Global Food Certification Market Size, Share, And Enhanced Productivity By Type (ISO 22000, Halal, Kosher, SQF, IFS, Free-from certifications, BRC, Others), By Application (Infant Food, Beverages, Bakery and Confectionery Products, Free-from foods, Meat, poultry, and seafood products, Dairy Products, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 169456

- Number of Pages: 211

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

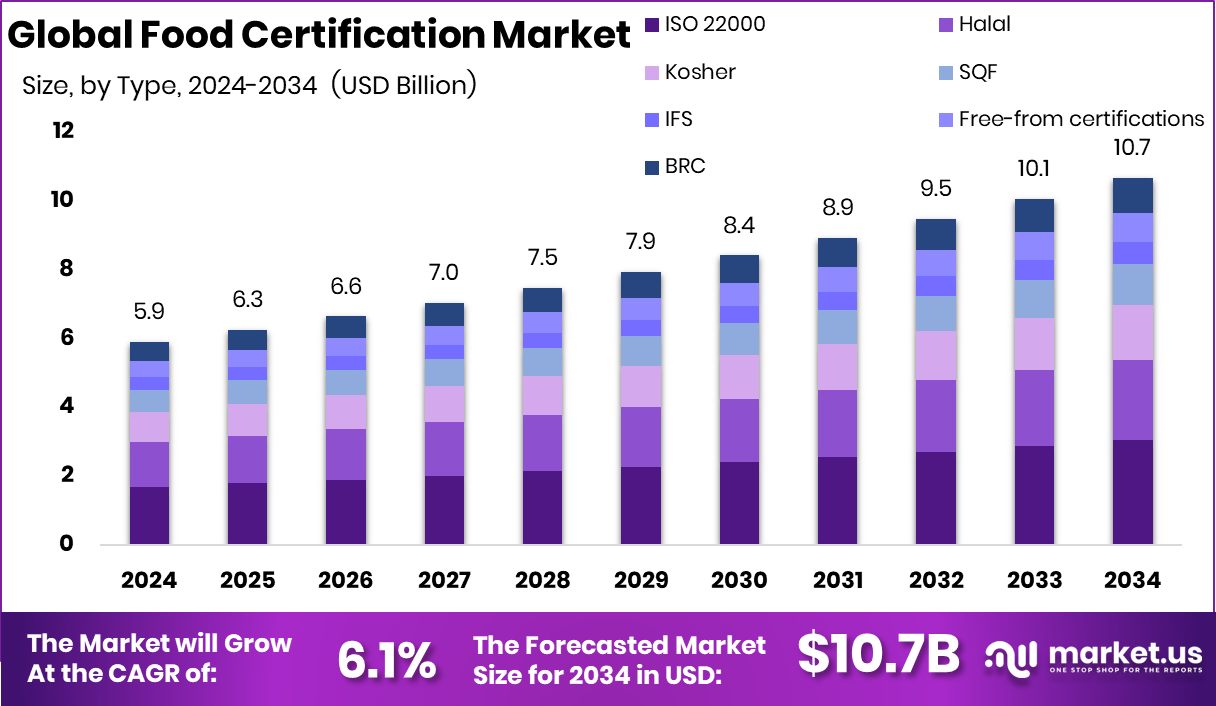

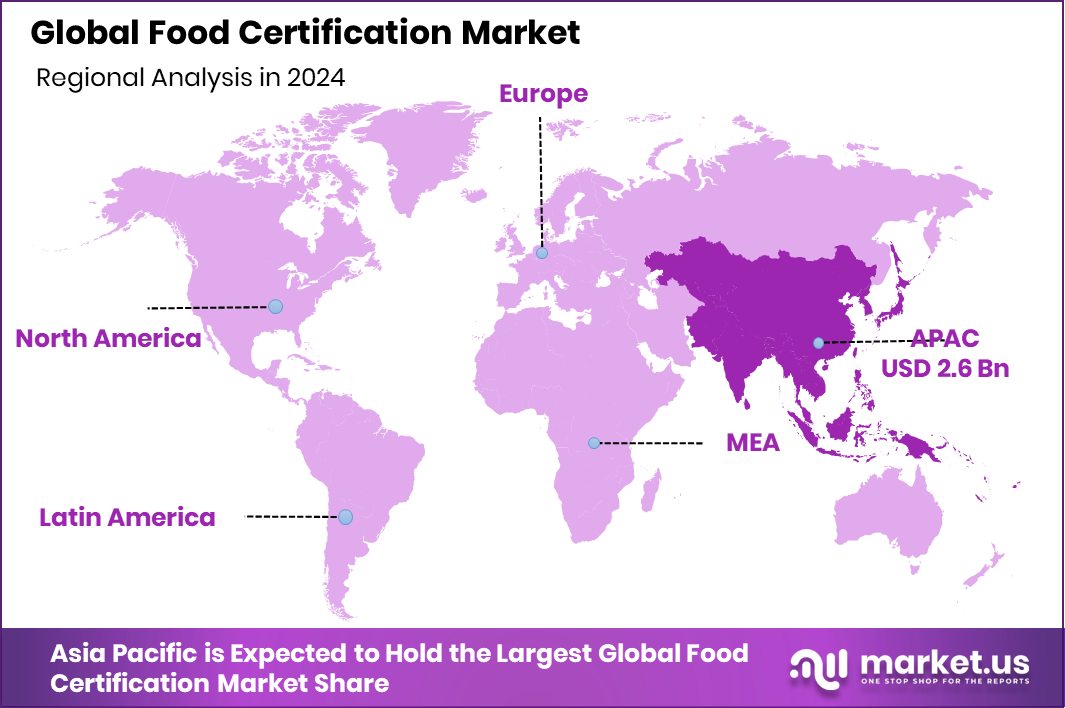

The Global Food Certification Market is expected to be worth around USD 10.7 billion by 2034, up from USD 5.9 billion in 2024, and is projected to grow at a CAGR of 6.1% from 2025 to 2034. High regulatory focus supports Asia Pacific’s 44.9% Food Certification Market share, totalling USD 2.6 Bn.

Food certification is a formal process that checks whether food products meet defined safety, quality, ethical, or process standards. It reassures consumers that food is produced, handled, and labelled in line with recognised rules for health, transparency, and trust. These certifications often cover hygiene, sourcing, allergens, organic methods, or ethical production.

The food certification market includes services that audit, test, verify, and approve food products across the supply chain. It supports manufacturers, farmers, and processors in meeting regulatory needs and consumer expectations. As food systems grow complex, certification acts as a bridge between producers, regulators, and end users.

A major growth factor is the rising investment in food innovation. Recent funding, such as The Baker’s Dozen raising $5 million, Awake Chocolate securing $5.8 million, and a French fermentation firm receiving $6 million, shows strong momentum. These growing food ventures rely on certification to access retail shelves and global markets.

Demand is driven by new product categories and public spending. Win-Win raised $4 million for cocoa-free chocolate, while Nevada may spend $7.3 million to support women and infant food assistance. Certified products gain preference in institutional and consumer programs.

The opportunity lies in scaling trust-led food businesses. David’s $75 million funding round highlights how fast-growing brands need certification to expand internationally, comply with rules, and maintain credibility as they enter larger distribution networks.

Key Takeaways

- The Global Food Certification Market is expected to be worth around USD 10.7 billion by 2034, up from USD 5.9 billion in 2024, and is projected to grow at a CAGR of 6.1% from 2025 to 2034.

- ISO 22000 (28.5%) holds a strong position in the Food Certification Market, supporting standardised food safety management across global supply chains.

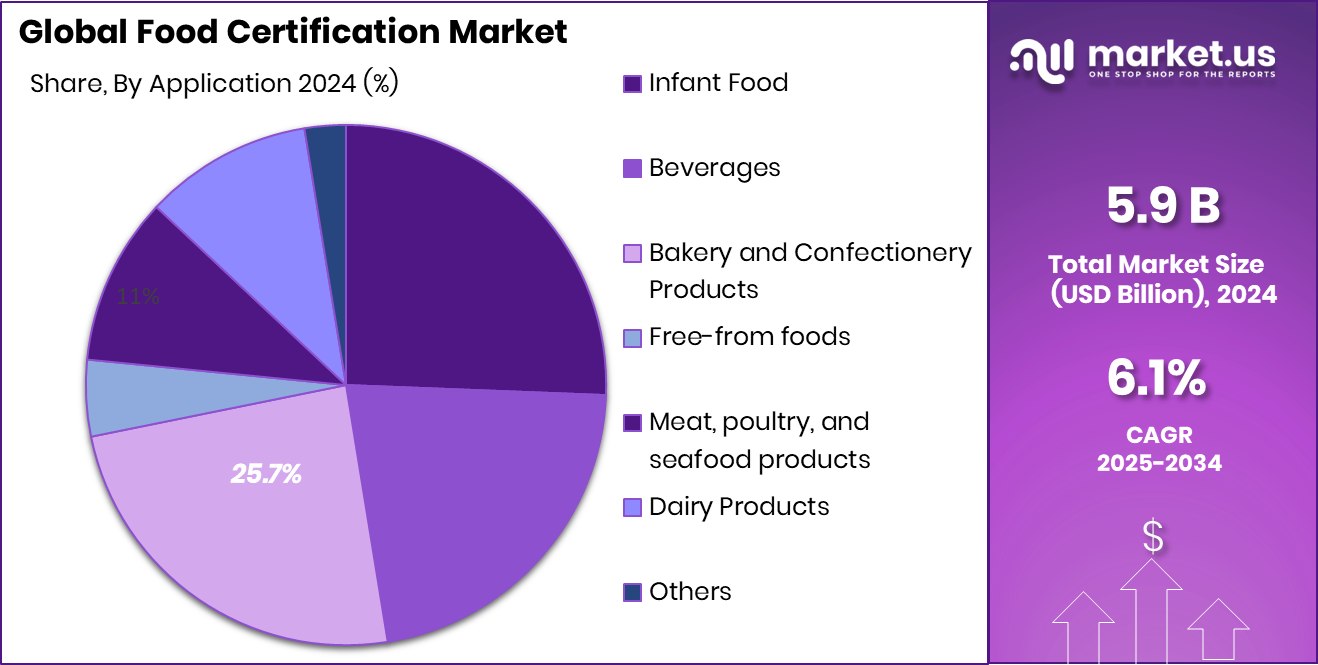

- Bakery and Confectionery Products (25.7%) drive the Food Certification Market, as producers prioritise safety, quality consistency, and consumer trust.

- Strong food manufacturing growth positions Asia Pacific as a leading region at 44.9%, reaching USD 2.6 Bn.

By Type Analysis

In the Food Certification Market, ISO 22000 holds 28.5%, ensuring globally consistent food safety systems.

In 2024, ISO 22000 held a dominant market position in the By Type segment of the Food Certification Market, with a 28.5% share. This leadership reflects the standard’s strong acceptance across global food supply chains due to its clear focus on food safety management systems.

ISO 22000 helps organisations control food safety hazards at every stage, from raw material handling to final distribution. Its structured approach aligns well with regulatory expectations and internal risk management practices, making it a preferred choice for food manufacturers, processors, and handlers.

The certification is widely valued for improving operational discipline and traceability without disrupting existing workflows. As food businesses increasingly aim to standardise processes and demonstrate safety assurance, ISO 22000 continues to remain a trusted framework supporting compliance, consistency, and long-term market credibility.

By Application Analysis

Within the Food Certification Market, bakery and confectionery applications account for 25.7%, driven by strict safety compliance.

In 2024, Bakery and Confectionery Products held a dominant market position in the By Application segment of the Food Certification Market, with a 25.7% share. This dominance is closely linked to the high volume of packaged bakery goods and confectionery items reaching consumers daily through organised retail and foodservice channels.

These products often have complex ingredient profiles, strict hygiene requirements, and short shelf lives, increasing the need for certified safety and quality systems. Certification helps ensure consistency in production, labelling accuracy, and allergen control, which are critical in this application segment.

Manufacturers in this space view certification as a practical tool to strengthen consumer confidence and meet regulatory expectations. As baked and sweet products continue to evolve in formulation and scale, certification remains central to managing risk and maintaining brand trust.

Key Market Segments

By Type

- ISO 22000

- Halal

- Kosher

- SQF

- IFS

- Free-from certifications

- BRC

- Others

By Application

- Infant Food

- Beverages

- Bakery and Confectionery Products

- Free-from foods

- Meat, poultry, and seafood products

- Dairy Products

- Others

Driving Factors

Rising Investment And Expansion In Food Manufacturing

One of the strongest driving factors of the Food Certification Market is the growing investment in food manufacturing and product expansion. As food companies scale production, certification becomes necessary to control safety, quality, and process consistency.

Dina Foods’ investment of £1 million in manufacturing upgrades shows how producers are increasing capacity to meet rising demand while maintaining compliance. Larger and more advanced facilities face stricter safety checks, making certification essential rather than optional. At the same time, Voyage Foods’ closing of a $52 million Series A+ funding round highlights rapid growth in alternative and speciality food production.

As new products move from small batches to mass markets, certification supports regulatory approvals, retail acceptance, and consumer trust. This steady flow of capital into food manufacturing directly fuels long-term demand for reliable food certification services.

Restraining Factors

High Certification Costs Slow Early-Stage Food Growth

One key restraining factor in the Food Certification Market is the high cost and complexity of certification for young and innovative food businesses. Early-stage food companies often work with new ingredients, processes, or technologies, which require additional testing and repeated audits. This raises expenses and extends approval timelines.

Even when companies secure funding, budgets are often prioritised for product development rather than compliance. For example, Singapore-based Prefer Brews raised $4.2 million to develop bean-free coffee and cocoa, while Nosh. Bio secured €3.2 million to scale fungi-based, animal-free protein.

In such cases, certification costs can consume a meaningful share of limited capital. As a result, some startups delay or limit certification activities, slowing broader adoption of formal food certification and reducing immediate demand for related services.

Growth Opportunity

Large Capital Raising Expands Certified Food Production

A major growth opportunity in the Food Certification Market comes from large-scale funding that supports the rapid expansion of food manufacturing operations. When companies raise substantial capital, they move toward higher production volumes, broader distribution, and stronger compliance frameworks.

The Milky Mist Dairy IPO raising Rs 2,035 crore highlights this shift toward scaled growth in organised food processing. As operations expand, certification becomes essential to manage food safety, quality control, and regulatory alignment across facilities and supply chains. Bigger production networks also require regular audits and standardised processes, increasing long-term demand for certification services.

Such large funding events accelerate formalisation within the food sector, creating clear opportunities for food certification providers as companies strive to meet market expectations and maintain trust at national and international levels.

Latest Trends

Rapid Growth Of Animal-Free Certified Food Products

A key latest trend in the Food Certification Market is the fast growth of animal-free and alternative dairy products. As more companies enter this space, certification is becoming important to validate safety, quality, and production methods.

Ace International, raising $35 million to expand dairy manufacturing, shows how traditional producers are also strengthening certified operations. At the same time, France’s Nutropy securing $8 million for animal-free cheese signals rising activity in novel food categories. These products often use new fermentation or protein processes, which increases the need for clear certification frameworks.

As an alternative and conventional dairy production scales, certification supports market access, regulatory approval, and consumer confidence, making it a central requirement for future-ready food businesses.

Regional Analysis

Asia Pacific dominates the Food Certification Market with a 44.9% share, valued at USD 2.6 Bn.

Asia Pacific emerged as the dominating region in the Food Certification Market, holding a 44.9% share and reaching a value of USD 2.6 Bn. This leadership reflects the region’s large food production base, expanding processed food sector, and increasing regulatory focus on food safety and export compliance. Rapid urbanisation, population growth, and rising packaged food consumption continue to strengthen the need for certified food systems across the Asia Pacific.

North America represents a mature regional market where food certification is deeply integrated into manufacturing and distribution practices. Strict food safety regulations, strong consumer awareness, and advanced supply chains support stable demand for certification services across processed foods, dairy, and ready-to-eat categories.

Europe shows steady adoption of food certification driven by harmonised food laws and structured quality systems. Emphasis on traceability, sustainability, and cross-border food trade encourages consistent use of certification to manage compliance and consumer trust.

The Middle East & Africa region is gradually expanding its food certification footprint. Growing food imports, rising investment in local food processing, and improving regulatory frameworks are pushing producers toward certified operations.

Latin America continues to develop as food exports grow. Certification supports regional producers in meeting international standards and improving market access, especially in agricultural and processed food segments.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, DEKRA continues to play a focused role in the global Food Certification Market through its strong background in testing, inspection, and certification services. The company’s food certification activities are closely linked to safety assurance, process audits, and operational compliance across food production and handling environments. DEKRA’s strength lies in its structured approach to risk management and conformity assessment, which supports food businesses in maintaining consistent safety practices as regulations and supply chains evolve.

SGS remains a widely recognised participant in food certification due to its long-standing expertise in verification, inspection, and laboratory testing. In food certification, SGS supports organisations across farming, processing, storage, and distribution stages. Its broad service scope helps food producers manage compliance requirements while improving transparency and traceability. The company’s global operational presence allows it to align certification practices with regional regulatory needs and export-driven food systems.

Intertek Group plc contributes to the Food Certification Market by offering assurance solutions that connect food safety, quality, and operational efficiency. Intertek’s certification services help companies validate production processes, manage food risks, and strengthen consumer confidence. Its integrated testing and auditing capabilities support both established food manufacturers and emerging food producers seeking structured certification frameworks for growth and market access.

Top Key Players in the Market

- DEKRA

- SGS

- Intertek Group plc

- AsureQuality

- Bureau Veritas

- LQRA

- DNV

- TÜV SÜD

- Kiwa

- ALS

Recent Developments

- In April 2025, DEKRA announced that global revenues rose to €4.29 billion in 2024, with the core business continuing to grow. At the same time, the number of core employees also increased, reinforcing DEKRA’s ability to expand certification and inspection services worldwide.

- In April 2024, SGS expanded its “Food Contact Product (FCP) Certification Mark,” widening the types of products covered (e.g. packaging, containers, utensils, and even small kitchen appliances) and increasing its geographical reach to markets including the USA, EU, UK, China, Canada and Mercosur.

Report Scope

Report Features Description Market Value (2024) USD 5.9 Billion Forecast Revenue (2034) USD 10.7 Billion CAGR (2025-2034) 6.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (ISO 22000, Halal, Kosher, SQF, IFS, Free-from certifications, BRC, Others), By Application (Infant Food, Beverages, Bakery and Confectionery Products, Free-from foods, Meat, poultry, and seafood products, Dairy Products, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape DEKRA, SGS, Intertek Group plc, AsureQuality, Bureau Veritas, LQRA, DNV, TÜV SÜD, Kiwa, ALS Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Food Certification MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Food Certification MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- DEKRA

- SGS

- Intertek Group plc

- AsureQuality

- Bureau Veritas

- LQRA

- DNV

- TÜV SÜD

- Kiwa

- ALS