Global Food Acidulants Market Size, Share, And Enhanced Productivity By Type (Citric Acid, Acetic Acid, Lactic Acid, Phosphoric Acid, Malic Acid, Others), By Form (Liquid, Powder), By Function (Flavor Enhancer, Microbial Control, pH Control, Preservative, Others),By Application (Bakery and Confectionery, Beverages, Dairy and Frozen Desserts, Meat Industry, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 173658

- Number of Pages: 338

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

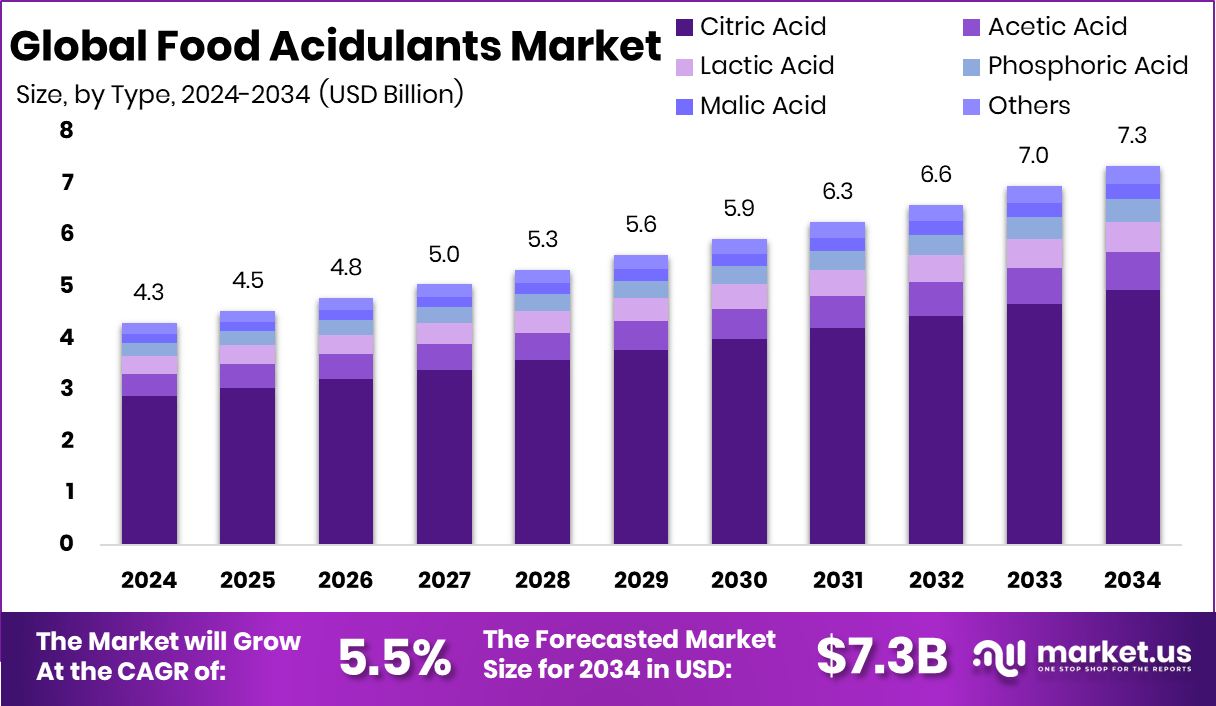

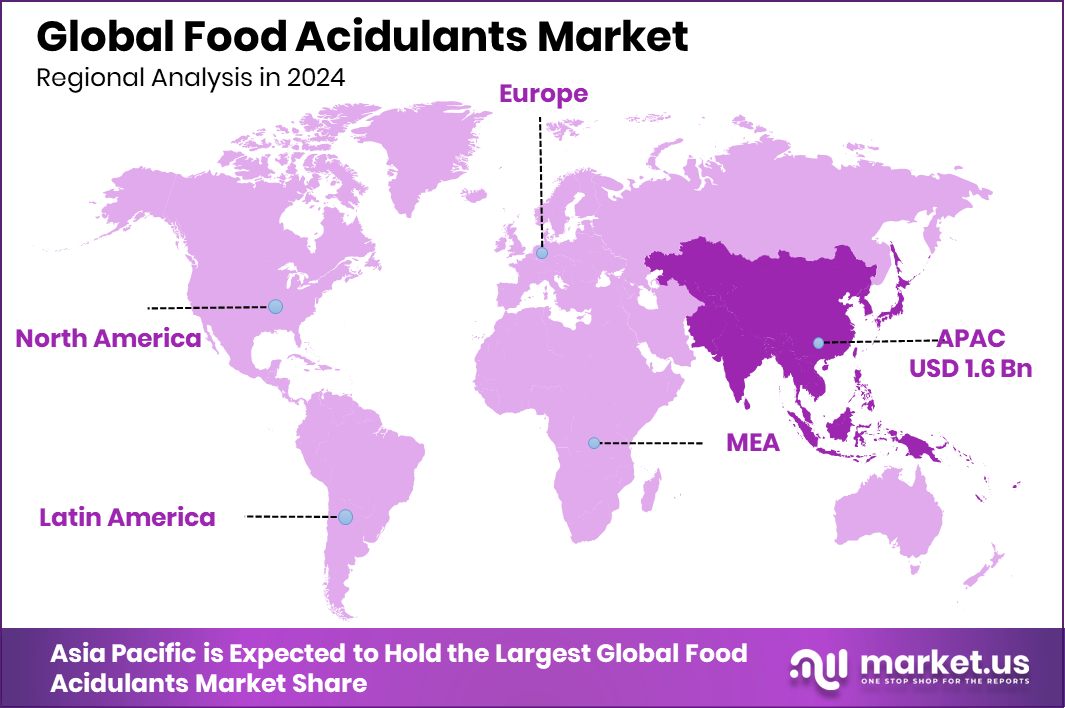

The Global Food Acidulants Market is expected to be worth around USD 7.3 billion by 2034, up from USD 4.3 billion in 2024, and is projected to grow at a CAGR of 5.5% from 2025 to 2034. Asia Pacific Food Acidulants Market reached USD 1.6 Bn, capturing 37.80% share of the region.

Food acidulants are ingredients added to foods and drinks to give a sour or tangy taste and control acidity. They help improve flavor balance, keep food fresh for longer, and maintain product safety. Acidulants are commonly used in beverages, bakery items, confectionery, dairy products, and processed foods, making everyday products taste better and stay stable.

The Food Acidulants Market covers the production and use of these acidity-controlling ingredients across packaged foods and beverages. As food processing expands globally, acidulants play a key role in meeting taste expectations, shelf-life needs, and quality standards. Their use supports both traditional foods and newer, innovative food formats.

One major growth factor is the rise of clean-label and alternative protein foods. Funding such as Matr Foods securing USD 23 million to scale clean-label mycelium meat highlights how new food products need precise acidity control for taste and safety. Similarly, Nxtfood’s USD 58 million funding round in 2025 supports plant-based meat production, where acidulants help replicate familiar flavors.

Demand is also driven by cultivated and next-generation proteins. UK-based BSF Enterprise raising USD 20 million to scale cultivated meat and leather reflects broader food innovation. These products rely on acidulants to ensure consistency, stability, and consumer acceptance during large-scale production.

Opportunities continue to grow as companies expand production capacity. The Better Meat Co. is scaling operations tenfold with Series A funding, alongside sector activity highlighted during Fork & Good’s acquisition of Orbillion Bio, showing strong momentum. This expansion creates sustained opportunities for food acidulants across emerging food categories.

Key Takeaways

- The Global Food Acidulants Market is expected to be worth around USD 7.3 billion by 2034, up from USD 4.3 billion in 2024, and is projected to grow at a CAGR of 5.5% from 2025 to 2034.

- In the Food Acidulants Market, citric acid dominates by type, holding a 67.2% share globally.

- Powder form leads the Food Acidulants Market, accounting for 69.1% due to easy handling worldwide.

- As a function, flavor enhancer applications command a 49.6% share in the Food Acidulants Market overall.

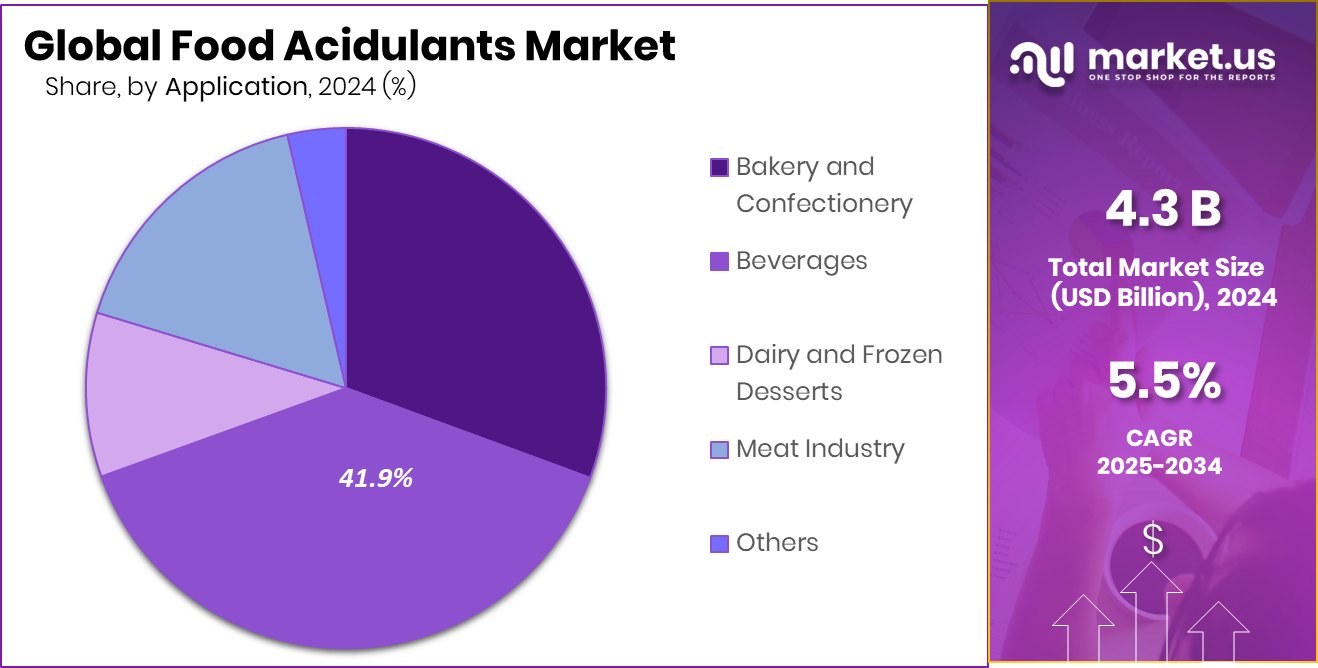

- Beverages remain the largest application, representing 41.9% of total demand in the Food Acidulants Market globally.

- In Asia Pacific Food Acidulants Market achieved 37.80% dominance, valued at USD 1.6 Bn.

By Type Analysis

Citric acid dominates the food acidulants market by type, holding a 67.2% share.

In 2024, citric acid held a dominant 67.2% share by type in the Food Acidulants Market, reflecting its wide acceptance across food and beverage formulations. Citric acid is preferred because it is naturally derived, safe to consume, and highly effective in controlling acidity. Food manufacturers rely on it to improve taste balance, extend shelf life, and maintain product stability.

Its compatibility with clean-label and plant-based trends further strengthens demand. In addition, citric acid is cost-effective and easy to source at scale, making it suitable for both large multinational brands and small food processors. Growing consumption of packaged foods, ready-to-drink beverages, and processed snacks continues to support its leading position across global markets.

By Form Analysis

Powder form leads the food acidulants market, accounting for 69.1% overall globally.

In 2024, the powder form accounted for 69.1% of the Food Acidulants Market by form, mainly due to its ease of handling and longer shelf life. Powdered acidulants are easier to transport, store, and dose accurately during food processing. Manufacturers prefer powder formats because they blend well with dry ingredients and dissolve efficiently during production. This form also reduces moisture-related spoilage risks, which is important for large-scale food operations.

Powder acidulants are widely used in bakery mixes, instant beverages, seasoning blends, and confectionery products. As food producers focus on operational efficiency and consistent product quality, the demand for powdered food acidulants continues to remain strong across both developed and emerging markets.

By Function Analysis

Flavor enhancer function drives food acidulant demand, representing 49.6% usage worldwide.

In 2024, flavor enhancement dominated the Food Acidulants Market by function, capturing a 49.6% share. Acidulants play a critical role in improving taste by balancing sweetness, saltiness, and bitterness in food products. They help create refreshing and sharp flavor profiles that consumers prefer, especially in beverages, candies, and savory snacks.

Flavor enhancement is particularly important as manufacturers reduce sugar and artificial additives while maintaining taste appeal. Acidulants also support flavor consistency across batches, which is essential for brand reliability. With rising consumer demand for better-tasting low-sugar and functional foods, food companies increasingly rely on acidulants to enhance flavor without compromising nutritional positioning or clean-label goals.

By Application Analysis

Beverages remain the key application in the food acidulants market, with a 41.9% share.

In 2024, beverages led the Food Acidulants Market by application with a 41.9% share, driven by strong global consumption of soft drinks, juices, energy drinks, and flavored waters. Acidulants are essential in beverages to control pH, enhance taste, and improve product stability. They help maintain freshness and prevent microbial growth, extending shelf life.

Beverage producers also use acidulants to deliver a refreshing mouthfeel and consistent flavor experience. The rapid growth of ready-to-drink beverages, health drinks, and fortified juices continues to boost demand. As consumers seek flavorful yet balanced drinks, acidulants remain a key ingredient supporting innovation and volume growth in the global beverage industry.

Key Market Segments

By Type

- Citric Acid

- Acetic Acid

- Lactic Acid

- Phosphoric Acid

- Malic Acid

- Others

By Form

- Liquid

- Powder

By Function

- Flavor Enhancer

- Microbial Control

- pH Control

- Preservative

- Others

By Application

- Bakery and Confectionery

- Beverages

- Dairy and Frozen Desserts

- Meat Industry

- Others

Driving Factors

Bio-Based Manufacturing Investments Accelerate Acidulant Demand Growth

Food acidulants benefit strongly from rising investment in bio-based and sustainable chemical manufacturing. In this context, Japan is funding a bamboo biofuel refinery project in India, which involves USD 400 million to build a bamboo-based biofuel refinery, supporting renewable feedstocks and cleaner chemical pathways.

Such projects encourage wider adoption of fermentation and biomass-based inputs, which are closely linked to food-grade acidulant production. In parallel, Pre-seed funding to transform chemical manufacturing raised USD 2 million to modernize chemical processes, improving efficiency and purity. These investments reduce dependence on fossil sources and help scale safer, food-compatible acids. Together, they drive growth by aligning food acidulants with sustainability goals, cost stability, and long-term raw material availability.

Restraining Factors

Advanced CO₂ Chemistry Raises Cost Pressures Challenges

Despite growth, the Food Acidulants Market faces restraints from rapid shifts toward advanced chemical platforms. Danish startup CO₂ utilization plant launched a new plant backed by USD 10 million in funding, focusing on converting carbon dioxide into chemicals. While innovative, such technologies often involve high capital and operating costs.

Similarly, New Iridium raised USD 2.65 million in seed funding to advance a sustainable chemical platform. These emerging methods can increase price competition and raise expectations for lower-carbon ingredients. For food acidulants, adapting to these technologies may require costly process upgrades, slowing adoption among smaller producers and creating short-term market pressure.

Growth Opportunity

Circular Feedstocks And Green Energy Unlock Expansion

Strong growth opportunities are emerging from the circular economy and clean-energy integration. Kimberly-Clark signed a GBP 125 million agreement to purchase green hydrogen from UK developers, signaling industrial demand for low-carbon inputs. This shift supports cleaner downstream chemical production, including food-grade acidulants.

In addition, TripleW raised USD 16.5 million Series B funding to produce lactic acid and bioplastics from food waste. Using waste as feedstock lowers costs and improves sustainability. These developments create opportunities for food acidulants produced through fermentation and recycling-based models, aligning with environmental regulations and food industry sustainability commitments.

Latest Trends

Regenerative Dairy And Clean-Label Foods Shape Trends

Latest trends in the Food Acidulants Market are closely linked to clean-label and regenerative food systems. Alec’s Ice Cream secured USD 11 million Series A funding to expand its Culture Cup line and support regenerative dairy farming. Products like these rely on natural acidulants for taste and stability.

Similarly, Sunscoop raised USD 2 million to expand allergen-free, dairy-free ice cream innovation. These trends increase demand for food acidulants that are natural, mild, and consumer-friendly. As brands move toward transparency and simpler ingredient lists, acidulants that support flavor without artificial additives are becoming increasingly important.

Regional Analysis

Asia Pacific led the Food Acidulants Market with 37.80% share, reaching USD 1.6 Bn.

In the Food Acidulants Market, Asia Pacific emerged as the dominating region in 2024, accounting for 37.80% of global demand and reaching a market value of USD 1.6 Bn. This leadership is supported by strong consumption of packaged foods and beverages, expanding food processing activities, and rising urban populations across the region.

In North America, steady demand is driven by high usage of acidulants in beverages, bakery, and processed foods, supported by a mature food manufacturing infrastructure and consistent consumer preferences for flavor-stable products.

Europe shows stable growth, benefiting from long-established food processing traditions and strong regulatory emphasis on food quality and safety, which sustains acidulant usage across multiple applications. The Middle East & Africa region continues to expand gradually as packaged food consumption rises alongside urbanization and retail development.

Meanwhile, Latin America demonstrates growing adoption of food acidulants, supported by increasing demand for flavored beverages and processed foods. Collectively, these regional dynamics highlight Asia Pacific’s clear dominance while other regions contribute steady, application-driven demand.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Tate & Lyle continues to play a strategic role in the global Food Acidulants Market through its strong focus on ingredient functionality and food formulation expertise. The company benefits from deep relationships with food and beverage manufacturers that value consistency, quality, and application support. Tate & Lyle’s capabilities in taste modulation and formulation allow food producers to balance acidity while meeting clean-label and reformulation goals. Its global operational presence and technical know-how help customers adapt acidulants across beverages, bakery, dairy, and processed foods, reinforcing its long-term relevance in the market.

Brenntag North America, Inc. stands out as a key distribution-driven player in the Food Acidulants Market. Its strength lies in efficient supply chain management, broad product availability, and strong regional customer support. Brenntag enables food manufacturers to access acidulants reliably, even amid fluctuating raw material conditions. The company’s value-added services, including logistics support and formulation assistance, enhance its position as a trusted partner rather than just a supplier. This distributor-led model supports stable demand across diverse food applications.

Univar Solutions LLC maintains a solid market position by combining ingredient distribution with technical and regulatory support. Its close collaboration with food manufacturers helps ensure compliance, consistency, and performance of acidulants in finished products. Univar’s customer-centric approach strengthens long-term partnerships across beverage, confectionery, and processed food segments.

Top Key Players in the Market

- Tate & Lyle

- Brenntag North America, Inc.

- Univar Solutions LLC

- ADM

- Jungbunzlauer Suisse AG

- Cargill, Incorporated

- Hawkins Watts Ltd.

- Corbion

- Bartek Ingredients Inc.

- FBC Industries

Recent Developments

- In December 2025, ICL Group announced it had entered a definitive agreement to acquire Bartek Ingredients, which leads in malic and fumaric acids worldwide. Bartek’s products help food and beverage companies enhance flavor, extend shelf life, and improve quality. The deal is a two-phase acquisition, starting with a cash investment for about 50% ownership, with full acquisition subject to future milestones. The company is also building a new production facility expected to significantly increase capacity by 2026.

- In June 2024, Tate & Lyle agreed to buy CP Kelco, a company that makes pectin, natural gums, and other food ingredients used in texture and mouthfeel. This deal was valued at about $1.8 billion and strengthens Tate & Lyle’s capabilities beyond traditional sweeteners into speciality food ingredient solutions.

Report Scope

Report Features Description Market Value (2024) USD 4.3 Billion Forecast Revenue (2034) USD 7.3 Billion CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Citric Acid, Acetic Acid, Lactic Acid, Phosphoric Acid, Malic Acid, Others), By Form (Liquid, Powder), By Function (Flavor Enhancer, Microbial Control, pH Control, Preservative, Others),By Application (Bakery and Confectionery, Beverages, Dairy and Frozen Desserts, Meat Industry, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Tate & Lyle, Brenntag North America, Inc., Univar Solutions LLC, ADM, Jungbunzlauer Suisse AG, Cargill, Incorporated, Hawkins Watts Ltd., Corbion, Bartek Ingredients Inc., FBC Industries Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Tate & Lyle

- Brenntag North America, Inc.

- Univar Solutions LLC

- ADM

- Jungbunzlauer Suisse AG

- Cargill, Incorporated

- Hawkins Watts Ltd.

- Corbion

- Bartek Ingredients Inc.

- FBC Industries