Global Energy As A Service Market Size, Share, And Business Benefits By Service Type (Energy Supply Service, Operational and Maintenance Service, Energy Optimization and Efficiency Service), By Energy Source (Renewable Energy, Conventional Energy, Hybrid Energy), By Solution Type (Software Solutions, Hardware Solutions, Integrated Solutions), By End User (Commercial, Residential, Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 154814

- Number of Pages: 199

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

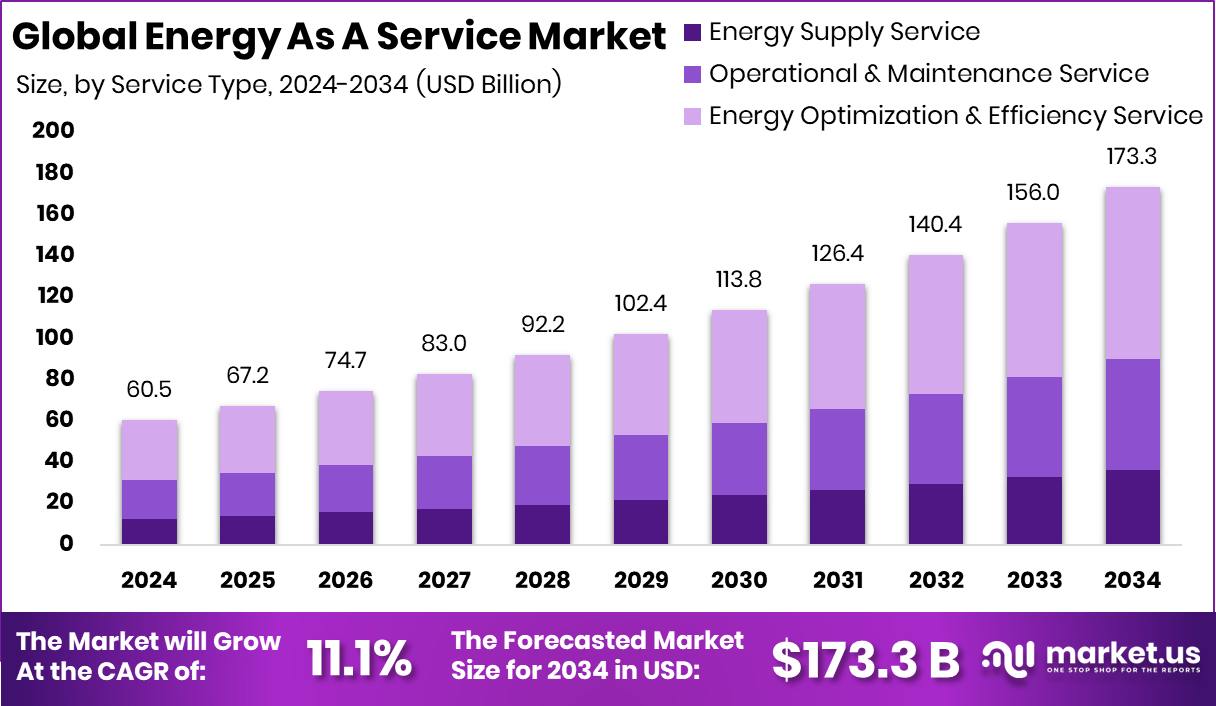

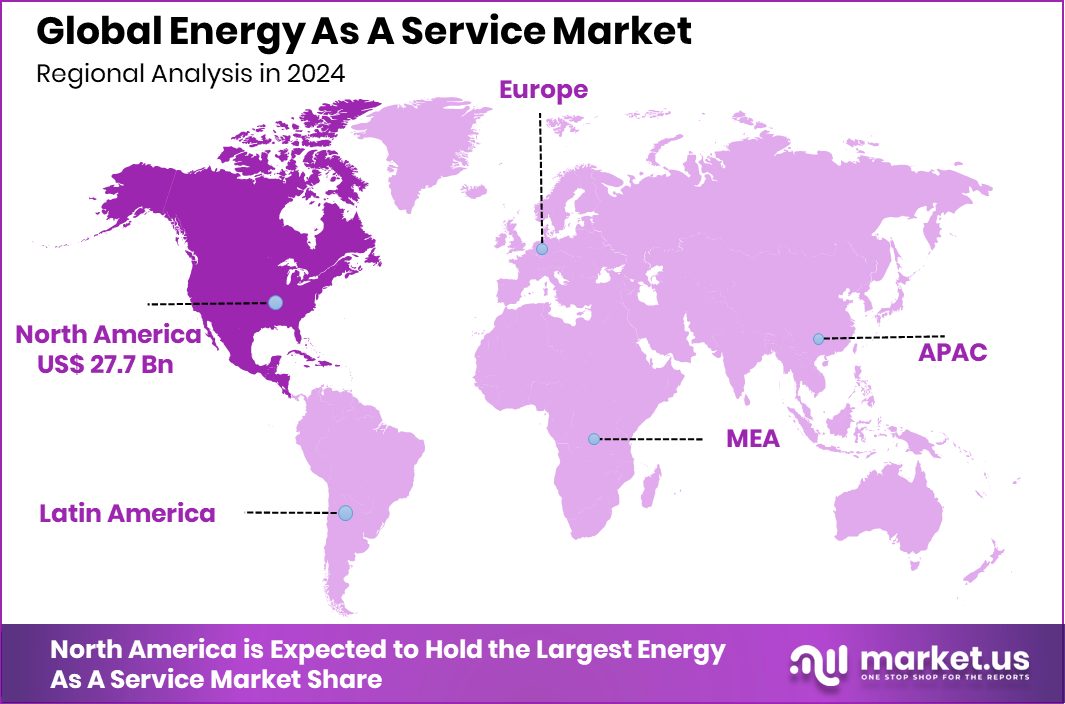

The Global Energy As A Service Market is expected to be worth around USD 173.3 billion by 2034, up from USD 60.5 billion in 2024, and is projected to grow at a CAGR of 11.1% from 2025 to 2034. Strong adoption of smart energy solutions supported North America’s USD 27.7 billion growth.

Energy as a Service (EaaS) is a business model that allows consumers—such as commercial buildings, factories, or government facilities—to outsource their energy needs to third-party providers. Instead of owning and maintaining energy infrastructure, customers pay for energy services like lighting, heating, or power backup on a subscription or pay-per-use basis. These services can include energy supply, energy management, efficiency improvements, and even renewable energy integration.

The Energy as a Service market refers to the industry built around offering such outsourced energy solutions. It includes players who design, finance, install, and operate energy systems for customers and then deliver energy as a packaged service. The model supports both grid-connected and decentralized energy systems, often using digital platforms for monitoring, analytics, and optimization.

Growth in this market is being driven by rising energy costs, aging energy infrastructure, and the shift towards decentralized and sustainable power systems. Governments promoting clean energy transitions and strict emission regulations are encouraging businesses to adopt service-based energy solutions. Additionally, the demand for improved energy efficiency and sustainability targets is pushing organizations to seek expert-managed services.

Demand for EaaS is also increasing due to the growing need for energy reliability and grid independence. Many businesses, especially those with 24/7 operations, require continuous and optimized power delivery. Energy as a Service offers customized solutions that ensure operational continuity without requiring in-house energy expertise or large capital investment.

Supporting this growth, several major funding rounds and investments have recently occurred. UK-based Pulse Clean Energy has secured €252.5 million to support the development of six ready-to-build battery energy storage systems (BESS) sites. Renalfa IPP has obtained €315 million in holdco-level financing from a banking consortium led by the European Bank for Reconstruction and Development (EBRD). APG has committed €560 million to invest in Octopus Australia’s renewable energy platform.

Renewable energy financing experienced a 63% surge in 2023, with solar emerging as the leading segment. Juniper Green Energy has advanced with a $1 billion funding boost to accelerate its clean energy initiatives. Allume Energy has successfully raised $4.6 million in its latest funding and M&A activity. India’s renewable energy sector is currently confronting a significant funding gap estimated at Rs 2 trillion. In Romania, INVL Renewable Energy Fund I has secured EUR 29 million to develop a 71 MW solar project.

Key Takeaways

- The Global Energy As A Service Market is expected to be worth around USD 173.3 billion by 2034, up from USD 60.5 billion in 2024, and is projected to grow at a CAGR of 11.1% from 2025 to 2034.

- In 2024, Energy Optimization and Efficiency Service held a 48.4% share in the Energy as a Service Market.

- Renewable Energy accounted for a 59.1% share, dominating the Energy as a Service Market by energy source segment.

- Integrated Solutions captured a 59.2% share, leading the solution type segment in the Energy as a Service Market.

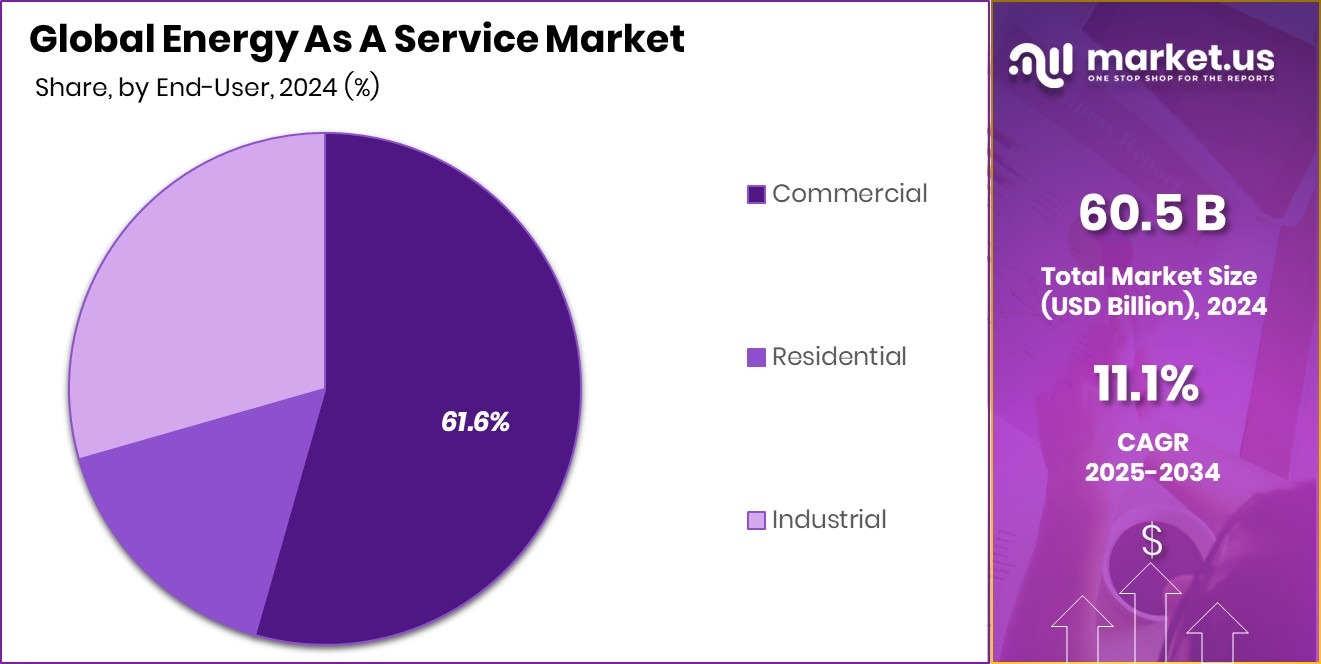

- The commercial segment led the end-user category, holding a commanding 61.6% share in the global market.

- The regional market value in North America reached approximately USD 27.7 billion.

By Service Type Analysis

Energy Optimization and Efficiency Service leads the Energy as a Service market.

In 2024, Energy Optimization and Efficiency Service held a dominant market position in the By Service Type segment of the Energy as a Service market, with a 48.4% share. This leadership can be attributed to the growing emphasis on reducing energy consumption, lowering operational costs, and meeting sustainability goals across commercial and industrial sectors.

Organizations are increasingly adopting efficiency-based energy services to improve building performance, reduce carbon emissions, and comply with government regulations on energy conservation. These services often involve data-driven monitoring, real-time energy analytics, and retrofitting existing systems with more efficient alternatives.

The demand for optimization and efficiency services has been further supported by rising electricity prices and the pressure to achieve net-zero targets. Businesses are seeking customized solutions that not only provide energy savings but also improve asset utilization and overall productivity. The 48.4% share reflects strong customer preference for outcome-based service models that guarantee savings and performance.

Additionally, service providers are focusing on integrating digital tools to enhance control, automate energy flows, and offer transparent energy usage reports. The combination of financial, environmental, and operational benefits continues to make energy optimization and efficiency services the most preferred segment in the Energy as a Service market in 2024.

By Energy Source Analysis

Renewable energy dominates as the preferred source of energy as a service.

In 2024, Renewable Energy held a dominant market position in the By Energy Source segment of the Energy as a Service market, with a 59.1% share. This strong position reflects a growing shift among consumers and service providers toward cleaner, more sustainable energy sources.

The increasing awareness around climate change, coupled with global initiatives aimed at reducing carbon emissions, has significantly accelerated the adoption of renewable energy within the EaaS model. Service providers are prioritizing solar, wind, and other renewable sources to deliver environmentally responsible energy services to commercial and industrial clients.

The 59.1% market share also indicates a clear preference for long-term cost savings and energy independence offered by renewable solutions. Clients are opting for service agreements that allow them to benefit from renewable energy without the burden of ownership or infrastructure maintenance.

Additionally, policy support in the form of incentives, subsidies, and renewable portfolio standards has played a key role in driving the segment’s growth. As renewable energy continues to prove its viability in meeting both economic and environmental objectives, it remains the leading choice within the Energy Source category of the Energy as a Service market in 2024.

By Solution Type Analysis

Integrated solutions drive growth within the Energy as a Service segment.

In 2024, Integrated Solutions held a dominant market position in the By Solution Type segment of the Energy as a Service market, with a 59.2% share. This dominance highlights the growing preference among end-users for bundled energy offerings that combine multiple services into a single, streamlined solution.

Integrated Solutions typically encompass energy supply, energy efficiency, and operational management, delivered under one contract, providing both technical and financial advantages. Clients are increasingly turning to such comprehensive packages to simplify energy management, reduce administrative complexity, and improve overall system performance.

The 59.2% market share reflects the rising demand for holistic energy approaches that can be customized to meet unique operational requirements while ensuring accountability and measurable results. By offering integrated control systems, smart monitoring, and performance-based outcomes, service providers are addressing both the reliability and efficiency needs of businesses.

This segment’s leading position also signals a strong market shift toward service models that prioritize convenience, cost-effectiveness, and long-term sustainability. In 2024, Integrated Solutions continued to gain traction due to their ability to deliver consistent energy outcomes, making them the preferred choice in the Solution Type category of the Energy as a Service market.

By End User Analysis

The commercial sector holds the highest share in the Energy as a Service market.

In 2024, Commercial held a dominant market position in the By End User segment of the Energy as a Service market, with a 61.6% share. This leading position reflects the increasing adoption of service-based energy models by commercial buildings such as offices, malls, hotels, and educational institutions.

These establishments face constant pressure to reduce operating costs, meet energy efficiency standards, and improve sustainability performance. As a result, they are opting for outsourced energy solutions that offer predictable costs, no upfront capital investment, and guaranteed performance outcomes.

The 61.6% market share indicates a clear inclination of the commercial sector towards flexible energy models that allow them to focus on core operations while ensuring energy reliability. Energy as a Service offers commercial users customized services such as lighting upgrades, HVAC optimization, and building automation—delivered under performance-based contracts. This approach not only helps in cost management but also enhances operational resilience and environmental compliance.

The commercial sector’s dominance in 2024 can be attributed to its scale of energy usage and growing need for professional energy management. The segment continues to lead the market due to its proactive approach toward energy transformation and preference for integrated, efficiency-driven service models.

Key Market Segments

By Service Type

- Energy Supply Service

- Operational and Maintenance Service

- Energy Optimization and Efficiency Service

By Energy Source

- Renewable Energy

- Conventional Energy

- Hybrid Energy

By Solution Type

- Software Solutions

- Hardware Solutions

- Integrated Solutions

By End User

- Commercial

- Residential

- Industrial

Driving Factors

Rising Energy Costs Push Service-Based Models

One of the main driving factors behind the growth of the Energy as a Service (EaaS) market is the steady increase in global energy costs. Many businesses, especially in commercial and industrial sectors, are finding it difficult to manage their rising electricity bills and energy-related expenses. EaaS offers them a practical solution by converting high, unpredictable energy costs into fixed monthly service payments.

This shift helps organizations avoid large capital investments in new energy infrastructure while still getting access to reliable, efficient energy. As prices of fossil fuels and grid electricity continue to rise, more customers are turning to service-based models to reduce financial pressure, improve budget planning, and access energy-saving technologies without owning them directly.

Restraining Factors

Lack of Awareness Slows Market Adoption Rate

One major restraining factor in the Energy as a Service (EaaS) market is the lack of awareness and understanding among potential users. Many businesses and building owners are still unfamiliar with how EaaS works or how it can benefit them financially and operationally. This confusion makes them hesitant to shift from traditional energy systems to service-based models. Some believe it is too complex or worry about depending on third-party providers.

As a result, even though EaaS offers long-term savings and efficiency, the market growth is held back by limited knowledge and low confidence. Education, clear communication, and demonstration of successful examples are needed to build trust and increase adoption in both developed and developing markets.

Growth Opportunity

Smart Buildings Open New Energy Service Opportunities

A key growth opportunity in the Energy as a Service (EaaS) market lies in the rising number of smart buildings. These buildings use advanced technologies like sensors, automation, and real-time energy monitoring to manage power usage more efficiently. As more commercial spaces, offices, and public buildings adopt smart infrastructure, the demand for managed energy services is expected to grow.

EaaS providers can offer tailored solutions that help building owners optimize performance, reduce energy waste, and lower costs. This creates a strong business case for adopting EaaS models. With smart buildings becoming more common in cities worldwide, service providers have a large opportunity to expand their offerings and form long-term contracts that support energy efficiency and sustainability goals.

Latest Trends

Bundled Energy Services Gain Strong Market Attention

One of the latest trends in the Energy as a Service (EaaS) market is the rising demand for bundled energy services. Instead of choosing separate services like energy supply or equipment upgrades, many businesses now prefer all-in-one solutions under a single contract. These bundled services often include energy supply, efficiency improvements, system monitoring, and maintenance.

This approach offers more convenience, better performance tracking, and cost savings. Customers find it easier to manage their energy use without dealing with multiple vendors. It also helps them meet sustainability goals more effectively. As energy needs become more complex, bundled service models are becoming more popular, making them a key trend shaping how energy is delivered and managed in 2024 and beyond.

Regional Analysis

In 2024, North America dominated the Energy as a Service market with 45.8%.

In 2024, North America held a dominant position in the global Energy as a Service market, accounting for 45.8% of the total share, with a market value of USD 27.7 billion. This strong presence can be attributed to the region’s early adoption of advanced energy technologies, increased investments in smart infrastructure, and a growing focus on energy efficiency across commercial and industrial sectors. The United States and Canada are leading in implementing service-based energy models, supported by favorable government policies and a mature energy management ecosystem.

Europe followed as a key regional contributor, with rising demand driven by sustainability targets and a strong regulatory framework promoting clean energy. In the Asia Pacific, the market is steadily expanding, fueled by rapid urbanization and increasing awareness about energy optimization.

Countries such as China, India, and Japan are showing interest in adopting service-based models to meet growing power demands efficiently. Meanwhile, the Middle East & Africa and Latin America are in the early stages of adoption, where opportunities are emerging due to infrastructure development and rising energy costs.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Schneider Electric has been recognized for its integrated energy management platforms and digital grid solutions, enabling clients to outsource complex energy functions while improving operational efficiency. The company’s ability to deliver scalable and modular solutions has strengthened its market position in commercial and industrial segments.

Siemens has demonstrated a well-rounded capability in energy services by combining its engineering expertise with advanced automation and monitoring systems. Siemens’ focus on smart infrastructure and industrial-grade solutions has allowed it to serve large-scale enterprises requiring high-performance energy operations under service contracts.

Engie stands out for its strong emphasis on renewable energy integration and sustainability. By offering clean energy generation and tailored service structures, the company has positioned itself as a partner for organizations seeking to transition to low‑carbon operations. Its focus on green energy assets and energy-as-a-contract models has been well received in corporate sustainability initiatives.

Honeywell International Inc. has leveraged its core competencies in building automation and control technologies to deliver energy optimization service models. Honeywell’s strength lies in deploying sensor-based systems and intelligent analytics to support energy efficiency upgrades under long-term service agreements.

Top Key Players in the Market

- Schneider Electric

- Siemens

- Engie

- Honeywell International Inc.

- Veolia

- EDF

- Johnson Controls

- Bernhard

- General Electric

- Entegrity

Recent Developments

- In March 2025, Schneider Electric announced over USD 700 million in investment into the U.S. energy sector, its largest US capital expenditure to date. This initiative is focused on expanding manufacturing, innovation centres, and laboratories dedicated to AI‑aware power systems. The investment aims to enhance the company’s capacity to serve growing demand for integrated EaaS solutions, especially in smart infrastructure and AI data‑centric facilities.

- In February 2024, Siemens Smart Infrastructure introduced Electrification X, a cloud-based IoT SaaS platform that helps customers manage and optimize electricity infrastructure across buildings and industries. This addition supports Siemens’ EaaS capabilities by enabling real-time energy monitoring, automation, and efficiency improvements as part of bundled service offerings.

Report Scope

Report Features Description Market Value (2024) USD 60.5 Billion Forecast Revenue (2034) USD 173.3 Billion CAGR (2025-2034) 11.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service Type (Energy Supply Service, Operational and Maintenance Service, Energy Optimization and Efficiency Service), By Energy Source (Renewable Energy, Conventional Energy, Hybrid Energy), By Solution Type (Software Solutions, Hardware Solutions, Integrated Solutions), By End User (Commercial, Residential, Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Schneider Electric, Siemens, Engie, Honeywell International Inc., Veolia, EDF, Johnson Controls, Bernhard, General Electric, Entegrity Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Energy As A Service MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Energy As A Service MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Schneider Electric

- Siemens

- Engie

- Honeywell International Inc.

- Veolia

- EDF

- Johnson Controls

- Bernhard

- General Electric

- Entegrity