Global IGZO Display Market Size, Share, Industry Analysis Report By Application (Smartphones, Television, Tablets, Laptops, Wearable Devices, Monitors, Wall Size Displays, Others), By End User (Residential, Commercial, Industrial), By Region, Global Opportunity Analysis, Future Outlook and Industry Trends Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 158647

- Number of Pages: 323

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

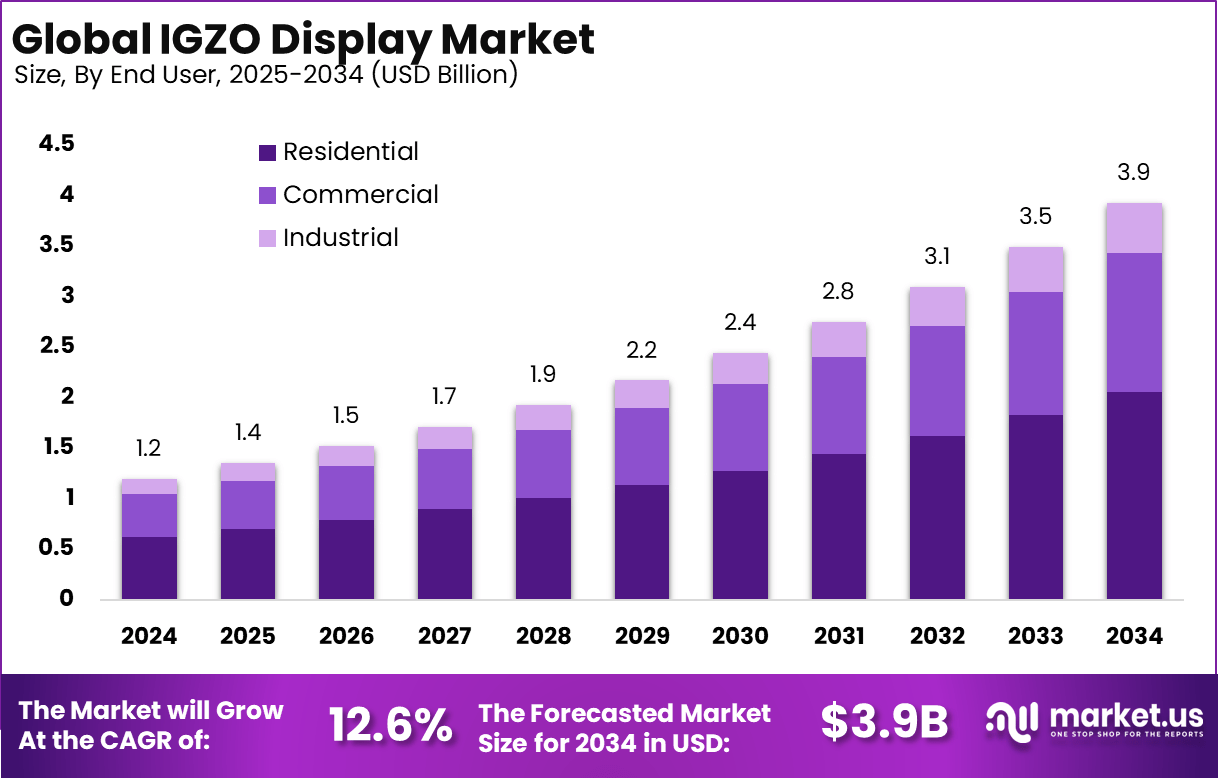

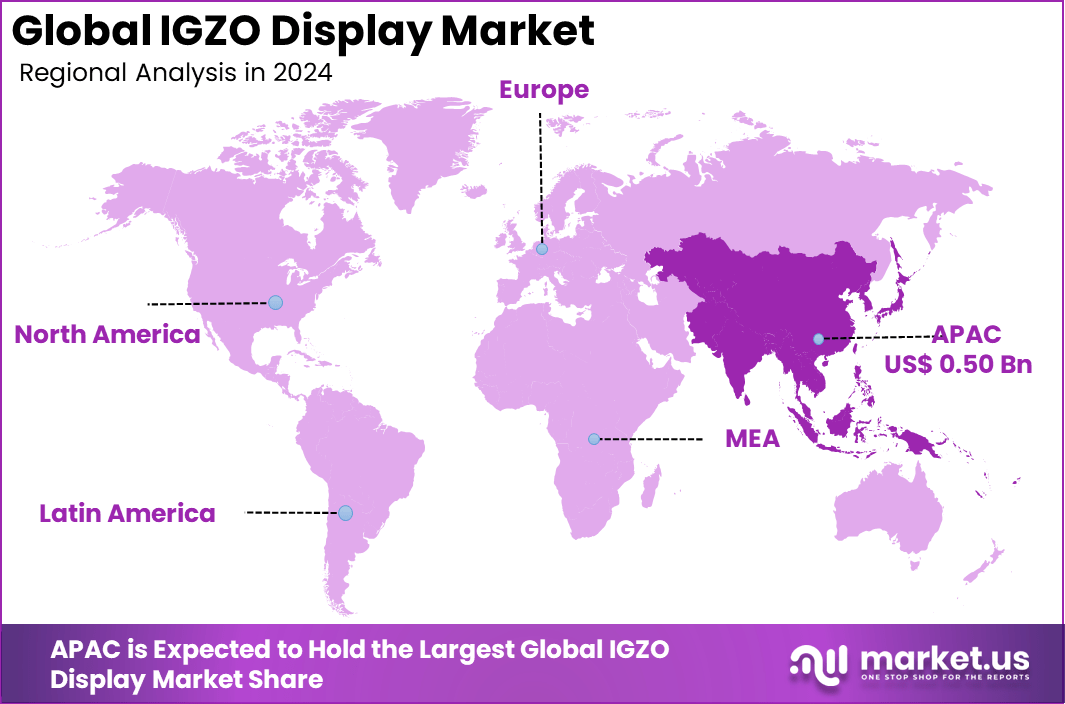

The Global IGZO Display Market size is expected to be worth around USD 3.9 billion by 2034, from USD 1.2 billion in 2024, growing at a CAGR of 12.6% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant market position, capturing more than a 42% share, holding USD 0.50 billion in revenue.

The IGZO Display Market refers to the industry built around displays that use indium gallium zinc oxide (IGZO) as the semiconductor material in thin-film transistors (TFTs). Compared to traditional amorphous silicon, IGZO technology provides higher electron mobility, allowing for improved resolution, faster refresh rates, and lower power consumption.

These displays are used in smartphones, tablets, laptops, televisions, monitors, automotive panels, and industrial devices, where performance, energy efficiency, and image quality are critical. One of the top driving factors is IGZO’s electron mobility, which is roughly 20-50 times higher than standard amorphous silicon, allowing for brighter displays and faster response times.

The shift towards 4K, 8K, and even higher resolutions is fueling adoption, especially as new AR and VR devices emerge that need extremely detailed imaging. Sustainability is another major factor – IGZO chips consume about 30% less power than older display technologies, making them attractive for manufacturers and better for reduced carbon footprints.

For instance, in October 2024, Sharp unveiled the Aquos R9 Pro, an innovative smartphone featuring a 240Hz OLED display powered by IGZO technology. This cutting-edge device combines high-end camera hardware with a stunning display, offering users exceptional performance and visual quality. The 240Hz refresh rate, enabled by IGZO, ensures smooth and fluid visuals, while also delivering improved energy efficiency and color accuracy.

Government-led investments are helping IGZO display innovation and production scale. In the Asia-Pacific region, government-supported display manufacturing contributes to about 70% of emerging tech innovations, fueling R&D initiatives and regional growth. Policies favoring green technologies have resulted in around a 30% increase in energy-efficient IGZO panel deployments nationwide.

Key Takeaway

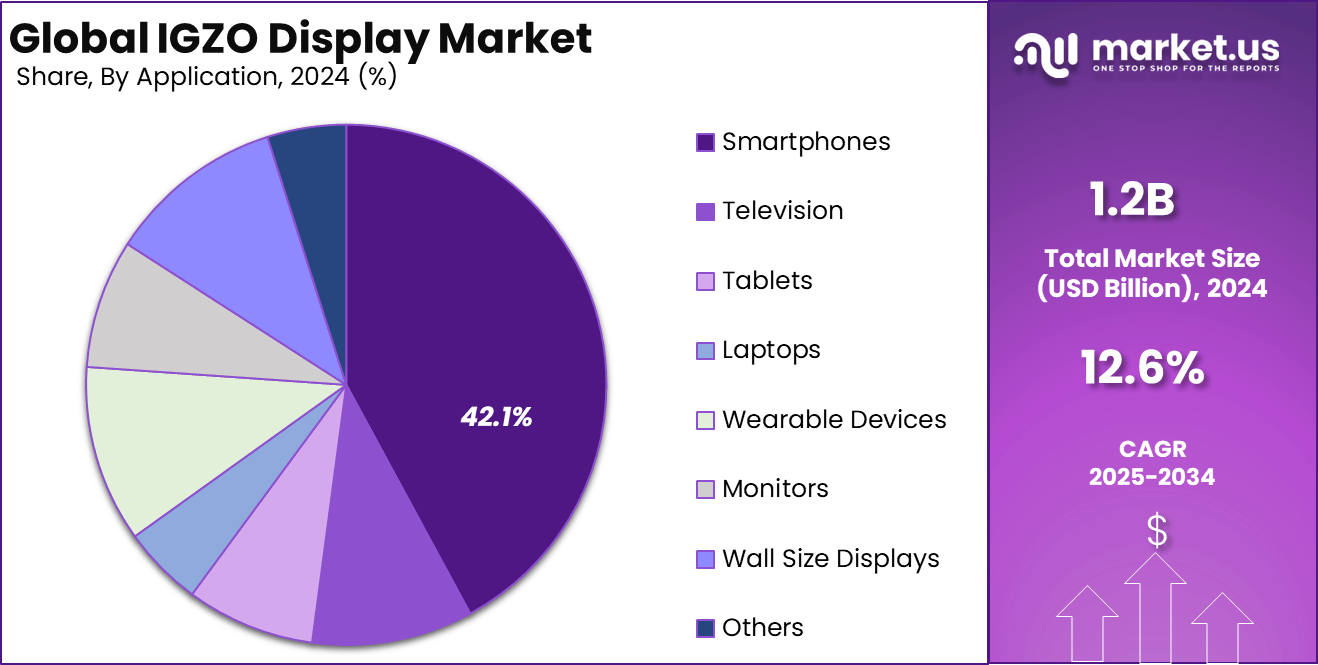

- In 2024, the Smartphones segment led the Global IGZO Display Market with a 42.1% share, reflecting strong demand from mobile device manufacturers.

- The Residential segment held the top position by application, securing a 52.3% share in 2024.

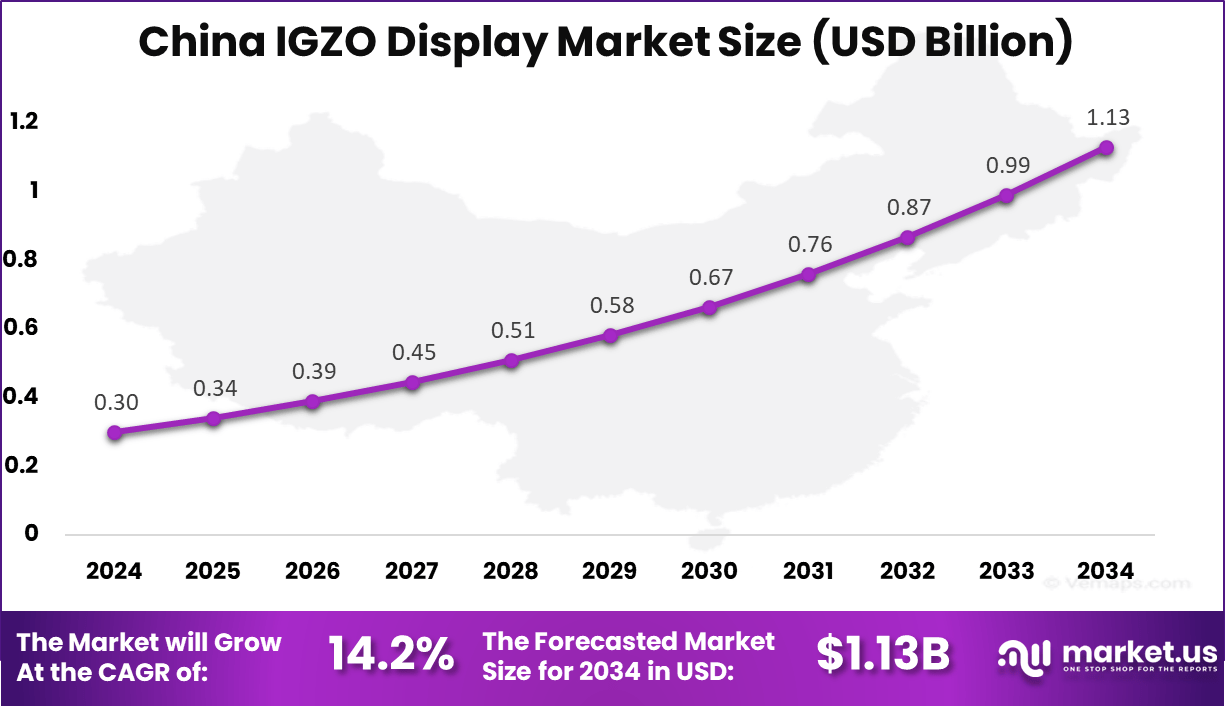

- The China IGZO Display Market was valued at USD 0.30 Billion in 2024, projected to expand at a solid CAGR of 14.2%.

- Regionally, Asia Pacific dominated with over 42% share in 2024, supported by large-scale electronics production and rising consumer adoption.

Analysts’ Viewpoint

Demand for IGZO displays has surged strongly, with smartphone penetration levels in regions such as the USA reaching around 81% of the population, and large-screen IGZO panels gaining a double-digit market share across Europe. The appeal is heightened by consumer demand for longer battery life and ultra-thin form factors, evident in the popularity of foldable phones and flexible tablets.

In Germany, medical-grade wearables utilizing IGZO are taking nearly 15% of the market as remote patient monitoring and fitness solutions expand. Investment opportunities remain strong as growth outpaces older display technologies. More than 40% of innovation activity centers on recycling initiatives and larger target designs, while display plants in Asia-Pacific lead IGZO advancements by contributing around 70% of new technology deployments.

Investors are drawn by the potential for scalable mass-market adoption in sectors from automotive cockpit screens to high-end gaming monitors, as well as government support for sustainable electronics manufacturing in multiple regions. From a business benefits perspective, IGZO displays yield considerable energy savings, better device lifespans due to lower thermal stress, and higher pixel densities that drive consumer appeal in premium device segments.

Companies achieve greater differentiation on features such as touch sensitivity, portable device endurance, and screen miniaturization, all while maintaining strong competitiveness in global electronics markets. Large screen IGZO displays help brands transition users more rapidly to advanced form factors, with flexibility and lightweight construction as additional advantages.

Role of Generative AI

Generative AI is transforming the IGZO display sector by streamlining production processes and promoting smarter factory automation. AI-driven systems now monitor manufacturing in real time, using predictive algorithms to detect defects with over 95% accuracy and minimize costly errors. This allows manufacturers to improve product consistency and achieve a reduction in average cycle times of more than 10% from previous years.

Generative AI also helps in supply chain optimization, enabling faster logistics using data-derived insights, which has resulted in an estimated 8% drop in raw material wastage across several facilities. These improvements collectively contribute to a notable enhancement in display quality and shorten time-to-market for new models

China IGZO Display Market Size

The market for IGZO Display within China is growing tremendously and is currently valued at USD 0.30 billion, the market has a projected CAGR of 14.2%. The market is growing tremendously due to the increasing demand for high-performance displays in consumer electronics, such as smartphones, tablets, and TVs.

China’s strong manufacturing capabilities, coupled with its leadership in the electronics and technology sectors, have accelerated the adoption of IGZO technology. The demand for energy-efficient, high-resolution displays is also driving growth, as IGZO technology offers superior power efficiency and visual performance. Additionally, the rise of flexible and foldable displays in the Chinese market further boosts the adoption of IGZO technology.

In 2024, Asia Pacific held a dominant market position in the Global IGZO Display Market, capturing more than a 42% share, holding USD 0.50 billion in revenue. This dominance is due to the region’s strong manufacturing base and technological advancements. Countries like China, Japan, and South Korea are key players, with significant investments in electronics and display technologies.

The high demand for consumer electronics, including smartphones, TVs, and wearables, coupled with the rapid growth of flexible display applications, has driven the adoption of IGZO technology. Additionally, favorable government policies and R&D investments further drive leadership.

For instance, In September 2022, E Ink and Sharp Display Technology partnered on oxide backplanes for next-generation ePaper, showcasing Asia Pacific’s leadership in IGZO display technology and aiming to improve performance in e-readers and digital signage.

Application Analysis

In 2024, Smartphones represent the largest share of IGZO display usage at 42.1%. The technology’s ability to deliver higher resolution, better refresh rates, and reduced power consumption makes it a natural fit for mobile devices. As user demand for advanced screen quality continues to grow, manufacturers are integrating IGZO into smartphones to enhance both efficiency and visual experience.

Another driver in this segment is the rising preference for gaming and streaming on mobile devices, where smoother graphics and improved display brightness are essential. IGZO helps balance performance with battery efficiency, which is a major concern for smartphone users. This balance has positioned smartphones as the most significant application area.

For Instance, in October 2021, Sharp unveiled the Aquos Phone Zeta, the world’s first smartphone featuring an IGZO display. This groundbreaking device marked a significant milestone in display technology, offering users enhanced visual performance with higher brightness, better power efficiency, and superior color accuracy.

End User Analysis

In 2024, the residential sector leads end-user adoption of IGZO displays with 52.3% share. Consumers increasingly seek premium display experiences in televisions, tablets, laptops, and home gadgets, which are powered by IGZO’s superior image clarity and energy efficiency. The ability to support ultra-high-definition resolution makes IGZO a natural choice for home entertainment devices.

The rise in smart homes and connected personal devices also adds momentum to this trend. Demand for sleek displays that combine thin form factors with longevity drives residential uptake. This shift highlights how IGZO technology is becoming integral to modern lifestyles at the household level.

For instance, in March 2022, Monoprice introduced an affordable IGZO display, expanding access to high-quality displays for the residential segment. This move addresses the growing demand for energy-efficient, high-resolution screens in home entertainment and personal computing devices.

Emerging Trends

IGZO displays have witnessed several new trends, including the expansion into foldable and flexible products. In the last year, the market segment for flexible IGZO panels grew to more than 200 million units annually, marking a significant uptick compared to five years ago. Larger screen sizes above 9.7 inches now account for over 65% of total IGZO shipments.

The sector has seen premium features like high refresh rates and advanced touch sensitivity become standard, with nearly 300 million IGZO displays offering these features projected for next year. Another emerging trend is the increasing use of IGZO screens for automotive infotainment and digital signage, making up roughly 28% of new applications in 2025.

Growth Factors

The main catalysts behind the growth of IGZO display adoption are the demand for energy-efficient screens and the boom in high-resolution content consumption. Over 60% of the current adoption in consumer electronics is driven by smartphones and tablets seeking longer battery life and sharper visuals.

IGZO’s electron mobility allows displays to offer superior image quality, and the technology’s low power consumption is responsible for up to 18% improvements in device battery longevity compared to older alternatives. Additionally, manufacturers have invested in new manufacturing techniques that lowered production costs by about 7% per year recently, contributing to wider accessibility of IGZO displays.

Key Market Segments

By Application

- Smartphones

- Television

- Tablets

- Laptops

- Wearable Devices

- Monitors

- Wall Size Displays

- Others

By End User

- Residential

- Commercial

- Industrial

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Drivers

Rising Demand for Energy-Efficient High-Resolution Displays

One key driver for IGZO displays is the surge in demand for screens that combine sharp clarity with energy savings in modern devices. IGZO technology is widely adopted because its electron mobility enables vibrant colors and crisp images while using less battery power, which suits smartphones, tablets, wearables, and high-end monitors.

As more consumer electronics brands introduce products that focus on display quality, IGZO displays are used to offer longer battery life and next-level image resolution. The trend is apparent in both portable gadgets and large displays, such as digital signage and advanced medical imaging devices.

For instance, in March 2024, ViewSonic announced the VX2781-4K PRO 6, a 4K IGZO IPS monitor featuring a 165Hz refresh rate. This new monitor highlights the growing trend of incorporating IGZO technology into high-performance displays, offering users superior color accuracy, faster refresh rates, and energy efficiency.

Restraint

Higher Production Costs Compared to Alternatives

A central restraint in the IGZO display market is the relatively high cost to manufacture these panels. While IGZO offers technical advantages, the specialized materials and processes required add to overall production expense. This cost premium can sometimes prompt manufacturers to choose established alternatives, especially for more budget-focused device segments.

This manufacturing hurdle limits mainstream adoption in certain device categories, as affordability remains important for mass-market electronics. Companies are working to lower production costs through new techniques and scaled manufacturing, but until there is greater parity with competing technologies, IGZO displays are expected to remain most prevalent in premium devices where performance justifies the cost.

Opportunities

Expanding Use in Healthcare Imaging Devices

An exciting opportunity is IGZO’s growing role in healthcare equipment, especially advanced X-ray and digital imaging systems. These medical devices demand precise image clarity and rapid processing, areas where IGZO displays excel due to their sensitive touch response and high resolution.

For instance, hospitals are moving toward digital radiology systems that use IGZO panels to deliver sharper images at lower energy consumption, enhancing both diagnostic accuracy and operational efficiency. As healthcare providers worldwide invest in improved patient care, the adoption of IGZO displays in portable and remote imaging equipment is rising.

For example, wearable medical devices in Germany feature IGZO screens that allow robust monitoring and real-time data visualization, helping healthcare professionals track chronic diseases more effectively. This growing demand in the medical sector creates new opportunities for display manufacturers beyond the consumer electronics market.

For instance, in June 2025, Sharp launched the Aquos R10, featuring a 240Hz IGZO OLED display and three 50MP Leica cameras. This new smartphone highlights the growing adoption of IGZO displays in consumer electronics, offering high refresh rates, superior image quality, and enhanced power efficiency.

Challenges

Complexity in Large-Scale Manufacturing and Scalability

One persistent challenge for the IGZO market is managing the complexity and scalability of production. IGZO displays require precise fabrication steps and quality control, making it difficult to ramp up output quickly or adapt to sudden shifts in demand. For instance, manufacturers targeting fast-growing segments like foldable and rollable devices must balance investment in new processes with risks of yield variation and quality issues.

Difficulty in scaling IGZO production impacts availability and cost, posing a challenge for broader market penetration. For example, automotive and advertising display sectors are beginning to adopt larger IGZO panels, yet production bottlenecks and technical hurdles can lead to supply shortages or higher prices for large-format applications. Overcoming these obstacles will be essential for IGZO to establish a lasting presence in multiple industries.

Key Players Analysis

In the IGZO display market, Apple, Samsung, and LG Electronics are the primary drivers of adoption. Their strong demand for high-resolution, energy-efficient displays in smartphones, tablets, and laptops has positioned them as leaders. These companies leverage IGZO technology to deliver thinner panels with faster response times and lower power consumption, catering to consumer electronics markets where display performance is a key differentiator.

Japanese firms including Sony Corporation and Fujitsu contribute with advanced research and specialized applications. Their focus lies in integrating IGZO panels into high-end devices, monitors, and industrial systems. These players emphasize precision, image clarity, and durability, making their products well-suited for professional and commercial environments where performance standards are critical.

Other companies such as ASUSTeK Computer and AU Optronics expand the market through innovation in laptops, gaming monitors, and large-format displays. Their role in scaling IGZO panel production and offering cost-effective solutions helps increase adoption in both consumer and enterprise markets. Together with regional and niche firms, these players ensure a diverse and competitive IGZO display ecosystem.

Top Key Players in the Market

- Apple Inc

- Sony Corporation

- FUJITSU

- ASUSTeK Computer Inc

- AU Optronics Corp

- SAMSUNG

- LG Electronics

- Others

Recent Developments

- In January 2025, Samsung showcased new display innovations at CES 2025, unveiling AI-enhanced screens and new microLED and lifestyle display products which build on their leadership in advanced panel technology expected to complement ongoing IGZO adoption in monitors and TVs.

- In May 2025, AU Optronics (AUO) highlighted its development of micro LED and AI research capabilities at an industry event, underscoring its investment in next-generation displays including IGZO tech for interactive automotive, retail, and wearable applications.

- In June 2024, ASUS unveiled a groundbreaking lineup of displays at Computex 2024, including ProArt 5K and 8K monitors, flexible ZenScreen displays, and wellness-focused ASUS VU monitors. These innovations are designed to enhance professional content creation, hybrid work, and entertainment experiences.

Report Scope

Report Features Description Market Value (2024) USD 1.2 Bn Forecast Revenue (2034) USD 3.9 Bn CAGR(2025-2034) 12.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Application (Smartphones, Television, Tablets, Laptops, Wearable Devices, Monitors, Wall Size Displays, Others), By End User (Residential, Commercial, Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Apple Inc., Sony Corporation, FUJITSU, ASUSTeK Computer Inc., AU Optronics Corp, SAMSUNG, LG Electronics, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-