Global Drug Screening Market By Product Type (Equipment (Immunoassay Analyzers, Chromatography Instruments, and Breath Analyzers), Consumables (Calibrators & Controls, Assay Kits, and Sample Collection Cups), and Laboratory Services), By Sample Type (Breath, Fluid/Saliva, Hair, and Others), By Drug (Cannabis/Marijuana, Alcohol, Cocaine, and Others), By End-user (Criminal Justice & Law Enforcement Agencies, Workplace & Schools, Drug Testing Laboratories, Hospitals, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 141277

- Number of Pages: 300

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

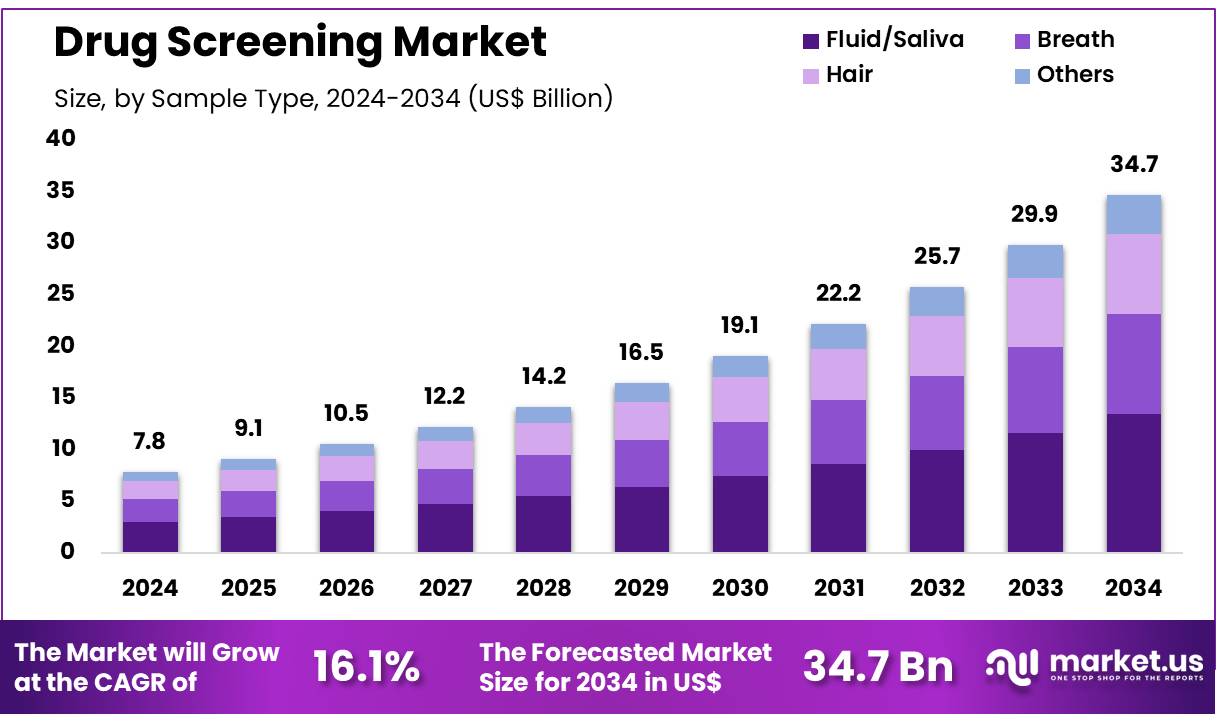

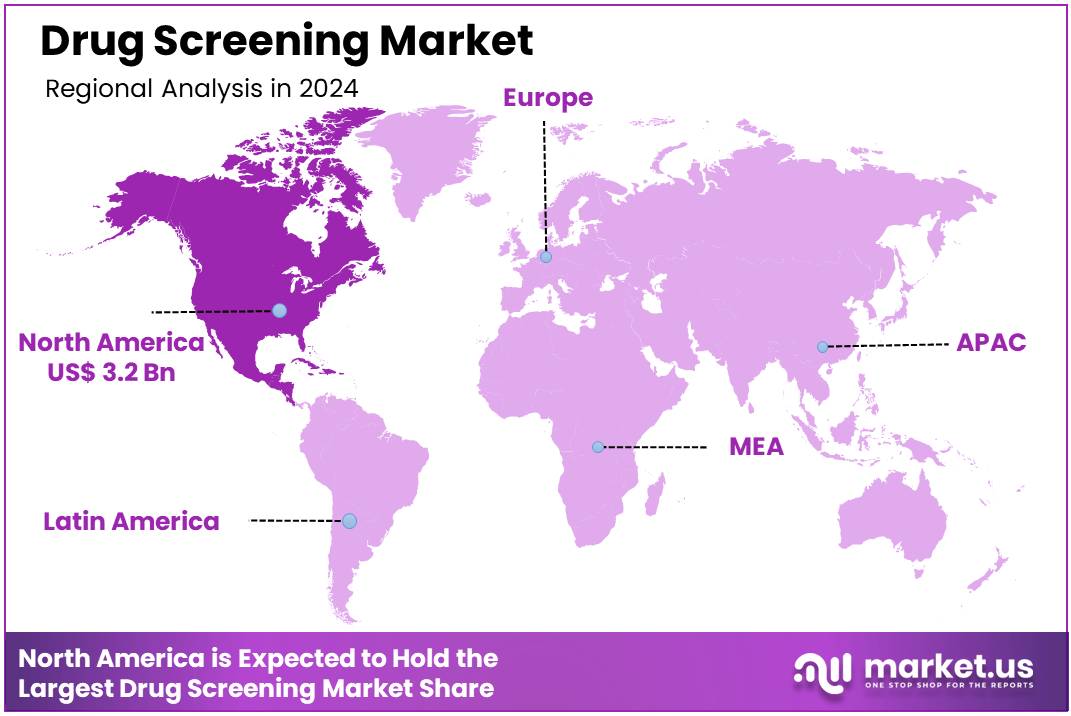

Global Drug screening Market size is expected to be worth around US$ 34.7 billion by 2034 from US$ 7.8 billion in 2024, growing at a CAGR of 16.1% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 41.3% share with a revenue of US$ 3.2 Billion.

Increasing concerns over substance abuse and workplace safety have driven significant demand for drug screening across various industries, including healthcare, law enforcement, transportation, and corporate sectors. Employers implement drug testing programs to ensure a safe work environment, minimize liability risks, and comply with regulatory requirements.

According to data from the U.S. Department of Transportation’s National Highway Traffic Safety Administration (NHTSA), 13,384 fatalities were recorded in alcohol-related traffic crashes in 2021. This figure represented a 14% increase from the previous year, highlighting the ongoing dangers of impaired driving. Rising cases of drug-related incidents in workplaces and public spaces have intensified the need for rapid and accurate testing methods.

Advancements in screening technologies, including immunoassays, chromatography, and mass spectrometry, have improved the detection of illicit substances and prescription drug misuse. Growing adoption of point-of-care testing and portable drug screening devices has enhanced accessibility and real-time results in emergency and roadside settings. Employers and law enforcement agencies increasingly integrate artificial intelligence and automation in drug screening processes to improve accuracy and efficiency.

The expansion of oral fluid and hair testing methods has provided non-invasive alternatives to traditional urine-based testing. Healthcare providers rely on drug screening for pain management programs and monitoring patient adherence to prescribed medications. Pharmaceutical companies use advanced screening solutions in clinical trials to ensure compliance and prevent drug interactions.

Regulatory frameworks continue to evolve, requiring businesses and organizations to adopt comprehensive testing policies that align with legal standards. As the demand for substance abuse prevention and workplace safety grows, innovations in drug screening technology will play a crucial role in enhancing public health and security.

Key Takeaways

- In 2024, the market for drug screening generated a revenue of US$ 7.8 billion, with a CAGR of 16.1%, and is expected to reach US$ 34.7 billion by the year 2033.

- The product type segment is divided into equipment, consumables, and laboratory services, with consumables taking the lead in 2023 with a market share of 45.6%.

- Considering sample type, the market is divided into breath, fluid/saliva, hair, and others. Among these, fluid/saliva held a significant share of 38.7%.

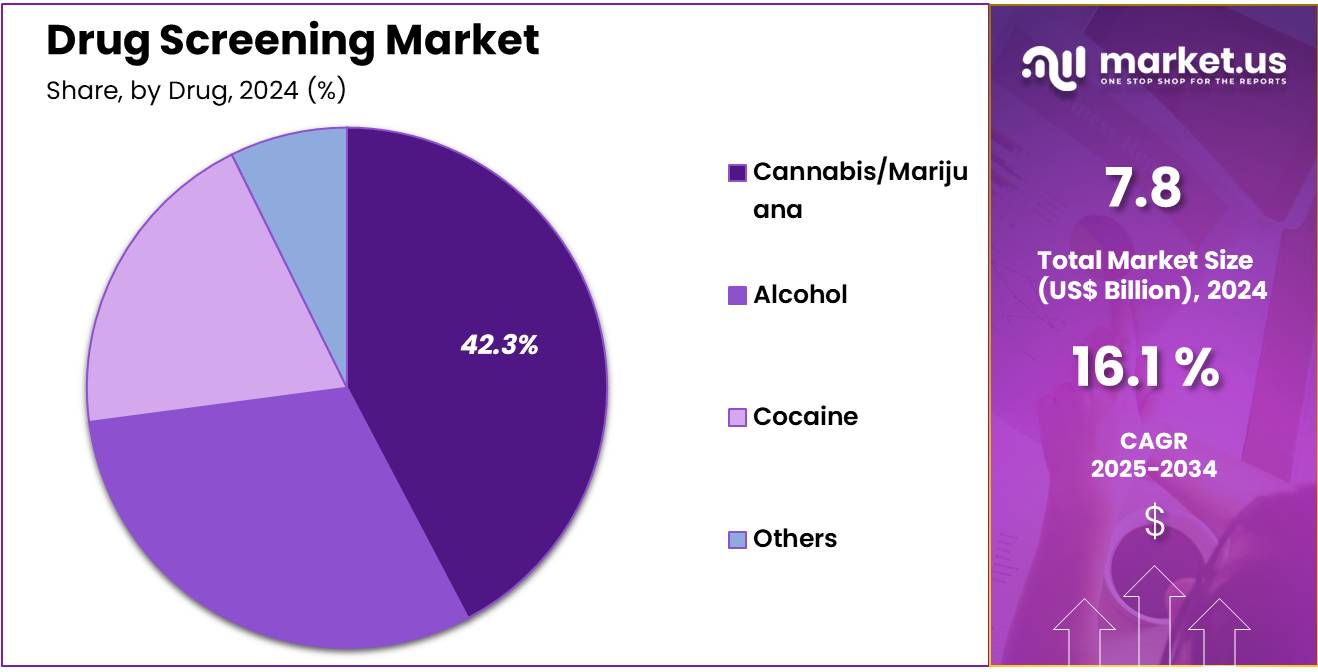

- Furthermore, concerning the drug segment, the market is segregated into cannabis/marijuana, alcohol, cocaine, and others. The cannabis/marijuana sector stands out as the dominant player, holding the largest revenue share of 42.3% in the drug screening market.

- The end-user segment is segregated into criminal justice & law enforcement agencies, workplace & schools, drug testing laboratories, hospitals, and others, with the drug testing laboratories segment leading the market, holding a revenue share of 48.5%.

- North America led the market by securing a market share of 41.3% in 2024.

Product Type Analysis

The consumables segment led in 2023, claiming a market share of 45.6% owing to the increasing demand for rapid and accurate testing solutions. As drug screening continues to play a crucial role in various industries, including healthcare, criminal justice, and workplace settings, the need for consumables, such as test kits, reagents, and collection devices, is anticipated to rise.

These consumables are essential for performing high-throughput testing and ensuring consistent results. Furthermore, the growing emphasis on drug abuse prevention programs and the expansion of workplace testing policies are projected to drive demand for consumable products in the drug screening market.

Sample Type Analysis

The fluid/saliva held a significant share of 38.7% due to the increasing preference for non-invasive testing methods. Fluid and saliva-based drug testing offer benefits such as ease of collection, lower costs, and a quick turnaround time for results, making them ideal for workplace screenings, law enforcement, and roadside drug testing.

These advantages are expected to drive adoption, especially as governments and organizations seek efficient solutions to detect substance abuse. Additionally, the growing prevalence of substance abuse and the demand for frequent, rapid screening are likely to contribute to the expansion of this segment.

Drug Analysis

The cannabis/marijuana segment had a tremendous growth rate, with a revenue share of 42.3% owing to the increasing legalization of marijuana in various regions. As more countries and states legalize cannabis for medical or recreational use, the need for reliable drug testing to monitor cannabis use is rising. Employers, law enforcement agencies, and healthcare providers are increasingly utilizing drug screening tools to detect marijuana use in various settings, including workplaces, schools, and hospitals.

This growing demand for cannabis testing is projected to drive the expansion of the cannabis/marijuana segment in the drug screening market.

End-user Analysis

The drug testing laboratories segment grew at a substantial rate, generating a revenue portion of 48.5% due to as the need for specialized drug testing services increases. This growth is driven by various factors, including heightened concerns about workplace safety, increasing drug abuse in society, and the implementation of stricter drug testing policies across industries.

Law enforcement agencies, educational institutions, and corporate organizations are expected to increase their reliance on drug testing laboratories for accurate, unbiased results. As regulations around drug use continue to evolve, the demand for specialized drug testing laboratories is projected to expand, supporting the growth of this segment in the drug screening market.

Key Market Segments

Product Type

- Equipment

- Immunoassay Analyzers

- Chromatography Instruments

- Breath Analyzers

- Consumables

- Calibrators & Controls

- Assay Kits

- Sample Collection Cups

- Laboratory Services

Sample Type

- Breath

- Fluid/Saliva

- Hair

- Others

Drug

- Cannabis/Marijuana

- Alcohol

- Cocaine

- Others

End-user

- Criminal Justice & Law Enforcement Agencies

- Workplace & Schools

- Drug Testing Laboratories

- Hospitals

- Others

Drivers

Growing Prevalence of Drug Consumption Driving the Drug Screening Market

Rising substance use is anticipated to drive the drug screening market as demand for workplace testing, law enforcement measures, and healthcare applications increases. A 2023 study from the National Survey on Drug Use and Health in the U.S. found that 45.6% of the 134.7 million alcohol consumers aged 12 and older had engaged in binge drinking within the past month. Marijuana remained the most commonly used illicit drug, underscoring shifting substance use trends. Employers are strengthening pre-employment and random drug testing programs to maintain workplace safety.

Government agencies are enforcing stricter regulations on drug use among transportation workers, healthcare professionals, and law enforcement personnel. Rehabilitation centers are integrating frequent drug tests to monitor patient progress and prevent relapses. Educational institutions are implementing drug screening protocols to address substance abuse among students.

Increased opioid misuse is driving the need for more precise detection tools in forensic investigations. Sports organizations are expanding anti-doping measures to prevent performance-enhancing drug use among athletes. Advancements in rapid test kits are improving detection capabilities in emergency medical settings.

The legalization of cannabis in various regions is influencing policies around THC screening and workplace regulations. The integration of AI in laboratory-based drug testing is enhancing accuracy and efficiency. The expansion of drug testing programs in developing economies is expected to contribute to market growth.

Restraints

Privacy Concerns and Legal Challenges are Restraining the Drug Screening Market

High regulatory scrutiny and ethical concerns are expected to limit the growth of the drug screening market by imposing compliance challenges on employers and testing agencies. Various labor laws restrict mandatory drug testing in workplaces, especially in regions with strong employee privacy protections. Legal disputes over wrongful termination and discrimination due to drug test results are increasing, making companies cautious about implementing widespread testing.

The legalization of recreational cannabis in several countries has complicated drug testing policies, particularly in workplaces where zero-tolerance policies conflict with personal use laws. Inaccuracies in rapid drug test kits occasionally lead to false positives, raising concerns about the reliability of screening methods. Advocacy groups are pushing for reforms to limit random drug testing unless directly related to workplace safety or legal obligations.

The high cost of laboratory-based drug testing discourages small and medium-sized enterprises from adopting stringent screening programs. Companies are facing increased pressure to balance workplace safety with employees’ rights, leading to modifications in drug testing policies.

Opportunities

Increasing Demand for Real-Time Substance Monitoring as an Opportunity for the Drug Screening Market

Rising demand for continuous monitoring solutions is expected to create significant opportunities in the drug screening market by improving detection accuracy and compliance tracking. In January 2024, Micro-Distributing, Inc. partnered with ABK Remote Drug Testing, Inc. to introduce the first live, around-the-clock remote drug testing service in the U.S.

This initiative leverages advanced technology to provide real-time substance monitoring for businesses and legal institutions. Wearable biosensors are emerging as a non-invasive alternative to traditional urine and blood tests. The use of point-of-care screening devices is increasing in healthcare settings to ensure rapid intervention for overdose cases. Employers are adopting smart drug monitoring systems to track workplace compliance more effectively.

AI-powered analytics in real-time testing platforms are enhancing accuracy and reducing false positives. The criminal justice system is integrating continuous substance monitoring to improve probation and parole compliance. The expansion of telemedicine and digital health solutions is promoting the use of remote drug screening for at-home monitoring.

Technological advancements in saliva- and sweat-based detection are improving the feasibility of real-time drug tracking. The growing need for comprehensive workplace safety measures is accelerating the adoption of on-demand screening solutions.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors have a significant impact on the drug screening market. On the positive side, increasing healthcare investments and rising concerns over substance abuse globally drive the demand for effective drug testing solutions. Governments’ focus on improving public health by addressing drug-related issues boosts the market, especially in the context of workplace drug testing, law enforcement, and rehabilitation centers.

However, economic downturns and budget cuts in government or corporate sectors could limit the adoption of advanced drug screening technologies. Geopolitical tensions and regulatory changes may create barriers to international trade and complicate the approval process for new drug testing solutions. Additionally, fluctuations in raw material costs and supply chain disruptions can hinder market growth. Despite these challenges, the ongoing push for workplace safety, public health improvement, and regulatory compliance ensures that the drug screening market will continue to expand.

Latest Trends

Increasing Investment in Cutting-Edge Sensor Technology Driving the Drug Screening Market:

Increasing investment in cutting-edge sensor technology is a recent trend significantly driving the drug screening market. High demand for more accurate, real-time, and non-invasive drug testing solutions has led to advancements in sensor technologies that improve the efficiency and reliability of drug screening processes.

These innovations are expected to enhance the detection of substances in various environments, from workplaces to law enforcement and medical facilities. Rising investments in research and development are anticipated to accelerate the adoption of sensor-based technologies, offering cost-effective and quick drug testing alternatives. As companies and governments seek more efficient methods for monitoring substance use, the demand for these advanced solutions will likely continue to grow.

In September 2022, a Durham-based startup secured £600,000 in funding to bring its cutting-edge sensor technology to market. The innovation enables real-time, non-invasive scanning of an individual’s skin to detect alcohol and drug levels, revolutionizing substance monitoring. As sensor technologies become more advanced and widespread, the market for drug screening is projected to experience significant growth.

Regional Analysis

North America is leading the Drug screening Market

North America dominated the market with the highest revenue share of 41.3% owing to rising substance abuse cases and stricter workplace testing regulations. A 2021 report from the United Nations Office on Drugs and Crime estimated that approximately 275 million people globally, aged 15 to 64, had used drugs at least once in the previous year, underscoring the need for expanded testing initiatives.

Employers across various industries increased investments in pre-employment and random drug testing to ensure workplace safety and compliance with federal guidelines. Law enforcement agencies strengthened roadside drug testing programs to curb impaired driving incidents, further driving demand for rapid screening methods. Technological advancements, including AI-driven analysis and portable testing devices, enhanced the accuracy and efficiency of detection systems.

The expansion of legal cannabis markets in the U.S. and Canada also led to increased regulatory scrutiny, prompting businesses and healthcare providers to adopt comprehensive testing protocols. Additionally, rising adoption of at-home and telehealth-based drug screening solutions improved accessibility and convenience for individuals undergoing rehabilitation or compliance testing.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to increasing government initiatives and expanding research capabilities. The strategic collaboration between Beijing-based ICE Bioscience and SPT Labtech in October 2024 highlights the region’s commitment to enhancing automation in life sciences and improving screening technologies. Rising drug abuse cases in densely populated countries like China and India are expected to drive stricter regulations and expanded workplace testing programs.

Law enforcement agencies are likely to adopt more advanced testing methodologies to monitor substance use more effectively. The increasing emphasis on clinical research and pharmaceutical development is anticipated to support investments in high-throughput screening technologies. Public awareness campaigns and education initiatives are projected to encourage early detection and rehabilitation efforts.

Additionally, improvements in healthcare infrastructure and growing collaborations between local and international diagnostic firms are expected to strengthen access to advanced screening tools, further driving market growth across Asia Pacific.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the drug screening market focus on advancing rapid testing technologies, including immunoassays and chromatography techniques, to enhance accuracy and efficiency. Companies invest in research and development to introduce portable and automated screening devices for workplace, clinical, and law enforcement applications.

Strategic partnerships with government agencies and private organizations help expand market reach and drive regulatory compliance. Geographic expansion into regions with increasing substance abuse concerns supports further growth. Many players also emphasize digital integration and real-time data analytics to improve result interpretation and streamline testing processes.

Abbott is a leading company in this market, offering innovative drug screening solutions like the Alere Tox Drug Test for fast and reliable detection. The company focuses on technological advancements and strategic collaborations to enhance testing accuracy and accessibility. Abbott’s commitment to quality and innovation positions it as a key player in drug testing and diagnostics.

Top Key Players

- Synergy Health plc

- Quest Diagnostics

- ICE Bioscience

- Danaher

- Broughton

- BioMerieux SA

- Biomedical Diagnostics

- Abbott

Recent Developments

- In October 2024, Broughton unveiled an updated version of Tox HQ, an intuitive online tool that facilitates toxicology assessments and regulatory compliance. The platform enables companies to discreetly submit products for safety evaluations, streamlining the approval process with advanced data-driven analytics.

- In December 2023, Quest Diagnostics in the U.S. introduced a new confirmatory testing service for novel psychoactive substances (NPS). The expanded panel screens for 88 different compounds, covering a wide range of drug classes to support more comprehensive toxicology assessments.

Report Scope

Report Features Description Market Value (2024) US$ 7.8 billion Forecast Revenue (2034) US$ 34.7 billion CAGR (2025-2034) 16.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Equipment (Immunoassay Analyzers, Chromatography Instruments, and Breath Analyzers), Consumables (Calibrators & Controls, Assay Kits, and Sample Collection Cups), and Laboratory Services), By Sample Type (Breath, Fluid/Saliva, Hair, and Others), By Drug (Cannabis/Marijuana, Alcohol, Cocaine, and Others), By End-user (Criminal Justice & Law Enforcement Agencies, Workplace & Schools, Drug Testing Laboratories, Hospitals, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Synergy Health plc, Quest Diagnostics, ICE Bioscience, Danaher, Broughton, BioMerieux SA, Biomedical Diagnostics, and Abbott. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Synergy Health plc

- Quest Diagnostics

- ICE Bioscience

- Danaher

- Broughton

- BioMerieux SA

- Biomedical Diagnostics

- Abbott