Global Fat Replacers Market Size, Share, And Business Benefits By Base Type (Carbohydrate, Lipid, Protein, Others), By Source (Plant, Animal), By Form (Liquid, Powder), By Application (Bakery and Confectionery, Dairy and Frozen Desserts, Beverages, Processed Meat, Dressings, Margarines, and Spreads, Convenience Foods, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152820

- Number of Pages: 344

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

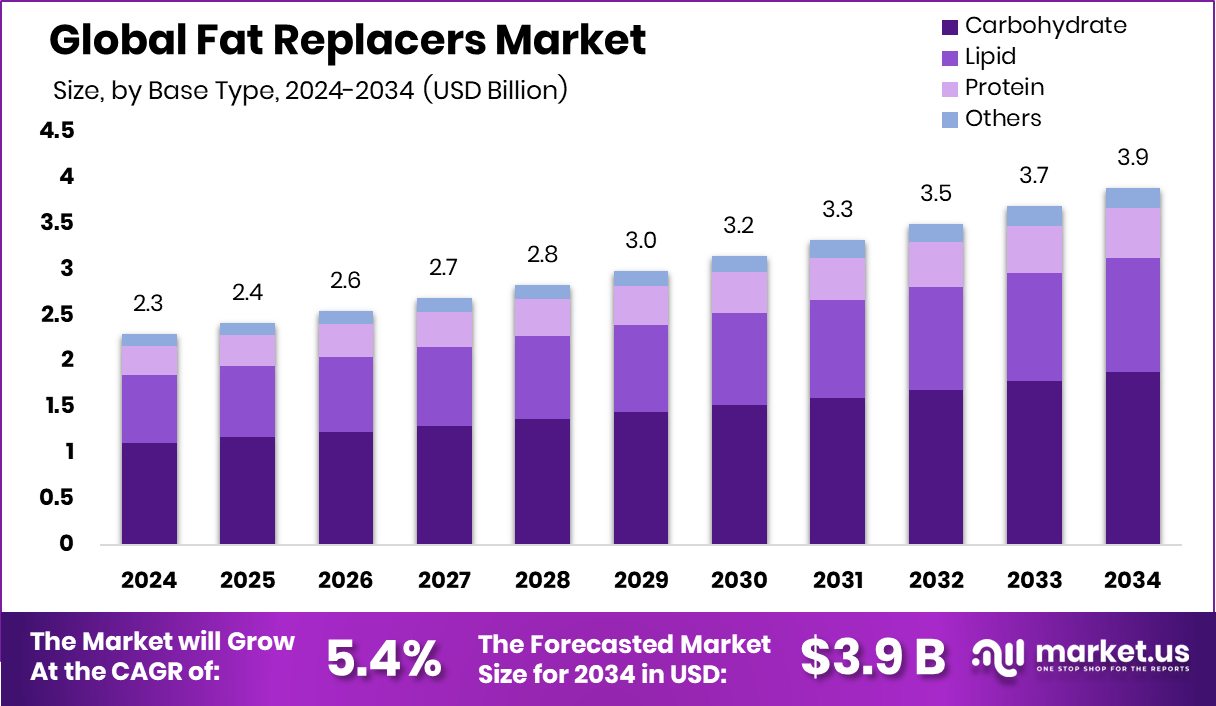

Global Fat Replacers Market is expected to be worth around USD 3.9 billion by 2034, up from USD 2.3 billion in 2024, and grow at a CAGR of 5.4% from 2025 to 2034. High health awareness and dietary shifts are boosting Asia-Pacific’s fat replacers market share to 44.20%.

The fat replacers market is growing steadily as public awareness around obesity, cardiovascular diseases, and calorie intake rises. Governments and health agencies across several countries are promoting reduced-fat dietary guidelines, which is encouraging food manufacturers to reformulate existing products. Naomi Patisserie & Bakehouse secures ₹5 crore funding from entrepreneur Kanthi Dutt, highlighting increasing investment in healthier food alternatives.

One major growth factor for the market is the increasing rate of lifestyle disorders such as obesity, type 2 diabetes, and hypertension. As more consumers seek healthier food alternatives, fat replacers are becoming essential for brands aiming to align their products with clean-label, low-fat, and low-calorie trends. The Baker’s Dozen secures $5 million in funding round led by Fireside Ventures, reflecting investor confidence in this shift.

David, a snack brand focused on muscle gain and fat loss, closes $75 million Series A funding led by Greenoaks with support from Valor Equity Partners, reinforcing the demand for functionally enhanced low-fat snacks. Bakery Mazowsze in Bloxwich receives £20,000 funding boost for expansion, signaling grassroots adoption in regional bakeries.

Consumer demand is also influenced by evolving dietary patterns, especially the shift towards plant-based and functional foods. Fat replacers that originate from natural or plant-based sources are gaining traction due to their perceived health benefits and compatibility with vegetarian or vegan diets.

Convenience store chain AMPM raises ₹1.6 crore through Agility Venture Partners, while Chaayos secures $53 million in Series C funding led by Alpha Wave Ventures and others, both demonstrating the widespread industry interest in healthier and convenient offerings. Burma Burma, a casual dining brand, raises $2 million in equity investment, further emphasizing the sector’s alignment with wellness-driven eating.

Key Takeaways

- Global Fat Replacers Market is expected to be worth around USD 3.9 billion by 2034, up from USD 2.3 billion in 2024, and grow at a CAGR of 5.4% from 2025 to 2034.

- In the fat replacers market, carbohydrate-based variants dominate, holding a significant share of 48.3%.

- Plant-sourced fat replacers lead the market with a commanding 67.2% due to rising natural preferences.

- Powder form fat replacers are widely used, capturing 66.6% share for their ease in food processing.

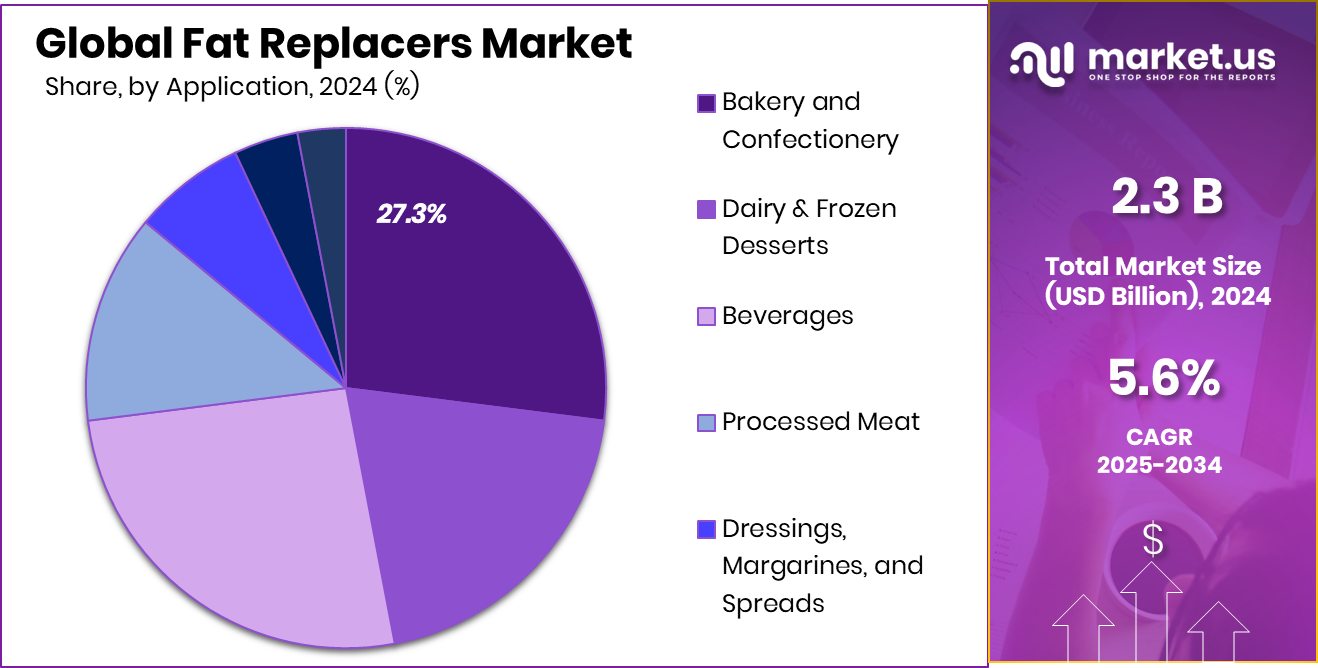

- Bakery and confectionery applications account for 27.3%, showcasing strong demand in low-fat sweet food segments.

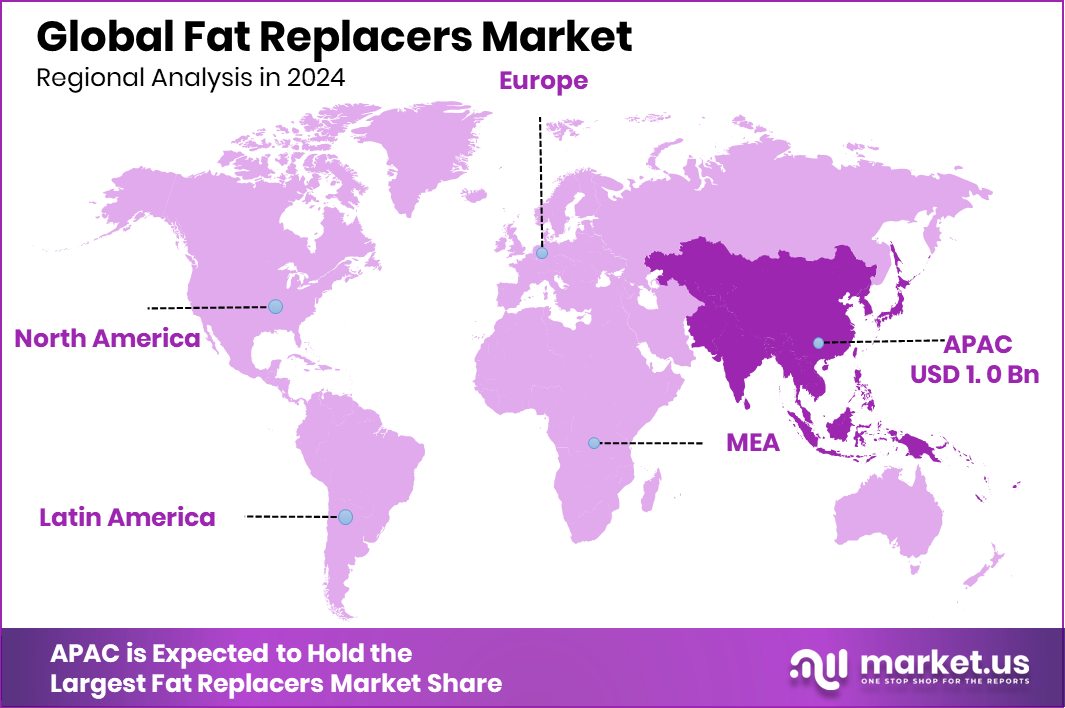

- The Asia-Pacific market value reached approximately USD 1.0 billion during the same year.

By Base Type Analysis

Carbohydrate-based fat replacers dominate with 48.3% market share globally.

In 2024, Carbohydrate held a dominant market position in the By Base Type segment of the Fat Replacers Market, with a 48.3% share. This significant share is primarily attributed to the widespread application of carbohydrate-based fat replacers in a variety of processed food products, including baked goods, dairy, sauces, and dressings.

Their ability to replicate the mouthfeel and texture of fat while significantly reducing caloric content has made them a preferred choice among food manufacturers aiming to reformulate products in line with health-focused consumer trends.

Carbohydrate-based fat replacers, typically derived from cellulose, gums, starches, and maltodextrins, offer excellent stability, functionality, and compatibility with multiple food matrices. Their natural origin and clean-label appeal further strengthen their market position, particularly as consumers show increasing preference for familiar and plant-derived ingredients.

The rise in demand for low-fat and calorie-reduced products, driven by growing awareness of lifestyle-related health risks such as obesity and heart disease, has contributed to sustained adoption of carbohydrate fat replacers.

By Source Analysis

Plant-based sources lead the fat replacers market, accounting for 67.2%.

In 2024, Plant held a dominant market position in the By Source segment of the Fat Replacers Market, with a 67.2% share. This commanding position is largely driven by the growing consumer preference for plant-derived ingredients in food formulations, particularly in health-conscious and clean-label product categories.

Plant-based fat replacers are widely recognized for their natural origin, compatibility with vegetarian and vegan diets, and their functional performance in mimicking the sensory attributes of fats.

The high share also reflects the increasing demand for products that align with sustainable and transparent sourcing practices. Consumers are more inclined toward ingredients derived from recognizable sources such as corn, soy, oats, and other botanicals, especially in the context of rising awareness around food safety and dietary impact.

The ability of plant-based fat replacers to offer both health and environmental benefits has significantly contributed to their widespread use across multiple food categories.

By Form Analysis

Powder form holds 66.6% share in the fat replacers market.

In 2024, Powder held a dominant market position in the By Form segment of the Fat Replacers Market, with a 66.6% share. This leadership is primarily attributed to the superior stability, shelf-life, and handling convenience offered by powdered fat replacers across a wide range of food applications.

Powder forms are favored in the manufacturing of processed foods such as baked items, dairy alternatives, soups, and sauces, where consistent performance and ease of formulation are critical.

The high share of powdered fat replacers also stems from their ability to blend seamlessly into dry mixes and ready-to-cook products, supporting large-scale production with minimal formulation adjustments.

Their compact storage, lower transportation costs, and extended usability further enhance their appeal to food processors aiming to reduce operational complexities. Powdered forms also allow for precise dosage control, ensuring consistent taste and texture across production batches.

By Application Analysis

Bakery and confectionery segment contributes 27.3% to the market applications.

In 2024, Bakery and Confectionery held a dominant market position in the By Application segment of the Fat Replacers Market, with a 27.3% share. This leading position is largely driven by the strong demand for healthier baked goods and confectionery items that maintain indulgent taste profiles while offering reduced fat content.

Consumers increasingly seek low-fat alternatives in cakes, cookies, pastries, chocolates, and similar products, without compromising on texture or flavor, prompting food manufacturers to adopt fat replacers extensively in this category.

The high share is also supported by the functional versatility of fat replacers in improving moisture retention, texture, and mouthfeel—critical elements in baked and confectionery products. These ingredients help reduce total calorie count while preserving sensory quality, which is essential in a market where consumer expectations around healthier indulgence continue to rise.

Additionally, the growing awareness of diet-related health concerns such as obesity and heart disease has further encouraged reformulation efforts in this application segment.

Key Market Segments

By Base Type

- Carbohydrate

- Lipid

- Protein

- Others

By Source

- Plant

- Animal

By Form

- Liquid

- Powder

By Application

- Bakery and Confectionery

- Dairy and Frozen Desserts

- Beverages

- Processed Meat

- Dressings, Margarines, and Spreads

- Convenience Foods

- Others

Driving Factors

Health Awareness is Driving Demand for Fat Replacers

One of the main reasons behind the growth of the fat replacers market is the rising awareness about health and wellness. People today are more informed about the negative effects of high-fat diets, such as obesity, heart disease, and diabetes. As a result, many are choosing low-fat or reduced-fat food options as part of a healthier lifestyle.

This shift is pushing food companies to replace traditional fats with healthier alternatives that still deliver good taste and texture. Fat replacers help make food lighter without losing its appeal. As more consumers read labels and look for products with fewer calories and healthier ingredients, the demand for fat replacers is increasing across many food categories.

Restraining Factors

Taste and Texture Challenges Limit Market Growth

One major challenge in the fat replacers market is maintaining the same taste and texture as real fat. Fat plays an important role in making food creamy, rich, and satisfying. When fat is removed or reduced, it can change how the food feels and tastes. Even though fat replacers are designed to mimic these qualities, they do not always perform exactly the same.

This can lead to a product that consumers find less appealing. If the food doesn’t taste as good, people may not buy it again, which slows down the market growth. For companies, it is difficult to find the right balance between lower fat content and the enjoyable eating experience that consumers expect.

Growth Opportunity

Rising Demand for Plant-Based Foods Globally

A major growth opportunity in the fat replacers market comes from the rising popularity of plant-based foods. More people around the world are choosing plant-based diets for health, environmental, or ethical reasons. This shift has increased the demand for food products made with natural, plant-based ingredients.

Fat replacers made from plants, such as fibers, gums, and starches, fit well into this trend. They are seen as healthier and more sustainable than animal-based ingredients. Food companies are now focusing on creating low-fat products that also meet the growing interest in clean labels and plant-based nutrition.

Latest Trends

Clean Label Fat Replacers Gain More Attention

One of the latest trends in the fat replacers market is the growing preference for clean label ingredients. Consumers are now looking for simple, natural, and easy-to-understand ingredients in the food they eat. This trend has pushed food producers to use fat replacers made from natural sources like oats, corn, or legumes, instead of synthetic or chemical alternatives.

People want to see ingredient lists that are short and familiar. Clean-label fat replacers not only help reduce fat but also build trust with health-conscious buyers. As transparency in food becomes more important, this trend is encouraging brands to create products that meet both health goals and consumer expectations for natural and recognizable ingredients.

Regional Analysis

In 2024, Asia-Pacific led the Fat Replacers Market with a 44.20% share.

In 2024, Asia-Pacific held the dominant position in the Fat Replacers Market, accounting for 44.20% of the global share, which equaled a market value of USD 1.0 billion. This dominance is driven by increasing consumer awareness regarding health and wellness, combined with a rising demand for low-fat food alternatives across rapidly urbanizing economies such as China, India, and Southeast Asia.

The shift toward healthier diets, particularly among middle-income populations, is encouraging food manufacturers to incorporate fat replacers in a wide range of processed foods. North America continues to be an important regional market, supported by a well-established food processing industry and high consumer interest in calorie-conscious and low-fat products.

Europe follows closely, where consumers focus on clean-label and functional foods, supporting the integration of plant-based fat replacers. Meanwhile, the Middle East & Africa region shows moderate growth potential, largely driven by emerging health trends and evolving food consumption patterns. Latin America also presents steady market activity, aided by urban development and gradual shifts in dietary habits.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, key players such as Ashland Global Holdings, Inc., Cargill Incorporated, Fiberstar, Inc., and FMC Corporation maintained strategic relevance in the global Fat Replacers Market by focusing on ingredient innovation, clean-label solutions, and functionality enhancement.

Ashland Global Holdings, Inc. continued to build on its strength in specialty ingredients by offering advanced formulation capabilities tailored to meet the demand for low-fat and reduced-calorie food applications.

Cargill Incorporated, with its wide agricultural footprint and vertically integrated supply chain, expanded the use of naturally sourced fat replacers, including plant-based fibers and starch derivatives. Its continued investment in plant-based ingredient systems aligned well with the growing consumer preference for sustainable and transparent food ingredients.

FMC Corporation, a key supplier of hydrocolloids, remained active in delivering fat-reduction ingredients that enhance food texture and mouthfeel. The company leveraged its portfolio of food-grade gums and cellulose derivatives to meet functional needs without compromising on quality.

Top Key Players in the Market

- Ashland Global Holdings, Inc.

- Cargill Incorporated

- Fiberstar, Inc.

- FMC Corporation

- Ingredion

- Kerry Group

- DKS Co Ltd.

- Palsgaard

- Roquette Frères

- Tate & Lyle

- Z Trim Holdings, Inc.

Recent Developments

- In September 2024, Ingredion Incorporated launched FIBERTEX CF 500 & CF 100, multi-benefit citrus fibre ingredients in the APAC region. These clean-label fibres improve texture, stability, and viscosity in food products such as bakery, dairy, meat, and plant-based items, supporting fat replacement and simple on-pack claims.

- In June 2024, Palsgaard teamed with Aarhus University to launch the PIER project, a €5 million initiative aimed at creating plant-based replacements for egg ingredients in baked goods, dressings, desserts, and ready meals, enhancing sustainability and reducing recipe costs.

Report Scope

Report Features Description Market Value (2024) USD 2.3 Billion Forecast Revenue (2034) USD 3.9 Billion CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Base Type (Carbohydrate, Lipid, Protein, Others), By Source (Plant, Animal), By Form (Liquid, Powder), By Application (Bakery and Confectionery, Dairy and Frozen Desserts, Beverages, Processed Meat, Dressings, Margarines, and Spreads, Convenience Foods, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Ashland Global Holdings, Inc., Cargill Incorporated, Fiberstar, Inc., FMC Corporation, Ingredion, Kerry Group, DKS Co Ltd., Palsgaard, Roquette Frères, Tate & Lyle, Z Trim Holdings, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Ashland Global Holdings, Inc.

- Cargill Incorporated

- Fiberstar, Inc.

- FMC Corporation

- Ingredion

- Kerry Group

- DKS Co Ltd.

- Palsgaard

- Roquette Frères

- Tate & Lyle

- Z Trim Holdings, Inc.