Global Energy Efficient Windows Market Size, Share, And Business Benefits By Operating Type (Awning, Casement, Double-hung, Fixed, Hopper, Sliding), By Glazing Type (Double Glazing, Triple Glazing, Others), By Component (Frame, Glass, Hardware), By Construction Type (New Construction, Renovation and Reconstruction), By End-User (Residential, Non-Residential), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 159958

- Number of Pages: 331

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Operating Type Analysis

- By Glazing Type Analysis

- By Component Analysis

- By Construction Type Analysis

- By End-User Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

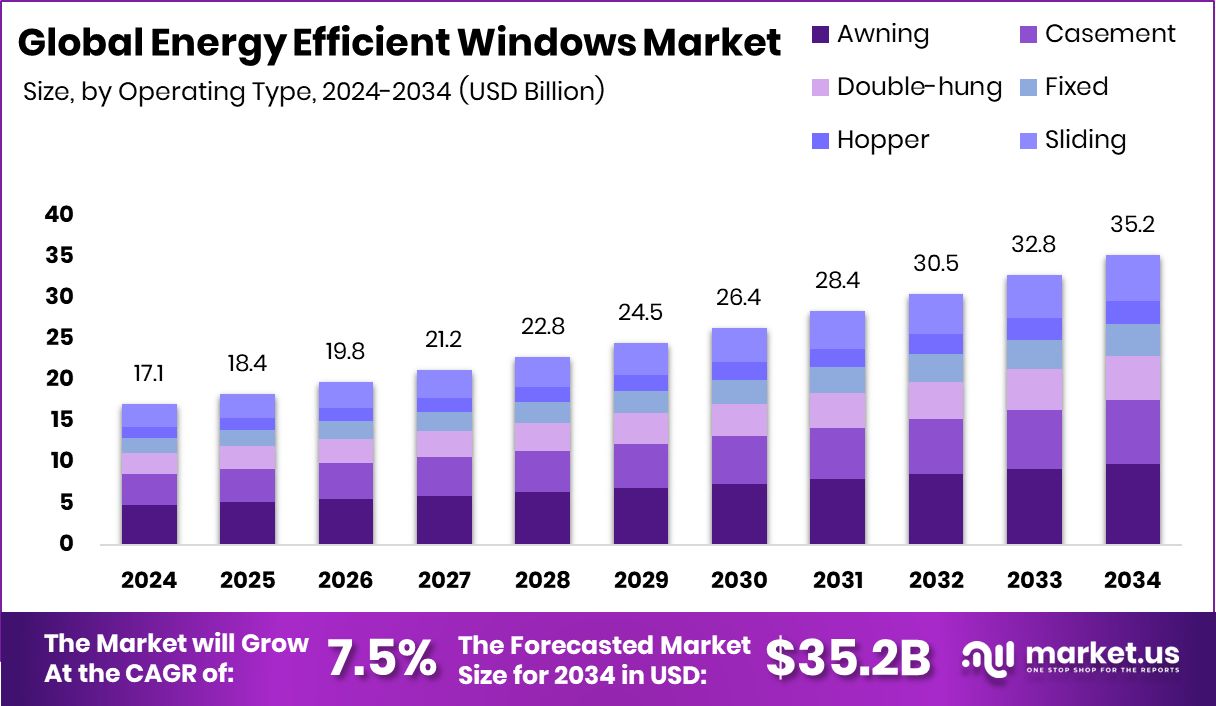

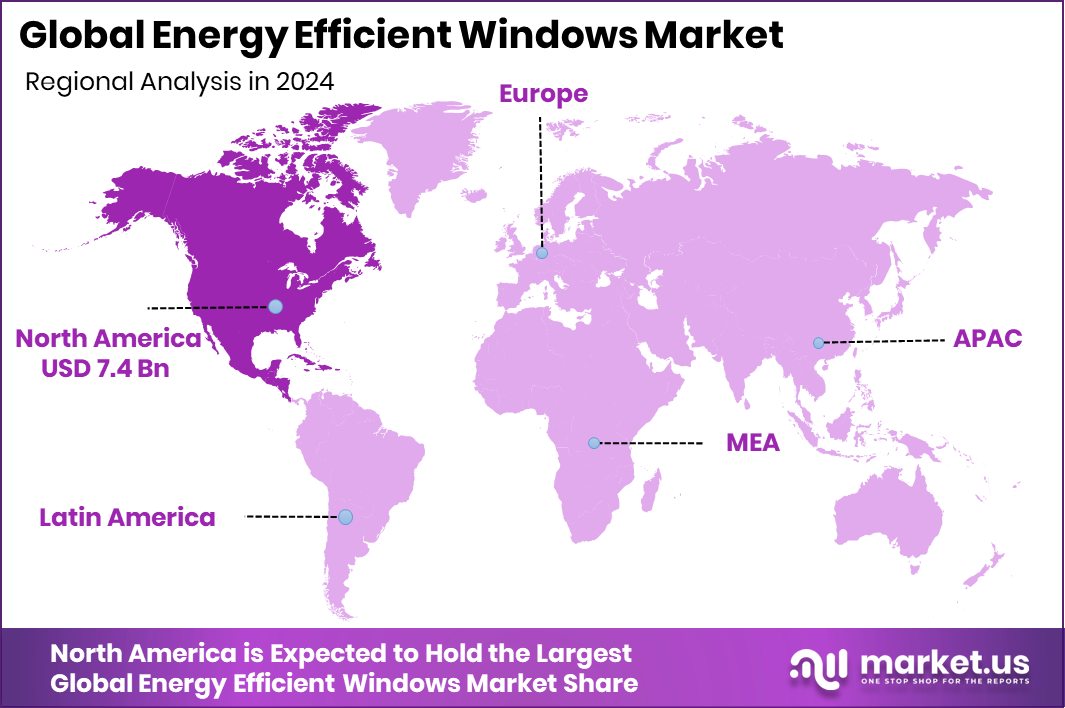

The Global Energy Efficient Windows Market is expected to be worth around USD 35.2 billion by 2034, up from USD 17.1 billion in 2024, and is projected to grow at a CAGR of 7.5% from 2025 to 2034. With a 43.30% share, North America dominated, generating USD 7.4 Bn value.

Energy efficient windows are specially designed windows that reduce the loss of heat in winter and keep homes cooler in summer. They use advanced glazing, insulated frames, and coatings that reflect heat while allowing natural light inside. This makes them a sustainable choice for households and commercial spaces, lowering energy bills and cutting carbon emissions.

The energy-efficient windows market refers to the global demand and supply of these windows across residential, commercial, and industrial sectors. It is shaped by rising energy costs, stricter building regulations, and growing awareness of green construction. Governments and institutions worldwide are supporting energy efficiency as part of their climate goals, driving adoption of these products.

The market is fueled by the increasing construction of new homes and renovation projects. For instance, governments are boosting construction capacity through initiatives like training the next generation of construction workers to build 1.5 million homes. At the same time, £302 million is being directed to repair and modernize education buildings, reflecting the demand for sustainable and efficient infrastructure.

Demand for energy-efficient windows is rising due to rising energy prices and the need to cut utility costs. Programs such as the U.S. Commerce Department’s nearly $18 million investment to increase homeownership opportunities and Sacramento’s $2.1 million funding for affordable apartments highlight how housing growth directly drives window demand.

Opportunities lie in public and private housing programs aimed at sustainability. The UK’s £2 billion investment in social and affordable housing and the £600 million pledge to strengthen construction skills are opening doors for large-scale adoption. Similarly, initiatives like the $1 million Launchpad program for North Lake Tahoe workforce housing show how localized funding can boost energy-efficient building materials, including windows, in growing communities.

Key Takeaways

- The Global Energy Efficient Windows Market is expected to be worth around USD 35.2 billion by 2034, up from USD 17.1 billion in 2024, and is projected to grow at a CAGR of 7.5% from 2025 to 2034.

- The energy-efficient windows market sees strong growth, with the awning type capturing 31.8% of the market share.

- Double glazing dominates at 69.3%, reflecting demand for better insulation and reduced energy consumption.

- Glass accounts for 73.4%, showing its critical role in enhancing window efficiency and sustainability.

- Renovation and reconstruction lead with 59.9%, highlighting retrofitting trends in energy-efficient building solutions.

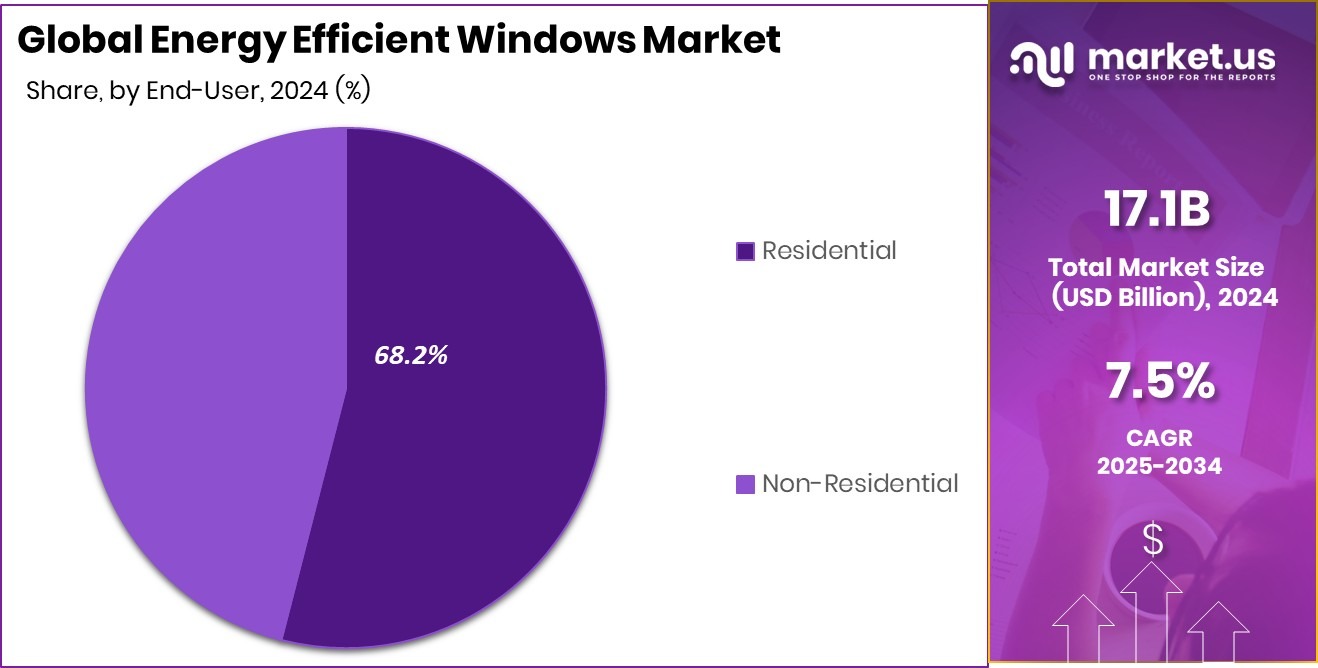

- The residential sector holds 68.2%, driven by rising homeownership and eco-friendly living preferences worldwide.

- The Energy Efficient Windows Market in North America reached USD 7.4 Bn, 43.30%.

By Operating Type Analysis

Energy energy-efficient windows market grows strongly, driven by renovation and reconstruction demand.

In 2024, Awning held a dominant market position in the By Operating Type segment of the Energy Efficient Windows Market, with a 31.8% share. This leadership reflects the strong preference for awning windows in both residential and commercial spaces, where ventilation and energy savings are critical. Their design allows windows to remain partially open during rain, providing airflow without compromising insulation. The segment’s performance highlights the balance of functionality and efficiency that awning windows offer, making them a practical choice for energy-conscious consumers.

With supportive government housing investments and ongoing construction activity, the awning segment is well-positioned to maintain its influence in driving adoption within the broader energy-efficient windows market.

By Glazing Type Analysis

Awning operating type holds a 31.8% share, showcasing functional consumer preference.

By Component Analysis

Double glazing dominates with 69.3%, reflecting strong insulation and energy-saving benefits.

In 2024, Glass held a dominant market position in the By Component segment of the Energy Efficient Windows Market, with a 73.4% share. This strong presence reflects the central role of advanced glazing technologies in improving thermal insulation and overall window performance. Glass is the primary element that determines how effectively a window can regulate heat transfer, reduce glare, and enhance natural lighting.

Its dominance shows the market’s reliance on innovative coatings and glazing methods that improve energy savings without compromising transparency. As building standards continue to emphasize efficiency and sustainability, the glass segment’s leadership highlights its essential contribution to the adoption and expansion of energy-efficient windows worldwide.

By Construction Type Analysis

Glass component leads at 73.4%, underscoring material importance in sustainable construction.

In 2024, Renovation and Reconstruction held a dominant market position in the By Construction Type segment of the Energy Efficient Windows Market, with a 59.9% share. This dominance reflects the rising focus on upgrading existing buildings to meet modern energy efficiency standards. Homeowners and commercial property owners are increasingly investing in replacing older windows with energy-efficient alternatives to reduce utility costs and improve comfort.

The segment’s strength highlights the large base of aging infrastructure requiring upgrades, driving sustained demand. Renovation and reconstruction activities not only support energy savings but also align with government-backed initiatives promoting sustainable building practices, securing this segment’s leading role in shaping the market landscape.

By End-User Analysis

The residential sector captures 68.2%, highlighting household adoption for lower energy costs.

In 2024, Residential held a dominant market position in the By End-User segment of the Energy Efficient Windows Market, with a 68.2% share. This leadership reflects the growing adoption of energy-efficient solutions among homeowners seeking to lower energy bills and improve living comfort. Rising housing activities, supported by government investments in affordable and sustainable homes, have further strengthened the segment’s presence.

Residential spaces demand solutions that combine insulation, natural light, and long-term savings, making energy-efficient windows an essential choice. The segment’s dominance underscores how household upgrades and new home constructions are driving the largest share of market demand, reinforcing residential as the key growth contributor within the sector.

Key Market Segments

By Operating Type

- Awning

- Casement

- Double-hung

- Fixed

- Hopper

- Sliding

By Glazing Type

- Double Glazing

- Triple Glazing

- Others

By Component

- Frame

- Glass

- Hardware

By Construction Type

- New Construction

- Renovation and Reconstruction

By End-User

- Residential

- Non-Residential

Driving Factors

Rising Construction and Renovation Boosts Window Demand

One of the biggest driving factors for the Energy Efficient Windows Market is the rise in new construction and renovation projects worldwide. Energy-efficient windows are now seen as essential for lowering utility costs and meeting sustainability goals in both homes and public facilities. Supportive funding is playing a key role in this demand. For example, Governor Hochul has proposed a $110 million Child Care Construction Fund to build and renovate child care facilities, which will require modern energy-saving materials, including windows.

Additionally, private investment is also helping; Trustup has raised €5M in funding, showing confidence in construction-related innovations. Together, these public and private efforts are creating strong momentum for the growth of energy-efficient windows.

Restraining Factors

High Initial Costs Limit Wider Market Adoption

A key restraining factor for the Energy Efficient Windows Market is the high upfront cost of installation. While these windows help reduce energy bills in the long run, the initial price is often much higher compared to standard windows. Many homeowners and small businesses find it difficult to afford this investment, especially in regions with limited financial support or subsidies.

The cost includes not only the advanced glass and frame materials but also professional installation, which adds to the overall expense. This price gap slows down adoption, particularly in low- and middle-income housing projects, where budgets are tighter. As a result, despite their long-term savings, high initial costs remain a significant barrier to faster market growth.

Growth Opportunity

Public Infrastructure Spending Creates a Window Market Opportunity

A major growth opportunity for the Energy Efficient Windows Market lies in the increasing public investment in infrastructure and building upgrades. Large-scale construction projects require materials that meet modern efficiency standards, and energy-efficient windows are a natural fit. For instance, Fort Worth has announced $659 million in downtown construction projects, which will include new buildings and renovations where energy-saving solutions will be in demand.

Similarly, New York City has earmarked a record $19.4 billion for school-related construction, creating a huge scope for advanced windows that improve insulation and comfort in learning environments. These significant public investments highlight how infrastructure development is opening new doors for the adoption of energy-efficient windows across multiple sectors.

Latest Trends

Smart Window Technology Emerging as a Growing Market Trend

One of the latest trends in the energy-efficient windows Market is the rise of smart window technology. These windows use advanced coatings and electronic controls to adjust tint and light transmission automatically, helping reduce energy use while improving comfort. Homeowners and commercial spaces are increasingly adopting such solutions to combine efficiency with convenience. This trend is further supported by large-scale funding in the construction sector.

For example, the Missouri House committee has approved $4 billion for state construction projects, creating opportunities for modern, high-performance materials like smart windows to be included in new builds and renovations. This shift highlights how innovation and investment are shaping the future of energy-efficient windows.

Regional Analysis

In 2024, North America held a 43.30% share, valued at USD 7.4 Bn.

The Energy Efficient Windows Market shows varied growth patterns across key global regions, reflecting different levels of construction activity, energy regulations, and sustainability priorities.

In 2024, North America emerged as the dominating region, capturing a 43.30% share valued at USD 7.4 billion. The strong presence in this region is supported by rising demand for energy-efficient solutions in both residential and non-residential buildings, alongside supportive government programs targeting sustainable construction.

Europe continues to show steady adoption, driven by stringent energy directives and a long-standing focus on reducing carbon emissions in building infrastructure. Asia Pacific, on the other hand, represents a fast-expanding region with rapid urbanization and infrastructure development, supported by growing middle-class demand for modern housing.

Meanwhile, the Middle East & Africa region is gradually embracing energy-efficient solutions as governments push for sustainable city projects to manage high energy consumption in hot climates.

Latin America presents emerging opportunities, as affordability initiatives and housing investments begin to incorporate energy-efficient features in new construction projects. Together, these regions highlight a global movement toward reducing building energy footprints, but North America clearly leads the market, setting benchmarks in both value and market share.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Andersen Corporation continued to build on its strong legacy by expanding product lines that emphasize durability and insulation performance, making it a trusted choice for homeowners seeking both style and energy savings. The company’s focus on design flexibility, paired with advanced glazing technologies, has kept it at the forefront of innovation in the sector.

Pella Corporation, known for combining craftsmanship with modern efficiency standards, strengthened its market presence by aligning energy efficiency with aesthetic appeal. Pella’s wide portfolio, spanning from affordable solutions to premium window systems, positioned the company strongly among both residential and commercial customers. Their approach of integrating performance with ease of use reflects growing customer expectations for sustainable yet practical solutions.

Marvin Windows and Doors contributed to the market with its strong focus on customization and high-performance designs. Marvin’s emphasis on blending traditional craftsmanship with contemporary energy-efficient materials positioned it as a key brand in projects that balance heritage aesthetics with modern efficiency. By catering to diverse customer needs, the company reinforced its reputation as a premium supplier in the global market.

Top Key Players in the Market

- Andersen Corporation

- Pella Corporation

- Marvin Windows and Doors

- JELD-WEN, Inc.

- Simonton Windows

- Atrium Windows & Doors

- Milgard Windows & Doors

- Harvey Building Products

- Kolbe Windows & Doors

Recent Developments

- In March 2025, Andersen launched a new national TV ad campaign called “Nice Windows,” featuring the Scott brothers to promote brand visibility and emphasize trust in their window and door offerings.

- In March 2024, Pella announced that its Steady Set™ interior installation system would be available in summer 2024 for its Reserve and Lifestyle Series wood windows, making installation faster and cleaner.

Report Scope

Report Features Description Market Value (2024) USD 17.1 Billion Forecast Revenue (2034) USD 35.2 Billion CAGR (2025-2034) 7.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Operating Type (Awning, Casement, Double-hung, Fixed, Hopper, Sliding), By Glazing Type (Double Glazing, Triple Glazing, Others), By Component (Frame, Glass, Hardware), By Construction Type (New Construction, Renovation and Reconstruction), By End-User (Residential, Non-Residential) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Andersen Corporation, Pella Corporation, Marvin Windows and Doors, JELD-WEN, Inc., Simonton Windows, Atrium Windows & Doors, Milgard Windows & Doors, Harvey Building Products, Kolbe Windows & Doors Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Energy Efficient Windows MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample

Energy Efficient Windows MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Andersen Corporation

- Pella Corporation

- Marvin Windows and Doors

- JELD-WEN, Inc.

- Simonton Windows

- Atrium Windows & Doors

- Milgard Windows & Doors

- Harvey Building Products

- Kolbe Windows & Doors