Global Electric Bicycle Market Size, Share, Growth Analysis By Propulsion Type (Pedal Assist, Throttle), By Battery Type (Lead Acid, Lithium-ion, Nickel Metal Hydride, Others), By Motor Type (Hub Motor, Mid-drive Motor), By Battery Capacity (Below 250W, 251W to 450W, 451W to 650W, Above 650W), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 162178

- Number of Pages: 384

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

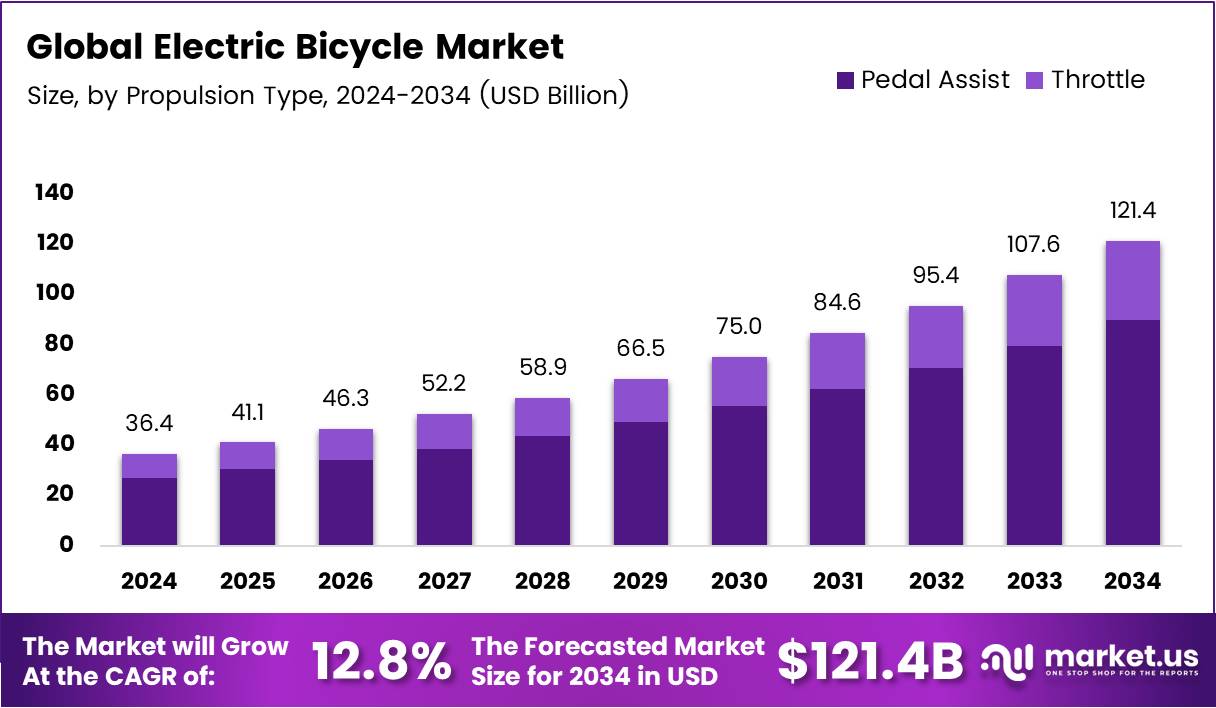

The Global Electric Bicycle Market size is expected to be worth around USD 121.4 Billion by 2034, from USD 36.4 Billion in 2024, growing at a CAGR of 12.8% during the forecast period from 2025 to 2034.

The Electric Bicycle Market represents a transformative segment of the global mobility industry, integrating sustainability with technological innovation. Electric bicycles, or e-bikes, combine traditional cycling mechanisms with electric motors, offering efficient, eco-friendly, and affordable urban transport solutions. As urban congestion rises, e-bikes provide a compelling alternative to fossil-fuel-based commuting.

Moreover, the market’s growth is driven by rising environmental awareness and government initiatives promoting green mobility. Many countries are investing in cycling infrastructure and electric mobility subsidies, which accelerate consumer adoption. Additionally, continuous advancements in lithium-ion battery technology enhance performance, range, and durability, making e-bikes increasingly attractive to both daily commuters and leisure riders.

Furthermore, rising fuel costs and stricter emission regulations are influencing consumer behavior toward sustainable transportation. Governments across Europe and Asia-Pacific actively promote electric bicycles through tax incentives and urban cycling policies. This policy alignment, combined with private investment in smart mobility, creates a dynamic environment for rapid market expansion.

The global Electric Bicycle Market also benefits from expanding product diversification and innovation. Manufacturers are integrating Internet of Things (IoT) features, lightweight materials, and improved safety systems. Such technological evolution supports premium product offerings, enabling strong market positioning. Consequently, e-bikes are transitioning from niche mobility options to mainstream urban transport solutions.

According to industry reports, e-bike riders generally feel safer on the road than regular cyclists, with 78.3% of e-bike users feeling safe compared to 63.7% of regular cyclists. Additionally, e-bikes achieve an average speed of 13.3 kph, surpassing the 10.4 kph of traditional bicycles. Since the 2000s, China has remained the largest e-bike market, representing over 90% of annual global production and sales, according to the same source.

Key Takeaways

- The Global Electric Bicycle Market is projected to reach USD 121.4 Billion by 2034 from USD 36.4 Billion in 2024, growing at a CAGR of 12.8%.

- Pedal Assist leads the By Propulsion Type segment with a 73.9% share due to energy efficiency and balanced performance.

- Lithium-ion batteries dominate the By Battery Type segment with a 58.3% share, driven by superior energy density and fast charging.

- Hub Motor holds the top position in the By Motor Type segment, accounting for 69.5% of the market.

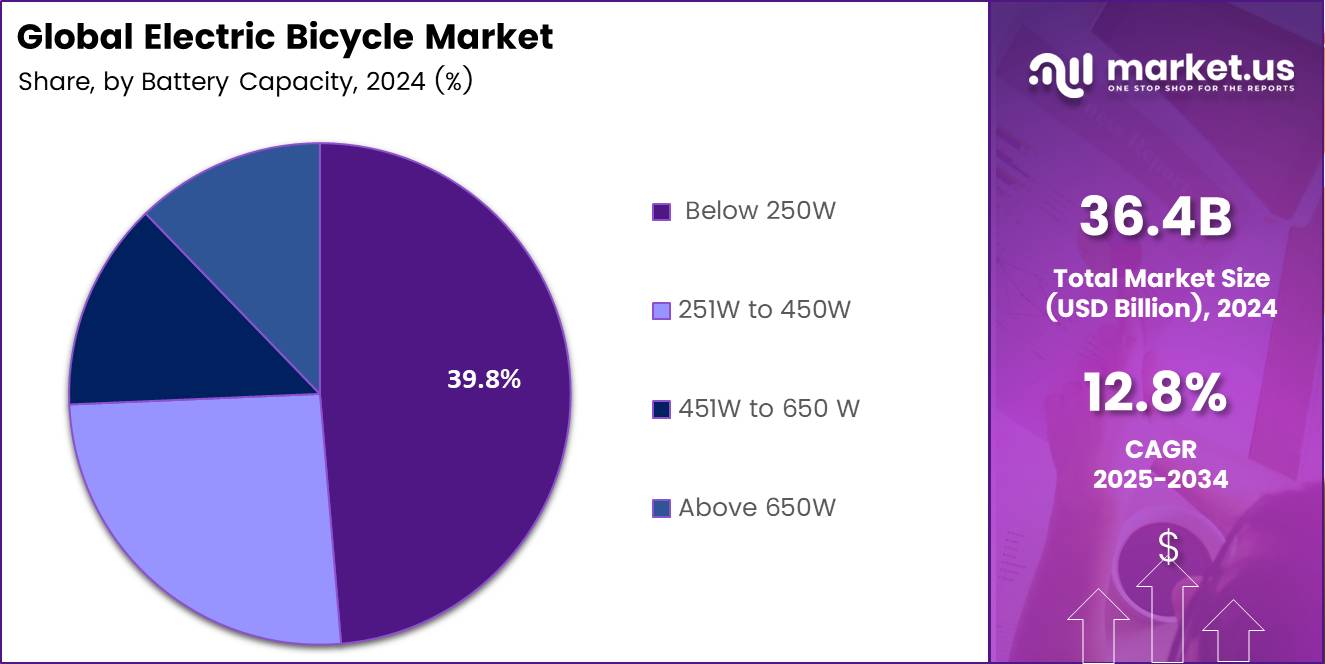

- Below 250W capacity dominates the By Battery Capacity segment with a 39.8% share, suitable for urban commuting.

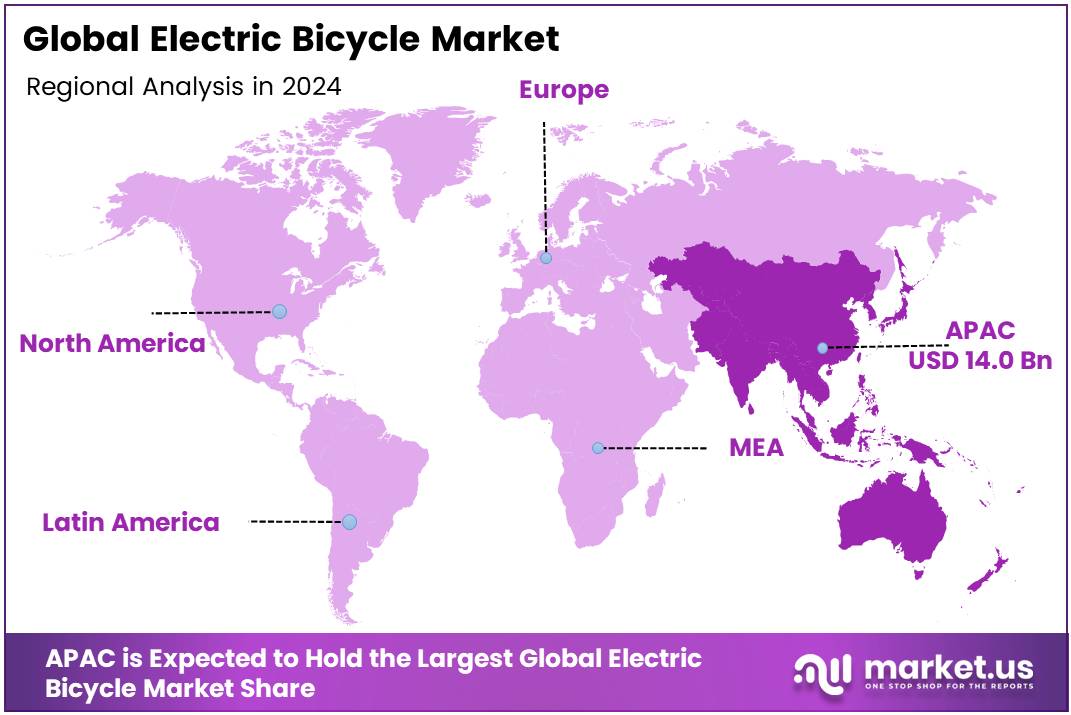

- Asia Pacific dominates regionally with a 38.6% market share, valued at USD 14.0 Billion in 2024.

By Propulsion Type Analysis

Pedal Assist dominates with 73.9% due to its energy efficiency and balanced riding experience.

In 2024, Pedal Assist held a dominant market position in the By Propulsion Type Analysis segment of the Electric Bicycle Market, with a 73.9% share. The strong preference for pedal assist systems is driven by their combination of manual and electric support, allowing riders to extend battery life while maintaining fitness activity. This hybrid functionality has made them highly popular across urban and recreational users. Moreover, government incentives promoting eco-friendly commuting further enhance the adoption of pedal-assist bicycles worldwide.

Throttle-based e-bikes are gaining popularity among users who prefer effortless acceleration without pedaling. These models appeal to older riders and those commuting in hilly areas, as they offer easy maneuverability and reduced fatigue. While their share is smaller than pedal assist, throttle e-bikes continue to expand in markets with dense urban infrastructure, supported by advancements in motor responsiveness and comfort-focused designs.

By Battery Type Analysis

Lithium-ion dominates with 58.3% owing to its lightweight design and superior energy density.

In 2024, Lithium-ion batteries held a dominant market position in the By Battery Type Analysis segment of the Electric Bicycle Market, with a 58.3% share. Their popularity stems from excellent recharge cycles, fast charging, and minimal maintenance requirements. As production costs decrease and energy density improves, manufacturers increasingly favor lithium-ion packs to meet efficiency and sustainability goals.

Lead Acid batteries remain in use for cost-sensitive models due to their affordability and availability. However, they are heavier and have shorter lifespans, which limits adoption in performance-oriented e-bikes. Still, in developing regions, lead acid remains viable for short-distance and rental applications.

Nickel Metal Hydride batteries offer moderate capacity and improved environmental safety compared to lead acid. Their usage is declining due to the rapid advancement of lithium-ion technology, but they remain a secondary choice in niche e-bike designs requiring mid-level performance and cost balance.

Other battery chemistries, including emerging solid-state and graphene-enhanced batteries, are gradually entering the market. These technologies promise higher safety and energy output, but their commercial adoption remains limited due to cost and scalability challenges, representing future growth potential for next-generation e-bike models.

By Motor Type Analysis

Hub Motor dominates with 69.5% driven by affordability and simplified integration.

In 2024, the Hub Motor segment held a dominant position in the By Motor Type Analysis segment of the Electric Bicycle Market, accounting for a 69.5% share. Its widespread use results from low manufacturing costs, simple maintenance, and compatibility with various frame designs. Hub motors offer quiet operation and reliable performance, making them ideal for commuter and city e-bikes. The rising popularity of rear-hub and integrated hub systems continues to reinforce this leadership position.

Mid-drive Motors are increasingly favored for high-performance and off-road e-bikes. They provide balanced weight distribution, improved torque, and superior hill-climbing efficiency. Although costlier, mid-drive systems attract riders seeking premium experiences and dynamic control, especially in the European and North American markets, where performance-oriented biking is on the rise.

By Battery Capacity Analysis

Below 250W dominates with 39.8% due to regulatory compliance and urban commuting suitability.

In 2024, Below 250W held a dominant market position in the By Battery Capacity Analysis segment of the Electric Bicycle Market, capturing a 39.8% share. This category thrives in regions like Europe and Asia, where regulations favor low-power e-bikes. Such models are ideal for city commuting, offering efficient performance, lightweight structure, and longer battery life per charge, making them accessible to a broader consumer base.

251W to 450W e-bikes are gaining traction among riders demanding extra support on uneven terrains. These models balance speed and range, appealing to daily commuters seeking moderate power without violating regulatory limits. Continuous improvements in motor efficiency and compact design are boosting adoption within this capacity segment.

451W to 650W capacity bikes cater to adventure riders and delivery fleets requiring longer range and higher speed. Their capability to handle steep inclines and extended rides makes them increasingly popular in commercial logistics and leisure biking sectors, despite higher costs.

Above 650W e-bikes are designed for performance enthusiasts and off-road users. They deliver superior acceleration, endurance, and power, suitable for rugged environments. Although limited by legal restrictions in some markets, this segment is projected to grow as demand for high-performance e-bikes rises globally.

Key Market Segments

By Propulsion Type

- Pedal Assist

- Throttle

By Battery Type

- Lead Acid

- Lithium-ion

- Nickel Metal Hydride

- Others

By Motor Type

- Hub Motor

- Mid-drive Motor

By Battery Capacity

- Below 250W

- 251W to 450W

- 451W to 650W

- Above 650W

Drivers

Rising Adoption of Sustainable Urban Mobility Solutions Drives Market Growth

The electric bicycle market is gaining momentum as cities look for cleaner and more efficient transportation options. With growing concerns about air pollution and traffic congestion, people are turning to e-bikes as a sustainable way to commute short and medium distances. Urban commuters prefer e-bikes because they reduce carbon emissions and provide an affordable alternative to cars.

Another major driver is the rapid advancement in lithium-ion battery technology. Modern batteries now offer longer ranges, shorter charging times, and better durability. These improvements make electric bicycles more practical and convenient for everyday use.

Government initiatives and subsidies are also fueling demand. Many countries offer tax benefits, rebates, or grants to encourage the adoption of electric mobility solutions, including e-bikes. This policy support is helping make e-bikes more accessible to a wider consumer base.

In addition, the continuous rise in fuel prices has encouraged many consumers to shift toward electric commuting. As the cost of gasoline and diesel increases, e-bikes present a cost-effective option for daily travel, promoting steady market growth.

Restraints

High Initial Cost of Electric Bicycles Compared to Conventional Bikes Restrains Market Growth

Despite strong market potential, the electric bicycle industry faces several restraints. The high upfront cost of e-bikes compared to regular bicycles remains a major challenge. The addition of electric motors, batteries, and control systems significantly increases manufacturing costs, limiting affordability for price-sensitive customers.

Limited charging infrastructure in developing regions further slows market growth. Many urban and rural areas still lack sufficient charging points, creating concerns about convenience and range limitations. This issue discourages some users from switching to e-bikes.

Battery-related challenges also impact the market. Short battery lifespan and expensive replacement costs reduce overall value for consumers, especially for those using e-bikes for daily commuting. Maintaining battery performance is crucial for long-term adoption.

Moreover, e-bikes face performance issues in extreme weather conditions. Factors like heavy rain, snow, or high temperatures can affect battery life and motor efficiency, limiting their reliability in certain regions.

Growth Factors

Expansion of Shared E-Bike and Micro-Mobility Platforms Creates Growth Opportunities

The electric bicycle market holds strong growth opportunities through the expansion of shared e-bike and micro-mobility platforms. Urban residents increasingly use shared mobility services for short trips, reducing dependence on private vehicles. This trend is driving investments in public e-bike sharing networks.

The integration of IoT and smart connectivity features offers another avenue for market expansion. Connected e-bikes enable real-time tracking, performance monitoring, and theft prevention, enhancing user experience and safety.

There is also a rising demand for cargo and delivery-specific electric bicycles. E-commerce growth and the need for last-mile delivery solutions have led businesses to adopt e-bikes for efficient and eco-friendly logistics. These bikes can carry heavier loads while reducing operating costs.

Emerging markets with growing urban congestion present vast untapped potential. As cities in Asia, Latin America, and Africa expand, electric bicycles can become a practical solution for daily commuting and delivery services, supporting long-term market growth.

Emerging Trends

Increasing Popularity of Foldable and Compact E-Bike Designs Shapes Market Trends

The electric bicycle market is witnessing exciting trends that are reshaping its growth path. One key trend is the development of lightweight carbon fiber frames, which improve efficiency and portability. These materials make e-bikes easier to handle and enhance battery performance through reduced weight.

The growing popularity of foldable and compact e-bike designs is transforming urban mobility. Such designs are ideal for commuters with limited parking space or those combining cycling with public transport, making e-bikes more versatile.

Technological innovations like regenerative braking and energy recovery systems are also becoming popular. These systems improve battery efficiency by converting braking energy into power, extending the bike’s range.

Additionally, collaborations between tech companies and e-bike manufacturers are creating connected ecosystems. Smart features such as GPS navigation, app integration, and performance analytics are enhancing user convenience and driving the next wave of innovation in the market.

Regional Analysis

Asia Pacific Dominates the Electric Bicycle Market with a Market Share of 38.6%, Valued at USD 14 Billion

The Asia Pacific (APAC) region holds the dominant position in the global electric bicycle market, accounting for a market share of 38.6% and valued at approximately USD 14.0 Billion. The region’s growth is primarily driven by high urbanization rates, increasing fuel costs, and strong government incentives promoting sustainable mobility. Countries such as China, Japan, and India are witnessing rising adoption of e-bikes for daily commuting, supported by well-developed manufacturing infrastructure and expanding charging networks.

North America Electric Bicycle Market Trends

The North American electric bicycle market is experiencing rapid growth fueled by the rising demand for eco-friendly transportation alternatives and health-conscious commuting. The United States and Canada are key contributors to this expansion, with consumers increasingly adopting e-bikes for both leisure and short-distance travel. Technological advancements in battery efficiency and the integration of smart connectivity features are also strengthening the region’s market potential.

Europe Electric Bicycle Market Trends

The European market continues to evolve, supported by robust environmental policies, urban mobility programs, and extensive cycling infrastructure. Countries like Germany, the Netherlands, and France are leading in e-bike adoption, driven by strong consumer preference for sustainable transport options. Government subsidies and safety regulations are further boosting sales across both the commuter and recreational segments.

Middle East and Africa Electric Bicycle Market Trends

In the Middle East and Africa (MEA) region, the electric bicycle market is emerging gradually, supported by growing environmental awareness and efforts to reduce dependence on conventional fuels. While still in the nascent stage, the market shows promise in urban centers with increasing interest in micro-mobility and smart city initiatives.

Latin America Electric Bicycle Market Trends

The Latin American market for electric bicycles is gaining traction, especially in countries like Brazil, Mexico, and Chile. The demand is primarily driven by the need for affordable and efficient urban mobility solutions amid rising fuel prices. Increasing awareness of environmental benefits and government initiatives to promote sustainable transport are further contributing to market growth in this region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Electric Bicycle Company Insights

Giant Bicycle, Inc. continues to be a major force in the global e-bike landscape with a strong product portfolio emphasizing innovation, design, and sustainability. The company’s focus on performance-oriented electric bicycles and robust distribution networks has significantly reinforced its global footprint.

Hero Cycles Ltd is leveraging its extensive manufacturing base and strategic international partnerships to expand in the e-mobility segment. The brand’s focus on affordable e-bikes tailored to urban commuters enhances its competitive edge in emerging markets.

Accell Group remains a key player with its diversified brand portfolio and commitment to advanced technology integration. The company’s strategic emphasis on connected and premium electric bikes aligns well with consumer trends toward smart and sustainable commuting.

Robert Bosch GmbH plays a critical role as a technology provider, driving innovation in e-bike components such as motors, batteries, and connectivity systems. Its technological expertise and partnerships with major bicycle manufacturers position it as a cornerstone in shaping the future of the electric bicycle ecosystem.

Top Key Players in the Market

- Giant Bicycle, Inc.

- Hero Cycles Ltd

- Accell Group

- Robert Bosch GmbH

- Kalkhoff Werke GmbH

- Pedego Electric Bikes

- Panasonic Corporation

- Mobility Holdings, Ltd. (Tern)

- Trek Bicycle Corporation

- Shimano Inc.

Recent Developments

- In Aug 2025: Yamaha successfully completes a €30 million takeover deal with Brose’s e-bike business. This marks the finalization of Yamaha’s strategic expansion into the European electric mobility market.

- In Mar 2025: Yamaha Motor announces the acquisition of the bicycle eKit business unit of German manufacturer Brose. The move strengthens Yamaha’s position in the premium e-bike components segment.

- In Mar 2025: Yamaha reaches an agreement to buy Brose’s e-bike drive business, setting the stage for full integration later that year. The acquisition aims to enhance innovation and global competitiveness in e-mobility solutions.

Report Scope

Report Features Description Market Value (2024) USD 36.4 Billion Forecast Revenue (2034) USD 121.4 Billion CAGR (2025-2034) 12.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Propulsion Type (Pedal Assist, Throttle), By Battery Type (Lead Acid, Lithium-ion, Nickel Metal Hydride, Others), By Motor Type (Hub Motor, Mid-drive Motor), By Battery Capacity (Below 250W, 251W to 450W, 451W to 650W, Above 650W) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Giant Bicycle, Inc., Hero Cycles Ltd, Accell Group, Robert Bosch GmbH, Kalkhoff Werke GmbH, Pedego Electric Bikes, Panasonic Corporation, Mobility Holdings, Ltd. (Tern), Trek Bicycle Corporation, Shimano Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Giant Bicycle, Inc.

- Hero Cycles Ltd

- Accell Group

- Robert Bosch GmbH

- Kalkhoff Werke GmbH

- Pedego Electric Bikes

- Panasonic Corporation

- Mobility Holdings, Ltd. (Tern)

- Trek Bicycle Corporation

- Shimano Inc.