Global Herb Infused Water Market Size, Share Analysis Report By Nature (Organic, Conventional), By Packaging (Glass Bottles, Pet Bottles, Jars, Others), By Herb Type (Mint, Basil, Rosemary, Thyme, Sage, Ginger, Lavender, Others), By Distribution Channels (Hypermarkets/Supermarkets, Specialty Stores, Online, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152580

- Number of Pages: 348

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

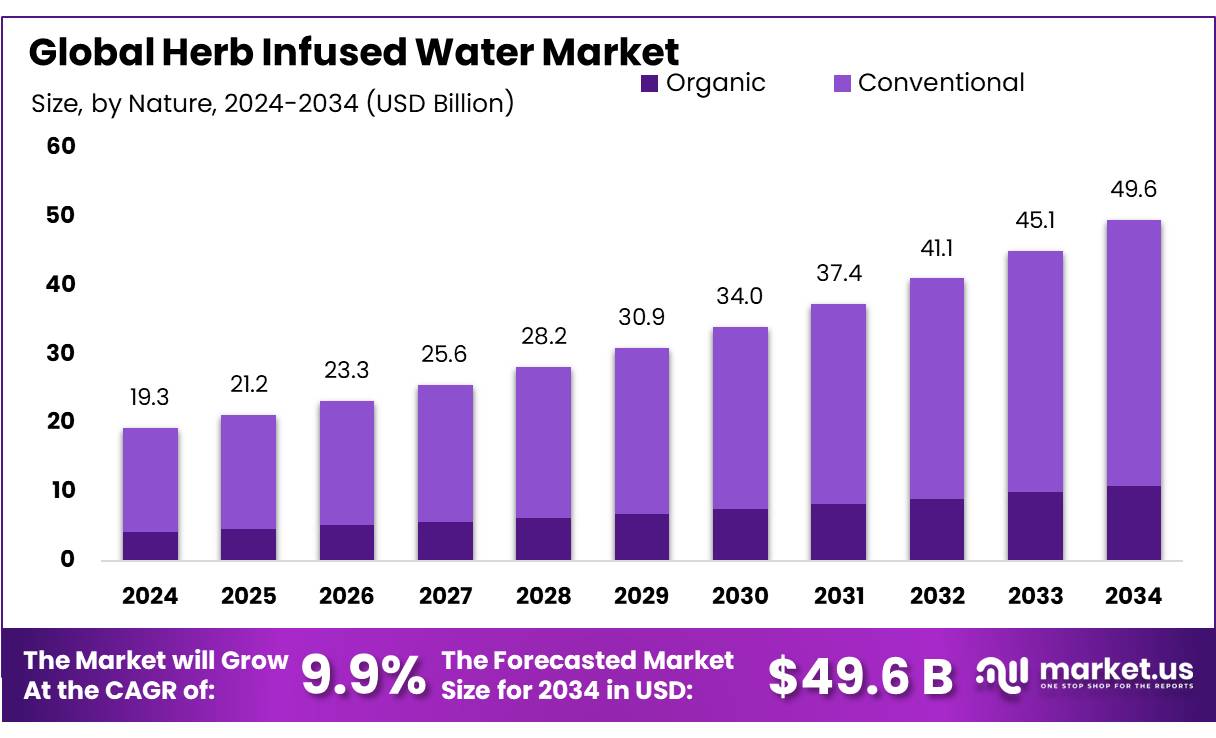

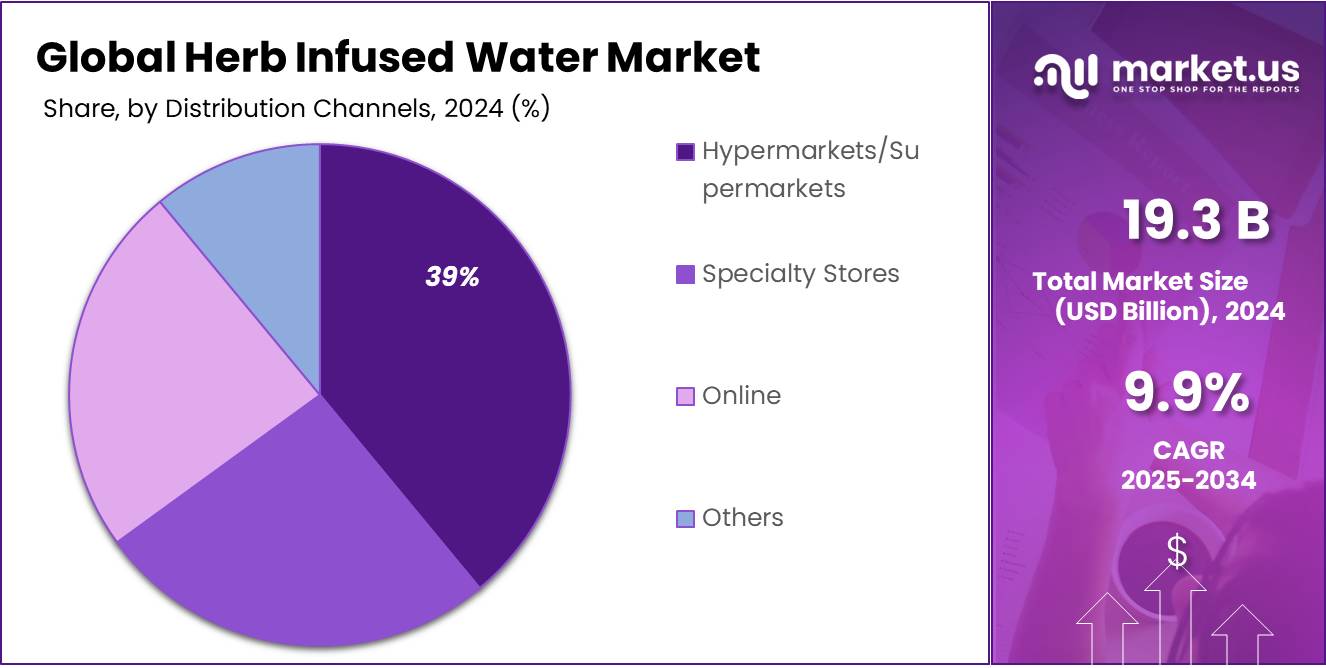

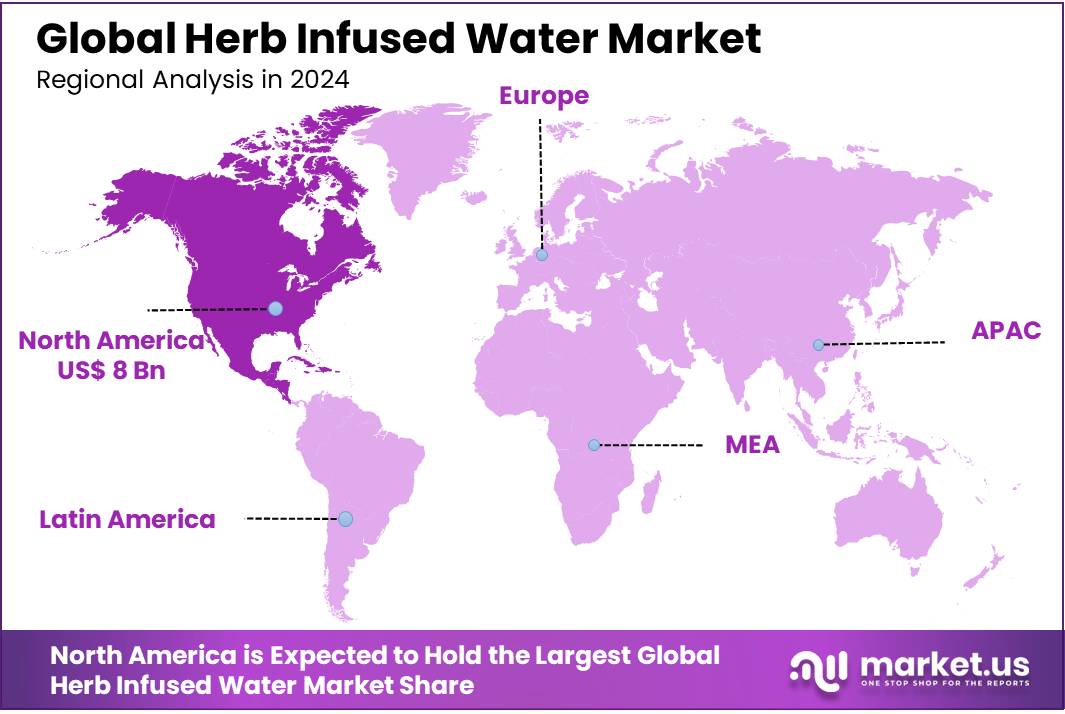

The Global Herb Infused Water Market size is expected to be worth around USD 49.6 Billion by 2034, from USD 19.3 Billion in 2024, growing at a CAGR of 9.9% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 41.9% share, holding USD 8.0 billion revenue.

Herb-infused water concentrates have emerged as a significant segment within India’s burgeoning health and wellness beverage industry. These concentrated extracts, derived from herbs like mint, basil, chamomile, and rosemary, offer consumers a convenient and flavorful alternative to traditional sugary drinks. By adding a few drops to water, consumers can enjoy the health benefits associated with these herbs, such as improved digestion, enhanced immunity, and stress relief, without the added calories or preservatives found in many commercial beverages.

Key demand drivers include heightened consumer health consciousness and the desire to reduce sugar intake, aligning with a “better-for-you” positioning. Functional attributes such as digestive aid, detoxification, and cognitive support bolster appeal. Specifically, the U.S. National Institute of Food and Agriculture (NIFA) reports culinary herb demand growing at up to 10% annually, with domestic production concentrated in California, Hawaii, and Florida, and imports exceeding USD 294 million/year. This structural supply constraint supports premium pricing and product innovation in concentrate formats.

Public-sector initiatives that improve water infrastructure indirectly benefit the functional beverage segment by ensuring quality water availability. For example, India has invested USD 240–250 billion in its water sector over the past decade, focusing on dam rehabilitation, groundwater restoration, and sanitation access. Rural water supply programs in India, supported by World Bank–funded projects totaling USD 3.4 billion, have enhanced access to safe drinking water for approximately 36 million people across 40,000 villages. These initiatives contribute to a reliable foundation for beverage production and formulation in emerging markets.

The market is also benefiting from the Indian government’s focus on promoting health and wellness. Programs like the Pradhan Mantri Bharatiya Janaushadhi Pariyojana aim to make affordable herbal products more accessible to the public, thereby encouraging the consumption of herbal-based beverages. As of 2024, over 10,000 Janaushadhi stores have been established across the country, with plans for further expansion.

Key Takeaways

- Herb Infused Water Market size is expected to be worth around USD 49.6 Billion by 2034, from USD 19.3 Billion in 2024, growing at a CAGR of 9.9%.

- Conventional held a dominant market position, capturing more than a 78.2% share in the herb-infused water market.

- Glass Bottles held a dominant market position, capturing more than a 49.3% share in the herb-infused water market.

- Mint held a dominant market position, capturing more than a 31.1% share in the herb-infused water.

- Hypermarkets/Supermarkets held a dominant market position, capturing more than a 39.4% share in the distribution of herb-infused water.

- North America emerged as the leading region in the herb-infused water market, commanding a 41.9% share, equivalent to approximately USD 8.0 billion.

By Nature Analysis

Conventional Herb-Infused Water Leads with 78.2% Market Share in 2024

In 2024, Conventional held a dominant market position, capturing more than a 78.2% share in the herb-infused water market. This strong lead can be attributed to its wide availability, lower price points, and familiarity among consumers who prefer traditional options over organic or specialty variants. Most major beverage manufacturers continue to rely on conventionally sourced herbs and ingredients to meet large-scale production demands.

The established supply chain for conventional herbs also supports consistent quality and scalability, which is essential for mainstream product lines. While organic products are slowly gaining popularity, especially in niche health-focused segments, the conventional category remains the top choice among both consumers and producers due to its affordability and broader reach.

By Packaging Analysis

Glass Bottles Dominate with 49.3% Share for Herb-Infused Water in 2024

In 2024, Glass Bottles held a dominant market position, capturing more than a 49.3% share in the herb-infused water market. This leadership is largely driven by the premium look and feel that glass packaging offers, appealing to health-conscious consumers who associate it with purity and freshness. Glass is also seen as a more sustainable and eco-friendly choice, aligning with the rising demand for environmentally responsible packaging.

Many beverage brands are choosing glass to enhance product visibility and shelf appeal, especially in cafes, organic stores, and wellness outlets. While plastic and other materials continue to serve convenience-focused segments, glass bottles remain the preferred packaging format for high-end and functional water products.

By Herb Type Analysis

Mint Leads Herb-Infused Water Market with 31.1% Share in 2024

In 2024, Mint held a dominant market position, capturing more than a 31.1% share in the herb-infused water segment. Its popularity is rooted in its refreshing taste, wide cultural acceptance, and perceived digestive health benefits, making it a top choice among both consumers and beverage producers.

Mint-infused water is widely available across retail and hospitality sectors due to its ability to blend well with other flavors and its strong consumer recall. From spas to supermarkets, mint remains a go-to herb for hydration products that promise both taste and wellness. The strong preference for mint is also supported by its year-round cultivation in many regions, ensuring a stable supply chain.

By Distribution Channel Analysis

Hypermarkets and Supermarkets Dominate with 39.4% Share in 2024 Herb-Infused Water Sales

In 2024, Hypermarkets/Supermarkets held a dominant market position, capturing more than a 39.4% share in the distribution of herb-infused water. This strong performance is mainly due to the wide reach, high footfall, and strong visibility these retail outlets offer to beverage brands. Consumers prefer shopping for health drinks like herb-infused water in these stores because of easy access to a variety of brands, competitive pricing, and in-store promotions.

The availability of chilled storage sections and wellness aisles also makes it easier for these products to attract impulse buyers. As herb-infused water becomes a regular addition to health-focused shopping baskets, hypermarkets and supermarkets continue to serve as the primary channel for both everyday shoppers and bulk buyers.

Key Market Segments

By Nature

- Organic

- Conventional

By Packaging

- Glass Bottles

- Pet Bottles

- Jars

- Others

By Herb Type

- Mint

- Basil

- Rosemary

- Thyme

- Sage

- Ginger

- Lavender

- Others

By Distribution Channels

- Hypermarkets/Supermarkets

- Specialty Stores

- Online

- Others

Emerging Trends

Increasing Consumer Demand for Functional Beverages

One of the most notable trends in the herb-infused water market is the rising consumer preference for functional beverages—drinks that offer health benefits beyond basic nutrition. This shift is driven by a growing awareness of the importance of hydration and the desire for natural, health-promoting ingredients.

According to the U.S. Department of Agriculture (USDA), the functional beverage sector, which includes herb-infused waters, has seen significant growth. In 2022, the USDA reported a 15% increase in the sales of functional beverages in the United States, reflecting a broader consumer trend towards products that support health and wellness. This surge is attributed to factors such as increased health consciousness, a desire for natural ingredients, and a shift away from sugary sodas and artificial drinks.

Government initiatives are also supporting this trend. The USDA’s Local Agriculture Market Program (LAMP) provides grants to enhance the competitiveness of local and regional food systems. In 2023, LAMP allocated $90 million to projects that promote local food production and distribution, including the development of functional beverages like herb-infused waters. These investments aim to strengthen local economies and provide consumers with access to healthier, locally sourced products.

Additionally, the Food and Drug Administration (FDA) has been updating food labeling requirements to provide clearer information on the health benefits of products. In 2025, the FDA released new guidelines to help consumers make informed choices about functional foods and beverages, including those infused with herbs. These guidelines are expected to further boost consumer confidence in the health claims associated with herb-infused waters.

Drivers

Growing Health Consciousness Among Consumers

A key driving factor for the growth of the herb-infused water market is the increasing health consciousness among consumers. With rising concerns about wellness and hydration, many are shifting away from sugary drinks and opting for healthier alternatives like herb-infused water. This trend is being accelerated by growing awareness about the benefits of herbs such as mint, ginger, and basil, which are known for their detoxifying, anti-inflammatory, and digestive properties.

According to the National Institutes of Health (NIH), herbs such as mint and ginger have long been recognized for their role in promoting digestive health and reducing inflammation, making them ideal for infusion into water.

In recent years, the demand for functional beverages has skyrocketed, particularly in developed regions. In the U.S., the functional beverage market, which includes herb-infused drinks, saw a 15% increase in sales in 2022, and this trend is expected to continue as more consumers gravitate toward natural, non-sugary alternatives to sodas and juices. This shift aligns with a broader societal movement towards cleaner, more mindful eating and drinking habits.

Government initiatives are also playing a role in supporting the growth of this market. For example, in 2021, the U.S. Food and Drug Administration (FDA) introduced regulations promoting the use of natural ingredients in beverage manufacturing, encouraging more companies to innovate with herbal ingredients in their products. This has spurred increased product launches and innovations within the herb-infused water sector.

Restraints

High Production Costs and Limited Shelf Life

One major restraining factor for the herb-infused water market is the high production cost and the limited shelf life of these products. Unlike traditional bottled beverages, herb-infused water often requires more specialized production processes, such as cold-pressing or using organic ingredients. These processes can lead to higher manufacturing costs, which are passed on to the consumer, making the product more expensive compared to conventional drinks. According to the U.S. Department of Agriculture (USDA), organic herbs and botanicals, commonly used in herb-infused water, typically cost 30% to 50% more than their conventional counterparts due to the more labor-intensive growing and harvesting methods.

Additionally, herb-infused water tends to have a shorter shelf life than traditional bottled beverages because it lacks preservatives and additives. Most herbal infusions are perishable, which limits their ability to be stored and transported for long periods. This creates logistical challenges, as manufacturers must ensure quick distribution and consumption, leading to higher operational costs. A report from the Food and Drug Administration (FDA) in 2022 highlighted that beverages with natural, perishable ingredients are more prone to microbial growth, thus reducing their shelf life and requiring more stringent quality control during production and transportation.

Despite the growing popularity of herb-infused water, these cost and shelf-life challenges may deter smaller companies from entering the market. Larger brands with established supply chains are better positioned to absorb the additional costs, but this leaves small businesses struggling to compete. To overcome this, some companies are exploring new packaging solutions, such as vacuum-sealed bottles or glass containers, which can extend shelf life and reduce spoilage.

Opportunity

Expansion of Organic Herb Production

A significant growth opportunity for the herb-infused water market lies in the expansion of organic herb production. As consumer demand for natural and organic products increases, there is a corresponding need for a reliable and sustainable supply of organic herbs. The U.S. Department of Agriculture (USDA) has recognized this need and is funding research to boost herb production in controlled environments, such as greenhouses and indoor farms. This approach aims to expand production nationwide, reduce reliance on imports, stabilize the supply, and create local jobs.

This initiative not only supports the growth of the herb-infused water market by ensuring a steady supply of organic herbs but also aligns with broader trends toward sustainability and local sourcing. By investing in controlled environment agriculture, the USDA is helping to meet the rising consumer preference for products made from organically grown ingredients.

Moreover, the expansion of organic herb production can lead to cost reductions in the long term. As production scales up and efficiencies are realized, the cost of organic herbs may decrease, making herb-infused water products more affordable for consumers. This could further accelerate market growth by making these beverages accessible to a broader audience.

Regional Insights

North America Leads with 41.9% Share and USD 8.0 Billion Size in 2024

In 2024, North America emerged as the leading region in the herb-infused water market, commanding a 41.9% share, equivalent to approximately USD 8.0 billion in sales. This dominance stems from robust consumer demand for health-focused beverages that offer natural, low-calorie alternatives to sugary drinks. The region benefits from well-established distribution channels across supermarkets, hypermarkets, and convenience stores, which facilitate broad market penetration and visibility.

Furthermore, North America’s leading position is supported by rising consumer preference for clean-label products and strategic expansion by major beverage players into functional and botanical-infused water lines. Innovation in product formulations—including flavored, organic, and functional variants—has been particularly successful in capturing the attention of wellness-driven consumers.

The region’s sophisticated regulatory environment and food safety standards also foster consumer trust. Meanwhile, strong e-commerce infrastructure has enabled direct-to-consumer sales, further boosting market access and convenience. Additional growth is anticipated as brands invest in premium packaging and tailored marketing campaigns.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Coca-Cola has ventured into the herb-infused water segment through its Topo Chico brand, introducing fruit-flavored sparkling waters infused with herbal extracts. This move aligns with the growing consumer demand for functional beverages that offer both hydration and health benefits. By leveraging its extensive distribution network and brand recognition, Coca-Cola aims to capture a share of the expanding herb-infused water market.

Danone, a global leader in the food and beverage industry, has expanded its portfolio to include functional waters infused with herbs and botanicals. Brands like Evian+ feature combinations such as Grapefruit & Basil and Cucumber & Mint, aiming to provide consumers with refreshing beverages that support hydration and wellness. Danone’s commitment to sustainability is evident, with 96% of its packaging being recyclable.

Hint Inc. offers a range of fruit-infused waters that are free from sugar, sweeteners, and preservatives. Their products, available in over 25 flavors, cater to health-conscious consumers seeking hydration without added calories or artificial ingredients. Hint’s focus on natural fruit essences and commitment to clean labeling resonate with the increasing demand for transparent and wholesome beverage options.

Nestlé Waters, a division of Nestlé, provides a variety of flavored and infused water products under brands like Nestlé Vitality and Sunkist. These offerings include vitamin-enhanced waters and herbal infusions, targeting consumers looking for functional beverages that promote health and hydration. Nestlé’s global presence and extensive distribution channels enable it to reach a wide audience, supporting the growth of the herb-infused water market.

Top Key Players Outlook

- Coca-Cola Company

- CQ Infused Beverages, LLC,

- Danone SA

- Hint Inc.

- Nestle Waters

- Ricola Group AG

- Simon Pearce

- Tata Global Beverages Limited

Recent Industry Developments

In 2024 Hint Inc, recorded approximately USD 75 million in annual revenue and employed around 179 people globally.

In 2024, Danone’s, Waters segment achieved a notable 5.1% like-for-like sales growth, totaling €4.98 billion, driven by strong performances from brands like evian, Volvic, and Zywiec Zdroj.

Report Scope

Report Features Description Market Value (2024) USD 19.3 Bn Forecast Revenue (2034) USD 49.6 Bn CAGR (2025-2034) 9.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Nature (Organic, Conventional), By Packaging (Glass Bottles, Pet Bottles, Jars, Others), By Herb Type (Mint, Basil, Rosemary, Thyme, Sage, Ginger, Lavender, Others), By Distribution Channels (Hypermarkets/Supermarkets, Specialty Stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Coca-Cola Company, CQ Infused Beverages, LLC,, Danone SA, Hint Inc., Nestle Waters, Ricola Group AG, Simon Pearce, Tata Global Beverages Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Coca-Cola Company

- CQ Infused Beverages, LLC,

- Danone SA

- Hint Inc.

- Nestle Waters

- Ricola Group AG

- Simon Pearce

- Tata Global Beverages Limited