Global Functional Bars Market By Product Type (Energy Bars, Protein-Rich Bars, Meal Replacement Bars, Low-Carbohydrate Bars), By Function (Weight Management, Others), By Category (Gluten-free, Conventional), By Distribution Channel (Hypermarkets/Supermarkets, Specialty Stores, Online Retail, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150828

- Number of Pages: 204

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

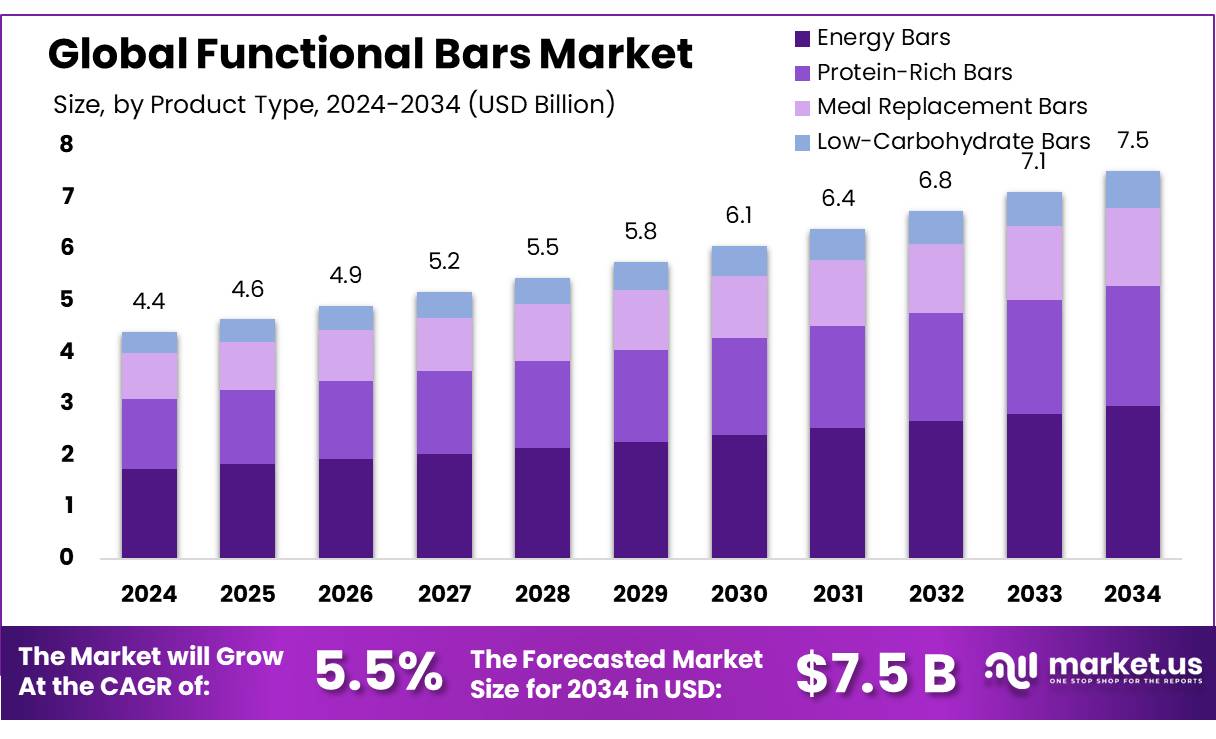

The Global Functional Bars Market size is expected to be worth around USD 7.5 Billion by 2034, from USD 4.4 Billion in 2024, growing at a CAGR of 5.5% during the forecast period from 2025 to 2034.

Functional bar concentrates—nutrient-dense formulations designed for health and wellness, such as protein, energy, or meal-replacement bars—have emerged as a significant subset within the broader functional foods industry. These bars typically integrate bioactive compounds, fortified ingredients, and concentrated nutrients intended to support immunity, weight management, athletic performance, or digestive health.

Government nutrition initiatives also reinforce this trend. In India, the Food Safety and Standards Authority of India (FSSAI) has promulgated revised guidelines for nutrient content claims, enabling enhanced use of fortified ingredients under clear regulatory definitions. Similarly, Canada reported that in 2023, non-animal derived protein ingredients comprised approximately 43,600 tonnes (>75%) of the plant-based protein market, with significant portions allocated to snack bars.

Key Takeaways

- Functional Bars Market size is expected to be worth around USD 7.5 Billion by 2034, from USD 4.4 Billion in 2024, growing at a CAGR of 5.5%.

- Energy Bars held a dominant market position, capturing more than a 39.5% share in the global functional bars market.

- Weight Management held a dominant market position, capturing more than a 69.4% share in the global functional bars market.

- Conventional held a dominant market position, capturing more than a 78.1% share in the global functional bars market.

- Hypermarkets/Supermarkets held a dominant market position, capturing more than a 42.9% share in the global functional bars market.

- North America stands as the leading region in the global functional bars market, commanding a substantial 45.3% share, equating to approximately USD 1.9 billion in 2025.

By Product Type

Energy Bars dominate with 39.5% share in 2024 due to their strong demand among fitness-conscious and on-the-go consumers.

In 2024, Energy Bars held a dominant market position, capturing more than a 39.5% share in the global functional bars market. This leadership was mainly driven by growing awareness around fitness, rising participation in active lifestyles, and the preference for convenient, high-protein snacks. Energy bars are often formulated with a mix of carbohydrates, proteins, vitamins, and minerals, making them a quick fuel source for athletes, gym-goers, and busy professionals.

Their popularity expanded beyond just sports users in 2024, reaching broader audiences looking for clean-label, nutrient-packed snacking alternatives. The launch of new plant-based and low-sugar energy bars also attracted health-conscious buyers. In 2025, this segment is expected to retain its lead as manufacturers introduce more targeted offerings, such as keto-friendly or endurance-focused bars, catering to niche but fast-growing consumer segments.

By Function

Weight Management leads with 69.4% share in 2024, driven by rising demand for low-calorie, high-protein bar options.

In 2024, Weight Management held a dominant market position, capturing more than a 69.4% share in the global functional bars market. This high share reflects growing consumer interest in maintaining a healthy weight through balanced nutrition. Functional bars aimed at weight management typically offer high protein content, controlled calorie counts, and added fiber to support satiety and metabolic health.

As more people adopt active lifestyles and seek portion-controlled snacks, these bars have become a preferred choice for both meal replacement and snack purposes. The availability of vegan, gluten-free, and keto-compliant variants further expanded their appeal in 2024. In 2025, the trend is expected to continue, with brands developing specialized formulations targeting weight-conscious consumers, such as fat-burning ingredients, reduced sugar blends, and clinically backed functional fibers—all contributing to the sustained demand in this segment.

By Category

Conventional bars lead with 78.1% share in 2024, thanks to their mass availability and broad consumer acceptance.

In 2024, Conventional held a dominant market position, capturing more than a 78.1% share in the global functional bars market. This significant share is largely due to the widespread availability of conventional bars across supermarkets, convenience stores, gyms, and online platforms. These bars are often priced competitively and cater to general wellness needs such as energy boost, hunger control, or added protein intake.

Unlike specialized bars that target niche dietary requirements, conventional functional bars appeal to a broader consumer base, including casual users and first-time buyers. Their familiar ingredients, wide flavor variety, and established brand recognition have made them a go-to option for everyday snacking. In 2025, this segment is expected to maintain its lead as manufacturers continue to enhance taste profiles and nutritional balance while keeping costs accessible to the mass market.

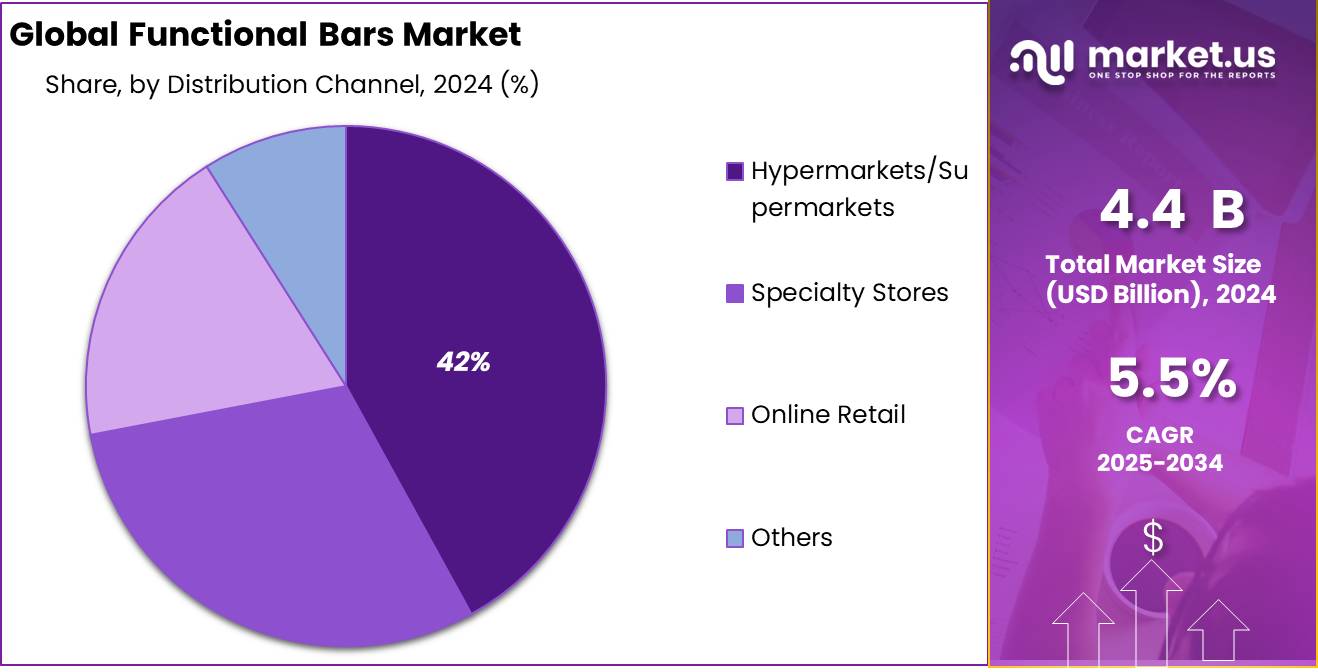

By Distribution Channel

Hypermarkets/Supermarkets lead with 42.9% share in 2024 due to strong product visibility and easy consumer access.

In 2024, Hypermarkets/Supermarkets held a dominant market position, capturing more than a 42.9% share in the global functional bars market. This strong position was supported by their wide product assortment, attractive shelf placement, and the convenience of physical product comparison. Consumers often prefer buying functional bars in these stores because they can check nutritional labels, try new flavors, and benefit from promotions or bulk discounts.

Supermarkets also enable impulse purchases, especially when bars are displayed near checkout areas or in health-focused aisles. Many well-known functional bar brands ensure strong retail presence in these formats to target a mainstream audience. In 2025, the segment is expected to maintain its dominance, as large retail chains expand their health food sections and continue to prioritize in-demand wellness products like protein and energy bars.

Key Market Segments

By Product Type

- Energy Bars

- Protein-Rich Bars

- Meal Replacement Bars

- Low-Carbohydrate Bars

By Function

- Weight Management

- Others

By Category

- Gluten-free

- Conventional

By Distribution Channel

- Hypermarkets/Supermarkets

- Specialty Stores

- Online Retail

- Others

Drivers

Rising Demand for Health-Conscious Snacks

The functional bars market has witnessed robust growth driven by the increasing demand for healthier snack alternatives. More consumers are shifting towards convenient, on-the-go products that offer nutritional benefits. In fact, according to the U.S. Department of Agriculture (USDA), the global demand for protein-rich snacks has surged by approximately 25% over the past five years. Consumers, especially in urban areas, are increasingly turning to functional bars as an easy source of nutrition to complement their busy lifestyles.

Government initiatives also play a significant role in promoting healthier eating habits. For instance, in 2022, the USDA launched its “Healthy Hunger-Free Kids Act,” which aims to improve the nutritional standards of snacks and meals in schools. This initiative, alongside the global trend of health-consciousness, has increased the production and consumption of functional foods, including bars that cater to dietary needs such as high protein, low sugar, and gluten-free options.

Furthermore, industry reports indicate that more consumers are adopting plant-based diets, which further propels the demand for functional bars made with natural, non-GMO ingredients. The Plant Based Foods Association (PBFA) reported a 27% increase in plant-based food sales in the U.S. from 2020 to 2023, with plant-based protein bars becoming particularly popular among consumers looking to integrate more plant-based proteins into their diet.

Restraints

High Cost of Raw Materials

One of the major factors restraining the growth of the functional bars market is the high cost of raw materials. Ingredients such as plant-based proteins, organic sweeteners, and specialty grains have seen a significant price increase in recent years. The Food and Agriculture Organization (FAO) reported that global food commodity prices rose by nearly 20% in 2023, with plant-based ingredients seeing some of the steepest increases. These higher costs put pressure on manufacturers, who may either face reduced profit margins or be forced to increase the retail prices of functional bars, which could deter price-sensitive consumers.

Additionally, the cost of sourcing high-quality, non-GMO, and organic ingredients is particularly challenging. For instance, plant-based protein prices have increased by up to 30% in some regions, according to the U.S. Department of Agriculture (USDA). This is due to both the rising demand for plant-based products and the challenges associated with scaling up sustainable agricultural practices. As these materials become more expensive, it can lead to higher production costs for functional bars, which are often marketed as premium, health-focused products.

Government initiatives aimed at reducing food production costs and supporting sustainable agriculture are expected to provide some relief in the long term. For example, the USDA’s Agricultural Marketing Service (AMS) has launched programs that incentivize sustainable farming practices, which could help stabilize the cost of raw materials. However, these initiatives may take years to fully impact the market, leaving manufacturers to contend with rising costs in the short term.

Opportunity

Expansion of E-commerce Channels

A significant growth opportunity for the functional bars market lies in the expansion of e-commerce channels. The shift towards online shopping, accelerated by the COVID-19 pandemic, has had a lasting impact on consumer purchasing behavior. According to the U.S. Census Bureau, e-commerce sales in the United States increased by 32.4% in 2020, and this trend has continued with further growth projected in 2024. Consumers are increasingly seeking the convenience of shopping online, where they can compare products, read reviews, and have products delivered to their doorsteps.

For the functional bars market, e-commerce presents a unique opportunity to reach a broader audience. By offering their products on platforms like Amazon, Walmart, and niche health-focused websites, brands can tap into a larger customer base, especially those looking for specific health benefits such as high protein, low sugar, or gluten-free bars. The convenience of online shopping and the ease of direct-to-consumer sales can help brands build loyalty and expand their reach beyond traditional retail channels.

Government initiatives supporting digital retail platforms have also paved the way for the e-commerce boom. For example, the U.S. Small Business Administration (SBA) has been promoting the use of digital platforms through initiatives like the “SBA 7(a) Loan Program,” which helps small businesses access funding to grow their online presence. Additionally, in 2021, the U.S. government launched the “Digital Equity Act,” aimed at increasing internet access for underserved populations, thus enhancing the potential customer base for online functional bar sales.

Trends

Clean Label and Natural Ingredients

A significant trend shaping the functional bars market in 2025 is the growing consumer preference for clean label and natural ingredients. Consumers are increasingly seeking products with transparent labeling, minimal processing, and ingredients they can recognize and trust. This shift is driven by a desire for healthier, more sustainable food options and a growing skepticism toward artificial additives and preservatives.

According to the U.S. Department of Agriculture (USDA), there has been a notable increase in the adoption of plant-based diets, with a 27% rise in plant-based food sales in the U.S. between 2020 and 2023. This trend is reflected in the functional bars market, where consumers are gravitating toward products made with natural, non-GMO ingredients. For instance, plant-based protein bars are gaining popularity as they align with the clean label movement and cater to the growing demand for plant-based nutrition.

Government initiatives are also supporting this trend. The USDA’s Agricultural Marketing Service (AMS) has launched programs that incentivize sustainable farming practices, which can lead to the availability of cleaner, more natural ingredients for food manufacturers. Additionally, the USDA’s National Organic Program provides certification for organic products, ensuring that ingredients meet strict standards for natural production methods.

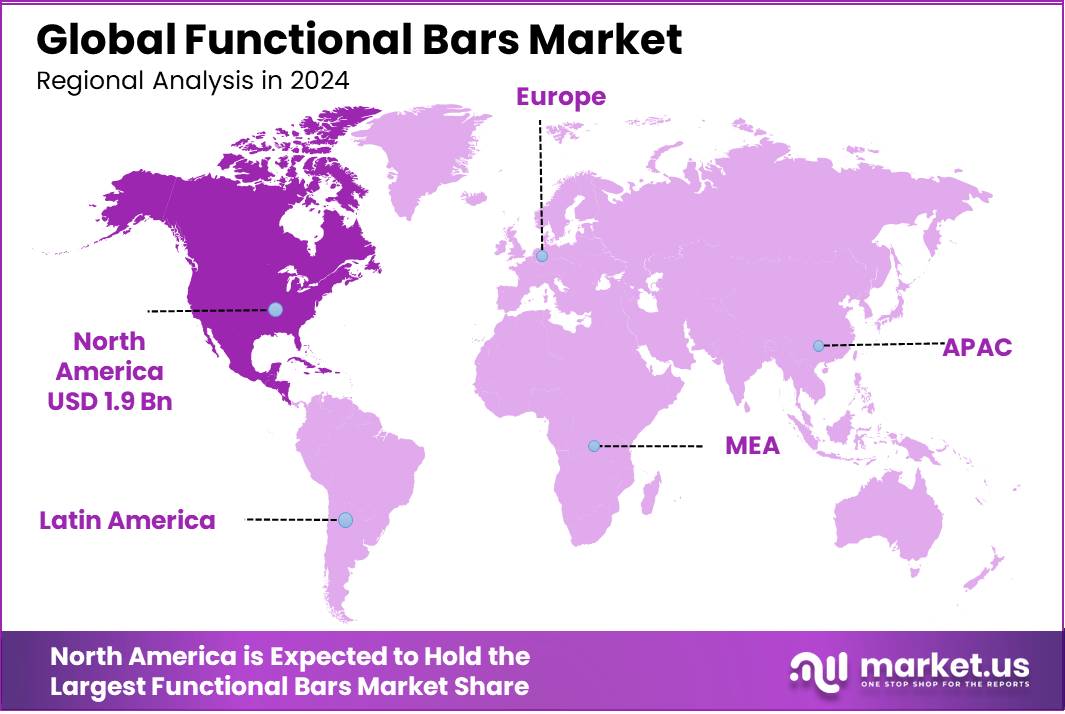

Regional Analysis

North America stands as the leading region in the global functional bars market, commanding a substantial 45.3% share, equating to approximately USD 1.9 billion in 2025. This dominance is propelled by a confluence of factors including heightened health consciousness, a surge in fitness activities, and an increasing preference for convenient, nutritious snacks among consumers.

The U.S. is the primary contributor to this market share, driven by a robust fitness culture, widespread gym memberships, and a growing inclination towards on-the-go meal replacements. According to the International Health, Racquet & Sportsclub Association (IHRSA), the U.S. boasts over 64 million gym members as of 2023, reflecting a significant consumer base for protein and energy bars.

The market’s growth trajectory is further supported by government initiatives promoting physical activity and balanced nutrition. Programs like the U.S. Department of Health and Human Services’ “Physical Activity Guidelines for Americans” and Canada’s “Food Guide” encourage healthier eating habits, indirectly boosting the demand for functional foods, including bars.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Founded in 1893 and headquartered in Floh‑Seligenthal, Germany, Viba Sweets GmbH focuses on confectionery manufacturing, including nougat, marzipan, fruit bars, and chocolate-coated snacks. The company employs approximately 479 staff and reported revenues of €40.9 million in 2021. In May 2024, Viba expanded its distribution footprint by acquiring a majority of Arko, Hussel, and Eilles outlets, increasing its workforce from around 450 to over 1,000 employees.

Nutrition & Santé SAS is a French manufacturer specialising in natural, active, and healthy nutrition products, including protein and energy bars for sport, slimming, and well being applications. The company emphasises clean label ingredients and sustainable sourcing, positioning itself in the organic and natural snacks segment. Its business model is structured across three divisions: Healthy Nutrition, Active Nutrition (slimming and sport), and Plant Based Nutrition, reflecting its diversified functional snack portfolio.

Atlantic Grupa d.d., headquartered in Zagreb, Croatia, is a major FMCG corporation operating across Central and Eastern Europe, with annual revenue of €1.08 billion in 2024 and over 5,300 employees. The company owns the Multipower brand and is a leading European producer of sports and functional food bars, operating 17 production facilities and a vertically integrated supply chain in multiple countries. In 2015, it invested approximately €13 million in an energy bar factory in Croatia to onshore production.

Top Key Players in the Market

- Viba Sweets GmbH

- Nutrition & Santé SAS

- Atlantic Grupa D.D.

- SternLife GmbH & Co. KG

- anona GmbH

- Glanbia Plc.

- BellRock Brands Canna River

- Dixie Elixirs

- Naturecan

- Bhang Corporation

- Uncrate

Recent Developments

In June 2024 anona GmbH, the company invested €16million to expand Plant2, adding a new 2,500m² production area in Colditz—its third facility—enabling increased output of protein and lifestyle bars.

In May 2024, Viba made a strategic move by acquiring ~125 outlets and integrating ~600 employees from the insolvent Hussel, Arko, and Eilles chains, boosting its tally to over 1000 team members.

Report Scope

Report Features Description Market Value (2024) USD 4.4 Bn Forecast Revenue (2034) USD 7.5 Bn CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Energy Bars, Protein-Rich Bars, Meal Replacement Bars, Low-Carbohydrate Bars), By Function (Weight Management, Others), By Category (Gluten-free, Conventional), By Distribution Channel (Hypermarkets/Supermarkets, Specialty Stores, Online Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Viba Sweets GmbH, Nutrition & Santé SAS, Atlantic Grupa D.D., SternLife GmbH & Co. KG, anona GmbH, Glanbia Plc., BellRock Brands Canna River, Dixie Elixirs, Naturecan, Bhang Corporation, Uncrate Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Viba Sweets GmbH

- Nutrition & Santé SAS

- Atlantic Grupa D.D.

- SternLife GmbH & Co. KG

- anona GmbH

- Glanbia Plc.

- BellRock Brands Canna River

- Dixie Elixirs

- Naturecan

- Bhang Corporation

- Uncrate