Global DG Ground-mounted Solar PV Market Size, Share Analysis Report By System Type (Fixed Tilt, Single Axis Tracker, Dual Axis Tracker), By Component (Solar Panels, Inverters, Mounting Structures, Balance of System), By Application (Residential, Commercial, Industrial, Utility) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170936

- Number of Pages: 256

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

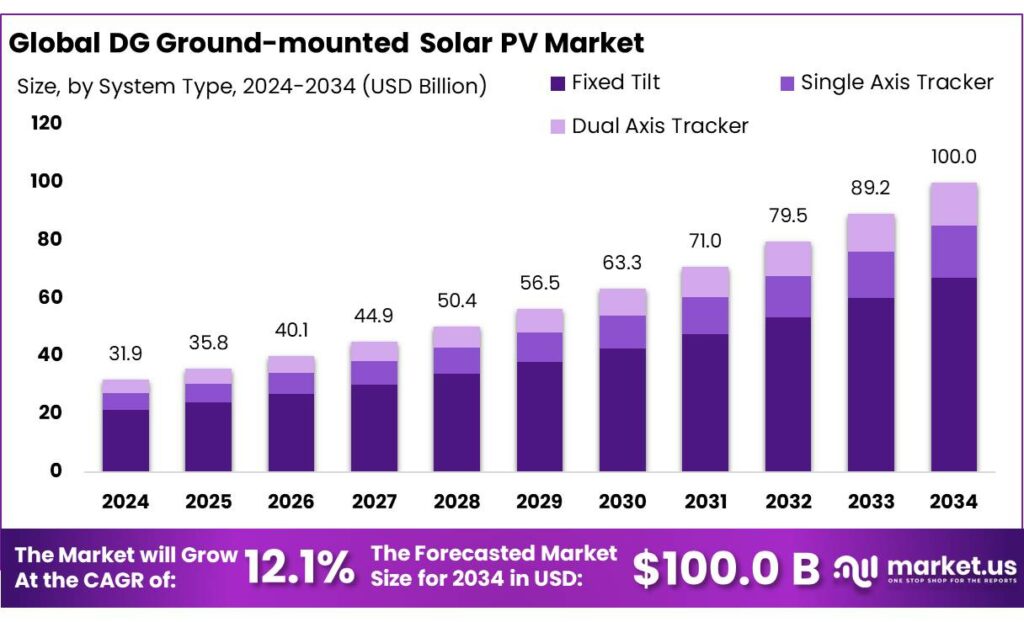

The Global DG Ground-mounted Solar PV Market size is expected to be worth around USD 100.0 Billion by 2034, from USD 31.9 Billion in 2024, growing at a CAGR of 12.1% during the forecast period from 2025 to 2034. In 2024, Europe held a dominant market position, capturing more than a 39.10% share, holding USD 1.4 Billion revenue.

Distributed Generation Ground-Mounted Solar PV refers to photovoltaic (PV) systems installed directly on land (rather than rooftops) to generate electricity close to the point of consumption or into the grid. These systems range from utility-scale solar farms to smaller commercial and industrial installations, forming a critical component of broader Distributed Energy Systems (DES) that enhance energy security, reduce transmission losses, and support decarbonization goals.

Solar PV overall has emerged as one of the fastest-growing renewable energy technologies globally. The total installed solar PV capacity reached ~1,865 GW by the end of 2024, driven by expanding ground-mounted and DG projects adding over 451 GW of capacity in 2024 alone—the largest increase among renewables. Ground-mounted DG installations, in particular, benefit from economies of scale, advanced tracking equipment, and declining module prices, reflecting the broader market trend where solar PV accounted for a record 320 TWh of electricity generation in 2023, up ~25% from 2022.

Driving factors for this expansion include rapid declines in PV module and balance-of-system costs, improvements in module efficiency, and increased corporate and utility procurement of renewable power. Solar PV continues to push global renewable capacity growth, with record installations adding 380 GW of new capacity in the first half of 2025, up ~64% year-on-year, underscoring strong industrial and investor confidence. The DG ground-mounted segment benefits from economies of scale, predictable cash flows via power purchase agreements (PPAs), and reduced per-unit energy costs compared to smaller decentralized systems.

Government initiatives and policy support are central to scaling ground-mounted PV. In India, the Ministry of New & Renewable Energy (MNRE) reports ~100.80 GW of ground-mounted solar capacity installed and 132.85 GW total solar PV capacity as of mid-2025. India’s broader renewable thrust aims for 500 GW of non-fossil fuel capacity by 2030, with solar expected to play a leading role. Policy actions include annual competitive bidding trajectories and incentives that reserve significant allocation for solar development.

Key Takeaways

- DG Ground-mounted Solar PV Market size is expected to be worth around USD 100.0 Billion by 2034, from USD 31.9 Billion in 2024, growing at a CAGR of 12.1%.

- Fixed Tilt held a dominant market position, capturing more than a 67.3% share in the DG ground-mounted solar PV market.

- Solar Panels held a dominant market position, capturing more than a 58.2% share in the DG ground-mounted solar PV market.

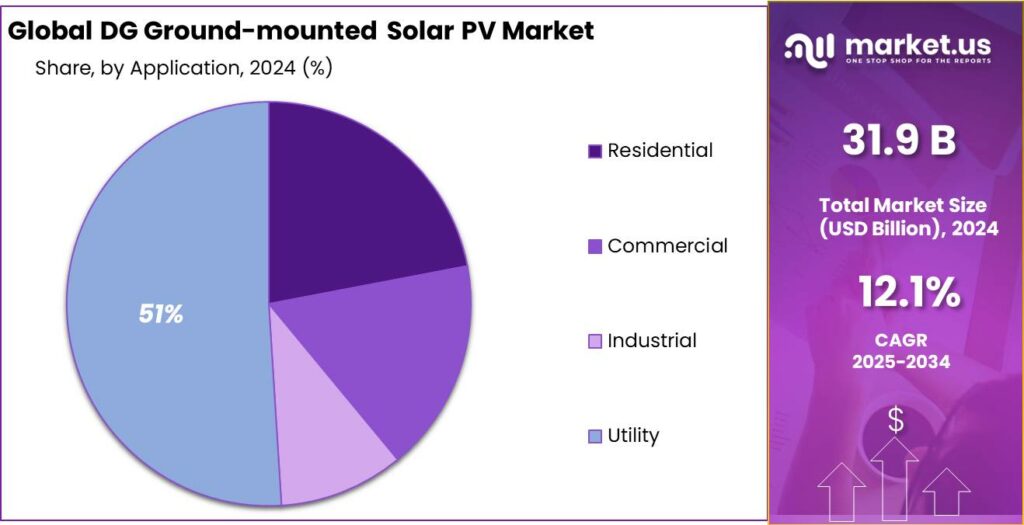

- Utility held a dominant market position, capturing more than a 51.5% share in the DG ground-mounted solar PV market.

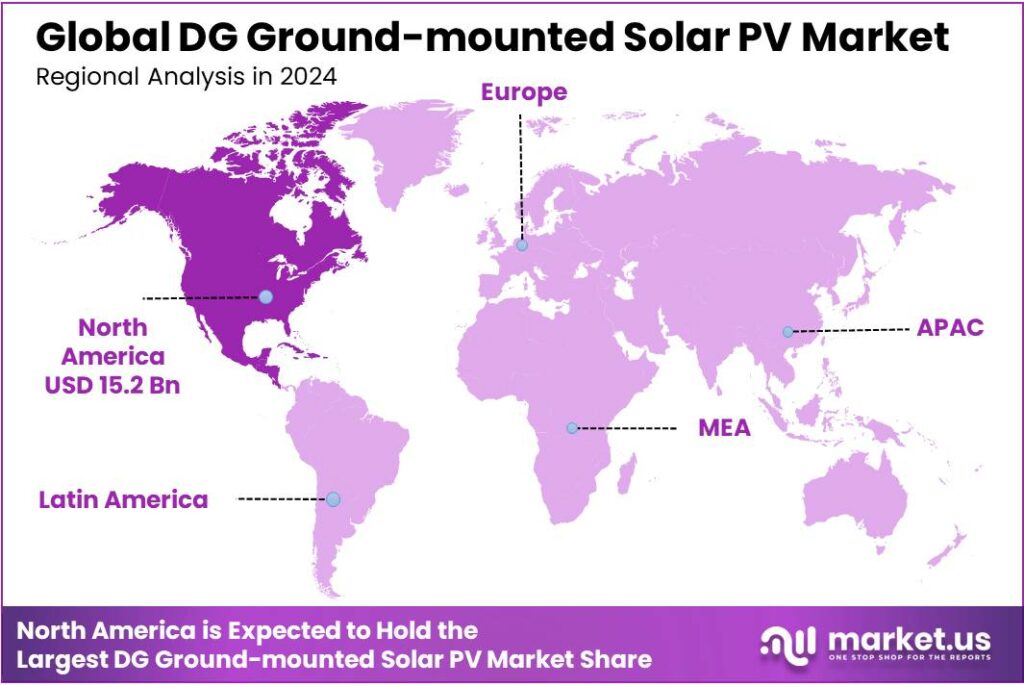

- North America held a dominant position in the distributed generation (DG) ground-mounted solar PV market, representing 47.9% of regional share and an estimated US$15.2 billion.

By System Type Analysis

Fixed Tilt systems lead with a 67.3% share due to their simple design and lower installation cost.

In 2024, Fixed Tilt held a dominant market position, capturing more than a 67.3% share in the DG ground-mounted solar PV market. This strong position was mainly supported by its straightforward structure, fewer moving parts, and lower capital and maintenance needs when compared with tracking systems. Fixed tilt systems are widely preferred for small to mid-scale distributed generation projects where land availability is stable and energy output predictability is important. The ease of installation helped project developers reduce construction time, while long-term operational stability supported consistent power generation over the system life.

The growing focus on fast project deployment and lower balance-of-system costs further supported the preference for fixed tilt configurations. As grid-connected DG solar projects expanded, fixed tilt systems remained the first choice for developers seeking proven performance, stable returns, and reduced technical complexity, reinforcing their leading role in the market.

By Component Analysis

Solar panels dominate with a 58.2% share driven by their direct role in power generation and falling module costs.

In 2024, Solar Panels held a dominant market position, capturing more than a 58.2% share in the DG ground-mounted solar PV market. This leadership was mainly supported by the continuous decline in module prices and steady improvements in panel efficiency. Solar panels account for the largest portion of total system cost and directly determine energy output, making them the most critical component in project planning.

Moving into 2025, demand for solar panels remained strong as distributed generation projects expanded across industrial, commercial, and agricultural sites. Stable supply chains and large-scale manufacturing supported consistent availability, while long-term performance warranties improved buyer confidence. The focus on faster project returns and higher lifetime energy production continued to favor investment in advanced panel technologies. As a result, solar panels maintained their dominant role within DG ground-mounted systems, reinforcing their position as the core value-driving component of the market.

By Application Analysis

Utility applications lead with a 51.5% share due to large project sizes and stable long-term power demand.

In 2024, Utility held a dominant market position, capturing more than a 51.5% share in the DG ground-mounted solar PV market. This strong share was mainly supported by the scale of utility-led solar installations, which are designed to deliver high and steady power output over long operating lifetimes. Utility projects benefit from better access to land, grid connectivity, and financing, allowing larger capacities to be deployed compared to other applications.

Moving into 2025, utility demand remained firm as grid operators focused on energy security and cost control. Long-term power purchase agreements and predictable cash flows made utility solar projects financially attractive. The ability to integrate energy storage and upgrade existing sites further strengthened this segment. As a result, utility applications continued to lead the DG ground-mounted solar PV market, maintaining their dominant role through scale, reliability, and long-term energy planning advantages.

Key Market Segments

By System Type

- Fixed Tilt

- Single Axis Tracker

- Dual Axis Tracker

By Component

- Solar Panels

- Inverters

- Mounting Structures

- Balance of System

By Application

- Residential

- Commercial

- Industrial

- Utility

Emerging Trends

Surge in Corporate Renewable Power Purchase Agreements (PPAs)

A clear and human-centred trend shaping the growth of DG ground-mounted solar PV systems today is the widespread adoption of long-term renewable energy Power Purchase Agreements (PPAs) by major businesses — notably including energy-intensive sectors like the food and beverage industry. This trend isn’t abstract or dry; it reflects real choices by companies to secure long-term renewable power, reduce risk from volatile energy costs, and make their operations more sustainable in a way that resonates with customers and communities.

- According to a broader analysis of renewable energy contracts, the food and drinks sector saw a 61.9% increase in corporate renewable PPAs signed in 2023 compared with 2022, making it one of the leading segments after retail — a signal that food companies are embracing solar contracts at scale. This sharp rise reflects a broader global appetite for renewable energy sourcing and shows that firms are looking beyond traditional energy markets for stable, low-carbon power.

This trend is important for DG ground-mounted solar PV because many of these large PPAs are tied to solar farms and utility-scale ground-mounted facilities, which feed directly into the grid but are effectively backing distributed generation for corporate use. For example, renewable energy developers like Lightsource BP signed 10 global PPAs in 2024 totaling about 1.3 GW of mainly solar capacity, with average contract durations of 12 years — a considerable amount of clean energy being committed to corporate offtake.

- These corporate PPA trends are supported by government policies and targets that make renewable energy more attractive. In India, for instance, the drive to expand renewable capacity has led to strong additions of solar generation, with renewables — led by solar — contributing roughly 227 GW of installed capacity by 2025 and showing a 420% year-on-year growth in additions by mid-2025.

Drivers

Corporate Renewable Energy Demand And Cost Savings

One of the clearest and most powerful drivers of ground-mounted distributed generation (DG) solar PV growth today is the corporate shift towards renewable energy — especially among large industrial and food companies seeking predictable energy costs and sustainable operations. This trend isn’t just buzz; it’s grounded in real action and real numbers from organizations that matter both for energy markets and for everyday consumers.

- According to the International Renewable Energy Agency (IRENA), newly built solar photovoltaic (PV) projects were on average 41% cheaper than the least expensive fossil-fuel alternative in 2024, making solar not only cleaner but also more cost-competitive. This price advantage directly benefits companies with high energy use — especially food manufacturers and retailers — who face rising energy bills and volatile fuel markets.

For many food and beverage players, energy is a major operational cost and carbon source. Renewable energy, and solar in particular, offers a solution that reduces long-term cost exposure and supports corporate sustainability goals at the same time. Solar power contracts and installations help firms lock in fixed electricity prices for decades, shielding them from unpredictable grid tariffs and fossil fuel price swings. For example, Power Purchase Agreements (PPAs) allow companies to buy solar electricity at a fixed per-kilowatt-hour rate that is typically lower than utility rates, often securing savings over the lifetime of the contract.

Governments also amplify this corporate driver by creating favourable policy environments for solar adoption. Many countries offer tax incentives, accelerated depreciation, or streamlined permitting for renewable energy projects, encouraging enterprises to build or contract DG solar capacity. In India, for example, renewable capacity surged as policy support and investment incentives helped the country reach around 170 GW of renewable energy capacity by 2025, with solar making the most significant contribution.

Restraints

Land Scarcity and Land-use Conflicts

One of the biggest real-world hurdles slowing down the adoption of ground-mounted distributed generation (DG) solar photovoltaic (PV) systems is the challenge of securing land — not just any land, but land that is suitable, affordable, and free from conflict. Solar farms require large, contiguous areas to install panels, trackers, inverters, access roads, and related infrastructure. While solar energy is clean and abundant, the physical footprint for ground-mounted installations is still significant, and finding land that doesn’t compete with other essential uses — especially agriculture and food production — is increasingly difficult.

In a densely populated country like India, this issue is particularly acute. Dedicated solar PV installations demand a lot of space: every 40-60 MW of utility-scale solar PV can require about 1 square kilometer of land. This land requirement competes directly with other needs such as farming, housing, and infrastructure development, making solar land allocation complex and costly.

- Renewable projects have met community resistance and legal challenges when farmland or community land rights are perceived to be at risk. For example, a 100 MW solar project in Nandgaon, Maharashtra faced protests from local farmers who claimed ancestral land rights, leading to intervention by the forest department and temporary project site closure. Such disputes are not isolated incidents — at least 31 green energy-related land conflicts affected nearly 44,000 people in India, underscoring how land acquisition and rights can slow energy transitions.

Government efforts to ease land challenges do exist, but their impact is mixed. Schemes like India’s National Solar Mission have spurred large solar parks and utility-scale capacity additions, but they still rely heavily on promoters securing or allocating land outside densely farmed regions. Innovators are exploring agrivoltaics — combining agriculture with solar panels so that crops and solar generation co-exist — but these models are still emerging and often require greater technical know-how and investment.

Opportunity

Corporate Renewable Energy Adoption in the Food Industry

One of the biggest and most human stories in the clean energy transition today is how large food companies are turning to solar power — especially ground-mounted distributed generation (DG) solar PV — to lower energy costs, improve sustainability, and meet the rising expectations of consumers and communities. This shift isn’t just abstract; it is reflected in real numbers and projects that show how renewable energy is becoming part of everyday business for food producers.

For food manufacturers and processors, energy is one of the biggest operating costs. Whether it’s running refrigeration units, ovens, packaging lines, or climate-controlled storage, factories use enormous amounts of electricity. This makes renewable energy not just an environmental choice, but a smart financial one. Solar power helps companies cut energy costs over time because once a solar installation is up and running, sunlight — the fuel — is free. That stability in energy pricing is especially valuable in an industry where electricity prices can fluctuate widely.

A powerful example comes from Hormel Foods, a major U.S. food producer. At its Swiss American Sausage Company facility in California’s Central Valley, a ground-mounted solar array generates about 1.2 million kilowatt-hours (kWh) of electricity each year — cutting reliance on fossil fuels and reducing what the company pays for power from the grid by around half at that site. Over time, projects like these help lock in lower energy costs while shrinking the company’s emissions footprint. Hormel has also increased its procurement of renewable energy so significantly that it now sources more than 936 million kWh of green power annually through a combination of solar arrays and renewable energy agreements.

- Government policies also play a critical role in opening these opportunities. In countries like India, the government’s push has seen solar capacity soar — installed renewable energy capacity reached 227 GW by 2025, with solar contributing a large share of that growth. The proportion of renewables in total installed capacity jumped from around 12.9% in 2013–14 to about 45.5% by March 2025, reflecting strong regulatory support and investment incentives that benefit corporate solar adopters.

Regional Insights

North America leads with a 47.9% share and US$15.2 Bn in 2024, driven by rapid DG ground-mounted deployment and strong utility and commercial demand

In 2024, North America held a dominant position in the distributed generation (DG) ground-mounted solar PV market, representing 47.9% of regional share and an estimated US$15.2 billion in market value. This leadership was underpinned by an exceptional build-out of ground-mounted capacity across the United States and Canada, where record annual installations and a mix of utility-scale and large DG projects increased demand for mounting systems, mo dules and BOS components.

The U.S. alone accounted for the bulk of activity in 2024, supported by favourable federal and state incentives, accelerating interconnection of new plants, and strong corporate and utility procurement; national reports recorded nearly 50 GWdc of new solar capacity in 2024, highlighting the scale of deployment.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

LONGi Solar is a leading mono-crystalline PV manufacturer serving DG ground-mounted markets worldwide. In 2024, the company achieved revenue of approximately USD 18 billion and shipped over 70 GW of wafers and modules. Its focus on high-efficiency mono PERC and TOPCon technologies supports large-scale DG growth.

Trina Solar supplies advanced modules and system solutions for DG ground-mounted solar PV. In 2024, the company reported revenue of nearly USD 14 billion with module shipments above 65 GW. Its Vertex series modules are widely adopted due to high power output and land-use efficiency.

JinkoSolar is one of the world’s largest PV module suppliers for ground-mounted DG projects. In 2024, the company shipped over 75 GW of modules and generated revenue exceeding USD 16 billion. High-efficiency N-type modules strengthened its position in cost-sensitive DG solar deployments.

Top Key Players Outlook

- First Solar, Inc.

- SunPower Corporation

- Canadian Solar Inc.

- JinkoSolar Holding Co., Ltd.

- Trina Solar Limited

- LONGi Solar

- JA Solar Technology Co., Ltd.

- Hanwha Q CELLS Co., Ltd.

- Seraphim Solar System Co., Ltd.

- Renesola Ltd.

- Astronergy Solar

Recent Industry Developments

In 2024, First Solar, Inc. continued to play a central role in the DG ground-mounted solar PV sector by supplying high-volume thin-film solar modules that are widely used in large ground-mounted installations due to their durability and performance in varied climates. The company achieved record-high 14.1 GW of module shipments in 2024 and generated approximately US$4.2 billion in net sales for the year, reflecting a significant increase from prior periods and strong operational execution in manufacturing and sales.

In 2024, Canadian Solar Inc. remained a major contributor to the DG ground-mounted solar PV sector by supplying high-volume solar modules and advancing project pipelines that support both distributed generation and utility-scale installations. The company’s CSI Solar segment shipped 31.1 GW of solar modules during 2024, reinforcing its global role in supplying panels for ground-mounted projects across North America, Europe, Asia and Latin America.

Report Scope

Report Features Description Market Value (2024) USD 31.9 Bn Forecast Revenue (2034) USD 100.0 Bn CAGR (2025-2034) 12.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By System Type (Fixed Tilt, Single Axis Tracker, Dual Axis Tracker), By Component (Solar Panels, Inverters, Mounting Structures, Balance of System), By Application (Residential, Commercial, Industrial, Utility) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape First Solar, Inc., SunPower Corporation, Canadian Solar Inc., JinkoSolar Holding Co., Ltd., Trina Solar Limited, LONGi Solar, JA Solar Technology Co., Ltd., Hanwha Q CELLS Co., Ltd., Seraphim Solar System Co., Ltd., Renesola Ltd., Astronergy Solar Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  DG Ground-mounted Solar PV MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

DG Ground-mounted Solar PV MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- First Solar, Inc.

- SunPower Corporation

- Canadian Solar Inc.

- JinkoSolar Holding Co., Ltd.

- Trina Solar Limited

- LONGi Solar

- JA Solar Technology Co., Ltd.

- Hanwha Q CELLS Co., Ltd.

- Seraphim Solar System Co., Ltd.

- Renesola Ltd.

- Astronergy Solar