Global Ethylene Propylene Diene Monomer Market By Type (Seals and O-Rings, Hoses, Gaskets, Rubber Compounds, Roofing Membranes, Connectors and insulators, Others), By Application (Automotive, Building and Construction, Electrical and Electronics, Lubricant Additive, Plastic Modifications, Tires and Tubes, Others), By Sales Channel (Direct Sales, Indirect Sales) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 151879

- Number of Pages: 305

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

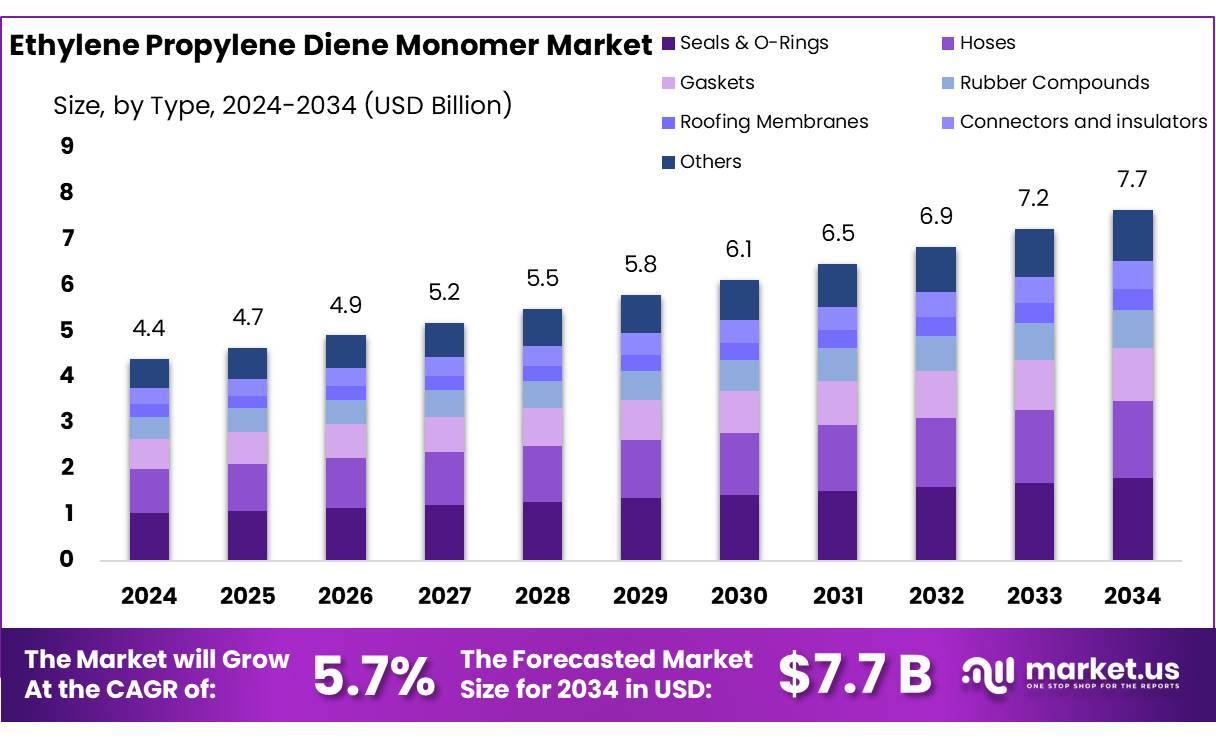

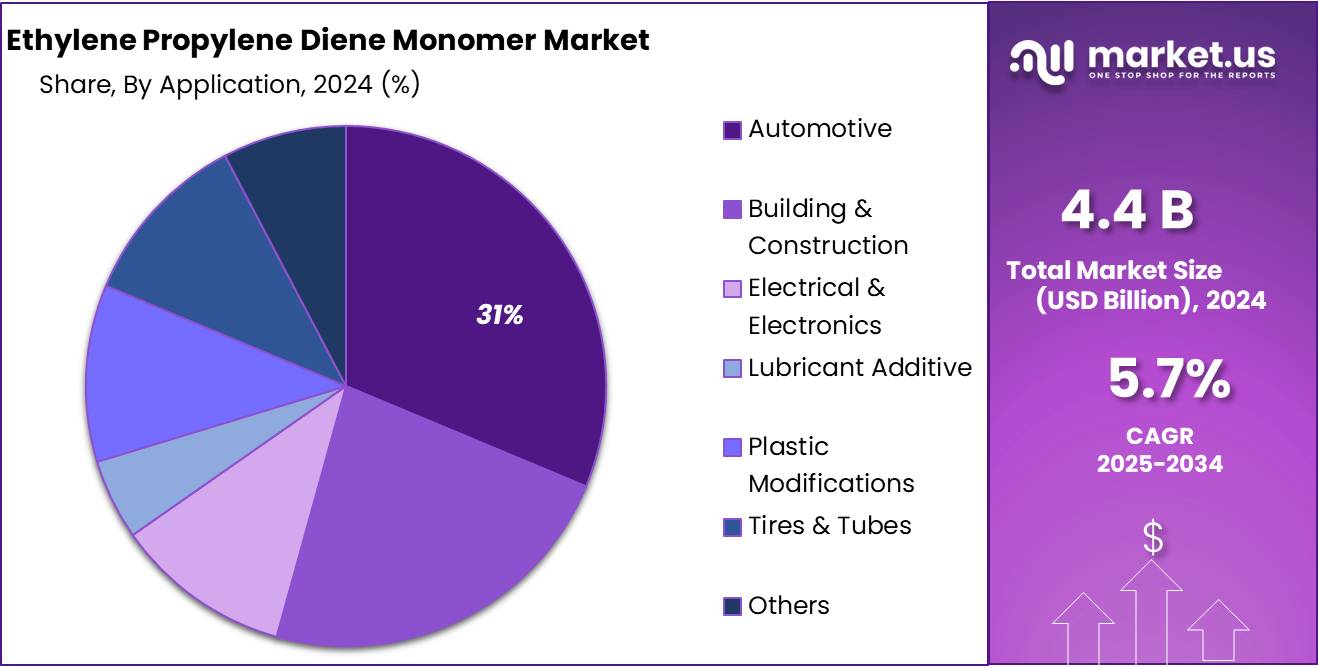

The Global Ethylene Propylene Diene Monomer Market size is expected to be worth around USD 7.7 Billion by 2034, from USD 4.4 Billion in 2024, growing at a CAGR of 5.7% during the forecast period from 2025 to 2034.

Ethylene Propylene Diene Monomer (EPDM) is a synthetic elastomer produced through the copolymerization of ethylene, propylene, and a diene comonomer. This material is characterized by its superior thermal stability, ozone resistance, and flexibility at low temperatures, making it suitable for applications such as automotive seals, roofing membranes, hoses, and electrical insulation. Production volumes in North America during 1997–2001 fluctuated between 347,000 and 397,000 metric tons annually, underscoring the scale of EPDM manufacturing.

The expansion of industries such as automotive and construction is the primary growth engine. For instance, EPDM sector demand is driven by applications like weather-stripping, seals, roofing membranes, and coolant hoses in electric vehicles (EVs), which are gaining policy and consumer momentum. The International Energy Agency reported a 40% rise in global EV sales to 3 million units in 2020, with a forecast to reach 300 million by 2030—stimulating demand for EPDM materials in high-durability automotive components.

Government policy and investment are also influencing EPDM concentrate usage. In the U.S., federal infrastructure funding and clean-energy incentives promote advanced roofing technologies incorporating EPDM membranes. The U.S. Census Bureau’s 8% construction value growth between 2020–21 was recognized under the Infrastructure Investment and Jobs Act (IIJA), illustrating the direct impact of policy on EPDM application. Similarly, the International Energy Agency (IEA) projection of EV sales up to 2030 underscores global regulatory push toward decarbonization, benefiting EPDM demand.

Key Takeaways

- Ethylene Propylene Diene Monomer Market size is expected to be worth around USD 7.7 Billion by 2034, from USD 4.4 Billion in 2024, growing at a CAGR of 5.7%.

- Seals & O-Rings held a dominant market position, capturing more than a 23.5% share of the global Ethylene Propylene Diene Monomer (EPDM) market.

- Automotive held a dominant market position, capturing more than a 31.3% share of the global Ethylene Propylene Diene Monomer (EPDM) market.

- Indirect Sales held a dominant market position, capturing more than a 68.9% share in the global Ethylene Propylene Diene Monomer (EPDM) market.

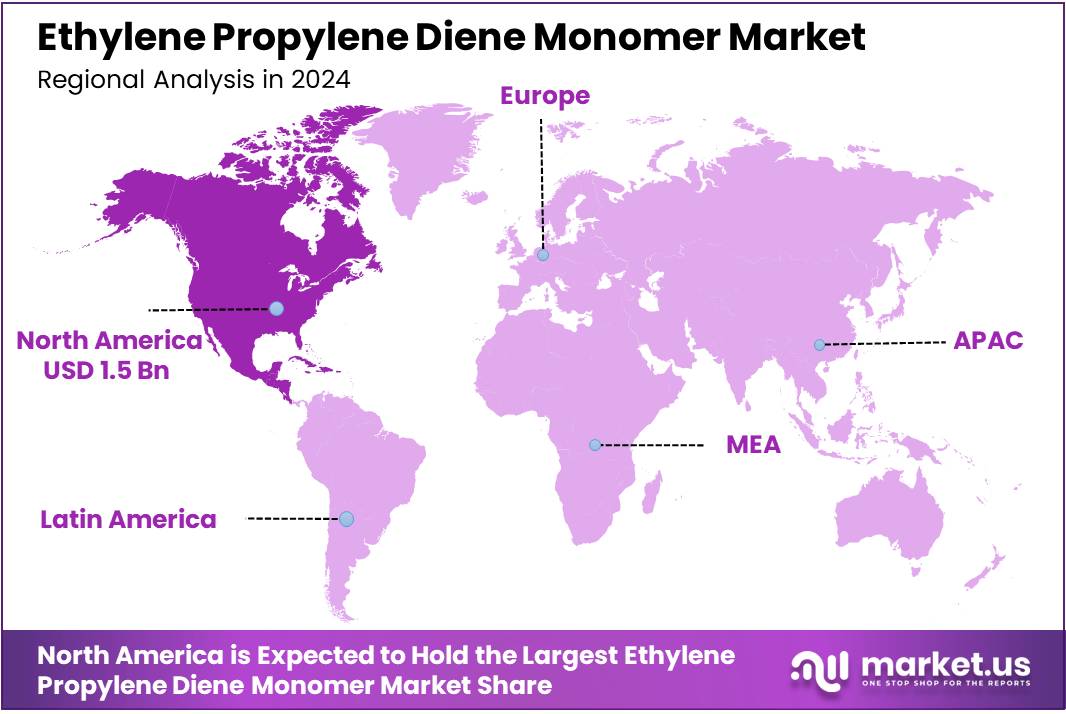

- North America held a dominant position in the global Ethylene Propylene Diene Monomer (EPDM) market, capturing more than 35.9% of the total market share, with an estimated market value of approximately USD 1.5 billion.

By Type

Seals & O-Rings lead the EPDM Market with 23.5% share in 2024, driven by durability and industrial demand

In 2024, Seals & O-Rings held a dominant market position, capturing more than a 23.5% share of the global Ethylene Propylene Diene Monomer (EPDM) market. This segment’s growth can be credited to the rising need for weather-resistant and durable sealing solutions across automotive, construction, and manufacturing sectors. EPDM-based seals and O-rings are widely preferred due to their ability to withstand harsh weather conditions, UV exposure, high temperatures, and chemical interactions, making them ideal for both static and dynamic applications.

In particular, the automotive industry continues to be a major end-user, as manufacturers seek materials that enhance vehicle performance and reduce maintenance costs. Additionally, industrial machinery and water systems increasingly rely on EPDM sealing components for leak prevention and long-term reliability.

By Application

Automotive dominates with 31.3% share in 2024, driven by rising EV production and material reliability

In 2024, Automotive held a dominant market position, capturing more than a 31.3% share of the global Ethylene Propylene Diene Monomer (EPDM) market. This strong share is mainly driven by the growing need for heat- and weather-resistant materials in vehicle manufacturing. EPDM is widely used in making door seals, window gaskets, under-the-hood parts, and coolant hoses due to its excellent resistance to heat, ozone, and moisture. With the shift toward electric vehicles, the demand for reliable insulation and sealing materials has further increased. Automakers are also using EPDM to improve energy efficiency by reducing air and water leaks, especially in high-performance EVs.

By Sales Channel

Indirect Sales dominate EPDM market with 68.9% share in 2024, supported by strong distributor networks and bulk procurement

In 2024, Indirect Sales held a dominant market position, capturing more than a 68.9% share in the global Ethylene Propylene Diene Monomer (EPDM) market. This dominance is largely due to the strong presence of established distributor networks and bulk procurement practices across key industrial regions. Most small to mid-sized manufacturers prefer sourcing EPDM materials through indirect channels, as it allows for flexible order sizes, timely deliveries, and technical support.

Distributors also play a vital role in maintaining regional inventories, which helps reduce lead times and ensure consistent supply. In sectors like automotive, construction, and machinery, procurement through indirect sales continues to be the preferred route because of value-added services such as logistics, material testing, and customized blends.

Key Market Segments

By Type

- Seals & O-Rings

- Shaft Seal

- Molded Packing & Seals

- Motor Vehicle Body Seal

- Others

- Hoses

- Hydraulic & Pressure Washer Hoses

- Industrial Hoses

- Others

- Gaskets

- Metallic

- Semi-metallic

- Non-metallic

- Rubber Compounds

- Car Bumpers

- Fender Extensions

- Rub Strips

- Others

- Roofing Membranes

- Connectors and insulators

- Others

By Application

- Automotive

- Building & Construction

- Electrical & Electronics

- Lubricant Additive

- Plastic Modifications

- Tires & Tubes

- Others

By Sales Channel

- Direct Sales

- Indirect Sales

Drivers

Surge in Food-Grade EPDM Demand Driven by Stricter Food Safety Standards

Rising consumer awareness around food safety and contamination prevention has placed regulatory pressure on manufacturers to adopt materials that meet or exceed hygiene standards. To this effect, EPDM that aligns with the U.S. FDA’s 21 CFR 177.2600 guidelines has seen increased adoption, particularly for repeated food-contact applications. The compliance with such regulations has made EPDM a preferred material in food and beverage plants, dairy operations, and pharmaceutical packaging lines.

On the policy front, state-level packaging regulations have played a crucial role. For example, on May 13, 2025, Maryland enacted its Extended Producer Responsibility (EPR) law for packaging and paper products, requiring producers to support up to 90% of associated recycling costs. This policy not only promotes recycling but also motivates manufacturers to switch to durable, recyclable materials like EPDM, known for their longevity and ability to withstand multiple wash cycles.

India is setting examples in sustainable practices too. Public recycling initiatives—such as the deployment of plastic water bottle recycling machines in major railway stations—reflect broader governmental support for circular design. These initiatives align with an increasing trend in the food and beverage industry toward eco-friendly packaging and durable material sourcing, benefiting the EPDM segment indirectly.

Restraints

Raw Material Price Volatility Limits EPDM Market Expansion

One significant restraining factor for the Ethylene Propylene Diene Monomer (EPDM) market is the unpredictable fluctuation in raw material prices. In North America, EPDM rubber prices fell by 1.66% quarter-on-quarter in early 2025, mainly due to a 13.8% drop in ethylene prices and a 6.2% decline in propylene costs. Such volatility directly affects manufacturers’ profit margins, as nearly half of EPDM’s cost base is tied to these two feedstocks. When raw material costs spike, producers often pass these increases downstream, leading to higher prices for automotive, construction, and consumer goods manufacturers.

From a policy standpoint, government initiatives can only partially mitigate this uncertainty. The EU’s REACH legislation aims to stabilize the supply chain by requiring comprehensive chemical registration and encouraging vertical integration. However, this does little to shield producers from global petrochemical price swings. Likewise, the U.S. Infrastructure Investment and Jobs Act includes provisions to boost domestic chemicals production, but export-oriented price instability remains a concern.

In India, the government has boosted support for circular economy schemes and petrochemical investments, yet domestic price stability continues to lag behind inflation-adjusted global petrochemical trends. This scenario has led to hesitancy in long-term procurement contracts by local manufacturers of EPDM-based goods.

Opportunity

Expansion of Food-Grade EPDM Offers Strong Growth Potential

Food and beverage processors are subject to strict hygiene regulations such as the U.S. Food and Drug Administration’s CFR Title 21 standards and European Union (EC) No 1935/2004 for materials in contact with food. These regulations require materials like EPDM to meet rigorous criteria for non-toxicity, contamination resistance, and durability across repeated cleaning cycles. EPDM’s excellent performance in these areas makes it a strong choice for environments involving frequent washdowns, high temperatures, and food contact.

Furthermore, environmental and sustainability initiatives are encouraging use of more durable, recyclable materials. For example, in the UK, government programs such as the Courtauld Agreement and the Plastic Pact aim to reduce single-use plastics in packaging, pushing manufacturers to explore long-life materials like EPDM. EPDM’s resilience enables it to withstand multiple sanitation cycles, contributing to waste reduction and circular economy goals.

In addition, automation and modernization of food facilities are rising globally. As more production lines incorporate conveyor systems, piping, and automated packaging units, food-grade EPDM is increasingly specified for its reliability and support of continuous operations.

Trends

Shift Towards Low-Carbon and Bio-Based EPDM Is Gaining Momentum

One of the most significant recent trends in the EPDM market is the growing emphasis on low-carbon and bio-based production. In March 2025, a study highlighted that by 2025 manufacturers will refine supply chains—especially through renewable naphtha and recycled feedstocks—and adopt greener production methods aimed at reducing CO2 emissions. This movement is driven by tightening environmental regulations across key regions including Europe and parts of Asia, where governments and major brand owners are demanding life-cycle assessments and alignment with circular economy targets

Bio-based EPDM materials, derived partly from biomass instead of petroleum, promise to lower carbon footprints and appeal to eco-conscious buyers. Pilot programs in Europe and North America have begun tracking EPDM made from recycled content, offering processors a way to claim reductions in embodied carbon. By linking material composition to sustainability reporting, food producers can demonstrate adherence to environmental policies without compromising safety or hygiene standards.

Meanwhile, governments are supporting greener practices. For example, the EU is integrating rubber products into its Circular Economy Action Plan, and many Asian nations are encouraging recycled-content mandates in industrial components. The CONCAWE/EU scheme now tracks greenhouse gas emissions for polymers like EPDM—information many major food processors need to comply with sustainability reporting.

Regional Analysis

North America leads EPDM Market with 35.9% share, valued at USD 1.5 Billion in 2024

In 2024, North America held a dominant position in the global Ethylene Propylene Diene Monomer (EPDM) market, capturing more than 35.9% of the total market share, with an estimated market value of approximately USD 1.5 billion. This strong performance is primarily driven by the region’s well-established automotive, construction, and industrial manufacturing sectors—each of which relies heavily on EPDM for its resistance to heat, weathering, and chemical exposure.

The United States, in particular, remains the largest contributor within the region, supported by a robust automotive industry that continues to integrate EPDM in vehicle seals, hoses, and insulation systems. According to the U.S. Bureau of Economic Analysis, motor vehicle output rose by over 5.1% in 2024, which in turn boosted demand for durable rubber materials like EPDM across OEM and aftermarket applications.

Additionally, North America benefits from advanced polymer production technologies and a strong network of suppliers and distributors, enabling timely availability of EPDM concentrates to end-use sectors. The region also prioritizes compliance with environmental and safety standards such as ASTM and EPA regulations, which further increases the adoption of high-quality EPDM in infrastructure and HVAC systems.

Moreover, government-backed investments under the Infrastructure Investment and Jobs Act have accelerated upgrades in public transport, buildings, and water systems—applications where EPDM plays a vital role due to its sealing and insulation capabilities. With continued innovation, strong domestic demand, and regulatory alignment, North America is expected to maintain its leadership in the EPDM market through 2025 and beyond.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Dow remains a key player in the Ethylene Propylene Diene Monomer (EPDM) market with a strong global presence and advanced polymer production capabilities. The company leverages its proprietary solution polymerization process to offer high-performance EPDM grades for automotive weather-stripping, construction membranes, and industrial seals. In 2024, Dow expanded its sustainable polymer initiatives by integrating recycled feedstocks and low-carbon processes into its EPDM production line, aligning with global climate goals and reinforcing its competitive edge in specialty elastomers.

ARLANXEO, a global leader in synthetic elastomers and a joint venture formerly with LANXESS, specializes in Keltan® EPDM products. With major production sites in the Netherlands and China, ARLANXEO supports industries like automotive, cable insulation, and HVAC systems. In 2024, the company invested in bio-based EPDM and digitalized production for better process efficiency. ARLANXEO’s Keltan Eco line—based partly on bio-ethylene—continues to gain popularity as industries move toward sustainable material sourcing and regulatory compliance.

KUMHO POLYCHEM is a prominent EPDM producer based in South Korea, known for its specialized rubber grades used in automotive parts, industrial hoses, and sealing applications. In 2024, the company focused on expanding its global reach by increasing exports to North America and Southeast Asia. KUMHO’s advanced polymer research enables the production of EPDM with enhanced elasticity and thermal stability. The firm also aligns with Korea’s national carbon neutrality strategy by exploring eco-friendly production technologies.

Top Key Players in the Market

- Dow

- Exxon Mobil Corporation

- Elevate (HOLCIM)

- ARLANXEO

- Johns Manville

- KUMHO POLYCHEM

- Sumitomo Chemical Co., Ltd.

- Lion Elastomers

- Mitsui Chemicals, Inc.

- PetroChina Company Limited

- Rubber Engineering & Development Company (REDCO)

- SK geo centric Co., Ltd.

- Versalis (Eni S.p.A)

- West American Rubber Company, LLC

Recent Developments

In 2024, Elevate, operated by Holcim, stood out in the EPDM roofing and lining market with a network of 21 manufacturing facilities in North America, producing advanced single-ply EPDM membranes, adhesives, and insulation systems.

In 2024, Johns Manville, a Berkshire Hathaway company, advanced its position in the EPDM roofing sector by launching the JM EPDM FIT Self-Adhered (SA) 60 mil membrane, officially released for shipment on October 1, 2024.

Report Scope

Report Features Description Market Value (2024) USD 4.4 Bn Forecast Revenue (2034) USD 7.7 Bn CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Seals and O-Rings, Hoses, Gaskets, Rubber Compounds, Roofing Membranes, Connectors and insulators, Others), By Application (Automotive, Building and Construction, Electrical and Electronics, Lubricant Additive, Plastic Modifications, Tires and Tubes, Others), By Sales Channel (Direct Sales, Indirect Sales) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Dow, Exxon Mobil Corporation, Elevate (HOLCIM), ARLANXEO, Johns Manville, KUMHO POLYCHEM, Sumitomo Chemical Co., Ltd., Lion Elastomers, Mitsui Chemicals, Inc., PetroChina Company Limited, Rubber Engineering & Development Company (REDCO), SK geo centric Co., Ltd., Versalis (Eni S.p.A), West American Rubber Company, LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Ethylene Propylene Diene Monomer MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Ethylene Propylene Diene Monomer MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Dow

- Exxon Mobil Corporation

- Elevate (HOLCIM)

- ARLANXEO

- Johns Manville

- KUMHO POLYCHEM

- Sumitomo Chemical Co., Ltd.

- Lion Elastomers

- Mitsui Chemicals, Inc.

- PetroChina Company Limited

- Rubber Engineering & Development Company (REDCO)

- SK geo centric Co., Ltd.

- Versalis (Eni S.p.A)

- West American Rubber Company, LLC