Global Flavor Enhancers Market Size, Share, And Business Benefits By Type (Natural Flavor Enhancers, Artificial Flavor Enhancers, Organic Flavor Enhancers), By Form (Liquid, Powder, Granular), By Application (Processed Foods, Beverages, Meat and Seafood, Baked Goods, Confectionery, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153046

- Number of Pages: 339

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

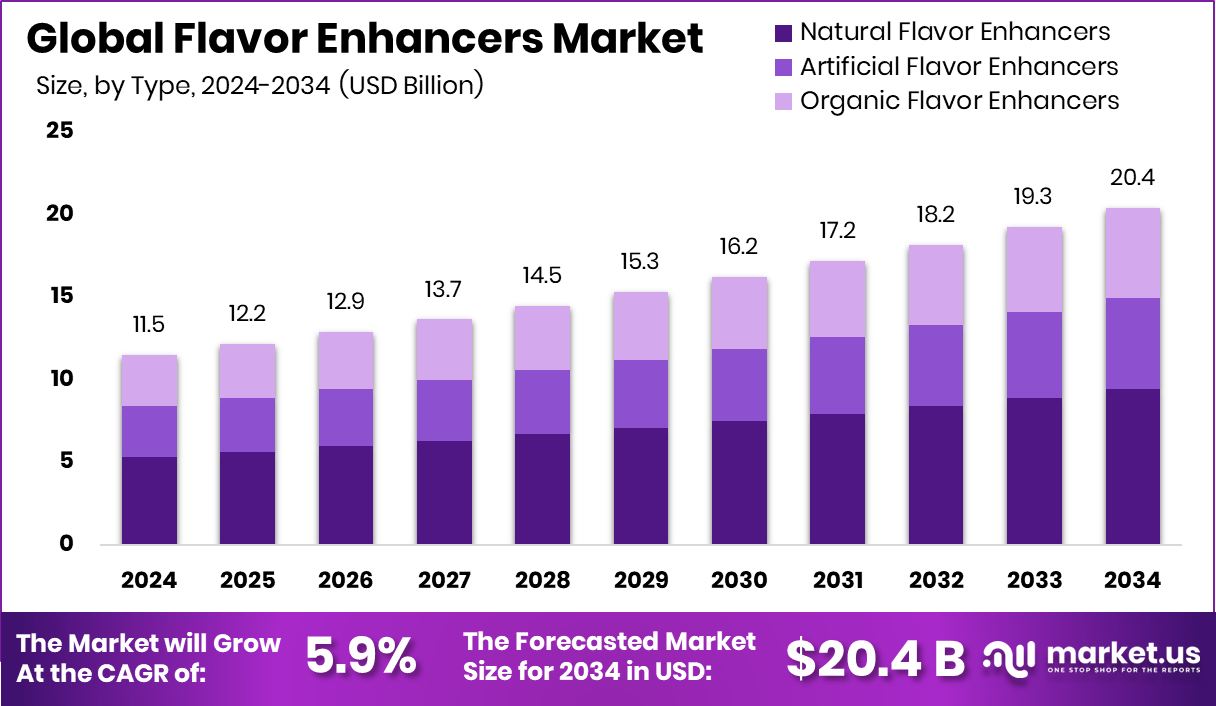

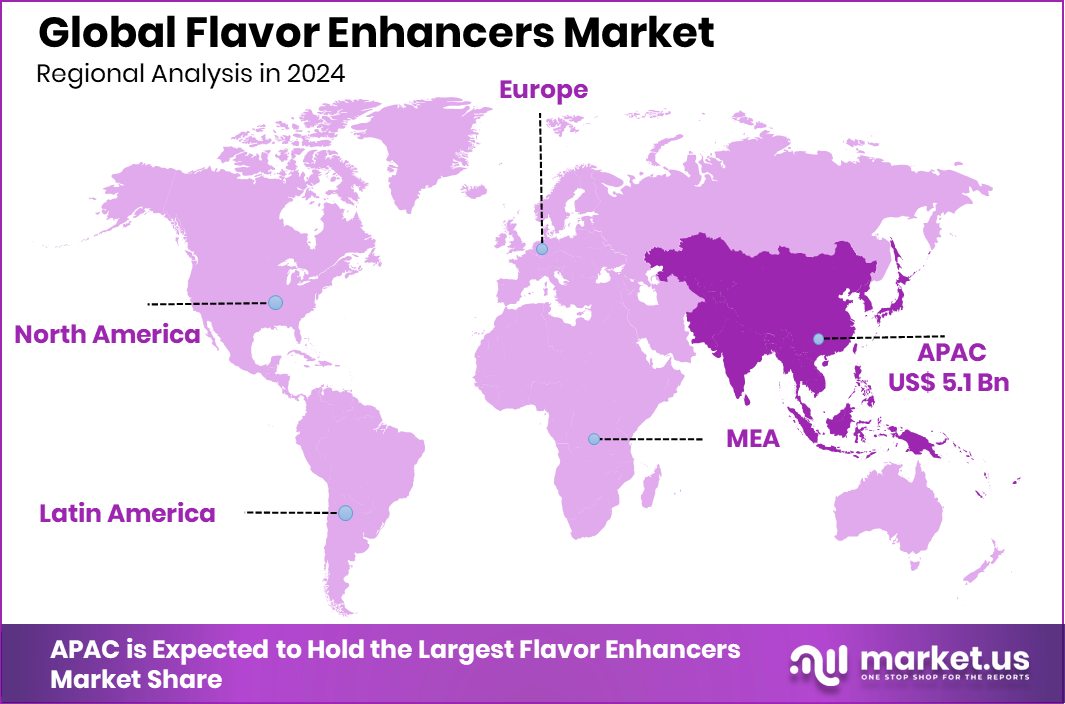

Global Flavor Enhancers Market is expected to be worth around USD 20.4 billion by 2034, up from USD 11.5 billion in 2024, and grow at a CAGR of 5.9% from 2025 to 2034. Strong demand for processed foods supported Asia-Pacific’s USD 5.1 billion market dominance.

Flavor enhancers are food additives used to improve the taste and aroma of food without adding a distinct flavor of their own. These substances work by intensifying the existing flavors in a product, making them more pronounced and appealing to the consumer. They are widely used across processed foods, snacks, soups, sauces, dairy products, and beverages to create a more enjoyable eating experience.

The flavor enhancers market is shaped by the growing demand for processed and convenience foods. As urban populations increase and lifestyles become busier, consumers are turning to ready-to-eat meals and packaged food products that offer longer shelf life and consistent taste. For instance, protein bar maker David, which earlier secured $10 million in a seed round, has now raised $75 million through its Series A funding.

The round was led by Greenoaks, with additional backing from Valor Equity Partners. This new capital will support the company’s efforts to scale manufacturing, speed up product innovation, and grow its inventory base, highlighting the broader industry trend toward scaling production to meet rising demand.

Rising health awareness is creating opportunities for natural and clean-label flavor enhancers. Consumers are becoming more selective about ingredients, avoiding artificial additives and seeking products made from natural sources. This trend has opened new avenues for manufacturers to explore plant-based or fermentation-derived enhancers that meet both taste and label transparency requirements.

Reflecting this momentum across the sector, the weekly agrifoodtech landscape also saw Little Leaf Farms secure $300 million, while Wonder raised $340 million to enhance its curbside meal service—underscoring investor confidence in companies innovating in food quality and convenience.

In addition, global cuisines are gaining popularity, which is increasing demand for complex and bold flavor profiles. This cultural shift in eating preferences is prompting food producers to incorporate a wider range of taste-enhancing agents that can elevate global dishes without overwhelming their authenticity.

Key Takeaways

- Global Flavor Enhancers Market is expected to be worth around USD 20.4 billion by 2034, up from USD 11.5 billion in 2024, and grow at a CAGR of 5.9% from 2025 to 2034.

- Natural flavor enhancers hold 46.2% share, driven by consumer demand for clean-label food products.

- Powdered flavor enhancers dominate the market with a 54.8% share due to convenience and easy blending.

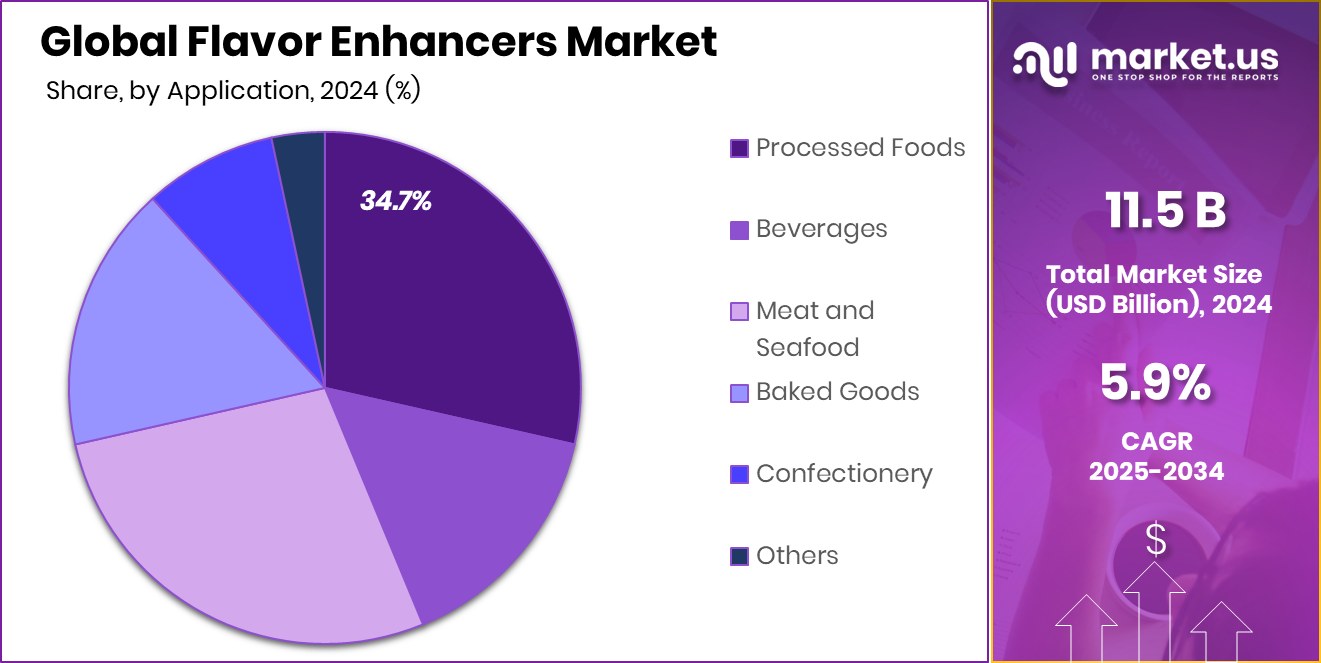

- Processed foods lead the flavor enhancers market at 34.7%, supported by rising demand for ready meals.

- The Asia-Pacific market value reached approximately USD 5.1 billion during the same year.

By Type Analysis

Natural flavor enhancers lead Flavor Enhancers Market with 46.2%.

In 2024, Natural Flavor Enhancers held a dominant market position in the By Type segment of the Flavor Enhancers Market, with a 46.2% share. This leadership can be attributed to the rising consumer preference for clean-label and health-conscious food products.

Natural flavor enhancers, derived from sources such as yeast extracts, plant-based compounds, and fermentation processes, have gained widespread acceptance among both manufacturers and consumers seeking alternatives to synthetic additives. Their ability to deliver robust taste profiles while aligning with the demand for natural and minimally processed ingredients has significantly contributed to their growing adoption.

Food producers are increasingly incorporating natural flavor enhancers into product formulations to meet evolving regulatory guidelines and consumer expectations around ingredient transparency. As awareness around the potential health impacts of artificial additives grows, natural variants are being positioned as safe and effective solutions that maintain or elevate taste without compromising nutritional value.

Their functional role in reducing the need for excess salt, sugar, and fat also supports reformulation strategies aimed at healthier offerings. With the continued shift towards wellness-oriented diets and clean-label consumption trends, the dominance of natural flavor enhancers within this segment is expected to remain steady, reinforcing their critical importance in modern food product development.

By Form Analysis

Powder form dominates the Flavor Enhancers Market at 54.8%.

In 2024, Powder held a dominant market position in the By Form segment of the Flavor Enhancers Market, with a 54.8% share. The strong performance of powdered flavor enhancers is largely driven by their superior stability, longer shelf life, and ease of incorporation into a wide range of food products. Powdered forms are widely preferred in the food processing industry due to their compatibility with dry mixes, seasoning blends, instant soups, and snack coatings, where moisture control is critical.

Manufacturers favor powdered flavor enhancers for their precision in formulation and cost-effective transportation and storage. The consistent concentration and uniform distribution properties of powders make them suitable for large-scale production environments, allowing for standardized taste across batches. Additionally, powdered variants often offer better solubility and dispersibility in dry or semi-dry applications, further expanding their utility in processed and packaged food segments.

The increasing demand for convenience and shelf-stable products has also supported the widespread adoption of powder form. As consumer lifestyles continue to shift toward quick and easy meal preparation, food producers are leveraging powdered enhancers to deliver flavor efficiency without compromising product integrity.

By Application Analysis

Processed foods segment drives Flavor Enhancers Market with 34.7%.

In 2024, Processed Foods held a dominant market position in the By Application segment of the Flavor Enhancers Market, with a 34.7% share. This significant market presence is primarily attributed to the increasing global consumption of packaged and convenience food products. Flavor enhancers play a critical role in processed foods by ensuring consistent taste, compensating for flavor loss during processing, and improving overall product appeal.

The growing reliance on ready-to-eat meals, frozen foods, canned products, and snack items has driven the integration of flavor enhancers into processed food formulations. Manufacturers depend on these additives to deliver uniform flavor profiles that meet consumer expectations across diverse regions and product formats. Additionally, the demand for affordable and longer-lasting food items has made processed foods a central component of modern diets, especially in urban settings.

The dominance of the processed foods segment underscores the essential role of flavor enhancers in large-scale food production, where taste optimization is a key factor for market success. As consumer behavior continues to favor time-saving food solutions, the application of flavor enhancers in processed foods remains a strategic priority for the food industry.

Key Market Segments

By Type

- Natural

- Flavor Enhancers

- Artificial Flavor Enhancers

- Organic Flavor Enhancers

By Form

- Liquid

- Powder

- Granular

By Application

- Processed Foods

- Beverages

- Meat and Seafood

- Baked Goods

- Confectionery

- Others

Driving Factors

Rising Demand for Tasty and Convenient Foods

One of the main driving factors of the flavor enhancers market is the growing consumer preference for tasty and easy-to-prepare food. As people lead busier lives, especially in urban areas, they are eating more packaged and ready-to-eat meals. These types of foods often require added flavor to taste fresh and appealing. Flavor enhancers help make these foods more delicious without changing their natural taste.

This growing demand for better-tasting snacks, instant noodles, sauces, and frozen meals is pushing food manufacturers to use more flavor enhancers. As a result, the flavor enhancers market is growing steadily, supported by the need for convenient food that still delivers a rich and satisfying flavor experience.

Restraining Factors

Health Concerns Over Artificial Additive Usage

A major restraining factor for the flavor enhancers market is the rising health concerns related to artificial additives. Many consumers are becoming more aware of the ingredients in their food and are trying to avoid products that contain synthetic flavor enhancers like monosodium glutamate (MSG). These additives are often linked—rightly or wrongly—to health issues such as allergies, headaches, or digestive problems.

As people move toward cleaner and more natural food choices, they may avoid items with chemical-sounding ingredients. This shift in consumer behavior is putting pressure on food manufacturers to find natural alternatives or reduce their use of artificial flavor enhancers, which can limit the growth of the market in certain regions or product categories.

Growth Opportunity

Growing Demand for Natural Food Additives Worldwide

A key growth opportunity in the flavor enhancers market lies in the rising global demand for natural food additives. As consumers become more health-conscious and aware of ingredient labels, they are choosing products made with natural sources rather than artificial chemicals.

This shift creates a strong market opportunity for flavor enhancers made from plant extracts, fermented ingredients, or other natural sources. Food manufacturers are responding by developing clean-label products that use these natural enhancers to improve taste without compromising health.

This trend is especially strong in premium and organic food categories. As the clean eating movement spreads across both developed and developing markets, natural flavor enhancers are expected to see increased demand and wider application in various food products.

Latest Trends

Surge in Clean‑Label and Plant‑Based Flavor Enhancers

A notable trend in the flavor enhancers market is the increasing shift toward clean-label and plant-based solutions. Consumers are gravitating toward products made with recognizable, natural ingredients, and this is extending into the realm of flavor enhancement.

Plant-derived extracts, yeast-based concentrates, and fermented compounds are being used to boost taste profiles without relying on synthetic chemicals. As more people seek foods that feel wholesome and transparent, manufacturers are adapting by reformulating recipes to feature these plant-based enhancers.

This trend is empowering food producers to highlight ingredient origins, appeal to health-conscious shoppers, and meet the demand for ethical and sustainable food systems. Clean-label flavor enhancers are therefore shaping product development and branding strategies across the food industry.

Regional Analysis

In 2024, Asia-Pacific led the flavor enhancers market with a 44.8% share.

In 2024, Asia-Pacific emerged as the leading region in the global Flavor Enhancers Market, capturing a dominant 44.8% share, valued at approximately USD 5.1 billion. This leadership is primarily supported by the region’s strong demand for processed and convenience foods across rapidly urbanizing markets such as China, India, and Southeast Asia.

The growing population, rising disposable incomes, and increasing consumer preference for packaged meals are driving greater usage of flavor enhancers in everyday food products. In addition, the expanding food manufacturing base across Asia-Pacific continues to support large-scale adoption of both natural and powdered flavoring solutions in regional supply chains.

North America also holds a significant position in the market, supported by its well-established food processing industry and a high demand for ready-to-eat products. Europe follows closely, with regional manufacturers increasingly focusing on cleaner labels and natural ingredients.

Meanwhile, Latin America and the Middle East & Africa represent smaller but steadily growing markets, driven by gradual changes in dietary patterns and the expanding reach of packaged foods. However, despite global expansion, Asia-Pacific maintains its dominance in both value and volume terms, owing to favorable economic conditions, evolving consumer habits, and strong manufacturing capabilities within the region’s food and beverage sector.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global Flavor Enhancers Market saw strategic activity from key players such as Firmenich, Red Bull, IFF, and Cargill, each leveraging their core capabilities to strengthen their market presence. Firmenich continued to advance its position through innovation in natural flavor formulations.

Red Bull, though primarily known for its energy beverages, demonstrated strategic influence on the flavor enhancers segment through proprietary taste formulations and product diversification. The company’s commitment to delivering a consistent sensory experience across global markets highlights its investment in flavor optimization, which plays a vital role in consumer retention and brand loyalty.

IFF (International Flavors & Fragrances) maintained a robust market presence with a focus on integrated flavor solutions tailored for health-conscious consumers. Its R&D infrastructure supported the development of enhancers that meet the dual goals of flavor improvement and reduced reliance on sugar, salt, and artificial additives.

Cargill capitalized on its extensive global supply chain and ingredient portfolio to offer scalable and sustainable flavor enhancer solutions. With capabilities across fermentation, plant-based compounds, and food innovation, Cargill responded effectively to changing regulatory frameworks and consumer demand.

Top Key Players in the Market

- Firmenich

- Red Bull

- IFF

- Cargill

- Symrise

- Fuchs

- Mane

- Kerry Group

- Givaudan

- Tate & Lyle

- BASF

- Ajinomoto

- Sensient Technologies

- Kraft Heinz

Recent Developments

- In July 2025, IFF expanded its Taste division’s RE‑IMAGINE WELLNESS initiative, introducing nutrient-dense flavor solutions for high-protein, weight-management foods that enhance taste without added sugar or salt.

- In October 2024, Firmenich completed the sale of its yeast extract business to Lesaffre, divesting the ~€120 million unit to reposition its portfolio toward high-growth flavor, texture, and health solutions.

Report Scope

Report Features Description Market Value (2024) USD 11.5 Billion Forecast Revenue (2034) USD 20.4 Billion CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Natural Flavor Enhancers, Artificial Flavor Enhancers, Organic Flavor Enhancers), By Form (Liquid, Powder, Granular), By Application (Processed Foods, Beverages, Meat and Seafood, Baked Goods, Confectionery, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Firmenich, Red Bull, IFF, Cargill, Symrise, Fuchs, Mane, Kerry Group, Givaudan, Tate & Lyle, BASF, Ajinomoto, Sensient Technologies, Kraft Heinz Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Firmenich

- Red Bull

- IFF

- Cargill

- Symrise

- Fuchs

- Mane

- Kerry Group

- Givaudan

- Tate & Lyle

- BASF

- Ajinomoto

- Sensient Technologies

- Kraft Heinz