Global Deli Meat Market Size, Share, And Business Benefits By Source (Pork, Chicken, Beef, Others), By Product (Cured, Uncured, Smoked, Roasted, Cooked), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Store, Specialty Store, Online Retailers, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 157435

- Number of Pages: 391

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

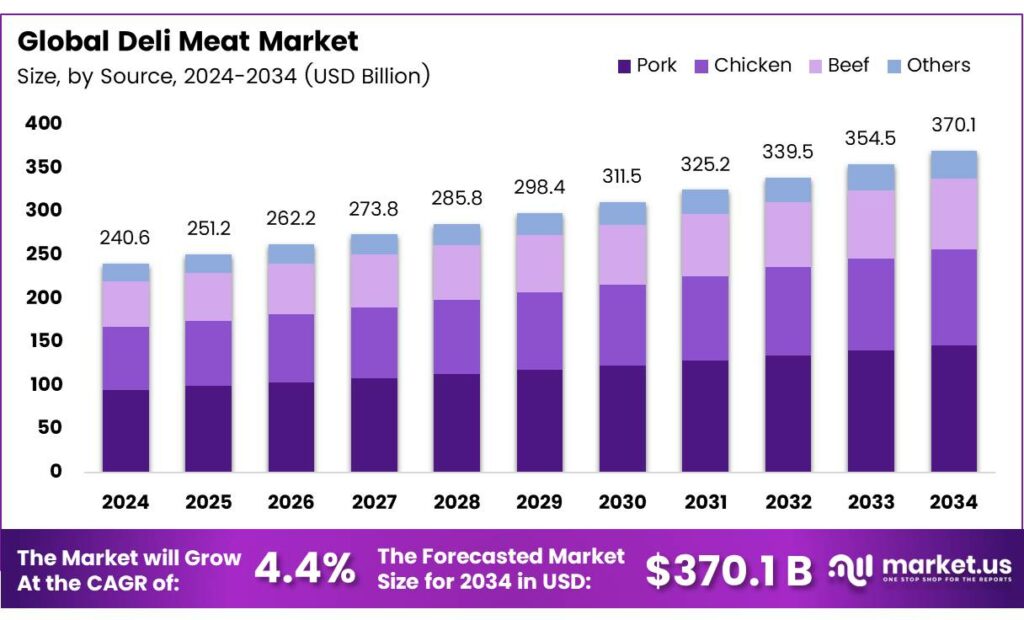

The Global Deli Meat Market size is expected to be worth around USD 370.1 Billion by 2034, from USD 240.6 Billion in 2024, growing at a CAGR of 4.4%% during the forecast period from 2025 to 2034.

The Deli Meat Market has grown into a vital part of the processed food industry, fueled by evolving consumer lifestyles, rapid urbanization, and rising demand for convenient protein options. Products like ham, turkey, salami, roast beef, and chicken slices are now staples in households, foodservice chains, and institutional catering. Their versatility makes them suitable for sandwiches, salads, pasta, and a variety of quick-serve dishes, offering both ease and flavor to everyday meals.

The origins of Deli meats trace back to the Paleolithic era, when meat was sun-dried for preservation. However, the deli meats we recognize today can be linked to around 500 BC, when they became popular with Roman and Etruscan populations. The concept of cold cuts essentially refers to cured or pre-cooked meat that is sliced and served cold. Their convenience has made them especially popular at gatherings, family events, and casual meals, where they can be served with little preparation.

Luncheon meat represents one of the most economical deli meat products. It is typically produced using an emulsion that includes about 30–35% lean meat, 20–24% fat, 30–35% water, and 5–10% powdered additives. The mixture is filled into waterproof casings and cooked until the core temperature reaches 70°C. Widely consumed in Australia, luncheon meat is most often used in sandwiches, serving as a quick and affordable protein source.

Milk-based ingredients play a functional role in improving the quality of such comminuted meat products. Two critical requirements, water holding capacity and fat-binding ability, are enhanced by incorporating milk proteins like caseinates and whey protein concentrates (WPCs). Since more than 70% of the water in lean meat is free water, which affects tenderness and juiciness, salts and milk proteins help retain this moisture after slaughter.

Key Takeaways

- The Global Deli Meat Market is projected to grow from USD 240.6 billion in 2024 to USD 370.1 billion by 2034, at a CAGR of 4.4%.

- Pork dominates with a 39.5% share in 2024, driven by popular products like ham, bacon, salami, and sausages.

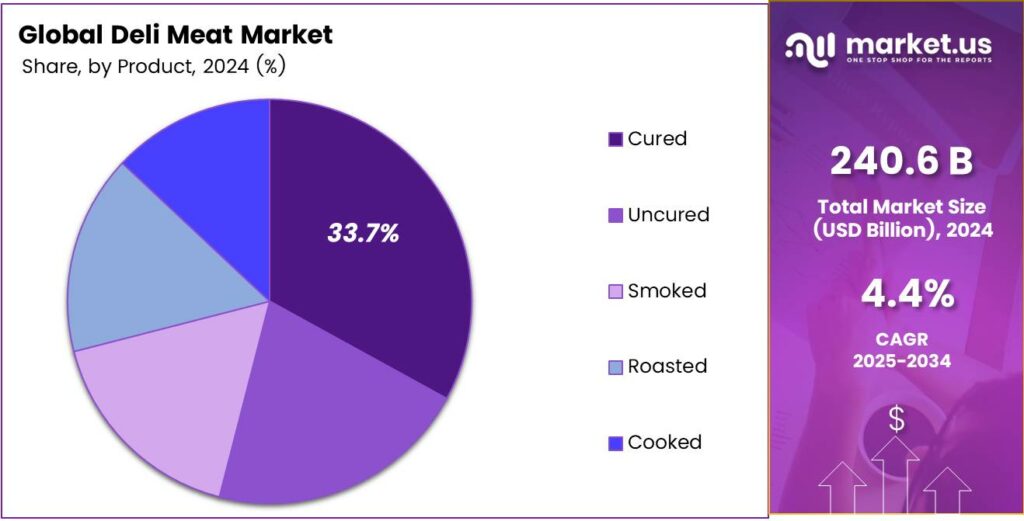

- Cured deli meats lead with a 33.7% share in 2024, favored for long shelf life and versatile applications.

- Supermarkets and Hypermarkets hold a 43.1% share in 2024, offering wide product availability and promotions.

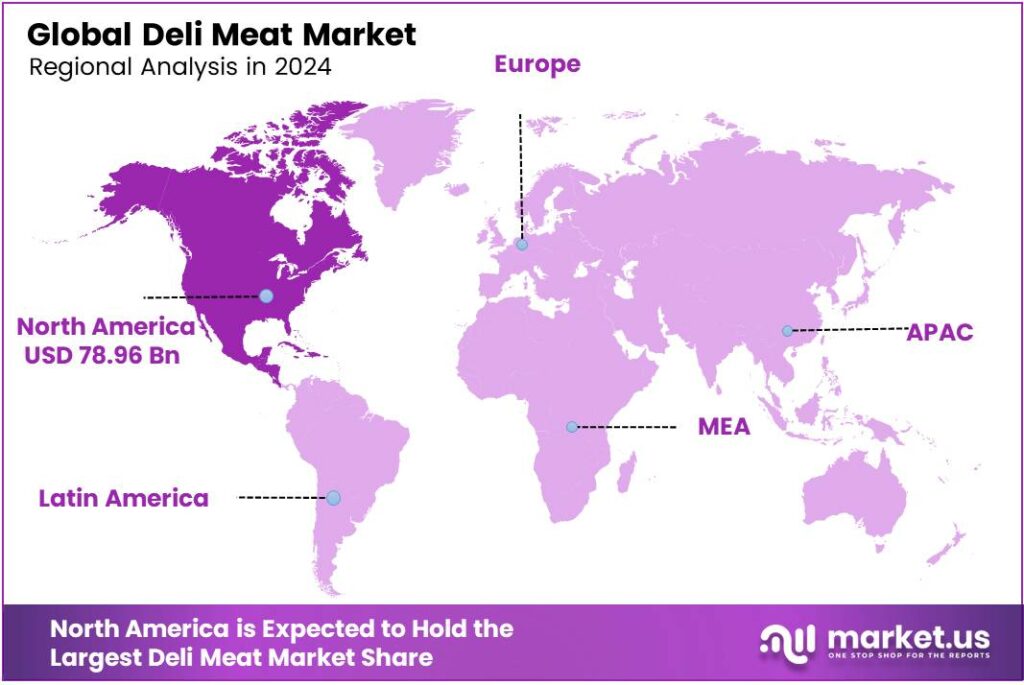

- North America leads with 32.9% market share, USD 78.96 billion in 2024, supported by robust retail and consumer demand.

Analyst Viewpoint

The Deli Meat Market is carving out a promising space for investors, driven by a growing appetite for convenient, protein-packed foods that fit into busy lifestyles. People are gravitating toward quick meal solutions like pre-sliced ham, turkey, or roast beef, especially in urban areas where time is tight.

This demand opens doors for investment in companies innovating with premium, health-focused products like organic or low-sodium options that cater to consumers who want both convenience and quality. Smaller brands pushing artisanal or plant-based deli meats are also gaining traction, offering opportunities for early-stage investments or partnerships.

However, the market isn’t without its challenges. Health concerns about processed meats, including links to heart disease and cancer, can spook consumers and hurt demand. Investors need to focus on firms that prioritize clean-label products and transparent sourcing to stay ahead of these risks.

By Source

Pork Maintains Stronghold with 39.5% Share

In 2024, Pork held a dominant market position, capturing more than a 39.5% share in the global deli meat market. Pork has long been a preferred source due to its wide variety of offerings, such as ham, bacon, salami, and sausages, which continue to be staples in retail stores and foodservice outlets.

The versatility of pork-based deli meats makes them popular in sandwiches, ready-to-eat meals, and catering services, helping the category maintain a significant lead. Consumers in both developed and emerging markets favor pork for its taste, availability, and competitive pricing compared to other meat sources.

The pork segment is expected to retain its strong market foothold as demand for processed and convenience foods grows. The rising popularity of quick-service restaurants and packaged meal options further supports pork’s role as a major contributor within the deli meat industry. Additionally, innovation in healthier and reduced-sodium pork-based deli products is likely to attract health-conscious consumers while preserving its wide consumer base.

By Product

Cured Products Lead with 33.7% Market Share

In 2024, Cured held a dominant market position, capturing more than a 33.7% share of the global deli meat market. Cured deli meats such as salami, pepperoni, prosciutto, and ham remain consumer favorites due to their long shelf life, rich flavor, and wide application across sandwiches, pizzas, and snack platters.

Their traditional appeal, combined with modern packaging innovations, has helped the cured segment sustain strong momentum in both retail and foodservice channels. Cured deli meats are expected to maintain their leadership, driven by steady demand in quick-service restaurants and convenience-driven households.

Consumers continue to value the combination of taste and preservation offered by curing methods, which makes these products highly suitable for ready-to-eat meals. Furthermore, premium artisanal cured meats are gaining traction among urban consumers seeking authentic flavors. This consistent performance highlights why cured meats stand as a cornerstone of the deli meat category, holding their strong market share and consumer preference into the next year.

By Distribution Channel

Supermarkets and Hypermarkets Drive 43.1% Market Share

In 2024, Supermarkets and Hypermarkets held a dominant market position, capturing more than a 43.1% share of the global deli meat market. These large retail outlets continue to be the leading sales channel, offering consumers wide product availability, diverse brand choices, and attractive promotions.

Their ability to provide both fresh and packaged deli meats in convenient formats makes them the preferred option for households looking for ready-to-eat meals and weekly grocery shopping. By 2025, the dominance of supermarkets and hypermarkets is expected to remain strong, supported by increasing urbanization and changing consumer lifestyles.

Busy families and working professionals prefer one-stop shopping experiences, where deli meats are often purchased alongside bakery items, dairy, and fresh produce. Additionally, retailers are investing in improved cold-chain logistics and in-store displays to ensure better product freshness and appeal. This sustained growth underscores the importance of supermarkets and hypermarkets in shaping deli meat consumption patterns worldwide.

Key Market Segments

By Source

- Pork

- Chicken

- Beef

- Others

By Product

- Cured

- Uncured

- Smoked

- Roasted

- Cooked

By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Store

- Specialty Store

- Online Retailers

- Others

Drivers

Rising Demand for High-Quality Protein

In simple terms, one of the biggest reasons deli meats stay in demand is because people need good protein, and these meats deliver it. Years of guidance from trusted bodies such as the World Health Organization (WHO) tell us that adults should aim for about 0.8 grams of protein per kilogram of body weight per day to meet basic health needs. That means someone weighing around 80 kg needs around 64 grams of protein daily.

That recommendation matters because it sets the baseline for why consumers turn to deli meats—they’re a convenient, tasty way to help reach that protein target. Not everyone has the time (or desire) to cook from scratch, and deli meats offer an easy solution, especially for busy people or families preparing quick meals.

What’s more, a recent article also reminds us that most people already get enough protein daily, often within their regular diet, emphasizing that wholesome sources like meat, fish, dairy, beans, and nuts can cover the requirement easily. But deli meats serve as a practical, sometimes cheaper and quicker option, especially for individuals balancing varied meals or needing something ready-to-eat.

Restraints

Health Risks Linked to Processed Meat

In plain, honest terms: one of the biggest barriers to the deli meat market is mounting health concerns—especially around processed meats. Multiple trusted health bodies around the world are flagging risks that make many people and governments a bit wary. Studies from the World Health Organization (WHO), via its International Agency for Research on Cancer (IARC), clearly label processed meat as a Group 1 carcinogen.

Specifically, just 50 grams of processed meat every day, that’s like a couple of slices of lunch meat, can raise the risk of colorectal cancer by about 18%. Governments and health organizations are taking note. In Australia, the Cancer Council advises consuming no more than 455 grams per week of lean red meat and avoiding processed meats altogether. In the United States, meanwhile, the average person eats 187 grams of processed meat per week, far exceeding what many health guidelines suggest as safe or modest

Opportunity

Rising Popularity of Poultry (Especially Chicken)

In straightforward, human terms, one big growth driver for the deli meat market is the increasing love for poultry, especially chicken, as a go-to choice. Trusted food statistics show that per person in the U.S., the availability of chicken has surged well ahead of other meats.

Americans had access to 68.1 pounds of chicken per person, compared to just 56.2 pounds of beef and 47.5 pounds of pork. What this tells us is that demand and thus shelf space for chicken-based deli meats is rising sharply. This shift aligns with health trends and government-backed dietary guidelines that encourage moderate meat consumption while favoring leaner proteins.

While the Dietary Guidelines for Americans (2020–2025) encourage limiting saturated fats and animal protein, they still include poultry as part of a balanced diet when paired with vegetables, grains, and legumes.

Trends

Rise of Blended (Hybrid) Meats Bridging Taste and Sustainability

There’s a new wave quietly gaining ground in the deli meats corner, and it’s not pure plant-based substitutes, but clever blended meats combining meat and plant ingredients, typically in the range of 30%–70% plant-based content. These hybrids are becoming popular because they offer the comfort of familiar flavor and texture while introducing healthier and more sustainable ingredients.

Insights from recent research, including a report in The Washington Post, show that these blended products sometimes even outperform all animal versions in blind taste tests. That’s big people are looking for the same juicy, savory bite they love, but with a smarter ingredient list.

These initiatives are critical. A hurdle for pure plant-based meats often lies in taste, cost, and texture, not to mention consumer perception. Blended meats, though, smooth those edges. They offer a stepping-stone for people who love the indulgent flavors of classic deli meats but are open to a touch of healthier or eco-friendly ingredients.

Regional Analysis

North America leads with a 32.9% share and a USD 78.96 billion market value.

North America commands a leadership position in the global deli meat market, contributing approximately 32.9%, or USD 78.96 billion, in revenue—underscoring its dominance in both scale and consumer preference. This substantial share is underpinned by well-developed retail infrastructures, such as expansive supermarket and hypermarket networks, and a strong cultural affinity for convenient, ready-to-eat meats.

Europe garners a significant slice of the market, driven by deep-rooted consumption of charcuterie, artisanal deli meats, and premium-quality meats across nations like Germany, Italy, and France. Regulatory rigor and the popularity of gourmet, Protected Designation of Origin (PDO) products further elevate regional value.

Although currently smaller in absolute size, the Asia-Pacific region boasts the fastest projected growth. Urbanization, rising incomes, and shifting dietary habits toward Western-style, convenience-ready meals are catalyzing expansion, particularly across China, India, and Southeast Asia.

Latin America and the Middle East & Africa (MEA) are experiencing modest but steady growth, supported by urban retail expansion and increasing interest in deli-style processed meats, especially among younger demographics and middle-income consumers.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Hormel Foods Corporation is renowned for its iconic SPAM brand and extensive portfolio, including Applegate natural meats. Its strength lies in strong brand loyalty, innovative product development in the natural and organic segments, and a robust retail distribution network. Strategic acquisitions have expanded its market reach, allowing it to effectively cater to evolving consumer demands for premium and healthier prepared meat options, solidifying its position as an industry leader.

Cargill Incorporated is a major player in the deli meat supply chain, providing vast quantities of turkey, chicken, and beef. Its strength is its immense scale, vertical integration from animal feed to processing, and a powerful B2B focus. Cargill supplies other major brands and foodservice providers, making it a foundational, albeit often less visible, powerhouse. This integrated model ensures cost efficiency and a reliable supply of primary proteins for further processing.

Tyson Foods, Inc. has an enormous production scale across chicken, beef, and pork. Its deli segment benefits from this vertical integration, ensuring supply control and cost advantages. With a portfolio of well-known brands like Hillshire Farm and Jimmy Dean, Tyson holds significant shelf space. The company focuses on innovation and convenience, offering pre-cooked and pre-sliced options that appeal to both retail and foodservice channels.

Top Key Players in the Market

- Hormel Foods Corporation

- Cargill Incorporated

- Tyson Foods, Inc.

- JBS

- Maple Leaf Foods

- Conagra Foodservice

- Carl Buddig and Company

- West Liberty Foods LLC

- Dietz and Watson

- Sysco Corporation

Recent Developments

- In 2024, Hormel expanded its Applegate brand with new organic deli meat offerings, emphasizing antibiotic-free and humanely raised meats to meet consumer demand for cleaner labels. Hormel has complied with updated USDA labeling requirements for deli meats, ensuring transparency in nutritional and ingredient information.

- In 2024, Cargill invested in a new protein innovation center in Colorado to develop value-added meat products, including deli meats, with a focus on improving texture and shelf life. Cargill partnered with the USDA on a pilot program to trace antibiotic-free pork supply chains, supporting deli meat brands that prioritize clean labels.

Report Scope

Report Features Description Market Value (2024) USD 240.6 Billion Forecast Revenue (2034) USD 370.1 Billion CAGR (2025-2034) 4.4%% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Pork, Chicken, Beef, Others), By Product (Cured, Uncured, Smoked, Roasted, Cooked), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Store, Specialty Store, Online Retailers, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Hormel Foods Corporation, Cargill Incorporated, Tyson Foods, Inc., JBS, Maple Leaf Foods, Conagra Foodservice, Carl Buddig and Company, West Liberty Foods LLC, Dietz and Watson, Sysco Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Hormel Foods Corporation

- Cargill Incorporated

- Tyson Foods, Inc.

- JBS

- Maple Leaf Foods

- Conagra Foodservice

- Carl Buddig and Company

- West Liberty Foods LLC

- Dietz and Watson

- Sysco Corporation