Global Electronic Security Market Size, Share Analysis Report By Component (Solution (Access and Control Systems, Surveillance and Alert System, Anti-theft Systems, Antiterrorist and Inspection Equipment, Others), Service (Professional Services, Managed Services)), By Deployment Mode (On-premises, Cloud-based), By Connectivity (Ethernet, Wireless, Cellular), By Application (Environmental, Public Sector, Customs Service Sector, Postal, Telecommunications, Residential, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150020

- Number of Pages: 274

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

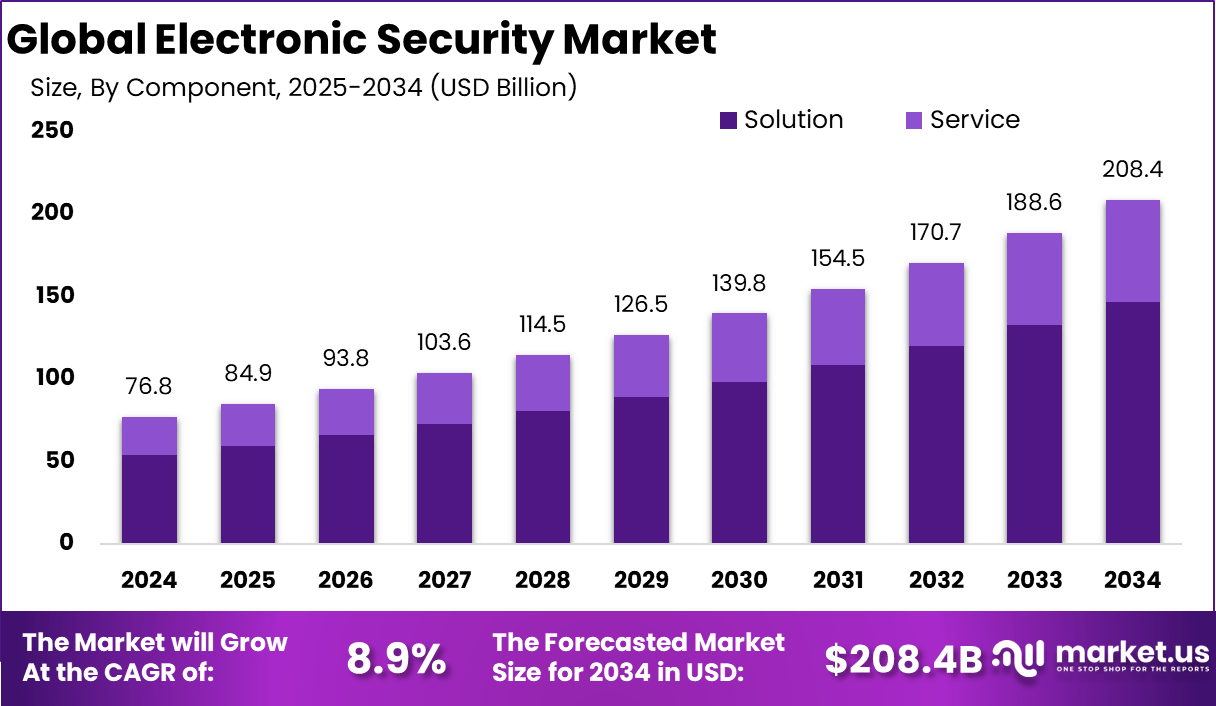

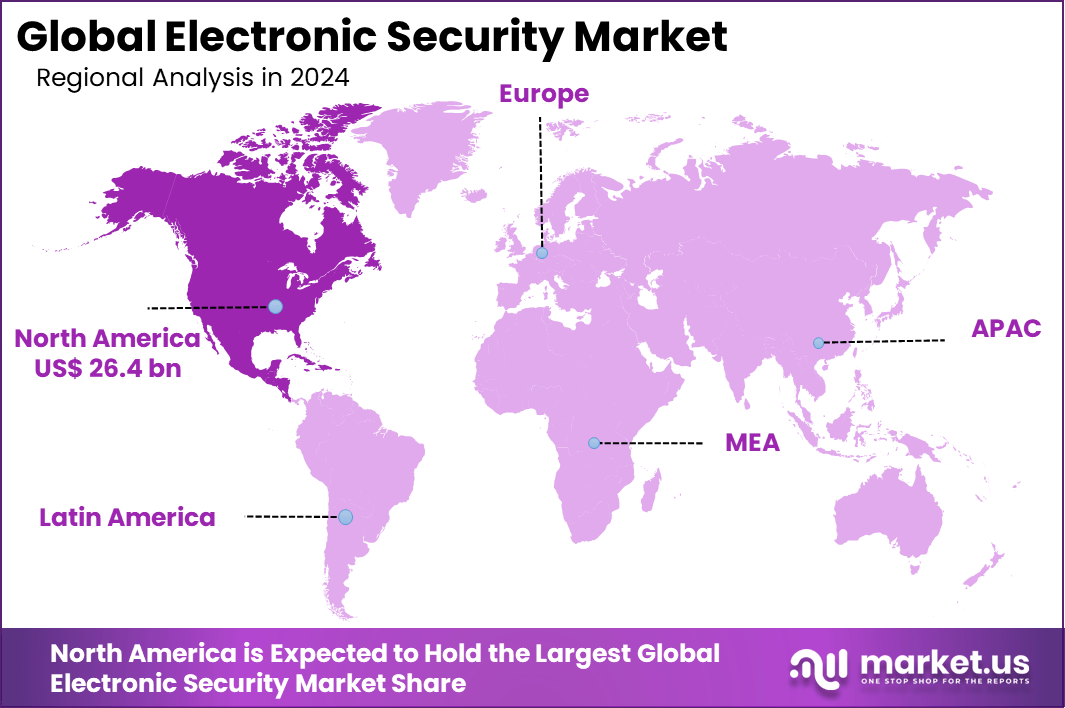

The Global Electronic Security Market size is expected to be worth around USD 208.4 billion by 2034, from USD 76.8 billion in 2024, growing at a CAGR of 8.9% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 34.4% share, holding USD 26.4 billion in revenue. The U.S. electronic security market is valued at USD 21.13 billion in 2024, growing at a CAGR of 7.2%.

Electronic security encompasses systems and devices designed to safeguard physical and digital assets through electronic means. These systems include surveillance cameras, access control mechanisms, alarm systems, and intrusion detection technologies. Several factors contribute to the expansion of the electronic security market. The surge in urbanization and infrastructure development necessitates enhanced security measures to protect assets and ensure public safety.

Additionally, the proliferation of smart devices and the Internet of Things (IoT) has led to the integration of advanced security systems that offer real-time monitoring and remote access. The escalating threat of cyber-attacks and the need for compliance with stringent regulatory standards further propel the demand for robust electronic security solutions.

Technological advancements play a pivotal role in the evolution of electronic security systems. The integration of artificial intelligence (AI) and machine learning enables systems to analyze vast amounts of data for anomaly detection and predictive analytics. Cloud-based solutions offer scalability and flexibility, allowing for centralized management and real-time updates.

The electronic security market presents numerous investment opportunities, particularly in emerging technologies and underserved regions. Companies specializing in AI-driven security solutions, cloud-based platforms, and biometric authentication systems are poised for growth. Additionally, the expansion of smart cities and the increasing adoption of IoT devices create avenues for investment in integrated security solutions.

For instance, In March 2025, Godrej Locks introduced the Advantis IoT9 Digital Lock, a major step forward in smart electronic security. This advanced lock features nine access modes, including mobile app control, fingerprint recognition, passcodes, RFID cards, and mechanical keys, offering flexibility for varied user preferences. Its built-in Wi-Fi connectivity enables remote operation, enhancing both convenience and control for users seeking secure, tech-enabled home solutions.

Investors can explore opportunities in both established markets and emerging economies where infrastructure development is accelerating. Governments play a crucial role in fostering the growth of the electronic security market through policies and initiatives that promote the adoption of advanced security systems. This support includes funding for research and development, incentives for businesses to implement security measures, and the establishment of standards that guide the industry.

Key Takeaways

- The global electronic security market is projected to reach USD 208.4 billion by 2034, up from USD 76.8 billion in 2024, registering a strong CAGR of 8.9% during the forecast period.

- North America led the global landscape in 2024, contributing over 34.4% of the total market share, with regional revenue standing at USD 26.4 billion.

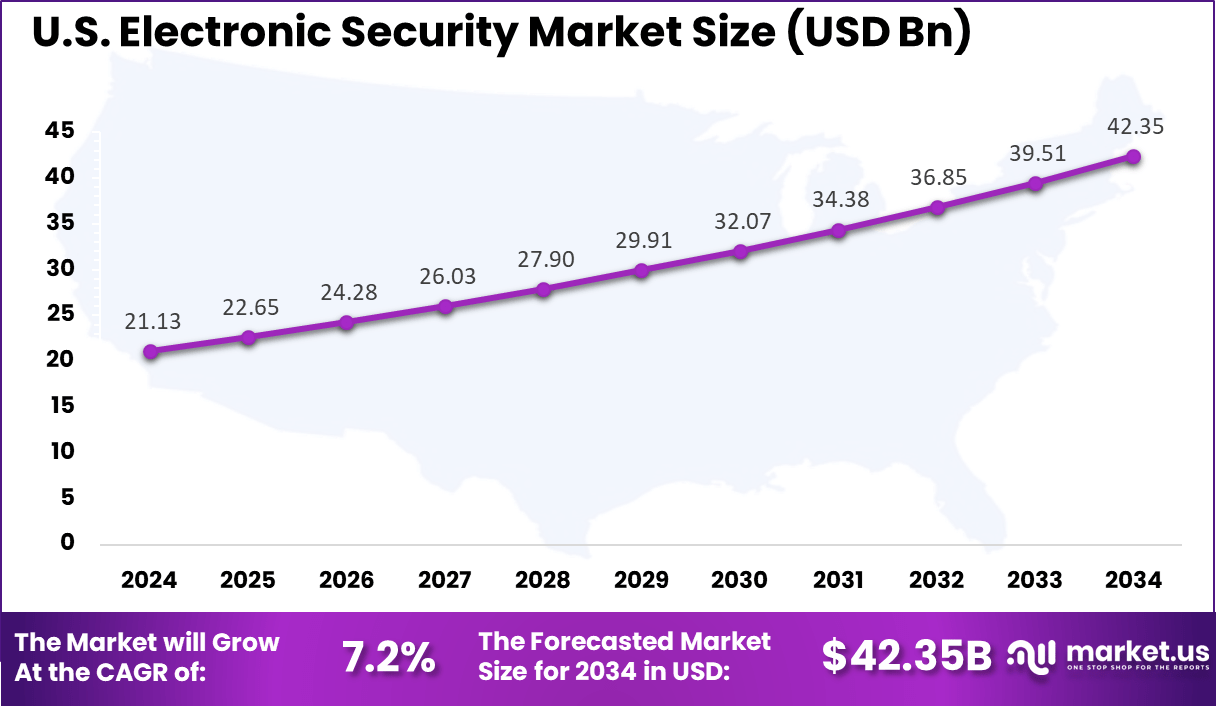

- The United States alone accounted for USD 21.13 billion in 2024 and is expected to grow steadily at a 7.2% CAGR, driven by rising infrastructure protection and corporate security needs.

- Within the market by component, solutions held the highest share at 70.4%, indicating the growing preference for comprehensive security platforms.

- In terms of deployment, on-premises models dominated with 60.8%, reflecting continued demand for in-house control and data sovereignty in sensitive sectors.

- By connectivity, Ethernet led with 40.6%, supported by its reliability in high-security environments.

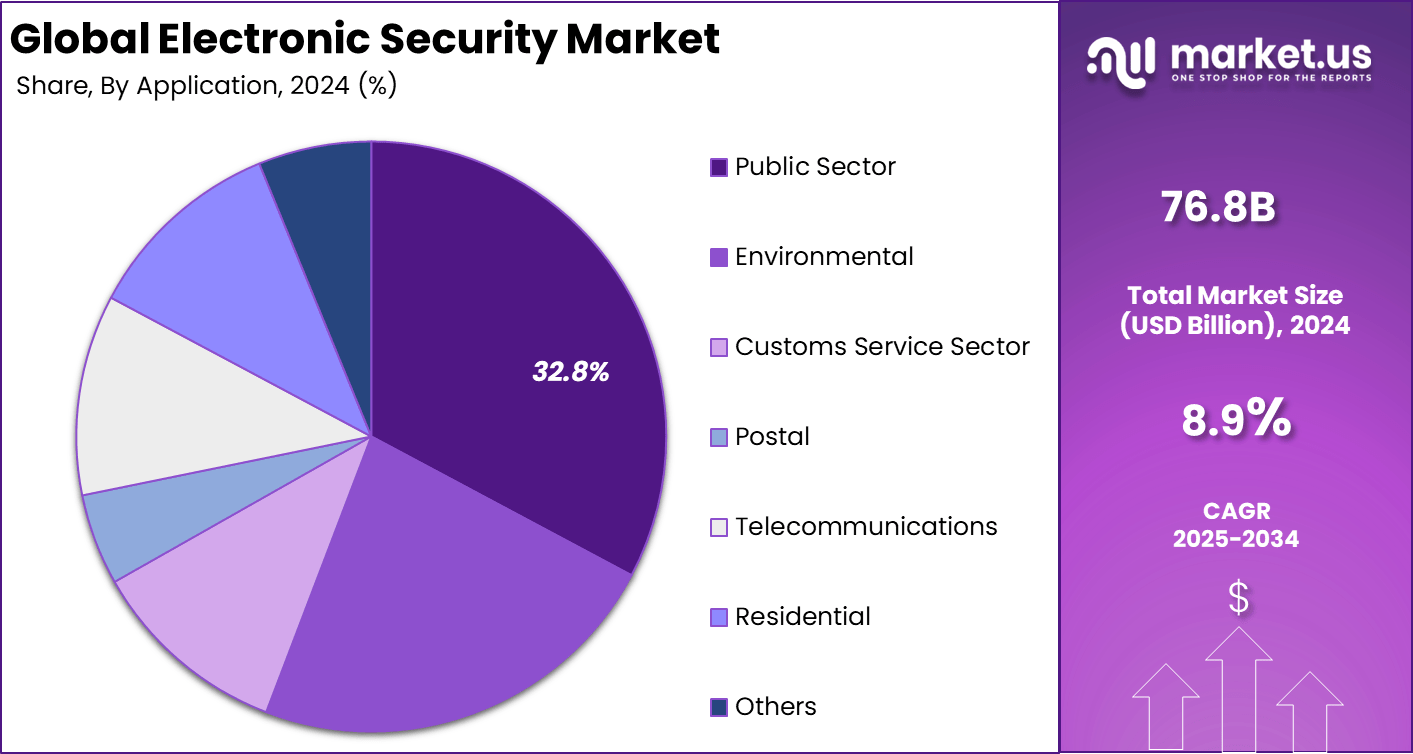

- From an application perspective, the public sector held the largest share at 32.8%, underlining increased government investment in smart surveillance and urban security systems.

US Market Expansion

The US Electronic Security Market is valued at approximately USD 21.13 Billion in 2024 and is predicted to increase from USD 29.91 Billion in 2029 to approximately USD 42.35 Billion by 2034, projected at a CAGR of 7.2% from 2025 to 2034.

For instance, In January 2025, the U.S. government introduced the Cyber Trust Mark, a cybersecurity labeling initiative aimed at improving consumer awareness around the security of Internet of Things (IoT) devices. Modeled after the Energy Star label, this program helps users identify products – such as smart home appliances, cameras, fitness trackers, and baby monitors – that comply with recognized cybersecurity standards.

In 2024, North America held a dominant position in the global electronic security market, capturing approximately 34.4% of the total market share and generating revenue of USD 26.4 billion. This leadership is attributed to several key factors, including advanced technological infrastructure, high adoption rates of security solutions, and stringent regulatory frameworks that mandate the implementation of electronic security measures across various sectors.

For instance, In August 2023, Datalec Precision Installations (IDIS), a South Korean video surveillance manufacturer, completed its acquisition of Costar Technologies, Inc., a U.S.-based provider of electronic security products. This strategic move aims to strengthen IDIS’s presence in the North American market. Notably, approximately 60% of Costar’s video products were already manufactured by IDIS under an existing ODM relationship, facilitating a seamless integration.

Component Insights

In 2024, the Solution segment held a dominant market position in the electronic security market, capturing more than a 70.4% share. This substantial lead is attributed to the growing demand for integrated security systems that encompass access control, surveillance, anti-theft mechanisms, and inspection equipment.

The increasing complexity of security threats necessitates comprehensive solutions that can address multiple vulnerabilities simultaneously, thereby driving the adoption of multifaceted security systems. The prominence of the Solution segment is further reinforced by advancements in technology, such as the integration of artificial intelligence (AI) and the Internet of Things (IoT) into security systems.

These innovations enhance the capabilities of security solutions, enabling real-time monitoring, predictive analytics, and automated responses to potential threats. Moreover, the scalability and flexibility of these solutions make them suitable for various applications across residential, commercial, and industrial sectors, contributing to their widespread adoption.

For Instance, in July 2024, Datalec Precision Installations (DPI) expanded its capabilities by launching in-house electronic security services. This development enables DPI to provide integrated security solutions including design, manufacturing, installation, and managed services without relying on third-party vendors. The move aims to improve project efficiency and cost-effectiveness, specifically targeting data center operators.

Deployment Mode Insights

In 2024, the On-premises segment held a dominant position in the electronic security market, capturing more than a 60.8% share. This substantial lead is primarily attributed to the heightened demand for direct control over security infrastructure, particularly among organizations operating in sectors with stringent regulatory requirements, such as government, defense, and critical infrastructure.

On-premises deployment offers these entities enhanced control over data management and security protocols, ensuring compliance with industry-specific standards and reducing reliance on third-party providers. Moreover, the ability to customize security solutions to meet specific organizational needs further reinforces the preference for on-premises systems in these sectors.

For instance In November 2024, Axis Communications launched AXIS Camera Station Edge (ACS Edge), reinforcing the market’s shift toward on-premises video management solutions. ACS Edge enables video data to be processed directly on Axis cameras, removing the reliance on external servers or cloud platforms. Localized processing boosts speed, lowers costs, and supports scalable electronic security systems.

Additionally, concerns regarding data sovereignty and latency have influenced the preference for on-premises solutions. Organizations handling sensitive information often opt for on-premises deployment to maintain data within their physical premises, thereby mitigating risks associated with data breaches and unauthorized access.

Furthermore, on-premises systems can offer lower latency compared to cloud-based solutions, which is critical for applications requiring real-time data processing and immediate response. The integration of on-premises systems with existing legacy infrastructure also facilitates seamless operations, minimizing disruptions and ensuring continuity in security management.

Connectivity Insights

In 2024, the Ethernet segment held a dominant position in the electronic security market, capturing more than a 40.6% share. This significant market share is primarily attributed to the widespread adoption of Ethernet connectivity in modern electronic security systems, such as surveillance cameras and access control devices.

The inherent advantages of Ethernet, including high data transfer rates, reliability, and low latency, make it a preferred choice for transmitting digital data to host computers in security applications. Additionally, the integration of Power-over-Ethernet (PoE) technology has streamlined installations by allowing both power and data to be delivered over a single cable, reducing infrastructure complexity and costs.

The dominance of Ethernet is further reinforced by its compatibility with existing network infrastructures, facilitating seamless integration and scalability. In industrial settings, the adoption of Industrial Ethernet has been notable, with reports indicating that it accounts for a substantial portion of new installations in factory automation.

For Instance, In March 2025, Viavi Solutions announced the acquisition of Spirent’s Ethernet and network security testing business from Keysight Technologies for $410 million. This strategic move enhances Viavi’s position in the Ethernet segment of the global electronic security market, particularly in sectors requiring robust network testing and security solutions.

Application Insights

In 2024, the Public Sector segment held a dominant position in the electronic security market, capturing more than a 32.8% share. This significant market presence is primarily attributed to the increasing emphasis on safeguarding critical infrastructure, ensuring public safety, and enhancing national security.

Government agencies and public institutions are investing heavily in advanced electronic security solutions, including surveillance systems, access control, and cybersecurity measures, to address evolving threats and comply with stringent regulatory requirements.

The adoption of electronic security systems in the public sector is further driven by the integration of smart technologies and the implementation of smart city initiatives. These initiatives aim to improve urban living conditions by incorporating intelligent security solutions that enable real-time monitoring, efficient emergency response, and proactive threat detection.

For instance, In February 2025, the City of Johannesburg approved a new by-law to regulate the use of closed-circuit television (CCTV) cameras within its jurisdiction. This legislation mandates that both private and public entities register CCTV systems that monitor public spaces, including body-worn cameras, drones, and automatic number plate recognition devices.

Key Market Segments

By Component

- Solution

- Access and Control Systems

- Surveillance and Alert System

- Anti-theft Systems

- Antiterrorist and Inspection Equipment

- Others

- Service

- Professional Services

- Managed Services

By Deployment Mode

- On-premises

- Cloud-based

By Connectivity

- Ethernet

- Wireless

- Cellular

By Application

- Environmental

- Public Sector

- Customs Service Sector

- Postal

- Telecommunications

- Residential

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trends

Integration of Artificial Intelligence and Machine Learning

The adoption of Artificial Intelligence (AI) and Machine Learning (ML) in electronic security systems has significantly enhanced threat detection capabilities. These technologies enable real-time analysis of vast data sets, allowing for the identification of unusual patterns and behaviors that may indicate security threats.

For instance, AI-powered surveillance cameras can differentiate between routine activities and potential security breaches, thereby reducing false alarms and improving response times. According to a report by CMS Information Security, AI and ML are transforming cybersecurity by enabling faster and more accurate threat detection.

Convergence of Physical and Cybersecurity Measures

The traditional separation between physical security and cybersecurity is diminishing, leading to a more integrated approach to threat management. This convergence ensures that both physical and digital assets are protected under a unified security strategy.

For example, access control systems now often include biometric authentication, which secures physical entry points while also safeguarding digital information. A study by Kisi highlights this trend, noting that merging IT and physical infrastructure can improve response times and strengthen collaboration across security functional areas .

Business Benefits

Enhanced Protection of Assets and Personnel

Implementing electronic security systems provides businesses with robust protection for both physical assets and personnel. Surveillance cameras, alarm systems, and access controls deter unauthorized access and can quickly alert authorities in case of security breaches.

This not only helps in preventing theft and vandalism but also ensures the safety of employees and customers. According to Koorsen Fire & Security, modern security systems can detect issues like fires or leaks early, minimizing potential damage.

Operational Efficiency and Cost Savings

Electronic security systems contribute to operational efficiency by automating routine security tasks and providing real-time monitoring capabilities. This automation reduces the need for extensive manual oversight, allowing security personnel to focus on more critical tasks.

Additionally, many insurance companies offer premium discounts to businesses that have comprehensive security systems in place, recognizing the reduced risk of incidents. As noted by Safeguard On Demand, such systems can lead to reduced insurance costs and provide valuable business intelligence.

Driver

Urbanization and Smart City Initiatives

The global trend of rapid urbanization has significantly increased the demand for advanced electronic security systems. As cities expand, there is a pressing need to ensure the safety of public spaces, transportation networks, and critical infrastructure. This necessity has led to the integration of sophisticated security solutions, such as surveillance cameras, access control systems, and emergency response mechanisms, into urban planning.

For instance, in December 2024, the Government of India announced new initiatives to enhance electronic security infrastructure across the country, as highlighted in a press release by the Press Information Bureau (PIB). These initiatives focused on strengthening surveillance systems, upgrading critical infrastructure security, and promoting the adoption of advanced electronic security solutions in public spaces.

The development of smart cities, which leverage technology to enhance the quality of urban services, further amplifies this demand. Smart city initiatives worldwide are incorporating electronic security measures to create safer and more efficient urban environments. These projects often involve the deployment of interconnected devices and systems that enable real-time monitoring and rapid response to incidents.

Restraint

High Installation and Maintenance Costs

The adoption of electronic security systems is often hindered by the substantial costs associated with their installation and ongoing maintenance. Advanced security solutions require significant investment in hardware, software, and infrastructure, which can be a barrier for small and medium-sized enterprises (SMEs) and residential users.

The financial burden is further compounded by the need for regular updates, system upgrades, and technical support to ensure optimal performance and address emerging security threats. These high costs can deter potential users from implementing comprehensive electronic security measures, particularly in cost-sensitive markets.

The financial constraints may lead to the adoption of less effective security solutions or the complete absence of such systems, thereby increasing vulnerability to security breaches. Addressing this restraint requires the development of cost-effective solutions and financing models that make electronic security more accessible to a broader range of users.

Opportunity

Integration of AI and IoT Technologies

The convergence of Artificial Intelligence (AI) and the Internet of Things (IoT) presents a significant opportunity for the electronic security market. AI enhances the capabilities of security systems by enabling real-time data analysis, predictive analytics, and automated decision-making.

For instance, In October 2024, the U.S. Department of Defense is actively testing advanced AI software to enhance physical security at military installations. These initiatives demonstrate how AI-driven technologies can improve threat detection, automate security monitoring, and enable faster, more accurate responses to potential risks.

When combined with IoT devices, such as sensors and cameras, AI can facilitate proactive threat detection and response, thereby improving the effectiveness of security measures. The integration of AI and IoT technologies allows for the development of intelligent security systems that can adapt to dynamic environments and evolving threats.

These systems can monitor vast areas, analyze patterns, and respond to incidents with minimal human intervention. The adoption of such advanced technologies is particularly beneficial in complex settings like smart cities, where the need for efficient and responsive security solutions is paramount. As AI and IoT technologies continue to evolve, their application in electronic security is expected to drive innovation and market growth.

Challenge

Escalating Cybersecurity Threats

The increasing sophistication and frequency of cyberattacks pose a significant challenge to the electronic security market. As security systems become more interconnected and reliant on digital technologies, they become attractive targets for cybercriminals seeking to exploit vulnerabilities.

Attacks such as ransomware, data breaches, and system intrusions can compromise the integrity of security systems, leading to operational disruptions and loss of sensitive information. The challenge is further exacerbated by the rapid pace of technological advancements, which can outstrip the development of adequate cybersecurity measures.

Organizations may struggle to keep their security systems updated and resilient against emerging threats. This dynamic landscape necessitates continuous investment in cybersecurity infrastructure, employee training, and the adoption of best practices to safeguard electronic security systems. Failure to address these challenges can undermine the effectiveness of security measures and erode trust in electronic security solutions.

Key Player Analysis

Axis Communications has made significant strides in sustainable data center solutions. In April 2024, the company launched Axis Cloud Connect, an open, cloud-based platform designed to deliver secure, scalable, and flexible security solutions. This platform integrates seamlessly with Axis devices, enabling managed services that support system and device management, video and data delivery, and robust cybersecurity.

In 2024, ADT introduced the ADT+ platform and Trusted Neighbor™ technology, enhancing its smart home security offerings. These innovations reflect ADT’s dedication to providing reliable and advanced security solutions. The company also reported strong financial results, including a record-high recurring monthly revenue balance and improved customer retention, indicating the positive impact of its new product launches.

Bosch announced in December 2024 the sale of its Building Technologies division’s product business for security and communications technology to the European investment firm Triton. This strategic move includes three business units: Video, Access and Intrusion, and Communication. The transaction, expected to close by mid-2025, aims to streamline Bosch’s operations and focus on core areas, potentially impacting its approach to sustainable data center solutions.

Top Key Players Covered

- Axis Communications (Canon Inc.)

- ADT Security Services Inc. (Apollo Global Management Inc.)

- Bosch Security Systems Inc.

- FLIR Systems Inc.

- Hitachi Ltd.

- Honeywell International Inc.

- IBM Corporation

- Tyco International (Johnson Controls)

- Lockheed Martin Corporation

- OSI Systems

- Siemens AG

- Thales Group

- Others

Recent Developments

- December 2024: Bosch signed an agreement to sell its Security and Communications Technology Product Business to private equity firm Triton. The transaction includes three business units: Video, Access and Intrusion, and Communication. Completion is expected by mid-2025.

- June 2024: ADT, through its parent company Intelligent Monitoring Group, announced the acquisition of Dataline Visual Link for AUD 7 million, aiming to enhance its electronic security offerings.

- April 2024: Hitachi Systems merged with its group company SecureBrain Corporation to expand its managed security services business globally.

Report Scope

Report Features Description Market Value (2024) USD 76.8 Bn Forecast Revenue (2034) USD 208.4 Bn CAGR (2025-2034) 8.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solution (Access and Control Systems, Surveillance and Alert System, Anti-theft Systems, Antiterrorist and Inspection Equipment, Others), Service (Professional Services, Managed Services)), By Deployment Mode (On-premises, Cloud-based), By Connectivity (Ethernet, Wireless, Cellular), By Application (Environmental, Public Sector, Customs Service Sector, Postal, Telecommunications, Residential, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Axis Communications (Canon Inc.), ADT Security Services Inc. (Apollo Global Management Inc.), Bosch Security Systems Inc., FLIR Systems Inc., Hitachi Ltd., Honeywell International Inc., IBM Corporation, Tyco International (Johnson Controls), Lockheed Martin Corporation, OSI Systems, Siemens AG, Thales Group, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Electronic Security MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Electronic Security MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Axis Communications (Canon Inc.)

- ADT Security Services Inc. (Apollo Global Management Inc.)

- Bosch Security Systems Inc.

- FLIR Systems Inc.

- Hitachi Ltd.

- Honeywell International Inc.

- IBM Corporation

- Tyco International (Johnson Controls)

- Lockheed Martin Corporation

- OSI Systems

- Siemens AG

- Thales Group

- Others