Global Fatty Amines Market Size, Share, And Business Benefits By Type (Primary Fatty Amines, Secondary Fatty Amines, Tertiary Fatty Amines), By Product (Coco Amine, Octadecyl Amine, Hydrogenated Tallow Akyl Amine, Tallow Amine, Oleyl Amine, Stearyl Amine, Others), By Application (Water Softener, Emulsifier, Corrosion Inhibitor, Asphalt Additives, Anti-caking, Othe rs), By End-use (Agrochemicals, Oilfield Chemicals, Water Treatment, Personal Care, Household, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 158695

- Number of Pages: 389

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

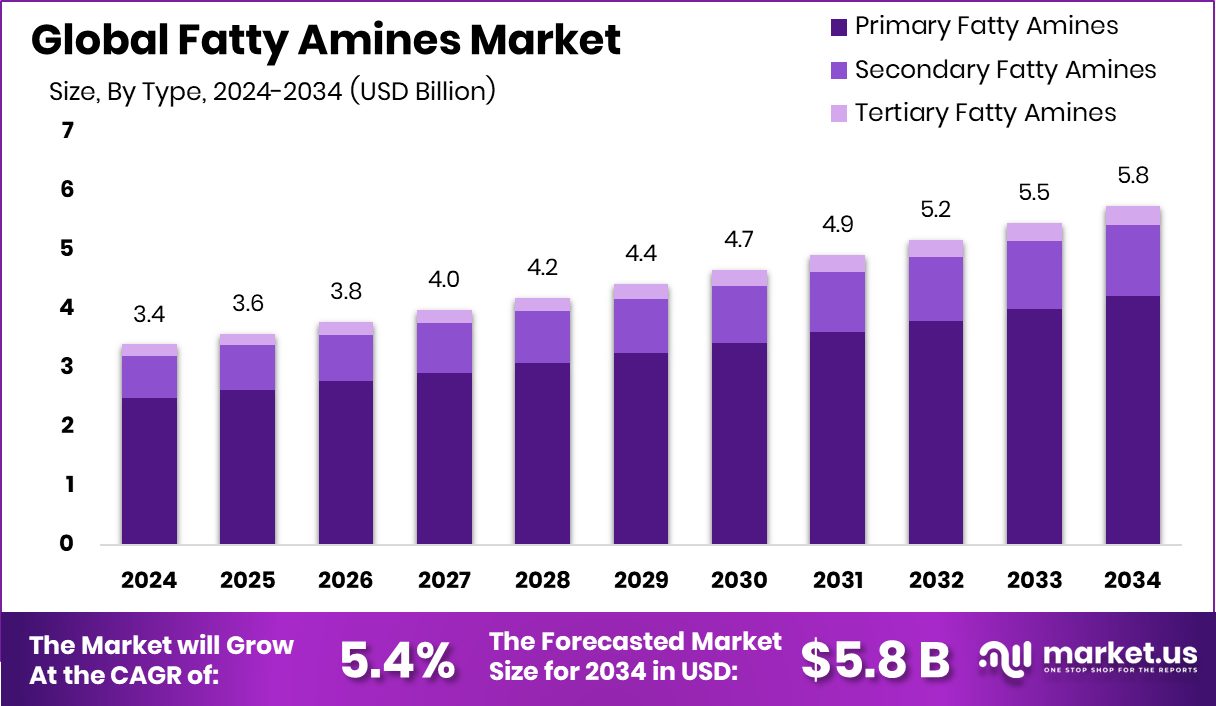

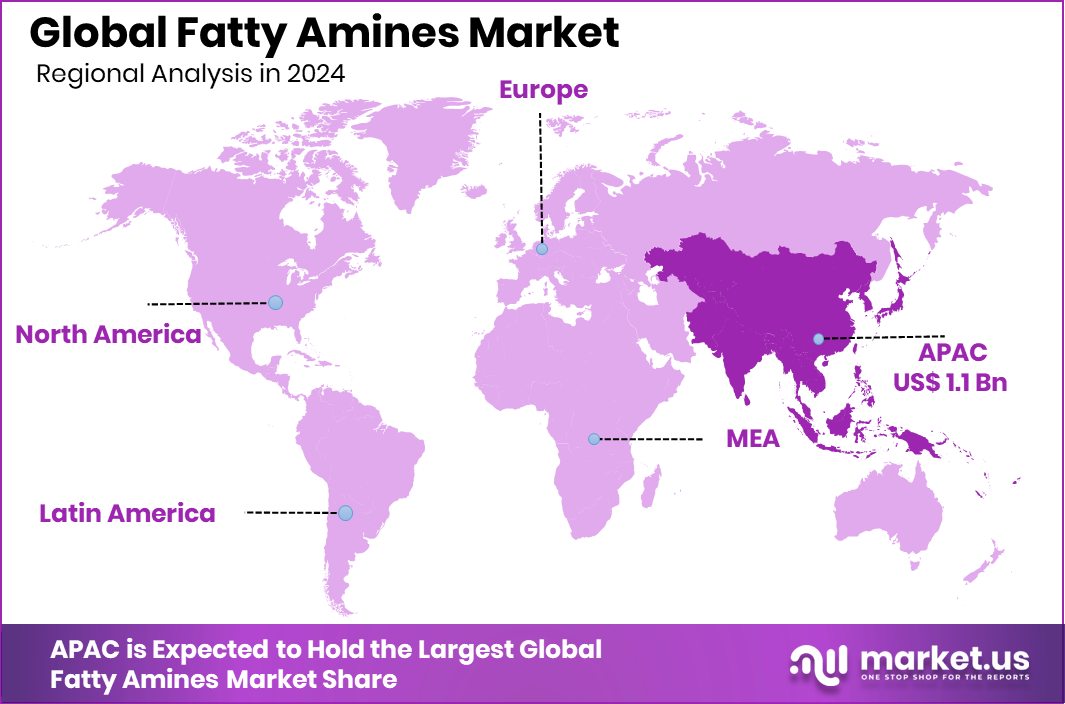

The Global Fatty Amines Market is expected to be worth around USD 5.8 billion by 2034, up from USD 3.4 billion in 2024, and is projected to grow at a CAGR of 5.4% from 2025 to 2034. With a 34.90% share, the Asia Pacific Fatty Amines Market reached USD 1.1 Bn in 2024.

Fatty amines are nitrogen-containing organic compounds made by reacting natural or synthetic fatty acids with ammonia or alcohols. Their long hydrocarbon tail makes them surface-active, so they work as cationic surfactants, emulsifiers, flotation aids, antistatic agents, corrosion inhibitors, and dispersants across many formulations.

The fatty amines market covers primary, secondary, and tertiary amines and their derivatives sold into industries such as agrochemicals, oilfield chemicals, water treatment, personal care, coatings, and plastics. Value is created by performance (e.g., wetting, conditioning, demulsifying), regulatory compliance, and the ability to tailor carbon-chain length and functionality for specific end-uses.

Tighter water and soil regulations, rising mining and energy complexity, and the push to improve crop nutrient efficiency. Public funding helps too—USDA’s Fertilizer Production Expansion Program expanded to as much as $900 million and has issued awards (e.g., $83 million in May 2024; $116 million in Dec 2024) that support domestic nutrient inputs and adjacent chemistries used in formulations.

Steady pull from crop protection adjuvants and fertilizer coatings, oilfield demulsifiers and corrosion inhibitors, and cationic coagulants/flocculants in municipal and industrial water. EPA’s Bipartisan Infrastructure Law allocations (over $50 billion for water, plus FY 2025 SRF allotments of $8.9 billion) reinforce multi-year spending on treatment chemicals.

Formulate low-residual, biodegradable amines for stringent discharge limits; design amine-based chemistries for produced-water reuse; and align with funded pilot projects. DOE’s Office of Fossil Energy and Carbon Management selected projects totaling nearly $8 million in April 2024 for produced-water treatment—creating collaboration and scale-up paths for advanced amine systems.

Key Takeaways

- The Global Fatty Amines Market is expected to be worth around USD 5.8 billion by 2034, up from USD 3.4 billion in 2024, and is projected to grow at a CAGR of 5.4% from 2025 to 2034.

- The Fatty Amines Market shows strong traction, with primary fatty amine holding a 48.3% share.

- Coco amine leads the product segment at 24.6%, highlighting its wide applications across multiple industries.

- Water softeners remain the top application, securing 26.9% of total market consumption worldwide.

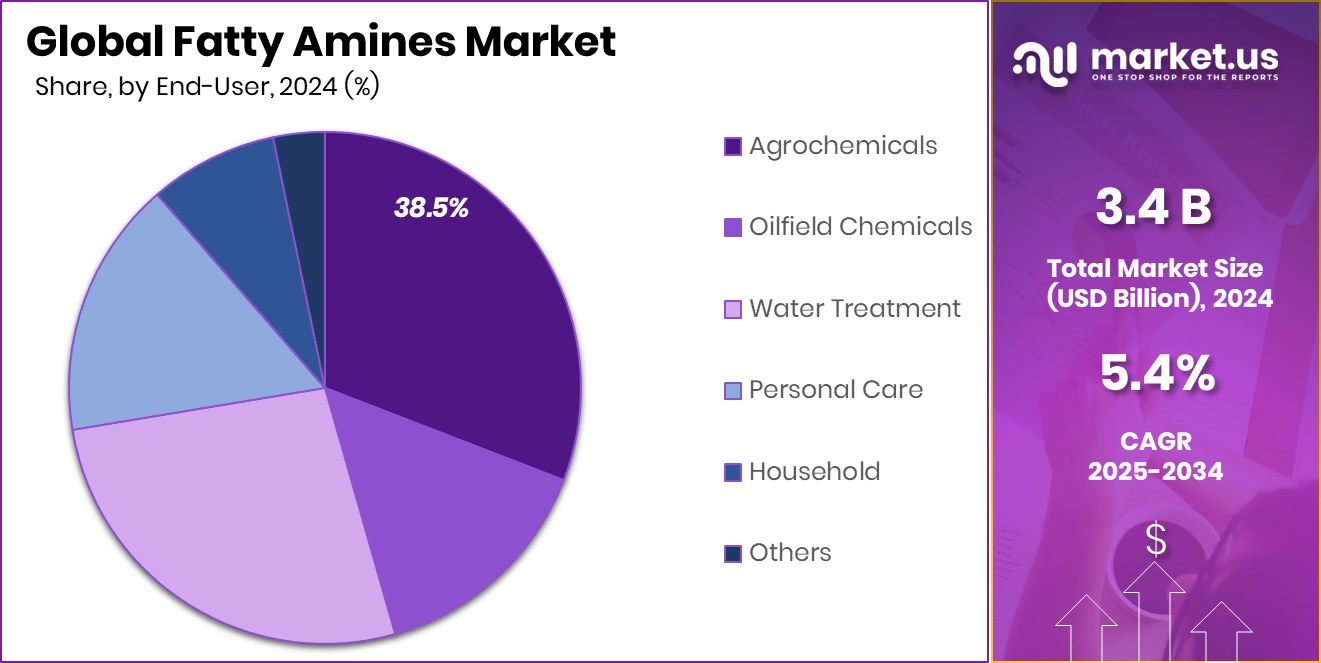

- Agrochemicals dominate end-use demand at 38.5%, reflecting government-backed agricultural and crop protection initiatives.

- Strong demand from agriculture and water treatment boosted the Asia Pacific Fatty Amines Market to USD 1.1 Bn.

By Type Analysis

The Fatty Amines Market shows strong momentum, with primary fatty amines holding 48.3%.

In 2024, Primary Fatty Amines held a dominant market position in the By Type segment of the Fatty Amines Market, with a 48.3% share. This strong position is supported by their extensive use in agrochemicals, water treatment, and oilfield chemicals, where their cationic nature makes them effective as emulsifiers, flotation agents, and corrosion inhibitors.The demand has further been encouraged by increasing government-backed funding for sustainable agricultural inputs and water treatment programs, ensuring reliable consumption levels. Their versatile chemical properties, combined with regulatory support for cleaner and more efficient formulations, have positioned primary fatty amines as the preferred choice in multiple end-use industries, reinforcing their market leadership and long-term relevance.

By Product Analysis

Coco amine contributes 24.6%, highlighting its vital role across multiple product categories.

In 2024, Coco Amine held a dominant market position in the By Product segment of the Fatty Amines Market, with a 24.6% share. This leadership is attributed to its widespread application in water treatment, agrochemicals, and oilfield chemicals, where its performance as a cationic surfactant and emulsifier is highly valued. Coco Amine’s natural origin and ability to deliver effective conditioning, dispersing, and corrosion-inhibiting properties have further strengthened its adoption.Government initiatives in agriculture and water treatment funding have also supported the growth of this segment by driving consistent demand for efficient chemical solutions. With strong end-user reliance and regulatory alignment, Coco Amine continues to anchor its position as a preferred fatty amine product.

By Application Analysis

Applications in water softeners dominate with 26.9%, boosting demand in treatment sectors.

In 2024, Water Softeners held a dominant market position in the By Application segment of the Fatty Amines Market, with a 26.9% share. This dominance is driven by the essential role of fatty amines in producing effective softening agents that prevent scale formation, enhance detergent performance, and improve overall water quality.Increasing investment in municipal and industrial water treatment projects has sustained demand, supported by government funding programs aimed at upgrading water infrastructure. Their efficiency in ensuring long-term equipment protection and reducing maintenance costs further adds to their market strength. With rising concerns over water quality and regulatory backing, water softeners using fatty amines remain a key growth driver in this segment.

By End-use Analysis

Agrochemicals lead with a 38.5% share, supported by government-backed agricultural funding programs.

In 2024, Agrochemicals held a dominant market position in the by-end-use segment of the Fatty Amines Market, with a 38.5% share. This strong position is supported by the extensive use of fatty amines in herbicide formulations, emulsifiers, and adjuvants that improve crop protection efficiency. Government initiatives to boost fertilizer and crop input production, such as the USDA’s Fertilizer Production Expansion Program, have further reinforced demand for amine-based agricultural solutions.

Their role in enhancing nutrient uptake, improving soil interaction, and ensuring higher crop yields makes fatty amines indispensable in modern farming. With sustained support from agricultural funding and increasing pressure to maximize food productivity, agrochemicals remain the leading end-use for fatty amines.

Key Market Segments

By Type

- Primary Fatty Amines

- Secondary Fatty Amines

- Tertiary Fatty Amines

By Product

- Coco Amine

- Octadecyl Amine

- Hydrogenated Tallow Akyl Amine

- Tallow Amine

- Oleyl Amine

- Stearyl Amine

- Others

By Application

- Water Softener

- Emulsifier

- Corrosion Inhibitor

- Asphalt Additives

- Anti-caking

- Others

By End-use

- Agrochemicals

- Oilfield Chemicals

- Water Treatment

- Personal Care

- Household

- Others

Driving Factors

Rising Demand from Agrochemicals Boosting Market Growth

One of the main driving factors for the fatty amines market is the strong demand from the agrochemical sector. Fatty amines are widely used in herbicides, pesticides, and fertilizer formulations, where they act as adjuvants and emulsifiers to improve efficiency and crop yields. With the global population rising, the need for higher agricultural productivity has become a priority, pushing farmers to rely on advanced crop protection products.

Government initiatives and funding programs in agriculture, such as fertilizer production support and subsidies for sustainable farming, are also strengthening demand. This consistent growth in the use of agrochemicals ensures that fatty amines remain in high demand, directly fueling the expansion of the overall market.

Restraining Factors

Environmental Concerns and Strict Regulations Limiting the Market

A key restraining factor for the fatty amines market is the growing concern over environmental impact and the tightening of global regulations. Fatty amines, though highly useful in agrochemicals, oilfield, and water treatment applications, can sometimes cause harmful effects if discharged untreated into soil or water. Many countries have introduced stricter environmental rules to control chemical usage and waste, which increases compliance costs for producers.

Companies are now required to invest more in cleaner technologies and eco-friendly formulations to meet regulatory standards, slowing down immediate market growth. These restrictions, while necessary for environmental safety, pose challenges for rapid expansion, making it harder for fatty amines to grow freely across all regions and applications.

Growth Opportunity

Expanding Water Treatment Projects Creating Strong Opportunity

A major growth opportunity for the fatty amines market lies in the rapid expansion of global water treatment projects. Fatty amines are widely used as coagulants, flocculants, and scale inhibitors, making them essential in both municipal and industrial water treatment. With rising concerns over clean drinking water, wastewater recycling, and sustainable industrial processes, governments are investing heavily in water infrastructure.

For instance, large-scale funding under water safety and infrastructure improvement programs is pushing demand for advanced treatment chemicals. This creates a steady market space for fatty amines, as they improve water quality and efficiency. The increasing focus on environmental sustainability and stricter regulations for water reuse will further accelerate opportunities in this segment.

Latest Trends

Shift Toward Biodegradable and Eco-Friendly Fatty Amines

One of the latest trends shaping the fatty amines market is the move toward biodegradable and eco-friendly formulations. Industries are under pressure to reduce their environmental footprint, and traditional amines are being replaced with greener alternatives that break down more easily without leaving harmful residues. This trend is especially visible in agrochemicals and water treatment, where regulatory frameworks are pushing for safer products that align with sustainability goals.

Manufacturers are investing in research to develop plant-based or renewable feedstock-derived fatty amines, meeting both consumer and government expectations for cleaner solutions. This shift not only helps companies stay compliant with strict environmental norms but also opens up new market opportunities in sustainable chemistry.

Regional Analysis

In 2024, the Asia Pacific held a 34.90% share of the Fatty Amines Market, worth USD 1.1 Bn.

The Fatty Amines Market shows notable regional variations, reflecting diverse industrial demand and government-backed investments. In 2024, Asia Pacific emerged as the dominating region, capturing 34.90% of the market share with USD 1.1 billion, driven by its strong agricultural base and expanding water treatment infrastructure.

North America follows with steady consumption, supported by advanced oilfield operations and government initiatives in water management. Europe demonstrates consistent growth owing to strict environmental regulations that encourage eco-friendly chemical adoption across industrial applications.

The Middle East & Africa region benefits from increasing oilfield chemical use and infrastructure projects, while Latin America shows gradual expansion supported by agricultural demand. Among these, Asia Pacific’s commanding position highlights its pivotal role in shaping global fatty amines consumption.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

India Glycols Ltd, recognized for its integration of bio-based chemicals, leveraged its capabilities in green chemistry to expand its fatty amines offerings. By aligning with sustainability goals and government-driven initiatives to support eco-friendly chemical production, the company positioned itself as a responsible supplier catering to the agrochemicals and water treatment industries.

Indo Amines Limited continued to demonstrate resilience in the specialty chemicals segment, maintaining its focus on fatty amines used across agrochemical and industrial formulations. With its growing manufacturing base and efforts to streamline capacity utilization, the company secured demand from domestic and export markets. Its emphasis on cost-effectiveness and technical performance ensured relevance across varied end-use sectors.

Global Amines Company Pte. Ltd., a joint venture with international expertise, played a pivotal role by supplying high-quality fatty amines tailored to specific industry needs. The company’s focus on innovation and reliable global supply chains supported its expansion across key regions. By addressing demand in water treatment, oilfield chemicals, and personal care, Global Amines strengthened its competitive positioning.

Top Key Players in the Market

- India Glycols Ltd

- Indo Amines Limited

- Global Amines Company Pte. Ltd.

- Huntsman International LLC.

- Solvay

- KLK OLEO

- Evonik

- PT. Ecogreen Oleochemicals

- Kao Corporation

- Nouryon

Recent Developments

- In September 2024, New amine products scaled. The FY23-24 Annual Report lists DBAPA, Bis-MAPA, ADMA-8/10, THIEC, and OCG/PGG moved to plant-scale (200–350 MT/month lines noted), strengthening the broader amines slate that supports fatty-amine-based formulations and blends.

- In April 2024, India Glycols reported Phase-II progress and partial commissioning of facilities (~5,000 MT/year, product-mix dependent) for new value-added chemical products, strengthening supply for chemistries used alongside fatty amines/amine-ethoxylates in crop care, oil & gas, and water treatment.

Report Scope

Report Features Description Market Value (2024) USD 3.4 Billion Forecast Revenue (2034) USD 5.8 Billion CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Primary Fatty Amines, Secondary Fatty Amines, Tertiary Fatty Amines), By Product (Coco Amine, Octadecyl Amine, Hydrogenated Tallow Akyl Amine, Tallow Amine, Oleyl Amine, Stearyl Amine, Others), By Application (Water Softener, Emulsifier, Corrosion Inhibitor, Asphalt Additives, Anti-caking, Others), By End-use (Agrochemicals, Oilfield Chemicals, Water Treatment, Personal Care, Household, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape India Glycols Ltd, Indo Amines Limited, Global Amines Company Pte. Ltd., Huntsman International LLC., Solvay, KLK OLEO, Evonik, PT. Ecogreen Oleochemicals, Kao Corporation, Nouryon Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- India Glycols Ltd

- Indo Amines Limited

- Global Amines Company Pte. Ltd.

- Huntsman International LLC.

- Solvay

- KLK OLEO

- Evonik

- PT. Ecogreen Oleochemicals

- Kao Corporation

- Nouryon