Global Engineered Wood Market Size, Share and Report Analysis By Type (Plywood, Medium Density Fiberboard (MDF), Cross Laminated Timber (CLT), Laminated Veneer Lumber (LVL), Oriented Strand Board (OSB), Glue Laminated Timber (Glulam), Particle Board), By Application (Construction, Floorig, Furniture, Packaging, Transport, Others), By End User (Residential, Non-Residential) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 175471

- Number of Pages: 337

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

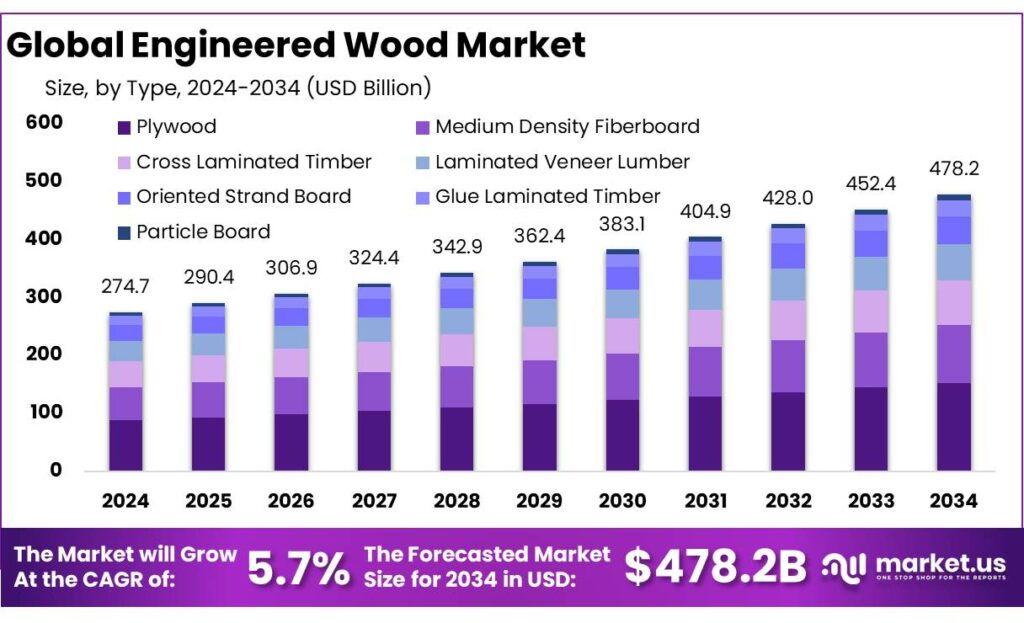

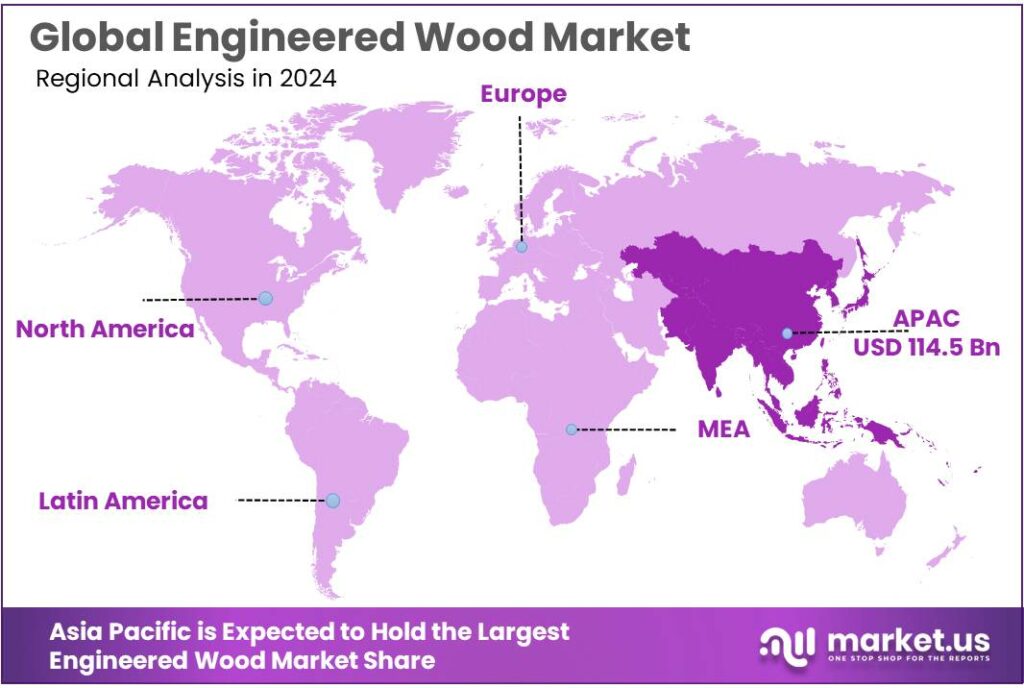

Global Engineered Wood Market size is expected to be worth around USD 478.2 Billion by 2034, from USD 274.7 Billion in 2024, growing at a CAGR of 5.7% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 41.7% share, holding USD 114.5 Billion in revenue.

Engineered wood—products such as cross-laminated timber, glulam, laminated veneer lumber (LVL), and structural panels—has moved from a “niche green material” to a mainstream construction input for mid-rise housing, commercial interiors, and industrial retrofits. The industry sits inside a large, resilient upstream base: global industrial roundwood removals reached a record 2.04 billion m³ in 2022, signaling deep supply-chain scale for sawmilling, panel boards, and downstream engineered applications.

- In Europe alone, roundwood production was about 510 million m³ in 2022, reinforcing the region’s capacity to supply structural wood and panel feedstocks.

The current industrial scenario is shaped by high-volume panel demand and a gradual shift toward mass-timber systems in multi-storey construction. FAO reported global wood-based panel production expanding 5% to 393 million m³, while panel trade grew 6% to 90 million m³, signaling recovering throughput and cross-border demand for engineered wood inputs and finished panels. Alongside this, broader forest-products reporting shows that trade values can swing materially with construction cycles and macro conditions, reinforcing why engineered wood producers focus on flexible capacity, diversified end-markets, and inventory discipline.

Key driving factors cluster around carbon performance, build efficiency, and policy signals. From a life-cycle perspective, peer-reviewed findings indicate timber buildings can show 28–47% lower embodied energy than concrete and steel comparators on average, which supports procurement decisions where embodied-carbon reporting is becoming standard practice.

- The U.S. Department of Agriculture announced $80 million in Wood Innovation Grants to expand timber markets and wood-product manufacturing, which directly supports mass-timber commercialization, processing upgrades, and project development pipelines.

In the EU, the updated Construction Products Regulation was published as Regulation (EU) 2024/3110, strengthening the regulatory infrastructure for product information and performance declarations—important for engineered wood’s acceptance in large projects.

In Europe, the new EU Construction Products Regulation (EU) 2024/3110 strengthens the framework for construction products and explicitly links the sector to improved sustainability performance information, reinforcing demand for documented, lower-impact materials and verified performance claims.

Key Takeaways

- Engineered Wood Market size is expected to be worth around USD 478.2 Billion by 2034, from USD 274.7 Billion in 2024, growing at a CAGR of 5.7%.

- Plywood held a dominant market position, capturing more than a 32.8% share.

- Construction held a dominant market position, capturing more than a 48.2% share.

- Residential held a dominant market position, capturing more than a 68.6% share.

- Asia Pacific accounted for 41.7% of the market, valued at 114.5 Bn.

By Type Analysis

Plywood leads the Engineered Wood Market with a strong 32.8% share in 2024.

In 2024, Plywood held a dominant market position, capturing more than a 32.8% share, reflecting its long-standing role as the most widely used engineered wood type across construction, furniture, and interior applications. Its leadership is supported by its versatile structure, durability, and compatibility with both residential and commercial building requirements. Industries relied heavily on plywood in 2024 as demand continued rising for cost-efficient and stable panel products that can withstand heavy loads, moisture variations, and frequent handling. The material’s widespread acceptance among contractors and architects further strengthened its presence across developing and mature markets.

By Application Analysis

Construction leads the Engineered Wood Market with a firm 48.2% share in 2024.

In 2024, Construction held a dominant market position, capturing more than a 48.2% share, driven by steady growth in residential, commercial, and infrastructure development. Engineered wood products such as plywood, OSB, LVL, and CLT continued to replace traditional solid wood and concrete in many regions because they offer better strength-to-weight ratios, faster installation, and improved sustainability. Builders increasingly preferred engineered wood in 2024 for framing, flooring systems, roofing panels, wall structures, partitions, and exterior sheathing, ensuring consistent demand throughout the year.

By End User Analysis

Residential segment leads the Engineered Wood Market with a strong 68.6% share in 2024.

In 2024, Residential held a dominant market position, capturing more than a 68.6% share, reflecting the growing reliance on engineered wood for homebuilding, interior upgrades, and renovation activities. The segment benefited from rising urban housing demand, increased preference for sustainable materials, and the widespread use of plywood, OSB, and laminated products in flooring, roofing, wall panels, and cabinetry. Homeowners in 2024 increasingly favored engineered wood because it provides strength, uniformity, and cost efficiency, making it a practical choice for both new constructions and remodeling projects.

Key Market Segments

By Type

- Plywood

- Medium Density Fiberboard (MDF)

- Cross Laminated Timber (CLT)

- Laminated Veneer Lumber (LVL)

- Oriented Strand Board (OSB)

- Glue Laminated Timber (Glulam)

- Particle Board

By Application

- Construction

- Floorig

- Furniture

- Packaging

- Transport

- Others

By End User

- Residential

- Non-Residential

Emerging Trends

Buy Clean procurement and EPD-first specifications are becoming the new normal for engineered wood

One clear trend shaping engineered wood in 2024–2025 is the move toward documented low-carbon building materials, where buyers want proof, not promises. Public agencies and large developers are increasingly asking for Environmental Product Declarations (EPDs) and other lifecycle documents during procurement. This trend is not just a sustainability discussion; it is becoming a practical requirement in how projects get approved and purchased, especially for public buildings, large renovations, and institutional construction.

The policy pressure behind this shift is strong because the building sector is a major climate lever. UNEP reports that buildings were responsible for 34% of global energy demand and 37% of energy- and process-related CO₂ emissions in 2022. When that reality meets national climate targets, governments start focusing on the materials that go into buildings, not only operational energy.

In the United States, this trend is becoming “real demand” through Buy Clean programs and related funding. A federal progress report on the Federal Buy Clean Initiative states that EPA announced more than $160 million in grants to 38 recipients to improve measurement of embodied carbon in construction materials. The same report highlights that suppliers are responding fast: in the first year of GSA’s Buy Clean program, suppliers published over 23,800 additional North American EPDs, with over 153 companies participating.

In 2025, public investment is also helping expand the engineered wood ecosystem, especially around domestic supply and manufacturing capability. USDA announced that the U.S. Forest Service is awarding $80 million in Wood Innovation Grants to spur wood products manufacturing and expand timber markets.

Drivers

Decarbonization rules in construction are pushing engineered wood into the mainstream

One major driving factor for engineered wood is the construction sector’s fast-growing focus on measuring and cutting embodied carbon. Buildings and construction remain a large emissions source, so material choices are getting more attention in public policy, procurement, and design. The UN Environment Programme notes that buildings were responsible for 34% of global energy demand and 37% of energy- and process-related CO₂ emissions in 2022.

This climate-and-compliance pressure is turning into real money and real documentation requirements. Under the U.S. Federal Buy Clean momentum, a federal progress report highlights that EPA announced more than $160 million in grants to 38 recipients to improve measurement of embodied carbon in construction materials. The same report notes that, in the first year of GSA’s Buy Clean program, suppliers published over 23,800 additional North American EPDs, with over 153 companies participating.

At the same time, building-code acceptance is removing friction for broader adoption—especially for taller wood structures. The International Code Council has documented that the 2021 International Building Code added three new construction types to recognize tall mass timber systems. This code evolution helps move mass timber from “special case” to “permitted pathway,” which improves confidence for insurers, plan reviewers, and project owners. When code pathways become clearer, engineered wood demand becomes less about persuasion and more about execution—designing, permitting, and building on schedule.

Industry production trends also support this demand pull. FAO’s forest products reporting shows wood-based panels at industrial scale, listing global wood-based panel production at 393 million m³ in 2024. This matters because a strong panel base underpins downstream engineered wood use—construction sheathing, subfloors, interior fit-outs, packaging, and prefabricated assemblies that depend on consistent panel availability.

Restraints

Raw Material Price Volatility and Supply Constraints Limit Engineered Wood Growth

One of the most significant restraining factors confronting the engineered wood industry today is the volatility in raw material prices and the inconsistent supply of timber, which together create uncertainty for manufacturers, builders, and end users. Unlike some construction materials that come from more predictable sources, engineered wood depends directly on forest outputs and associated value chains.

For example, fluctuations in timber supply and prices were highlighted in broader wood manufacturing discussions, where raw material shortages caused by environmental factors or pest outbreaks have directly impacted production costs for wood panels and engineered products. Manufacturers noted that changes in timber supply caused by climate-related stresses and regulatory limits affect production costs and influence pricing strategies in the sector.

This reality of unstable timber pricing and availability hurts engineered wood producers in several ways. First, unpredictable input costs make long-term planning difficult. A factory that intends to run multiple product lines needs certainty around wood chip, veneer, and fiber costs — without it, budgeting and investment in capacity expansion becomes riskier. Second, profit margins shrink when raw material costs rise faster than finished product prices can adjust, especially in competitive markets where alternative materials like steel, cement, or plastics might undercut engineered wood based on cost alone.

Governments and international bodies are aware of these constraints and are taking steps to balance sustainability with supply stability. Initiatives to expand planted forest areas, promote sustainable forest management, and develop better forest inventories aim to ensure that timber supply can meet long-term demand without degrading ecosystems. However, these policies take time to influence market dynamics and often contribute to short-term price volatility as harvest levels and regulatory requirements evolve.

Opportunity

Public “low-carbon building” programs are opening a clear runway for mass timber and engineered wood

A major growth opportunity for engineered wood is the rapid expansion of low-carbon construction programs, especially where governments are putting real budgets behind “clean materials” and verified environmental reporting. The logic is straightforward: when public agencies start buying based on carbon performance, it creates a dependable pipeline for products that can document impacts and scale supply. UNEP notes that buildings account for over 34% of global energy demand and around 37% of energy and process-related CO₂ emissions.

In the United States, federal “Buy Clean” activity is turning into measurable market pull. A federal progress report states that in July 2024, EPA announced more than $160 million in grants to 38 recipients to improve the measurement of embodied carbon in construction materials. The same report notes that, in the first year of GSA’s Buy Clean program, suppliers published over 23,800 additional North American Environmental Product Declarations (EPDs), with over 153 companies participating (including firms publishing first-ever EPDs).

There is also a practical pathway opening on the building-code side, which reduces adoption risk for mass timber. The International Code Council documented that the 2021 International Building Code (IBC) added three new construction types (IV-A, IV-B, IV-C) to support tall mass timber. Industry technical summaries around these provisions commonly note allowances up to 18 stories and 270 feet under the updated framework, which improves confidence for developers considering larger timber buildings.

On the supply-side, government funding is actively trying to expand timber manufacturing and product innovation capacity—another direct growth lever for engineered wood. USDA announced that the U.S. Forest Service is awarding $80 million in Wood Innovation Grants (July 2025) to spur wood products manufacturing and expand timber markets.

Regional Insights

Asia Pacific dominates the Engineered Wood Market with 41.7% share, valued at 114.5 Bn, supported by scale manufacturing and rapid urban building needs.

Asia Pacific leads the engineered wood market because the region combines high construction demand with deep, cost-efficient panel manufacturing. In 2024, Asia Pacific accounted for 41.7% of the market, valued at 114.5 Bn, as housing starts, commercial fit-outs, and infrastructure-linked building kept plywood, OSB, LVL, and other panel products in steady rotation. A key structural advantage is that Asia is home to 54% of the world’s urban population—more than 2.2 billion people—creating continuous demand for apartments, public facilities, and renovation activity that consumes engineered wood across walls, flooring, roofing, and interiors.

On the supply side, Asia Pacific benefits from strong regional production concentration, especially in wood-based panels. FAO’s forest products statistics show China at 45% of global wood-based panel production, with other Asian producers also listed among leading countries (including India at 4% and Thailand at 3%), highlighting why panel availability and manufacturing capacity are structurally stronger in this region than elsewhere.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

UFP Industries manages operations across 170+ facilities worldwide, supporting construction, packaging, and industrial wood markets. With revenues surpassing USD 8.2 billion, the company supplies engineered components, treated wood, and structural panels. Its wide distribution network and diversified product lines make it a key contributor to engineered wood growth.

Weyerhaeuser manages 10.5 million acres of timberland in the U.S. and licenses 14 million acres in Canada. With revenues above USD 7.7 billion, the company supplies OSB, plywood, and engineered structural lumber. Vertical integration from forests to mills gives Weyerhaeuser strong control over raw materials and product quality.

Huber Engineered Woods operates five U.S. manufacturing plants, producing ZIP System® sheathing, AdvanTech® flooring, and specialty engineered panels. The company is part of J.M. Huber Corporation, which exceeds USD 3 billion in annual revenue. Its innovation-driven portfolio strengthens premium categories within the engineered wood market.

Top Key Players Outlook

- Raute Group

- Universal Forest Products, Inc

- Boise Cascade Company

- Weyerhaeuser Company

- Huber Engineered Woods LLC

- PFEIFER GROUP

- Lamiwood Designer Floor

- Celulosa Arauco Y Constitucion SA

- Louisiana-Pacific Corporation (LP)

Recent Industry Developments

In 2024, Raute delivered strong scale-up results with EUR 204.6 million net sales and EUR 121 million order intake, while comparable EBITDA reached EUR 19.8 million and earnings per share were EUR 1.96; the Group also reported 783 employees at year-end and proposed a dividend of EUR 0.55 per share—signals of improved profitability and shareholder returns after a stronger delivery year.

In 2025, Universal Forest Products signaled continued reinvestment, expecting about $350 million in capital projects, aimed at automation, technology upgrades, and added capacity—important for meeting tighter build schedules and more engineered component demand.

Report Scope

Report Features Description Market Value (2024) USD 274.7 Bn Forecast Revenue (2034) USD 478.2 Bn CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Plywood, Medium Density Fiberboard (MDF), Cross Laminated Timber (CLT), Laminated Veneer Lumber (LVL), Oriented Strand Board (OSB), Glue Laminated Timber (Glulam), Particle Board), By Application (Construction, Floorig, Furniture, Packaging, Transport, Others), By End User (Residential, Non-Residential) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Raute Group, Universal Forest Products, Inc, Boise Cascade Company, Weyerhaeuser Company, Huber Engineered Woods LLC, PFEIFER GROUP, Lamiwood Designer Floor, Celulosa Arauco Y Constitucion SA, Louisiana-Pacific Corporation (LP) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Raute Group

- Universal Forest Products, Inc

- Boise Cascade Company

- Weyerhaeuser Company

- Huber Engineered Woods LLC

- PFEIFER GROUP

- Lamiwood Designer Floor

- Celulosa Arauco Y Constitucion SA

- Louisiana-Pacific Corporation (LP)