Global Electrical Galvanized Steel Market Size, Share Analysis Report By Product Form (Sheets, Coils And Wires, And Others), By Application (Construction, Automotive, Agriculture, Renewable Energy, Power And Utilities, Industrial Machinery, Transport Infrastructure, Consumer Goods, And Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 162617

- Number of Pages: 209

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

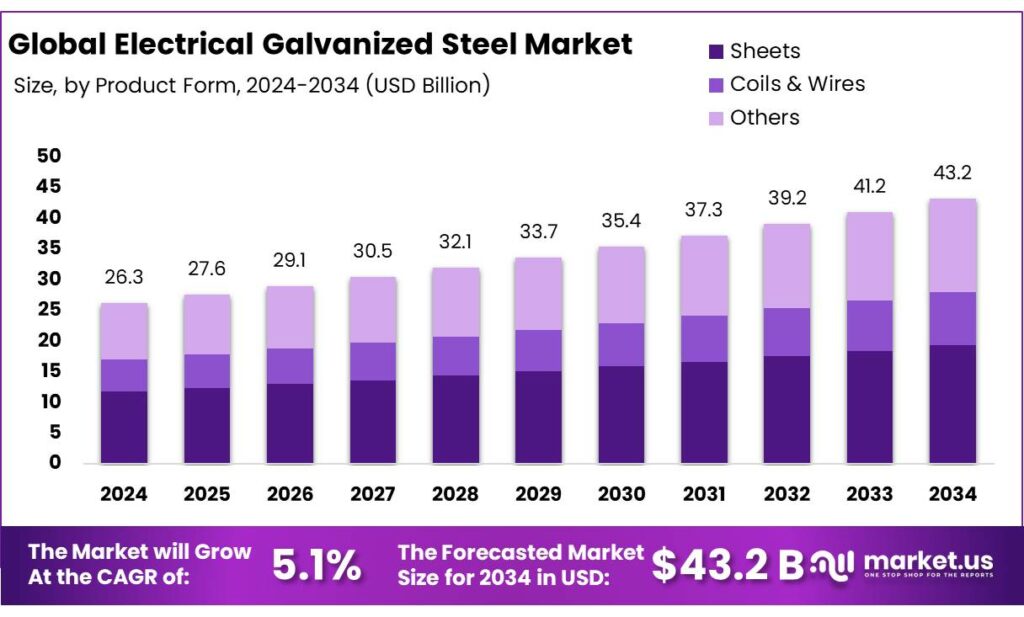

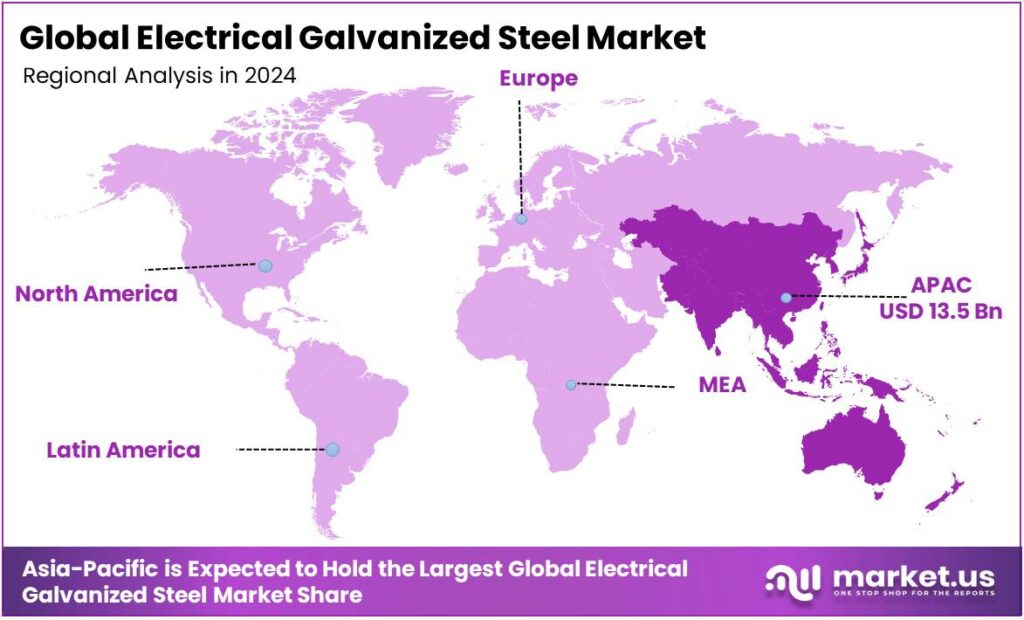

The Global Electrical Galvanized Steel Market size is expected to be worth around USD 43.2 Billion by 2034, from USD 26.3 Billion in 2024, growing at a CAGR of 5.1% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 51.4% share, holding USD 11.2 Billion in revenue.

Electrical galvanized steel is carbon steel coated with a thin, uniform layer of zinc through an electrolytic process to protect it from corrosion. The zinc coating protects the steel from rust, though it offers less protection than thicker coatings from the hot-dip method for prolonged exposure to corrosive environments. This method uses an electric current to deposit the zinc onto the steel surface in a bath. The electrolytic process results in an extremely uniform and smooth zinc layer.

The smooth finish makes it an excellent base for painting and is suitable for applications where a clean appearance is important. Most of the steel produced is consumed by the construction and infrastructure sector around the globe. As there is a global shift towards a sustainable economy, the reuse and recycling of steel has gained momentum. Additionally, the renewable energy growth has reflected in demand for galvanized steel, and solar and wind energy infrastructure requires extensive use of galvanized steel.

- Globally, in 2023, the crude steel production reached around 1.9 billion tons, and 219 kg of steel was used in new products per person.

Key Takeaways

- The global electrical galvanized steel market was valued at USD 26.3 billion in 2024.

- The global electrical galvanized steel market is projected to grow at a CAGR of 5.1% and is estimated to reach USD 43.2 billion by 2034.

- Based on the forms of steel, the electrical galvanized steel sheets dominated the market, with around 44.9% of the total global market.

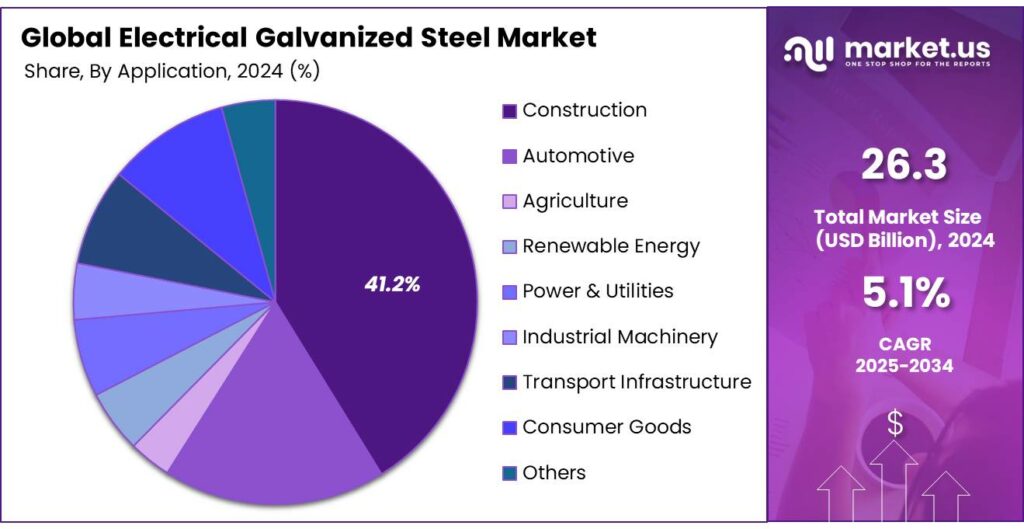

- Among the applications of electrical galvanized steel, the construction industry emerged as a major segment in the market, with 41.2% of the market share.

- In 2024, the Asia Pacific was the most dominant region in the electrical galvanized steel market, accounting for around 51.4% of the total global consumption.

Purity Analysis

Electrical Galvanized Steel Sheets Dominated the Market in 2024.

The electrical galvanized steel market is segmented based on product forms into sheets, coils & wires, and others. The electrical galvanized steel sheets dominated the market, comprising around 44.9% of the market share. The sheets are more widely used than coils, wires, or other forms due to their versatility, ease of handling, and suitability for a broad range of applications. Sheets offer uniform thickness and a flat surface, making them ideal for fabrication into electrical panels, enclosures, appliance housings, and parts in the automotive and construction sectors.

Unlike coils, which require additional processing to flatten, sheets are ready for immediate use in manufacturing, reducing time and labor costs. In addition, their standardized dimensions make storage, transport, and assembly more efficient. Similarly, coils, wires, and other forms are used for specific applications, which makes sheets the most used product volume-wise.

Application Analysis

The Construction Industry Emerged as a Leading Segment in the Electrical Galvanized Steel Market.

On the basis of applications of electrical galvanized steel, the market is segmented into construction, automotive, agriculture, renewable energy, power & utilities, industrial machinery, transport infrastructure, consumer goods, and others. Approximately 41.2% of the revenue in the electrical galvanized steel market is generated by the construction and infrastructure industry.

The steel is predominantly used in the construction industry due to its superior corrosion resistance, structural strength, and cost-effectiveness, which are essential for building applications. It is widely utilized in roofing, wall systems, framing, ductwork, and support structures, where long-term durability and protection against moisture are critical. Unlike sectors such as automotive or consumer goods, where materials are often chosen for weight reduction or aesthetic finish, construction prioritizes robustness and longevity.

Additionally, the scale of material required in construction projects, ranging from residential buildings to large infrastructure, makes galvanized steel a practical choice due to its availability in large volumes and ease of fabrication. In addition, its fire resistance and recyclability better align with modern construction standards and sustainability goals.

Key Market Segments

By Product Form

- Sheets

- Coils & Wires

- Others

By Application

- Construction

- Automotive

- Agriculture

- Renewable Energy

- Solar

- Wind

- Others

- Power & Utilities

- Industrial Machinery

- Transport Infrastructure

- Consumer Goods

- Others

Drivers

Construction and Infrastructure Industry Drives the Electrical Galvanized Steel Market.

The construction and infrastructure industry plays a crucial role in driving demand for electrical galvanized steel, owing to its durability, corrosion resistance, and versatility in structural applications. Galvanized steel is widely used in building frames, roofing, support beams, and wall systems, especially in urban infrastructure projects.

In countries experiencing rapid urbanization, such as India and Indonesia, construction and infrastructure activity have surged, contributing significantly to the increased consumption of galvanized steel. For instance, according to the Indian Ministry of Commerce and Industry, US$1 trillion investments in infrastructure were proposed by India’s planning commission during the 12th five-year plan in 2024.

The galvanized steel is commonly used in highway guardrails, bridges, and railway infrastructure due to its strength and long-term performance under harsh weather conditions. Additionally, the push for smart cities and green buildings has further fueled the demand, as galvanized steel supports sustainable construction by offering a long service life and recyclability. This makes it a preferred material for both residential and commercial construction across developed and emerging economies.

Restraints

Environmental Regulations Might Increase the Production Costs of the Electrical Galvanized Steel.

Environmental regulations aimed at reducing emissions, controlling waste, and minimizing the environmental impact of industrial processes are likely to increase production costs in the electrical galvanized steel market. The galvanization process, which involves coating steel with zinc, can generate emissions and by-products that must be carefully managed under stricter environmental laws. Compliance with air and water pollution standards, energy efficiency mandates, and waste disposal protocols often requires costly upgrades to equipment and processes. For instance, electro-galvanizing facilities may need to install advanced filtration systems or adopt cleaner energy sources, both of which can raise operational expenses.

Additionally, regulations may limit the use of certain chemicals in the coating process, prompting the industry to explore alternative, potentially more expensive materials or techniques. In the European Union, where carbon emissions from steel production are closely monitored, producers face pressure to adopt low-emission technologies, which can further impact costs. These regulatory challenges may affect competitiveness, especially for smaller manufacturers.

Opportunity

Renewable Energy Growth Creates Opportunities in the Electrical Galvanized Steel Market.

The rapid expansion of renewable energy infrastructure is creating significant opportunities in the electrical galvanized steel market. As solar, wind, and hydroelectric power projects increase globally, the demand for strong, corrosion-resistant materials has surged.

- According to the International Energy Agency, global annual renewable capacity was 666 GW in 2024. Solar PV and wind are forecasted to account for 95% of all renewable capacity additions through 2030 as their generation costs are lower than for both fossil and non‑fossil alternatives in most countries, and policies continue to support them.

Electrical galvanized steel is widely used in mounting structures for solar panels, wind turbine components, and electrical enclosures due to its durability and ability to withstand harsh environmental conditions. For instance, solar farms require extensive steel framing systems to support panels over large areas, and galvanized coatings help extend their lifespan with minimal maintenance. Similarly, in wind energy, galvanized steel is used in turbine towers, anchor bolts, and electrical conduit systems.

- According to industry estimates, solar power installations alone use thousands of tons of galvanized steel annually. With more than 30% of new electricity capacity worldwide coming from renewables in recent years, the need for robust materials such as galvanized steel is expected to grow in tandem with the global push for cleaner energy solutions.

Trends

Shift Towards Circular Economy.

The construction sector is a priority for a circular economy, as, based on a full life cycle of the buildings, it is responsible for 50% of extracted materials, 50% of total energy consumption, 33% of water use, and 35% of the waste generation. Steel is an integral part of the construction sector, and the construction sector is a major driver for the production of steel. This compels the electrical galvanized steel market to focus on the circular economy. The galvanized steel is highly valued for its ability to be recycled multiple times without loss of mechanical properties, making it an ideal material in sustainable manufacturing and construction.

- By weight, 81% of all steel products are recovered for recycling at the end of their life. This includes 85% of automobiles, 82% of appliances, 70% of containers, 72% of reinforcing bars, and 98% of structural steel.

- Globally, it is estimated that about 630 million tons of recycled steel are used each year in global steel production, thereby preventing almost 950 million tons of CO2 emissions, and still, in 2022, 1.91 tons of CO2 were emitted per ton of crude steel cast.

For instance, decommissioned electrical panels, old transmission towers, and structural components can be dismantled, melted, and reprocessed into new steel products, reducing the need for raw material extraction and lowering carbon emissions. Additionally, industries are designing products with disassembly and reuse in mind, promoting longer life cycles for galvanized steel components. This aligns with environmental goals and government policies focused on waste reduction, making the recyclability of galvanized steel a key trend driving sustainable industrial practices.

Geopolitical Impact Analysis

Geopolitical Tensions Are Impacting the Electrical Galvanized Steel Market by Disrupting the Essential Supply Chains in the Market.

The geopolitical tensions, such as trade disputes, regional conflicts, and shifting international alliances, are significantly impacting the electrical galvanized steel market. Disruptions in global supply chains, especially for raw materials such as zinc and iron ore, are causing delays and price fluctuations. For instance, tensions in the Middle East and Eastern Europe have disrupted mining operations and shipping routes, affecting the steady supply of essential inputs for steel production.

Additionally, sanctions on countries involved in steel or zinc exports, such as Russia and Iran, have forced manufacturers to seek alternative, and often more expensive, sources. According to global trade data, countries heavily reliant on imports for zinc or semi-finished steel products have experienced delays of several weeks in shipments, which directly impacts production timelines.

Moreover, rising fuel and energy costs due to geopolitical instability further strain steel manufacturing, particularly in energy-intensive processes like galvanization. In 2022, 20.99 GJ of energy were consumed per ton of crude steel cast. In Asia, territorial disputes and restrictions on cross-border trade have affected the flow of galvanized steel products and components used in electrical systems.

As governments prioritize national security and energy independence, some are imposing export controls or increasing tariffs, leading to reduced international availability. These factors contribute to increased uncertainty, making it harder for manufacturers to plan production and pricing strategies effectively.

Regional Analysis

Asia Pacific Held the Largest Share of the Global Electrical Galvanized Steel Market.

In 2024, the Asia Pacific dominated the global electrical galvanized steel market, holding about 51.4% of the total global consumption. The region holds the largest share of the global electrical galvanized steel market, driven by rapid industrialization, urbanization, and infrastructure development across key economies such as China, India, Japan, and South Korea. China, as the world’s largest steel producer and consumer, significantly contributes to regional dominance.

- According to the European Steel Association, in 2023, approximately 74% of the world’s crude steel production took place in the Asia Pacific. The top three producers in the region are China, India, and Japan. China accounted for most production with around 52% of the world’s production, India for 7.6%, and Japan for 4.7%.

The massive investments of China in construction, transportation, and renewable energy projects create a strong demand for electrical galvanized steel in structural supports, electrical enclosures, and energy transmission infrastructure. Similarly, India’s push for electrification in rural areas and expansion of smart city initiatives has led to increased usage of galvanized steel in electrical and utility applications.

Japan and South Korea, known for their advanced manufacturing and automotive industries, also contribute through the use of high-quality galvanized steel in electrical components and appliances. The region’s large-scale production capacity, availability of raw materials, and government-driven infrastructure programs further reinforce its leading position in the market.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

As there is global demand for electro-galvanized steel, almost all major players in the market have invested in expanding their manufacturing facilities to cater to the growing need. In addition, several players have formed joint ventures in the regions with extensive reserves. The companies in the market focus on gaining various certifications from the government.

The major market players in the electrical galvanized steel market are ArcelorMittal, Nippon Steel Corporation, POSCO, JFE Steel Corporation, ThyssenKrupp Steel, United States Steel Corporation, NLMK Group, JSW Steel, Tata Steel, China Baowu Steel Group (Baoshan Iron & Steel), HBIS Group (Hebei Iron & Steel Group), SeAH Steel Holdings, Kobe Steel (KOBELCO), Marcegaglia Steel Group, and KG Dongbu Steel.

Key Development

- In February 2025, ArcelorMittal announced that it had invested in building an advanced, non-grain-oriented electrical steel (NOES) manufacturing facility in Alabama, which will be capable of producing up to 150,000 metric tons of NOES annually.

- In March 2023, United States Steel Corporation announced that its electrical steel product, InduX, had begun production at its Big River Steel facility with the commissioning of its non-grain-oriented (NGO) electrical steel line.

The major players in the industry

- ArcelorMittal S.A.

- Nippon Steel Corporation

- POSCO

- JFE Steel Corporation

- ThyssenKrupp Steel Europe AG

- United States Steel Corporation (U.S. Steel)

- NLMK Group

- JSW Steel Ltd.

- Tata Steel Limited

- China Baowu Steel Group (Baoshan Iron & Steel Co., Ltd.)

- HBIS Group (Hebei Iron & Steel Group Co., Ltd.)

- SeAH Steel Holdings Corporation

- Kobe Steel, Ltd. (KOBELCO)

- Marcegaglia Steel Group

- KG Dongbu Steel Co., Ltd.

- Other Key Players

Report Scope

Report Features Description Market Value (2024) USD 26.3 Bn Forecast Revenue (2034) USD 43.2 Bn CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Form (Sheets, Coils & Wires, Others), By Application (Construction, Automotive, Agriculture, Renewable Energy, Power & Utilities, Industrial Machinery, Transport Infrastructure, Consumer Goods, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape ArcelorMittal, Nippon Steel Corporation, POSCO, JFE Steel Corporation, ThyssenKrupp Steel, United States Steel Corporation, NLMK Group, JSW Steel, Tata Steel, China Baowu Steel Group (Baoshan Iron & Steel), HBIS Group (Hebei Iron & Steel Group), SeAH Steel Holdings, Kobe Steel (KOBELCO), Marcegaglia Steel Group, KG Dongbu Steel, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Electrical Galvanized Steel MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Electrical Galvanized Steel MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ArcelorMittal S.A.

- Nippon Steel Corporation

- POSCO

- JFE Steel Corporation

- ThyssenKrupp Steel Europe AG

- United States Steel Corporation (U.S. Steel)

- NLMK Group

- JSW Steel Ltd.

- Tata Steel Limited

- China Baowu Steel Group (Baoshan Iron & Steel Co., Ltd.)

- HBIS Group (Hebei Iron & Steel Group Co., Ltd.)

- SeAH Steel Holdings Corporation

- Kobe Steel, Ltd. (KOBELCO)

- Marcegaglia Steel Group

- KG Dongbu Steel Co., Ltd.

- Other Key Players