Global Environmental Catalysts Market By Type (Heterogeneous, Homogeneous, and Biocatalysts (Enzymes)), By Application (Air Pollution Control, Water And Wastewater Treatment, Mobile Emission Control, Stationary Emission Control, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171729

- Number of Pages: 346

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

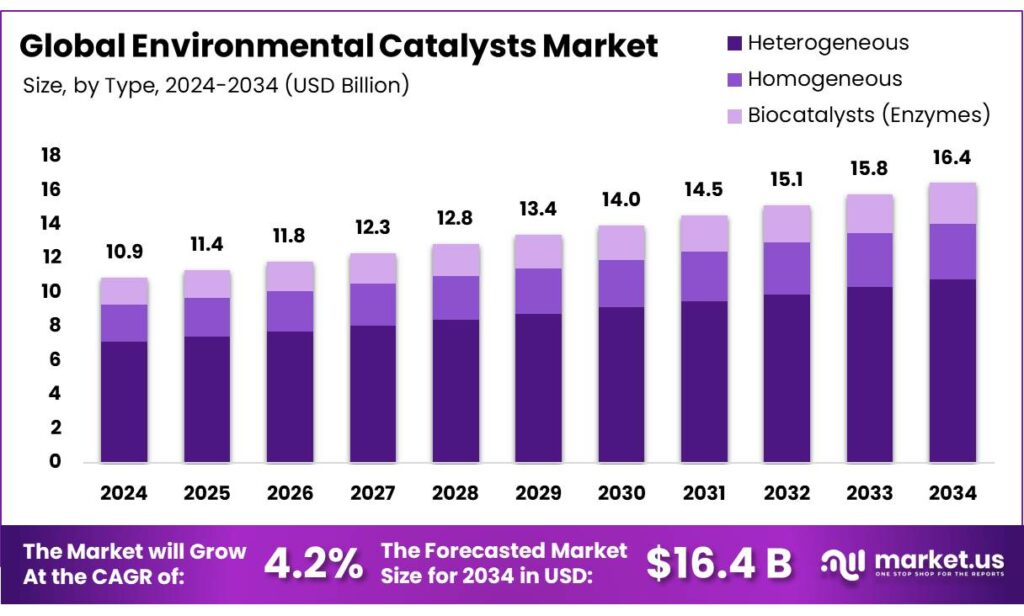

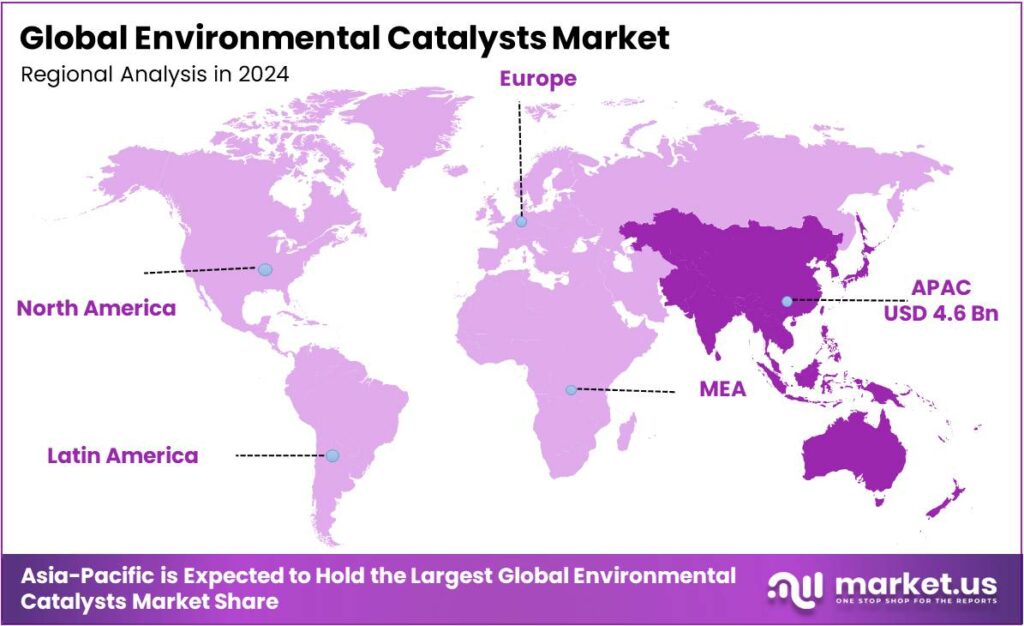

The Global Environmental Catalysts Market size is expected to be worth around USD 16.4 Billion by 2034, from USD 10.9 Billion in 2024, growing at a CAGR of 4.2% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 36.8% share, holding USD 24.3 Billion in revenue.

Environmental catalysts are substances that speed up chemical reactions to break down or convert harmful pollutants into less toxic substances, playing a crucial role in cleaning air and water by reducing emissions from cars, factories, and other sources, helping fight smog, greenhouse gases, and hazardous chemicals. The market is primarily driven by the increasing need to mitigate pollution and comply with stringent regulatory standards across various industries.

The market is significantly shaped by the automotive sector, where catalysts are used in vehicles to reduce emissions of harmful pollutants. However, challenges such as the improper disposal of spent catalysts and the rising cost of precious metals used in catalytic processes persist. Simultaneously, there is a growing shift towards bio-based catalysts as industries seek more sustainable alternatives.

Additionally, the market is characterized by the demand to reduce pollution. Only seven countries in the world, less than 4%, which are Australia, Estonia, New Zealand, Iceland, Grenada, Puerto Rico, and French Polynesia, had air quality levels at or below the healthy annual average recommended by the World Health Organization (WHO) in 2024.

- According to a report by UNICEF, annually, more than 700,000 deaths in children under 5 years are linked to air pollution, which represents around 15% of all global deaths in children under five.

Key Takeaways

- The global environmental catalysts market was valued at USD 10.9 billion in 2024.

- The global environmental catalysts market is projected to grow at a CAGR of 4.2% and is estimated to reach USD 16.4 billion by 2034.

- Based on the types, heterogeneous catalysts dominated the market, with a market share of around 65.5%.

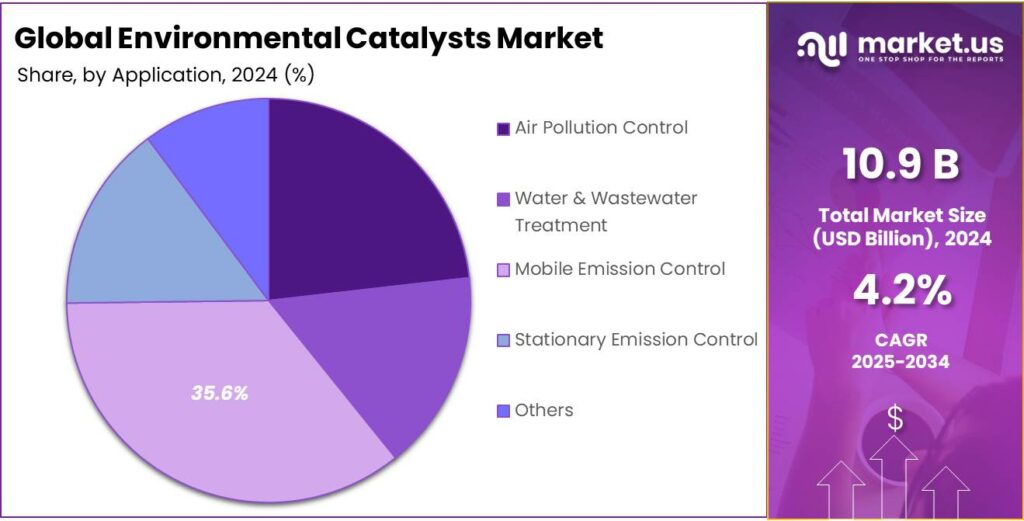

- Among the applications of environmental catalysts, mobile emission control held a major share in the market, 35.6% of the market share.

- In 2024, the Asia Pacific was the most dominant region in the environmental catalysts market, accounting for around 42% of the total global consumption.

Type Analysis

Heterogeneous Environmental Catalysts Are a Prominent Segment in The Market.

The environmental catalysts market is segmented based on type into heterogeneous, homogeneous, and biocatalysts (enzymes). The heterogeneous catalysts dominated the market, comprising around 65.5% of the market share, primarily due to their robustness, ease of separation, and versatility in industrial applications. Unlike homogeneous catalysts, which are in the same phase as the reactants and require complex separation processes, heterogeneous catalysts are often solid and can be easily separated from the reaction mixture, making them more practical for large-scale industrial use. This characteristic reduces operational costs and simplifies recycling.

Additionally, heterogeneous catalysts are more stable under extreme operating conditions, such as high temperatures and pressures, which are common in automotive and industrial processes. Biocatalysts, while highly selective and environmentally friendly, often suffer from limitations such as sensitivity to temperature and pH, as well as higher production costs, making them less viable for high-volume applications compared to their heterogeneous counterparts.

Application Analysis

The Environmental Catalysts Were Mostly Utilized for Mobile Emission Control.

Based on the applications of environmental catalysts, the market is divided into air pollution control, water & wastewater treatment, mobile emission control, stationary emission control, and others. The mobile emission control application dominated the market, with a market share of 35.6%, particularly in the automotive industry, due to stringent regulations and the urgent need to reduce vehicle emissions. Mobile sources, such as cars, trucks, and buses, are significant contributors to air pollution, particularly in urban areas, where traffic density is high.

Emission standards, such as the EPA regulations, require the installation of catalytic converters in vehicles to reduce harmful gases such as nitrogen oxides (NOx), carbon monoxide (CO), and hydrocarbons (HC). In contrast, air pollution control in stationary sources, such as power plants, and water or wastewater treatment, often relies on alternative technologies, such as scrubbers or biological treatments, which may not require the same level of catalytic intervention.

Key Market Segments

By Type

- Heterogeneous

- Homogeneous

- Biocatalysts (Enzymes)

By Application

- Air Pollution Control

- Water & Wastewater Treatment

- Mobile Emission Control

- Stationary Emission Control

- Others

Drivers

Stringent Regulatory Frameworks Drive the Environmental Catalysts Market.

Stringent regulatory frameworks are significantly influencing the growth and innovation within the environmental catalysts market. Governments worldwide are implementing increasingly rigorous environmental standards to reduce pollutants and greenhouse gas emissions, thereby encouraging the adoption of catalytic technologies. For instance, the European Union’s Euro 6 standards, which limit the emissions of nitrogen oxides (NOx) and particulate matter from vehicles, have driven automotive manufacturers to invest in advanced catalytic converters. In addition, the U.S. Environmental Protection Agency (EPA) mandates the use of catalysts in industrial processes to lower emissions from power plants and refineries.

Furthermore, these regulations are pushing industries to adopt cleaner technologies for waste management and air purification. Moreover, countries such as India, Japan, and China are tightening their air quality standards, necessitating the widespread use of environmental catalysts in manufacturing and energy sectors. For instance, in India, polluters failing to inform authorities about emission breaches now face penalties from INR10,000 to INR15 lakh, plus INR10,000 daily for continued non-compliance. This regulatory pressure enhances environmental sustainability and creates substantial demand for innovative catalyst solutions.

Restraints

Concerns Related to Improper Disposal of Spent Catalysts Might Hamper the Growth of the Environmental Catalysts Market.

Concerns regarding the improper disposal of spent catalysts pose a significant challenge to the growth of the environmental catalysts market. Catalysts, particularly those used in automotive and industrial applications, often contain precious metals such as platinum, palladium, and rhodium, which, if not properly recycled, can lead to environmental contamination. Improper disposal can lead to toxic runoff, soil contamination, and the release of harmful metals into the environment. Moreover, as environmental regulations become stricter, the disposal of these materials is increasingly under scrutiny, with several jurisdictions imposing heavy penalties for improper handling.

To mitigate these risks, industries are focusing on improving recycling techniques, as the current lack of standardized recycling practices and infrastructure could hinder the market’s growth, particularly in developing regions where waste management systems are less advanced. For instance, in September 2025, Accurate Recycling, a giant in the recycling business, launched the Certified OEM Converter Program, where catalytic converters are not exclusively seen as scrap commodities. Some selected units can be tested, cleaned, and recertified to meet EPA standards, making them suitable for resale as functioning, emissions-compliant auto parts.

Opportunity

Rapid Expansion of the Transportation Sector Creates Opportunities in the Environmental Catalysts Market.

The rapid expansion of the transportation sector is presenting significant opportunities in the environmental catalysts market. As global urbanization accelerates and vehicle ownership rises, particularly in emerging economies, the demand for cleaner, more efficient transportation systems is of key significance.

- According to the European Automobile Manufacturers’ Association (ACEA), worldwide registrations of cars rose 5% to 37.4 million units in 2024, led by China’s 12% surge, and global car production grew by 3.5% to 37.7 million, with Asia leading the market, China, Japan, and India being the rapidly growing markets.

For instance, in 2022, China alone produced over 27 million vehicles, making it the world’s largest automobile producer, and India followed with nearly 5.5 million units. As the number of vehicles on the road increases, it creates a significant risk of respiratory/heart issues, cancers, smog, and a significant contribution to greenhouse gases, which drive climate change. This increasing risk has heightened the demand for catalysts that reduce harmful emissions such as nitrogen oxides (NOx) and hydrocarbons.

Trends

Shift Towards Bio-Based Catalysts.

The shift towards bio-based catalysts is an emerging and significant trend in the environmental catalysts market, driven by the increasing demand for sustainable and eco-friendly alternatives to traditional catalysts. Bio-based catalysts, derived from renewable resources such as enzymes, microorganisms, and plant-based materials, are offering several environmental benefits, including lower toxicity and reduced carbon footprints. For instance, in December 2025, EnviroZyme enhanced its BioAid nutrient product line and launched microbial solutions, such as BioRemove Phenol, to degrade specific organic components and contaminants.

Additionally, the adoption of biocatalysts in industrial processes, such as the synthesis of green chemicals, is gaining momentum due to their efficiency at lower temperatures and pressures, which reduces energy consumption. There is a high utilization of enzymes, which have replaced chemical catalysts, in several industrial applications, including detergents and food processing. The transition aligns with global efforts to reduce reliance on fossil fuels and promote circular economies, encouraging further development of bio-based catalytic solutions in sectors such as energy, agriculture, and waste management.

Geopolitical Impact Analysis

Geopolitical Tensions Are Impacting the Environmental Catalysts Market by Disrupting the Essential Supply Chains in the Market.

The geopolitical tensions have had a notable impact on the environmental catalysts market, influencing supply chains and regulatory landscapes. Escalating trade disputes, particularly between major economies such as the U.S. and China, have led to disruptions in the supply of critical raw materials such as platinum, palladium, and rhodium, which are essential for the production of automotive and industrial catalysts.

For instance, global palladium prices surged due to supply disruptions caused by conflicts in the maritime route of the South China Sea and trade tariffs on Chinese imports, affecting the cost structures of catalytic converter manufacturers. Additionally, sanctions imposed on specific countries, such as Russia, which produces between 25% and 30% of the world’s palladium, have intensified the pressure on global catalyst manufacturers, leading to higher prices and limited availability.

Moreover, geopolitical tensions have affected the pace of international cooperation on environmental standards, as nations prioritize economic and political interests over collective environmental goals. This uncertainty in trade relations and regulatory alignment leads to slower adoption of environmental catalysts, particularly in developing regions that rely on imports of both raw materials and technology.

Regional Analysis

Asia Pacific Held the Largest Share of the Global Environmental Catalysts Market.

In 2024, the Asia Pacific dominated the global environmental catalysts market, holding about 42% of the total global consumption. The region holds the largest share of the global environmental catalysts market, driven by rapid industrialization, urbanization, and stringent environmental regulations across key countries. China, as the largest contributor to the region’s market, is aggressively tackling air pollution with policies that mandate the use of advanced catalytic technologies in automotive and industrial sectors.

According to the United Nations Industrial Development Organization, manufacturing employment in the Asia Pacific increased by 1.7%, as the region accounted for 56.7% of the world’s manufacturing value added (MVA) in 2023. Similarly, the Asia Pacific is a very large market for automotive, with China accounting for 40% of global capacity, surpassing the European Union.

Furthermore, Asia Pacific’s growing chemical and manufacturing industries, particularly in countries such as South Korea and Taiwan, are increasingly deploying environmental catalysts to comply with emission control regulations, fostering further market expansion in the region.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The companies are focusing on innovation and developing more efficient and sustainable catalysts, such as bio-based or advanced heterogeneous catalysts, to meet evolving regulatory standards. In addition, the players emphasize strategic partnerships with automakers, industrial manufacturers, and government agencies to secure long-term contracts and ensure compliance with stringent emission regulations.

Similarly, companies focus on expanding their geographic presence through investments and acquisitions, particularly in emerging markets where industrialization and vehicle ownership are rapidly growing. Furthermore, some major players invest in recycling technologies to address concerns related to spent catalysts, enhancing their environmental credentials and cost-efficiency.

The following are some of the major players in the industry

- BASF SE

- Johnson Matthey

- Clariant AG

- Umicore

- Topsoe

- Honeywell

- Albemarle

- Evonik Industries

- Solvay

- R. Grace & Co.

- Shell Plc

- JGC Catalysts and Chemicals Ltd.

- CATALER CORPORATION

- Other Key Players

Key Development

- In August 2024, BASF announced the commercial launch of Fourtiva, a new Fluid Catalytic Cracking (FCC) catalyst for gasoil to mild resid feedstock.

- In August 2024, Clariant, a sustainability-focused specialty chemical company, announced that a deoxygenation catalyst from its EnviCat Green series was selected for a major green ammonia project in China.

Report Scope

Report Features Description Market Value (2024) US$10.9 Bn Forecast Revenue (2034) US$16.4 Bn CAGR (2025-2034) 4.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Heterogeneous, Homogeneous, and Biocatalysts (Enzymes)), By Application (Air Pollution Control, Water & Wastewater Treatment, Mobile Emission Control, Stationary Emission Control, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape BASF SE, Johnson Matthey, Clariant AG, Umicore, Topsoe, Honeywell, Albemarle, Evonik Industries, Solvay, W. R. Grace & Co., Shell Plc, JGC Catalysts and Chemicals Ltd., Cataler Corporation, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Environmental Catalysts MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Environmental Catalysts MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- Johnson Matthey

- Clariant AG

- Umicore

- Topsoe

- Honeywell

- Albemarle

- Evonik Industries

- Solvay

- R. Grace & Co.

- Shell Plc

- JGC Catalysts and Chemicals Ltd.

- CATALER CORPORATION

- Other Key Players