Global Glass Wool Insulation Market Size, Share Analysis Report By Form (Blanket Insulation, Loose-Fill Insulation, Board Insulation, Batt Insulation), By Property ( Thermal Insulation, Acoustic Insulation, Fire Resistance), By Application (Residential Buildings, Commercial Buildings, Industrial Buildings, Transportation, Others), By End-Use (New Construction, Renovation and Remodeling) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159936

- Number of Pages: 362

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

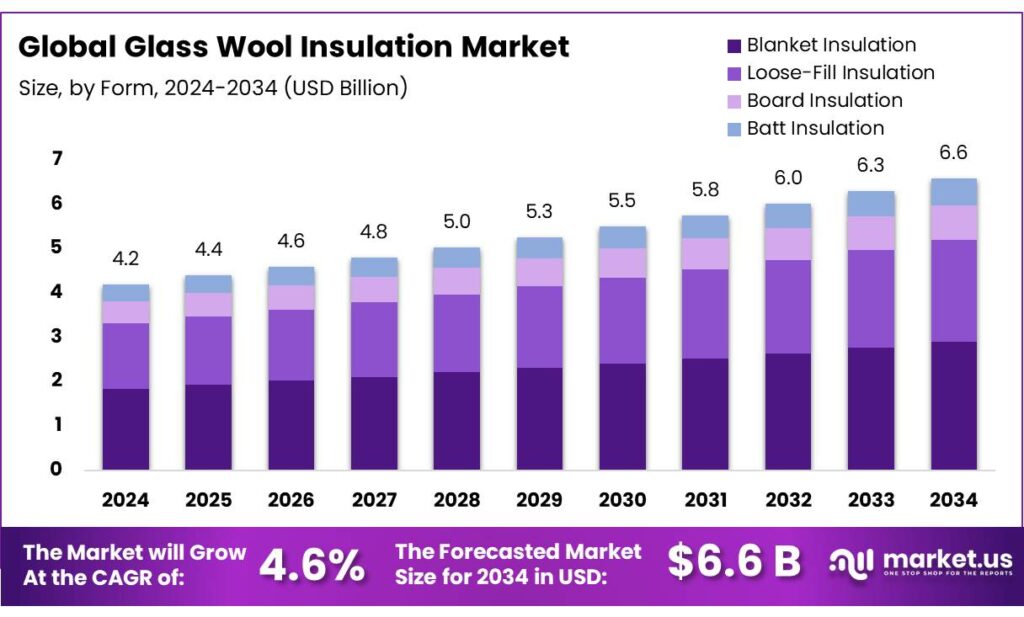

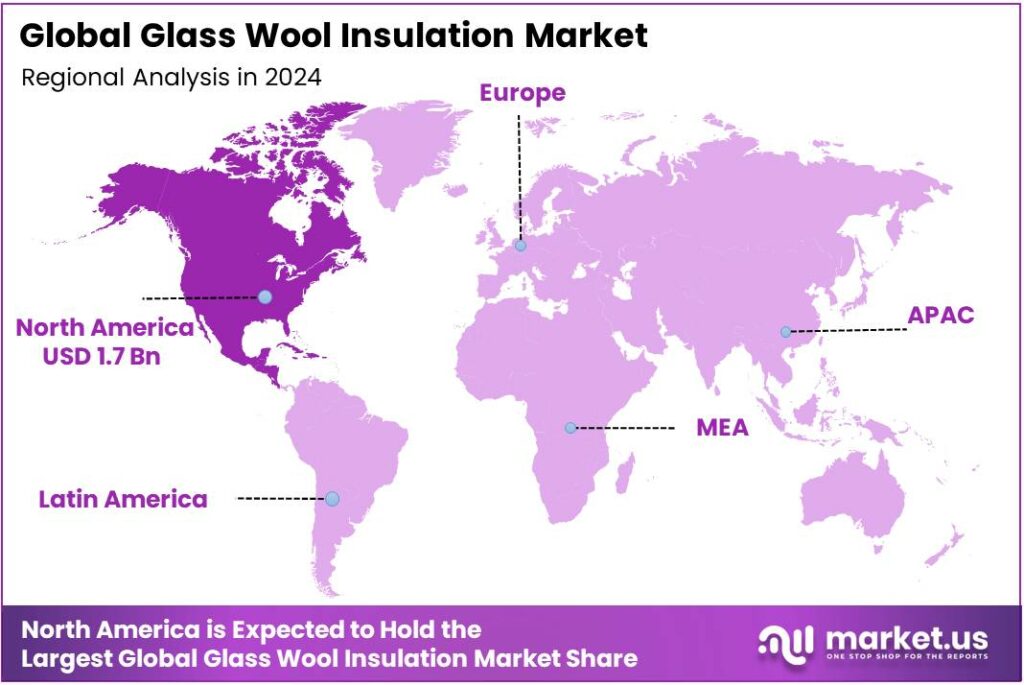

The Global Glass Wool Insulation Market size is expected to be worth around USD 6.6 Billion by 2034, from USD 4.2 Billion in 2024, growing at a CAGR of 4.6% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 42.3% share, holding USD 1.7 Billion in revenue

Glass wool insulation, also known as fiberglass insulation, is a widely utilized material in the construction and industrial sectors due to its superior thermal and acoustic properties. Manufactured by melting sand and recycled glass at high temperatures, the resulting fibers are bonded to form a lightweight, flexible, and non-combustible product. This material is predominantly used in residential, commercial, and industrial applications to enhance energy efficiency and reduce noise pollution.

Several driving factors contribute to the market’s expansion. Government initiatives promoting energy efficiency and sustainable building practices are significant drivers. For instance, the U.S. Environmental Protection Agency’s ENERGY STAR program encourages homeowners to invest in proper insulation to reduce energy consumption. Additionally, stringent building codes and regulations worldwide mandate the use of energy-efficient materials, further boosting the demand for glass wool insulation.

Government initiatives further bolster the demand for glass wool insulation. The Great British Insulation Scheme, with a budget of £1 billion over three years, aims to enhance energy efficiency in residential properties through various insulation measures. In the U.S., programs like ENERGY STAR provide tax credits for energy-efficient home upgrades, including insulation improvements.

The glass wool insulation market is characterized by the presence of several key players, including Owens Corning, Knauf Insulation, and Saint-Gobain. These companies are focusing on product innovation, sustainability, and expanding their manufacturing capabilities to meet the growing demand. For example, Owens Corning, a leading manufacturer of insulation products, reported a revenue of USD 10.98 billion in 2024

Key Takeaways

- Glass Wool Insulation Market size is expected to be worth around USD 6.6 Billion by 2034, from USD 4.2 Billion in 2024, growing at a CAGR of 4.6%.

- Blanket Insulation held a dominant market position, capturing more than a 43.9% share of the glass wool insulation market.

- Thermal Insulation held a dominant market position, capturing more than a 56.2% share of the glass wool insulation market.

- Residential Buildings held a dominant market position, capturing more than a 38.6% share of the glass wool insulation market.

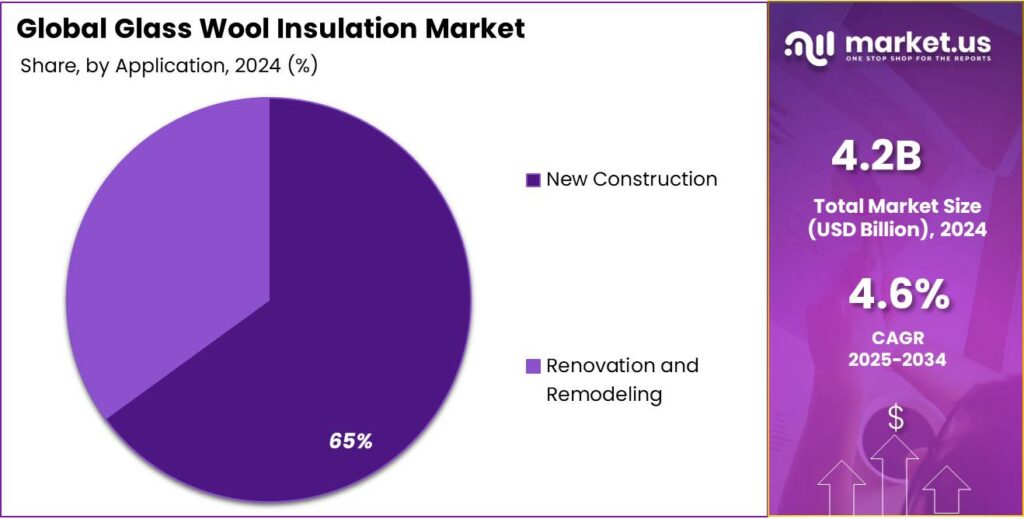

- New Construction held a dominant market position, capturing more than a 65.4% share of the glass wool insulation market.

- North America held a dominant position in the glass wool insulation market, capturing more than a 42.3% share, equating to approximately USD 1.7 billion.

By Form Analysis

Blanket Insulation dominates with 43.9% share in 2024 due to its versatility and ease of installation

In 2024, Blanket Insulation held a dominant market position, capturing more than a 43.9% share of the glass wool insulation market. This form of insulation is widely preferred in both residential and commercial construction due to its flexibility, ease of handling, and ability to cover large areas efficiently. Its continuous roll format allows for quick installation in walls, ceilings, and floors, reducing labor time and costs. Over the year, the demand for Blanket Insulation has been driven by increasing construction activities and the push for energy-efficient buildings.

In 2025, the adoption of Blanket Insulation is expected to maintain strong momentum as builders and homeowners continue prioritizing thermal and acoustic comfort, along with compliance to energy regulations. The form’s adaptability to varied building structures, combined with its cost-effectiveness compared to other insulation types, reinforces its leading market position in the glass wool segment.

By Property Analysis

Thermal Insulation leads with 56.2% share in 2024 driven by energy efficiency needs

In 2024, Thermal Insulation held a dominant market position, capturing more than a 56.2% share of the glass wool insulation market. This property is highly valued across residential, commercial, and industrial sectors for its ability to significantly reduce heat transfer, improve energy efficiency, and lower heating and cooling costs. The growing focus on sustainable construction and the enforcement of energy-saving building codes have further boosted its adoption.

In 2025, Thermal Insulation is expected to continue its strong growth trajectory, as both new construction and retrofitting projects increasingly rely on materials that enhance indoor comfort while minimizing energy consumption. Its effectiveness in maintaining stable indoor temperatures, along with cost benefits over time, reinforces its leading role in the glass wool insulation segment.

By Application Analysis

Residential Buildings lead with 38.6% share in 2024 due to rising energy-efficient construction

In 2024, Residential Buildings held a dominant market position, capturing more than a 38.6% share of the glass wool insulation market. The rising focus on energy-efficient homes and sustainable living has driven the adoption of glass wool insulation in this segment. Its ability to provide excellent thermal and acoustic comfort makes it ideal for walls, roofs, and floors in residential structures. In 2025, the demand from residential construction is expected to grow steadily as new housing projects and renovation initiatives increasingly incorporate energy-saving materials. The ease of installation, cost-effectiveness, and proven performance of glass wool insulation reinforce its strong presence in residential applications, helping homeowners reduce energy consumption while enhancing indoor comfort.

By End-Use Analysis

New Construction dominates with 65.4% share in 2024 driven by expanding building projects

In 2024, New Construction held a dominant market position, capturing more than a 65.4% share of the glass wool insulation market. The high demand in this segment is attributed to rapid urbanization, rising infrastructure development, and the construction of energy-efficient buildings. Glass wool insulation is widely used in new projects due to its superior thermal performance, fire resistance, and acoustic benefits, which make it ideal for modern construction standards.

In 2025, the trend is expected to continue as governments and developers emphasize sustainable building practices, ensuring that new constructions increasingly adopt high-performance insulation materials. Its ease of installation and long-term cost savings further strengthen its dominance in the new construction segment.

Key Market Segments

By Form

- Blanket Insulation

- Loose-Fill Insulation

- Board Insulation

- Batt Insulation

By Property

- Thermal Insulation

- Acoustic Insulation

- Fire Resistance

By Application

- Residential Buildings

- Commercial Buildings

- Industrial Buildings

- Transportation

- Others

By End-Use

- New Construction

- Renovation and Remodeling

Emerging Trends

Embracing Sustainability: Glass Wool Insulation in the Food Industry

In recent years, the food industry has increasingly turned to sustainable practices to enhance energy efficiency and reduce environmental impact. One notable development is the growing adoption of glass wool insulation in food processing facilities. This trend not only addresses energy conservation but also aligns with global sustainability goals.

Recognizing the importance of energy efficiency, the Indian government has implemented several initiatives to promote sustainable practices across industries. Programs like the Perform, Achieve, and Trade (PAT) scheme under the National Mission for Enhanced Energy Efficiency (NMEEE) encourage industries to reduce specific energy consumption through financial incentives and tradable energy-saving certificates. These initiatives have led to a significant increase in the adoption of energy-efficient technologies, including insulation materials like glass wool.

The food industry, known for its energy-intensive operations, stands to benefit significantly from the adoption of glass wool insulation. By improving thermal efficiency, these materials help maintain consistent temperatures in processing and storage areas, leading to reduced energy consumption. Moreover, glass wool insulation is often made from recycled materials, contributing to a circular economy and reducing the carbon footprint of manufacturing facilities.

Drivers

Energy Efficiency in Food Processing Facilities

In the food industry, maintaining consistent temperatures is crucial for product quality and safety. Glass wool insulation plays a significant role in enhancing energy efficiency by minimizing heat loss or gain in processing equipment, refrigeration units, and storage areas. This leads to substantial energy savings and improved operational performance.

According to a study by the U.S. Department of Energy, industrial insulation can reduce energy consumption by up to 25% in certain applications. This reduction is particularly beneficial in the food sector, where energy-intensive processes are common. For instance, in dairy processing, maintaining precise temperatures is essential to preserve product quality and comply with health regulations.

Moreover, the use of glass wool insulation contributes to environmental sustainability. The material is often made from recycled glass, aligning with green building practices and reducing the carbon footprint of manufacturing facilities. This eco-friendly aspect is increasingly important as consumers and regulatory bodies emphasize sustainability in food production.

Restraints

Cost Implications of Glass Wool Insulation in the Food Industry

While glass wool insulation offers significant benefits in energy efficiency and temperature control within food processing facilities, its initial cost remains a notable barrier for many businesses.

In India, the price of glass wool insulation varies based on density and thickness. For instance, products range from ₹60 to ₹330 per square meter, depending on specifications such as density and temperature resistance. This variability can make it challenging for food manufacturers, especially small and medium-sized enterprises (SMEs), to budget for insulation upgrades.

- The upfront investment required for quality insulation materials, coupled with installation costs, can be substantial. For example, a facility requiring 1,000 square meters of insulation at an average cost of ₹200 per square meter would face an expenditure of ₹200,000 just for materials. When factoring in labor and potential downtime during installation, the total cost can escalate quickly.

This financial burden is particularly challenging in the food industry, where profit margins are often slim, and the focus is on maintaining product quality and safety. The reluctance to invest in insulation due to cost concerns can lead to higher energy consumption, less efficient temperature control, and ultimately, increased operational costs.

Recognizing these challenges, the Indian government has introduced various initiatives to promote energy efficiency in industries, including the Perform, Achieve, and Trade (PAT) scheme under the National Mission for Enhanced Energy Efficiency (NMEEE). While these programs aim to reduce energy consumption, the initial capital required for insulation upgrades can still be a deterrent for many food processing units.

Opportunity

Government Support for Glass Wool Insulation in the Food Sector

In India, the government’s emphasis on energy efficiency and sustainable building practices has significantly influenced the adoption of glass wool insulation in various industries, including food processing. This support is evident through initiatives like the Smart Cities Mission and the Energy Conservation Building Code (ECBC), which promote the use of energy-efficient materials and technologies. Such policies have led to a notable increase in the adoption of glass wool insulation, particularly in the building and construction sector.

The adoption of glass wool insulation in food processing facilities offers several benefits, including improved energy efficiency and compliance with environmental standards. By reducing energy consumption, food manufacturers can lower operational costs and contribute to sustainability goals. Additionally, the use of recycled glass in the production of glass wool aligns with the growing emphasis on circular economy principles.

Government initiatives and policies play a crucial role in promoting the adoption of glass wool insulation in the food industry. These efforts not only enhance energy efficiency but also support environmental sustainability, making glass wool insulation a viable and beneficial choice for food processing facilities in India.

Regional Insights

North America leads with 42.3% share in 2024, valued at USD 1.7 billion, driven by stringent energy codes and robust construction activities

In 2024, North America held a dominant position in the glass wool insulation market, capturing more than a 42.3% share, equating to approximately USD 1.7 billion in market value. This leadership is attributed to the region’s stringent building codes, such as the International Energy Conservation Code (IECC), which mandate high-performance insulation materials in both residential and commercial constructions. The U.S. accounted for the majority of this share, driven by its substantial construction sector and commitment to energy efficiency.

The demand for glass wool insulation in North America is bolstered by its superior thermal and acoustic properties, making it a preferred choice for applications requiring high durability and fire resistance, such as residential roofing and wall insulation. According to the U.S. Department of Energy, nearly 40% of total energy consumption in the U.S. is attributed to residential and commercial buildings, underscoring the importance of effective insulation solutions.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Alghanim Industries, a leading conglomerate in the Middle East, is a significant player in the glass wool insulation market. With a strong presence in the construction and energy sectors, the company provides a range of insulation products, including glass wool, for both industrial and residential applications. Alghanim focuses on sustainability and energy efficiency, aligning with regional regulations to improve building performance and environmental impact.

CertainTeed, a subsidiary of Saint-Gobain, is a prominent manufacturer of building materials, including glass wool insulation. The company offers a wide range of thermal, acoustic, and fire-resistant insulation products for residential and commercial buildings. CertainTeed is committed to sustainability, with a focus on reducing energy consumption and improving the energy efficiency of buildings. Their glass wool insulation is designed to meet high-performance standards, helping to reduce energy costs and support environmental goals in construction projects.

Bradford Insulation Industries Ltd. is an Australian company specializing in the production of insulation materials, including glass wool. Bradford’s insulation products are widely used in residential, commercial, and industrial sectors. The company emphasizes sustainability, offering energy-efficient solutions that help reduce carbon footprints. Bradford is known for its commitment to product quality and innovation, providing thermal, acoustic, and fire-resistant insulation solutions to meet building standards and improve energy efficiency.

Top Key Players Outlook

- Alghanim Industries

- Armacell

- BASF

- Bradford Insulation Industries Ltd.

- Celotex

- CertainTeed

- Knauf Insulation SPRL

- Saint-Gobain

- Dow

- DuPont

- Johns Manville Corporation

Recent Industry Developments

In 2024, Alghanim’s subsidiary, İzocam, completed the acquisition of 100% of HİS Yalıtım, a Turkish producer of stone wool. This move not only diversified Alghanim’s insulation portfolio but also strengthened its position in the Turkish market, where demand for energy-efficient building materials is on the rise.

In 2024 CertainTeed, the North American building thermal insulation market was valued at approximately USD 9.15 billion, with glass wool insulation holding a significant share due to its excellent thermal and acoustic properties. CertainTeed’s focus on energy-efficient solutions and sustainable practices aligns with the growing demand for eco-friendly building materials.

Report Scope

Report Features Description Market Value (2024) USD 4.2 Bn Forecast Revenue (2034) USD 6.6 Bn CAGR (2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Blanket Insulation, Loose-Fill Insulation, Board Insulation, Batt Insulation), By Property ( Thermal Insulation, Acoustic Insulation, Fire Resistance), By Application (Residential Buildings, Commercial Buildings, Industrial Buildings, Transportation, Others), By End-Use (New Construction, Renovation and Remodeling) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Alghanim Industries, Armacell, BASF, Bradford Insulation Industries Ltd., Celotex, CertainTeed, Knauf Insulation SPRL, Saint-Gobain, Dow, DuPont, Johns Manville Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Glass Wool Insulation MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Glass Wool Insulation MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Alghanim Industries

- Armacell

- BASF

- Bradford Insulation Industries Ltd.

- Celotex

- CertainTeed

- Knauf Insulation SPRL

- Saint-Gobain

- Dow

- DuPont

- Johns Manville Corporation