Global Environmental Remediation Market Size, Share, And Business Benefits By Site Type (Public, Private), By Medium (Soil, Water, Air), By End-use (Oil and Gas, Mining and Forestry, Agriculture, Automotive, Waste Management, Manufacturing, Construction, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 159979

- Number of Pages: 292

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

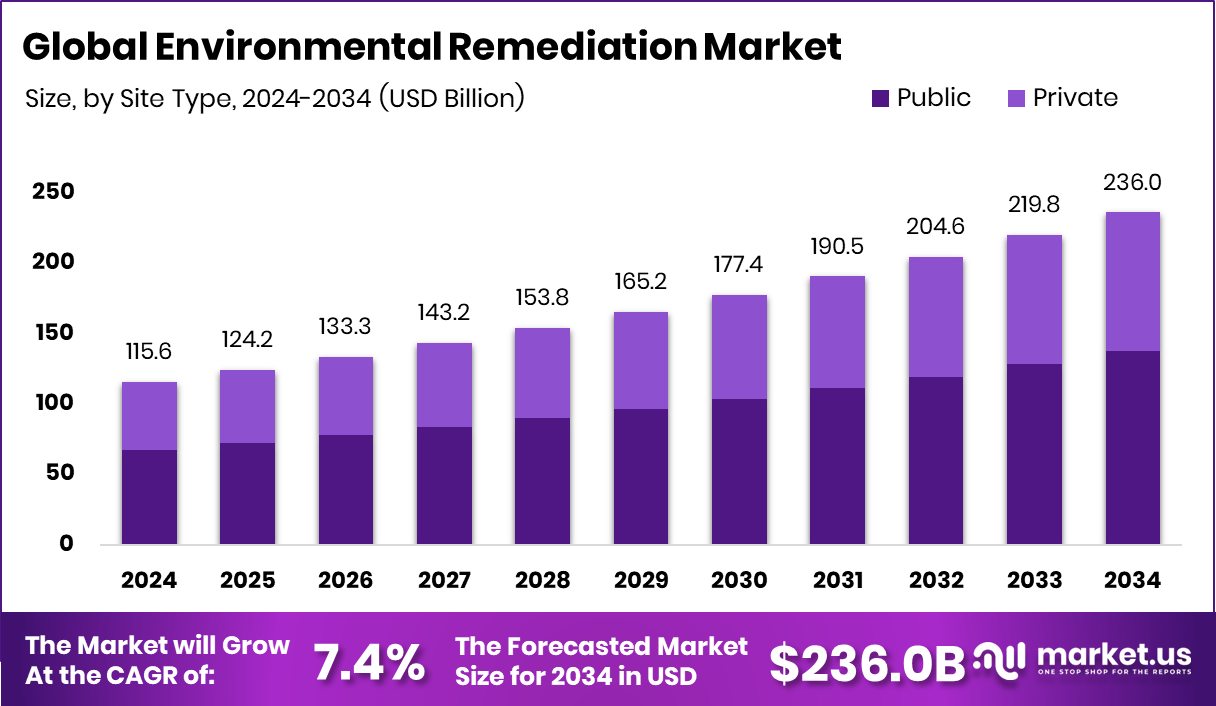

The Global Environmental Remediation Market is expected to be worth around USD 236.0 billion by 2034, up from USD 115.6 billion in 2024, and is projected to grow at a CAGR of 7.4% from 2025 to 2034. North America’s dominance highlights strict regulations and funding, driving a USD 53.0 Bn value.

Environmental remediation refers to the process of removing pollution, contaminants, or hazardous substances from soil, groundwater, surface water, or sediment to restore an area to a safe and usable condition. It is often carried out at industrial sites, landfills, or areas impacted by oil spills and chemical leaks. The main goal is to protect human health and the environment by cleaning up pollutants and preventing further damage.

The environmental remediation market represents the industry focused on providing technologies, services, and solutions to clean and restore polluted sites. This market spans soil washing, bioremediation, groundwater treatment, excavation, and other methods that help industries and governments address environmental challenges. As urbanization and industrial activities grow, demand for remediation continues to rise.

Stricter environmental regulations and growing awareness of pollution’s impact on public health are major growth factors. Governments worldwide are setting tougher cleanup standards, which compel industries to invest in remediation technologies.

Demand is fueled by increasing industrial accidents, legacy pollution from old facilities, and ongoing contamination of water sources. Rising public pressure for cleaner environments also drives industries and municipalities to take immediate action.

There are opportunities in adopting green and cost-efficient cleanup methods like bioremediation and phytoremediation. At the same time, policy decisions shape the industry. For instance, the U.S. Spending Bill will grant $40 billion in fossil fuel subsidies, while President Trump’s handouts to the fossil fuel industry will cost the public $80 billion over the next decade. Such measures highlight the paradox of supporting polluting industries while remediation needs grow, creating further space for innovation and sustainable solutions.

Key Takeaways

- The Global Environmental Remediation Market is expected to be worth around USD 236.0 billion by 2034, up from USD 115.6 billion in 2024, and is projected to grow at a CAGR of 7.4% from 2025 to 2034.

- Public sites account for 58.3%, highlighting government responsibility in driving Environmental Remediation Market initiatives.

- Soil leads with 48.5%, as contamination cleanup remains central to the Environmental Remediation Market scope.

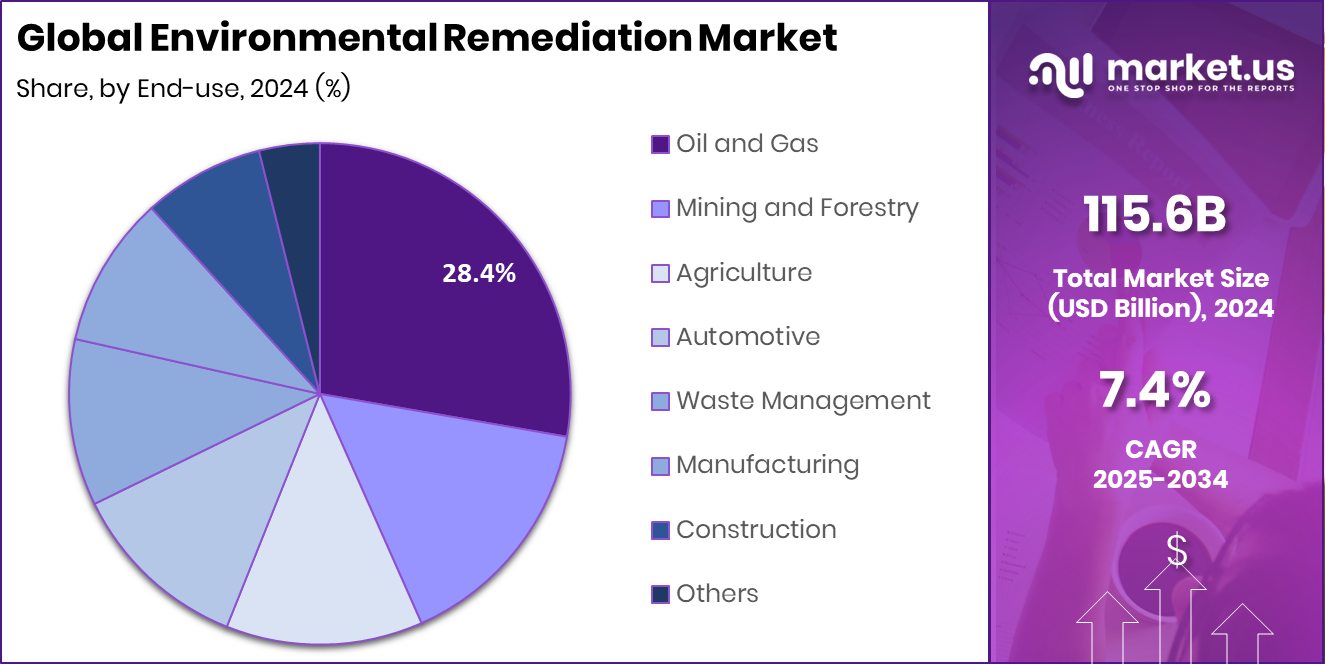

- Oil and gas hold 28.4%, emphasizing industry reliance on the Environmental Remediation Market for compliance.

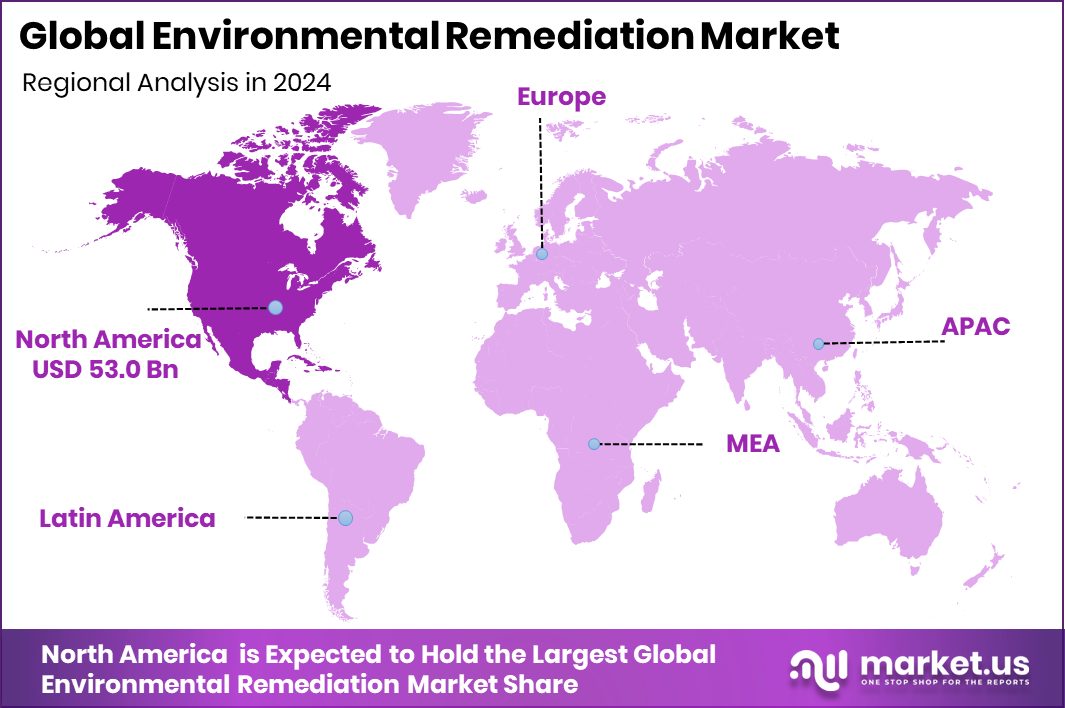

- The North American market size reached USD 53.0 Bn, reflecting strong remediation demand.

By Site Type Analysis

Environmental Remediation Market growth highlights a 58.3% share from public sites.

In 2024, Public held a dominant market position in the By Site Type segment of the Environmental Remediation Market, with a 49.2% share. This strong presence reflects the critical role of public sector initiatives and government-led cleanup programs in addressing large-scale contamination. Publicly managed sites often include former industrial areas, municipal landfills, and regions impacted by hazardous waste, where remediation is essential to safeguard communities and ecosystems.The significant share highlights the growing emphasis on restoring public lands and ensuring compliance with environmental regulations. This dominance also points to continued investments by governments and public authorities in remediation projects, underscoring their responsibility in managing pollution and setting long-term sustainability goals.

By Medium Analysis

By Medium, Soil represents 48.5% of the Environmental Remediation Market share.

In 2024, Soil held a dominant market position in the By Medium segment of the Environmental Remediation Market, with a 49.2% share. This leadership reflects the high frequency of contamination found in soil due to industrial discharge, agricultural chemicals, and improper waste disposal.Soil remediation remains a priority as it directly impacts agricultural productivity, groundwater safety, and human health. The strong share underscores the demand for effective cleanup methods such as excavation, stabilization, and biological treatments that restore land for safe use. With soil being the most visibly affected medium in contaminated areas, its dominance in this segment highlights the pressing need for remediation solutions that protect both ecological systems and surrounding communities.

By End-use Analysis

Oil and gas drive the Environmental Remediation Market with a 28.4% share.

In 2024, Oil and Gas held a dominant market position in the end-use segment of the Environmental Remediation Market, with a 49.2% share. This leading position is driven by the sector’s high environmental risk profile, where activities such as drilling, refining, and transportation often result in soil and groundwater contamination. The significant share highlights the continuous demand for remediation to address oil spills, leakage, and hazardous waste generated across the value chain.

With strict environmental regulations and the growing need to manage legacy pollution at extraction and refining sites, the oil and gas industry remains the largest contributor to remediation projects. This dominance underscores its critical role in shaping remediation priorities and investments.

Key Market Segments

By Site Type

- Public

- Private

By Medium

- Soil

- Water

- Air

By End-use

- Oil and Gas

- Mining and Forestry

- Agriculture

- Automotive

- Waste Management

- Manufacturing

- Construction

- Others

Driving Factors

Rising Government Funding and Environmental Safety Measures

One of the strongest driving factors for the Environmental Remediation Market is the growing role of government funding and safety-focused initiatives. Public authorities are increasingly investing in projects that clean contaminated land, restore water sources, and ensure healthier ecosystems. Such support not only accelerates the pace of remediation but also encourages the adoption of modern and eco-friendly technologies.

Strong financial backing provides stability for large-scale cleanup operations, especially in areas impacted by industrial and agricultural activities. Recent announcements further highlight this trend. The U.S. Department of Agriculture will release $20 million of frozen farmer funds, and the Agriculture Committee has unveiled a budget bill that proposes a $17 million funding boost. These measures emphasize long-term environmental protection goals.

Restraining Factors

High Cleanup Costs Limit Wider Remediation Adoption

A key restraining factor for the Environmental Remediation Market is the high cost of cleanup activities. Restoring polluted soil, water, or land often requires advanced technologies, specialized labor, and long project timelines, which can significantly increase expenses. For many small industries and local authorities, the financial burden makes it difficult to initiate or sustain remediation projects.

In some cases, the cost of treatment may even exceed the perceived value of the restored site, causing delays or limited action. These high costs also discourage the use of innovative but expensive methods, even if they are more effective. As a result, financial barriers remain a major challenge in ensuring widespread and timely adoption of remediation solutions.

Growth Opportunity

Expanding Urban Agriculture Drives New Remediation Opportunities

A major growth opportunity in the Environmental Remediation Market comes from the rise of urban agriculture and innovative farming practices. As more cities encourage food production within urban spaces, the need to clean and restore contaminated soils becomes critical. Many urban areas carry legacies of industrial pollution, making remediation essential before safe farming can take place. This creates a strong demand for cost-effective and sustainable cleanup methods that can transform idle or polluted land into productive agricultural zones.

Recent initiatives also highlight this shift, as the USDA announced a $14.4 million investment in urban agriculture and innovative production. Such funding not only promotes local food security but also boosts remediation opportunities in expanding city landscapes.

Latest Trends

Adoption of Green and Smart Remediation Technologies

One of the latest trends in the Environmental Remediation Market is the shift toward green and smart technologies that make cleanup more sustainable and efficient. Bioremediation using plants or microbes, along with AI-powered monitoring tools, is gaining momentum as industries and governments look for cost-effective and eco-friendly methods.

Smart technologies help track contamination in real time, reducing delays and improving project outcomes. This trend is further supported by global funding directed toward sustainable agriculture and innovation. For example, Invest International backed Amsterdam’s ACT Fund with EUR 10 million and USD 10 million to fuel regenerative agriculture, and $1 million was allocated for AI-powered agriculture technology. Such investments highlight a strong link between technology and environmental cleanup progress.

Regional Analysis

In 2024, North America led the Environmental Remediation Market with a 45.9% share.

The Environmental Remediation Market demonstrates varied regional contributions, reflecting differences in industrial activities, environmental regulations, and public investment.

North America emerged as the dominating region in 2024, holding a 45.9% share valued at USD 53.0 Bn. This leadership is supported by strict regulatory frameworks and significant government spending on cleanup projects across contaminated soil and groundwater.

Europe continues to remain an active region, driven by its long-standing emphasis on sustainability and restoration of industrial sites, while the Asia Pacific is witnessing strong momentum owing to rapid urbanization and growing environmental concerns linked to expanding manufacturing hubs.

The Middle East & Africa region is gradually strengthening its focus on remediation, particularly in areas affected by oil extraction and mining-related contamination. Latin America also presents opportunities, as environmental protection policies and land restoration projects are gaining attention in resource-driven economies.

While North America holds the largest share, Europe and the Asia Pacific show steady involvement in large-scale projects, and emerging regions are gradually expanding their role.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ENTACT continues to be recognized for its expertise in field remediation and geotechnical construction services. The company’s integrated approach, which combines remediation with earthwork and civil services, enables it to address contamination in both soil and groundwater efficiently. Its hands-on execution model sets it apart in delivering large-scale projects with high safety and compliance standards.

DEME boasts strong capabilities in dredging and marine engineering, positioning it well for sediment remediation projects. With many coastal and river systems requiring cleanup due to industrial pollution, DEME’s specialized knowledge in water-based remediation supports the restoration of ecologically sensitive areas. Its engineering-driven solutions strengthen the market’s ability to manage offshore and nearshore contamination challenges.

WSP, with its global presence, adds depth to the market through consulting, design, and management expertise. The firm’s involvement in environmental and engineering solutions ensures clients can navigate regulatory requirements while adopting sustainable remediation strategies. WSP’s advisory capabilities help in planning long-term environmental programs that align with both corporate and public objectives.

Top Key Players in the Market

- ENTACT

- DEME.

- WSP

- CLEAN HARBORS, INC.

- Sequoia Environmental

- Bristol Industries, LLC.

- In-Situ Oxidative Technologies, Inc.

- HDR, Inc.

- AECOM.

- Tetra Tech Inc.

- BRISEA

- Jacobs

Recent Developments

- In July 2025, ENTACT made public its increased emphasis on beneficial reuse strategies—repurposing treated soils and sediments instead of disposing of them offsite—to reduce costs and improve sustainability in remediation operations.

- In May 2025, DEME completed the acquisition of Norwegian offshore wind contractor Havfram—a move that boosts its offshore capabilities, although more focused on energy infrastructure, it broadens DEME’s marine reach.

Report Scope

Report Features Description Market Value (2024) USD 115.6 Billion Forecast Revenue (2034) USD 236.0 Billion CAGR (2025-2034) 7.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Site Type (Public, Private), By Medium (Soil, Water, Air), By End-use (Oil and Gas, Mining and Forestry, Agriculture, Automotive, Waste Management, Manufacturing, Construction, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ENTACT, DEME., WSP, CLEAN HARBORS, INC., Sequoia Environmental, Bristol Industries, LLC., In-Situ Oxidative Technologies, Inc., HDR, Inc., AECOM, Tetra Tech Inc., BRISEA, Jacobs Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Environmental Remediation MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample

Environmental Remediation MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ENTACT

- DEME.

- WSP

- CLEAN HARBORS, INC.

- Sequoia Environmental

- Bristol Industries, LLC.

- In-Situ Oxidative Technologies, Inc.

- HDR, Inc.

- AECOM.

- Tetra Tech Inc.

- BRISEA

- Jacobs