Global Flotation Reagents Market Size, Share, And Enhanced Productivity By Type (Collectors, Frothers, Modifiers, Activators, PH Regulators, Dispersants, Others), By Form(Anionic Reagents, Cationic Reagents, Non-Ionic Reagents), By Mining Method (Open-pit Mining, Underground Mining), By Application (Coal, Graphite, Coke, Non-Sulfhide-Ores, Sulfhide Ores, Phosphate, Others), By End-use (Mining and Metallurgy, Water Treatment Plants, Oil and Gas Industry, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 176796

- Number of Pages: 291

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

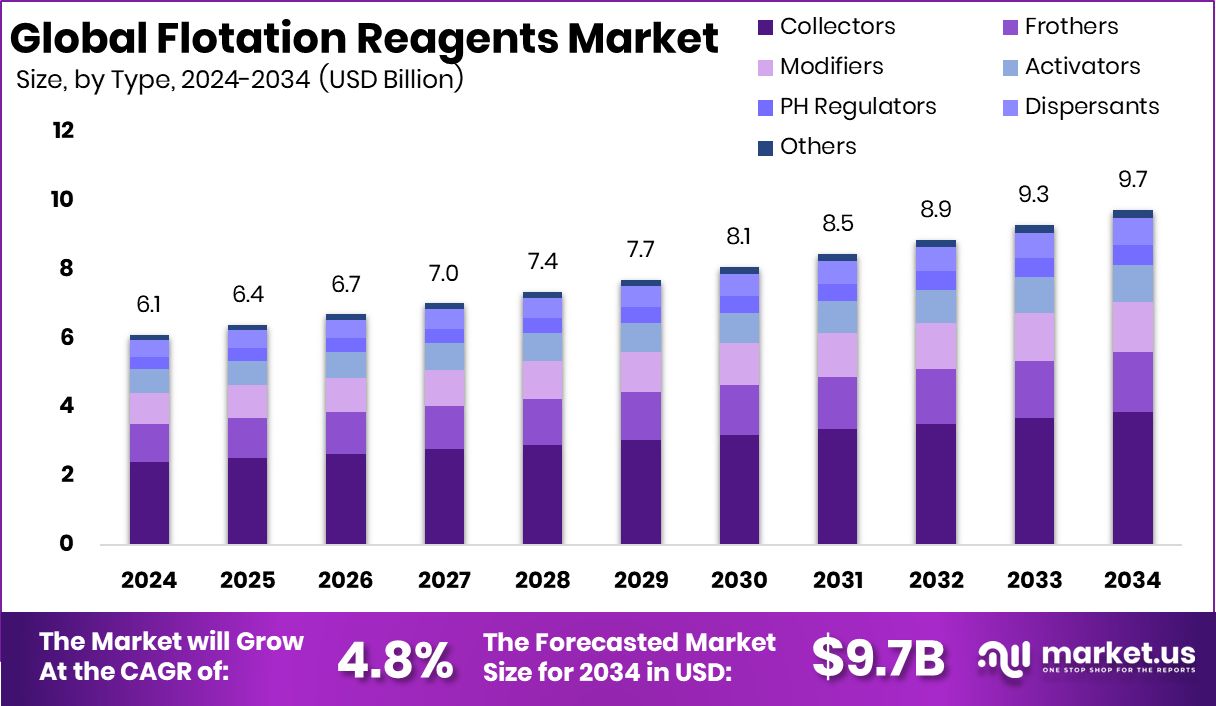

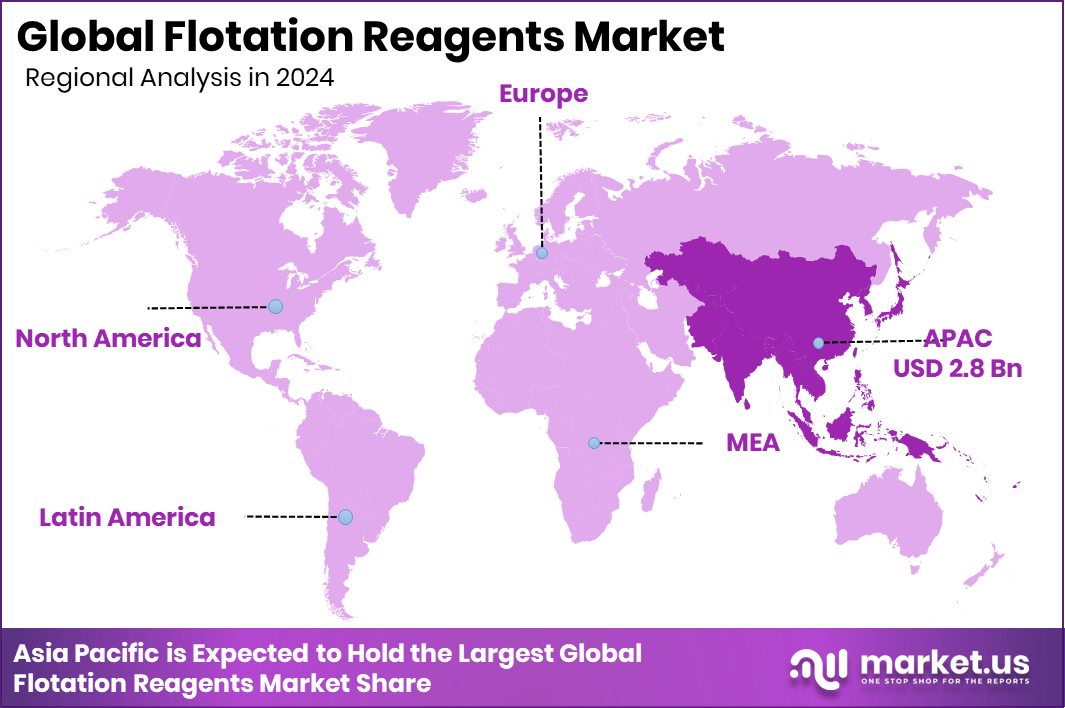

The Global Flotation Reagents Market is expected to be worth around USD 9.7 billion by 2034, up from USD 6.1 billion in 2024, and is projected to grow at a CAGR of 4.8% from 2025 to 2034. In 2024, Asia Pacific dominated at 47.4%, contributing USD 2.8 Bn.

Flotation reagents are chemical substances used during the mineral separation process to help particles attach to air bubbles and float to the surface. They control surface properties of minerals, allowing valuable materials to be separated from unwanted ones. These reagents include collectors, frothers, modifiers, activators, pH regulators, and dispersants, each performing a specific role in improving recovery and purity during flotation.

The Flotation Reagents Market represents the global demand for these chemicals across industries such as mining and metallurgy, water treatment, and oil and gas. It covers various forms, including anionic, cationic, and non-ionic reagents that support both open-pit and underground mining operations. The market grows as industries require efficient ways to extract resources from complex ores.

Growth in this market is strongly supported by rising investments and renewed confidence in mineral extraction. Recent financial movements like Mycroft raising $3.5 million, Tirupati Graphite securing £4.5 million, and Trusty raising $1 million reflect broader momentum that indirectly boosts demand for flotation chemicals used in mineral upgrading.

Demand continues to rise as graphite, coal, and non-sulfide ore projects expand worldwide. Larger funding rounds, such as Graphite raising $52 million, increase exploration activity, which in turn creates more need for effective flotation solutions.

New opportunities emerge as mining projects accelerate, especially with government-backed interest. Developments like Titan Mining gaining attention with EXIM considering $120 million graphite funding encourage fresh production, strengthening long-term prospects for flotation reagents across major extraction regions.

Key Takeaways

- The Global Flotation Reagents Market is expected to be worth around USD 9.7 billion by 2034, up from USD 6.1 billion in 2024, and is projected to grow at a CAGR of 4.8% from 2025 to 2034.

- The Flotation Reagents Market shows strong momentum as Collectors lead the type segment with 39.6% share.

- In the Flotation Reagents Market, Anionic Reagents dominate the form segment, capturing a notable 48.5%.

- The Flotation Reagents Market grows steadily as open-pit mining remains dominant with 71.2% usage share.

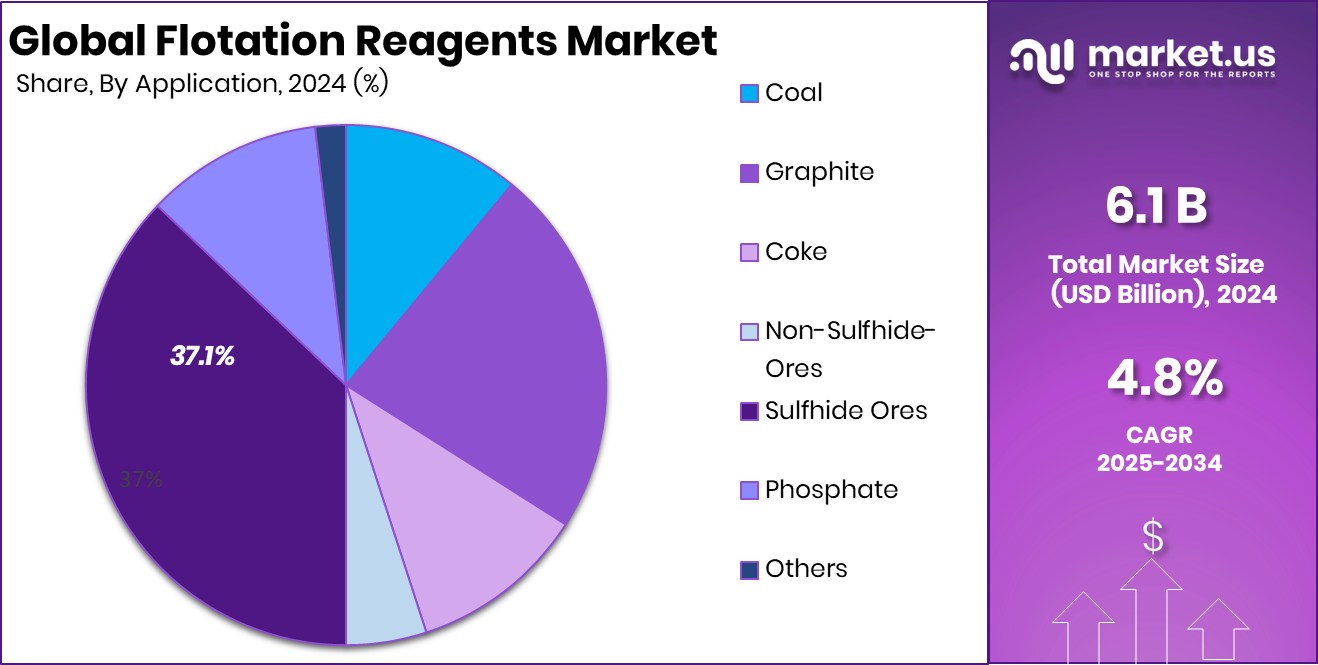

- Within the Flotation Reagents Market, the sulfide ores application leads demand, securing a significant 37.1% portion.

- The Flotation Reagents Market expands rapidly as mining and metallurgy command a dominant 71.3% end-use share.

- Strong mining activities helped the Asia Pacific secure 47.4% and generate USD 2.8 Bn.

By Type Analysis

The Flotation Reagents Market is led by Collectors holding 39.6% globally.

In 2024, the Flotation Reagents Market continued to expand steadily, with Collectors holding a dominating 39.6% share under the type segment. This category remained essential because collectors directly influence the surface properties of minerals, helping separate valuable ores from gangue. Their consistent demand stemmed from widespread use in copper, lead, zinc, and precious metal processing.

As mining companies focused on improving yield, collectors became even more important for enhancing recovery rates and reducing operational losses. The segment benefited from technological enhancements, rising ore complexity, and the need for efficient beneficiation processes. Overall, collectors stayed at the center of flotation operations, shaping both performance standards and procurement priorities across major mining regions.

By Form Analysis

In the Flotation Reagents Market, Anionic Reagents dominate with a strong 48.5% share.

In 2024, the Flotation Reagents Market saw major traction in the form segment, where Anionic Reagents dominated with 48.5%. These reagents proved vital in processing oxidized ores, phosphate, and industrial minerals, helping mines manage diverse chemical environments. Their ability to deliver strong selectivity and efficient separation made them a preferred choice for operators looking to optimize flotation stages.

Growth in base metal extraction and increasing operations in regions with high-grade oxide deposits supported this rise. Additionally, sustainability-focused mining triggered interest in formulations that deliver strong results with lower environmental impact. This balance between performance and compliance pushed anionic reagents to lead the market.

By Mining Method Analysis

The Flotation Reagents Market grows as Open-pit Mining contributes a massive 71.2%.

In 2024, the Flotation Reagents Market was strongly shaped by mining methods, with Open-pit Mining accounting for 71.2% of usage. Open-pit sites handled large ore volumes, creating constant demand for flotation chemicals to maintain processing efficiency. These operations targeted metals such as copper, iron ore, and gold, which required a consistent reagent supply to achieve desired recovery levels.

The method’s cost-efficiency and suitability for mechanized extraction further expanded reagent consumption. As ore deposits grew deeper but remained accessible from the surface, open-pit mines relied on optimized flotation strategies to handle varying mineral compositions. This dominant share reflected the operational scale and chemical intensity typical of open-pit environments.

By Application Analysis

The Flotation Reagents Market expands steadily, with Sulfide Ores accounting for 37.1%.

In 2024, the Flotation Reagents Market observed strong application demand from Sulfide Ores, contributing 37.1% of the segment. Sulfide minerals such as copper, nickel, lead, and zinc remained central to global industrial supply chains, driving consistent usage of flotation chemicals. The processing of these ores required precise reagent combinations to achieve selective separation and high recovery rates.

As many sulfide ore grades continued declining globally, the need to enhance processing efficiency became more important. Mines depended on collectors, frothers, and depressants tailored for sulfide systems, sustaining this segment’s market influence. The continued focus on energy-efficient extraction and maximizing metal yield reinforced the sulfide ores’ leadership position.

By End-use Analysis

The Flotation Reagents Market strengthens because Mining and Metallurgy capture 71.3% share.

In 2024, the Flotation Reagents Market was heavily influenced by end-use patterns, with Mining and Metallurgy leading at 71.3%. These industries relied on flotation chemicals to extract, refine, and upgrade mineral resources used across construction, energy, electronics, and manufacturing. As global demand for metals increased, especially in renewable energy technologies and electric infrastructure, the consumption of reagents also accelerated.

Mining operations prioritized chemical efficiency to handle complex ore bodies, while metallurgical facilities required consistent reagent performance to maintain output quality. This broad industrial dependence kept mining and metallurgy firmly positioned as the largest end-use category, supporting continuous demand for advanced flotation solutions.

Key Market Segments

By Type

- Collectors

- Frothers

- Modifiers

- Activators

- PH Regulators

- Dispersants

- Others

By Form

- Anionic Reagents

- Cationic Reagents

- Non-Ionic Reagents

By Mining Method

- Open-pit Mining

- Underground Mining

By Application

- Coal

- Graphite

- Coke

- Non-Sulfhide-Ores

- Sulfhide Ores

- Phosphate

- Others

By End-use

- Mining and Metallurgy

- Water Treatment Plants

- Oil and Gas Industry

- Others

Driving Factors

Rising demand for efficient mineral processing

Growing demand for efficient mineral processing continues to push the use of flotation reagents, especially as mines handle more complex and lower-grade ores. This demand is reinforced by public infrastructure spending that indirectly supports chemical and water-related industries. Recent moves, such as Ecology preparing funding for 121 clean water projects and Guthrie securing over $76 million for community projects in Kentucky’s Second District, strengthen the broader ecosystem that benefits industrial chemical use.

As mining operations expand and regulatory pressure rises for cleaner extraction, companies increasingly depend on reagents that improve recovery, reduce waste, and maintain stable processing performance. This combination of operational need and supportive public investment keeps demand moving steadily upward.

Restraining Factors

Environmental rules limiting chemical usage

Environmental rules remain one of the strongest barriers to market expansion, as many regions now restrict chemical usage that may affect water quality or land conditions. Government spending on upgrading water systems also highlights the rising scrutiny on industrial discharges.

For example, Ontario is investing $38.6 million in Renfrew–Nipissing–Pembroke water upgrades, and Arkansas is advancing $154 million in water and wastewater projects illustrates how tightly water-related activities are being monitored. These efforts, while beneficial for communities, often mean additional compliance costs and stricter operational limits for reagent use. As environmental expectations increase, companies must adapt quickly, creating friction for market growth.

Growth Opportunity

Expanding graphite exploration is boosting consumption

The expansion of graphite exploration and processing creates fresh opportunities for flotation reagents as the material becomes essential for batteries and advanced technologies. New water infrastructure is also emerging in developing regions, indirectly boosting chemical demand. The new water treatment plant in Sistan and Baluchestan, supporting 10,000 people, reflects expanding industrial foundations in underserved areas.

Likewise, nearly $30 million directed to improvements for the Edmonson County Water District helps strengthen regional utilities. These advancements encourage mining and mineral-processing projects to scale, opening more space for innovative flotation solutions tailored for graphite, coal, and non-sulfide ores.

Latest Trends

Shift toward eco-friendly flotation formulations

A clear trend in the market is the shift toward eco-friendly flotation formulations, driven by environmental expectations and the need for cleaner industrial practices. Communities and governments are prioritizing water protection, creating momentum for greener chemical alternatives.

Recent public investments—such as $1 million announced for the Eddyville wastewater plant in Eddyville and the PIDG’s $8.68 million investment in the Hoa-Binh-Xuan Mai clean water facility—signal how strongly water-related sustainability is shaping industrial decisions. As these clean-water programs expand, mining operations increasingly look for flotation reagents that reduce environmental impact while maintaining performance, reinforcing the shift toward safer, more responsible formulations.

Regional Analysis

Asia Pacific led the Flotation Reagents Market with 47.4%, reaching USD 2.8 Bn.

In the Flotation Reagents Market, Asia Pacific emerged as the dominating region, accounting for a 47.4% share, valued at USD 2.8 Bn, supported by its large-scale mining operations and expanding mineral processing capacity across countries such as China, Australia, and India. North America followed with steady demand driven by established copper, gold, and industrial mineral projects that rely heavily on flotation technologies for efficient recovery.

Europe maintained a consistent market presence supported by its focus on optimized mineral beneficiation and regulatory-driven processing standards across major mining nations. The Middle East & Africa region showed gradual growth, influenced by expanding mining investments and increased exploration activities in countries with untapped mineral reserves.

Latin America continued to represent a key market cluster due to its strong production of copper, lithium, and precious metals, sustaining the need for effective flotation solutions. Across all regions, operational expansion and ore quality variations kept flotation reagents essential for maintaining recovery performance, reinforcing Asia Pacific’s leadership and ensuring balanced demand in other global markets.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

AkzoNobel N.V. strengthened its presence by focusing on specialty surfactants and performance additives tailored for mineral processing. The company continued improving reagent efficiency to support ore recovery in copper, phosphate, and industrial mineral applications. Its emphasis on sustainable chemistries and customer-specific formulations helped reinforce long-term partnerships with major mining clients, especially in markets undergoing ore grade declines.

Arkema Group contributed to market competitiveness by leveraging its expertise in specialty polymers and performance chemicals that enhance flotation selectivity and stability. The company’s portfolio supported operators dealing with complex ore compositions, offering reagents that improved separation while optimizing overall process costs. Arkema’s regional expansion in high-growth mining clusters further supported its influence in the reagents space, helping it address increasing demand for tailored mineral beneficiation solutions.

BASF SE remained a major contributor through its wide range of collectors, frothers, and modifiers engineered for both sulfide and oxide ore systems. The company focused on innovations that improve metallurgical recovery and reduce chemical consumption per ton of ore processed. Its strong technical support network and process-focused approach helped mining operations maintain reagent performance consistency across varying ore bodies.

Top Key Players in the Market

- AkzoNobel N.V.

- Arkema Group

- BASF SE

- Beijing Hengju Chemical Group Co., Ltd.

- Borregaard AS

- Chevron Phillips Chemical Company LLC

- Clariant AG

- Dow Chemical Company

- Ecolab Inc.

- Evonik Industries AG

Recent Developments

- In October 2024, Chevron Phillips Chemical announced that its CEO, Steve Prusak, will join the American Chemistry Council (ACC) board, strengthening the company’s involvement in broader chemical industry leadership and collaboration.

- In June 2024, Dow agreed to acquire Circulus, a North American company that recycles polyethylene plastics, adding about 50,000 metric tons per year of recycled material capacity. This move boosts Dow’s offering in sustainable materials and aligns with its materials science goals.

Report Scope

Report Features Description Market Value (2024) USD 6.1 Billion Forecast Revenue (2034) USD 9.7 Billion CAGR (2025-2034) 4.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Collectors, Frothers, Modifiers, Activators, PH Regulators, Dispersants, Others), By Form(Anionic Reagents, Cationic Reagents, Non-Ionic Reagents), By Mining Method (Open-pit Mining, Underground Mining), By Application (Coal, Graphite, Coke, Non-Sulfhide-Ores, Sulfhide Ores, Phosphate, Others), By End-use (Mining and Metallurgy, Water Treatment Plants, Oil and Gas Industry, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape AkzoNobel N.V., Arkema Group, BASF SE, Beijing Hengju Chemical Group Co., Ltd., Borregaard AS, Chevron Phillips Chemical Company LLC, Clariant AG, Dow Chemical Company, Ecolab Inc., Evonik Industries AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Flotation Reagents MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample

Flotation Reagents MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- AkzoNobel N.V.

- Arkema Group

- BASF SE

- Beijing Hengju Chemical Group Co., Ltd.

- Borregaard AS

- Chevron Phillips Chemical Company LLC

- Clariant AG

- Dow Chemical Company

- Ecolab Inc.

- Evonik Industries AG