, RF inductors, and high-frequency components. Their products support consumer electronics, automotive systems, and industrial equipment. These companies focus on miniaturization, higher current handling, and improved thermal performance.

Samsung Electro-Mechanics, Pulse Electronics (Yageo), Delta Electronics, Coilcraft, Bourns, Würth Elektronik, and Sumida strengthen the competitive landscape with diversified inductive components for communication devices, power supplies, and IoT hardware. Their solutions emphasize low-loss materials, high reliability, and advanced magnetic design. These providers support fast-growing applications such as 5G, renewable energy systems, and high-density power modules.

TE Connectivity, Chilisin Electronics, AVX (Kyocera AVX), Bel Fuse, Sunlord Electronics, Eaton (Coiltronics), KEMET (Yageo), API Delevan, and other participants expand the market with specialized inductors for automotive electronics, aerospace systems, and industrial automation. Their offerings include custom magnetics, shielded inductors, and robust high-temperature solutions. These companies focus on durability, precision, and compliance with stringent industry standards.

Top Key Players in the Market

- TDK Corporation

- Murata Manufacturing Co. Ltd

- Vishay Intertechnology Inc.

- Panasonic Holdings Corporation

- Taiyo Yuden Co. Ltd

- Samsung Electro-Mechanics Co. Ltd

- Pulse Electronics (Yageo Corporation)

- Delta Electronics Inc.

- Coilcraft Inc.

- Bourns Inc.

- Würth Elektronik GmbH & Co. KG

- Sumida Corporation

- TE Connectivity Ltd

- Chilisin Electronics Corporation

- AVX Corporation (Kyocera AVX)

- Bel Fuse Inc.

- Sunlord Electronics Co. Ltd

- Eaton Corporation (Coiltronics)

- KEMET Corporation (Yageo)

- API Delevan Inc.

- Others

Future Outlook

The Inductor Market outlook is positive, with steady growth anticipated due to rising demand from consumer electronics, automotive, telecommunications, and renewable energy sectors. Technological advancements in miniaturization, efficiency, and high-frequency performance are driving adoption across applications like electric vehicles, IoT devices, and 5G infrastructure.

Opportunities lie in

- Growing adoption of inductors in electric vehicles and hybrid electric vehicles for power management and advanced driver assistance systems.

- Increasing demand for compact, high-performance inductors in consumer electronics and telecommunication devices supporting 5G and IoT technologies.

- Expansion of renewable energy projects and smart grid infrastructure requiring efficient energy storage and power conversion components.

Recent Developments

- November, 2025, TDK Corporation celebrated its 90th anniversary and won the Best IR Award, reflecting its market leadership with investments in AI and energy technology innovations.

- August, 2025, Taiyo Yuden published its Safety & Environmental Report focusing on decarbonization and energy efficiency.

Report Scope

Report Features Description Market Value (2024) USD 7.3 Bn Forecast Revenue (2034) USD 12.9 Bn CAGR(2025-2034) 5.90% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Inductance (Fixed Inductors, Variable Inductors), By Type (Film Type, Multilayered, Wire Wound, Molded), By Core Type (Air Core, Ferromagnetic/Ferrite Core, Iron Core), By Shield Type (Shielded, Unshielded), By Mounting Technique(Surface Mount, Through Hole), By End-user(Automotive, Industrial, RF & Telecommunication, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape TDK Corporation, Murata Manufacturing Co. Ltd, Vishay Intertechnology Inc., Panasonic Holdings Corporation, Taiyo Yuden Co. Ltd, Samsung Electro-Mechanics Co. Ltd, Pulse Electronics (Yageo Corporation), Delta Electronics Inc., Coilcraft Inc., Bourns Inc., Würth Elektronik GmbH & Co. KG, Sumida Corporation, TE Connectivity Ltd, Chilisin Electronics Corporation, AVX Corporation (Kyocera AVX), Bel Fuse Inc., Sunlord Electronics Co. Ltd, Eaton Corporation (Coiltronics), KEMET Corporation (Yageo), API Delevan Inc., and others. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- TDK Corporation

- Murata Manufacturing Co. Ltd

- Vishay Intertechnology Inc.

- Panasonic Holdings Corporation

- Taiyo Yuden Co. Ltd

- Samsung Electro-Mechanics Co. Ltd

- Pulse Electronics (Yageo Corporation)

- Delta Electronics Inc.

- Coilcraft Inc.

- Bourns Inc.

- Würth Elektronik GmbH & Co. KG

- Sumida Corporation

- TE Connectivity Ltd

- Chilisin Electronics Corporation

- AVX Corporation (Kyocera AVX)

- Bel Fuse Inc.

- Sunlord Electronics Co. Ltd

- Eaton Corporation (Coiltronics)

- KEMET Corporation (Yageo)

- API Delevan Inc.

- Others