Global Food Lyophilization Equipment Market Size, Share, And Enhanced Productivity By Type (Tray-style Freeze Dryers, Manifold Freeze Dryers, Rotary Freeze Dryers), By Operation Scale (Industrial-Scale Lyophilization, Pilot-Scale Lyophilization, Laboratory-Scale Lyophilization), By Technology (Conventional Freeze Dryers, Smart Freeze Dryers, Hybrid Lyophilizers), By Application (Fruits and Vegetables, Meat and Seafood, Beverages, Prepared Meals, Dairy Products, Pet Food, Probiotics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 171548

- Number of Pages: 357

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

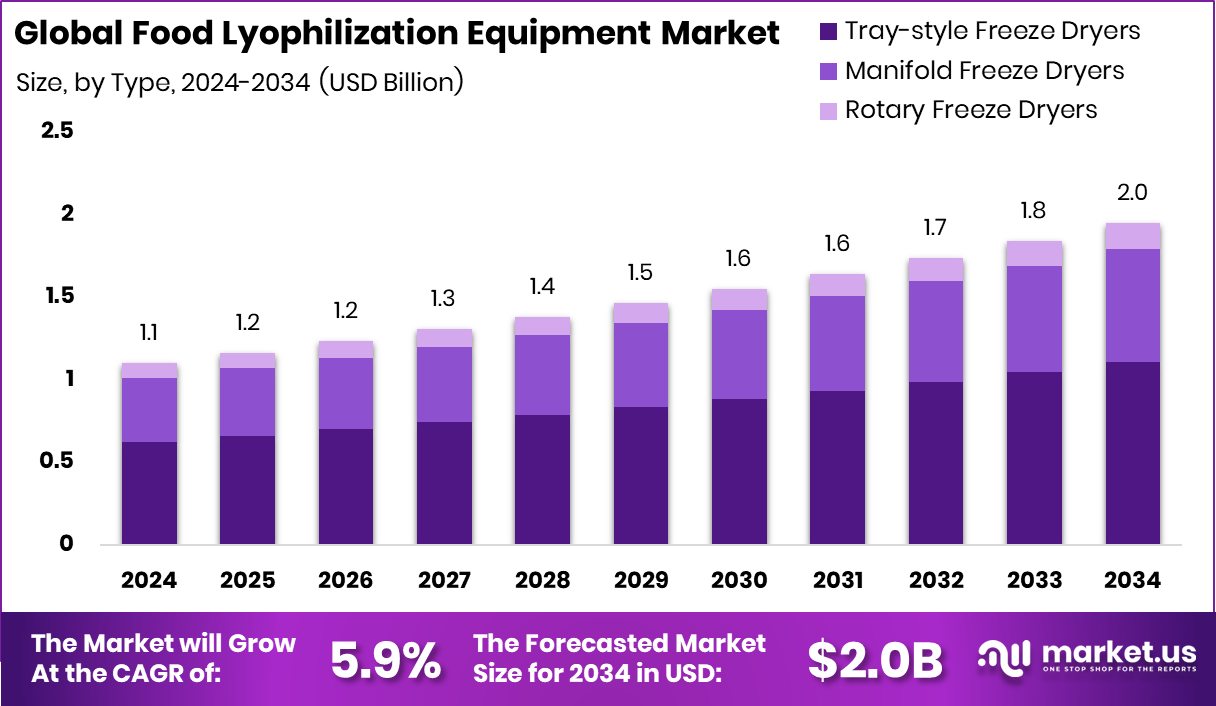

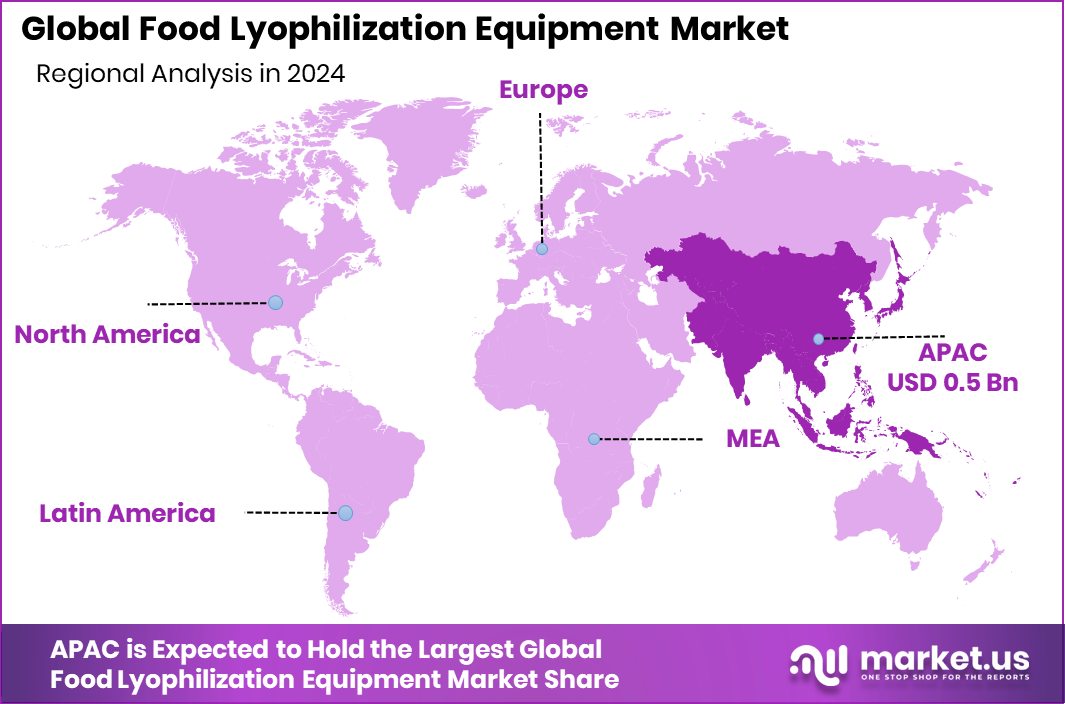

The Global Food Lyophilization Equipment Market is expected to be worth around USD 2.0 billion by 2034, up from USD 1.1 billion in 2024, and is projected to grow at a CAGR of 5.9% from 2025 to 2034. Asia Pacific remains the key food lyophilization equipment market at 47.80% share USD 0.5 Bn region.

Food lyophilization equipment refers to machines used to freeze-dry food by removing moisture under low temperature and vacuum conditions. This process helps preserve the original taste, texture, shape, and nutritional value of food for long periods. It is widely used for sensitive products such as fruits, vegetables, dairy ingredients, probiotics, and functional foods, where stability and shelf life are critical without using preservatives.

The Food Lyophilization Equipment Market covers the demand and adoption of these freeze-drying systems across the food processing and nutrition sectors. Growth is closely linked to the expansion of health-focused foods, probiotics, and microbiome-based products that require precise moisture control. Companies working on gut health and nutrition increasingly depend on freeze-drying to maintain product effectiveness and safety.

One key growth factor is rising investment in probiotic and microbiome innovation. Funding such as BiomEdit’s $18.4m Series B, Ostia Sciences’ $1.46M seed funding, and £1.8m for probiotics research highlights strong scientific activity that relies on stable drying technologies for formulation and storage.

Market demand is driven by the commercial scaling of gut-health solutions. Investments like Sun Genomics’ $8.65M Series A, Seed Health’s $40M Series A, and General Mills’ $12M funding for GoodBelly Probiotics reflect growing production needs, supporting wider adoption of food lyophilization equipment.

- Evolve raised $55M Series D, and Pendulum Therapeutics secured $54M Series C, signaling long-term demand for advanced freeze-drying systems to support clinical-grade and consumer nutrition products.

Key Takeaways

- The Global Food Lyophilization Equipment Market is expected to be worth around USD 2.0 billion by 2034, up from USD 1.1 billion in 2024, and is projected to grow at a CAGR of 5.9% from 2025 to 2034.

- Tray-style freeze dryers dominated the Food Lyophilization Equipment Market with 56.8% share, driven by uniform drying efficiency.

- Industrial-scale lyophilization accounted for 56.2% of the market share, supported by high-volume food processing demand.

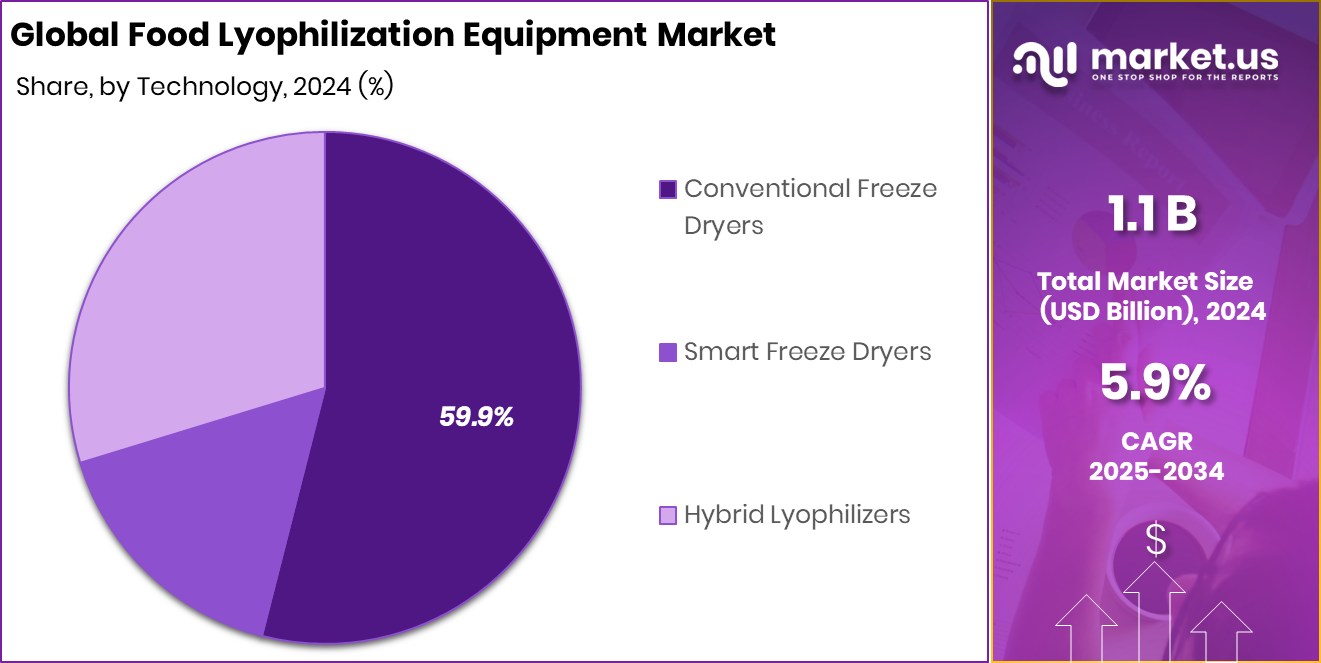

- Conventional freeze-dryers led technology adoption with 59.9% share due to reliability and lower operational complexity.

- Fruits and vegetables represented 31.6% application share, fueled by rising demand for shelf-stable nutritious foods.

- Asia Pacific dominates the Food Lyophilization Equipment Market, holding a 47.80% share worth USD 0.5 Bn in the region.

By Type Analysis

In Food Lyophilization Equipment Market, tray-style freeze dryers dominate with 56.8% share.

In 2024, Tray-style Freeze Dryers held a dominant market position in By Type segment of the Food Lyophilization Equipment Market, with a 56.8% share. This strong position reflects their wide acceptance across food processing operations that require consistent drying results and controlled batch processing. Tray-style systems are valued for their structured loading design, which supports uniform heat and mass transfer during lyophilization. This design helps maintain product shape, texture, and nutritional quality, which are critical outcomes in food preservation.

The 56.8% share also highlights the preference for equipment that can handle varied product sizes and processing volumes without compromising stability. Tray-style freeze dryers support predictable processing cycles, making them suitable for manufacturers focused on quality consistency and operational reliability. Their established use across food applications continues to reinforce their leading role within this segment.

By Operation Scale Analysis

Industrial-scale lyophilization leads Food Lyophilization Equipment Market operations, accounting for 56.2% globally.

In 2024, Industrial-Scale Lyophilization held a dominant market position in By Operation Scale segment of Food Lyophilization Equipment Market, with a 56.2% share. This dominance indicates strong demand from large food processors seeking high-capacity systems to support continuous and large-volume production needs. Industrial-scale equipment enables efficient handling of bulk quantities while maintaining uniform drying performance across batches.

The 56.2% share reflects the importance of scalable operations in meeting rising processed and preserved food demand. Industrial-scale lyophilization supports standardized production workflows, reduces processing time per unit, and improves output control. These factors make it a preferred choice for manufacturers prioritizing throughput, consistency, and long-term operational efficiency within food lyophilization processes.

By Technology Analysis

Conventional freeze dryers hold leadership in Food Lyophilization Equipment Market technology, 59.9%.

In 2024, Conventional Freeze Dryer held a dominant market position in By Technology segment of Food Lyophilization Equipment Market, with a 59.9% share. This leadership is driven by the proven reliability and widespread familiarity of conventional freeze-drying technology in food processing environments. The technology is well understood, offering stable performance across a wide range of food products while preserving structure and nutritional integrity.

Holding a 59.9% share, conventional freeze-dryers continue to be favored for their predictable operating parameters and established processing outcomes. Food manufacturers rely on this technology to ensure consistent quality and repeatable results. Its continued dominance reflects confidence in traditional systems that deliver dependable performance without operational complexity.

By Application Analysis

Fruits and vegetables remain applications within Food Lyophilization Equipment Market, holding 31.6%.

In 2024, Fruits and Vegetables held a dominant market position in the Application segment of the Food Lyophilization Equipment Market, with a 31.6% share. This segment leads due to the high suitability of freeze-drying for preserving color, texture, and nutritional value in fruits and vegetables. Lyophilization helps extend shelf life while maintaining product quality, which is essential for consumer acceptance.

The 31.6% share highlights sustained processing demand for fruits and vegetables across preserved and specialty food categories. Freeze-dried fruits and vegetables benefit from a lightweight structure, ease of storage, and rehydration efficiency. These advantages continue to support their strong application presence within the food lyophilization equipment market.

Key Market Segments

By Type

- Tray-style Freeze Dryers

- Manifold Freeze Dryers

- Rotary Freeze Dryers

By Operation Scale

- Industrial-Scale Lyophilization

- Pilot-Scale Lyophilization

- Laboratory-Scale Lyophilization

By Technology

- Conventional Freeze Dryers

- Smart Freeze Dryers

- Hybrid Lyophilizers

By Application

- Fruits and Vegetables

- Meat and Seafood

- Beverages

- Prepared Meals

- Dairy Products

- Pet Food

- Probiotics

- Others

Driving Factors

Rising Premium Pet Food Demand Drives Adoption

The Food Lyophilization Equipment Market is strongly driven by the rapid growth of premium and fresh pet food. Pet owners increasingly prefer high-quality, natural, and nutrient-rich food for cats and dogs, pushing manufacturers to adopt freeze-drying technology. Lyophilization helps retain protein quality, flavor, and shelf life without preservatives, making it ideal for fresh and raw pet food products. This shift is clearly supported by rising investments in the pet food ecosystem, indicating higher production volumes and advanced processing needs.

Funding activity shows how fast this segment is scaling. KatKin raised $50 million to expand its fresh cat food operations, highlighting the need for reliable freeze-drying equipment to support larger batches and consistent quality. Other growing brands are also strengthening demand for processing infrastructure. Wipro Consumer Care Ventures led a $1 million funding in Goofy Tails, while Muttley Crew raised $425,000 in a seed round to expand pet food sales across India.

Restraining Factors

High Production Costs Limit Wider Market Adoption

One major restraining factor in the Food Lyophilization Equipment Market is the high cost of setting up and operating freeze-drying systems. Lyophilization equipment requires heavy upfront investment, skilled operation, and significant energy use, which can be challenging for young and growing food brands. Many startups in the pet and specialty food space must carefully balance product quality with cost efficiency, often slowing equipment adoption or expansion plans.

Funding activity highlights this challenge. Buddy Bites raised $1 million, Untamed secured $12.8 million, and Oh Norman! raised $2 million with support from Mars Petcare, showing strong interest but also the capital intensity of scaling premium food production. Even with funding, companies must prioritize spending across branding, distribution, and formulation, making expensive freeze-drying equipment a cautious decision rather than an immediate purchase.

Growth Opportunity

Expanding Dairy Alternatives Drive Freeze-Drying Opportunities

A major growth opportunity in the Food Lyophilization Equipment Market comes from the rapid expansion of dairy and dairy-alternative products. Manufacturers are increasingly using freeze-drying to improve shelf life, retain nutrients, and maintain taste in milk powders, protein-rich formulations, and value-added dairy ingredients. This trend is supported by strong funding activity, showing rising production capacity and innovation across the dairy ecosystem.

Ace International raised $35 million to scale dairy manufacturing, while Ripple Foods secured $17 million to meet growing demand for organic, high-protein pea milk. Large domestic investments also reflect long-term growth confidence, including Milky Mist Dairy’s IPO of Rs 2,035 Cr and Parag Milk Foods raising Rs 161 Cr with new investor backing. As dairy players expand portfolios and volumes, the need for efficient, high-quality freeze-drying equipment continues to rise.

Latest Trends

Fresh Produce Preservation Drives Freeze-Drying Adoption

A key latest trend in the Food Lyophilization Equipment Market is the growing focus on preserving fresh fruits and vegetables for longer shelf life and wider distribution. Food companies are increasingly using freeze-drying to retain color, taste, and nutrients while reducing spoilage and transport losses. This trend is strongly supported by investments aimed at strengthening fresh produce supply chains, where long storage stability is critical.

Handpickd raised $15 Mn to optimize fruit and vegetable supply chains, showing rising emphasis on quality preservation and processing efficiency. Similarly, KisanKonnect secured INR 72 Cr to expand fresh produce sales, indicating higher volumes moving through modern processing systems. As fresh produce businesses scale, freeze-drying equipment is becoming an important solution to manage seasonality, reduce waste, and improve product reach.

Regional Analysis

Asia Pacific leads the Food Lyophilization Equipment Market with a 47.80% share valued USD 0.5 Bn.

Asia Pacific emerged as the dominating region in the Food Lyophilization Equipment Market, accounting for 47.80% of the total market and valued at USD 0.5 Bn. This strong position reflects the region’s expanding food processing base, growing consumption of preserved and convenience foods, and increasing adoption of advanced drying technologies across large-scale operations. Manufacturers in Asia Pacific continue to prioritize efficiency, consistency, and shelf-life enhancement, reinforcing the region’s leadership in lyophilization equipment demand.

North America represents a mature and technology-driven market, supported by established food processing standards and steady equipment replacement cycles. Europe follows closely, driven by strong quality regulations and widespread use of freeze-dried ingredients across packaged and specialty food categories.

The Middle East & Africa region shows gradual market development, supported by rising interest in food preservation solutions suited for extended storage and distribution. Latin America contributes by improving food processing capabilities and increasing awareness of freeze-dried food benefits.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

GEA Group Aktiengesellschaft continues to hold a strong position in the Food Lyophilization Equipment Market through its engineering depth and long-standing expertise in food processing systems. In 2024, the company’s focus remains on delivering reliable, large-scale freeze-drying solutions aligned with industrial food production needs. Its strength lies in integrating lyophilization within broader processing lines, helping food manufacturers maintain product quality, consistency, and operational efficiency. GEA’s emphasis on robust system design supports long production cycles and stable performance.

Hosokawa Micron Powder Systems plays a specialized role in the market by leveraging its strong background in powder and particle processing technologies. In 2024, the company’s lyophilization offerings are viewed as well-suited for applications requiring precise control over particle structure and moisture content. Its analytical approach to drying technology supports consistent outcomes, making it relevant for food products where texture and rehydration behavior are critical quality parameters.

Tofflon Science and Technology Group Co., Ltd. is increasingly recognized for its scale-focused lyophilization systems. In 2024, the company’s presence reflects strong capabilities in industrial freeze-drying equipment manufacturing. Its systems are designed to support high-throughput food processing environments, positioning Tofflon as a competitive supplier for producers seeking efficiency, stability, and standardized drying performance at scale.

Top Key Players in the Market

- GEA Group Aktiengesellschaft

- Hosokawa Micron Powder Systems

- Tofflon Science and Technology Group Co., Ltd.

- Martin Christ Gefriertrocknungsanlagen GmbH

- Spincotech

- Cuddon Freeze Dry

- LOBOAO

- SED Pharma

- Kemolo

- Frozen in Time, Ltd.

Recent Developments

- In August 2025, Hosokawa Micron Group showcased its turnkey powder processing systems at Powtech TechnoPharm 2025. The presentation focused on complete solutions from grinding to drying and mixing, demonstrating the company’s broad capacity to deliver integrated processing technologies for industries like food, chemicals, and pharmaceuticals. This shows Hosokawa’s commitment to comprehensive systems and reliability in processing equipment.

- In October 2024, GEA introduced the RAY® Plus series of batch freeze dryers designed especially for food applications. This next-generation equipment offers better energy efficiency, improved hygiene, and flexible processing, making it a more efficient solution for food producers needing scalable, high-capacity freeze drying.

Report Scope

Report Features Description Market Value (2024) USD 1.1 Billion Forecast Revenue (2034) USD 2.0 Billion CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Tray-style Freeze Dryers, Manifold Freeze Dryers, Rotary Freeze Dryers), By Operation Scale (Industrial-Scale Lyophilization, Pilot-Scale Lyophilization, Laboratory-Scale Lyophilization), By Technology (Conventional Freeze Dryers, Smart Freeze Dryers, Hybrid Lyophilizers), By Application (Fruits and Vegetables, Meat and Seafood, Beverages, Prepared Meals, Dairy Products, Pet Food, Probiotics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape GEA Group Aktiengesellschaft, Hosokawa Micron Powder Systems, Tofflon Science and Technology Group Co., Ltd., Martin Christ Gefriertrocknungsanlagen GmbH, Spincotech, Cuddon Freeze Dry, LOBOAO, SED Pharma, Kemolo, Frozen in Time, Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Food Lyophilization Equipment MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Food Lyophilization Equipment MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- GEA Group Aktiengesellschaft

- Hosokawa Micron Powder Systems

- Tofflon Science and Technology Group Co., Ltd.

- Martin Christ Gefriertrocknungsanlagen GmbH

- Spincotech

- Cuddon Freeze Dry

- LOBOAO

- SED Pharma

- Kemolo

- Frozen in Time, Ltd