Global High Conductivity Alloy Conductor Market Size, Share, And Industry Analysis Report By Product Type (Copper Alloys, Aluminum Alloys, Others), By Application (Power Transmission, Electronics, Automotive, Aerospace, Others), By End User (Utilities, Industrial, Commercial, Residential, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 171436

- Number of Pages: 309

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

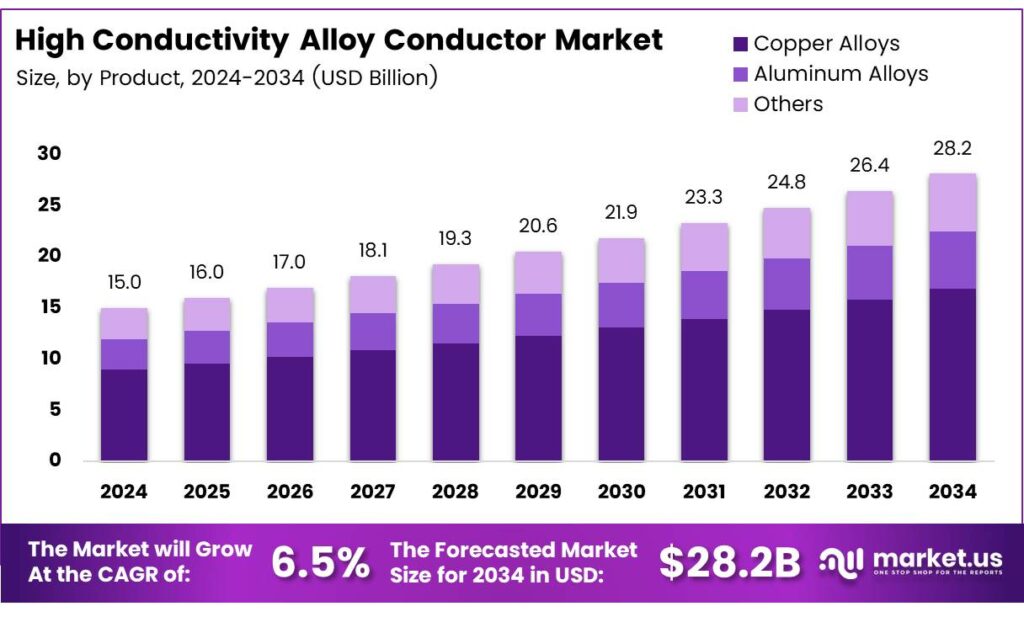

The Global High Conductivity Alloy Conductor Market size is expected to be worth around USD 28.2 billion by 2034, from USD 15.0 billion in 2024, growing at a CAGR of 6.5% during the forecast period from 2025 to 2034.

The High Conductivity Alloy Conductor space is a critical enabler of modern power transmission, electrification, and thermally efficient systems. Fundamentally, the High Conductivity Alloy Conductor Market covers engineered copper and aluminum-based alloys designed to transmit electricity efficiently while balancing strength, durability, and heat management across infrastructure, industrial, and energy applications.

High-conductivity alloy conductors sit between pure metals and conventional alloys. They are engineered to minimize electrical losses while meeting mechanical and environmental performance requirements. Consequently, demand rises where grid reliability, lightweight design, and thermal stability matter, including power distribution, renewable integration, transportation electrification, and advanced industrial equipment manufacturing.

- The International Annealed Copper Standard, pure aluminum delivers electrical conductivity of about 65% IACS, while aluminum alloys typically range between 30–50% IACS, depending on composition. According to the Aluminum Association, aluminum’s thermal conductivity spans 200–235 W/m·K, supporting efficient heat dissipation in power applications.

Copper alloys containing 60–99.9% copper maintain strong conductivity while improving strength through alloying with elements like beryllium, tin, zinc, or nickel. Electrically, high-purity copper reaches 100% IACS, while alloyed grades fall between 15–60% IACS, delivering lower losses and reduced heat generation versus aluminum alloys.

The High Conductivity Alloy Conductor Market reflects a balance between performance, regulation, and long-term operating efficiency. Seed trends such as grid efficiency, low-loss conductors, thermal-resistant alloys, and lightweight power transmission will continue shaping procurement decisions, positioning this market as a foundational component of next-generation electrical infrastructure.

Key Takeaways

- The Global High Conductivity Alloy Conductor Market is projected to grow from USD 15.0 billion in 2024 to USD 28.2 billion by 2034, registering a 6.5% CAGR.

- Copper Alloys dominate the product landscape with a market share of 58.3%, driven by superior conductivity and long-term reliability.

- Power Transmission leads application demand, accounting for 39.2% of total market consumption due to grid expansion needs.

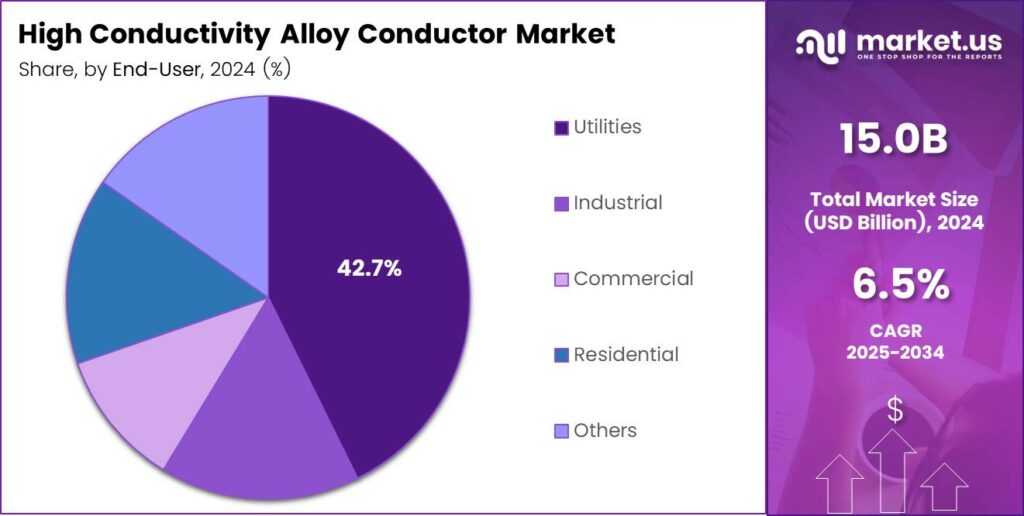

- Utilities are the largest end-user segment, holding a share of 42.7% as investments in power infrastructure continue.

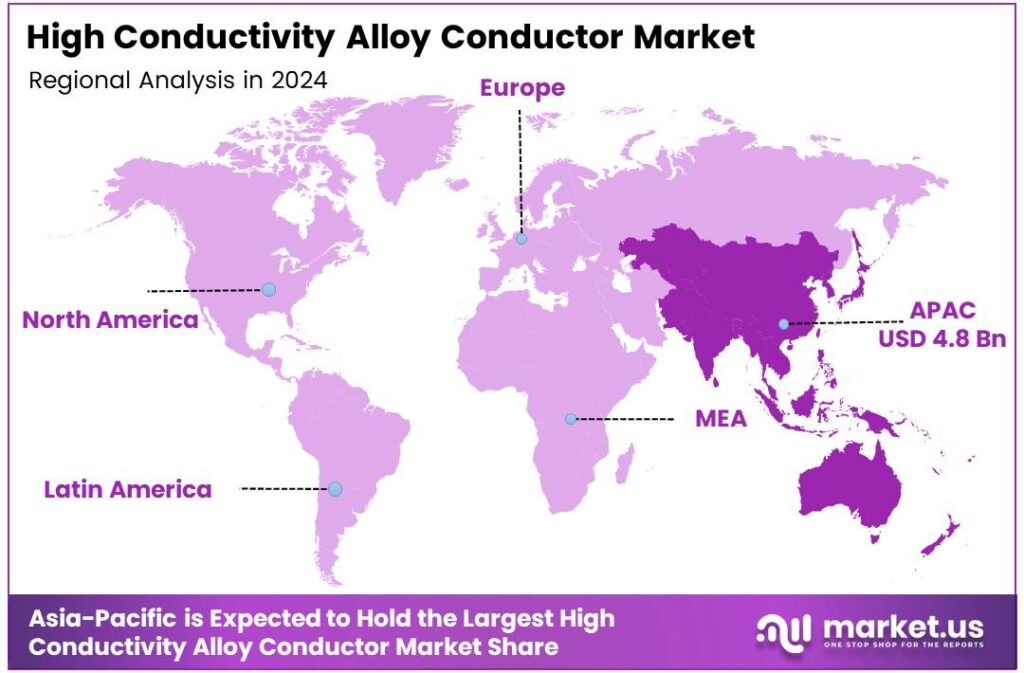

- Asia Pacific is the leading regional market with a share of 32.1%, valued at approximately USD 4.8 billion in 2024.

By Product Type Analysis

Copper Alloys dominate with 58.3% due to superior electrical conductivity and reliability.

In 2024, Copper Alloys held a dominant market position in the By Product Type Analysis segment of the High Conductivity Alloy Conductor Market, with a 58.3% share. This dominance is driven by consistent conductivity performance, strong thermal stability, and long service life. Consequently, copper alloys remain preferred for critical power and industrial applications.

Aluminum Alloys represent an important sub-segment, gaining traction due to lightweight characteristics and cost advantages. Moreover, aluminum-based conductors support easier installation and reduced structural load. Therefore, they are increasingly selected for large-scale transmission projects where weight efficiency and economic feasibility are critical decision factors.

The Others category includes niche alloy compositions tailored for specialized environments. These conductors address specific requirements such as corrosion resistance or mechanical strength. As a result, they find selective adoption in customized electrical systems, although their overall penetration remains limited compared to mainstream copper and aluminum alloys.

By Application Analysis

Power Transmission dominates with 39.2% due to rising grid expansion and reliability needs.

In 2024, Power Transmission held a dominant market position in the By Application Analysis segment of the High Conductivity Alloy Conductor Market, with a 39.2% share. This leadership is supported by expanding transmission networks and grid modernization initiatives. Therefore, demand remains strong for conductors delivering low losses and stable performance.

Electronics applications rely on high-conductivity alloys for precise current flow and heat dissipation. Moreover, compact system designs require materials with predictable electrical behavior. As electronic devices advance, alloy conductors continue to support efficiency, miniaturization, and operational reliability across multiple electronic assemblies.

Automotive usage benefits from conductivity alloys in electrification and power distribution systems. Meanwhile, Aerospace applications emphasize weight-to-performance balance and thermal stability. The Others segment supports diverse industrial uses, where tailored conductivity solutions are applied based on operational and environmental requirements.

By End-User Analysis

Utilities dominate with 42.7% due to continuous investments in power infrastructure.

In 2024, Utilities held a dominant market position in the By End-User Analysis segment of the High Conductivity Alloy Conductor Market, with a 42.7% share. This dominance reflects sustained investments in transmission, distribution, and grid reliability. Consequently, utilities prioritize materials that ensure long-term conductivity and operational stability.

Industrial end-users adopt high-conductivity alloy conductors to support heavy machinery, automation systems, and energy-intensive operations. Moreover, consistent electrical performance helps reduce downtime and improve efficiency. Therefore, industrial demand remains steady across manufacturing, processing, and large-scale production facilities.

Commercial and Residential segments focus on safety, durability, and efficient power delivery. Meanwhile, the Others category includes institutional and specialized users with customized electrical needs. Together, these segments contribute to diversified demand, supporting broader market stability beyond large utility-driven consumption.

Key Market Segments

By Product Type

- Copper Alloys

- Aluminum Alloys

- Others

By Application

- Power Transmission

- Electronics

- Automotive

- Aerospace

- Others

By End User

- Utilities

- Industrial

- Commercial

- Residential

- Others

Emerging Trends

Shift Toward Lightweight and High-Performance Materials Shapes Trends

One major trend in the high-conductivity alloy conductor market is the growing preference for lightweight materials. Aluminum-based high-conductivity alloys are increasingly used as they reduce overall system weight while maintaining electrical efficiency. This trend is especially visible in overhead transmission lines.

- Modern conductors are designed to operate at higher temperatures without losing conductivity. This allows utilities to increase power capacity without building new lines. New aluminum-zirconium and aluminum-magnesium-silicon alloy systems are gaining traction because they offer up to 15–20% higher ampacity compared to conventional ACSR conductors. Global primary aluminum production reached 70.5 million metric tons.

Sustainability is also shaping market trends. Manufacturers are developing alloy conductors that use recyclable materials and support lower energy losses. This aligns with global energy efficiency and emission reduction goals. Digital monitoring integration is gaining attention as well. Advanced conductors are being paired with sensors to track performance and detect faults.

Drivers

Rising Power Transmission and Electrification Needs Drive Market Growth

The high-conductivity alloy conductor market is strongly driven by rising electricity demand across residential, commercial, and industrial sectors. Rapid urbanization and population growth are pushing governments to expand power transmission and distribution networks. High-conductivity alloy conductors help reduce energy losses during transmission, making them essential for efficient grid performance.

- Renewable energy projects, such as wind and solar power. High-conductivity alloys support stable power flow over long distances, which improves renewable energy integration. The U.S. Department of Energy, nearly 70% of U.S. transmission lines are over 25 years old, creating strong demand for conductors that can carry more current on existing towers without structural changes.

The growth of electric vehicles and charging infrastructure also supports market demand. EV charging stations need conductors with high electrical efficiency to manage fast charging safely. Utilities and infrastructure developers prefer advanced alloy conductors to meet these technical needs.

Restraints

Fluctuating Raw Material Prices Limit Market Expansion

One major restraint in the high-conductivity alloy conductor market is the volatility of raw material prices. Key inputs such as copper, aluminum, and alloying metals experience frequent price changes due to global supply and demand imbalances. These fluctuations increase production costs and reduce profit margins for manufacturers.

- The U.S. Grid Resilience and Innovation Partnerships (GRIP) Program has committed USD 10.5 billion to modernize transmission infrastructure, indirectly accelerating adoption of high-conductivity alloy conductors that can quickly boost grid capacity.

High initial investment requirements also act as a barrier, especially for small and medium-sized manufacturers. Advanced alloy processing technologies require specialized equipment and skilled labor, which raises capital expenditure. This limits market entry and slows capacity expansion.

Growth Factors

Smart Grid Investments Create New Growth Opportunities

The expansion of smart grid infrastructure presents strong growth opportunities for the high-conductivity alloy conductor market. Smart grids require conductors that offer low resistance, high durability, and stable performance under variable loads. High-conductivity alloys meet these technical needs effectively.

Rising investments in cross-border power transmission and high-voltage direct current projects also support market growth. These projects demand advanced conductors to minimize losses over long distances. Alloy conductors provide higher efficiency compared to traditional options.

Industrial electrification is another opportunity area. Manufacturing facilities are upgrading electrical systems to support automation and energy-efficient operations. This increases demand for reliable and high-performance conductors. In emerging economies, rural electrification programs are creating new demand pockets.

Regional Analysis

Asia Pacific Dominates the High Conductivity Alloy Conductor Market with a Market Share of 32.1%, Valued at USD 4.8 Billion

Asia Pacific leads the High Conductivity Alloy Conductor Market, supported by strong expansion in power transmission, renewable energy integration, and rapid industrial electrification. In 2024, Asia Pacific accounted for a dominant 32.1% share, with the market valued at around USD 4.8 billion, reflecting its critical role in global electricity network expansion.

North America represents a mature yet steadily growing market, driven by grid modernization and increasing electricity reliability standards. Utilities across the region are focusing on replacing aging transmission infrastructure with high-efficiency alloy conductors. Growth is also supported by rising renewable energy penetration and cross-border power transmission projects.

Europe’s market growth is supported by aggressive decarbonization targets and renewable energy expansion. The region is witnessing increasing deployment of advanced conductors in offshore wind connections and interregional power links. Energy transition policies and investments in resilient grid infrastructure continue to stimulate demand.

The U.S. market is driven by large-scale grid modernization programs and increasing electricity demand from data centers and electrified transport. Utilities are prioritizing high-performance conductors to enhance grid resilience and efficiency. Aging transmission assets are being replaced with advanced alloy-based solutions. Long-term infrastructure spending and energy transition goals continue to support steady market development.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Southwire Company, LLC, in 2024 stands out for its practical push toward higher-efficiency conductors that help utilities and industrial customers move more power with lower losses. Its positioning benefits from grid hardening, renewable interconnections, and the growing need to uprate existing corridors without rebuilding everything. The company’s strength is execution—scaling proven conductor designs and supporting faster project delivery cycles.

Prysmian Group continues to sit at the center of the global power-cable ecosystem, which gives it a natural pull-through advantage for high-conductivity alloy conductor adoption in transmission and distribution upgrades. In 2024, its viewpoint looks anchored in large project capability, qualification expertise, and the ability to align conductor choices with broader system performance targets. It also benefits from customers preferring bankable suppliers for high-voltage and grid expansion programs.

Nexans S.A. in 2024 is well-placed where electrification spending is strongest—grid modernization, renewable integration, and reliability-driven replacement demand. The company’s market posture reflects a “value-through-engineering” approach: optimizing conductor performance for load, temperature, and installation constraints rather than competing only on price.

Sumitomo Electric Industries, Ltd. brings deep materials and manufacturing discipline that supports consistent conductor performance at scale. In 2024, it is viewed as a technically credible player for customers who prioritize specification compliance, long service life, and stable quality across large tenders. Its broader electrical infrastructure footprint also helps it align alloy conductor offerings with evolving utility standards and procurement rigor.

Top Key Players in the Market

- Southwire Company, LLC

- Prysmian Group

- Nexans S.A.

- Sumitomo Electric Industries, Ltd.

- Furukawa Electric Co., Ltd.

- LS Cable & System Ltd.

- Leoni AG

- Encore Wire Corporation

- Hengtong Group Co., Ltd.

- KEI Industries Limited

Recent Developments

- In 2025, Southwire has been active in advancing overhead conductor technologies, particularly with high-temperature, low-sag solutions like their HS285 ACSS conductors, which utilize annealed aluminum for improved conductivity and strength in transmission applications.

- In 2025, Prysmian will focus on high-voltage cable innovations, including aluminum-based conductors. The company launched a new 525 kV HVDC cable technology aimed at efficient, reliable, and eco-friendly power transmission, utilizing advanced materials for enhanced performance.

Report Scope

Report Features Description Market Value (2024) USD 15.0 Billion Forecast Revenue (2034) USD 28.2 Billion CAGR (2025-2034) 6.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Copper Alloys, Aluminum Alloys, Others), By Application (Power Transmission, Electronics, Automotive, Aerospace, Others), By End User (Utilities, Industrial, Commercial, Residential, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Southwire Company, LLC, Prysmian Group, Nexans S.A., Sumitomo Electric Industries, Ltd., Furukawa Electric Co., Ltd., LS Cable & System Ltd., Leoni AG, Encore Wire Corporation, Hengtong Group Co., Ltd., KEI Industries Limited Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  High Conductivity Alloy Conductor MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

High Conductivity Alloy Conductor MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Southwire Company, LLC

- Prysmian Group

- Nexans S.A.

- Sumitomo Electric Industries, Ltd.

- Furukawa Electric Co., Ltd.

- LS Cable & System Ltd.

- Leoni AG

- Encore Wire Corporation

- Hengtong Group Co., Ltd.

- KEI Industries Limited