Global Fragrance Emulsifier Market Size, Share, And Business Benefits By Notes (Fresh Notes, Oriental Notes, Woody Notes, Fruity Notes, Floral Notes, Others), By Application (Personal Care, Cosmetics, Pharmaceuticals, Others), By Distribution Channel (Hypermarkets and Supermarkets, Convenience Stores, Specialty Stores, Online Retail, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 156943

- Number of Pages: 378

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

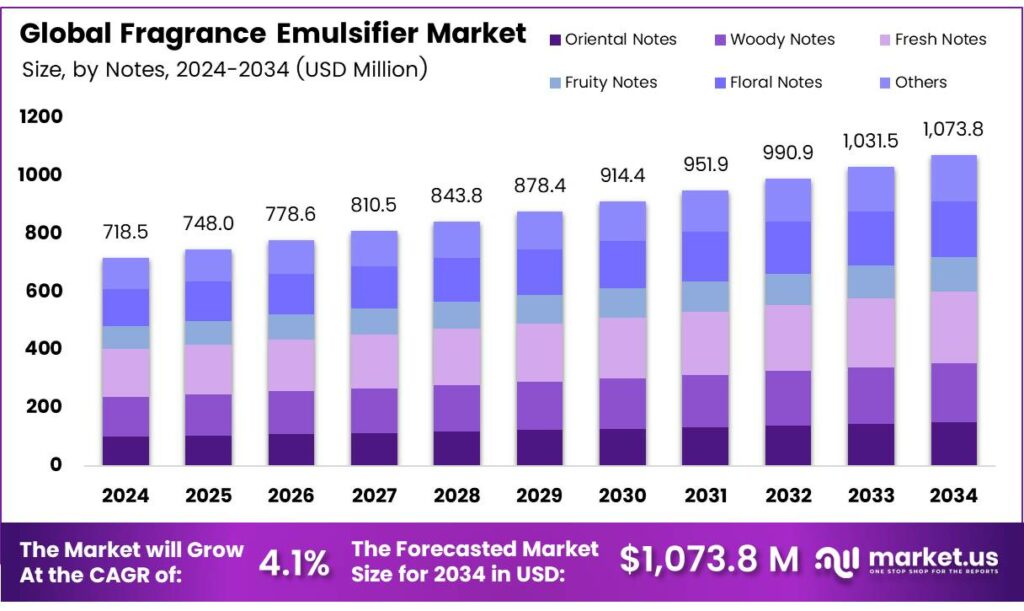

The Global Fragrance Emulsifier Market size is expected to be worth around USD 1073.8 Million by 2034, from USD 718.5 Million in 2024, growing at a CAGR of 4.1% during the forecast period from 2025 to 2034.

The Fragrance Emulsifier Market is witnessing consistent growth as the demand for advanced formulations in cosmetics, personal care, and household products continues to rise. Emulsifiers play a critical role in stabilizing oil and water-based mixtures, ensuring the even distribution of fragrances in diverse applications. The presence of natural, organic, and biodegradable emulsifiers is also becoming more prominent as regulatory frameworks and consumer preferences increasingly shift towards sustainable and safer formulations.

Globally, the fragrance and flavour industry is valued at USD 24.10 billion, and India contributes about USD 500 million. While India’s market has grown at an annual rate of around 11% in recent years, it is projected to expand even faster, driven by rising personal care needs, greater brand awareness, higher disposable incomes, and demand from the middle class for affordable perfumes and deodorants.

On the other hand, challenges remain in global fragrance usage. For instance, around 16% of eczema patients in Europe are sensitised to fragrance ingredients. Population studies suggest that 1–3% of the general European population may have contact allergies linked to fragrances. Although the overall trend of fragrance-related allergies has remained relatively stable over the past decade, the specific causes have shifted, with some allergens declining and others becoming more prevalent.

The fragrance emulsifier is positioned for stable expansion, supported by technological advancements, evolving consumer preferences, and the rising global demand for personal and home care products. This steady industrial momentum highlights its importance in shaping the future of the fragrance and beauty industry worldwide. Future growth opportunities lie in the development of plant-based and eco-friendly emulsifiers.

Key Takeaways

- The Global Fragrance Emulsifier Market is expected to reach USD 1073.8 million by 2034 from USD 718.5 million in 2024, with a CAGR of 4.1%.

- Fresh Notes segment held a 23.4% market share in 2024, driven by demand for clean, light aromas in personal care and home products.

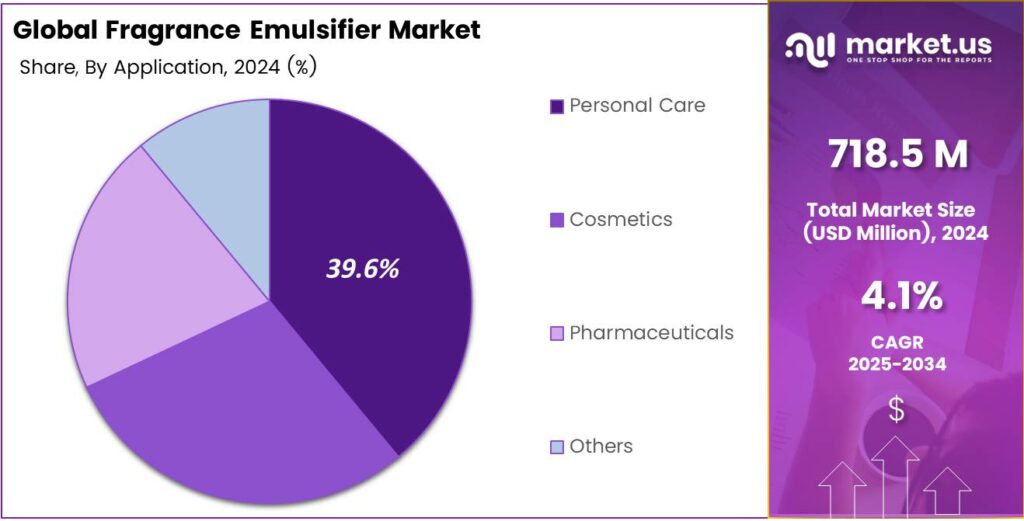

- The Personal Care segment captured a 39.6% market share in 2024, fueled by use in lotions, shampoos, and body sprays.

- Hypermarkets and Supermarkets led distribution in 2024 with a 37.9% share, due to wide product variety and consumer trust.

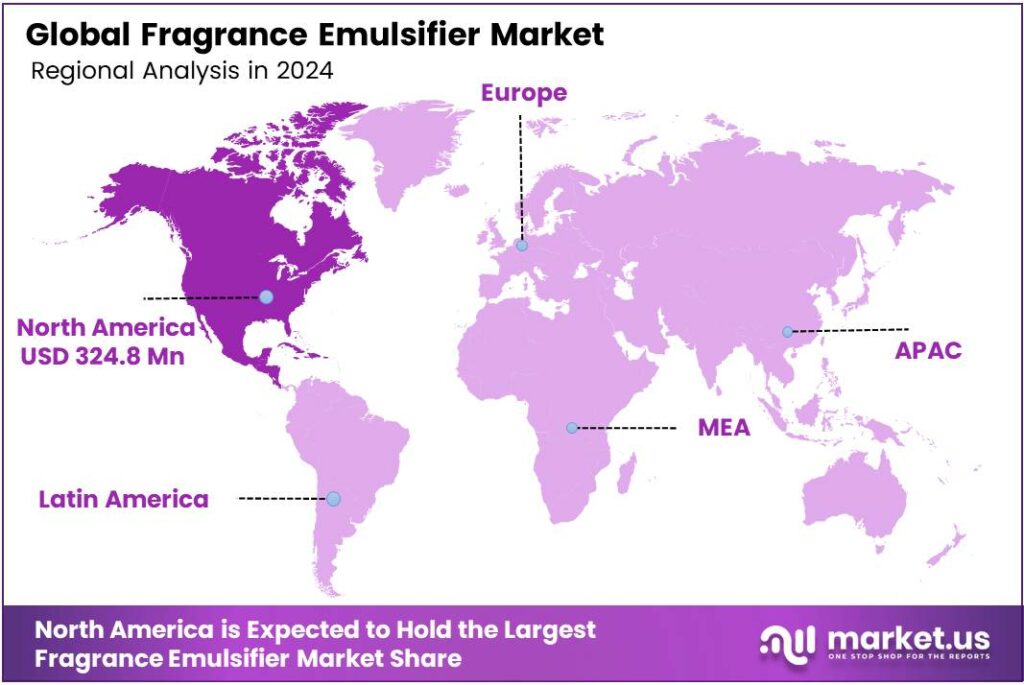

- North America dominated with a 45.2% market share in 2024, generating USD 324.8 million, driven by a mature cosmetics industry and clean label trends.

Analyst Viewpoint

The fragrance emulsifier market presents a compelling case for investors, driven by rising consumer demand for scented products across personal care, household, and industrial applications. With the global market for emulsifiers projected to grow steadily, the fragrance emulsifier segment is carving out a niche due to its critical role in stabilizing and enhancing scented formulations.

Investment opportunities abound in sustainable and natural emulsifiers, as consumers increasingly prioritize eco-friendly and health-conscious products. For instance, the shift toward plant-based and biodegradable emulsifiers aligns with broader wellness trends, offering companies a chance to capture premium market segments.

Technological advancements, such as AI-driven formulation and fermentation processes, are game-changers, reducing environmental impact and enabling personalized solutions. Yet, adopting these technologies requires significant upfront investment, which could strain cash flows. Balancing innovation with regulatory compliance and cost management will be key for companies to thrive and offer investors sustainable returns.

By Notes

Fresh Notes Dominance – 23.4% Market Share

In 2024, Fresh Notes held a dominant market position, capturing more than a 23.4% share in the fragrance emulsifier market. This segment has gained wide popularity due to its clean, light, and revitalizing aroma, which appeals strongly to consumers looking for natural freshness in personal care and home fragrance products.

The demand for Fresh Notes continues to rise, particularly in body sprays, perfumes, lotions, and soaps, where consumers increasingly prefer crisp and energizing scents over heavy or musky tones. This trend is expected to sustain as younger demographics, especially millennials and Gen Z, show a growing inclination toward refreshing and subtle fragrances that align with wellness and minimalistic lifestyles.

The expansion of premium skincare and cosmetic lines incorporating fresh-scented emulsifier blends further strengthens this segment’s outlook. Additionally, brands are leveraging fresh fragrance emulsifiers in functional products such as deodorants and air fresheners, adding to their widespread use across multiple end-user applications.

By Application

Personal Care Leading the Market – 39.6% Share

In 2024, Personal Care held a dominant market position, capturing more than a 39.6% share in the fragrance emulsifier market. This strong position comes from the widespread use of fragrance emulsifiers in products like lotions, shampoos, creams, deodorants, and body sprays.

Consumers increasingly look for pleasant scents combined with functional benefits, making emulsifiers essential for achieving stability and consistency in these formulations. The personal care industry has also been quick to adapt to changing consumer tastes, offering both premium and affordable products that highlight refreshing and long-lasting fragrances.

This aligns with consumer preferences for products that not only smell appealing but also carry a sense of wellness and environmental responsibility. The rising influence of urban lifestyles and increasing disposable incomes across emerging economies is also driving higher consumption of personal care products, directly supporting this segment’s growth.

By Distribution Channel

Hypermarkets and Supermarkets Driving Sales – 37.9% Share

In 2024, Hypermarkets and Supermarkets held a dominant market position, capturing more than a 37.9% share in the fragrance emulsifier market. This leadership is largely due to their wide product assortment, attractive promotions, and the trust consumers place in established retail chains.

These outlets provide easy accessibility to a broad range of personal care, household, and cosmetic products that utilize fragrance emulsifiers, making them the first choice for both urban and semi-urban shoppers. The ability to compare brands side by side and benefit from seasonal discounts further strengthens consumer preference for this channel.

The segment is expected to maintain its strong presence as supermarkets continue to expand their footprints in emerging economies and upgrade in-store experiences with digital kiosks, personalized promotions, and premium product displays. Rising consumer expectations for convenience and one-stop shopping are reinforcing the importance of hypermarkets in fragrance product distribution.

Key Market Segments

By Notes

- Fresh Notes

- Oriental Notes

- Woody Notes

- Fruity Notes

- Floral Notes

- Others

By Application

- Personal Care

- Cosmetics

- Pharmaceuticals

- Others

By Distribution Channel

- Hypermarkets and Supermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

- Others

Drivers

Rising Demand for Sustainable Ingredients Driving Growth

One of the major driving factors for the fragrance emulsifier market is the growing demand for sustainable and environmentally friendly ingredients in personal care and cosmetic formulations. Consumers across the world are becoming more conscious about the products they use on their skin and in their homes. This has created a strong push for natural and biodegradable ingredients, including fragrance emulsifiers that are safe, stable, and eco-friendly.

For example, according to the European Chemical Agency (ECHA), nearly 70% of consumers in Europe actively check product labels for safer and more sustainable formulations before purchase, which directly impacts the adoption of cleaner emulsifiers in fragrance products. Government initiatives are further accelerating this transition.

The European Union’s Green Deal and Chemicals Strategy for Sustainability aim to reduce harmful chemical use and encourage innovations that lower environmental footprints. This directly supports the wider adoption of sustainable fragrance emulsifiers. Additionally, organizations such as the OECD emphasize the role of safer surfactants and emulsifiers in reducing water pollution, as these compounds are widely used in personal care and cleaning products.

Restraints

Regulatory Complexity and Cost

One big challenge with fragrance emulsifiers is how tangled and costly the rules have become. The chemical industry where fragrance emulsifiers live faces a tens of millions of rules problem. In the U.S. alone, there are more than one million regulatory restrictions affecting chemical manufacturing, and that number has doubled in just twenty years.

For fragrance emulsifiers specifically, international bodies like IFRA (International Fragrance Association) and RIFM (Research Institute for Fragrance Materials) set safety limits, ban or restrict certain ingredients, and issue strict guidelines based on deep scientific review. The EU bans over 2,500 cosmetic and fragrance ingredients, while the U.S. only bans about 30, so global companies must juggle very different rules depending on where they sell.

Opportunity

Surging Demand for Natural, Sustainable, and Personalized Fragrance Experiences

In recent years, people everywhere have started caring more about the stories behind what they wear and use on their skin. They aren’t just looking for a nice scent; they want fragrances that are kind to people and the planet, and that feel tailored to them.

Consumers today are increasingly leaning toward natural and eco-friendly choices, pushing fragrance emulsifier makers to focus on plant-based and renewable ingredients that align with ethics and transparency. At the same time, there is a strong shift toward customized scent experiences, where shoppers seek perfumes and grooming products that feel unique and personal.

This has encouraged brands to design emulsifiers that can deliver complex, long-lasting, and innovative fragrance profiles tailored to individual tastes. Alongside these changes, both large and small companies are pouring resources into technological innovation, creating smarter emulsifiers that improve fragrance stability, enhance release, and offer a softer, more appealing feel on the skin.

Trends

Biotech and Bio-based Ingredients Gaining Traction

A quiet revolution is unfolding in the fragrance emulsifier world, biotechnology and sustainable bio‑based ingredients are emerging as powerful, hopeful forces. Instead of relying solely on petroleum or traditional botanical extracts, more and more innovators are turning to biotechnological methods, things like fermentation, enzymes, or even microbial synthesis to craft ingredients that are kinder to both skin and planet.

Filipino craft perfumer named Lina. She dreams of a scent that blends local coconut and lemongrass but worries about the environmental impact of sourcing wild botanicals sustainably. Suddenly, biotech becomes her ally. Thanks to fermentation-based notes like ambrofix, she can weave in that luxurious amber-like aroma without harming forests or wildlife. It’s a real innovation that hums with care for nature.

These biotech ingredients aren’t just imaginative, they’re practical, too. Because they’re fermented, supply becomes predictable and scalable. No more waiting for seasonal crops or worrying about overharvest and supply chain shocks caused by climate crises. Plus, public regulators from the EU’s ECHA to bodies in other regions are increasingly supportive of sustainable replacements.

Regional Analysis

North America leads with a 45.2% share and a USD 324.8 Million market value.

North America continues to dominate the global fragrance emulsifier market, accounting for 45.2% of total market share with an estimated USD 324.8 million in revenue. This commanding lead stems from strong demand across personal care, household, and industrial segments, driven by a mature cosmetics industry, stringent product safety standards, and a growing consumer preference for clean label formulations.

In Europe, the market holds a substantial share, driven by stringent cosmetics regulations under the European Chemicals Agency (ECHA), increasing consumer awareness, and a strong inclination toward natural and sustainable ingredients. Emulsifiers that comply with EcoCert and COSMOS certifications gain quick traction here. The industrial use of fragrances in laundry, cleaning, and aromatherapy is also robust, contributing significantly to regional demand.

The Asia Pacific region is emerging as a rapid growth hotspot led by countries like China, India, Japan, and South Korea with rising urban incomes, accelerating beauty and personal care adoption, and expanding middle-class consumer segments. Market growth in APAC is fueled by both local and international players aggressively expanding manufacturing and distribution networks.

Latin America and the Middle East & Africa (MEA) are smaller but steadily expanding markets. Latin America benefits from a growing beauty-conscious population and increasing imports of specialized emulsifier products. MEA sees demand from emerging beauty markets and niche perfumery segments, where premium emulsifiers find application in luxury fragrances and skin care products.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Givaudan SA leverages its unparalleled fragrance expertise to develop high-performance emulsifiers. Their focus is on creating innovative, sustainable solutions that enhance scent delivery and stability in complex formulations. With significant R&D investment and a global presence, they provide tailored ingredients for diverse applications, from fine perfumery to household products, solidifying their position as an industry innovator and trusted partner for major brands worldwide.

Firmenich, this Geneva-based powerhouse, combines legendary creativity with scientific precision. Their approach to fragrance emulsifiers is deeply integrated with their perfume composition, ensuring optimal scent authenticity and performance. A strong commitment to green chemistry drives their development of biodegradable and naturally-derived emulsifying agents, catering to the growing demand for sustainable and high-impact fragrance solutions in a competitive market.

Symrise excels by offering a holistic approach from its Scent & Care division. Their strength lies in creating multifunctional emulsifiers that not only stabilize fragrances but also provide sensory benefits to the final product. By focusing on customer-specific needs and market trends, Symrise delivers efficient, reliable, and innovative emulsification systems that enhance the longevity and diffusion of scents across all consumer goods categories.

Top Key Players in the Market

- Givaudan SA

- Firmenich

- Symrise

- IFF

- ICC Industries

- Takasago

- Mane SA

- Robertet SA

- Sensient Technologies Corporation

Recent Developments

- In 2025, Givaudan Active Beauty unveiled PrimalHyal UltraReverse, described as the smallest and most sustainable hyaluronic acid ever developed, designed to enhance cosmetic formulations. This aligns with their focus on innovative cosmetic active ingredients for beauty and personal care products, which often include emulsifiers to stabilize fragrance compounds.

- In 2025, DMS-Firmenich inaugurated two new production lines in Castets, France, one for pine-derived ingredients and another for biodegradable musk Habanolide, used in perfumery. The fragrance and emulsifier sector is being developed by combining Firmenich’s expertise in natural flavors and fragrances with DSM’s focus on health and nutrition.

Report Scope

Report Features Description Market Value (2024) USD 718.5 Million Forecast Revenue (2034) USD 1073.8 Million CAGR (2025-2034) 4.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Notes (Fresh Notes, Oriental Notes, Woody Notes, Fruity Notes, Floral Notes, Others), By Application (Personal Care, Cosmetics, Pharmaceuticals, Others), By Distribution Channel (Hypermarkets and Supermarkets, Convenience Stores, Specialty Stores, Online Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Givaudan SA, Firmenich, Symrise, IFF, ICC Industries, Takasago, Mane SA, Robertet SA, Sensient Technologies Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Fragrance Emulsifier MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample

Fragrance Emulsifier MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Givaudan SA

- Firmenich

- Symrise

- IFF

- ICC Industries

- Takasago

- Mane SA

- Robertet SA

- Sensient Technologies Corporation