Global Fruit Beers Market Size, Share, And Business Benefits By Type (Cream Ales, Blonde Ales, Wheat Beers, IPAs, Stouts), By Flavor (Peach, Raspberry, Cherry, Apricot, Others), By Distribution Channel (Bars and Restaurants and Supermarkets, Departmental Stores, Specialty Stores, Online Retailers, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 154203

- Number of Pages: 274

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

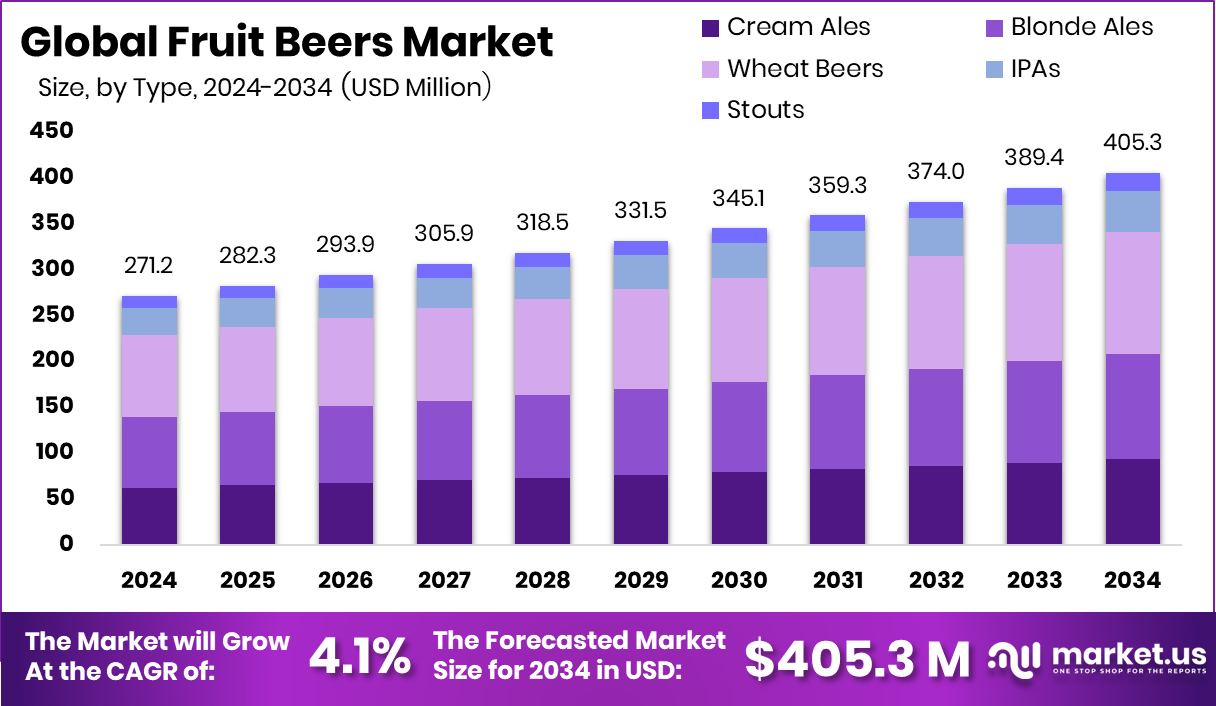

The Global Fruit Beers Market is expected to be worth around USD 405.3 million by 2034, up from USD 271.2 million in 2024, and is projected to grow at a CAGR of 4.1% from 2025 to 2034. High fruit beer consumption in Europe supports its 42.90% market dominance globally.

Fruit beer is a type of alcoholic beverage made by fermenting traditional beer ingredients—such as barley, hops, and yeast—with the addition of real fruit or fruit flavors. It is known for its refreshing taste, vibrant aroma, and fruity character, which appeal to consumers seeking lighter and more flavorful alternatives to regular beer.

Common fruits used include cherries, raspberries, peaches, and blueberries, offering both sweet and tart flavor profiles. Depending on production methods, fruit beer can range from low-alcohol beverages to standard beer strength, often consumed chilled and enjoyed in casual and social settings. According to industry report, Jubel, a fruit lager company, has secured £2.7 million in funding.

The fruit beer market refers to the global trade and consumption of fruit-based beer products across various regions. This market includes both commercial breweries and craft producers that create innovative fruit-flavored beverages to cater to shifting consumer preferences. It encompasses different styles—ranging from wheat-based fruit beers to sour ales and seasonal brews—distributed through retail outlets, pubs, and online platforms. According to an industry report, Goa Brewing Co. has raised $700,000 to support its operations.

The rising preference for flavored alcoholic drinks among young adults is a primary growth factor. Health-conscious drinkers are also leaning toward lower-alcohol options with perceived natural ingredients, making fruit beer an attractive choice. Additionally, cultural shifts toward social drinking in emerging markets are opening new avenues for fruit beer brands. According to an industry report, Carlsberg is set to acquire Britvic, the maker of Robinsons, in a deal worth £3.3 billion.

Consumer demand is strongly driven by the desire for variety, experimentation, and premium quality beverages. Fruit beers offer a unique sensory experience that blends the refreshing qualities of fruit with the richness of beer, which appeals to both occasional and regular drinkers. Seasonal offerings and regional fruit flavors further stimulate repeat consumption. According to an industry report, Coolberg, a non-alcoholic beer brand, has closed a Series A funding round of $3.5 million.

Key Takeaways

- The Global Fruit Beers Market is expected to be worth around USD 405.3 million by 2034, up from USD 271.2 million in 2024, and is projected to grow at a CAGR of 4.1% from 2025 to 2034.

- Wheat-based fruit beers held a 32.9% market share due to their smooth, refreshing, and fruity taste.

- Peach-flavored fruit beers captured a 31.2% share, favored for their sweet aroma and smooth mouthfeel.

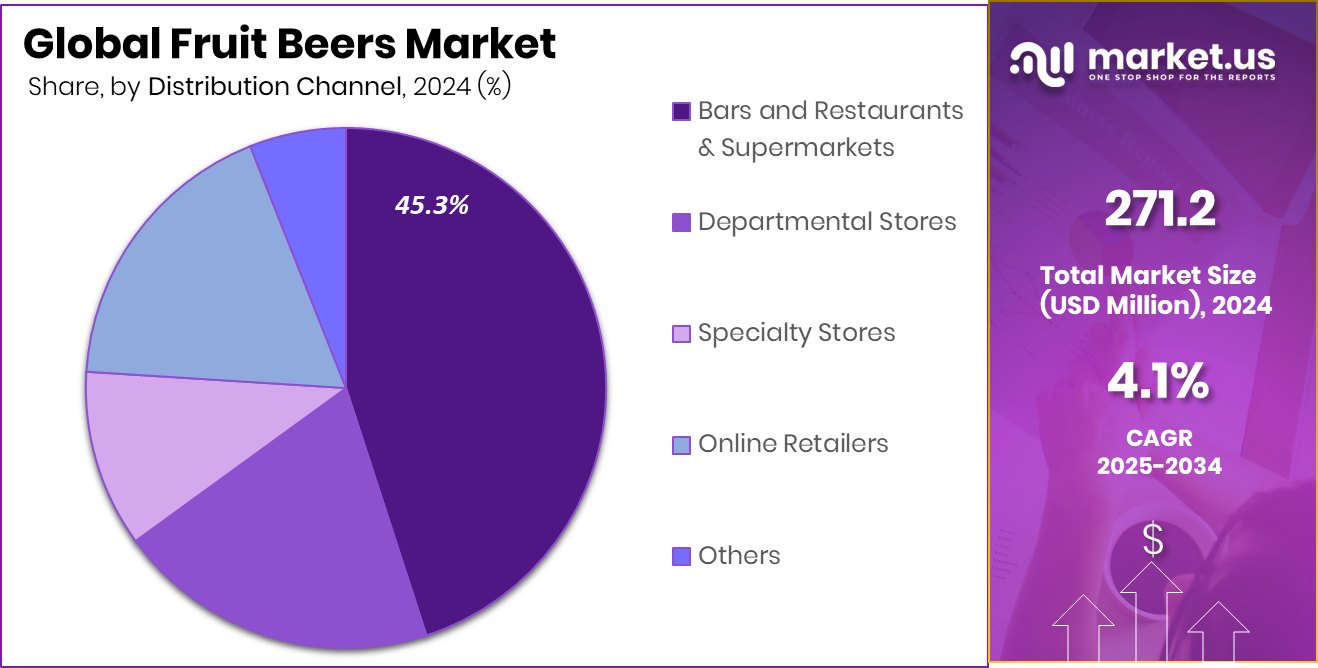

- Bars, restaurants, and supermarkets accounted for a 45.3% share due to wide accessibility and high footfall.

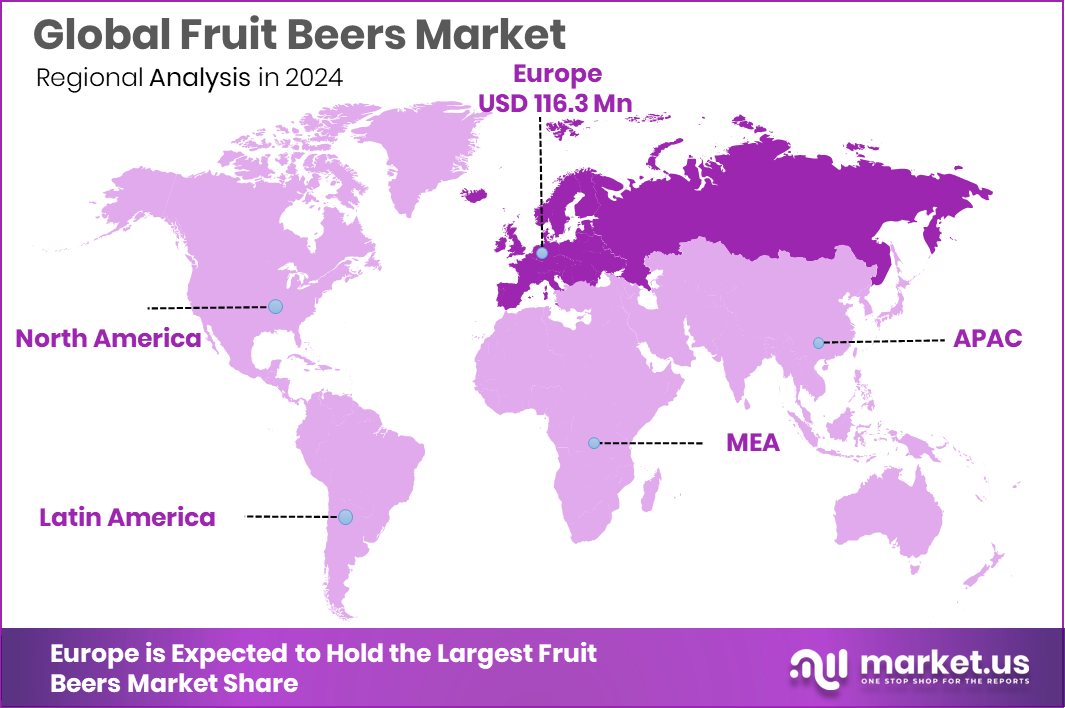

- Europe’s fruit beer sales reached USD 116.3 million, reflecting strong regional demand.

By Type Analysis

Wheat beers dominate the fruit beers market with a 32.9% share.

In 2024, Wheat Beers held a dominant market position in the By Type segment of the Fruit Beers Market, with a 32.9% share. This leading position can be attributed to the smooth, light-bodied nature of wheat-based brews, which blend exceptionally well with fruit infusions.

The soft texture and mild flavor of wheat beer allow the natural fruit notes—such as citrus, berries, or stone fruits—to emerge more prominently, making it a preferred base for fruit beer formulations. Its refreshing profile and lower bitterness levels have made it increasingly popular among younger consumers and casual drinkers who seek approachable, easy-to-drink alcoholic beverages.

The segment’s growth is further supported by evolving consumer preferences toward fruity, aromatic, and less bitter beer alternatives. Wheat Beers infused with fruit cater well to this trend, offering balance and drinkability. Additionally, seasonal fruit wheat beers are widely appreciated for their vibrant flavors and limited-edition appeal, which encourages trial and repeat purchases.

As on-premise consumption continues to recover and off-trade channels remain active, wheat-based fruit beers are expected to maintain strong visibility across bars, taprooms, and retail shelves. Their compatibility with a range of fruit profiles continues to drive innovation within this segment, reinforcing its market leadership.

By Flavor Analysis

Peach flavor leads the market with a 31.2% contribution.

In 2024, Peach held a dominant market position in the By Flavor segment of the Fruit Beers Market, with a 31.2% share. The sweet, mellow, and aromatic profile of peach has made it a preferred flavor choice among consumers seeking a balanced and flavorful drinking experience.

Peach blends seamlessly with various beer bases, especially lighter styles, offering a smooth taste that appeals to a broad demographic, including new and casual drinkers. Its natural fruitiness, combined with moderate acidity, provides a refreshing finish that enhances consumer satisfaction.

The growing popularity of fruit-infused alcoholic beverages has contributed to the rising demand for peach-flavored variants. Seasonal releases and craft batches featuring peach as a key ingredient have gained significant traction in both on-trade and off-trade channels. The familiarity of peach as a fruit flavor, along with its ability to complement the overall body of beer without overpowering it, has strengthened its appeal in the market.

Additionally, the visual appeal and aroma of peach-based beers have made them an attractive option for promotional campaigns and tasting events, further boosting their market visibility. With its continued acceptance and sensory appeal, peach remains a reliable flavor anchor in the fruit beers market landscape.

By Distribution Channel Analysis

Bars and supermarkets account for 45.3% of total sales.

In 2024, Bars and Restaurants and Supermarkets held a dominant market position in the By Distribution Channel segment of the Fruit Beers Market, with a 45.3% share. This dominance reflects a strong consumer preference for convenient access and social consumption experiences.

Bars and restaurants serve as primary venues for on-premise consumption, where consumers often seek new flavors and seasonal offerings of fruit beers in a relaxed and social setting. The availability of diverse fruit beer options on tap or in bottles enhances visibility and encourages trial among patrons.

Simultaneously, supermarkets contribute significantly to off-premise sales by offering a broad range of fruit beer selections in one place. Their well-established distribution networks and in-store promotions support higher volume sales, especially for popular flavors and established brands. Shelf visibility and easy accessibility at supermarkets also drive impulse purchases, particularly among casual buyers.

The combined strength of these two channels—bars for experiential consumption and supermarkets for convenience and variety—has ensured a steady sales flow across different consumer segments. Their ability to cater to both regular and seasonal demand positions them as key growth enablers in the fruit beer market. This dual-channel dominance is expected to support continued market expansion and consumer engagement.

Key Market Segments

By Type

- Cream Ales

- Blonde Ales

- Wheat Beers

- IPAs

- Stouts

By Flavor

- Peach

- Raspberry

- Cherry

- Apricot

- Others

By Distribution Channel

- Bars, restaurants, and Supermarkets

- Departmental Stores

- Specialty Stores

- Online Retailers

- Others

Driving Factors

Rising Demand for Flavored Alcoholic Drinks Worldwide

One of the main driving factors for the fruit beers market is the increasing demand for flavored alcoholic beverages across the globe. Many consumers, especially younger adults and casual drinkers, prefer drinks that are lighter, sweeter, and more enjoyable in taste compared to traditional beer. Fruit beers provide a refreshing alternative with flavors like peach, cherry, or raspberry, making them appealing to those who want something different.

The rise of social drinking culture and growing interest in craft and seasonal beverages have further supported this trend. As people look for variety and new experiences in what they drink, fruit beers are gaining popularity as a flavorful and approachable choice in both on-premise and retail settings.

Restraining Factors

Low Alcohol Content Limits Regular Beer Consumers’ Interest

A major restraining factor for the fruit beers market is the lower alcohol content compared to regular or traditional beers. While fruit beers are appreciated for their flavor, many regular beer consumers prefer stronger alcoholic beverages. The light and sweet taste, which appeals to new or casual drinkers, may not attract seasoned beer drinkers looking for a more intense beer experience.

This mismatch in preference can limit the market’s reach among a broader audience. Additionally, some consumers perceive fruit beers as less “authentic” or too experimental, which affects repeat purchases. As a result, the market may face challenges in fully converting traditional beer drinkers or expanding beyond niche and seasonal consumption.

Growth Opportunity

Expansion Through Craft Peach-Infused Seasonal Releases Now

A significant growth opportunity for the fruit beers market lies in expanding seasonal releases of peach-infused craft beers. Peach has already secured a leading position with a 31.2% share in the flavor segment, demonstrating strong consumer appeal. Building on this popularity, breweries can develop limited-edition peach beer styles tailored to different seasons—such as lighter wheat-peach blends in summer or richer peach ales in spring—providing consumers with new and exciting options.

Such offerings also allow brands to emphasize natural ingredients, fresh fruit sourcing, and artisanal processes, which align with current consumer interest in authentic and premium beverages. By leveraging peach’s strong flavor recognition through thoughtfully timed and packaged seasonal craft releases, the fruit beers market can stimulate demand, drive repeat purchases, and enhance brand loyalty.

Latest Trends

Popularity of Low- and No‑Alcohol Fruit Beers Rising

A key trend shaping the fruit beers market is the growing appeal of low-alcohol and non-alcoholic fruit beers. Many consumers are choosing lighter options that still deliver the taste and aroma of fruit-infused beer but with reduced or no alcohol content. These beverages meet the needs of wellness-conscious individuals and those seeking moderation without sacrificing flavor.

Fruit beers with low or zero alcohol provide a refreshing alternative for social occasions, driving trial among groups that otherwise might avoid traditional alcoholic drinks. As breweries develop more balanced recipes with real fruit and minimal alcohol, consumer acceptance continues to grow. Increased availability in supermarkets and taprooms further supports this trend.

Regional Analysis

In 2024, Europe led the Fruit Beers Market with 42.90% market share.

In 2024, Europe held the dominant position in the global fruit beers market, accounting for 42.90% of the total share, equivalent to USD 116.3 million. This leadership is supported by strong consumer preference for flavored alcoholic beverages, a well-established beer culture, and widespread availability of fruit beer variants across both premium and mass-market channels.

In North America, demand continues to rise due to growing interest in craft brewing and experimentation with fruity flavor profiles, particularly among younger demographics. The Asia Pacific region is witnessing gradual growth, fueled by changing drinking habits and expanding urban populations, although it remains comparatively less developed in this category.

In Latin America and the Middle East & Africa, the market presence is still emerging, with limited availability and modest consumer reach, but increasing exposure to international beverage trends is laying the foundation for future expansion. Europe’s significant market share underscores its central role in driving product innovation and volume growth in the fruit beers segment globally.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Jester King Craft Brewery LLC is recognized for its artisan approach to fruit‑infused beers. The brewery’s focus on high‑quality, barrel‑aged batches using locally sourced fruits enhances its reputation among premium and craft‑oriented consumers. Its seasonal fruit beer offerings frequently generate high demand, enabling limited‑edition runs that encourage brand engagement. The brewery’s craft ethos supports its positioning as a flavor‑driven innovator within the fruit beers segment, appealing especially to connoisseur consumers seeking authenticity and complexity.

New Glarus Brewing Company commands a strong regional presence and is noted for its fruit‑flavored seasonal and year‑round beers. The company’s emphasis on approachable flavor combinations and fruity profiles has enabled it to capture substantial loyalty among mainstream beer drinkers. Its fruit beer portfolio benefits from consistent quality and broad availability within its distribution footprint, supporting high repeat purchase rates and strong brand recognition in its operating region.

Allagash Brewing Company positions itself as a premium brewer offering modern interpretations of fruit‑infused styles. By leveraging its experience in wheat and Belgian‑inspired beer bases, the company achieves elegant fruit integrations that resonate with both craft and flavor‑seeking consumers. Its innovative product development, combined with curated fruit blends, contributes to elevated sensory appeal.

Top Key Players in the Market

- Jester King Craft Brewery LLC.

- New Glarus Brewing Company.

- Allagash Brewing Company

- Siren Craft Brew

- Founders Brewing Co.

- New Belgium Brewing Company, Inc.

- The Boston Beer Company, Inc.

- Anchor Brewing

- The Golden Road

- Sixpoint Brewery

Recent Developments

- In December 2024, Sixpoint Brewery introduced a new fruit-flavored sour beer called Apricot Plum. This release was part of the brewery’s Mad Scientist small batch series, known for its creative and experimental brews. The Apricot Plum sour featured a balanced flavor profile, combining tartness with the natural sweetness of apricot and plum.

- In April 2024, Allagash introduced “Once Upon an Orchard – Cherries, Plums, and Raspberries,” a spontaneous wild ale aged with cherries, plums, and raspberries for approximately 2.5 months. The resulting beer offers layered notes of cherry, raspberry, stone fruit, amaretto, and marzipan, finishing with a tart and refreshing profile.

Report Scope

Report Features Description Market Value (2024) USD 271.2 Million Forecast Revenue (2034) USD 405.3 Million CAGR (2025-2034) 4.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Cream Ales, Blonde Ales, Wheat Beers, IPAs, Stouts), By Flavor (Peach, Raspberry, Cherry, Apricot, Others), By Distribution Channel (Bars and Restaurants and Supermarkets, Departmental Stores, Specialty Stores, Online Retailers, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Jester King Craft Brewery LLC., New Glarus Brewing Company, Allagash Brewing Company, Siren Craft Brew, Founders Brewing Co., New Belgium Brewing Company, Inc., The Boston Beer Company, Inc., Anchor Brewing, The Golden Road, Sixpoint Brewery Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Jester King Craft Brewery LLC.

- New Glarus Brewing Company.

- Allagash Brewing Company

- Siren Craft Brew

- Founders Brewing Co.

- New Belgium Brewing Company, Inc.

- The Boston Beer Company, Inc.

- Anchor Brewing

- The Golden Road

- Sixpoint Brewery