Global Dishwasher Detergent Market By Type (Liquid, Powder, Tablet), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Others), By End-User (Residential, Commercial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150607

- Number of Pages: 223

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

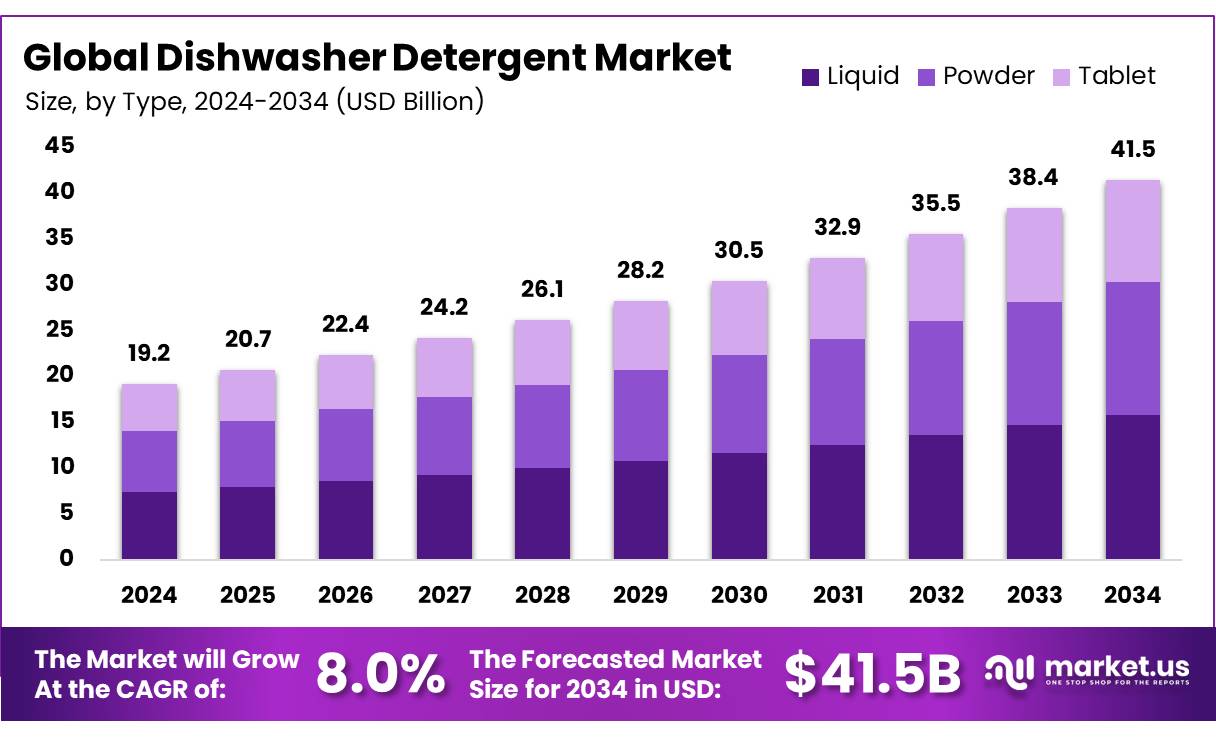

The Global Dishwasher Detergent Market size is expected to be worth around USD 41.5 Bn by 2034, from USD 19.2 Bn in 2024, growing at a CAGR of 8.0% during the forecast period from 2025 to 2034.

The dishwasher detergent market consists of various range of cleaning products formulated to remove food residues, grease, and stains from kitchen utensils, cookware, and dishware. These detergents typically contain cleansing agents such as synthetic detergents, soaps, or Sodium Lauryl Sulfate (SLS), often combined with mild abrasives to enhance cleaning performance.

These are used for cleansing utensils, crockery, kitchen shelves, and at times for wash basins, etc. where cleansing is effected by the combined action of detergency and scrubbing. Available in various formats including liquids, gels, powders, bars, and single-dose packets dishwasher detergents cater to a wide array of consumer preferences and usage scenarios.

The global dishwasher detergent market serves both residential and commercial sectors. The increasing adoption of dishwashers, particularly in developed regions, along with a growing demand for convenient, efficient, and time-saving cleaning solutions, has significantly driven the expansion of the global dishwasher detergent market.

Key Takeaways

- The global dishwasher detergent market was valued at USD 19.5 billion in 2024.

- The global dishwasher detergent market is projected to grow at a CAGR of 8.0% and is estimated to reach USD 41.5 billion by 2034.

- Among types, liquid accounted for the largest market share of 38.2%. Driven by its ease of use, fast solubility, and strong cleaning performance.

- By distribution channel, supermarkets/hypermarkets accounted for the majority of the market share at 52.3%. Driven by their wide product variety, competitive pricing, and strong consumer demand.

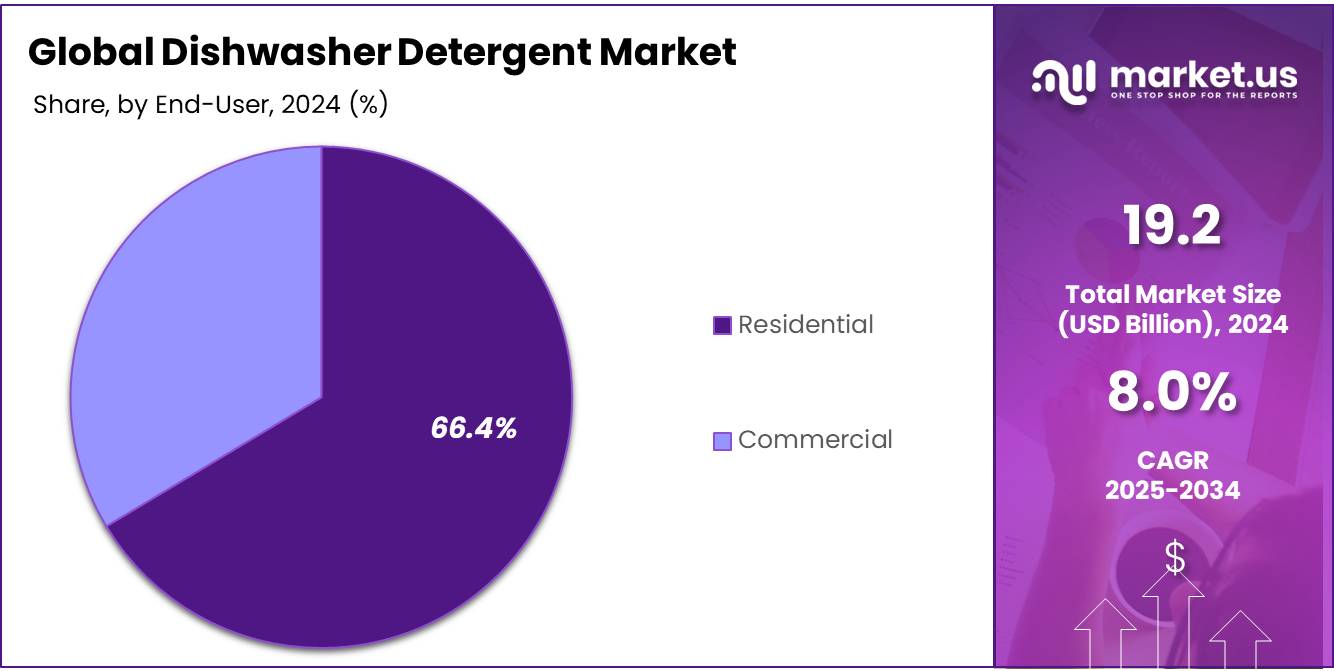

- Among end-users, residential accounted for the largest market share of 66.4%. Driving the market share by growing dishwasher adoption and demand for convenient, eco-friendly cleaning solutions.

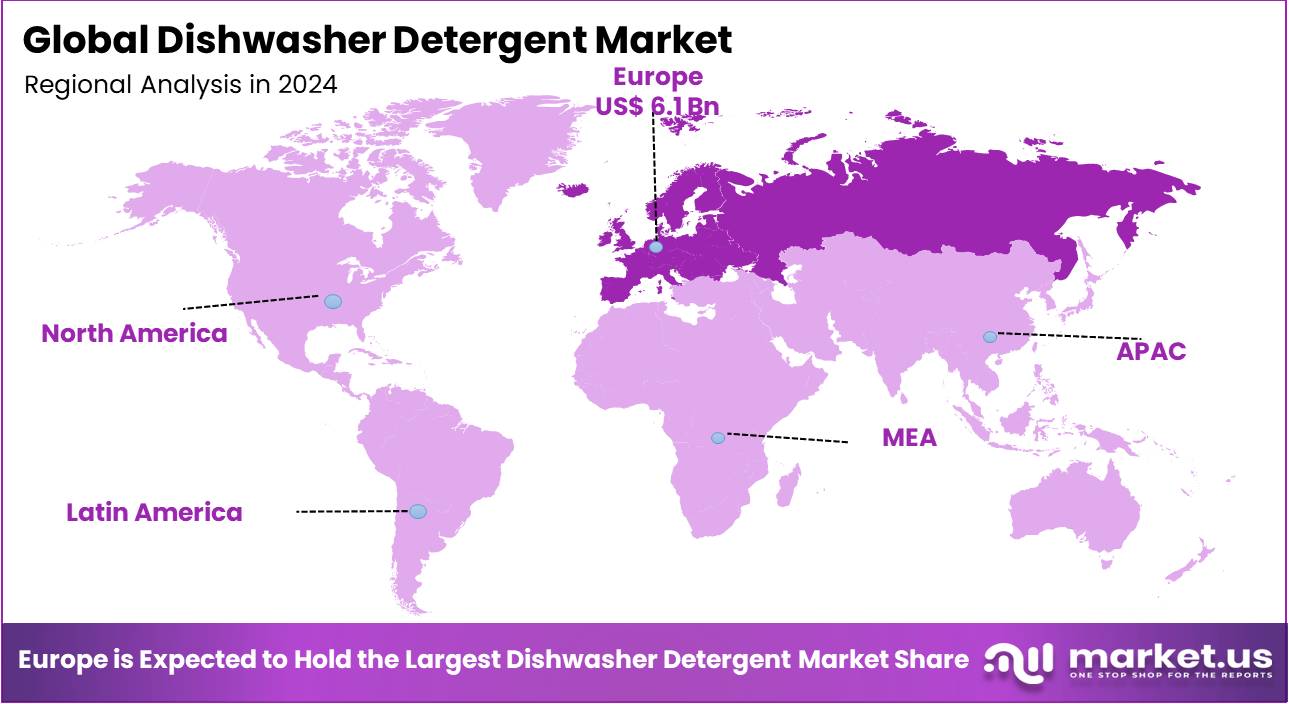

- Europe is estimated as the largest market for dishwasher detergent with a share of 32.1% of the market share.

Type Analysis

The Liquid Segment Dominate Market Share, Driven By Its Ease Of Use, Fast Solubility, And Strong Cleaning Performance.

The Dishwasher Detergent market is segmented based on type into liquid, powder, and tablet. In 2024, the Liquid segment held a significant revenue share of 38.2%. Due to its ease of use, quick solubility, and effective grease-cutting properties. Consumers favor liquid detergents for their convenience, ability to dose accurately, and compatibility with a wide range of dishwasher models. Additionally, liquid detergents often incorporate advanced cleaning enzymes and eco-friendly ingredients, aligning with the growing demand for sustainable and high-performance products, which further supports their strong market position.

Distribution Channel Analysis

Supermarkets/Hypermarkets Held The Market Share, Driven By Their Wide Product Variety, Competitive Pricing, And Strong Consumer Demand.

By distribution channel, the market is categorized into supermarkets/hypermarkets, convenience stores, online retail, and others. The supermarkets/hypermarkets segment emerging as the dominant channel, holding 52.3% of the total market share in 2024. This dominance is attributed to the extensive product variety offered, competitive pricing strategies, and high consumer foot traffic in these retail outlets. Additionally, supermarkets and hypermarkets provide a one-stop shopping experience, allowing consumers to conveniently purchase detergents alongside other household essentials. Their widespread presence in both urban and suburban areas further reinforces their role as the preferred distribution channel for dishwasher detergents.

End-User Analysis

The Residential Segment Driving The Market Share By Growing Dishwasher Adoption And Demand For Convenient, Eco-Friendly Cleaning Solutions.

In terms of end-users, the dishwasher detergent market comprises residential and commercial. In 2024, residential led the market, accounting for a dominant 66.4% share. Due to the increasing penetration of dishwashers in households and a rising consumer preference for convenient, efficient cleaning solutions. Additionally, greater awareness of eco-friendly and effective detergents has driven demand among residential users, further fueling market growth in this segment.

Key Market Segments

By Type

- Liquid

- Powder

- Tablet

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Others

By End-User

- Residential

- Commercial

Drivers

Increased Hygiene Awareness Post-Pandemic

The increased hygiene awareness following the COVID-19 pandemic has been a significant driver of growth in the global dishwasher detergent market. As the pandemic increased Consumers’ focus on cleanliness and disinfection has significantly boosted demand for automatic dishwashing detergents with enhanced antibacterial and germ-killing properties. This shift in consumer preference has encouraged manufacturers to innovate with formulations that ensure superior hygiene performance while maintaining eco-friendliness and dish safety also fueling market expansion.

- Stepan, a leading manufacturer of surfactants and quaternary ammonium disinfectants, experienced an 8% increase in North American surfactant sales in 2020 compared to the previous year. This growth was largely driven by heightened demand in consumer product markets for cleaning, disinfection, and personal care products amid the COVID-19 pandemic.

- According to reports published by Tata survey report, the demand for home-cleaning consumables, including dishwasher detergents, surged by over 45% during the pandemic, with strong growth continuing post-pandemic as hygiene remains a top consumer priority.

Additionally, the growing adoption of dishwashers in both residential and commercial sectors particularly in urban areas with fast-paced lifestyles is further accelerating market growth. The emphasis on effective odor control, skin protection in manual detergents, and sustainable ingredients continues to influence product development and purchasing decisions, positioning the dishwasher detergent market for sustained expansion in the coming years.

Furthermore, government regulations and initiatives promoting environmentally friendly cleaning products, such as the EPA’s endorsement of eco-labeled detergents and incentives for sustainable manufacturing practices, are supporting market growth by encouraging the adoption of safer and greener dishwasher detergent formulations.

- For instance, United States, the Environmental Protection Agency (EPA) encourages the use of commercial dishwasher detergents that comply with private sector environmental standards and carry ecolabels, although fewer specific government incentive programs are promoting these products.

Restraints

Concern Over Chemical Ingredients In Detergent

The growing concern regarding chemical ingredients in dishwasher detergents is one of the key factors restraining the global market growth. Many traditional formulations contain harmful substances such as phosphates and chlorine-based compounds, which contribute to water pollution and pose risks to aquatic ecosystems. As environmental awareness increases and regulatory pressures increase, manufacturers are shifting toward safer, eco-friendly alternatives often at higher production costs.

This transition can limit affordability and adoption, particularly in price-sensitive regions, limiting overall market expansion. Governments worldwide are implementing stringent regulations on the chemical ingredients used in dishwasher detergents to mitigate environmental and health risks. These regulatory measures are compelling manufacturers to reformulate products, often leading to increased production costs. While these changes aim to reduce the environmental impact of detergents, they also present challenges for manufacturers in terms of compliance and cost management.

- Recent EU regulations under the Green Deal and Zero Pollution Action Plan are tightening controls on dishwasher detergent ingredients by reducing phosphorus use, banning microplastics, and eliminating harmful chemicals.

- The Bureau of Indian Standards (BIS) has updated specifications to limit phosphate content in household laundry and dishwasher detergents. This move follows directives from the National Green Tribunal (NGT) to address environmental concerns such as algal blooms in lakes.

Opportunity

Technological Advancement In Dishwashers

Technological advancements in dishwasher detergent formulations are presenting significant growth opportunities within the global dishwasher detergent market. Emerging trends toward sustainable product development and increasing consumer demand for eco-friendly products have prompted manufacturers to shift focus toward plant-based ingredients, enzymatic solutions, and AI-driven optimization techniques. These innovations enhance cleaning efficacy, minimize environmental impact, and personalize detergent usage according to individual requirements and water conditions.

Additionally, the development of eco-friendly detergents utilizing renewable resources is another key factor providing growth opportunities. As dishwasher detergent manufacturers have introduced formulations derived from cellulose nanofibers sourced from wood and zein protein extracted from corn. Both of these materials are biodegradable and demonstrate effective stain-removal capabilities on dishes and fabrics. In addition, these natural-based detergents exhibit cleaning performance comparable to, or exceeding, that of conventional products at higher concentrations, while simultaneously reducing harmful residues and environmental footprint.

Another significant advancement lies in the integration of artificial intelligence (AI) within detergent formulation processes. AI technologies are being implemented to analyze extensive datasets encompassing variables such as water quality, washing machine parameters, and consumer preferences. This offers the development of optimized detergent formulations customized with real-time washing conditions including water temperature, load size, and soil type. Such AI-driven “smart” detergents dynamically adjust their cleaning properties, ensuring optimal cleaning outcomes, minimizing detergent waste, and providing personalized performance. Further supporting the development of sustainable dishwasher detergents.

- For instance, In November 2021 Nordic Ecolabelling developed dishwashing tablets that are diluted at least 10 times by the user to form the finished product.

Trends

Biodegradable, Plant-Based, and Non-Toxic Dishwashing Detergents.

The global dishwasher detergent market is undergoing a significant transformation. The increasing consumer demand for biodegradable, plant-based, and non-toxic dishwasher detergents has significantly propelled the growth of the global dishwasher detergent market. Growing environmental awareness and health consciousness have shifted consumer preferences away from conventional detergents containing harsh chemicals toward sustainable and safer alternatives. This shift has expanded the market by attracting a broader customer base, including environmentally conscious and health-aware consumers who were previously reluctant to use traditional products.

Furthermore, regulatory pressures on the use of harmful substances such as phosphates and microplastics have accelerated innovation and reformulation within the industry, prompting manufacturers to develop eco-friendly dishwashing detergents that comply with evolving environmental standards. The introduction of plant-based surfactants, natural enzymes, and biodegradable ingredients has enhanced dishwashing detergent performance while aligning with consumer values, resulting in increased adoption and repeat purchases.

Additionally, the focus on packaging sustainability using recyclable and refillable containers and third-party certifications has strengthened brand trust and consumer loyalty, further driving dishwashing detergents market expansion. Together, these factors have not only diversified the product offerings but also enhanced the overall market appeal, thereby contributing to the sustained growth of the global dishwasher detergent market.

- For instance, Regulations like the EU Ecolabel, which mandate biodegradability, reduced packaging, and effective cleaning, have driven manufacturers to develop eco-friendly dishwasher detergents, boosting innovation and accelerating global market growth.

Geopolitical Impact Analysis

U.S. Tariffs Disrupted Dishwasher Detergent Trade and Market Growth

In 2025, the imposition of new 10% tariffs by the US government on both raw materials and finished goods has introduced increased cost pressures across the dishwasher detergent supply chain. Key ingredient suppliers, including surfactants and enzymes, are now subject to higher import taxes, shifting manufacturers to explore alternative sourcing strategies or pursue vertical integration to enhance supply chain stability and manage expenses effectively.

These tariffs have increased import duties on key ingredients such as surfactants and enzymes, leading manufacturers to seek alternative sourcing strategies or pursue vertical integration to stabilize supply chains and control rising costs. As a result, brands have adjusted their product strategies by focusing either on economy lines to appeal to price-sensitive consumers or on premium products that justify higher prices through added value and sustainable features. This dual approach reflects the industry’s efforts to maintain market share and profitability amid the challenges posed by evolving trade policies and increased production expenses.

Regional Analysis

Europe Dominated The Dishwasher Detergent Market

In 2024, Europe dominated the global dishwasher detergent market, accounting for 32.1% of the total market share, driven by stringent environmental regulations and strong consumer demand for sustainable and safe cleaning products. The region’s progressive regulatory framework, including standards such as the EU Ecolabel, sets criteria for biodegradability and minimal environmental impact, pushing manufacturers to innovate with plant-based, phosphate-free, and non-toxic detergent formulations. These regulations boosted the market by encouraging eco-friendly product development. European consumers exhibit a heightened preference for transparency and sustainability, favoring detergents that incorporate natural ingredients such as citrus extracts, enzymes, and biodegradable surfactants.

The market is further supported by increasing awareness around water conservation and waste reduction, leading to the adoption of concentrated detergents and refillable packaging solutions. Technological advancements, including AI-driven detergent optimization tailored to diverse water conditions across the continent, are also gaining momentum. This integration allows for personalized cleaning solutions, improving efficiency while minimizing waste. These factors—regulatory shifting, consumer eco-consciousness, and innovation position Europe as a leading region in the global dishwasher detergent market, driving both sustainability and growth.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Key Players In The Dishwasher Detergent Market Dominate The Market Through Strategic Innovation, Premium Positioning, And Global Reach.

The global dishwasher detergent market is highly competitive, with key players including Procter & Gamble, Reckitt Benckiser, Unilever Plc, Colgate-Palmolive, and Henkel AG. These companies dominate through strong brand portfolios, extensive global distribution networks, and continuous investment in product innovation. Many are focusing on eco-friendly and biodegradable formulations to align with evolving consumer preferences and regulatory standards. Strategic partnerships, mergers, and acquisitions further enhance their market presence. Additionally, rising competition from regional and private-label brands is pushing major players to differentiate through performance, sustainability, and pricing strategies.

The following are some of the major players in the industry

- Procter & Gamble

- Reckitt Benckiser

- Unilever PLC

- BSH Home Appliances Group

- Chemisynth

- Henkel AG & Co. KGaA

- Colgate-Palmolive

- The Clorox Company

- Dropps

- Method Products

- Seventh Generation Inc.

- Blueland

- The Caldrea Company

- Ecover

- Grove Collaborative, Inc.

- Other Key Players

Recent Development

- In March 2025 – Cascade launched its New & Improved Cascade Platinum Plus, featuring a proprietary enzyme formula and Dawn grease-fighting power to tackle stuck-on food, grease, and spotty dishes. Backed by comedian Kenan Thompson, the product aims to simplify post-meal cleanup for increasingly adventurous home cooks.

- In October 2024 – Dropps launched UltraWash Plus, one of the first bio based multi-chamber dishwasher detergent pods, combining advanced cleaning with USDA-certified bio based ingredients and recyclable packaging. Now available at Meijer and Save Mart, the launch supports Dropps’ mission of effective, sustainable cleaning.

- In September 2024 – Henkel and Reckitt were awarded new patents advancing dishwashing chemistry Henkel’s patent eliminates amine oxide in manual dishwashing via polymer blends, while Reckitt’s patent introduces a heterogeneous bleach catalyst using copper oxide on zirconium oxide for enhanced automatic dishwashing performance.

- In June 2020 – Blueland launched the Dish Duo, featuring refillable, zero-waste dishwasher tablets and powder dish soap. Both products are petroleum-free, biodegradable, and free from dyes and fragrances—reinforcing Blueland’s commitment to sustainable, plastic-free cleaning solutions.

Report Scope

Report Features Description Market Value (2024) USD 19.2 Bn Forecast Revenue (2034) USD 42.5 Bn CAGR (2025-2034) 8.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Liquid, Powder, Tablet), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Others), By End-User (Residential, Commercial) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, & Rest of MEA Competitive Landscape Procter & Gamble, Reckitt Benckiser, BSH Home Appliances Group, Chemisynth, Henkel AG & Co. KGaA, Colgate-Palmolive, The Clorox Company, Dropps, Method Products, Seventh Generation Inc., Blueland, The Caldrea Company, Ecover, Unilever PLC, Grove Collaborative, Inc., Cascade, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Dishwasher Detergent MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Dishwasher Detergent MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Procter & Gamble

- Reckitt Benckiser

- Unilever PLC

- BSH Home Appliances Group

- Chemisynth

- Henkel AG & Co. KGaA

- Colgate-Palmolive

- The Clorox Company

- Dropps

- Method Products

- Seventh Generation Inc.

- Blueland

- The Caldrea Company

- Ecover

- Grove Collaborative, Inc.

- Other Key Players