Healthcare Gamification Market By Product Type (Exercise & Serious Game and Casual Game), By Application (Education/Training of Physicians, Education/Training of Hospital Staff, Commercial Gains for Patients, Pharmaceutical Sales Training, Insurance Companies Using Gamification, and Gamification in Clinical Trials), By End-User (Enterprise-Based, Consumer-Based, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153025

- Number of Pages: 291

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

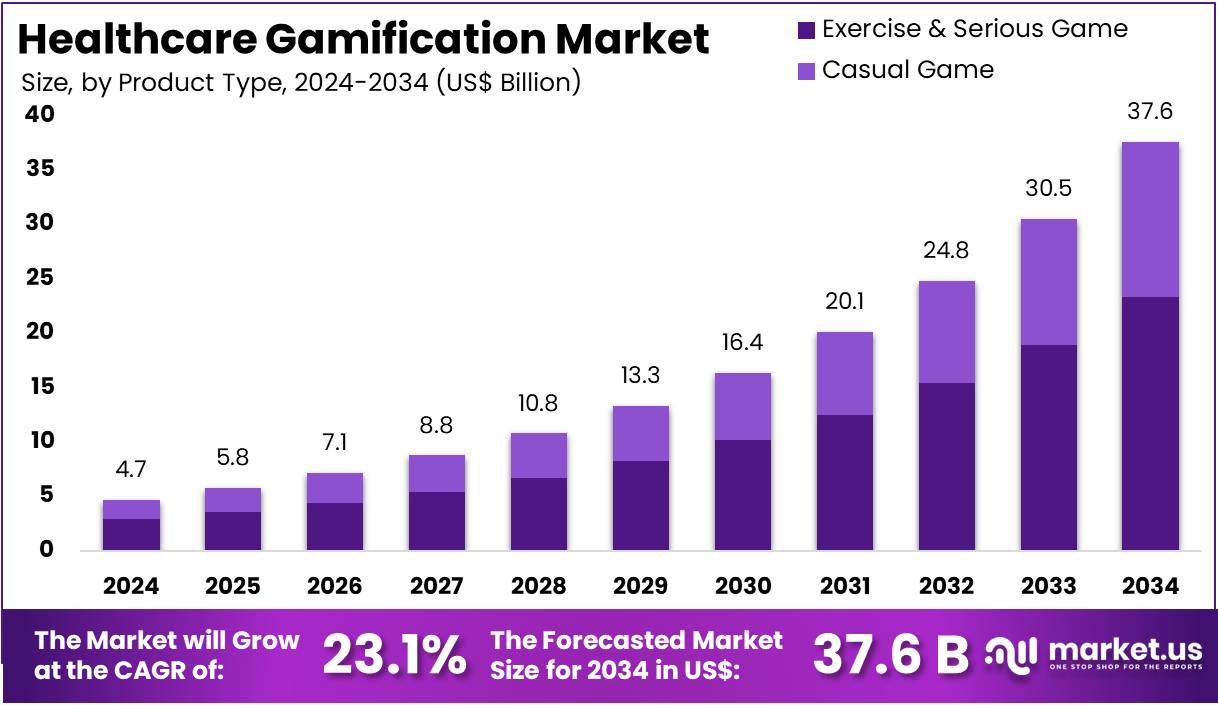

The Healthcare Gamification Market Size is expected to be worth around US$ 37.6 billion by 2034 from US$ 4.7 billion in 2024, growing at a CAGR of 23.1% during the forecast period 2025 to 2034.

Growing demand for patient engagement and the increasing emphasis on personalized healthcare solutions are driving the expansion of the healthcare gamification market. Healthcare gamification leverages game mechanics, rewards, and competitive elements to encourage healthy behaviors, improve patient adherence to treatment plans, and enhance overall wellness.

As the healthcare industry shifts toward preventative care, gamification strategies are gaining traction by motivating patients to adopt healthier lifestyles through interactive and engaging platforms. These tools are particularly effective in managing chronic conditions, mental health, and wellness, where consistent behavior change is critical for improving patient outcomes.

Recent trends show that mobile health applications and wearable devices are integrating gamification to track physical activity, monitor diet, and provide personalized feedback. In August 2022, Akili successfully merged with Social Capital Suvretta Holdings Corp. I, marking the start of Akili, Inc.’s trading on the Nasdaq Capital Market under the ticker symbol “AKLI.” Akili’s focus on digital therapeutics, including its FDA-approved video game-based treatment for children with ADHD, reflects the increasing trend of using gamification not just for engagement, but also as a therapeutic intervention.

Additionally, healthcare gamification platforms are evolving to include social features, enabling patients to share progress, receive encouragement, and connect with others facing similar health challenges. As the healthcare sector continues to embrace digital transformation, the market for healthcare gamification offers significant opportunities for innovation, leading to better patient outcomes, higher engagement, and a more proactive approach to health management.

Key Takeaways

- In 2024, the market for healthcare gamification generated a revenue of US$ 4.7 billion, with a CAGR of 23.1%, and is expected to reach US$ 37.6 billion by the year 2034.

- The product type segment is divided into exercise & serious game and casual game, with exercise & serious game taking the lead in 2023 with a market share of 62.1%.

- Considering application, the market is divided into education/training of physicians, education/training of hospital staff, commercial gains for patients, pharmaceutical sales training, insurance companies using gamification, and gamification in clinical trials. Among these, education/training of physicians held a significant share of 34.5%.

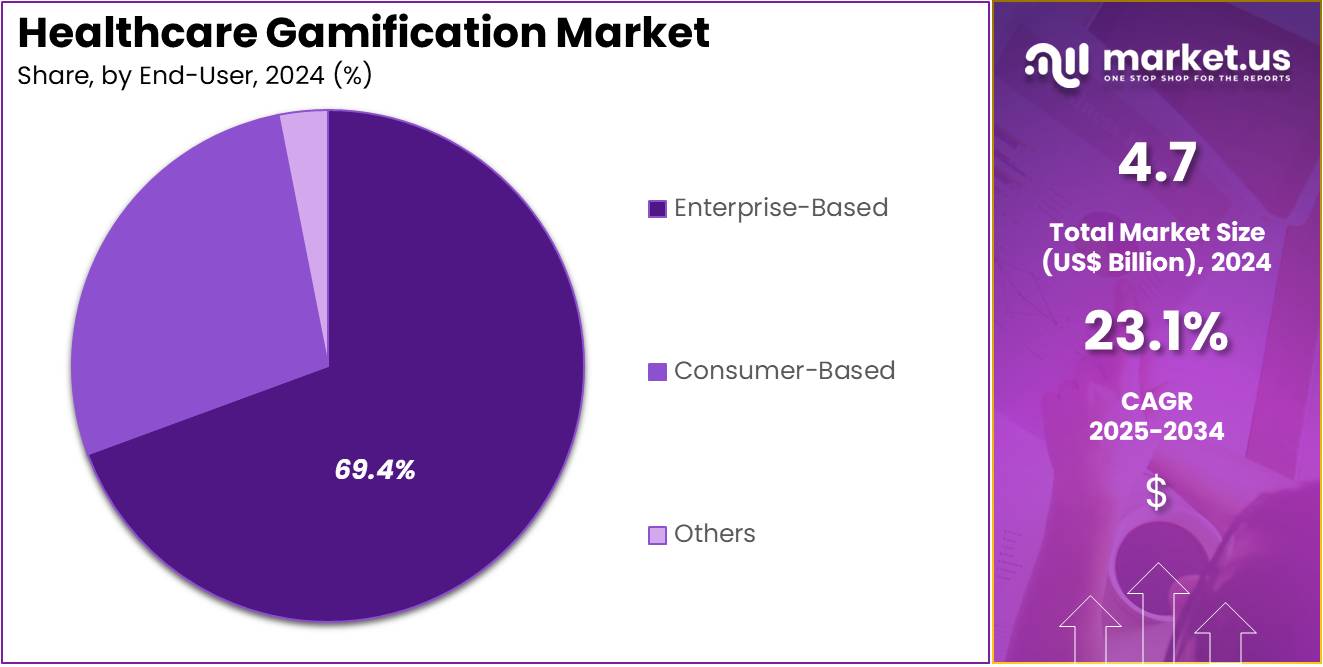

- Furthermore, concerning the end-user segment, the market is segregated into enterprise-based, consumer-based, and others. The enterprise-based sector stands out as the dominant player, holding the largest revenue share of 69.4% in the healthcare gamification market.

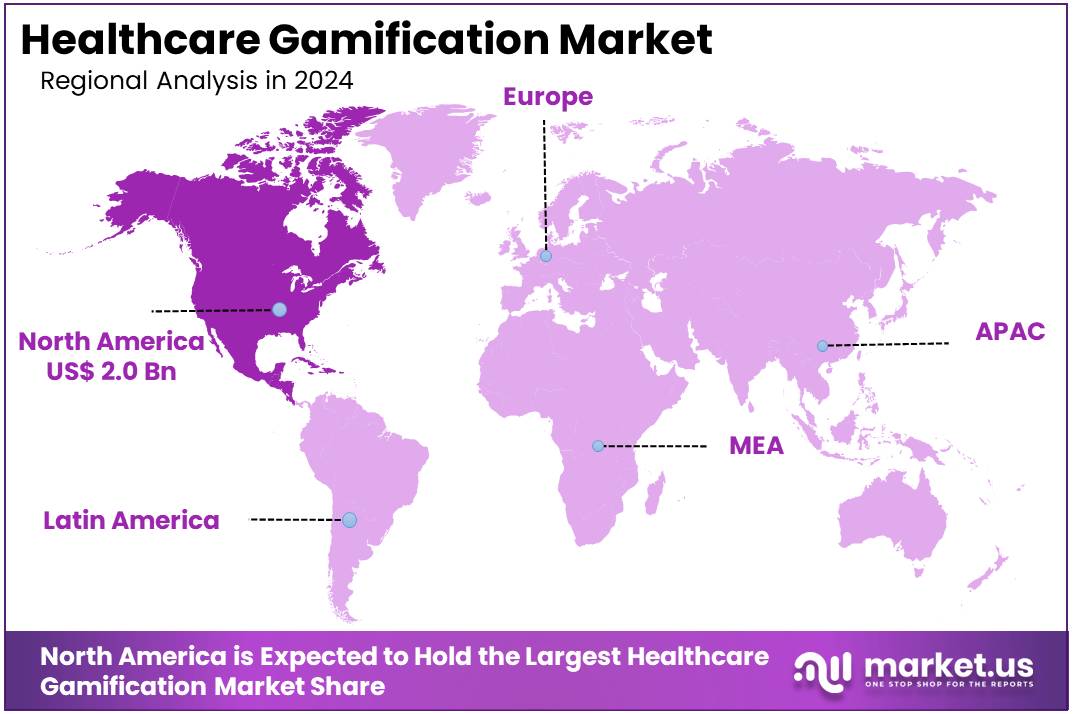

- North America led the market by securing a market share of 41.8% in 2023.

Product Type Analysis

Exercise & serious games dominate the healthcare gamification market with a share of 62.1%. This segment’s growth is expected to continue as these games provide structured, goal-oriented, and engaging ways to improve physical health and wellness. The rising focus on preventive healthcare, along with the growing interest in at-home fitness solutions, is likely to fuel the demand for exercise games.

As individuals increasingly seek interactive and engaging methods to improve their fitness, serious games that blend gaming elements with health and fitness goals are gaining popularity. Healthcare organizations and fitness platforms are anticipated to adopt these games for rehabilitation and chronic disease management, allowing users to complete therapy exercises at home while tracking progress.

Furthermore, the integration of artificial intelligence (AI) and augmented reality (AR) in exercise games is expected to enhance user engagement and provide more personalized experiences, contributing to market expansion. As the demand for home-based fitness solutions continues to rise, the exercise & serious game segment is projected to see sustained growth, especially in the context of managing long-term health conditions such as obesity and cardiovascular diseases.

Application Analysis

The education and training of physicians through gamification holds a dominant share of 34.5% in the healthcare gamification market. This segment’s growth is expected to be driven by the increasing demand for interactive and effective learning tools in medical education. Gamification enables physicians to practice decision-making and diagnostic skills in a simulated, low-risk environment, making it highly effective for teaching complex medical procedures.

The integration of gamified platforms in medical schools, hospitals, and continuing medical education (CME) programs is anticipated to significantly enhance the learning experience for physicians, offering a more engaging and practical alternative to traditional training methods. The growing emphasis on hands-on learning and skill development in the medical field is likely to boost the adoption of these platforms.

Additionally, the ability of gamified systems to track progress and provide instant feedback is expected to improve learning outcomes and physician performance. As healthcare systems continue to focus on improving the quality of care, the adoption of gamification in physician education and training is projected to rise, driving growth in this segment.

End-User Analysis

The enterprise-based segment holds a dominant share of 69.4% in the healthcare gamification market. This segment’s growth is expected to continue as more healthcare organizations, including hospitals, insurance companies, and pharmaceutical companies, integrate gamification into their business strategies. Enterprise-based gamification offers several benefits, including increased employee engagement, improved training programs, and enhanced productivity.

Hospitals and healthcare providers are adopting gamification to train and motivate staff, improve patient outcomes, and enhance workflow efficiency. Pharmaceutical companies are also using gamification for sales training and customer engagement, encouraging employees to learn in a more interactive and rewarding environment.

The growing recognition of gamification as a powerful tool for corporate training and business operations is likely to contribute to the expansion of this segment. Additionally, the increasing use of gamified apps for patient engagement, behavior modification, and chronic disease management is expected to drive the market further. As enterprise-based gamification continues to show positive results in improving employee and patient engagement, its adoption is projected to increase across various sectors of the healthcare industry.

Key Market Segments

By Product Type

- Exercise & Serious Game

- Casual Game

By Application

- Education/Training of Physicians

- Education/Training of Hospital Staff

- Commercial Gains for Patients

- Pharmaceutical Sales Training

- Insurance Companies Using Gamification

- Gamification in Clinical Trials

By End-User

- Enterprise-Based

- Consumer-Based

- Others

Drivers

Increasing Adoption of Digital Health Tools and Wearables is Driving the Market

The increasing adoption of digital health tools and the widespread use of wearable technology among consumers are significant drivers propelling the healthcare gamification market. As individuals become more comfortable utilizing apps and devices to track their health metrics, there is a growing demand for interactive and engaging methods to manage wellness, preventative care, and chronic conditions.

Gamification integrates elements such as points, rewards, challenges, and social interaction into health apps, making the process of adhering to treatment plans or adopting healthy behaviors more enjoyable and motivating. This approach transforms routine health tasks into engaging experiences. The Centers for Disease Control and Prevention (CDC) consistently highlights the importance of digital tools in public health initiatives.

While specific statistics for gamification are emerging, CDC data related to digital health adoption provides context. A CDC report in April 2024 noted significant progress in connecting public health data systems to healthcare IT, highlighting the increasing integration of digital technologies in healthcare delivery. Furthermore, the use of wearable healthcare devices is rising.

A report published in January 2025 noted that approximately 30% of the adult US population utilized wearable healthcare devices in 2023. This widespread availability of digital platforms and wearable technology provides a robust foundation for the growth of gamified healthcare solutions, driving market expansion by enhancing user engagement in health management.

Restraints

Concerns over Data Privacy and Security Risks are Restraining the Market

Significant concerns regarding data privacy and the security risks associated with collecting sensitive user information are a considerable restraint on the healthcare gamification market. Gamified health applications often require access to personal health data, behavioral patterns, and physiological metrics to provide tailored experiences. The potential for data breaches, unauthorized access, or the misuse of this sensitive information erodes user trust and discourages adoption.

High-profile incidents of data breaches in the broader healthcare sector demonstrate the vulnerability of digital health platforms. The US Department of Health and Human Services (HHS) Office for Civil Rights (OCR) tracks healthcare data breaches, offering insight into the scope of the problem. According to OCR data breach reports, the number of records exposed or impermissibly disclosed in healthcare increased significantly between 2022 and 2024.

For instance, The HIPAA Journal reported in January 2025 that 275 million records were breached in 2024, a notable increase from 168 million records breached in 2023, and 57 million in 2022. While these statistics include traditional healthcare providers, they underscore the pervasive security risks in the digital health sector. The lack of standardized security protocols and regulatory oversight specifically for consumer-facing gamified health apps heightens these concerns, making users hesitant to share their information and thereby restraining market growth.

Opportunities

Integrating Gamification into Mental Health and Behavioral Therapies is Creating Growth Opportunities

The increasing recognition of mental health as a critical component of overall wellness and the effectiveness of gamification in behavioral change are creating significant growth opportunities in the healthcare gamification market. Mental health conditions often require long-term management and adherence to treatment plans, areas where traditional methods frequently face challenges in sustained engagement.

Gamified applications provide engaging and accessible platforms for cognitive behavioral therapy (CBT), mindfulness exercises, and stress management, offering users interactive tools to track mood, practice coping strategies, and receive personalized feedback. The US National Institute of Mental Health (NIMH) provides statistics highlighting the prevalence of mental illness, underscoring the demand for innovative treatment approaches.

According to NIMH data, in 2022, an estimated 59.3 million adults in the US had some form of mental illness, representing 23.1% of the adult population. This substantial population base presents a vast market for digital solutions. By leveraging gamification mechanics, developers can enhance motivation, reduce the stigma associated with seeking mental health support, and provide scalable, personalized interventions, opening significant avenues for market expansion and innovation in digital mental health services.

Impact of Macroeconomic / Geopolitical Factors

Global economic shifts, including inflation and varying national investment priorities, significantly influence the healthcare gamification market by affecting development costs and consumer spending on digital health solutions. The creation of sophisticated gamified applications requires substantial investment in software development, cloud infrastructure, and cybersecurity, all subject to macroeconomic pressures.

Inflation can increase the operational expenses for developers, potentially leading to higher subscription fees for users or reduced investment in research and development. However, shifts in healthcare spending towards preventative care and digital solutions, driven by cost-containment efforts, can also spur market growth.

A report on global software spending published by WIPO in June 2025 noted that global software spending reached US$675 billion in 2024, up nearly 50% from 2020, reflecting a significant post-pandemic push to invest in improved software. This trend benefits the healthcare gamification market by increasing the overall availability and affordability of software infrastructure. While economic fluctuations may temporarily impact consumer spending on premium features, the long-term trend of prioritizing engaging and cost-effective digital health tools fosters a resilient market environment and drives continued innovation in the sector.

Evolving US trade policies, including tariffs and regulations on technology imports, are shaping the healthcare gamification market by influencing the cost of IT infrastructure and the emphasis on robust data protection. While the market relies heavily on intellectual property (software), the hardware components necessary for development and deployment, such as servers and specialized computing tools, often face tariffs. This can increase the operational costs for app developers and cloud service providers, potentially leading to higher pricing for consumers or reduced profitability.

A market analysis from March 2025 stated that uncertainty around the timing, scope, and duration of US tariffs makes it difficult for companies to assess potential impacts, particularly in sectors with deeply integrated technology supply chains. Conversely, a heightened focus on cybersecurity and data privacy, often driven by government regulations and trade concerns, is compelling developers to build more secure platforms. This emphasis on securing sensitive health data encourages innovation in privacy-preserving technologies and strengthens the overall trustworthiness of gamified health solutions in the US. The evolving regulatory landscape, while potentially adding compliance costs, ultimately contributes to a more secure and reliable digital health ecosystem.

Latest Trends

Focus on Serious Games for Training and Rehabilitation is a Recent Trend

A prominent recent trend in the healthcare gamification market in 2024 and 2025 is the intensified focus on “serious games” for medical training, education, and patient rehabilitation. Unlike traditional health apps focused on wellness, serious games are specifically designed to educate, train, or rehabilitate users through engaging and immersive simulations. This includes virtual reality (VR) and augmented reality (AR) experiences for surgical training, physical therapy exercises, and cognitive rehabilitation.

Healthcare institutions and providers are increasingly adopting these tools to improve skill retention, reduce training costs, and enhance patient outcomes. A June 2025 article in Neurology: Education highlighted a study showing that medical students using an interactive, video-based serious game for teaching neurologic emergencies retained more knowledge over time than those learning through traditional seminars. This demonstrates the effectiveness of gamified approaches in clinical education.

Furthermore, organizations are increasingly developing serious games for physical rehabilitation, motivating patients to complete repetitive exercises through competitive or rewarding gameplay. This trend represents a maturation of the market, shifting from general wellness apps to clinically validated tools that provide measurable benefits in professional training and patient recovery.

Regional Analysis

North America is leading the Healthcare Gamification Market

North America dominated the market with the highest revenue share of 41.8% owing to the shift towards patient-centric care and the recognition that engaging, interactive platforms can significantly improve adherence to treatment plans and promote preventative health behaviors. Gamification leverages behavioral science principles to motivate users through rewards, challenges, and competition, particularly within fitness and chronic disease management.

A major factor driving this growth is the increasing integration of these interactive tools by large healthcare providers and insurance companies. Companies like UnitedHealth Group, a key market player, reported robust growth in their Optum segment, which includes digital health services. Optum Health’s revenue per consumer served increased by 29% in 2022, reflecting the expansion of care delivery services including digital engagement.

The widespread adoption of technology in the United States, where 83% of people aged 3 and older used the internet in some fashion in 2023, a rise from 80% in 2021, as reported by the National Telecommunications and Information Administration (NTIA), supports the proliferation of these digital health platforms. The market is also benefiting from the increased use of wearables and mobile applications that track activity and offer personalized health challenges, driving higher user engagement and retention in wellness programs offered by health systems.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to rapidly evolving digital infrastructure, increased disposable incomes, and a growing emphasis on preventative healthcare in countries like China, India, and Japan. Governments across the region are prioritizing digital health transformation, providing a strong impetus for the adoption of engaging digital health tools.

In India, for example, the Ayushman Bharat Digital Mission (ABDM), an initiative of the Government of India, is expected to accelerate the integration of technology into healthcare, with over 730 million Ayushman Bharat Health Accounts (ABHA) created by January 2025, according to the Press Information Bureau. This initiative is likely to support the development of diverse digital health applications.

Furthermore, the total number of telephone subscribers in India reached 1,199.28 million as of March 2024, as reported by the Telecom Regulatory Authority of India (TRAI), providing a massive user base. Chinese government policies outlined in “Healthy China 2030” are also expected to emphasize preventative health and technology utilization. As consumers in the region become more digitally savvy and health-conscious, they are projected to embrace these motivating applications for managing chronic conditions, improving fitness, and adopting healthier lifestyles.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the healthcare gamification market employ various strategies to drive growth and enhance user engagement. They focus on integrating advanced technologies such as artificial intelligence and machine learning to offer personalized health interventions and predictive analytics. Companies also expand their service offerings to include chronic disease management, mental health support, and wellness programs, thereby catering to a broader user base.

Strategic partnerships with healthcare providers, insurers, and technology firms enable these companies to enhance their service offerings and expand market reach. Additionally, they invest in user-friendly interfaces and mobile applications to improve accessibility and user experience. Geographical expansion, particularly in emerging markets, further contributes to their growth trajectory.

One key player, Akili Interactive Labs, is a digital medicine company specializing in developing prescription digital therapeutics. The company focuses on creating clinically validated, software-based treatments for cognitive disorders, leveraging gamification principles to engage users. Akili’s flagship product, EndeavorRx, is the first FDA-approved video game-based therapy for pediatric ADHD. By combining neuroscience and gaming technology, Akili aims to transform the treatment landscape for cognitive conditions, offering an innovative approach to patient care.

Top Key Players in the Healthcare Gamification Market

- Sephora

- Nike

- Microsoft Corporation

- Mango Health

- Google LLC

- Ginkgo Health

- Fitbit

- BrainLAB AG

Recent Developments

- In December 2024, Ginkgo Health, an AI-powered healthcare technology provider, launched Ginkgo Active, a comprehensive app aimed at promoting overall wellness by offering customized exercise plans for users.

- In October 2022, Fitbit collaborated with behavioral analytics firm Pretaa to enhance health outcomes for millions of Americans dealing with substance misuse, aiming to use data-driven solutions to support recovery.

Report Scope

Report Features Description Market Value (2024) US$ 4.7 billion Forecast Revenue (2034) US$ 37.6 billion CAGR (2025-2034) 23.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Exercise & Serious Game and Casual Game), By Application (Education/Training of Physicians, Education/Training of Hospital Staff, Commercial Gains for Patients, Pharmaceutical Sales Training, Insurance Companies Using Gamification, and Gamification in Clinical Trials), By End-User (Enterprise-Based, Consumer-Based, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sephora, Nike, Microsoft Corporation, Mango Health, Google LLC, Ginkgo Health, Fitbit, BrainLAB AG. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Healthcare Gamification MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Healthcare Gamification MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Sephora

- Nike

- Microsoft Corporation

- Mango Health

- Google LLC

- Ginkgo Health

- Fitbit

- BrainLAB AG