Global Glass Curtain Wall Market Size, Share, And Business Benefits By Fabrication (Stick System, Unitized System), By Construction Type (Refurbishment, New Construction), By Application (Commercial, Residential), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 159828

- Number of Pages: 387

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

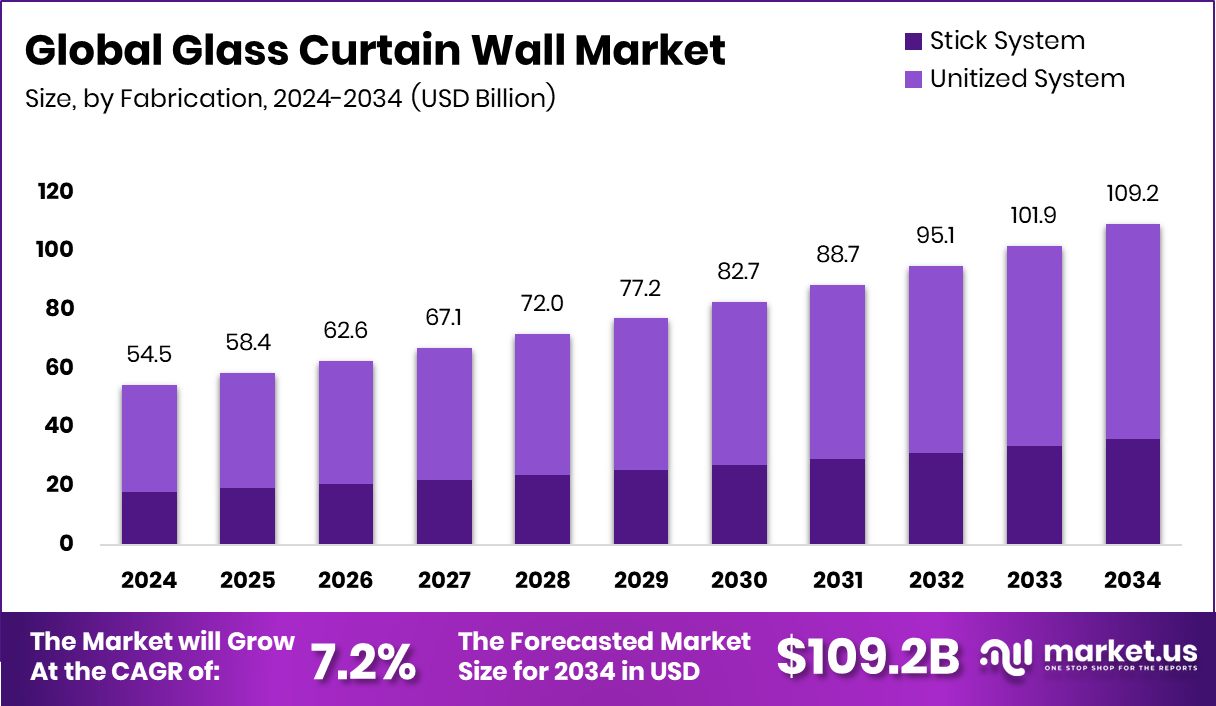

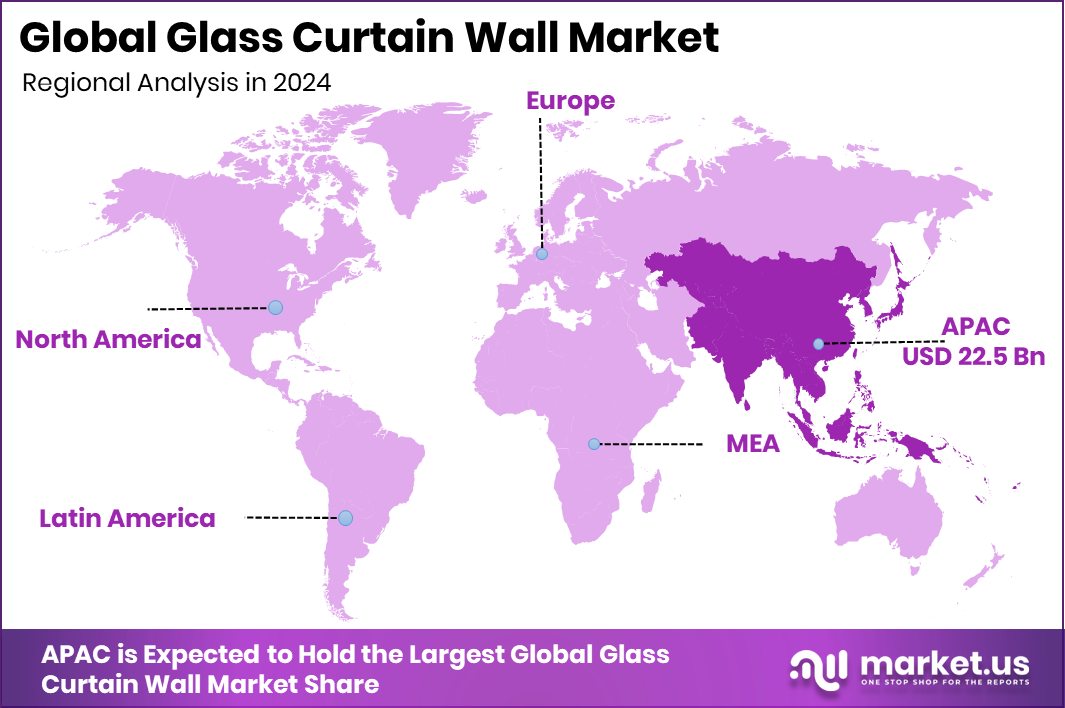

The Global Glass Curtain Wall Market is expected to be worth around USD 109.2 billion by 2034, up from USD 54.5 billion in 2024, and is projected to grow at a CAGR of 7.2% from 2025 to 2034. With a 41.4% share, the Asia Pacific region recorded USD 22.5 billion in growth.

A glass curtain wall is a lightweight, non-structural outer covering of a building that is usually made of large panels of glass framed with metal. Unlike load-bearing walls, it does not carry the structural weight of the building but is designed to resist weather, air, and wind loads while allowing natural light inside. Modern architecture uses curtain walls extensively in commercial towers, airports, and institutional complexes because they combine aesthetics with energy efficiency and durability.

The glass curtain wall market has grown in tandem with urbanization and the increasing demand for high-rise and commercial buildings. The increasing preference for energy-efficient designs and sustainable construction has also pushed adoption. With governments worldwide pushing green building codes and safety standards, the use of glass curtain walls has become central to urban planning and smart city projects. The market is benefiting from both technological improvements in glass manufacturing and strong public infrastructure spending.

One of the key growth drivers is urbanization. According to the UN, 68% of the world’s population will live in urban areas by 2050, creating massive demand for high-rise construction. Glass curtain walls are preferred for modern city skylines due to their efficiency and architectural appeal.

Demand is also driven by the push for sustainable buildings. Energy-efficient glass reduces cooling costs by up to 30%, aligning with global climate goals. Many governments offer tax incentives and certifications for projects that adopt such designs, which further fuels adoption.

Opportunities are emerging through large-scale government funding in housing and education infrastructure. Clarion secured £26 million of government funding to build affordable homes. The government is mobilizing the next generation of construction workers to build 1.5 million homes. Commerce has invested nearly $18 million to increase homeownership opportunities. An additional £302 million has been committed to upgrading further education colleges with modern buildings. Alongside this, hardworking families will benefit from £2 billion in new grant funding to deliver up to 18,000 social and affordable homes. These investments will directly strengthen the need for curtain wall systems, particularly in urban projects.

Key Takeaways

- The Global Glass Curtain Wall Market is expected to be worth around USD 109.2 billion by 2034, up from USD 54.5 billion in 2024, and is projected to grow at a CAGR of 7.2% from 2025 to 2034.

- The glass curtain wall market is dominated by unitized systems, accounting for a 67.4% share.

- New construction projects drive market expansion, contributing to 75.6% of overall glass curtain wall adoption.

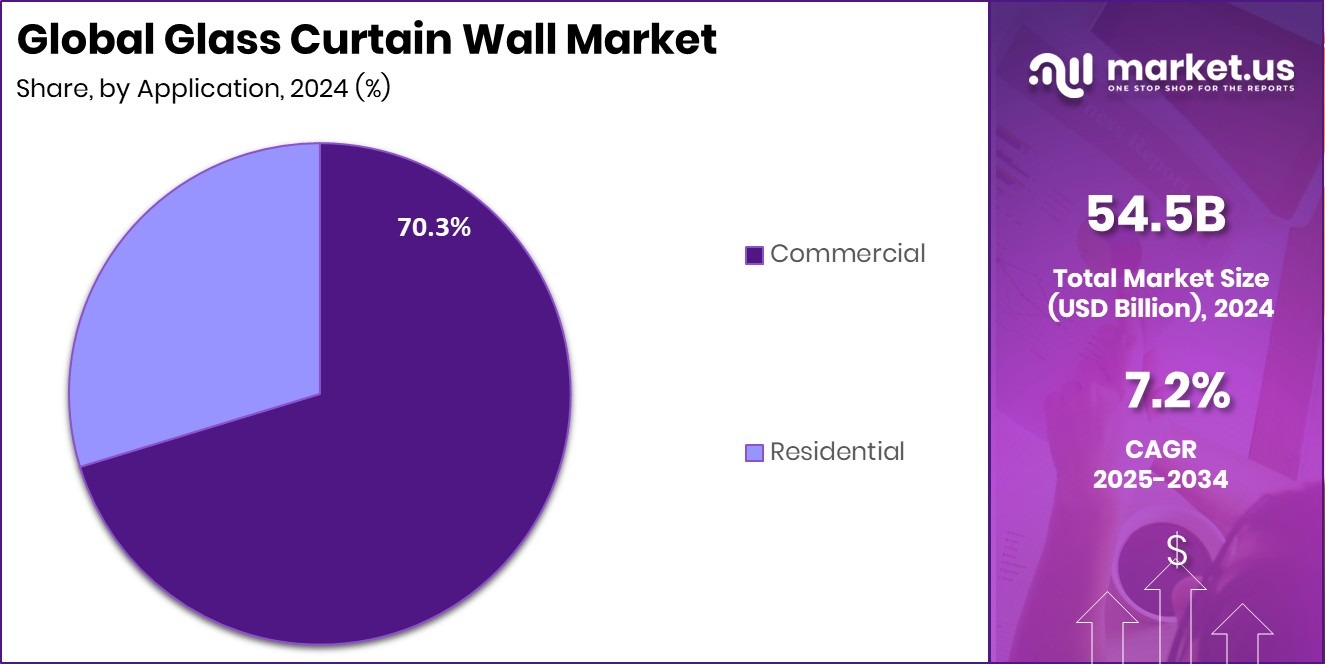

- The commercial sector leads demand in the glass curtain wall market, holding a 70.3% share.

- The Asia Pacific Glass Curtain Wall Market generated USD 22.5 billion, capturing 41.4% share.

By Fabrication Analysis

The glass curtain wall market favors unitized system fabrication at 67.4%.

In 2024, Unitized System held a dominant market position in the By Fabrication segment of the Glass Curtain Wall Market, with a 67.4% share. This strong presence reflects the growing adoption of unitized curtain wall systems in modern construction, driven by their faster installation process and reduced labor requirements compared to conventional methods.

Developers and contractors favor unitized systems as they are pre-assembled in controlled environments, ensuring higher quality and minimizing on-site challenges. The significant market share highlights how large-scale urban projects, particularly high-rise buildings, are increasingly opting for this approach to save time, enhance precision, and improve long-term performance in façade construction.

By Construction Type Analysis

In the Glass Curtain Wall Market, new construction dominates with 75.6%.

In 2024, New Construction held a dominant market position in the By Construction Type segment of the Glass Curtain Wall Market, with a 75.6% share. This leadership underscores the strong demand for glass curtain walls in newly built commercial towers, residential complexes, and institutional projects. The high share reflects how modern construction increasingly integrates advanced façade systems to achieve both aesthetic appeal and energy efficiency.

With rapid urbanization and large-scale infrastructure initiatives, new construction projects continue to prioritize curtain wall systems as part of sustainable building design. The significant market weight of this segment highlights its role as the primary driver of adoption in the industry.

By Application Analysis

Commercial use leads the Glass Curtain Wall Market, holding a 70.3% share.

In 2024, Commercial held a dominant market position in the By Application segment of the Glass Curtain Wall Market, with a 70.3% share. This dominance highlights the extensive use of curtain wall systems in offices, business complexes, retail spaces, and other commercial establishments. The segment’s strength is linked to the rising demand for modern architectural designs that emphasize natural lighting, energy efficiency, and premium aesthetics to attract tenants and customers.

Commercial projects, particularly in urban centers, continue to drive large-scale adoption of glass curtain walls as they enhance building value and align with sustainability goals. The substantial share reflects the sector’s pivotal role in shaping market growth.

Key Market Segments

By Fabrication

- Stick System

- Unitized System

By Construction Type

- Refurbishment

- New Construction

By Application

- Commercial

- Residential

Driving Factors

Rising Urban Housing and Infrastructure Development Demand

One of the main driving factors for the Glass Curtain Wall Market is the rapid growth in urban housing and infrastructure projects. As more people move into cities, the need for modern buildings, high-rise apartments, and commercial complexes keeps rising. Glass curtain walls are chosen for these structures because they save energy, allow natural light, and add a modern look.

Governments are also supporting construction projects with major funding, making growth faster. For example, the Launchpad program has begun with $1 million to boost workforce housing construction in North Lake Tahoe. Similarly, Governor Lamont announced CT Home Funds, a $30 million plan to incentivize and expand homeownership in Connecticut. These initiatives directly strengthen demand for advanced façade solutions.

Restraining Factors

High Installation and Maintenance Costs Limit Adoption

A major restraining factor for the Glass Curtain Wall Market is the high cost of installation and ongoing maintenance. Unlike conventional walls, curtain wall systems require advanced engineering, specialized materials, and skilled labor, which significantly increase the overall project budget. The expenses don’t stop at installation—regular upkeep is essential to maintain energy efficiency, safety, and aesthetics.

Cleaning large glass panels in high-rise buildings demands specialized equipment and services, adding to operational costs. For many developers, especially in smaller or mid-scale projects, these expenses can outweigh the benefits. This cost barrier often discourages adoption in regions where construction budgets are tighter, slowing down the wider expansion of the market despite rising demand.

Growth Opportunity

Expanding Affordable Housing and Urban Development Projects

A key growth opportunity for the Glass Curtain Wall Market lies in the expansion of affordable housing and large-scale urban development projects. As cities grow, there is a stronger push for modern, sustainable, and visually appealing buildings. Glass curtain walls fit these needs perfectly, as they bring natural light, reduce energy use, and give structures a modern design.

Governments are stepping in with major investments to meet housing demand, which will boost adoption further. For instance, Governor Hochul awarded more than $270 million to build and preserve 1,800 affordable homes across New York. Additionally, the Pro-Housing Communities initiative announced over $100 million for projects in areas committed to building more housing, creating clear opportunities for curtain wall applications.

Latest Trends

Growing Focus on Sustainable and Energy-Efficient Designs

One of the latest trends in the Glass Curtain Wall Market is the shift toward sustainable and energy-efficient designs. Builders and architects are increasingly choosing curtain wall systems with advanced glazing technologies that reduce heat gain, lower energy bills, and improve indoor comfort. This trend aligns with global climate goals and green building standards, where energy savings and reduced carbon emissions are top priorities.

The market is seeing rising demand for double-glazed and low-emissivity glass panels that balance transparency with insulation. Supporting this, governments are actively funding housing and construction projects. For example, the Federal government and N.L. announced $44 million in construction funding, while HACN received $500,000 to build new homes in Tahlequah, boosting sustainable growth.

Regional Analysis

In 2024, the Asia Pacific held a 41.4% share, reaching USD 22.5 billion.

The Glass Curtain Wall Market is segmented across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America, each region contributing uniquely to overall growth. Among these, Asia Pacific emerged as the dominating region in 2024, holding a 41.4% share valued at USD 22.5 billion. The dominance of the Asia Pacific is closely tied to rapid urbanization, extensive high-rise construction, and government-backed infrastructure projects across countries such as China, India, and Southeast Asia.

North America continues to witness steady demand for energy-efficient building solutions, with a strong focus on sustainability and modern architectural designs. Europe’s market is influenced by stringent energy regulations and the renovation of aging building structures, creating space for advanced curtain wall applications.

Meanwhile, the Middle East & Africa region is experiencing rising adoption, driven by ongoing mega-projects, urban expansion, and smart city initiatives in countries like the UAE and Saudi Arabia.

Latin America, though smaller in share compared to other regions, is showing consistent growth supported by infrastructure development and urban housing needs. Overall, while each region presents opportunities, the Asia Pacific region leads the global market both in value and share, setting the benchmark for growth and innovation.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

AGC Inc., with its strong global presence, has been at the forefront of delivering high-performance architectural glass, including energy-efficient and sustainable options that align with modern construction needs. Their innovations in glazing technology have made them a preferred supplier for large-scale commercial and residential projects.

Central Glass Co. LTD continues to strengthen its role by focusing on specialized glass products designed for building applications. Its ability to provide tailored solutions for both functionality and design has enhanced its relevance in the façade sector. With a balanced focus on quality and advanced processing technologies, the company remains a trusted name for developers seeking durability and precision in construction materials.

Guardian Industries Corp. plays a critical role through its wide portfolio of glass products that support energy savings and modern architectural trends. By offering high-transparency and performance-driven curtain wall glass, Guardian has positioned itself strongly within global markets. Collectively, these companies are steering the market forward by meeting the rising demand for sustainable, efficient, and aesthetically advanced curtain wall systems.

Top Key Players in the Market

- AGC Inc.

- Central Glass Co.LTD

- Guardian Industries Corp.

- Nippon Sheet Glass Co., Ltd

- Saint-Gobain group

- Elicc Group

- EFCO Corporation

- EFP International B.V

- Reynaers Group

- Schott AG

Recent Developments

- In 2025, Saint-Gobain increased its local production capacity and committed to opening more facilities in the second half of the year to better support its sustainable glass offerings and competitive positioning.

- In 2025, EFCO products were specified in the Square at South End mixed-use tower in Charlotte, where EFCO’s curtain wall, storefront, and entrance systems were used to meet LEED certification goals.

Report Scope

Report Features Description Market Value (2024) USD 54.5 Billion Forecast Revenue (2034) USD 109.2 Billion CAGR (2025-2034) 7.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Fabrication (Stick System, Unitized System), By Construction Type (Refurbishment, New Construction), By Application (Commercial, Residential) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape AGC Inc., Central Glass Co.LTD, Guardian Industries Corp., Nippon Sheet Glass Co., Ltd, Saint-Gobain group, Elicc Group, EFCO Corporation, EFP International B.V, Reynaers Group, Schott AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Glass Curtain Wall MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample

Glass Curtain Wall MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- AGC Inc.

- Central Glass Co.LTD

- Guardian Industries Corp.

- Nippon Sheet Glass Co., Ltd

- Saint-Gobain group

- Elicc Group

- EFCO Corporation

- EFP International B.V

- Reynaers Group

- Schott AG