Global Diethylenetriamine Market Size, Share, And Business Benefit By Type (Purity (Greater Than 99%), Purity (99%-95%), Purity (Less Than 95%)), By Application (Polyamide Resins, Lube Oil Additives, Fuel Additives, Corrosion Inhibitors, Chelating Agents, Additives, Wet-Strength Resins, Surfactants, Epoxy Curing Agents, Ion Exchange Resins, Others), By End-Use Industry (Oil and Gas, Personal Care and Cosmetics, Building and Construction, Paper and Pulp, Marine, Adhesives and Sealants, Automotive, Textiles, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 166766

- Number of Pages: 278

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

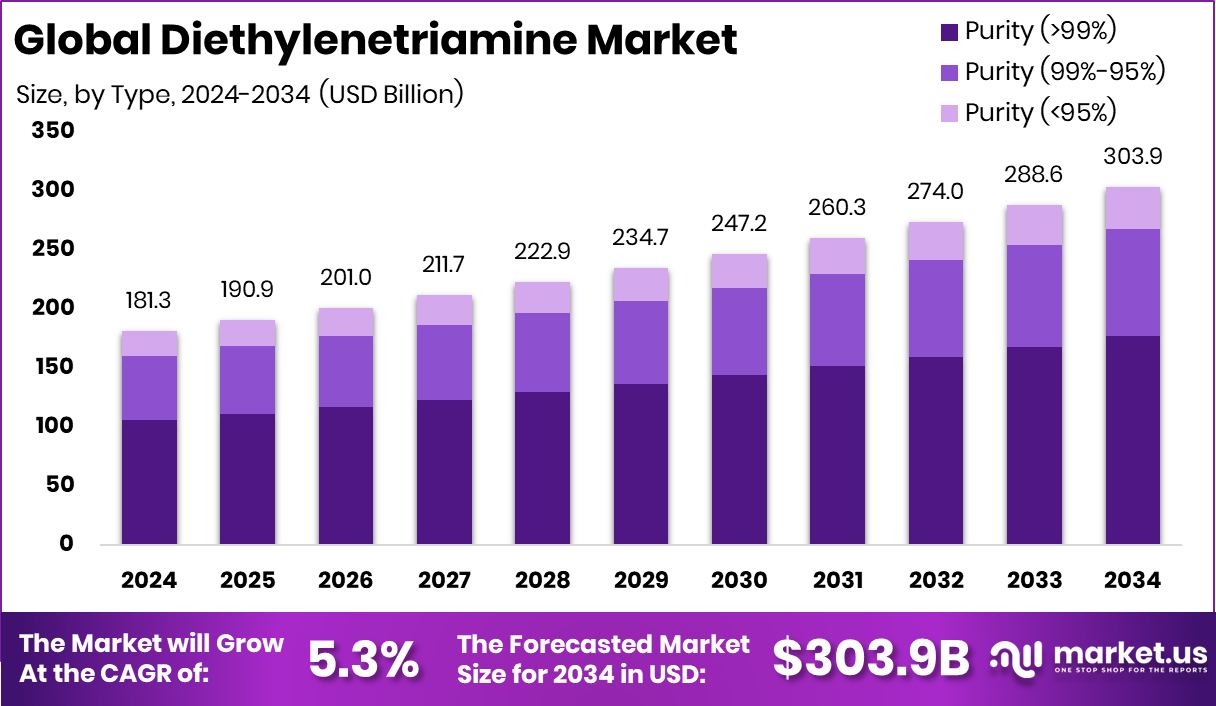

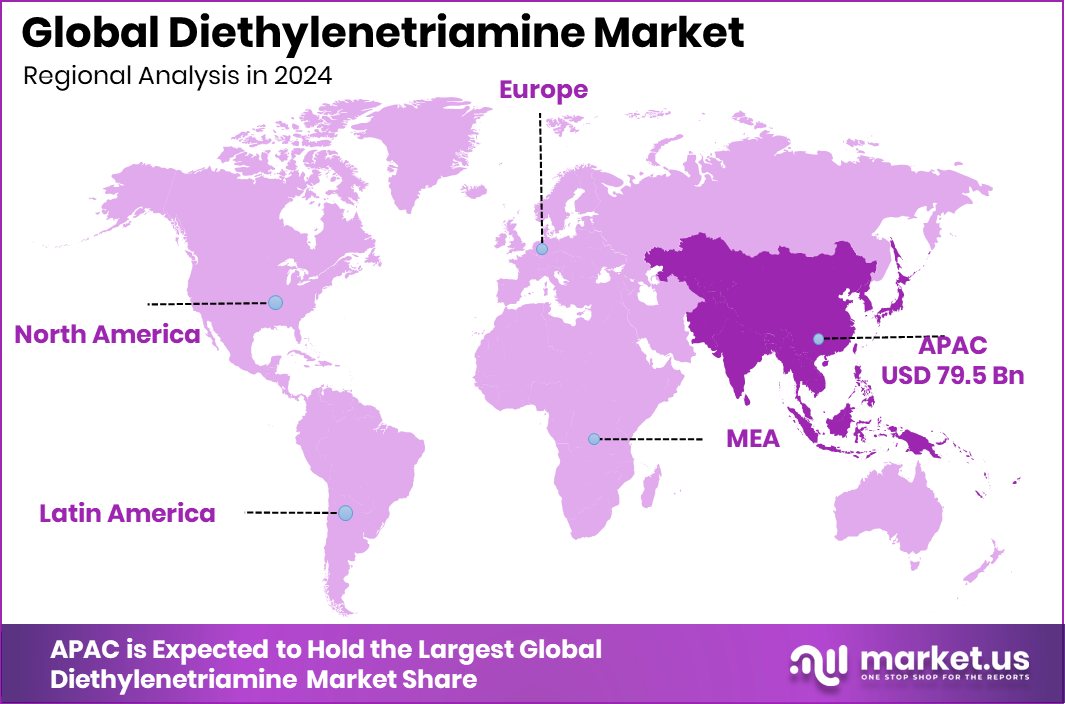

The Global Diethylenetriamine Market is expected to be worth around USD 303.9 billion by 2034, up from USD 181.3 billion in 2024, and is projected to grow at a CAGR of 5.3% from 2025 to 2034. Asia Pacific maintains dominant demand, supported by its 43.90% and USD 79.5 Bn standing.

Diethylenetriamine is a clear, strongly alkaline organic compound used as a building block in resins, lubricants, surfactants, and fuel additives. It reacts easily with acids and epoxies, which makes it valuable for producing adhesives, curing agents, paper wet-strength resins, and corrosion-control chemicals. Its versatility keeps it important across coatings, energy, and industrial processing.

The Diethylenetriamine market reflects this wide industrial reach. Demand grows steadily as manufacturers look for chemicals that improve performance in coatings, fuels, and specialty polymers. It also benefits from ongoing investments in cleaner fuel technologies and advanced materials, pushing producers to scale capacity and improve formulation efficiency.

Growth is mainly driven by rising use in epoxy curing systems, lubricants, and fuel-treatment chemicals. Innovations in additive manufacturing, strengthened by funding such as Quantica’s €19.7 million Series A expansion, indirectly support demand for high-functioning chemical intermediates like Diethylenetriamine.

Market demand is also supported by the global shift toward cleaner production. Funding movements such as FuelGems’ $900K raise and Sinopec’s $690 million fund show how energy-linked industries continue adopting performance-enhancing additives where Diethylenetriamine fits naturally.

Opportunity emerges as governments and financial institutions reshape energy spending. With the U.S. earmarking $40 billion in fossil-fuel subsidies and major U.S. banks still channeling $73 billion into new projects, industrial chemical consumption remains resilient. Even Norway’s challenge in deploying its €1.7 trillion oil fund highlights ongoing reliance on sectors that use specialty amines, creating long-term space for Diethylenetriamine applications.

Key Takeaways

- The Global Diethylenetriamine Market is expected to be worth around USD 303.9 billion by 2034, up from USD 181.3 billion in 2024, and is projected to grow at a CAGR of 5.3% from 2025 to 2034.

- The Diethylenetriamine Market is dominated by Purity (>99%), holding a 58.2% share in 2024.

- The Diethylenetriamine Market is dominated by Polyamide Resins applications, capturing a 28.9% share globally.

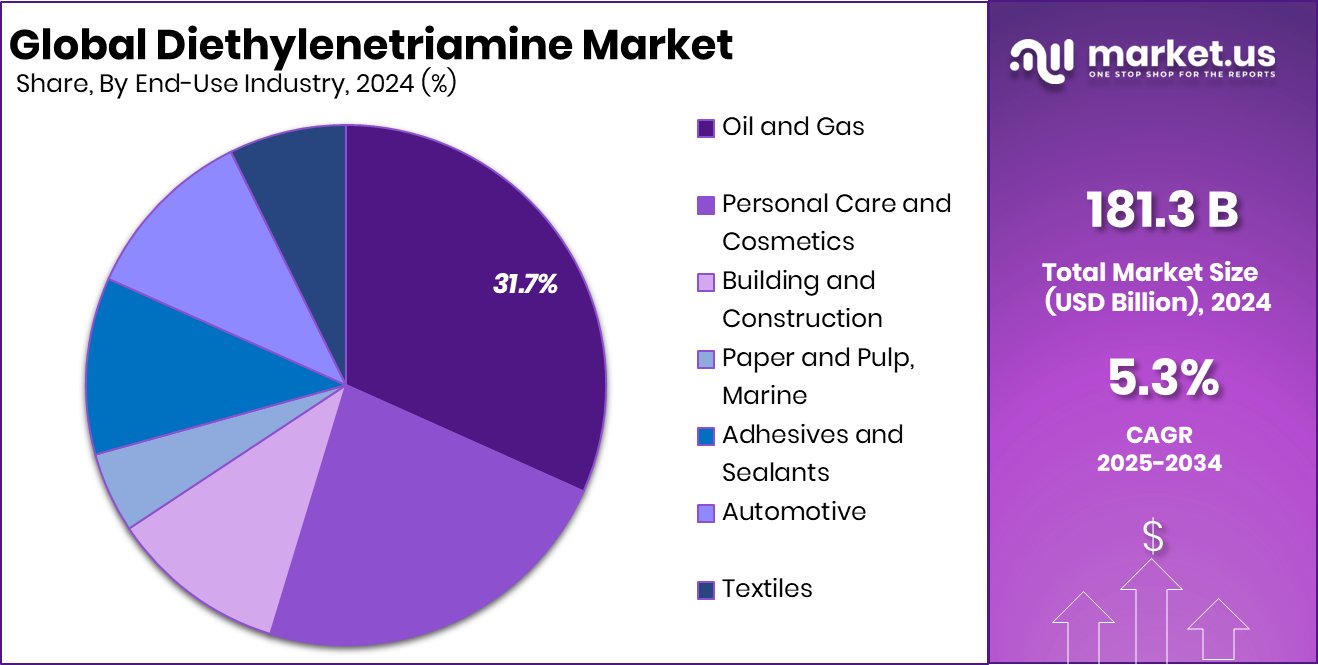

- The Diethylenetriamine Market is dominated by the Oil and Gas sector, securing a strong 31.7% share.

- The Asia Pacific records a substantial market value of USD 79.5 Bn today.

By Type Analysis

In 2024, Purity >99% dominated the Diethylenetriamine Market with 58.2% share.

In 2024, Purity (>99%) held a dominant market position in the By Type segment of the Diethylenetriamine Market, with a 58.2% share. This high-purity grade continues to attract strong demand because industries depend on consistent chemical performance, especially in applications where reaction accuracy and product stability matter. Companies prefer this grade for producing resins, surface-active agents, and fuel-related additives, as it supports cleaner processing and reduces contamination risks.

Its stability also makes it suitable for advanced material systems that require precise formulation control. The dominance of the >99% purity segment shows how end-users are shifting toward high-specification inputs, ensuring better output efficiency and lower operational issues across industrial, energy, and specialty chemical applications.

By Application Analysis

Polyamide Resins dominated the Diethylenetriamine Market with 28.9% share.

In 2024, Polyamide Resins held a dominant market position in the By Application segment of the Diethylenetriamine Market, with a 28.9% share. This lead comes from the strong use of Diethylenetriamine as a key building block in producing high-performance polyamide resins used for coatings, adhesives, and industrial protective layers. Industries rely on these resins for their durability, chemical resistance, and flexibility, which makes the application segment consistently stable.

The preference for Diethylenetriamine in resin formulation also reflects manufacturers’ push for materials that enhance bonding strength and long-term product reliability. The 28.9% share demonstrates how essential this application remains, supported by steady industrial demand for advanced resin systems across multiple processing environments.

By End-Use Industry Analysis

Oil and Gas dominated the Diethylenetriamine Market with a 31.7% share.

In 2024, Oil and Gas held a dominant market position in the By End-Use Industry segment of the Diethylenetriamine Market, with a 31.7% share. This leadership reflects the compound’s essential role in producing corrosion inhibitors, chelating agents, and fuel-treatment chemicals widely used across exploration, refining, and pipeline operations. The sector continues to rely on Diethylenetriamine because it helps maintain equipment integrity, supports cleaner processing, and enhances fluid stability in demanding environments.

Its performance benefits align well with routine operational needs in upstream and downstream activities. The 31.7% share highlights how deeply integrated Diethylenetriamine remains in oil and gas workflows, reinforcing its position as a critical supporting chemical in ongoing industrial and energy-related applications.

Key Market Segments

By Type

- Purity (>99%)

- Purity (99%-95%)

- Purity (<95%)

By Application

- Polyamide Resins

- Lube Oil Additives

- Fuel Additives

- Corrosion Inhibitors

- Chelating Agents

- Additives

- Wet-Strength Resins

- Surfactants

- Epoxy Curing Agents

- Ion Exchange Resins

- Others

By End-Use Industry

- Oil and Gas

- Personal Care and Cosmetics

- Building and Construction

- Paper and Pulp, Marine

- Adhesives and Sealants

- Automotive

- Textiles

- Others

Driving Factors

Rising Industrial Demand Strengthens Global Market Growth

A key driving factor for the Diethylenetriamine market is the steady rise in industrial applications that depend on reliable chemical performance. Industries such as coatings, adhesives, and energy processing continue to use Diethylenetriamine because it enhances material strength, improves bonding, and supports efficient production workflows. This broad usefulness keeps demand stable even when industrial conditions shift.

Growth momentum is also encouraged by ongoing capital flows into construction and infrastructure, which indirectly support the consumption of resins and additives made using diethylenetriamine. A notable example is Pearl Properties securing $173 million to develop a large Rittenhouse Square apartment project, reflecting strong construction activity. Such investments create long-term demand for high-performance materials, reinforcing the market’s upward direction.

Restraining Factors

Safety Regulations and Handling Risks Slow Expansion

One major restraining factor for the Diethylenetriamine market is the strict safety rules linked to its handling and storage. Because the chemical is highly reactive and can cause irritation, industries must invest in proper protective systems, specialized equipment, and trained workers. These extra steps increase operational costs and slow adoption, especially among smaller manufacturers. The regulatory pressure also forces companies to upgrade facilities before expanding production, which delays market growth.

Even though governments support workforce development—such as the State Government boosting Western Australia’s construction skills through a $37.5 million budget investment—compliance costs in chemical environments remain high. This makes safety-related requirements a steady challenge, limiting faster expansion of diethylenetriamine usage.

Growth Opportunity

Expanding Construction Activities Create New Market Openings

A major growth opportunity for the Diethylenetriamine market comes from the rising demand for advanced resins, coatings, and protective materials used across large construction projects. As builders look for chemicals that improve durability and environmental resistance, Diethylenetriamine becomes more valuable for producing high-performance materials. The construction sector’s steady expansion strengthens this opportunity.

A clear example is a developer securing $173 million in construction financing for what will become Philadelphia’s tallest apartment building. Such large-scale investments increase the need for stronger adhesives, protective coatings, and structural materials—many of which depend on Diethylenetriamine during formulation. As infrastructure and urban development accelerate, the market gains a long runway for long-term growth.

Latest Trends

Rising Focus on Low-Emission Material Innovations

A key trend shaping the Diethylenetriamine market is the growing push toward low-emission and cleaner material technologies. Industries are actively looking for chemical ingredients that can support greener production, reduce waste, and meet tightening environmental rules.

Diethylenetriamine benefits from this shift because it is widely used in advanced resins, adhesives, and industrial coatings that help improve efficiency and lower environmental impact. This trend is reinforced by rising investment in climate-focused construction solutions.

One clear example is Tangible raising $3 million to measure and cut carbon emissions in building materials. Such funding accelerates demand for chemicals that fit cleaner and smarter material systems, making sustainability-driven innovation a defining trend for the Diethylenetriamine market.

Regional Analysis

Asia Pacific leads the Diethylenetriamine Market with a 43.90% share strength.

Asia Pacific dominates the Diethylenetriamine Market with a 43.90% share, valued at USD 79.5 Bn, reflecting its strong industrial base, expanding manufacturing activity, and steady demand for resins, coatings, and energy-related chemical applications. The region’s large production landscape and continuous construction activity help reinforce its leading position.

North America follows with consistent consumption supported by mature chemical processing industries and a stable base of end-use sectors that rely on performance-driven materials. Europe shows steady uptake as regulations encourage the use of efficient chemical intermediates in coatings, adhesives, and engineered materials, keeping demand balanced across key economies.

The Middle East & Africa region benefits from its growing energy and industrial segments, which maintain interest in chemical inputs used for operational reliability. Latin America shows gradual progress as industrial users prioritize materials that improve stability and performance in manufacturing workflows.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In the global Diethylenetriamine market for 2024, BASF SE continues to demonstrate a steady and strategic presence through its strong integration in amine production and long-standing expertise in specialty chemical formulations. The company’s wide industrial reach supports consistent demand for Diethylenetriamine across coatings, resins, and fuel-treatment applications, positioning BASF as a reliable supplier for performance-driven materials.

Delamine maintains its relevance in the market through a focused manufacturing approach centered on high-quality ethyleneamines. Its ability to deliver consistent purity and dependable supply makes it an important participant, particularly for industries that prioritize stable chemical performance. Delamine’s streamlined portfolio helps it serve end-users seeking reliable intermediates for resins, adhesives, surfactants, and specialty chemical processes.

Diamines and Chemicals Ltd. contributes to market stability through its production capabilities and specialization in amine-based intermediates. The company’s operational focus supports various downstream applications where Diethylenetriamine plays a core functional role. Its commitment to delivering industrial-grade amines ensures continued relevance in sectors such as oil and gas, lubricants, and polymer systems.

Top Key Players in the Market

- BASF SE

- Delamine

- Diamines and Chemicals Ltd.

- The Dow Chemical Company

- Tosoh Corporation

- Huntsman Corporation

- Arabian Amines Company

- AkzoNobel N.V

Recent Developments

- In May 2025, Huntsman announced that its new E-GRADE® unit in Conroe, Texas, is now operational. The unit is designed to produce high-purity, low-trace metal amines, including quaternary amines and amine oxides, intended for use in semiconductor chip manufacturing.

- In March 2024, Dow announced the intent to invest in a world-scale carbonate solvents facility on the U.S. Gulf Coast, targeting growth in the electric vehicle and energy-storage market. Although not specific to DETA, the move reflects broader derivatives growth.

Report Scope

Report Features Description Market Value (2024) USD 181.3 Billion Forecast Revenue (2034) USD 303.9 Billion CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Purity (>99%), Purity (99%-95%), Purity (<95%)), By Application (Polyamide Resins, Lube Oil Additives, Fuel Additives, Corrosion Inhibitors, Chelating Agents, Additives, Wet-Strength Resins, Surfactants, Epoxy Curing Agents, Ion Exchange Resins, Others), By End-Use Industry (Oil and Gas, Personal Care and Cosmetics, Building and Construction, Paper and Pulp, Marine, Adhesives and Sealants, Automotive, Textiles, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, Delamine, Diamines and Chemicals Ltd., The Dow Chemical Company, Tosoh Corporation, Huntsman Corporation, Arabian Amines Company, AkzoNobel N.V Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Diethylenetriamine MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Diethylenetriamine MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- Delamine

- Diamines and Chemicals Ltd.

- The Dow Chemical Company

- Tosoh Corporation

- Huntsman Corporation

- Arabian Amines Company

- AkzoNobel N.V