Global Flavonoids Market Size, Share Analysis Report By Type (Anthocyanins, Flavones, Anthoxanthins, Others), By Source (Citrus Fruits, Berries, Soybeans, Tea, Cocoa, Herbs and Spices, Others), By Form (Powder, Liquid, Others), By Application (Nutraceutical and Functional Foods, Pharmaceuticals, Cosmetics, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 168949

- Number of Pages: 252

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

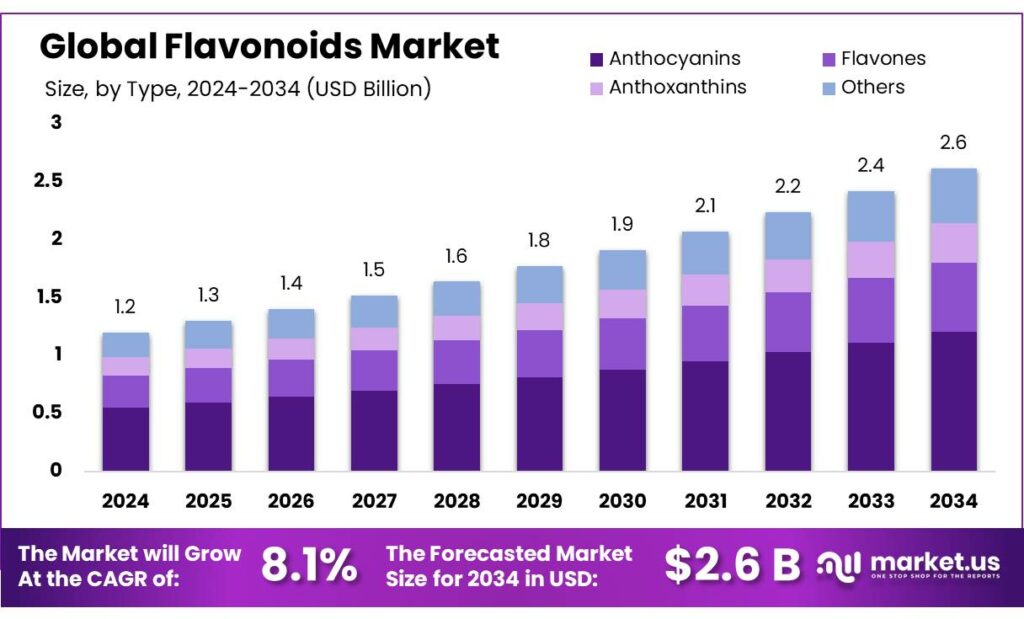

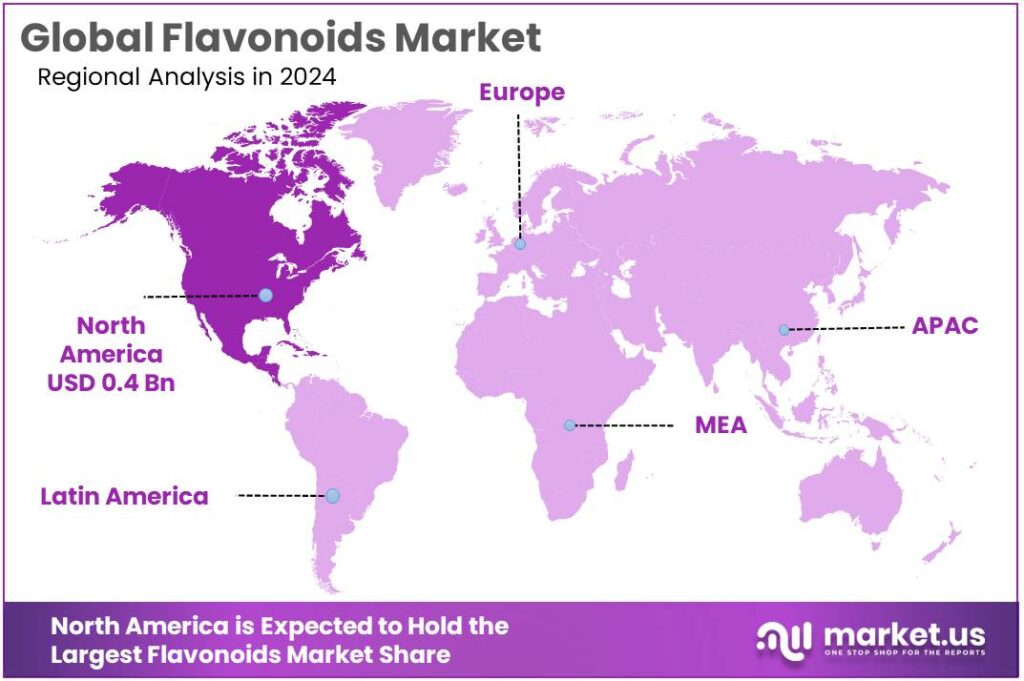

The Global Flavonoids Market size is expected to be worth around USD 2.6 Billion by 2034, from USD 1.2 Billion in 2024, growing at a CAGR of 8.1% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 38.1% share, holding USD 0.4 Billion revenue.

Flavonoids are a large group of plant-based polyphenols found in fruits, vegetables, tea, cocoa, and wine, widely used as natural antioxidants, pigments, and bioactive ingredients across food, nutraceutical, pharmaceutical, and cosmetic industries. From a health perspective, population studies suggest mean total dietary flavonoid intake worldwide typically ranges between 150–600 mg per day, though some countries show much lower or higher levels. In the United States, average intake has been estimated between 20 mg and 1,000 mg per day, highlighting large gaps and the potential for fortified and functional products to raise consumption.

Industrial interest in flavonoids is strongly linked to public health policies that push consumers toward plant-rich diets. The World Health Organization recommends adults consume at least 400 g per day of fruits and vegetables to lower the risk of non-communicable diseases such as cardiovascular disease and some cancers. This guidance indirectly supports demand for flavonoid-rich products, as manufacturers develop juices, functional beverages, dietary supplements, and plant-based snacks that help consumers approach these targets while marketing the antioxidant benefits more explicitly than whole foods can.

- Scientific evidence has reinforced this commercial momentum. In the large European EPIC-InterAct study, participants with total flavonoid intake above 608.1 mg/day had about a 10% lower risk of type 2 diabetes compared with those consuming less than 178.2 mg/day. More recently, a long-term cohort study of over 120,000 people found that around 500 mg of flavonoids per day – roughly two cups of tea plus some fruit – was associated with a 16% lower all-cause mortality and about a 10% lower risk of cardiovascular disease, type 2 diabetes, and respiratory disease. These outcomes give formulators strong, evidence-based narratives for cardiovascular and metabolic health products.

Regulatory bodies are also shaping the industry. The European Food Safety Authority has approved a specific health claim for cocoa flavanols, noting that a daily intake of 200 mg of cocoa flavanols can help maintain normal endothelium-dependent vasodilation, supporting healthy blood flow. Such claims create benchmarks for dosage and quality that drive investment into standardized flavonoid extracts and clinically supported ingredient brands, particularly for chocolate, cocoa beverages, and cardiovascular supplements.

On the production side, manufacturers are increasingly aligning flavonoid sourcing with global sustainability and climate goals. The FAO and UNEP estimate that about 14% of the world’s food, worth roughly USD 400 billion annually, is lost between harvest and retail, with losses particularly high for fruits and vegetables – key flavonoid sources. At the same time, food loss and waste account for roughly 8–10% of global greenhouse-gas emissions, making valorization of by-products and waste streams a policy-relevant opportunity.

Key Takeaways

- Flavonoids Market size is expected to be worth around USD 2.6 Billion by 2034, from USD 1.2 Billion in 2024, growing at a CAGR of 8.1%.

- Anthocyanins held a dominant market position, capturing more than a 45.8% share of the global flavonoids market.

- Berries held a dominant market position, capturing more than a 33.1% share of the global flavonoids market.

- Powder held a dominant market position, capturing more than a 65.2% share of the global flavonoids market.

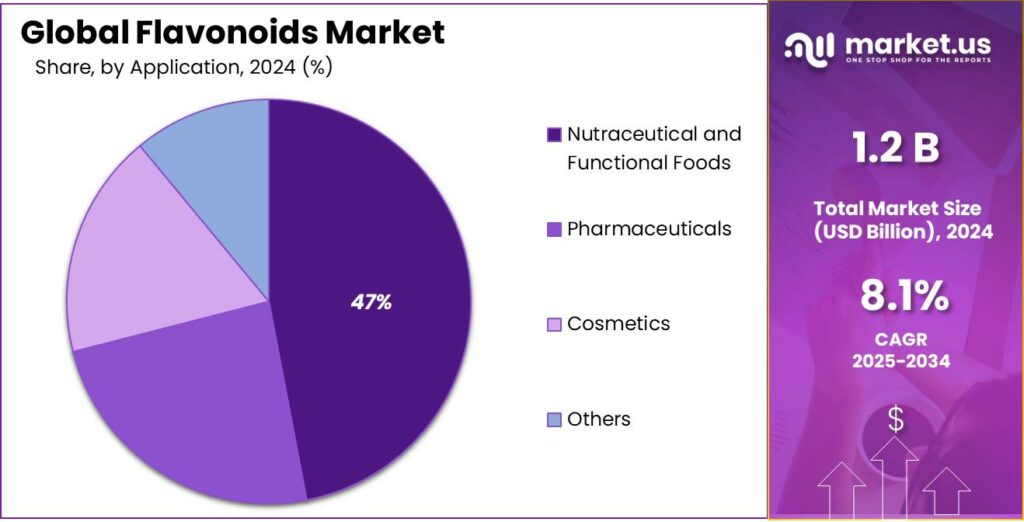

- Nutraceutical and Functional Foods held a dominant market position, capturing more than a 47.3% share.

- North America held a dominant position in the global flavonoids market, capturing more than a 38.1% share, with an estimated market value of USD 0.4 billion.

By Type Analysis

Anthocyanins lead with 45.8% due to their strong antioxidant properties and widespread use in health products.

In 2024, Anthocyanins held a dominant market position, capturing more than a 45.8% share of the global flavonoids market. The segment’s leadership is driven by increasing consumer demand for natural antioxidants, colorants, and nutraceuticals derived from fruits, berries, and vegetables. Anthocyanins are widely used in dietary supplements, functional foods, beverages, and cosmetics due to their health benefits, including anti-inflammatory and cardiovascular support. In 2025, the segment is expected to maintain strong growth, supported by rising health awareness, clean-label trends, and expanding applications in the food and pharmaceutical industries.

By Source Analysis

Berries dominate with 33.1% as a preferred source due to high flavonoid content and natural health benefits.

In 2024, Berries held a dominant market position, capturing more than a 33.1% share of the global flavonoids market. The segment’s leadership is attributed to the naturally high flavonoid content found in berries such as blueberries, blackberries, and cranberries, which are widely used in dietary supplements, functional foods, and beverages. In 2025, demand is expected to grow steadily as consumers increasingly prefer natural, plant-based sources for antioxidant and health-promoting ingredients. Berries continue to be favored for their potency, versatility, and clean-label appeal in health-conscious markets.

By Form Analysis

Powder form leads with 65.2% due to its easy handling, stability, and broad application across industries.

In 2024, Powder held a dominant market position, capturing more than a 65.2% share of the global flavonoids market. This form is preferred for its long shelf life, ease of transportation, and uniform dispersion in food, beverage, dietary supplements, and cosmetic formulations. In 2025, the powder segment is expected to maintain strong growth as manufacturers increasingly adopt it for functional products, nutraceuticals, and fortified beverages, where consistency, stability, and precise dosing are critical for product performance and consumer trust.

By Application Analysis

Nutraceutical and Functional Foods lead with 47.3% driven by rising health-conscious consumer demand.

In 2024, Nutraceutical and Functional Foods held a dominant market position, capturing more than a 47.3% share of the global flavonoids market. The segment’s growth is driven by increasing consumer preference for health-promoting ingredients in dietary supplements, fortified beverages, and functional snacks. Flavonoids are valued for their antioxidant, anti-inflammatory, and cardiovascular benefits, making them ideal for nutraceutical formulations. In 2025, demand is expected to rise further as awareness of preventive health measures grows, encouraging manufacturers to expand flavonoid-enriched functional products globally.

Key Market Segments

By Type

- Anthocyanins

- Flavones

- Anthoxanthins

- Others

By Source

- Citrus Fruits

- Berries

- Soybeans

- Tea

- Cocoa

- Herbs and Spices

- Others

By Form

- Powder

- Liquid

- Others

By Application

- Nutraceutical and Functional Foods

- Pharmaceuticals

- Cosmetics

- Others

Emerging Trends

Functional, Everyday Foods Turning into Convenient Flavonoid Delivery Systems

A very clear trend in the flavonoids space is the quiet shift from pills and “hard-core” supplements to everyday foods and drinks that are carefully formulated as flavonoid carriers. Instead of asking people to swallow capsules, food companies are building flavonoid benefits into juices, teas, cocoa drinks, yogurts and plant-based snacks that fit normal routines. This move matches what public health bodies have been saying for years: nutrition should come first from food, not from tablets.

- Non-communicable diseases such as heart disease, cancer, diabetes and chronic lung disease now account for about 74% of all global deaths, according to the World Health Organization (WHO). That burden keeps health systems under pressure and has pushed governments to promote diets richer in protective plant compounds. WHO recommends that adults eat at least 400 grams of fruits and vegetables per day, roughly five portions, to cut NCD risk.

Consumer behaviour is moving in the same direction. The International Food Information Council’s 2024 Food & Health Survey, based on 3,000 U.S. adults, shows that around half of Americans say they are following a specific diet or eating pattern, and six in ten now replace traditional meals with snacks or smaller eating occasions. “Fresh” and “low in sugar” continue to rank among the top qualities people use to define a healthy food, and there is strong interest in foods that support energy, weight management, digestion and healthy ageing.

Regulation is also nudging flavonoids deeper into the functional food mainstream. The European Food Safety Authority has recognised that 200 mg of cocoa flavanols per day can help maintain normal endothelium-dependent vasodilation, supporting healthy blood flow, and has authorised a specific health claim when products meet this level. That single number has become a design target for cocoa drinks, chocolate, and ready-to-drink beverages that market cardiovascular support while staying within strict EU rules.

Drivers

Rising Government-Backed Push for Plant-Based Diets and Preventive Nutrition

One of the strongest driving factors for the flavonoids industry is the global policy shift toward plant-based diets as a tool to prevent lifestyle diseases. Governments and international food and health bodies are no longer treating fruits and vegetables as optional nutrition; they are positioning them as a frontline defense against heart disease, diabetes, obesity, and certain cancers. Since flavonoids are naturally present in fruits, vegetables, tea, cocoa, and grains, this policy direction directly increases industrial demand for flavonoid-rich and flavonoid-fortified products.

- The World Health Organization (WHO) formally recommends a minimum intake of 400 grams of fruits and vegetables per person per day to reduce the risk of non-communicable diseases such as cardiovascular disorders and some cancers. Despite this guidance, WHO data shows that globally, more than 70% of adults consume less than the recommended level, creating a clear gap between dietary advice and real intake.

Government nutrition guidelines reinforce this demand at a national level. In the United States, the Dietary Guidelines for Americans promote increased intake of fruits, vegetables, and plant-based bioactives, highlighting that over 90% of Americans do not meet vegetable intake recommendations, while 80% fall short on fruit intake.

Scientific validation has further strengthened government and industry confidence. A multi-country European dietary study reported that people consuming more than 600 mg of flavonoids per day showed a significantly lower risk of developing type-2 diabetes compared with those consuming less than 200 mg per day.

Restraints

Limited Bioavailability and Strict Regulatory Limits Restrain Flavonoids Adoption

One of the biggest restraining factors for the flavonoids industry is the challenge of low bioavailability, combined with strict food and health regulations that limit how flavonoids can be used, dosed, and promoted in commercial products. While flavonoids are widely recognized for their antioxidant and health-supporting properties, the human body does not absorb them easily, which creates a gap between laboratory benefits and real-world effectiveness.

According to the European Food Safety Authority (EFSA), many flavonoids show poor absorption rates below 5–10% when consumed in conventional food formats, meaning most of the compound passes through the body without delivering measurable benefits. This limitation forces food and supplement manufacturers to use higher dosages or advanced delivery systems such as encapsulation or modified extracts.

Regulatory constraints further slow down growth. EFSA and other regulatory bodies require strong human clinical evidence before approving health claims. As of now, EFSA has approved a very limited number of flavonoid-related health claims, including cocoa flavanols where a daily intake of 200 mg is required to help maintain normal blood vessel function. Regulatory constraints further slow down growth. EFSA and other regulatory bodies require strong human clinical evidence before approving health claims.

Cost and supply variability add another layer of restraint. Flavonoids are primarily extracted from fruits, vegetables, tea leaves, and cocoa, all of which are vulnerable to climate variability. The Food and Agriculture Organization (FAO) reports that climate-related shocks have reduced global fruit and vegetable yields in some regions by 5–20% in recent years, affecting raw material availability and price stability.

Opportunity

Upcycling Food Waste into High-Value Flavonoid Ingredients Creates a Strong Growth Opportunity

One of the most promising growth opportunities for flavonoids lies in upcycling food and agricultural waste into valuable bioactive ingredients. Large volumes of fruits and vegetables are processed every year for juice, wine, sauces, and ready-to-eat foods, and a significant share of their flavonoid-rich parts—such as peels, skins, and seeds—are still discarded. Government agencies and food organizations are now actively encouraging waste recovery, turning this challenge into a long-term opportunity for flavonoid producers.

The Food and Agriculture Organization (FAO) estimates that around 14% of the world’s food is lost before it reaches retail markets, equal to nearly USD 400 billion in economic value each year. Fruits and vegetables account for some of the highest loss rates in the food system. These losses include citrus peels, grape skins, apple pomace, onion skins, and berry residues—materials naturally rich in flavonoids such as hesperidin, quercetin, anthocyanins, and catechins.

This shift is strongly supported by climate and sustainability policy. The United Nations Environment Programme (UNEP) reports that food waste is responsible for 8–10% of global greenhouse gas emissions. As governments try to cut emissions without compromising food availability, recovering bioactive compounds from waste streams has become a preferred solution. Extracting flavonoids from food processing by-products helps companies reduce emissions, limit landfill use, and strengthen ESG performance—while creating new revenue streams.

Consumer demand supports this direction. Surveys referenced by global food organizations show that over 60% of consumers prefer food brands that actively reduce waste and improve sustainability, especially in Europe and North America. This makes “upcycled flavonoids” an attractive story for clean-label foods, supplements, and beverages, where sustainability and health benefits now influence purchasing decisions together.

Regional Insights

North America dominates with 38.1%, valued at USD 0.4 billion, driven by high consumer health awareness and nutraceutical adoption.

In 2024, North America held a dominant position in the global flavonoids market, capturing more than a 38.1% share, with an estimated market value of USD 0.4 billion. The region’s leadership is primarily attributed to increasing consumer awareness regarding preventive healthcare, rising demand for functional foods, and strong adoption of dietary supplements enriched with natural bioactive compounds. The United States and Canada, being major markets, have witnessed substantial growth in flavonoid-based products, particularly anthocyanins and other potent flavonoids derived from berries, citrus fruits, and green tea.

Additionally, North America benefits from well-established food and beverage industries, supportive regulatory frameworks, and a growing trend toward clean-label and plant-based ingredients, which encourages the inclusion of flavonoids in various consumer products. The region’s market growth is further propelled by research and development activities, investments in product innovation, and collaborations between ingredient suppliers and manufacturers to develop fortified and functional offerings.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Biosynth is a leading global supplier of high-purity flavonoids, offering a broad range of natural and synthetic compounds for research, nutraceutical, and pharmaceutical applications. In 2024, the company produced approximately 15,000 kg of flavonoids, generating revenue around USD 12 million. Biosynth focuses on quality, consistency, and custom synthesis services, supporting dietary supplement manufacturers, functional food developers, and research institutions. Its strong R&D capabilities enable development of specialized flavonoids, meeting regulatory and functional requirements in health-focused product markets.

Extrasynthese is a European manufacturer specializing in natural and synthetic flavonoids for research, nutraceutical, and pharmaceutical applications. In 2024, the company produced about 7,200 kg of flavonoids, generating USD 6.5 million in revenue. Extrasynthese emphasizes high-quality, well-characterized compounds and custom synthesis services. Its flavonoid portfolio supports functional food, dietary supplement, and pharmaceutical development, enabling innovation in antioxidant-rich formulations. The company leverages strong R&D capabilities and European manufacturing standards to maintain product consistency and reliability.

Nacalai Tesque provides flavonoids and related bioactive compounds to research, nutraceutical, and industrial markets. In 2024, its flavonoid production reached about 8,000 kg, generating USD 7.5 million in revenue. The company emphasizes purity, reproducibility, and custom solutions for researchers and manufacturers. Its portfolio includes anthocyanins, catechins, and other flavonoids for dietary supplement and functional food development. Strong technical expertise and regional presence in Asia support innovation, quality assurance, and compliance with global standards.

Top Key Players Outlook

- Biosynth

- Cayman Chemical Company, Inc.

- Nacalai Tesque Inc.

- YAAN TIMES BIOTECH

- Extrasynthese

- INDOFINE Chemical Company, Inc.

- LKT Laboratories, Inc.

Recent Industry Developments

In 2024 Biosynth, reported annual revenue USD 45.0 million for its chemical and reagent operations, reflecting stable demand for its products from pharmaceutical, food, and academic customers.

In 2024 Extrasynthese, reported annual revenue was approximately USD 2.0 million for its fine‑chemicals business, reflecting its focus as a niche supplier rather than large‑scale mass producer.

Report Scope

Report Features Description Market Value (2024) USD 1.2 Bn Forecast Revenue (2034) USD 2.6 Bn CAGR (2025-2034) 8.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Anthocyanins, Flavones, Anthoxanthins, Others), By Source (Citrus Fruits, Berries, Soybeans, Tea, Cocoa, Herbs and Spices, Others), By Form (Powder, Liquid, Others), By Application (Nutraceutical and Functional Foods, Pharmaceuticals, Cosmetics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Biosynth, Cayman Chemical Company, Inc., Nacalai Tesque Inc., YAAN TIMES BIOTECH, Extrasynthese, INDOFINE Chemical Company, Inc., LKT Laboratories, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Biosynth

- Cayman Chemical Company, Inc.

- Nacalai Tesque Inc.

- YAAN TIMES BIOTECH

- Extrasynthese

- INDOFINE Chemical Company, Inc.

- LKT Laboratories, Inc.