Global Functional Powder Drinks Concentrates Market By Product (Functional Powder Drinks Concentrates With Added Sugar, Sugar-Free Functional Powder Drinks Concentrates), By Distribution Channel (Supermarkets and Hypermarkets, Retailers, Convenience Stores, Online Stores, Others) , By Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 148038

- Number of Pages: 338

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

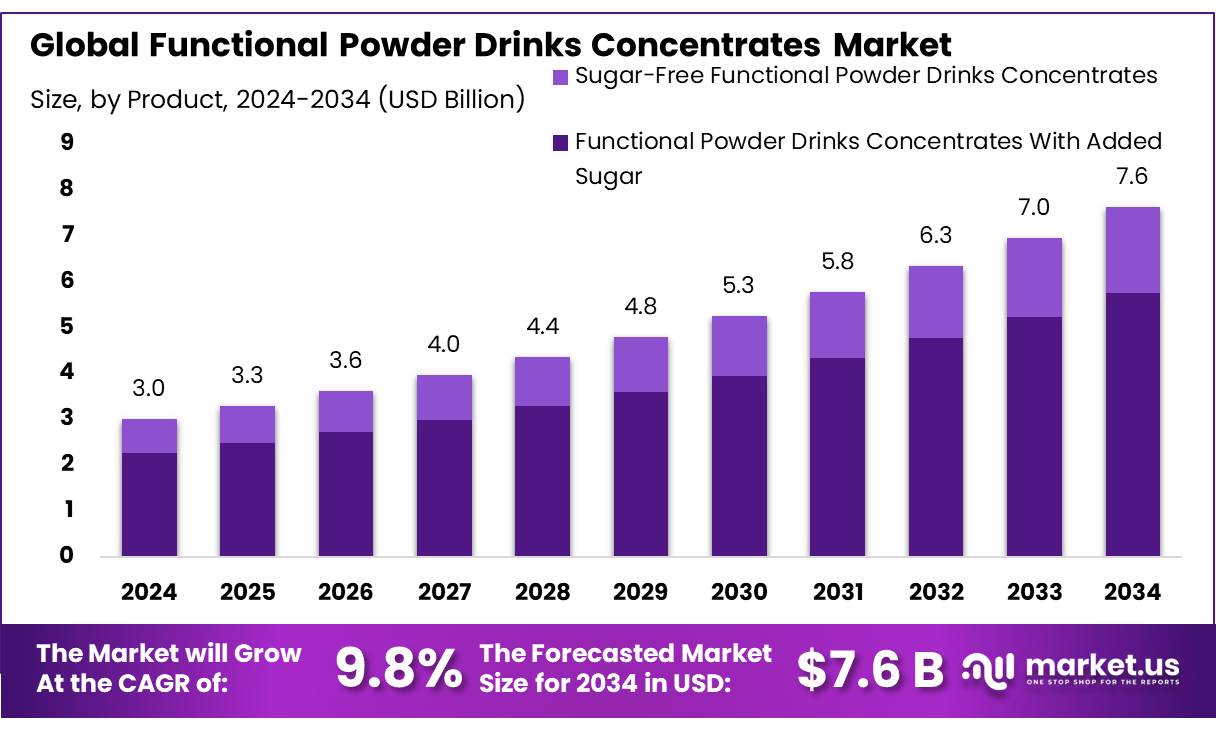

The Global Functional Powder Drinks Concentrates Market size is expected to be worth around USD 7.6 Billion by 2034, from USD 3.0 Billion in 2024, growing at a CAGR of 9.8% during the forecast period from 2025 to 2034.

Functional powder drink concentrates have emerged as a significant segment within the global beverage industry, offering consumers convenient, health-oriented alternatives to traditional sugary drinks. These products are designed to provide specific health benefits, such as enhanced immunity, improved digestion, or increased energy levels, through the inclusion of functional ingredients like vitamins, minerals, probiotics, and adaptogens.

Government initiatives play a crucial role in fostering the growth of the functional beverage sector in India. The Ministry of AYUSH promotes the use of traditional medicine systems like Ayurveda, Unani, and Siddha, encouraging the integration of these practices into modern wellness products. This support facilitates innovation and the development of functional beverages that resonate with Indian consumers’ preferences for natural and holistic health solutions.

The functional powder drink concentrate market is poised for continued expansion. Opportunities lie in product innovation, such as the development of sugar-free and plant-based concentrates, and the exploration of emerging markets. Companies are increasingly focusing on sustainable packaging and clean-label products to meet consumer demand for transparency and environmental responsibility. The integration of digital platforms for marketing and distribution further enhances accessibility and consumer engagement.

Key Takeaways

- Functional Powder Drinks Concentrates Market size is expected to be worth around USD 7.6 Billion by 2034, from USD 3.0 Billion in 2024, growing at a CAGR of 9.8%.

- Functional Powder Drinks Concentrates with Added Sugar held a dominant market position, capturing more than a 75.2% share.

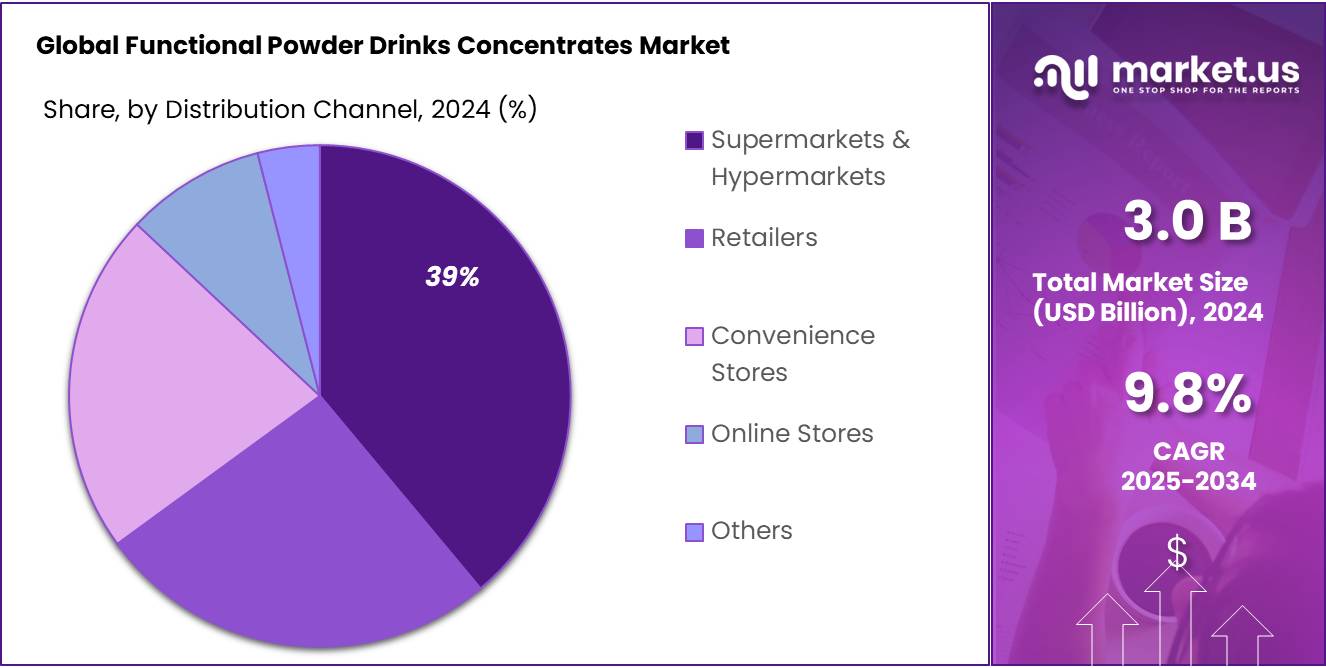

- Supermarkets & Hypermarkets held a dominant market position, capturing more than a 38.9% share.

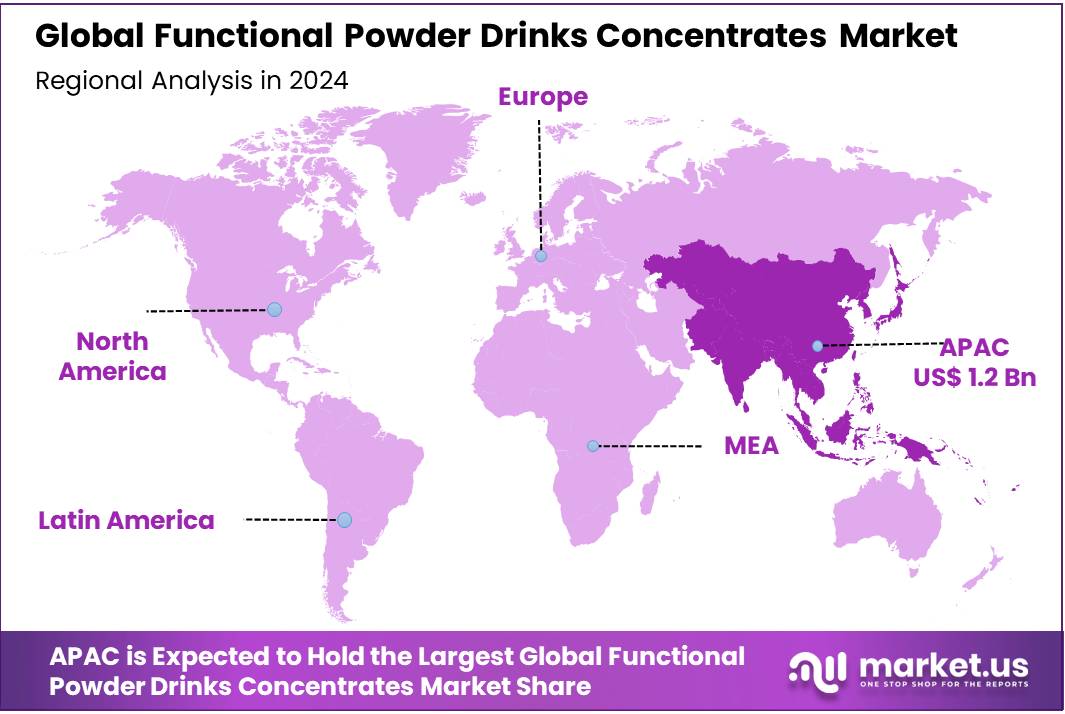

- Asia-Pacific (APAC) region held a dominant position in the global functional powder drink concentrates market, capturing over 42.6% of the market share, valued at approximately USD 1.2 billion.

By Product

Functional Powder Drinks Concentrates With Added Sugar Dominates with 75.2% Share in 2024

In 2024, Functional Powder Drinks Concentrates with Added Sugar held a dominant market position, capturing more than a 75.2% share. This segment continues to lead the market primarily due to its widespread appeal to consumers who prefer the sweetness and flavor enhancement that sugar offers in their beverages. The popularity of sweetened products is a direct response to the growing consumer demand for instant energy boosts and indulgent flavors, which are key attributes of functional powder drinks with added sugar.

This dominance is expected to persist into 2025, with the added sugar segment projected to maintain a steady share of the market. Although there is increasing consumer preference for sugar-free or low-sugar alternatives, the demand for sweeter, more traditional flavors remains strong, especially in regions with higher consumption of sugary beverages. These concentrates often target specific health benefits like energy, weight management, and immunity support, which have further solidified their strong position in the functional drink segment.

By Distribution Channel

Supermarkets & Hypermarkets Lead with 38.9% Market Share in 2024

In 2024, Supermarkets & Hypermarkets held a dominant market position, capturing more than a 38.9% share of the Functional Powder Drinks Concentrates market. This strong market presence is largely attributed to the convenience, variety, and accessibility these retail outlets offer consumers. Supermarkets and hypermarkets are often the go-to shopping destinations for everyday essentials, including functional drinks, which makes them the preferred channel for consumers seeking both convenience and a wide selection of brands and products.

The segment’s dominance is expected to continue into 2025, with supermarkets and hypermarkets remaining a primary distribution channel for functional powder drink concentrates. Consumers value the ability to physically assess the products, compare prices, and take advantage of in-store promotions. Additionally, the increasing trend of large-format stores offering dedicated health and wellness sections has further boosted the growth of this channel.

Key Market Segments

By Product

- Functional Powder Drinks Concentrates With Added Sugar

- Sugar-Free Functional Powder Drinks Concentrates

By Distribution Channel

- Supermarkets & Hypermarkets

- Retailers

- Convenience Stores

- Online Stores

- Others

Drivers

Health Consciousness Fuels Growth in Functional Powder Drink Concentrates

A significant driving factor behind the expansion of the functional powder drink concentrates market is the increasing global emphasis on health and wellness. Consumers are becoming more proactive about their health, leading to a surge in demand for beverages that offer specific health benefits. This trend is particularly evident in India, where the functional beverages sector is experiencing rapid growth.

This growing health consciousness is influencing consumer preferences, with a notable shift towards beverages that support immunity, digestion, and overall well-being. Functional powder drink concentrates, which are fortified with nutrients such as vitamins, minerals, and probiotics, align well with these health-focused demands. The convenience of these products, combined with their health benefits, makes them an attractive option for consumers seeking to enhance their daily nutrition.

Government initiatives also play a pivotal role in promoting health and wellness, further driving the market. In India, the Ministry of AYUSH has been actively promoting traditional medicine systems like Ayurveda, which often emphasize the use of natural ingredients in health products. This support encourages the development and consumption of functional beverages that incorporate traditional knowledge with modern nutritional science.

Restraints

Rising Raw Material Costs and Supply Chain Disruptions

A significant challenge facing the functional powder drink concentrates market is the escalating cost of raw materials and ongoing supply chain disruptions. These factors have been impacting manufacturers’ ability to maintain consistent pricing and product availability. For instance, fluctuations in the prices of key ingredients such as sugar, flavorings, and packaging materials have led to increased production costs. Additionally, supply chain disruptions, often due to geopolitical tensions or logistics challenges, have resulted in delays and shortages, further straining the market.

In India, these issues are particularly pronounced. The country’s reliance on imports for certain raw materials makes it vulnerable to global supply chain fluctuations. For example, the COVID-19 pandemic highlighted the vulnerabilities in global supply chains, affecting the timely availability of essential ingredients and packaging materials. This situation has compelled manufacturers to seek alternative sourcing strategies, such as local procurement, to mitigate risks.

The Indian government’s initiatives like ‘Make in India’ and ‘Aatmanirbhar Bharat’ aim to bolster domestic manufacturing and reduce dependency on imports. These programs encourage companies to invest in local production capabilities, which can help alleviate some of the supply chain challenges. By fostering a more self-reliant manufacturing ecosystem, the government seeks to enhance the resilience of industries, including the functional beverage sector, against global supply chain disruptions.

Despite these efforts, the functional powder drink concentrates market continues to face challenges related to raw material costs and supply chain stability. Addressing these issues requires a multifaceted approach, including diversifying supply sources, investing in local production, and adopting more resilient supply chain strategies. Only through such comprehensive measures can the industry hope to navigate these challenges and sustain its growth trajectory.

Opportunity

Government Initiatives and Policy Support

A significant growth opportunity for the functional powder drink concentrates market lies in the Indian government’s initiatives aimed at boosting domestic manufacturing and promoting health and wellness. Programs like ‘Make in India’ and ‘Aatmanirbhar Bharat’ are designed to encourage local production, reduce dependency on imports, and foster innovation within the food and beverage sector. These policies are particularly relevant for the functional beverage industry, which is experiencing rapid growth.

India’s functional beverage market is projected to grow at a compound annual growth rate (CAGR) of 10.44% from 2025 to 2030, reflecting increasing health consciousness among consumers. This growth is supported by government efforts to enhance the food processing sector, which is expected to reach a value of $535 billion by 2025-26. Such initiatives create a conducive environment for the development and expansion of functional drink concentrate products.

Furthermore, the Indian government’s focus on promoting traditional medicine systems like Ayurveda through the Ministry of AYUSH encourages the integration of these practices into modern wellness products. This support facilitates innovation and the development of functional beverages that resonate with Indian consumers’ preferences for natural and holistic health solutions.

Trends

Consumer Demand for Clean-Label, Plant-Based Functional Powders

A significant trend shaping the functional powder drink concentrates market is the increasing consumer preference for clean-label and plant-based formulations. This shift reflects a broader movement towards transparency, natural ingredients, and sustainability in food and beverages. Consumers are becoming more discerning, seeking products with minimal artificial additives and those that align with ethical and health-conscious choices.

Government initiatives also support this trend. Programs like ‘Make in India’ and ‘Aatmanirbhar Bharat’ aim to boost domestic manufacturing and reduce dependency on imports. These initiatives encourage companies to invest in local production capabilities, which can help alleviate some of the supply chain challenges and promote the development of clean-label, plant-based functional beverages.

As consumer awareness continues to rise, the demand for functional powder drink concentrates with clean-label and plant-based ingredients is expected to grow. This trend presents opportunities for manufacturers to innovate and cater to the evolving preferences of health-conscious consumers.

Regional Analysis

Asia-Pacific (APAC) Leads Functional Powder Drink Concentrates Market with 42.6% Share in 2024

In 2024, the Asia-Pacific (APAC) region held a dominant position in the global functional powder drink concentrates market, capturing over 42.6% of the market share, valued at approximately USD 1.2 billion. This robust market presence is driven by several key factors unique to the region.

Rapid urbanization and changing lifestyles in APAC have led to an increased demand for convenient, health-focused beverage options. Countries like India, China, Japan, and South Korea are witnessing a surge in health consciousness among consumers, prompting a shift towards functional beverages that offer benefits such as immunity support, energy boosting, and digestive health. The growing middle-class population with higher disposable incomes further fuels this demand.

Government initiatives in the region also play a pivotal role in promoting the growth of the functional beverage market. For instance, India’s ‘Make in India’ and ‘Aatmanirbhar Bharat’ campaigns encourage domestic manufacturing and innovation in the food and beverage sector. Such policies not only reduce dependency on imports but also stimulate local production of functional drink concentrates, aligning with consumer preferences for locally sourced and produced goods.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Ajinomoto Co. Inc. is a global leader in the production of amino acids, food ingredients, and functional beverages. The company has a strong presence in the functional powder drinks concentrates market, offering products that cater to health-conscious consumers. Their innovative approach to nutrition through functional ingredients such as amino acids, peptides, and probiotics positions them as a prominent player in this sector. With a focus on health and wellness, Ajinomoto continues to expand its portfolio globally.

Amway Corp. is a direct selling giant known for its health and wellness products. The company offers a wide range of functional powder drink concentrates under its Nutrilite brand. Amway’s concentrates are formulated with essential vitamins, minerals, and antioxidants designed to support overall health and vitality. Their commitment to quality and innovation in the wellness sector has positioned them as a key player in the functional drinks market, catering to a global consumer base.

Fonterra Cooperative Group Ltd. is a New Zealand-based global dairy cooperative that has made a significant impact in the functional beverage market. The company offers a variety of dairy-based functional powder drink concentrates that deliver essential nutrients like protein, calcium, and probiotics. Fonterra’s extensive research and commitment to high-quality dairy products have helped it maintain a strong position in the market, particularly in regions like Asia-Pacific where dairy-based functional drinks are highly popular.

Top Key Players in the Market

- Ajinomoto Co. Inc.

- Amway Corp.

- Fonterra Cooperative Group Ltd.

- Glanbia plc

- Herbalife International of America Inc.

- MusclePharm

- Steadfast Nutrition

- PepsiCo

- Ajinomoto

- Fonterra

- GlaxoSmithKline

- TC Pharma

Recent Developments

In 2024, Ajinomoto’s strategic focus on “AminoScience” led to the development of sustainable solutions aimed at improving well-being. This initiative underscores the company’s dedication to creating products that not only meet nutritional requirements but also contribute to societal health goals.

Amway Corp. has solidified its position in the functional powder drink concentrates market through its Nutrilite brand, which continues to experience growth despite broader revenue challenges. In 2024, Amway reported a 3% decline in overall revenue; however, sales of its Nutrilite nutritional products increased by 2%, indicating a strong consumer preference for health-focused offerings .

Report Scope

Report Features Description Market Value (2024) USD 3.0 Bn Forecast Revenue (2034) USD 7.6 Bn CAGR (2025-2034) 9.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Functional Powder Drinks Concentrates With Added Sugar, Sugar-Free Functional Powder Drinks Concentrates), By Distribution Channel (Supermarkets and Hypermarkets, Retailers, Convenience Stores, Online Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Ajinomoto Co. Inc., Amway Corp., Fonterra Cooperative Group Ltd., Glanbia plc, Herbalife International of America Inc., MusclePharm, Steadfast Nutrition, PepsiCo, Ajinomoto, Fonterra, GlaxoSmithKline, TC Pharma Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Functional Powder Drinks Concentrates MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample

Functional Powder Drinks Concentrates MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Ajinomoto Co. Inc.

- Amway Corp.

- Fonterra Cooperative Group Ltd.

- Glanbia plc

- Herbalife International of America Inc.

- MusclePharm

- Steadfast Nutrition

- PepsiCo

- Ajinomoto

- Fonterra

- GlaxoSmithKline

- TC Pharma