Global Healthcare Biometrics Market Analysis By Technology (Single Factor Authentication (Face Recognition, Fingerprint Recognition, Iris Recognition, Hand Geometry Recognition, Vein Recognition, Voice Recognition, Gait Recognition, Signature Recognition, Behavioral Recognition, Others), Multi Factor Authentication, Multimodal Authentication), By Component (Hardware, Software, Services), By Application (Patient Identification & Tracking, Medical Record & Data Security, Care Provider Authentication, Access Control, Remote Patient Monitoring, Pharmacy Dispensing, Others), By End-User (Hospitals & Clinics, Healthcare Institutions, Clinical Laboratories, Research & Academic Institutes, Pharma & Life Science Companies, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 160286

- Number of Pages: 204

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

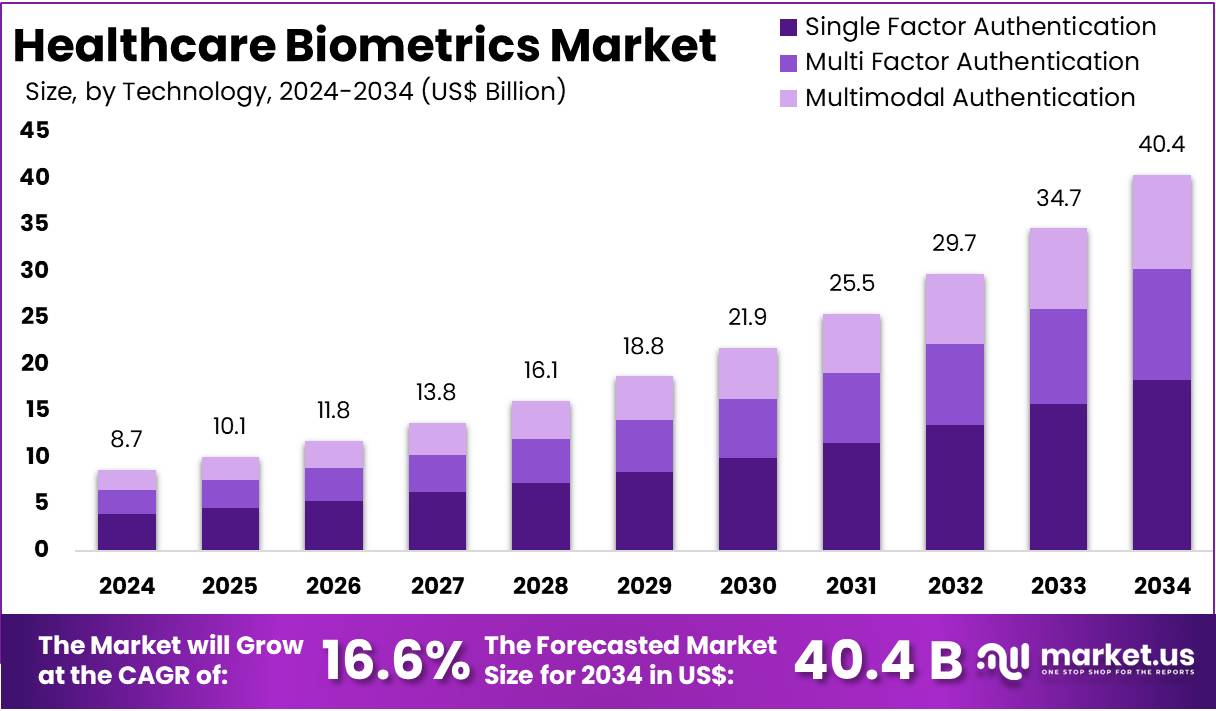

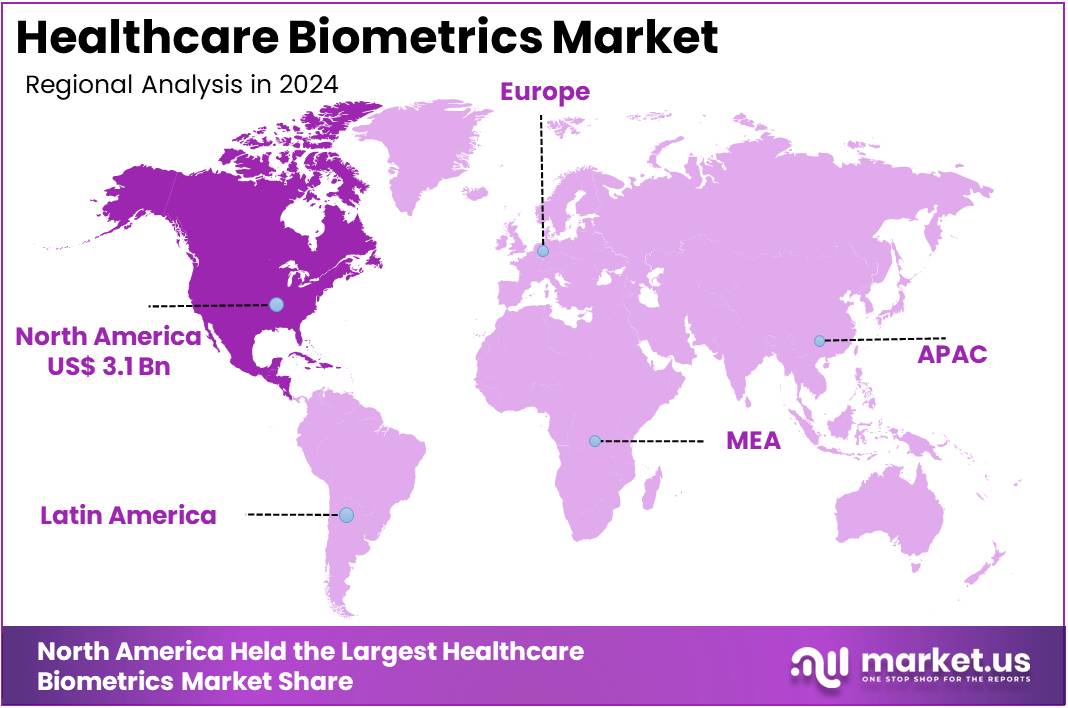

The Global Healthcare Biometrics Market size is expected to be worth around US$ 40.4 Billion by 2034, from US$ 8.7 Billion in 2024, growing at a CAGR of 16.6% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 35.9% share and holds US$ 3.1 Billion market value for the year.

Healthcare Biometrics refers to the use of technologies such as fingerprint recognition, iris scanning, facial recognition, and voice authentication in medical environments. These solutions replace traditional identification methods like passwords and ID cards. According to the World Health Organization (WHO), strong identity assurance is a key element in its Global Strategy on Digital Health (2020–2025). This global policy direction is encouraging hospitals and public health systems to adopt secure biometric authentication to ensure trusted care delivery.

Patient safety is a central driver of adoption. WHO reports that medication errors cause financial losses of about USD 42 billion each year globally. Accurate patient identification is promoted as a safety solution to reduce wrong-patient events in registration, prescribing, dispensing, and medical procedures. For example, biometric systems allow rapid verification at every point of care, ensuring correct patient matching and minimizing risks. This focus on reducing avoidable harm has positioned biometrics as an essential safety tool in healthcare systems.

The rapid expansion of telemedicine has added new demand for biometric solutions. In the United States, 37% of adults used telemedicine in 2021, and usage remained high in 2022 even after the pandemic peak. According to U.S. health data, secure and convenient sign-in methods are now critical for remote healthcare. Biometric logins integrated into patient apps meet both usability and privacy rules. For instance, facial recognition or fingerprint authentication provides a fast and compliant way for patients to access telehealth services.

Healthcare data breaches have further intensified the need for advanced security. The U.S. Department of Health & Human Services’ breach portal shows persistent large-scale exposures of protected health information. These events create regulatory and reputational risks for hospitals. To address this, healthcare providers are upgrading identity and access management with biometrics. Study by NIST also highlights the role of biometric authentication in building phishing-resistant systems, thereby reducing account compromise incidents in high-risk environments.

Demographic change is another factor shaping demand. United Nations projections indicate that the share of people aged 65 years and older will rise sharply in the coming decades. Older adults typically require multiple medications and frequent healthcare interactions. Biometric solutions ensure reliable patient matching in such complex care pathways. For example, quick fingerprint or iris recognition helps providers manage growing patient volumes while supporting safe, efficient workflows for aging populations.

Finally, global identification gaps are being bridged with biometric-enabled programs. The World Bank’s ID4D initiative estimates that about 850 million people still lack official IDs. Many new national digital identity systems include biometric features, and healthcare is a priority use case. For instance, NHS England has enabled FaceID and fingerprint logins for its NHS App after research showed strong user demand. Similarly, the EU’s 2024 Digital Identity framework promotes secure digital wallets, reinforcing the role of biometrics in healthcare access across regions.

Key Takeaways

- The global healthcare biometrics market is projected to grow from US$ 8.7 Billion in 2024 to approximately US$ 40.4 Billion by 2034.

- The market is anticipated to record a compound annual growth rate (CAGR) of 16.6% during the forecast period spanning 2025 to 2034.

- In 2024, the Single Factor Authentication category led the technology segment, capturing more than 45.5% of the overall healthcare biometrics market share.

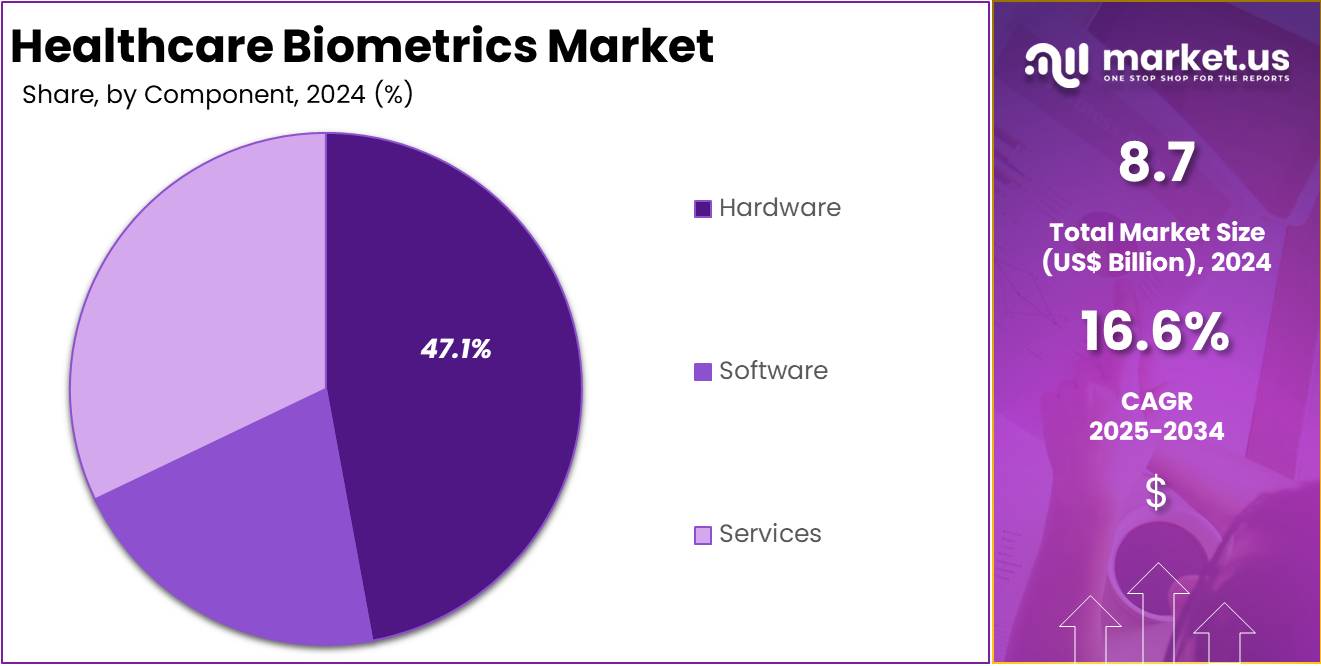

- Hardware dominated the component segment of the healthcare biometrics market in 2024, holding a commanding share of over 47.1% of the total.

- Patient Identification & Tracking accounted for the largest share in the application segment, representing more than 31% of the market in 2024.

- Hospitals and Clinics emerged as the leading end-users in 2024, capturing more than 42.4% share within the healthcare biometrics market globally.

- North America held a dominant regional position in 2024, capturing over 35.9% market share, valued at approximately US$ 3.1 Billion.

Technology Analysis

In 2024, the Single Factor Authentication Section held a dominant market position in the Technology Segment of Healthcare Biometrics Market, and captured more than a 45.5% share. This segment included fingerprint, face, iris, hand geometry, vein, voice, and other recognition systems. Fingerprint technology remained the most widely deployed because of low cost and high accuracy. Face recognition saw rising adoption due to its contactless nature. Other methods such as iris and vein recognition gained selective use in high-security environments.

Multi-Factor Authentication showed strong growth momentum. Its rise was supported by increasing cybersecurity risks and regulatory compliance requirements. Hospitals and clinics applied MFA to secure remote EHR access, protect privileged accounts, and safeguard e-prescriptions. The growing trend toward passwordless systems and phishing-resistant solutions further supported uptake. Although MFA involved higher costs and required usability adjustments, it delivered stronger protection against identity fraud. Its role was expected to expand across critical healthcare applications.

Multimodal Authentication combined two or more biometric methods to provide stronger accuracy and resilience. Hospitals used these systems in sensitive areas such as medication vaults and restricted access zones. Combining modalities such as face and iris, or palm vein and fingerprint, lowered error rates while improving liveness detection. Despite higher upfront investment and complex integration, multimodal systems were seen as effective in meeting stringent security demands. Their adoption was expected to accelerate as healthcare institutions prioritized safety and compliance.

Overall, Single Factor Authentication continued to dominate the market by share. Multi-Factor Authentication recorded faster adoption, driven by rising security threats. Multimodal Authentication demonstrated the strongest potential for accuracy improvements and compliance alignment. Across all segments, demand was shaped by cost efficiency, workflow compatibility, and privacy requirements. Contactless technologies were favored, while passwordless authentication gained priority. The market outlook indicated steady growth, supported by enhanced security needs, patient safety requirements, and regulatory enforcement across the healthcare sector.

Component Analysis

In 2024, the Hardware Section held a dominant market position in the Component Segment of the Healthcare Biometrics Market, and captured more than a 47.1% share. The dominance was supported by the increasing use of fingerprint scanners, iris recognition systems, and palm vein devices. Hospitals, clinics, and diagnostic centers adopted these technologies to strengthen patient identification. Rising concerns about security in healthcare facilities also pushed demand. The strong need for reliable access control helped hardware secure the largest share.

The Software Section recorded significant traction within the market. This segment grew due to the rising demand for data processing, storage, and analysis. The integration of advanced algorithms improved authentication accuracy. Cloud-based platforms also accelerated adoption across healthcare systems. The need for secure electronic health record management encouraged greater software use. Software acted as a bridge between biometric hardware and data-driven healthcare operations. Its growth reflected the increasing reliance on digital systems for safe patient information handling.

The Services Section showed steady expansion and played a crucial supportive role. Services included integration, consulting, and ongoing maintenance of biometric systems. Healthcare institutions relied on third-party expertise to manage complex deployments. The increasing demand for training and continuous system monitoring added further value. Hospitals and providers adopted service-based models to ensure system efficiency. The expansion was driven by the complexity of modern biometric networks. Services are expected to continue supporting sustainable adoption of biometrics across healthcare facilities worldwide.

Application Analysis

In 2024, the Patient Identification & Tracking section held a dominant market position in the Application Segment of the Healthcare Biometrics Market, and captured more than a 31% share. This strong position has been attributed to growing adoption in hospitals and clinics. The segment benefits from the need to reduce duplicate records and prevent identity fraud. Analysts observed that biometric solutions are being widely implemented to improve patient verification, minimize errors, and enhance overall treatment safety.

The Medical Record & Data Security segment secured a substantial portion of the market. Its growth has been driven by increasing cases of cyber threats and unauthorized access to electronic health records. Experts emphasized that healthcare institutions are investing in biometric systems to ensure compliance with data protection standards. The Care Provider Authentication segment also showed steady momentum. The use of strong biometric checks has been encouraged to provide authorized access to patient information and clinical workflows.

Access Control applications displayed rising deployment in hospitals and laboratories. The need to safeguard operating rooms, pharmacies, and sensitive research areas has accelerated adoption. At the same time, Remote Patient Monitoring is emerging as a fast-growing area. Its expansion has been supported by the rising trend of telemedicine and home healthcare. Furthermore, Pharmacy Dispensing systems have gained attention for regulating drug distribution. The Others category, which includes administrative and research uses, continues to contribute to the overall market expansion.

End-User Analysis

In 2024, the Hospitals & Clinics section held a dominant market position in the end-user segment of the healthcare biometrics market, and captured more than a 42.4% share. This growth was linked to a rising number of patients and strict compliance needs. Biometric systems were widely used to improve patient identification and access control. Healthcare institutions also showed strong adoption levels. The demand was influenced by policies, investments in digital health, and the need for accurate data handling.

Clinical laboratories represented another key end-user segment in the healthcare biometrics market. Adoption in this area was driven by the need to protect sensitive results, authenticate staff, and streamline laboratory operations. The surge in diagnostic testing volumes further boosted biometric integration. Research and academic institutes also contributed to market demand. Their adoption was mostly for protecting research data and improving access security. Partnerships with pharmaceutical companies and healthcare providers supported this steady growth.

Pharmaceutical and life science companies adopted healthcare biometrics to secure laboratories and safeguard trial data. Compliance with global standards and intellectual property protection were major drivers in this segment. Other end-users, such as rehabilitation centers and specialized care units, contributed at a smaller but stable rate. Their focus was on staff verification, patient monitoring, and access control. Although less prominent, this group still enhanced overall adoption patterns. Together, these end-user segments shaped a broad and expanding healthcare biometrics market.

Key Market Segments

By Technology

- Single Factor Authentication

- Face Recognition

- Fingerprint Recognition

- Iris Recognition

- Hand Geometry Recognition

- Vein Recognition

- Voice Recognition

- Gait Recognition

- Signature Recognition

- Behavioral Recognition

- Others

- Multi Factor Authentication

- Multimodal Authentication

By Component

- Hardware

- Software

- Services

By Application

- Patient Identification & Tracking

- Medical Record & Data Security

- Care Provider Authentication

- Access Control

- Remote Patient Monitoring

- Pharmacy Dispensing

- Others

By End-User

- Hospitals & Clinics

- Healthcare Institutions

- Clinical Laboratories

- Research & Academic Institutes

- Pharma & Life Science Companies

- Others

Drivers

Rising Need for Secure Patient Identification

The healthcare biometrics market is being propelled by the rising demand for secure patient identification. Accurate verification of patient identity is critical in reducing medical errors, ensuring that patients receive the right treatment and medication. Hospitals and clinics face increasing pressure to implement systems that eliminate mistakes in patient data handling. Biometric solutions such as fingerprint, facial, and iris recognition are being adopted widely to meet this need. Their use provides unmatched accuracy and creates trust in healthcare delivery systems.

Fraud prevention is another important factor supporting market growth. The misuse of patient data, including insurance fraud, has created a pressing need for advanced security measures. Traditional methods such as ID cards or PIN codes are prone to theft or duplication. In contrast, biometric authentication is unique and almost impossible to replicate. This strengthens the security of medical records and protects healthcare institutions from financial and reputational risks. Consequently, adoption of biometric solutions continues to rise across healthcare organizations.

Additionally, the protection of sensitive health information is a major driver of biometrics in healthcare. With digital health records becoming the norm, safeguarding patient privacy has become a regulatory and ethical requirement. Biometric technology provides robust access control and ensures that only authorized personnel can access confidential information. This reduces the risk of data breaches and aligns with strict compliance standards such as HIPAA. As cybersecurity threats grow, healthcare providers increasingly rely on biometrics to secure patient data and maintain compliance.

Restraints

High Implementation Costs

The implementation of biometric technologies in healthcare is facing notable restraints due to high upfront costs. These costs include expenses related to specialized hardware, advanced software, and secure system integration. For low- and middle-income healthcare providers, such investments remain financially burdensome. Limited budget allocations in these facilities reduce the possibility of adopting these technologies on a wide scale. As a result, the initial capital required for deployment acts as a significant barrier, slowing the adoption of biometric solutions in critical healthcare environments.

The integration of biometric systems also requires additional investments in staff training and maintenance. Healthcare facilities must ensure technical staff are well-equipped to handle system updates, troubleshooting, and compliance requirements. These hidden expenses add further weight to the overall cost structure. In many cases, resource-constrained hospitals and clinics prioritize immediate medical needs over technological upgrades. Consequently, the long-term benefits of biometrics are overshadowed by pressing short-term operational challenges, making implementation difficult in underfunded healthcare systems.

Furthermore, the lack of financial incentives or government subsidies worsens the situation for smaller healthcare providers. While larger hospitals in developed regions can justify these expenditures, smaller facilities struggle to secure necessary funding. Without adequate financial support, many organizations delay or abandon biometric implementation projects. This uneven adoption creates disparities in healthcare data security and patient identification standards. The high initial investment, combined with limited financial resources, continues to act as a critical restraint for the global healthcare biometrics market.

Opportunities

Integration with Telehealth and Digital Health Platforms

The integration of healthcare biometrics with telehealth platforms offers a major growth avenue. The expansion of remote medical services has created a demand for secure identity verification. Biometric solutions such as fingerprint, iris, and facial recognition can support patient authentication during virtual consultations. This ensures that sensitive medical data is accessed only by authorized individuals. As telemedicine adoption increases globally, healthcare biometrics will play a crucial role in enhancing trust, protecting privacy, and ensuring compliance with healthcare regulations.

The use of biometrics in digital health services also strengthens compliance with strict data security requirements. Regulations such as HIPAA in the United States and GDPR in Europe mandate high standards of patient data protection. Biometric authentication addresses these requirements by reducing risks of data breaches and unauthorized access. By integrating biometrics into digital health platforms, providers can enhance both patient confidence and regulatory adherence. This dual advantage positions healthcare biometrics as a vital enabler of secure remote care delivery.

Additionally, the rising consumer demand for seamless and user-friendly healthcare services is boosting the adoption of biometrics in telehealth. Patients prefer quick, reliable, and secure methods of authentication instead of passwords or PINs. Biometric technologies meet these expectations while ensuring accuracy and convenience. As healthcare ecosystems become increasingly digital, the synergy between biometrics and telehealth platforms presents a strong opportunity. It enables providers to differentiate their offerings, attract patients seeking secure care, and establish a competitive advantage in the evolving healthcare market.

Trends

Shift Toward Multimodal Biometric Systems in Healthcare

The healthcare biometrics market is witnessing a notable shift toward multimodal biometric systems. These solutions integrate fingerprint, iris, and facial recognition technologies into a single framework. The approach enhances system reliability by reducing dependency on a single modality. By combining multiple identifiers, higher accuracy in patient verification is achieved. This minimizes the risk of errors and identity fraud, which are critical issues in healthcare environments. Consequently, multimodal systems are being adopted as a standard for secure patient identification.

The demand for multimodal biometric systems is driven by the need for improved security and efficiency. Traditional single-mode solutions often face challenges such as false positives or low accuracy in complex healthcare settings. Multimodal systems address these limitations by cross-verifying identities across multiple biometric markers. This strengthens authentication and ensures accurate access control for medical staff and patients. The growing integration of electronic health records and digital healthcare platforms further accelerates the adoption of these advanced systems.

The shift toward multimodal biometric systems reflects broader industry priorities of data protection and compliance. Regulatory frameworks such as HIPAA in the U.S. and GDPR in Europe emphasize patient privacy and secure data handling. Healthcare providers are responding by investing in robust biometric technologies that align with these regulations. In addition, rising concerns over cybersecurity threats in healthcare systems are increasing reliance on biometric safeguards. This trend is expected to drive long-term growth and innovation in healthcare biometrics globally.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 35.9% share and valued at over USD 3.1 billion in the healthcare biometrics market. The region’s leadership is driven by advanced digital maturity and strong regulatory frameworks supporting biometric authentication. According to the Office of the National Coordinator for Health IT (ONC), by 2021 nearly 96% of non-federal acute-care hospitals and about 80% of office-based physicians in the United States were using certified electronic health record (EHR) systems. This widespread adoption has created a large base for biometric integration.

Healthcare spending has also reinforced growth in this market. As per OECD’s Health at a Glance 2023, health outlays per person in the United States reached USD 12,555 in 2022, more than double the OECD average. This high spending capacity enables hospitals, clinics, and physician groups to invest in advanced identity and access management systems, including biometric solutions. For instance, biometric log-in and e-prescribing functions are increasingly being deployed to enhance security and efficiency in patient care workflows.

Regulatory frameworks have directly influenced adoption. The U.S. Drug Enforcement Administration mandates two-factor authentication for electronic prescriptions of controlled substances. According to 21 CFR Part 1311, biometrics can serve as one of the required factors, and the DEA provides specific performance criteria, including false-match rate thresholds, for biometric subsystems. This prescriptive guidance has driven healthcare providers to adopt biometrics for compliance while ensuring security in e-prescribing environments.

Cybersecurity challenges have further accelerated deployment. Data from the U.S. Department of Health and Human Services shows that healthcare data breaches remain consistently high. For example, the Office for Civil Rights maintains a public portal of large breach incidents, underlining the risks facing hospitals and providers. These rising threats have increased enterprise demand for stronger identity controls, with biometrics becoming a critical layer to protect patient records and minimize credential misuse.

Interoperability initiatives have also contributed to market dominance in North America. According to ONC priorities, accurate patient identity matching across national health exchange networks is essential for safe data sharing. Hospitals report significant participation in these networks, which increases the value of biometric tools in ensuring accurate patient identity resolution. Together, high EHR penetration, elevated health spending, regulatory enforcement, growing cyber risks, and interoperability needs firmly position North America as the leading region in the healthcare biometrics market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players such as Thales, BIO-key International, and NEC Corporation are driving the healthcare biometrics market. Thales offers strong identity management and multimodal solutions, which are useful in patient safety and fraud prevention. BIO-key International integrates biometrics with IAM platforms to deliver secure and seamless access to healthcare systems. NEC Corporation is recognized for its highly accurate facial recognition, often ranked among the best in global benchmarks. These companies are strengthening healthcare security while improving patient identity verification across multiple points of care.

Technology innovation is also supported by Qualcomm Technologies and HID Global Corporation. Qualcomm provides embedded biometric capabilities, such as ultrasonic fingerprint authentication, for medical devices and telehealth platforms. HID Global, strengthened by its Lumidigm and Crossmatch acquisitions, specializes in multispectral fingerprint solutions. These technologies are reliable for use in clinical settings and provide high accuracy even in difficult environments. Their solutions are valuable in patient identification, controlled substance workflows, and healthcare staff access management. These contributions address growing demands for secure and compliant systems.

Other notable participants include IDEMIA, Suprema Inc., and Imprivata Inc. IDEMIA is well positioned with its digital identity solutions, which support both patient and provider verification. Suprema Inc. delivers biometric access control devices widely adopted in hospitals and laboratories. Imprivata Inc. holds a strong reputation as a healthcare identity specialist, offering fast and secure authentication for clinicians. These players are gaining traction in electronic prescribing, single sign-on, and compliance-driven applications. Their tailored solutions reflect a growing focus on usability, workflow efficiency, and patient safety in healthcare facilities.

Additional contributors are Fujitsu, Hitachi Ltd., Aware Inc., ZKTeco Inc., FaceTec, Vision-Box, and others. Fujitsu and Hitachi bring vein recognition systems that perform well for patient identification where other modalities fail. Aware Inc. provides biometric software frameworks adaptable for healthcare IAM. ZKTeco offers touchless systems, suitable for hygiene-sensitive hospital environments. FaceTec delivers advanced liveness detection for remote onboarding, while Vision-Box ensures secure biometric orchestration. These companies, alongside market leaders, enhance the adoption of biometrics by delivering robust, accurate, and scalable solutions for healthcare institutions worldwide.

Market Key Players

- Thales

- BIO-key International

- NEC Corporation

- Qualcomm Technologies Inc.

- HID Global Corporation

- IDEMIA

- Suprema Inc.

- Imprivata Inc.

- Fujitsu

- Hitachi Ltd.

- Aware Inc.

- ZKTeco Inc

- Crossmatch

- Lumidigm

- FaceTec

- Vision-Box

Recent Developments

- In January 2024: HID announced the acquisition of Vizzia Technologies. This move strengthened HID’s real-time location systems (RTLS) portfolio by enhancing asset management and tracking capabilities. The acquisition was aimed at healthcare facilities and is expected to bolster HID’s competitive position in the healthcare sector by incorporating more advanced location systems tailored to clinical environments.

- In March 2024: Thales supplied the first biometric payment card in Türkiye for Garanti BBVA. This marked the first launch of its kind in the country. The card integrated Fingerprint Cards AB’s T-Shape sensor (T2) with Thales’ biometric payment infrastructure. The initiative demonstrated Thales’ growing presence in biometric applications within financial and healthcare-adjacent areas, particularly in secure payment authentication.

- In September 2024: NEC introduced a new biometric authentication system capable of verifying up to 100 individuals per minute while in motion. Unlike traditional systems, this innovation did not require physical gates, thereby reducing congestion in high-traffic areas such as venues and infrastructure facilities. The global rollout began in September, with initial deployment in Japan, the United States, and Singapore.

- In October 2024: Qualcomm announced plans to explore automotive applications for biometrics and FIDO passkeys. The company’s research focused on enabling identity verification, personalization, and secure in-vehicle payments. This move highlighted Qualcomm’s intent to extend biometric technology into the automotive sector, merging security with convenience.

Report Scope

Report Features Description Market Value (2024) US$ 8.7 Billion Forecast Revenue (2034) US$ 40.4 Billion CAGR (2025-2034) 16.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technology (Single Factor Authentication (Face Recognition, Fingerprint Recognition, Iris Recognition, Hand Geometry Recognition, Vein Recognition, Voice Recognition, Gait Recognition, Signature Recognition, Behavioral Recognition, Others), Multi Factor Authentication, Multimodal Authentication), By Component (Hardware, Software, Services), By Application (Patient Identification & Tracking, Medical Record & Data Security, Care Provider Authentication, Access Control, Remote Patient Monitoring, Pharmacy Dispensing, Others), By End-User (Hospitals & Clinics, Healthcare Institutions, Clinical Laboratories, Research & Academic Institutes, Pharma & Life Science Companies, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Thales, BIO-key International, NEC Corporation, Qualcomm Technologies Inc., HID Global Corporation, IDEMIA, Suprema Inc., Imprivata Inc., Fujitsu, Hitachi Ltd., Aware Inc., ZKTeco Inc, Crossmatch, Lumidigm, FaceTec, Vision-Box, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Healthcare Biometrics MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Healthcare Biometrics MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Thales

- BIO-key International

- NEC Corporation

- Qualcomm Technologies Inc.

- HID Global Corporation

- IDEMIA

- Suprema Inc.

- Imprivata Inc.

- Fujitsu

- Hitachi Ltd.

- Aware Inc.

- ZKTeco Inc

- Crossmatch

- Lumidigm

- FaceTec

- Vision-Box