HIV Drugs Market By Product Type (Nucleoside Reverse Transcriptase Inhibitors (NRTIs), Non-Nucleoside Reverse Transcriptase Inhibitors (NNRTIs), Protease Inhibitors (PIs), Integrase Inhibitors, Entry and Fusion Inhibitors, and Combination Class Drugs), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151718

- Number of Pages: 337

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

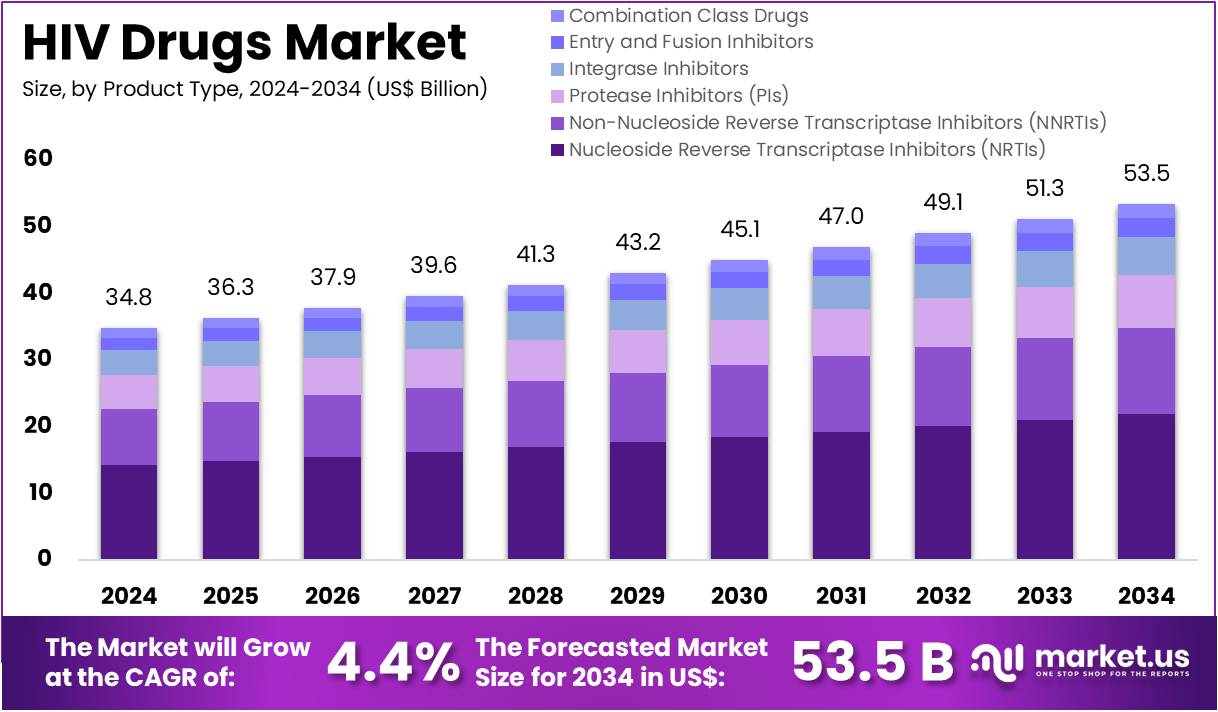

The HIV Drugs Market Size is expected to be worth around US$ 53.5 billion by 2034 from US$ 34.8 billion in 2024, growing at a CAGR of 4.4% during the forecast period 2025 to 2034.

HIV drugs are pharmaceutical treatments designed to manage Human Immunodeficiency Virus (HIV), a condition that attacks the immune system and, if left untreated, can lead to Acquired Immunodeficiency Syndrome (AIDS). These medications do not cure HIV, but they significantly reduce the viral load, delay disease progression, and improve quality of life. The primary treatment, known as Antiretroviral Therapy (ART), typically combines drugs from various classes, including NRTIs, NNRTIs, protease inhibitors, integrase inhibitors, and entry inhibitors.

According to UNAIDS 2023, around 39.9 million people globally were living with HIV, including 38.6 million adults and 1.4 million children. Among them, 53% were female. At the end of 2023, 30.7 million individuals were receiving ART, representing 77% treatment coverage. Awareness campaigns have proven effective, with 86% of people knowing their HIV status. However, about 5.4 million remained unaware. AIDS-related deaths reached 630,000 in 2023—a 69% decline from the 2004 peak and 51% lower than in 2010.

The global HIV drugs market is being driven by rising awareness, innovations in drug formulation, and large-scale prevention efforts. For instance, oral PrEP (Pre-exposure Prophylaxis), which includes tenofovir-based daily regimens, is widely recommended by the World Health Organization. Additionally, new innovations are reshaping treatment landscapes. For example, injectable PrEP options such as cabotegravir (Apretude) offer protection every two months, while lenacapavir—approved by the U.S. FDA in June 2025—delivers near-100% efficacy with biannual dosing.

According to PEPFAR data from September 2024, 20.6 million people (including 566,000 children) were receiving ART under its programs. The initiative also supported 2.5 million new PrEP initiations and facilitated over 83.8 million HIV tests. However, recent funding threats to PEPFAR and USAID may jeopardize global progress. A study by UNAIDS warns that these financial disruptions could result in approximately 2,300 additional HIV infections per day worldwide if preventive distribution is interrupted.

Growing demand for discreet and convenient access to HIV medications is also reshaping market dynamics. For example, East Sussex launched an online platform in August 2024 to provide PrEP, allowing individuals to access treatment privately. Such digital health innovations improve adherence and reach underserved populations. Single-tablet regimens and long-acting injectables are further helping to simplify treatment protocols, reduce pill burden, and support long-term disease management.

Looking ahead, if global prevention and treatment targets for 2025 are not met, UNAIDS projects up to 1.4 million new infections by 2030. Therefore, market growth will depend heavily on sustained government support, accessible treatment innovations, and continued awareness efforts. The evolving pipeline and policy landscape indicate a cautiously optimistic outlook for the global HIV drugs market.

Key Takeaways

- In 2024, the market for HIV drugs generated a revenue of US$ 34.8 billion, with a CAGR of 4.4%, and is expected to reach US$ 53.5 billion by the year 2034.

- The product type segment is divided into nucleoside reverse transcriptase inhibitors (NRTIs), non-nucleoside reverse transcriptase inhibitors (NNRTIs), protease inhibitors (PIs), integrase inhibitors, entry and fusion inhibitors, and combination class drugs, with nucleoside reverse transcriptase inhibitors taking the lead in 2023 with a market share of 41.0%.

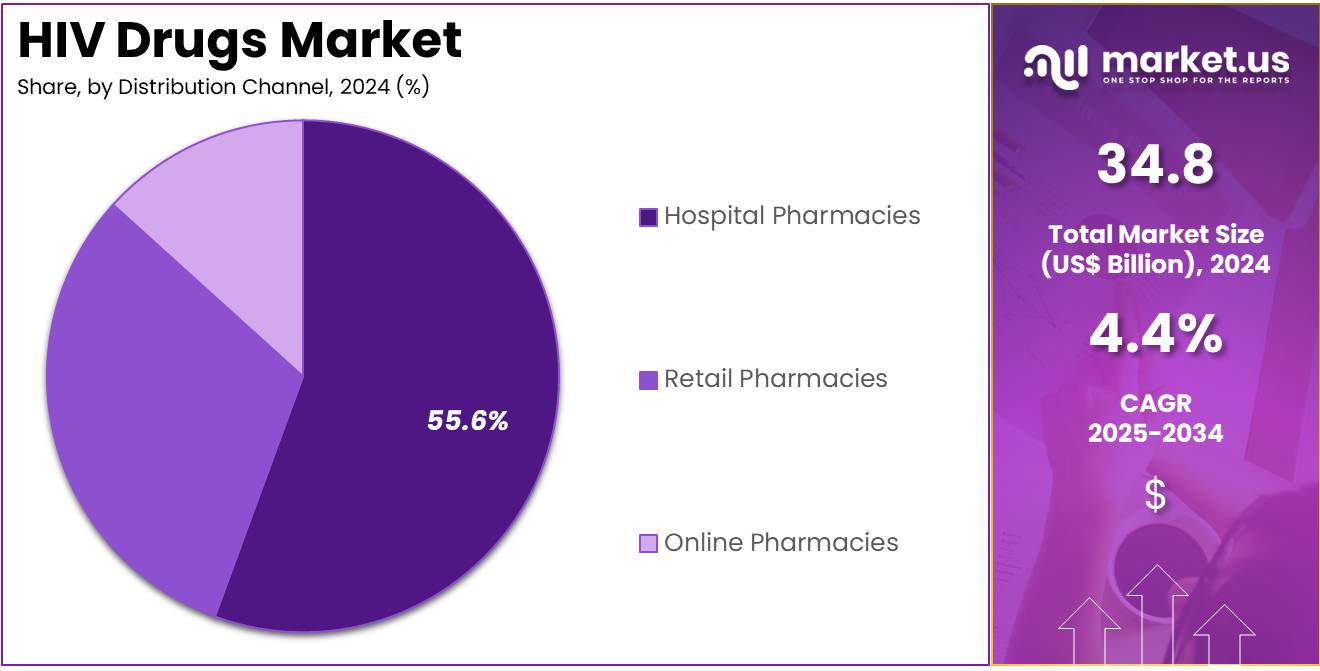

- Considering distribution channel, the market is divided into hospital pharmacies, retail pharmacies, and online pharmacies. Among these, hospital pharmacies held a significant share of 55.6%.

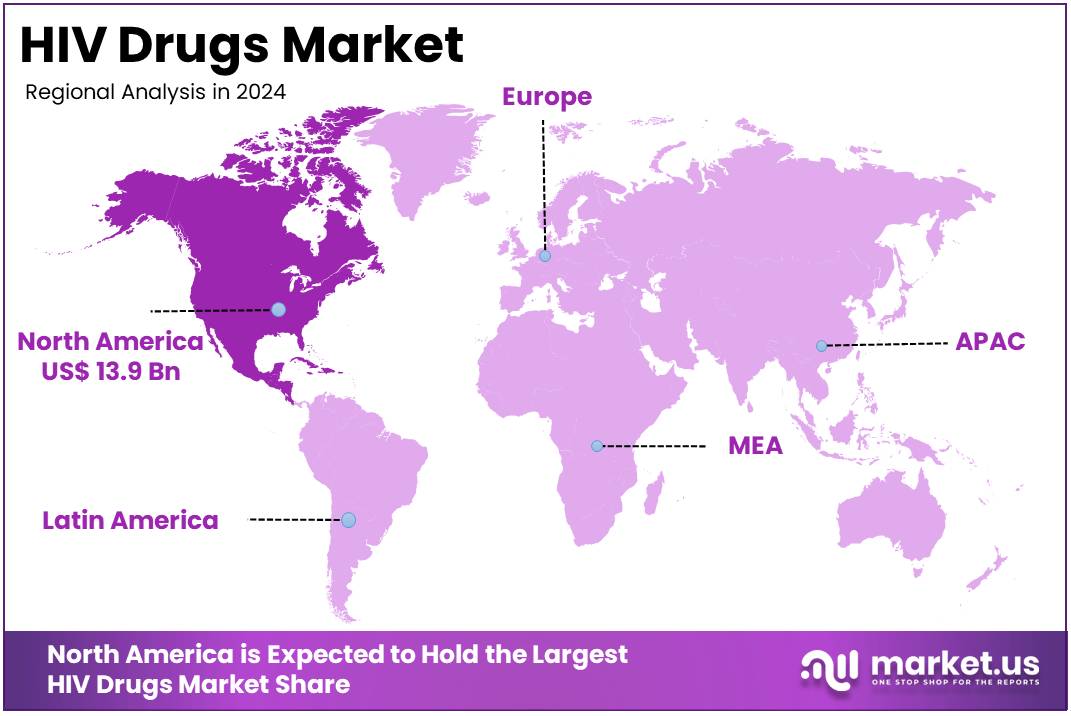

- North America led the market by securing a market share of 39.8% in 2023.

Product Type Analysis

Nucleoside reverse transcriptase inhibitors (NRTIs) are expected to dominate the HIV drugs market, comprising 41.0% of the market share. NRTIs have been the cornerstone of antiretroviral therapy (ART) for many years due to their proven efficacy in inhibiting the HIV reverse transcriptase enzyme, which is essential for the replication of the virus.

The continued dominance of NRTIs in the market is anticipated to be driven by their use as the first-line treatment in combination with other ART classes, particularly in resource-limited settings where they are the most affordable option. Furthermore, ongoing research and clinical trials focused on improving the efficacy, safety, and tolerability of NRTIs are expected to drive their sustained use. As the demand for HIV treatment grows globally, especially in developing regions, the market for NRTIs is projected to expand, maintaining its position as a dominant class of HIV drugs.

Distribution Channel Analysis

Hospital pharmacies are projected to be the leading distribution channel for HIV drugs, holding 55.6% of the market share. Hospitals play a crucial role in the administration of HIV treatments, especially for patients with advanced stages of the disease who require complex drug regimens and close monitoring. Hospital pharmacies are likely to continue their dominant position as healthcare providers increasingly adopt more sophisticated, combination-based ART regimens for managing HIV.

The growing focus on ensuring adherence to HIV treatment protocols, coupled with the increased availability of specialized healthcare professionals in hospital settings, will likely drive the demand for HIV drugs through this distribution channel. Additionally, hospitals are key in offering personalized treatment plans, which will further solidify their role in the HIV drugs market, particularly with the rise of ART’s integration into long-term patient management.

Key Market Segments

By Product Type

- Nucleoside Reverse Transcriptase Inhibitors (NRTIs)

- Non-Nucleoside Reverse Transcriptase Inhibitors (NNRTIs)

- Protease Inhibitors (PIs)

- Integrase Inhibitors

- Entry and Fusion Inhibitors

- Combination Class Drugs

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Drivers

Increasing Global Prevalence of HIV is Driving the Market

The persistent global prevalence of Human Immunodeficiency Virus (HIV) and the growing number of people living with the infection continue to be a primary driver for the market for medications treating the condition. Despite significant advancements in prevention and treatment, new infections continue to occur, necessitating lifelong antiretroviral therapy (ART) for affected individuals.

As of 2023, approximately 39.9 million people were estimated to be living with HIV globally, as reported by the UNAIDS Fact Sheet 2024. This substantial and ongoing patient population consistently drives demand for a steady supply of existing antiretroviral medications and fuels the development of novel, more effective, and better-tolerated treatment regimens. The commitment to achieving universal access to treatment further expands the market by ensuring more individuals receive the necessary medications to manage their condition and prevent further transmission.

Restraints

Emergence of Drug Resistance is Restraining the Market

The ongoing emergence of drug resistance in HIV strains poses a significant restraint on the market for these vital medications. As the virus replicates and mutates, it can develop resistance to existing antiretroviral drugs, diminishing their effectiveness and necessitating the development of new compounds or complex salvage regimens.

The World Health Organization (WHO) “HIV drug resistance – brief report 2024” indicated that while dolutegravir (DTG)-containing regimens show high viral suppression, observational data reveal DTG resistance emerging at levels higher than anticipated in clinical trials, with some surveys reporting levels ranging from 3.9% to 8.6%. This continuous evolutionary challenge requires pharmaceutical companies to invest heavily in research and development to overcome resistance patterns, increasing R&D costs and potentially limiting the lifespan of existing therapeutic options.

Opportunities

Development of Long-Acting Injectables Creates Growth Opportunities

The development and increasing approval of long-acting injectable formulations for both HIV treatment and prevention present significant growth opportunities in the market. These innovative formulations reduce the frequency of dosing from daily pills to less frequent injections (e.g., monthly, bi-monthly, or even bi-annually), addressing challenges of adherence, convenience, and stigma associated with daily oral medication.

The US Food and Drug Administration (FDA) approved injectable lenacapavir for HIV prevention in June 2025, a milestone welcomed by the World Health Organization (WHO), following promising 2024 results from the PURPOSE 1 and PURPOSE 2 trials. This advancement significantly enhances patient quality of life and simplifies treatment regimens, making it a highly attractive option for both patients and healthcare providers, and is poised to expand market access and improve treatment outcomes, particularly for populations facing adherence challenges.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic factors significantly influence the market for medications addressing HIV, primarily through their impact on global healthcare funding, government procurement programs, and patient access to affordable treatment. In periods of strong global economic growth, countries often allocate more resources to public health initiatives, including HIV prevention, testing, and treatment programs, facilitating broader access to these essential medications.

Conversely, economic downturns or high inflation rates can strain national budgets, potentially leading to reduced funding for drug procurement or increased out-of-pocket costs for patients, thereby limiting market expansion in some regions. The International Monetary Fund (IMF) projects global growth to remain stable at around 3.1% in 2024, which provides a generally steady economic backdrop for continued investment in healthcare.

Geopolitical factors, such as international aid for HIV programs, intellectual property rights, and the stability of global supply chains for active pharmaceutical ingredients (APIs) and finished products, also play a crucial role. Political instability or trade disputes can disrupt manufacturing and distribution networks, affecting the timely availability and pricing of these life-saving medicines. However, the international community’s sustained commitment to ending the HIV epidemic, championed by organizations like the WHO and UNAIDS, ensures a continuous and strong demand for these vital drugs, driving innovation and market resilience.

Current US tariff policies can directly impact the market for medications treating HIV by altering the cost of imported active pharmaceutical ingredients (APIs), excipients, and finished drug products. Given the globalized nature of pharmaceutical manufacturing, many essential components for these medications are sourced from various international suppliers.

The US Census Bureau’s foreign trade data indicates that US imports of medicinal and pharmaceutical products reached US$ 234 billion in 2024, with top exporters including Ireland, Switzerland, and Germany, underscoring the reliance on global supply chains. Any new tariffs imposed on these categories could directly increase the operational costs for US-based pharmaceutical companies involved in manufacturing or distributing these medications. This could translate to higher prices for these medications or reduced profit margins for companies, potentially affecting patient access or the financial viability of drug development.

Conversely, these tariff policies can act as a powerful incentive for pharmaceutical manufacturers to invest in expanding or establishing domestic production capabilities for HIV medication APIs and finished products within the US. This strategic shift towards localized manufacturing aims to create a more secure and resilient supply chain for essential medicines, reducing dependence on potentially volatile international sources and enhancing national health security, despite the immediate challenges of increased initial investment and compliance costs.

Latest Trends

Increased Focus on HIV Prevention Strategies (PrEP) is a Recent Trend

A key trend in the HIV drugs market is the global rise in Pre-Exposure Prophylaxis (PrEP) adoption. PrEP refers to the preventive use of antiretroviral drugs by HIV-negative individuals to lower their risk of infection. Its growing use reflects a shift from reactive to proactive HIV management. Organizations such as UNAIDS are promoting PrEP to reduce new infections. This trend is influencing market dynamics, as pharmaceutical companies expand their focus from treatment-based therapies to prevention-driven products using specific drug combinations.

The Joint United Nations Programme on HIV/AIDS (UNAIDS) has set clear global targets for PrEP usage. The goal is to have 21.2 million people initiate or continue PrEP use by 2025. This ambitious objective highlights strong international commitment to preventive care. With increased public health funding and awareness campaigns, PrEP is becoming a major part of national HIV strategies. Governments in both developed and developing nations are prioritizing the scale-up of PrEP access, which is expected to accelerate demand for related antiretroviral drug formulations.

Data from the U.S. Centers for Disease Control and Prevention (CDC) reinforces this growth trend. According to the CDC’s MMWR report from November 2024, a total of 2,278,743 PrEP initiations were supported in 37 countries during 2017–2023. Notably, 856,816 of these occurred in 2023 alone. This reflects successful public health interventions and greater healthcare provider engagement. The expansion of PrEP is helping diversify the HIV drugs market, creating new opportunities for market entrants and existing drug manufacturers alike.

Regional Analysis

North America is leading the HIV Drugs Market

North America dominated the market with the highest revenue share of 39.8% owing to continuous innovation in drug development, expanded access to pre-exposure prophylaxis (PrEP), and a sustained focus on achieving viral suppression among people living with HIV. The US Centers for Disease Control and Prevention (CDC) reported that in 2023, 1,132,739 individuals aged 13 and older were living with diagnosed HIV in the United States and six territories, creating a consistent demand for effective treatments.

The US Food and Drug Administration (FDA) continues to approve new formulations and long-acting options, such as lenacapavir (Yeztugo) from Gilead Sciences, which received FDA approval in June 2025 as the first and only twice-yearly injectable for HIV prevention, representing a major breakthrough. Key pharmaceutical players demonstrate this market’s expansion through their revenues; Gilead Sciences reported its HIV product sales increased by 8% to US$ 19.6 billion for the full year 2024 compared to 2023, driven primarily by higher demand for its treatments, including Biktarvy sales which grew 13% to US$13.4 billion in 2024. These advancements in treatment options and consistent demand underscore the market’s dynamic growth.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to increasing awareness and testing initiatives, expanding access to antiretroviral therapy, and supportive government policies aimed at controlling the epidemic. The Joint United Nations Programme on HIV/AIDS (UNAIDS) reported that 6.7 million people living with HIV resided in Asia and the Pacific in 2023, highlighting a significant patient population.

Countries like China are actively integrating advanced HIV treatments into their national programs; for instance, the Chinese government included a dolutegravir-based regimen as a second-line treatment in its National Free Antiretroviral Treatment program starting in 2023, benefiting over one million people living with HIV.

India’s National AIDS Control Programme (NACP) Phase-V, launched for 2021-2026 with an outlay of approximately US$1.85 billion (Rs. 15,471.94 crore), aims to provide free high-quality lifelong treatment, with over 1.6 million people living with HIV receiving antiretroviral therapy (ART) through 725 centers as of June 2023. These sustained efforts by governments to improve access to diagnosis and treatment are anticipated to significantly expand the market for these vital medications across Asia Pacific.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the HIV drug market implement a variety of strategic initiatives to maintain competitive advantage. A major focus is on expanding their product portfolios by developing new therapies and research tools for HIV treatment and prevention. These efforts aim to meet the evolving needs of patients and healthcare providers. Companies invest in improving drug efficacy and safety profiles to strengthen their market position. This approach not only supports regulatory approvals but also boosts confidence among clinicians and patients, driving higher adoption of antiretroviral therapies worldwide.

Research and development remain central to innovation in the HIV drug market. Companies allocate significant resources to explore long-acting treatments and combination therapies that improve patient adherence. Strategic partnerships with biotech firms, academic institutions, and clinical networks accelerate drug discovery and clinical testing. These collaborations enable faster development cycles and help bring new therapies to market more efficiently. Such partnerships also allow companies to tap into specialized expertise and innovative technologies.

Market expansion is another key strategy adopted by leading HIV drug manufacturers. Firms are establishing regional manufacturing units and robust distribution channels to ensure timely delivery of HIV treatments. This global footprint helps meet the rising demand, particularly in low- and middle-income countries. Efficient logistics and localized production capabilities also reduce costs and improve access. Additionally, companies aim to comply with international health regulations and country-specific guidelines to support smooth product deployment.

Gilead Sciences, Inc. is a major player in the HIV drug market, headquartered in Foster City, California. The company is known for its extensive range of antiretroviral drugs, including Biktarvy, Descovy, and Truvada. These products are widely prescribed in global HIV treatment protocols. Gilead is also advancing injectable options like lenacapavir (Yeztugo), which has shown 99.9% effectiveness in preventing HIV through sexual transmission. With a strong focus on research, innovation, and global reach, Gilead continues to lead the development of next-generation HIV solutions.

Top Key Players in the HIV Drugs Market

- ViiV Healthcare

- Theratechnologies Inc

- Mylan Pharmaceuticals Inc

- Gilead Sciences, Inc

- Hoffmann-La Roche Ltd

- Cipla Ltd

- Boehringer Ingelheim International GmbH

- AbbVie

Recent Developments

- In March 2025: Gilead Sciences, Inc. revealed positive results from its Phase 2 clinical trials evaluating Lenacapavir and broadly neutralizing antibodies (bNAbs) for HIV treatment. Conducted in South Africa, these trials showed the effectiveness of a twice-yearly regimen. This breakthrough could transform HIV care by offering a convenient, long-term treatment, driving growth in the HIV therapy market.

- In June 2023: AbbVie began Phase I clinical trials for ABBV-1882, an innovative HIV treatment combining ABBV-181 and ABBV-382. These drugs target immune system components to combat HIV. If successful, this new treatment could improve outcomes and contribute to the continued growth of the HIV treatment market.

Report Scope

Report Features Description Market Value (2024) US$ 34.8 billion Forecast Revenue (2034) US$ 53.5 billion CAGR (2025-2034) 4.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Nucleoside Reverse Transcriptase Inhibitors (NRTIs), Non-Nucleoside Reverse Transcriptase Inhibitors (NNRTIs), Protease Inhibitors (PIs), Integrase Inhibitors, Entry and Fusion Inhibitors, and Combination Class Drugs), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ViiV Healthcare, Theratechnologies Inc, Mylan Pharmaceuticals Inc, Gilead Sciences, Inc, F. Hoffmann-La Roche Ltd, Cipla Ltd, Boehringer Ingelheim International GmbH, AbbVie. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ViiV Healthcare

- Theratechnologies Inc

- Mylan Pharmaceuticals Inc

- Gilead Sciences, Inc

- Hoffmann-La Roche Ltd

- Cipla Ltd

- Boehringer Ingelheim International GmbH

- AbbVie