Digital X-Ray Equipment Market By Product Type (Fixed and Portable), By Technology (Computed Radiography and Direct Radiography), By Application (General Imaging, Dental, Orthopedic, Cancer, and Others), By End-user (Hospitals, Diagnostic Centers, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 133016

- Number of Pages: 291

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

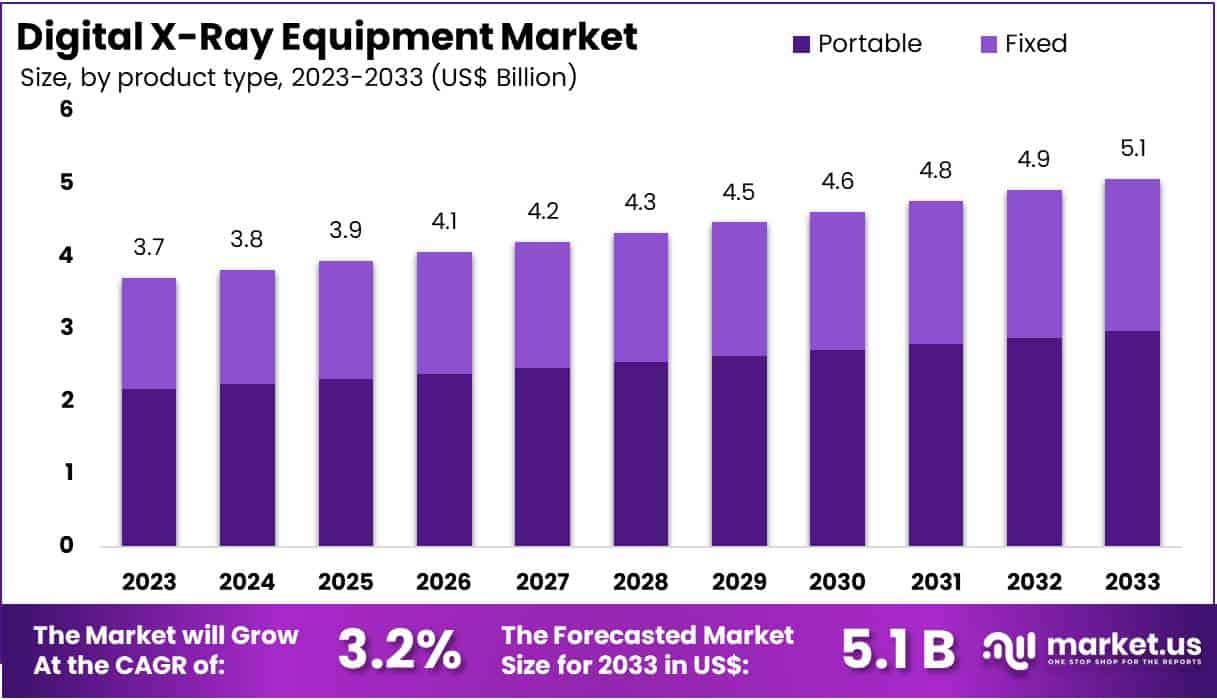

The Global Digital X-Ray Equipment Market size is expected to be worth around US$ 5.1 Billion by 2033, from US$ 3.7 Billion in 2023, growing at a CAGR of 3.2% during the forecast period from 2024 to 2033.

Growing adoption of advanced imaging technologies in healthcare drives the demand for digital X-ray equipment, which plays a crucial role in diagnostic and interventional procedures. This equipment finds applications in various fields, including orthopedics, cardiology, dentistry, and emergency care, where accurate and rapid imaging significantly improves patient outcomes.

Enhanced image quality, reduced radiation exposure, and faster processing times distinguish digital X-ray systems from conventional counterparts, fostering their widespread utilization. The integration of AI in diagnostic imaging has streamlined workflows by enabling automated detection of anomalies and improving diagnostic accuracy.

In June 2022, NHS England reported approximately 3.44 million imaging tests, with Plain Radiography (X-ray) accounting for 1.71 million, underscoring the pivotal role of X-rays in routine diagnostics. The shift toward portable and mobile digital X-ray systems has further broadened their use in remote and point-of-care settings.

Healthcare providers increasingly prioritize cost-effective and efficient solutions, driving investments in digital radiography. Innovations such as wireless detectors, cloud-based image storage, and seamless integration with electronic health records (EHRs) enhance operational efficiency and data management.

Furthermore, rising awareness about early disease detection fuels the adoption of digital X-rays in preventive care programs. Collaborative ventures between medical device manufacturers and healthcare institutions aim to develop more user-friendly and versatile imaging systems.

Key Takeaways

- In 2023, the market for digital X-ray equipment generated a revenue of US$ 3.7 billion, with a CAGR of 3.2%, and is expected to reach US$ 5.1 billion by the year 2033.

- The product type segment is divided into fixed and portable, with portable taking the lead in 2023 with a market share of 58.7%.

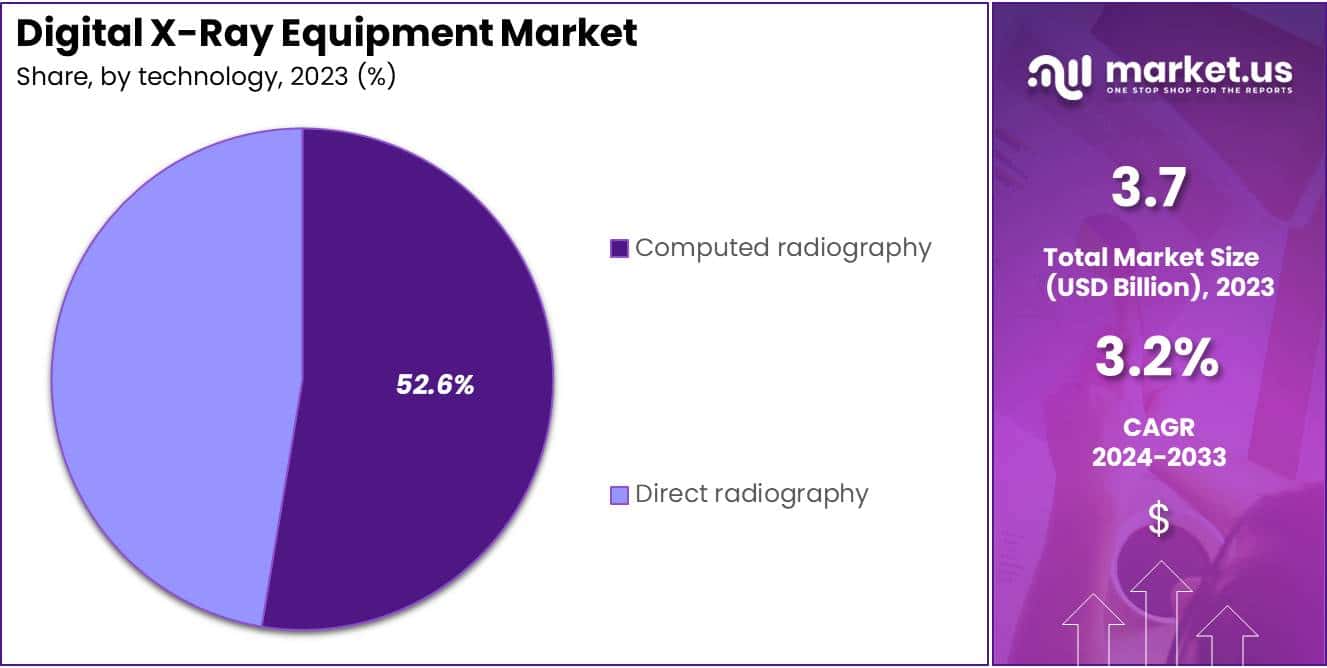

- Considering technology, the market is divided into computed radiography and direct radiography. Among these, computed radiography held a significant share of 52.6%.

- Furthermore, concerning the application segment, the market is segregated into general imaging, dental, orthopedic, cancer, and others. The general imaging sector stands out as the dominant player, holding the largest revenue share of 36.9% in the digital X-ray equipment market.

- The end-user segment is segregated into hospitals, diagnostic centers, and others, with the hospitals segment leading the market, holding a revenue share of 47.8%.

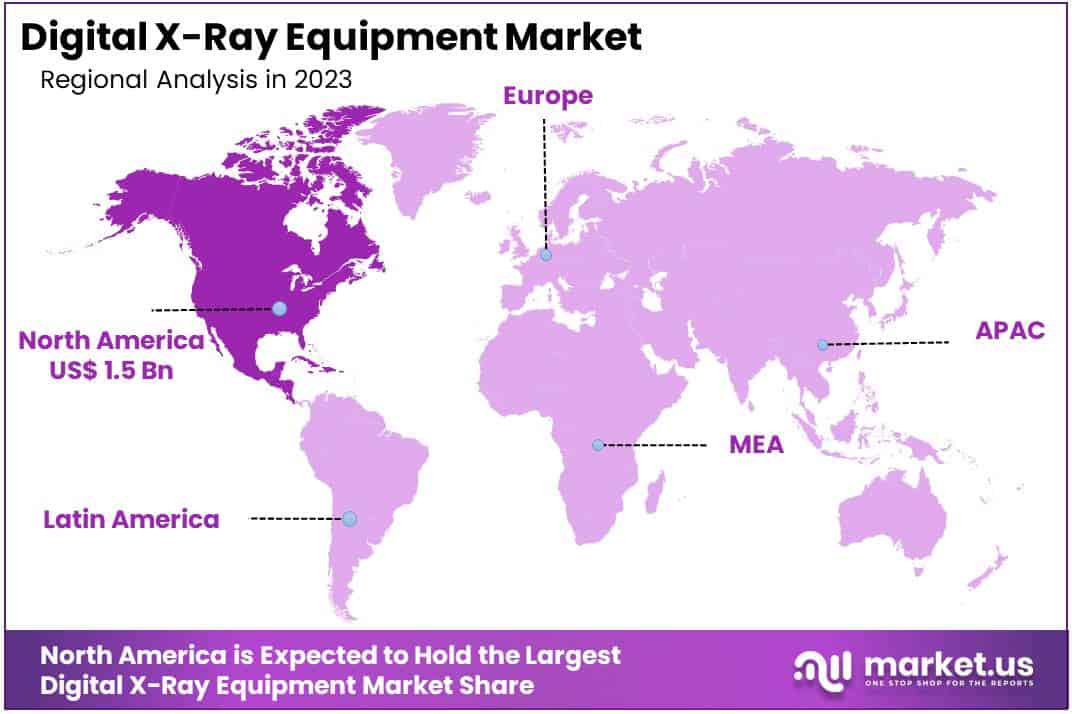

- North America led the market by securing a market share of 40.2% in 2023.

Product Type Analysis

The portable segment led in 2023, claiming a market share of 58.7% owing to increasing demand for mobile and flexible diagnostic solutions. This growth is driven by the rising need for point-of-care imaging in emergency rooms, critical care units, and remote locations.

Healthcare facilities prioritize portable systems to improve patient outcomes by delivering rapid diagnostic results. Advancements in battery technology and wireless connectivity further enhance the efficiency and usability of portable X-ray devices. The growing adoption in military and sports medicine also contributes to the segment’s expansion.

Furthermore, the increasing prevalence of chronic diseases, including cardiovascular and respiratory conditions, supports the rising use of portable X-ray systems for routine monitoring. The segment is anticipated to benefit from technological innovations that reduce device weight and improve image quality. Heightened demand in developing regions, where healthcare infrastructure is still evolving, is likely to further fuel market growth.

Technology Analysis

The computed radiography held a significant share of 52.6% due to its cost-effectiveness and compatibility with existing conventional X-ray systems. Hospitals and clinics in developing markets favor computed radiography for its affordability compared to direct radiography systems.

The technology also provides a transition path for facilities upgrading from analog to digital imaging. Increasing awareness about the benefits of digitization in imaging, such as improved storage and retrieval of patient data, supports its adoption. Additionally, the ease of integration with picture archiving and communication systems (PACS) enhances its appeal.

The segment is likely to experience further growth due to its applicability in various diagnostic fields, including general imaging and dental applications. Technological enhancements aimed at improving image resolution and reducing scanning time are anticipated to drive continued demand.

Application Analysis

The general imaging segment had a tremendous growth rate, with a revenue share of 36.9% owing to its broad application across various medical conditions. This segment includes routine diagnostic procedures for chest, abdominal, and musculoskeletal imaging, which are critical in detecting a wide range of health issues.

The rising prevalence of chronic diseases, such as arthritis and cardiovascular disorders, increases the demand for general imaging services. Additionally, the growing geriatric population contributes to a higher frequency of general diagnostic imaging. Advances in imaging technology, including better resolution and faster processing times, enhance diagnostic accuracy and workflow efficiency.

Healthcare providers prioritize general imaging systems for their versatility and cost-effectiveness in both inpatient and outpatient settings. The segment is also expected to benefit from increased healthcare spending and initiatives aimed at improving diagnostic capabilities in emerging economies. Expanded use in preventative care and routine health check-ups is likely to support further growth.

End-user Analysis

The hospitals segment grew at a substantial rate, generating a revenue portion of 47.8% due to the high volume of diagnostic procedures conducted in these settings.

Hospitals invest heavily in advanced imaging technologies to improve diagnostic accuracy and patient care. The rising number of admissions for chronic and acute conditions boosts the demand for X-ray services. Additionally, hospitals serve as referral centers for complex diagnostic cases, necessitating state-of-the-art imaging systems.

Government funding and public-private partnerships for healthcare infrastructure development further support this segment. The integration of digital imaging with electronic health records (EHR) enhances operational efficiency and data management in hospital environments. Larger budgets allow hospitals to adopt innovative technologies, such as AI-powered image analysis, to optimize diagnostic workflows.

The segment is also anticipated to grow due to the expansion of hospital networks in developing regions, where access to advanced diagnostic tools remains a priority.

Key Market Segments

By Product Type

- Fixed

- Portable

By Technology

- Computed Radiography

- Direct Radiography

By Application

- General Imaging

- Dental

- Orthopedic

- Cancer

- Others

By End-user

- Hospitals

- Diagnostic Centers

- Others

Drivers

Increasing Prevalence of Cancer Driving Market Growth

Increasing cancer prevalence is anticipated to drive demand in the digital X-ray equipment market. As early detection plays a crucial role in cancer management, healthcare providers increasingly rely on advanced imaging solutions for accurate diagnostics. According to data published by the World Health Organization in February 2024, global cancer cases are projected to rise to over 35 million by 2050, a significant increase of 77% from the 20 million cases reported in 2022.

This surge underscores the growing need for efficient diagnostic tools, including digital X-ray systems, which offer high-resolution imaging and quick results. As cancer screening programs expand, the adoption of digital X-rays is likely to accelerate, particularly in regions investing heavily in healthcare infrastructure.

Restraints

High Costs Restraining Market Growth

High costs associated with digital X-ray systems are expected to hamper market growth, particularly in low- and middle-income countries. These systems require substantial initial investments, including equipment procurement and installation, which often limit their adoption in resource-constrained healthcare settings.

Additionally, maintenance and operational expenses further increase the financial burden, discouraging smaller diagnostic centers and hospitals from upgrading to digital solutions. This restraint is anticipated to slow market penetration, despite the growing demand for advanced imaging technologies. The high price points also reduce affordability for patients, particularly in regions lacking sufficient health insurance coverage, which further impedes market expansion.

Opportunities

Expansion of Diagnostic Centers Creating Opportunities

Growing expansion of medical diagnostic centers is projected to create significant opportunities for the digital X-ray equipment market. The rising demand for accessible and accurate diagnostic services has led to the establishment of new healthcare facilities in urban and rural areas. In October 2021, the Memorial Community Health, Inc. in the US added a digital X-ray system to its Clay Center clinic, reflecting the ongoing efforts to enhance diagnostic capabilities.

Government initiatives aimed at improving healthcare infrastructure are expected to further boost market growth by increasing the availability of advanced imaging systems. As diagnostic centers expand, the demand for digital X-ray equipment is likely to rise, supporting broader adoption across diverse healthcare settings.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors play a crucial role in shaping the global market for advanced radiology solutions. Economic slowdowns and inflation often lead to reduced healthcare spending, limiting hospital budgets for upgrading imaging technology. Geopolitical conflicts can disrupt supply chains, delaying equipment delivery and increasing costs for manufacturers.

However, the rising need for accurate diagnostics in aging populations and growing healthcare infrastructure investments in emerging economies support market expansion. Favorable trade agreements and international collaboration further drive growth by facilitating technology transfer and improving access to advanced medical devices. Despite challenges, the demand for innovative imaging solutions remains strong as healthcare providers prioritize efficiency and accuracy in diagnostics.

Trends

Supportive Initiatives by Health-Based Organizations

Growing support from health-based organizations has emerged as a key driver of the radiology market. These initiatives aim to enhance healthcare access and improve diagnostic capabilities, particularly in underserved regions. For example, in July 2022, the European Union and the WHO donated advanced imaging devices to Armenia’s Ministry of Health, equipping radiology departments in seven hospitals.

Such contributions are anticipated to improve diagnostic outcomes and boost adoption rates. Increased collaboration between governments and international health bodies is likely to accelerate the deployment of cutting-edge technologies in both developed and developing countries. This trend supports the market by expanding the reach of critical diagnostic tools to a broader population, ensuring better healthcare outcomes globally.

Regional Analysis

North America is leading the Digital X-Ray Equipment Market

North America dominated the market with the highest revenue share of 40.2% owing to technological advancements and increased demand for high-quality diagnostic imaging. The adoption of advanced digital radiography systems in healthcare facilities played a pivotal role in enhancing diagnostic accuracy and workflow efficiency. In April 2021, Crouse Medical Imaging, based in the United States, implemented Philips DigitalDiagnost C90 VS, a cutting-edge digital radiography system designed to deliver superior image quality and streamlined operations.

The rising prevalence of chronic diseases, such as cardiovascular conditions and cancer, further drove the need for precise imaging solutions. Additionally, government initiatives promoting the adoption of digital healthcare technologies and the presence of key market players contributed significantly to market expansion. The shift toward value-based care and increased investments in healthcare infrastructure also bolstered the adoption of advanced imaging technologies across the region.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to rapid advancements in healthcare infrastructure and increasing demand for diagnostic imaging. The region’s expanding geriatric population and rising incidence of chronic diseases are anticipated to boost the need for efficient and accurate imaging solutions.

In October 2021, Samsung collaborated with VUNO, a South Korean AI medical software company, to integrate VUNO’s AI-assisted diagnostic tools into Samsung’s ceiling-mounted digital radiography systems. This partnership is likely to enhance imaging precision and diagnostic efficiency, catering to the growing demand for innovative healthcare technologies.

Additionally, the proliferation of telemedicine and digital health initiatives across countries such as China, India, and Japan is expected to accelerate market growth. Increasing government investments in healthcare modernization and rising consumer awareness of early disease detection are estimated to further support the expansion of this market in the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The major players in the digital X-ray equipment market are actively engaged in the development and introduction of innovative products, as well as implementing strategic initiatives aimed at enhancing their competitive positioning. Key players in this market focus on developing advanced imaging technologies to enhance diagnostic accuracy and streamline workflows for healthcare providers. They prioritize strategic collaborations with hospitals and diagnostic centers to expand their market presence and improve customer access.

Companies invest in research and development to introduce innovative, user-friendly systems with features like AI integration and cloud connectivity. Expanding into emerging markets helps them tap into growing healthcare infrastructure and increasing demand for advanced diagnostic tools. Additionally, they offer comprehensive service and maintenance packages to ensure long-term customer satisfaction and loyalty.

Top Key Players in the Digital X-Ray Equipment Market

- Siemens Healthineers AG

- Shimadzu International

- Philips Healthcare

- Nanox Imaging Ltd.

- Mindray Medical International

- GE Healthcare

- Fujifilm

- Carestream Health

Recent Developments

- In August 2021: Nanox Imaging Ltd. announced its intention to acquire Zebra Medical Vision for up to US$ 200 million. This strategic move aims to integrate Zebra’s artificial intelligence capabilities into Nanox’s digital X-ray technology, enhancing diagnostic accuracy and efficiency in medical imaging.

- In March 2021: Fujifilm completed the acquisition of Hitachi’s Diagnostic Imaging-related business for approximately US$ 1.6 billion. This acquisition expanded Fujifilm’s product portfolio to include advanced digital X-ray systems, strengthening its position in the global medical imaging market.

Report Scope

Report Features Description Market Value (2023) US$ 3.7 billion Forecast Revenue (2033) US$ 5.1 billion CAGR (2024-2033) 3.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Fixed and Portable), By Technology (Computed Radiography and Direct Radiography), By Application (General Imaging, Dental, Orthopedic, Cancer, and Others), By End-user (Hospitals, Diagnostic Centers, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Siemens Healthineers AG, Shimadzu International, Philips Healthcare, Nanox Imaging Ltd., Mindray Medical International, GE Healthcare, Fujifilm, and Carestream Health. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Digital X-Ray Equipment MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample

Digital X-Ray Equipment MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Siemens Healthineers AG

- Shimadzu International

- Philips Healthcare

- Nanox Imaging Ltd.

- Mindray Medical International

- GE Healthcare

- Fujifilm

- Carestream Health