Global Food Deaerators Market Size, Share, And Enhanced Productivity By Type (Spray-Type Deaerators, Tray-Type Deaerators, Vacuum-Type Deaerators), By Function (Oxygen Removal, Carbon Dioxide Removal, Others), By Application (Beverages, Dairy Products, Soups and Sauces, Bakery and Confectionery, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 171872

- Number of Pages: 329

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

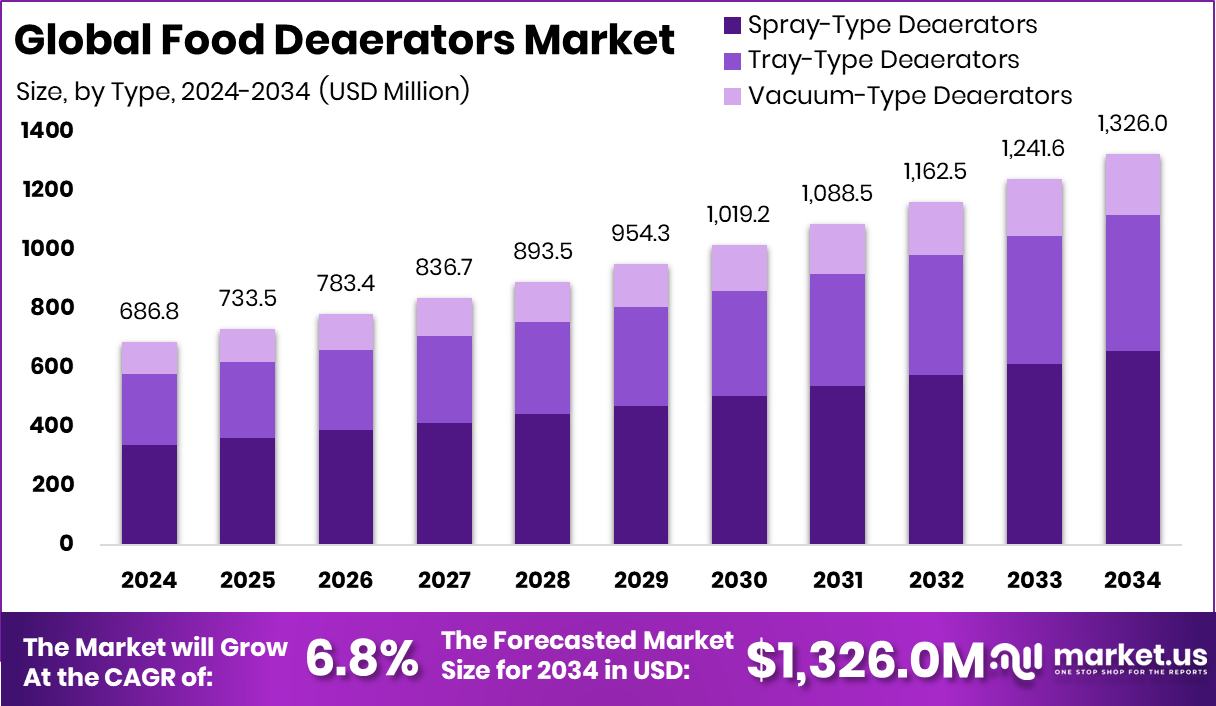

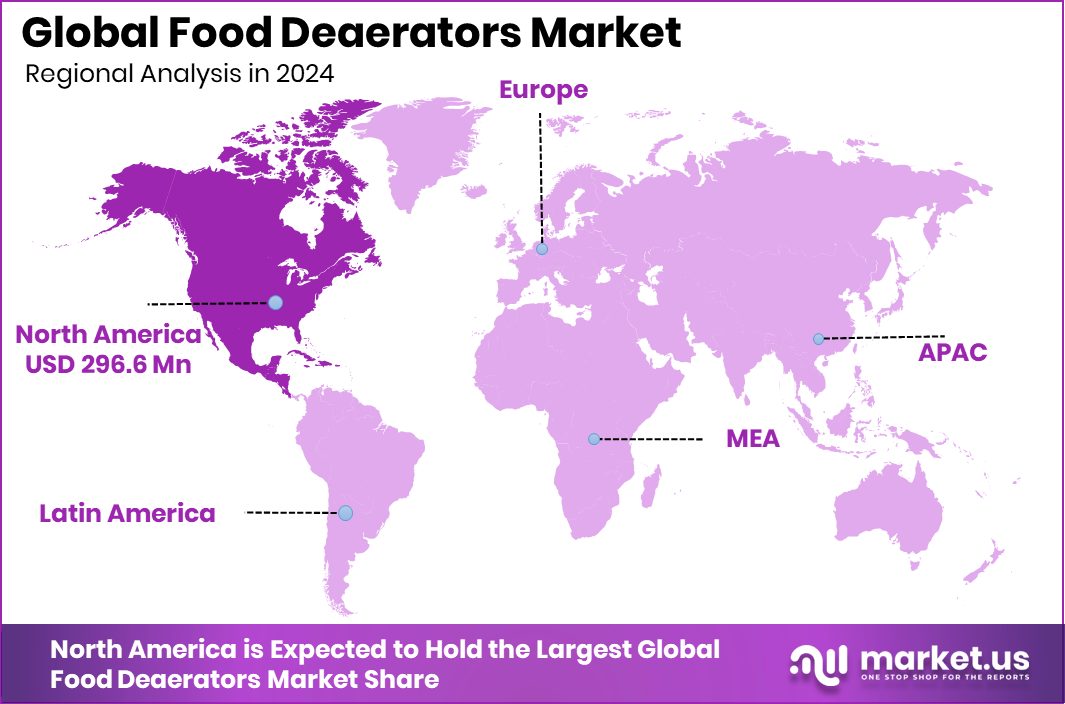

The Global Food Deaerators Market is expected to be worth around USD 1,326.0 million by 2034, up from USD 686.8 million in 2024, and is projected to grow at a CAGR of 6.8% from 2025 to 2034. The Food Deaerators Market in North America reached USD 296.6 Mn at 43.2%.

Food deaerators are systems used in liquid food and beverage processing to remove dissolved oxygen, unwanted gases, and air bubbles. Removing oxygen helps protect flavor, color, freshness, and shelf life, especially in products like juices, dairy liquids, sauces, and brewing formulations. By lowering oxidation, deaerators help manufacturers maintain stability and quality during production, storage, and filling.

The Food Deaerators Market refers to the global demand for these systems across beverage factories, dairy plants, bakeries, confectionery producers, and ready-to-drink processing lines. As quality expectations grow, manufacturers increasingly rely on deaeration to prevent product degradation and ensure consistent sensory performance. Rising packaged beverage output and cleaner processing practices continue shaping the overall market landscape.

Several growth factors support expanding interest in deaeration technologies. Bakery and confectionery activities have accelerated, backed by investments such as Gaja Capital leading a Rs 60 crore round in Bakers Circle, the £20,000 funding boost for Bakery Mazowsze, and the PBGC’s $3.4 billion support for the bakery union pension plan. These signals of industry stability encourage equipment upgrades, including deaerators for liquid mixes and fillings.

Demand is further strengthened by rising innovation in cocoa-free and upcycled food alternatives. Recent developments include French Fermentation Firm securing $6M, Win-Win raising $4M, Awake Chocolate attracting $5.8M, Wilde revealing a $20M round, and Voyage Foods closing a $52M Series A+. These investments push companies to adopt advanced processing systems that protect flavor and texture.

The market also benefits from opportunities emerging in regional manufacturing. Smaller producers expanding capacity—such as the £300,000 funding secured by a Bristol-based manufacturer—drive demand for reliable deaeration equipment that supports efficient, stable production lines for both new and existing product categories.

Key Takeaways

- The Global Food Deaerators Market is expected to be worth around USD 1,326.0 million by 2034, up from USD 686.8 million in 2024, and is projected to grow at a CAGR of 6.8% from 2025 to 2034.

- Spray-type deaerators hold a strong 49.5% share, highlighting their dominance in the Food Deaerators Market.

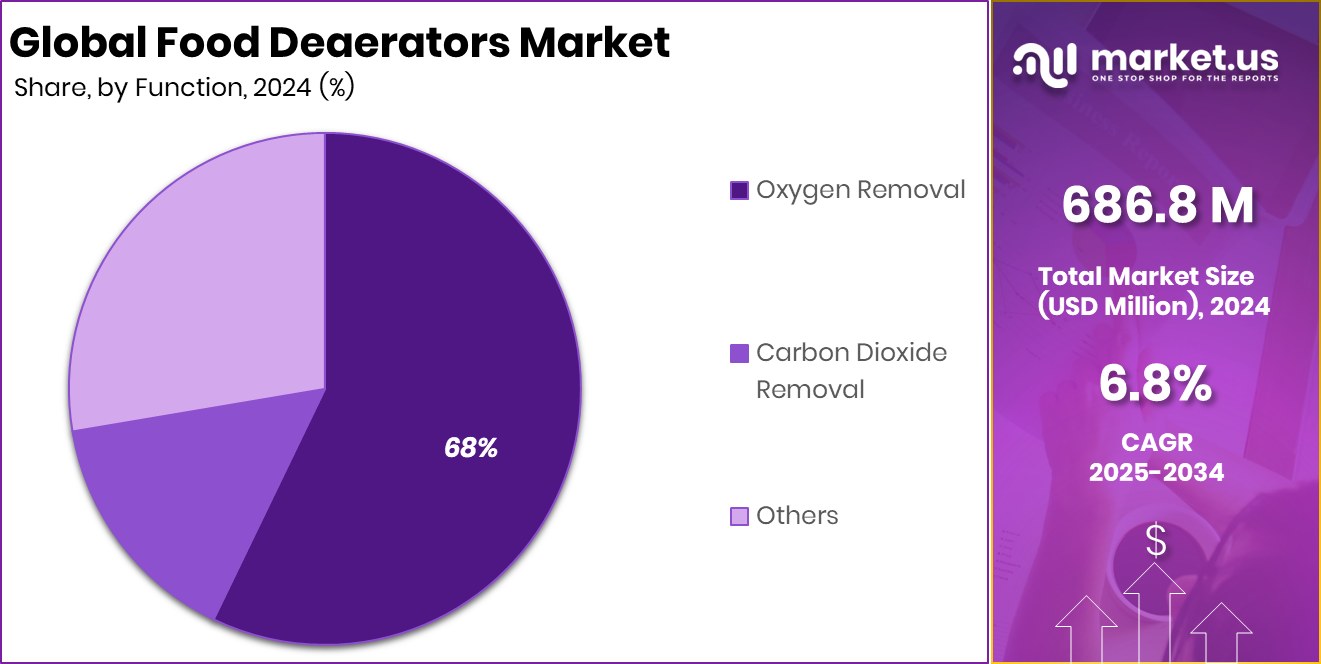

- Oxygen removal represents 68.2% share, showing its critical role in extending food and beverage freshness.

- Beverages account for 45.4% share, confirming they remain the largest application in the Food Deaerators Market.

- In 2024, North America achieved 43.2% market dominance, totaling USD 296.6 Mn.

By Type Analysis

Food Deaerators Market grows as spray-type deaerators reach 49.5% global share.

In 2024, Spray-Type Deaerators held a dominant market position in the By Type segment of the Food Deaerators Market, with a 49.5% share. This leadership reflects their widespread acceptance for delivering consistent and efficient oxygen removal across various liquid food products. Spray-type systems are valued for their ability to manage high flow rates while maintaining stable product quality, making them suitable for modern processing lines.

Their design supports better heat transfer and uniform degassing, which helps manufacturers maintain the freshness and shelf stability of sensitive food items. As food processors continue prioritizing efficiency and reliability, spray-type deaerators remain the preferred technology, strengthening their market hold and supporting long-term adoption across diverse production environments.

By Function Analysis

Rising demand strengthens the Food Deaerators Market, with oxygen removal holding 68.2% dominance.

In 2024, Oxygen Removal held a dominant market position in the By Function segment of the Food Deaerators Market, with a 68.2% share. This strong position reflects the essential role of oxygen reduction in preserving flavor, color, and product integrity across liquid foods. Eliminating dissolved oxygen helps manufacturers prevent oxidation, improve shelf life, and maintain consistent sensory qualities in packaged products.

The high share also highlights growing industry awareness of the direct connection between oxygen exposure and product degradation. Food processors increasingly rely on oxygen removal technologies to meet strict quality standards and maintain clean-label expectations. As a result, oxygen removal continues to be the primary function driving the use of food deaerators across processing environments.

By Application Analysis

Expanding beverage processing boosts the Food Deaerators Market, as beverages capture 45.4% share.

In 2024, Beverages held a dominant market position in the By Application segment of the Food Deaerators Market, with a 45.4% share. This dominance is supported by the beverage sector’s strong need to control dissolved gases to ensure product stability, especially in juices, soft drinks, functional beverages, and brewed drinks. Deaeration helps maintain clarity, taste, and overall freshness, making it a critical processing step.

The high share also reflects rising production volumes and the emphasis on consistent quality in large-scale beverage manufacturing. By minimizing oxidation and foaming issues, deaerators enable smoother filling operations and longer product shelf life. These benefits collectively reinforce the beverage segment’s leading position within the market.

Key Market Segments

By Type

- Spray-Type Deaerators

- Tray-Type Deaerators

- Vacuum-Type Deaerators

By Function

- Oxygen Removal

- Carbon Dioxide Removal

- Others

By Application

- Beverages

- Dairy Products

- Soups and Sauces

- Bakery and Confectionery

- Others

Driving Factors

Rising Dairy Production Boosts Deaerator Demand

The Food Deaerators Market is growing strongly as dairy processing expands worldwide, increasing the need for equipment that protects freshness and prevents oxidation in milk-based liquids. This trend is reinforced by major developments in the dairy sector. Ace International raising $35 million highlights growing investment toward modern dairy production, creating more opportunities for advanced deaeration systems in processing lines. As producers scale output, removing dissolved oxygen becomes essential for maintaining flavor and product stability.

Another major push comes from innovation in dairy alternatives. Nutropy securing $8M in funding to develop animal-free cheese reflects rising demand for stable, clean-label formulations where deaerators help maintain smooth texture and consistency. Additionally, Milky Mist Dairy Food filing a Rs 2,035 crore IPO shows growing industrial confidence, encouraging plants to upgrade to high-performance deaeration technologies.

Government support also contributes to this momentum, especially with the Cabinet approving a Rs 2,000 crore NCDC grant that benefits dairy cooperatives aiming to improve processing quality. These combined developments strengthen the need for reliable deaerators across both traditional and emerging dairy segments.

Restraining Factors

High Production Costs Slow Market Expansion

One major restraining factor for the Food Deaerators Market is the high cost of installing and maintaining advanced deaeration systems, especially for smaller dairy and plant-based producers. While innovations in alternative dairy continue to grow, many companies still face financial pressure when upgrading processing equipment. For example, Brazil’s Future Cow raising R$4.85M to scale animal-free dairy proteins shows the heavy funding required just to expand production capacity, leaving limited room for additional investments such as deaerators.

Cost challenges are also visible among plant-based dairy manufacturers. The Finnish Food Factory securing $11.8M highlights how large funding rounds are often necessary simply to build or expand facilities, suggesting that advanced processing tools may remain unaffordable for early-stage producers. Similarly, Opalia achieving its first sale ahead of a $4M fundraise reflects how new dairy-tech companies must prioritize survival and scale before committing to high-value equipment purchases.

Even traditional dairy farms receiving $750,000 to boost long-term success indicate that financial support often goes toward basic upgrades rather than specialized machinery. These circumstances collectively slow the broader adoption of food dehydrators, limiting market growth among smaller and emerging producers.

Growth Opportunity

Expanding Dairy and Plant-Based Production Boosts Opportunities

A major growth opportunity for the Food Deaerators Market comes from the rapid expansion of both fresh dairy and plant-based dairy production, creating strong demand for equipment that improves product stability and taste. The sector is receiving significant financial support, such as Country Delight securing $25M, which reflects rising investment in fresh milk delivery and processing. As these companies scale, they require efficient deaeration systems to maintain quality across high-volume liquid products.

Growth is also accelerating in sustainable dairy alternatives. Kinish raising 120 million yen for plant-based dairy and Alec’s Ice Cream securing $11M to support regenerative dairy farms highlight the shift toward cleaner, value-driven formulations. Deaerators become essential in these segments to protect flavor, prevent oxidation, and ensure smooth textures. Government and institutional support add further momentum.

Governor Hochul’s $15.8M award for water-quality improvements indirectly strengthens dairy processing readiness, while the EU Bank’s $36M funding for a German sustainable protein startup signals a growing ecosystem for alternative proteins. Together, these developments create a strong pipeline of producers who will rely on advanced deaeration technology to deliver consistent, high-quality dairy and plant-based beverages.

Latest Trends

Expanding Dairy and Plant-Based Production Boosts Opportunities

A major growth opportunity for the Food Deaerators Market comes from the rapid expansion of both fresh dairy and plant-based dairy production, creating strong demand for equipment that improves product stability and taste. The sector is receiving significant financial support, such as Country Delight securing $25M, which reflects rising investment in fresh milk delivery and processing. As these companies scale, they require efficient deaeration systems to maintain quality across high-volume liquid products.

Growth is also accelerating in sustainable dairy alternatives. Kinish raising 120 million yen for plant-based dairy and Alec’s Ice Cream securing $11M to support regenerative dairy farms highlight the shift toward cleaner, value-driven formulations. Deaerators become essential in these segments to protect flavor, prevent oxidation, and ensure smooth textures. Government and institutional support add further momentum.

Governor Hochul’s $15.8M award for water-quality improvements indirectly strengthens dairy processing readiness, while the EU Bank’s $36M funding for a German sustainable protein startup signals a growing ecosystem for alternative proteins. Together, these developments create a strong pipeline of producers who will rely on advanced deaeration technology to deliver consistent, high-quality dairy and plant-based beverages.

Regional Analysis

North America led the Food Deaerators Market with 43.2% share worth USD 296.6 Mn.

In 2024, North America emerged as the dominant region in the Food Deaerators Market, holding a 43.2% share valued at USD 296.6 Mn. This strong position reflects the region’s advanced food processing infrastructure and high adoption of deaeration technologies to maintain product quality across beverages and packaged liquid foods. Manufacturers in the U.S. and Canada prioritize consistency, extended shelf life, and oxidation control, supporting the region’s leadership in the market.

Europe followed with steady demand driven by well-established beverage, dairy, and processed food industries, where deaeration remains a key quality-control step. The Asia Pacific region continued expanding as food and beverage production scaled across emerging economies.

Rising consumption and growing industrial capacity strengthened its importance in the global landscape. The Middle East & Africa showcased selective adoption aligned with expanding food processing activities, while Latin America maintained gradual growth supported by its developing packaged food sector.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, GEA Group continued to strengthen its position in the global Food Deaerators Market by leveraging its deep expertise in food processing technologies. The company’s systems are known for efficiency, reliability, and precise gas removal, which aligns well with the growing demand for consistent quality in liquid food products. GEA’s focus on hygienic design and process optimization helped it remain a preferred partner for beverage, dairy, and food manufacturers seeking stable and scalable deaeration solutions.

SPX FLOW maintained a strong presence through its specialized fluid-handling and thermal-processing capabilities. The company’s emphasis on reducing oxygen levels, improving flavor stability, and supporting energy-efficient operations positioned it as a key supplier for modern processing plants. SPX FLOW’s engineered systems are valued for enabling smoother production flows and minimizing oxidation risks, which remain central to food and beverage quality management.

Krones AG, known for integrated beverage and liquid-food technologies, reinforced its role by offering deaeration solutions tailored for high-throughput production. Its equipment supports consistent product clarity and shelf stability, making it widely used in bottling and beverage processing lines. Krones’ ability to integrate deaerators into complete filling and packaging systems further strengthened its strategic relevance in the market.

Top Key Players in the Market

- GEA Group

- SPX FLOW

- Krones AG

- Alfa Laval

- Bucher Unipektin AG

- Tetra Pak

- Meyer Industries, Inc

- Sidel

- JBT Corporation

- Pall Corporation

Recent Developments

- In February 2025, APV, a brand of SPX FLOW that works on processing equipment for food and beverage, won the SEAL Business Sustainability Award for its Seamless Infusion Vessel innovation that improves efficiency and run times in UHT and beverage processing.

- In March 2024, GEA introduced a new real-time monitoring solution for food processing technology, aimed at improving machine availability, reducing downtime, and supporting more efficient food and beverage production processes. This new digital solution enhances operational performance for processing and packaging lines.

- In March 2024, Krones completed the acquisition of Netstal Maschinen AG, a company working in filling and packaging technology. This strengthens Krones’ offerings in processing equipment used for food and beverage containers.

Report Scope

Report Features Description Market Value (2024) USD 686.8 Million Forecast Revenue (2034) USD 1,326.0 Million CAGR (2025-2034) 6.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Spray-Type Deaerators, Tray-Type Deaerators, Vacuum-Type Deaerators), By Function (Oxygen Removal, Carbon Dioxide Removal, Others), By Application (Beverages, Dairy Products, Soups and Sauces, Bakery and Confectionery, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape GEA Group, SPX FLOW, Krones AG, Alfa Laval, Bucher Unipektin AG, Tetra Pak, Meyer Industries, Inc, Sidel, JBT Corporation, Pall Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Food Deaerators MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Food Deaerators MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- GEA Group

- SPX FLOW

- Krones AG

- Alfa Laval

- Bucher Unipektin AG

- Tetra Pak

- Meyer Industries, Inc

- Sidel

- JBT Corporation

- Pall Corporation