Global Cyclohexanone Market Size, Share, And Business Benefit By Grade (Technical Grade, Reagent Grade), By Form (Solid, Liquid), By Type (Nylon 6, Nylon 66, Polyester Polyol, Others), By Application (Caprolactam, Adipic Acid, Solvents, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 165207

- Number of Pages: 281

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

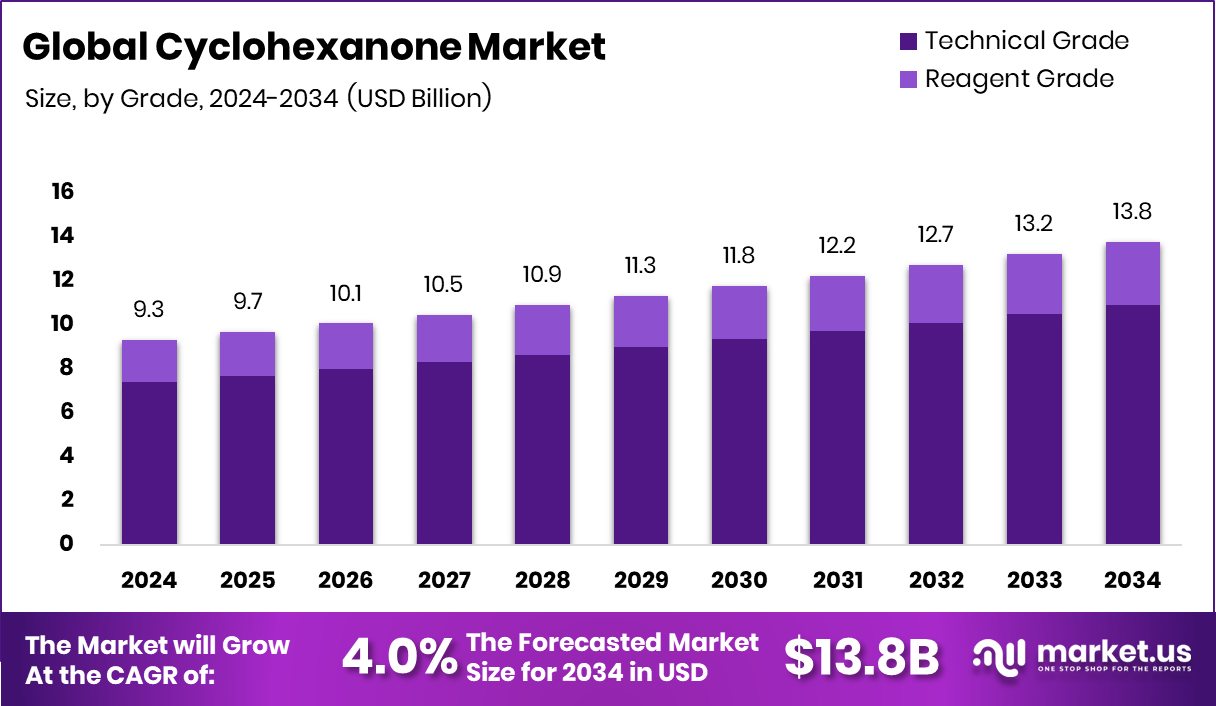

The Global Cyclohexanone Market is expected to be worth around USD 13.8 billion by 2034, up from USD 9.3 billion in 2024, and is projected to grow at a CAGR of 4.0% from 2025 to 2034. Strong demand from the nylon and polymer sectors continues to sustain Asia Pacific’s 45.9% growth.

Cyclohexanone is a clear, oily liquid with a sweet, pungent odor and is an important industrial chemical. It is mainly used as an intermediate in the production of nylon, adipic acid, and caprolactam. It also acts as a solvent for paints, coatings, resins, and adhesives. Due to its versatility, it plays a vital role in chemical manufacturing and polymer industries across the globe.

The Cyclohexanone market represents the global trade and usage of this compound in sectors like textiles, automotive, plastics, and construction. Growing industrialization and expansion of synthetic fiber production are fueling the market’s steady growth. Its demand reflects the overall health of the chemical and polymer value chain.

One of the major growth factors is the rising demand for nylon-based materials in automotive interiors, industrial machinery, and packaging. As industries shift toward lightweight and durable materials, cyclohexanone consumption increases due to its crucial role in polymer synthesis.

Significant opportunities are emerging with the global shift toward green chemistry and circular economy models. Funding examples like Bioweg’s $19 million Series A, Epoch Biodesign’s $18.3 million, and Samsara Eco’s $100 million plus and $65 million rounds show strong investor interest in bio-based and recycling technologies. These initiatives indicate growing potential for sustainable cyclohexanone alternatives in the near future.

Key Takeaways

- The Global Cyclohexanone Market is expected to be worth around USD 13.8 billion by 2034, up from USD 9.3 billion in 2024, and is projected to grow at a CAGR of 4.0% from 2025 to 2034.

- The Cyclohexanone Market’s Technical Grade segment dominates with a strong 79.3% share in 2024.

- Liquid form holds a major position in the Cyclohexanone Market, accounting for 89.8% overall share.

- Nylon 6 type leads the Cyclohexanone Market, contributing to nearly 50.0% of total consumption.

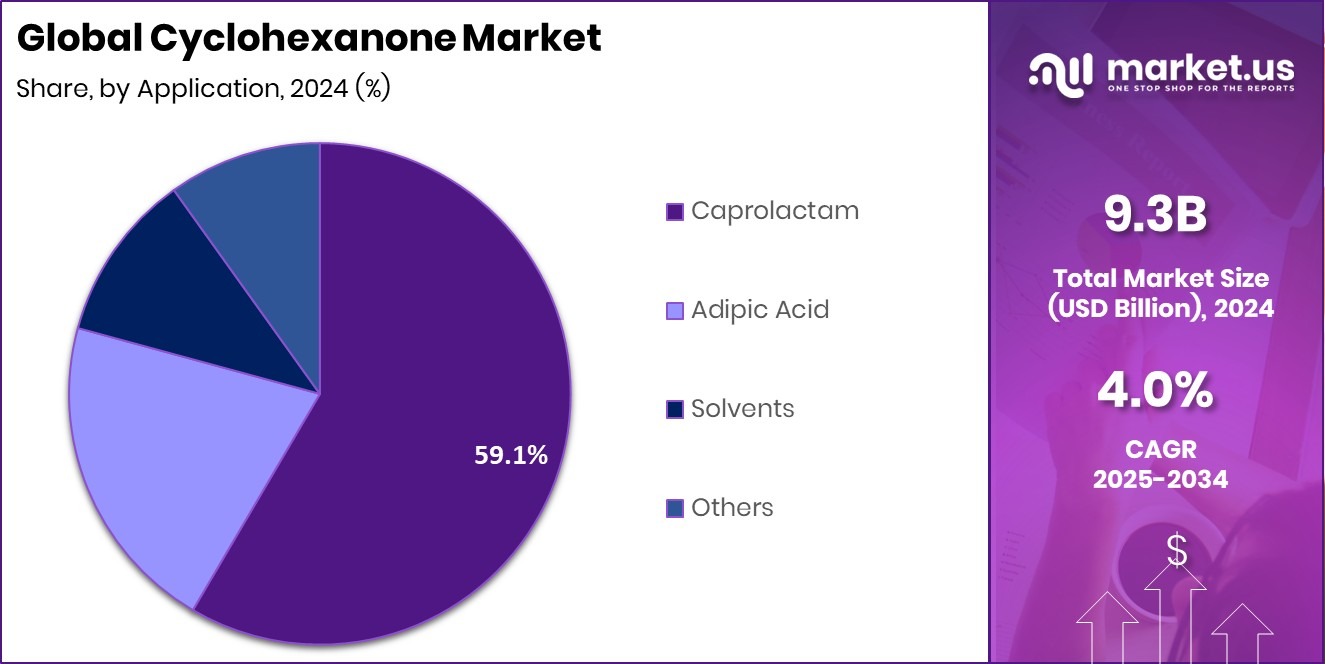

- Caprolactam application remains the largest in the Cyclohexanone Market, securing around 59.1% market share.

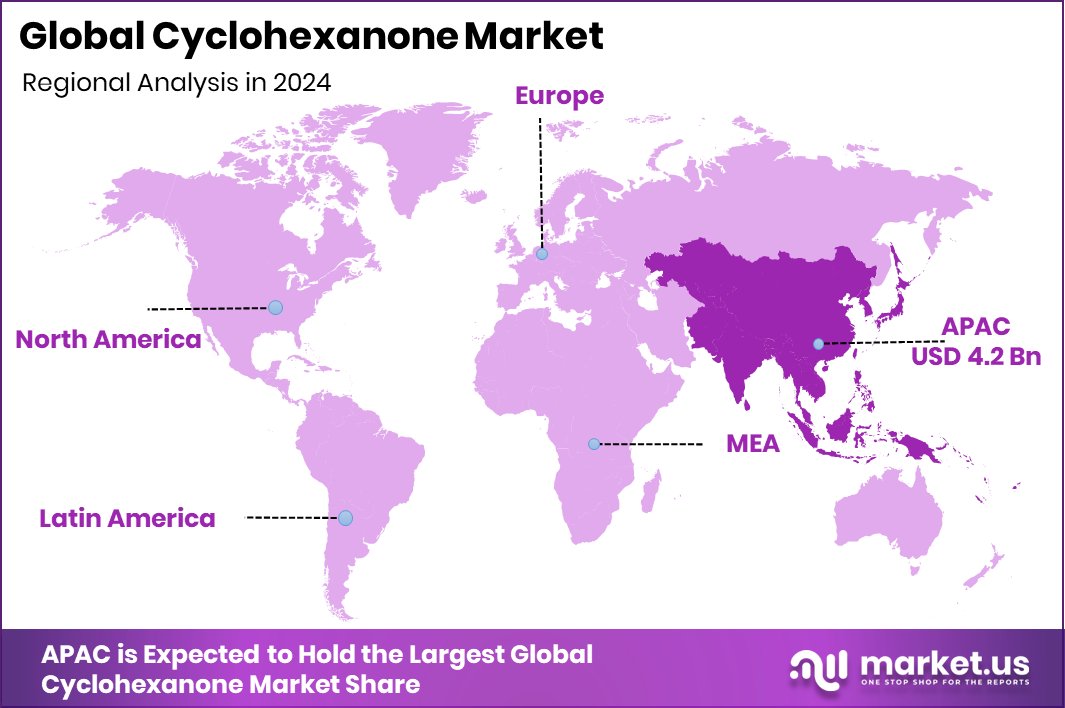

- The Asia Pacific market value reached around USD 4.2 billion, driven by industrial expansion.

By Grade Analysis

The Cyclohexanone Market’s Technical Grade segment holds 79.3% major share.

In 2024, Technical Grade held a dominant market position in the By Grade segment of the Cyclohexanone Market, with a 79.3% share. This dominance is attributed to its extensive use in industrial processes such as the production of nylon intermediates, coatings, and solvents.

Technical grade cyclohexanone is preferred by manufacturers due to its high purity level, cost-effectiveness, and compatibility with large-scale chemical synthesis. Its consistent performance and suitability for industrial formulations make it the primary choice in chemical, textile, and polymer manufacturing sectors.

The steady demand from nylon producers and resin manufacturers continues to reinforce the dominance of the Technical Grade category within the global Cyclohexanone market landscape.

By Form Analysis

Liquid form dominates the Cyclohexanone Market, accounting for 89.8% overall usage.

In 2024, Liquid held a dominant market position in the By Form segment of the Cyclohexanone Market, with an 89.8% share. The liquid form is widely preferred in industrial applications due to its excellent solubility and easy handling during manufacturing processes.

It serves as a key solvent and intermediate in the production of nylon, coatings, and chemical formulations. The liquid state allows for efficient blending, faster reaction rates, and improved process control, making it suitable for large-scale industrial use.

Its versatility and stability in various chemical environments have reinforced its strong adoption across end-use industries, maintaining the liquid form’s leading position within the Cyclohexanone market in 2024.

By Type Analysis

Nylon 6 type leads the Cyclohexanone Market with 50.0% contribution.

In 2024, Nylon 6 held a dominant market position in the By Type segment of the Cyclohexanone Market, with a 50.0% share. The dominance of this segment is driven by the extensive use of cyclohexanone as a key precursor in nylon production, particularly for nylon-6 and nylon-66.

These materials are widely used in automotive, textile, and industrial applications due to their strength, flexibility, and durability. The increasing demand for lightweight and high-performance materials in manufacturing continues to boost nylon output, directly supporting cyclohexanone consumption.

Its critical role in polymer synthesis has solidified nylon’s leadership within this market segment, reflecting its importance to the global chemical and materials industry in 2024.

By Application Analysis

Caprolactam application drives the Cyclohexanone Market, capturing 59.1% total share.

In 2024, Caprolactam held a dominant market position in the By Application segment of the Cyclohexanone Market, with a 59.1% share. This strong position is attributed to cyclohexanone’s vital role as a primary raw material in the synthesis of caprolactam, which is further used in nylon-6 production.

The widespread use of nylon-6 in textiles, engineering plastics, and industrial fibers continues to drive steady demand for caprolactam. Its high purity and consistent performance make it indispensable in polymer manufacturing processes.

The robust expansion of the textile and automotive sectors further reinforced the dominance of the caprolactam segment, establishing it as the leading application area for cyclohexanone across global industrial operations in 2024.

Key Market Segments

By Grade

- Technical Grade

- Reagent Grade

By Form

- Solid

- Liquid

By Type

- Nylon 6

- Nylon 66

- Polyester Polyol

- Others

By Application

- Caprolactam

- Adipic Acid

- Solvents

- Others

Driving Factors

Rising Nylon Production Boosting Cyclohexanone Demand

One of the key driving factors for the Cyclohexanone Market is the increasing production of nylon, particularly nylon-6 and nylon-66, used widely in textiles, automotive parts, and engineering plastics. Cyclohexanone acts as a crucial raw material for producing caprolactam, the core intermediate in nylon manufacturing. The growing demand for lightweight and durable materials in automotive and industrial applications continues to drive this trend.

Moreover, sustainability-focused investments are accelerating innovation in the polymer and fiber industries. For instance, H&M-backed Syre is eyeing $700 million in new funding after its deal with Nike, signaling strong confidence in advanced and circular textile solutions. Such developments further support the upward momentum of cyclohexanone consumption across global manufacturing sectors.

Restraining Factors

Environmental Regulations and Toxicity Concerns Limiting Growth

One major restraining factor for the Cyclohexanone Market is the increasing environmental and safety regulations related to its production and usage. Cyclohexanone is derived from petrochemical processes that release harmful emissions, making it subject to strict environmental controls.

Its volatile and flammable nature also raises concerns about worker safety and handling risks in manufacturing facilities. These factors often increase compliance costs and limit market expansion in regions with tight environmental policies.

Additionally, the growing shift toward sustainable and recycled alternatives is creating competition for traditional chemical intermediates. In this direction, DePoly has secured a total of $30 million in funding to advance plastic recycling innovations, emphasizing the market’s gradual move toward greener chemical substitutes.

Growth Opportunity

Bio-Based Innovations Creating New Market Opportunities

A major growth opportunity in the Cyclohexanone Market lies in the development of bio-based and sustainable production methods. As industries shift toward greener chemistry, researchers are exploring renewable feedstocks to produce cyclohexanone with reduced carbon footprints. This transition aligns with global efforts to cut dependency on fossil-derived chemicals and meet stricter environmental regulations.

Companies are actively investing in technologies that promote circularity and resource efficiency. For example, MacroCycle recently closed a $6.5 million financing round to advance circular plastics and sustainable chemical recycling.

Such funding highlights a growing commitment to innovation and eco-friendly manufacturing, positioning bio-based cyclohexanone as a promising alternative for future applications in polymer and specialty chemical production.

Latest Trends

Growing Polyester Recycling Projects Driving Industry Shift

A key trend shaping the Cyclohexanone Market is the rising investment in polyester and chemical recycling technologies. As global industries move toward sustainability, new recycling projects are gaining large-scale support to reduce plastic waste and dependence on virgin petrochemical feedstocks. This shift is gradually influencing the upstream demand for intermediates like cyclohexanone, which play a role in polymer production.

The growing focus on closed-loop manufacturing and green chemistry is creating new opportunities for cleaner chemical processes. A notable example is Bình Định granting an investment licence to SYRE’s $1 billion polyester recycling project, which underscores the increasing push for circular economy solutions and signals how large investments are reshaping the broader materials and chemicals landscape.

Regional Analysis

In 2024, the Asia Pacific dominated the Cyclohexanone Market with a 45.9% share.

In 2024, Asia Pacific held a dominant position in the global Cyclohexanone Market, accounting for 45.9% of the total share, valued at USD 4.2 billion. The region’s strong presence is driven by expanding chemical manufacturing, textile production, and polymer industries in countries such as China, India, and Japan. Rapid industrialization and increasing demand for nylon in automotive and engineering applications further enhance market growth.

North America follows with steady demand supported by established chemical infrastructure and consistent consumption in coatings and industrial solvents. Europe continues to show stable growth, driven by technological advancements and stringent quality standards in chemical processing.

Meanwhile, the Middle East & Africa and Latin America markets are gradually expanding due to developing industrial bases and rising investments in manufacturing. The Asia Pacific region remains the clear leader, supported by a strong production network, cost-efficient operations, and growing domestic consumption, reinforcing its dominance in the global Cyclohexanone market landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Gujarat State Fertilizers & Chemicals Limited (GSFC) continues to strengthen its position in the Cyclohexanone market through integrated chemical manufacturing and cost-efficient production capabilities. The company benefits from its backward integration in raw materials and strong domestic demand from the polymer and fiber industries. GSFC’s focus on operational efficiency and sustainability-driven production has helped it maintain consistent growth in India’s expanding chemical sector.

Asahi Kasei Corporation demonstrates technological excellence and process innovation in cyclohexanone production, leveraging its advanced chemical engineering expertise. The company’s focus on high-purity intermediates supports the demand for nylon and specialty polymers. Its continuous investment in R&D and expansion across Asia enhances its global footprint and competitiveness in value-added chemical markets.

BASF, a global leader in chemicals, plays a vital role in advancing cyclohexanone applications through sustainable production technologies and innovation in intermediates. The company’s wide industrial reach and focus on greener processes align with growing sustainability goals in the chemical value chain. BASF’s diversified portfolio and robust operational network support stable global supply and reinforce its influence in the cyclohexanone market, particularly in high-performance materials and coatings segments, positioning it as a key contributor to the industry’s technological evolution in 2024.

Top Key Players in the Market

- Gujarat State Fertilizers & Chemicals Limited (GSFC)

- Asahi Kasei Corporation

- BASF

- Domo Chemicals

- Ostchem

- Fibrant

- JIGCHEM UNIVERSAL

- ARIHANT SOLVENTS AND CHEMICALS

- Qingdao Hisea Chem Co., Ltd.

- LUXI GROUP

- Chang Chun Group

Recent Developments

- In September 2025, Asahi Kasei announced it will unveil PFAS-free polyamide and continuous carbon-fibre-reinforced plastics (CFRP) recycling technology at the trade fair K 2025. The company will display its new materials for automotive and industrial use, including bio-based polyamide compounds and advanced recycling methods for CFRP pressure vessels.

- In November 2024, BASF officially opened a new production line for water-based dispersions at its Heerenveen site in the Netherlands. This line increases capacity without additional CO₂ emissions and underlines BASF’s push into more sustainable chemical-intermediate manufacturing.

Report Scope

Report Features Description Market Value (2024) USD 9.3 Billion Forecast Revenue (2034) USD 13.8 Billion CAGR (2025-2034) 4.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (Technical Grade, Reagent Grade), By Form (Solid, Liquid), By Type (Nylon 6, Nylon 66, Polyester Polyol, Others), By Application (Caprolactam, Adipic Acid, Solvents, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Gujarat State Fertilizers & Chemicals Limited (GSFC), Asahi Kasei Corporation, BASF, Domo Chemicals, Ostchem, Fibrant, JIGCHEM UNIVERSAL, ARIHANT SOLVENTS AND CHEMICALS, Qingdao Hisea Chem Co., Ltd., LUXI GROUP, Chang Chun Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Gujarat State Fertilizers & Chemicals Limited (GSFC)

- Asahi Kasei Corporation

- BASF

- Domo Chemicals

- Ostchem

- Fibrant

- JIGCHEM UNIVERSAL

- ARIHANT SOLVENTS AND CHEMICALS

- Qingdao Hisea Chem Co., Ltd.

- LUXI GROUP

- Chang Chun Group