Global Garbage Truck Market Size, Share, Growth Analysis By Truck (Rear loader, Front loader, Side loader, Roll off), By Fuel (Diesel, Electric, Gasoline), By Technology (Automatic, Manual, Semi-automatic), By End Use (Urban Garbage Treatment, Building & Mining Industry, Industrial Waste Collection, Municipal Waste Collection, Construction and Demolition Waste Collection, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 154510

- Number of Pages: 307

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

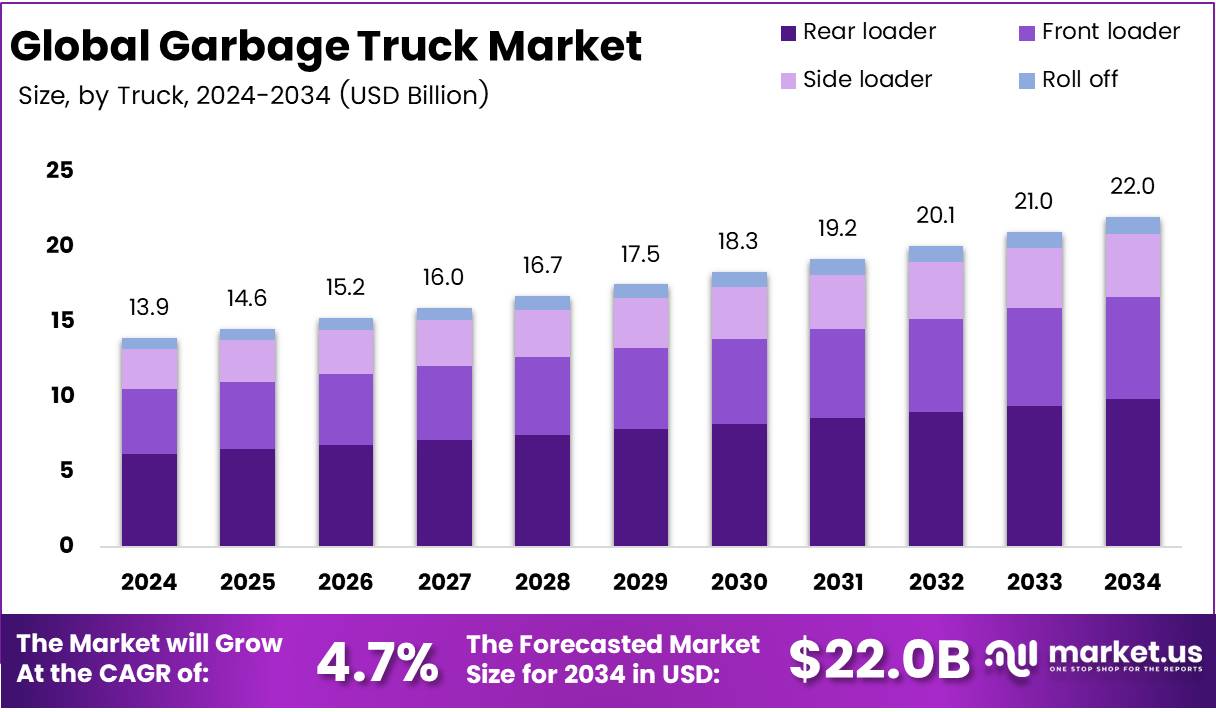

The Global Garbage Truck Market size is expected to be worth around USD 22.0 Billion by 2034, from USD 13.9 Billion in 2024, growing at a CAGR of 4.7% during the forecast period from 2025 to 2034.

Garbage Truck Market refers to the global business of vehicles used for waste collection, transport, and disposal. These trucks play a vital role in urban sanitation and public health management. Market scope includes vehicle manufacturing, maintenance services, leasing, and parts supply across municipal, industrial, and private waste management segments.

Modern garbage trucks are evolving rapidly with advancements in automation, electrification, and fleet telematics. Manufacturers focus on fuel efficiency, reduced emissions, and safety features like low-entry cabs and rear cameras. Hydraulic systems and compactors are also being upgraded to handle higher volumes, diverse waste types, and minimize manual intervention.

Growth in the garbage truck market is supported by rapid urbanization, rising waste generation, and stricter regulatory norms. Cities are expanding collection fleets and replacing aging vehicles. Fleet operators seek energy-efficient trucks with better uptime. This drives demand for modular body designs, hybrid powertrains, and customizable route management technologies.

Opportunities are increasing in electric garbage trucks due to emissions regulations and fuel cost pressures. Manufacturers offering EV models with strong torque and range optimization attract early adopters. Additionally, aftermarket service providers are entering the market with diagnostics, maintenance scheduling, and digital fleet management solutions for garbage trucks.

Government investment remains strong, especially in developed nations aiming for smart, sustainable urban infrastructure. Incentives are available for low-emission vehicles, depot electrification, and retrofitting older trucks. Regulations around noise pollution, operator safety, and recycling compliance further boost demand for next-generation, sensor-equipped garbage trucks.

According to emerald, in Norway, electric heavy-truck sales represented 7.8% of new registrations in 2024, showing a strong shift toward zero-emission fleets. Light commercial electric vehicles also reached nearly 30%, indicating robust adoption across vehicle classes. This trend supports future growth in electric garbage trucks across Europe and beyond.

According to mdpi, 55% of respondents in a 2024 Oman survey said they are willing to consider electric vehicles as their next personal vehicle. This suggests growing public acceptance of EVs, which may translate to smoother adoption in the commercial waste vehicle segment, especially in emerging markets.

According to tradeindia, a garbage truck can last up to 15 to 20 years if maintained, cleaned, and inspected regularly. This longevity makes them a valuable asset when managed well and supports long-term investment planning by fleet operators aiming to maximize asset utilization and minimize operational costs.

Key Takeaways

- The Global Garbage Truck Market is projected to reach USD 22.0 Billion by 2034, up from USD 13.9 Billion in 2024, growing at a CAGR of 4.7% from 2025 to 2034.

- Rear loader trucks dominated the Truck Analysis segment in 2024 with a 44.2% market share due to their efficiency and ease of residential waste collection.

- Diesel-powered trucks led the Fuel Analysis segment with a 62.5% share in 2024, favored for their durability and accessibility.

- Automatic technology held a 51.4% market share in 2024, dominating the Technology Analysis segment due to increased operator convenience and reduced training needs.

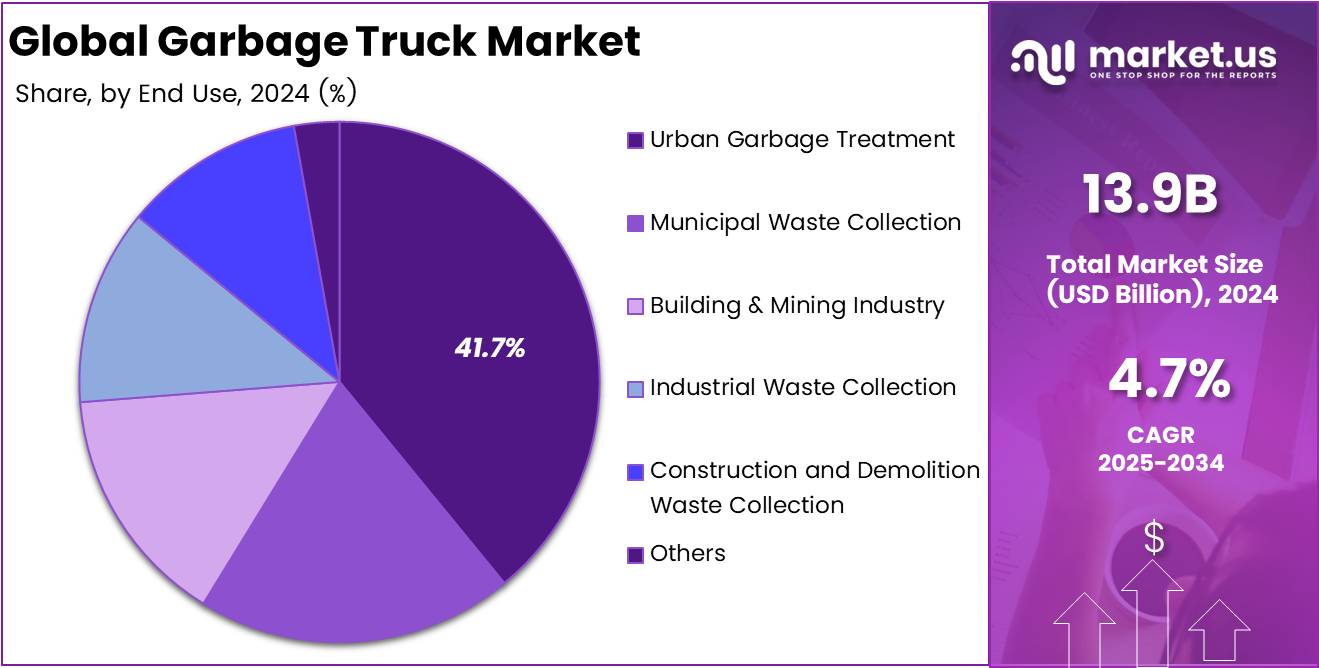

- The Urban Garbage Treatment segment held a 41.7% share in 2024, driven by growing urban populations and stricter municipal waste regulations.

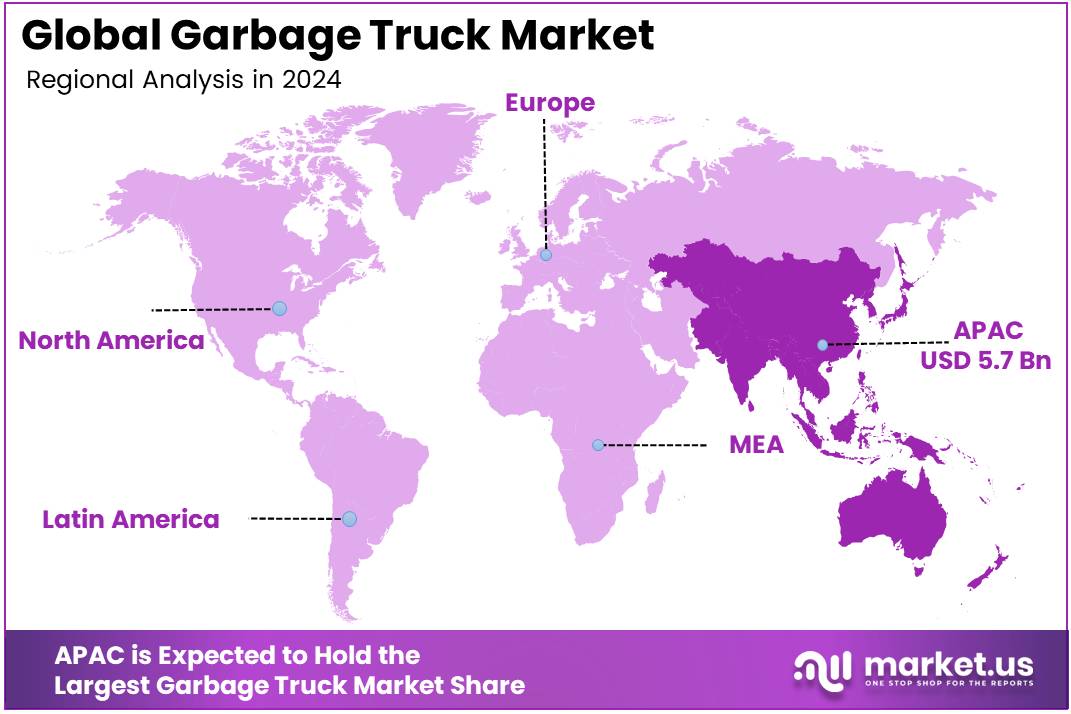

- Asia Pacific led the regional market with a 41.1% share and a valuation of USD 5.7 Billion in 2024, fueled by urbanization, infrastructure growth, and government-led smart city initiatives.

Truck Analysis

Rear Loader leads with 44.2% share due to its efficient compacting capabilities and wide adoption in residential areas.

In 2024, Rear loader held a dominant market position in By Truck Analysis segment of Garbage Truck Market, with a 44.2% share. These trucks are widely used for residential waste collection, offering easy loading and efficient compacting features. Their versatility and cost-effective maintenance make them a popular choice among municipalities.

Front loader trucks followed, gaining notable traction in commercial and industrial applications. With their large bin-handling capacity, they cater to areas with higher waste volumes. Despite lagging behind, their growth potential remains strong as urban infrastructure scales up.

Side loader trucks also contributed a substantial portion of the market. Their appeal lies in automated arm systems that reduce manual labor and enhance safety. These are particularly suited for curbside collection in densely populated regions.

Roll-off trucks held a niche segment, commonly utilized for large-scale cleanups and construction site waste. While their market share was comparatively lower, their role remains critical in the handling of bulky and non-compactable waste.

Fuel Analysis

Diesel dominates with 62.5% due to its reliability and robust fueling infrastructure.

In 2024, Diesel held a dominant market position in By Fuel Analysis segment of Garbage Truck Market, with a 62.5% share. Diesel-powered garbage trucks continue to be the backbone of waste collection fleets, known for their durability and availability across urban and rural areas.

Electric trucks, though still emerging, are gaining momentum due to sustainability initiatives and stricter emission norms. Their quiet operation and zero tailpipe emissions make them ideal for urban environments, yet infrastructure and range limitations have constrained faster adoption.

Gasoline trucks captured a modest portion of the market, largely in regions where cost or maintenance simplicity outweighs performance demands. However, rising fuel prices and environmental considerations are likely to influence their usage trajectory.

Technology Analysis

Automatic technology leads with 51.4% driven by ease of operation and rising labor cost concerns.

In 2024, Automatic held a dominant market position in By Technology Analysis segment of Garbage Truck Market, with a 51.4% share. The preference for automatic systems stems from enhanced operator convenience, efficiency, and reduction in training time. Fleet operators value the consistent performance and reduced driver fatigue.

Manual systems retained presence, particularly in legacy fleets or low-budget municipal setups. Their low cost and mechanical simplicity appeal to certain regions, though they lag in productivity and ergonomics.

Semi-automatic systems served as a transitional solution, offering partial automation. These are favored in regions balancing operational efficiency and cost sensitivity. However, the shift toward full automation is gradually reducing their share.

End Use Analysis

Urban Garbage Treatment dominates with 41.7% due to increasing urbanization and organized waste collection programs.

In 2024, Urban Garbage Treatment held a dominant market position in By End Use Analysis segment of Garbage Truck Market, with a 41.7% share. The growing urban population and stringent municipal regulations have spurred investment in waste infrastructure, fueling demand for garbage trucks in city environments.

Municipal Waste Collection followed closely, playing a vital role in public sanitation and routine waste disposal. Government contracts and public-private partnerships continue to bolster this segment’s growth.

Industrial Waste Collection saw steady demand, especially in manufacturing hubs where proper disposal of by-products is essential. Similarly, the Building & Mining Industry leveraged garbage trucks for site waste management, although seasonal activity impacted volume consistency.

Construction and Demolition Waste Collection was driven by infrastructure development, requiring trucks capable of handling heavier debris. Lastly, the ‘Others’ segment included niche applications and remote area collection, contributing modestly to overall market share.

Key Market Segments

By Truck

- Rear loader

- Front loader

- Side loader

- Roll off

By Fuel

- Diesel

- Electric

- Gasoline

By Technology

- Automatic

- Manual

- Semi-automatic

By End Use

- Urban Garbage Treatment

- Building & Mining Industry

- Industrial Waste Collection

- Municipal Waste Collection

- Construction and Demolition Waste Collection

- Others

Drivers

Adoption of Robotics and Automation in Waste Collection Drives Market Growth

Automation is improving pick-up speed, route accuracy, and safety. Robotic arms on side‑loader trucks shorten stop times and reduce manual handling. This lets municipalities cover more households with the same fleet size, lifting asset productivity and lowering cost per ton collected.

Sensors and cameras enable precise bin identification and contamination checks. Operators get real‑time alerts if loads exceed limits or if lids are open, reducing spillage and service complaints. Better service reliability directly supports contract renewals and upselling of premium collection tiers.

Automation also supports night operations with fewer crews. Quieter, faster routes ease traffic conflicts and improve citizen satisfaction scores. For fleet managers, this widens usable operating windows and raises revenue potential per vehicle per day.

In developing cities, automated trucks pair well with new urban infrastructure. Standardized bins, curbside layouts, and transfer stations allow consistent robotic gripping and faster cycles. Vendors that bundle trucks with route software and training gain a clear competitive edge.

Restraints

Inconsistent Waste Management Regulations Across Regions Restrain Market Growth

Rules for truck specs, axle loads, and emissions differ widely by country and even by city. This fragmentation forces OEMs to build many variants, raising engineering and certification costs. Small production runs limit economies of scale and keep unit prices elevated.

Procurement models also vary. Some regions use long municipal tenders; others rely on short private contracts. Unclear renewal terms discourage investment in advanced trucks with longer payback periods. As a result, buyers often defer upgrades even when lifecycle savings are compelling.

Operator licensing and safety standards are inconsistent. Training curricula for automated systems may not be recognized across borders. This raises onboarding time and liability risk, slowing adoption of robotics and semi‑autonomous features.

Waste segregation rules change fleet needs. Where source separation is strict, multi-compartment bodies are required; elsewhere, single-stream dominates. OEMs must customize bodies and lifters, complicating inventory planning and aftersales support.

Growth Factors

Government Subsidies for Electrification of Waste Fleet Unlock Growth

Targeted incentives lower the upfront cost gap between electric and diesel garbage trucks. Grants, tax credits, and low‑interest loans make total cost of ownership attractive, especially for predictable, stop‑start routes ideal for regeneration braking.

Municipal sustainability targets favor zero‑emission collection in dense neighborhoods. Noise and tailpipe reductions improve community acceptance of early-morning routes. This enables extended service windows and tighter route density, amplifying productivity benefits.

Public funding for depot charging and on‑route fast chargers reduces infrastructure barriers. Bundled programs that cover chargers, software, and grid upgrades speed deployment and de‑risk procurement decisions for city councils.

Electrification stimulates new service models. Energy-as-a-service and battery leasing shift capex to opex, aligning with constrained municipal budgets. Vendors that offer performance guarantees and uptime SLAs can capture premium margins.

Emerging Trends

Increasing Use of Telematics for Real-Time Fleet Monitoring Shapes Market Trends

Telematics provides live visibility into route progress, bin lifts, fuel or energy use, and idle time. Dispatchers can reroute trucks around congestion and balance workloads mid‑shift, improving on‑time performance and customer satisfaction.

Data-driven maintenance is gaining ground. Engine hours, hydraulic pressures, and vibration signatures alert teams before failures occur. Predictive maintenance cuts unplanned downtime and extends body, lifter, and compactor life.

Subscription-based collection models rely on telematics for proof of service. Time‑stamped lift records and geotagged photos reduce disputes and enable tiered pricing based on actual usage. This supports recurring revenue for private haulers.

Powertrain choice is diversifying. Bi‑fuel and hybrid trucks help fleets meet emission goals while managing range and refueling risks. Telematics compares duty cycles across routes to select the best powertrain per geography.

Regional Analysis

Asia Pacific Dominates the Garbage Truck Market with a Market Share of 41.1%, Valued at USD 5.7 Billion

The Asia Pacific region leads the global garbage truck market, driven by rapid urbanization, rising municipal waste volumes, and strong infrastructure development across emerging economies. Governments in countries such as China and India are prioritizing smart city initiatives and sustainable waste management practices, which is fueling demand for efficient refuse collection vehicles. With a commanding 41.1% market share and a valuation of USD 5.7 billion, the region continues to witness robust investment in public sanitation and waste handling technologies.

North America Garbage Truck Market Trends

North America represents a mature yet dynamic market for garbage trucks, supported by stringent environmental regulations and the growing adoption of electric and hybrid waste collection vehicles. Municipalities are focusing on fleet modernization and sustainability, leading to the replacement of aging fleets with technologically advanced alternatives. Additionally, urban centers in the U.S. and Canada are actively adopting automated and semi-automated garbage trucks to enhance operational efficiency.

Europe Garbage Truck Market Trends

The European garbage truck market is marked by an emphasis on sustainability, circular economy goals, and strict waste disposal regulations. Countries across the region are integrating smart waste collection systems and leveraging electric mobility in their sanitation fleets. The region is also witnessing growing public and private investments in eco-friendly refuse collection technologies aimed at reducing carbon footprints and increasing recycling rates.

Middle East and Africa Garbage Truck Market Trends

The Middle East and Africa region is experiencing steady growth in the garbage truck market, driven by urban development projects and the expansion of municipal services in major cities. While infrastructure in some parts remains underdeveloped, there is a clear push towards modernizing waste collection systems. Government initiatives aimed at improving urban cleanliness and health standards are expected to propel market expansion over the coming years.

Latin America Garbage Truck Market Trends

Latin America’s garbage truck market is gradually evolving, supported by increasing awareness around urban waste management and improved governmental initiatives. As cities grow and the demand for reliable sanitation infrastructure rises, countries in the region are focusing on upgrading their waste collection capabilities. Though budgetary constraints may challenge rapid adoption, incremental improvements and public-private collaborations are stimulating market development.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Garbage Truck Company Insights

In 2024, the global garbage truck market continues to evolve with key players advancing their product portfolios and leveraging technology to meet sustainability and efficiency demands.

Autocar LLC remains a dominant force in North America, known for its robust, custom-engineered refuse trucks that cater to the specific needs of waste management operators. Its continued investment in electric and zero-emission models is solidifying its position in the eco-conscious fleet transition.

Bridgeport Manufacturing focuses on precision-engineered garbage truck bodies, earning a reputation for durable, high-quality equipment. In 2024, the company is strengthening its presence through partnerships and responsive customer service in municipal and private sectors.

Ceec Trucks Industry Co. Ltd. is expanding its global footprint by offering cost-effective and versatile waste management solutions. With a growing demand in emerging economies, the company leverages its competitive pricing and adaptable product range to increase market share.

Curbtender Inc. is enhancing its smart waste collection capabilities with a lineup of lightweight, highly maneuverable trucks ideal for urban environments. Its innovation-driven approach, especially in automation and hybrid technology, continues to appeal to sustainability-focused municipalities.

Top Key Players in the Market

- Autocar LLC

- Bridgeport Manufacturing

- Ceec Trucks Industry Co. Ltd.

- Curbtender Inc.

- Dennis Eagle Inc.

- Dongfeng Motor Group Co. Ltd.

- FAUN Umwelttechnik GmbH & Co. KG

- FULONGMA GROUP Co.,Ltd.

- Heil Environmental

- Kirchhoff Group

Recent Developments

- In Jun 2025, GFL Environmental Services acquired OSI, marking one of its first major deals since the company’s spin-off. This acquisition strengthens GFL’s market position and signals a renewed growth strategy post-restructuring.

- In Mar 2025, Casella Waste Systems announced the acquisition of Royal Carting and Welsh Sanitation, expanding its footprint in the Northeastern U.S. The move is expected to enhance operational efficiency and customer reach in key regional markets.

- In Jan 2024, the City of Erie secured a $3 million state grant to purchase electric garbage trucks. This initiative supports the city’s sustainability goals and reduces emissions in municipal waste management operations.

Report Scope

Report Features Description Market Value (2024) USD 13.9 Billion Forecast Revenue (2034) USD 22.0 Billion CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Truck (Rear loader, Front loader, Side loader, Roll off), By Fuel (Diesel, Electric, Gasoline), By Technology (Automatic, Manual, Semi-automatic), By End Use (Urban Garbage Treatment, Building & Mining Industry, Industrial Waste Collection, Municipal Waste Collection, Construction and Demolition Waste Collection, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Autocar LLC, Bridgeport Manufacturing, Ceec Trucks Industry Co. Ltd., Curbtender Inc., Dennis Eagle Inc., Dongfeng Motor Group Co. Ltd., FAUN Umwelttechnik GmbH & Co. KG, FULONGMA GROUP Co.,Ltd., Heil Environmental, Kirchhoff Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Autocar LLC

- Bridgeport Manufacturing

- Ceec Trucks Industry Co. Ltd.

- Curbtender Inc.

- Dennis Eagle Inc.

- Dongfeng Motor Group Co. Ltd.

- FAUN Umwelttechnik GmbH & Co. KG

- FULONGMA GROUP Co.,Ltd.

- Heil Environmental

- Kirchhoff Group