Global Crude Oil Pipelines Market Size, Share Analysis Report By Type (Carbon Steel Tubing, Oil-resistant Rubber Hose), By Product Type (Crude Oil Pipelines, Refined Product Pipelines, Others), By Application ( Transportation, Storage, Distribution, Others), By Location (Onshore, Offshore) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171310

- Number of Pages: 398

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

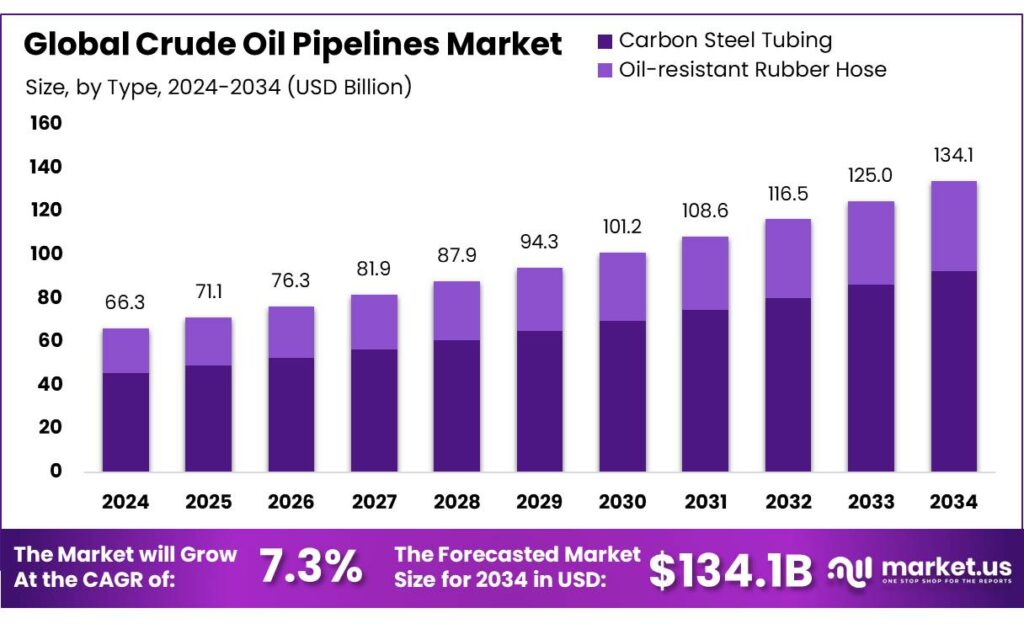

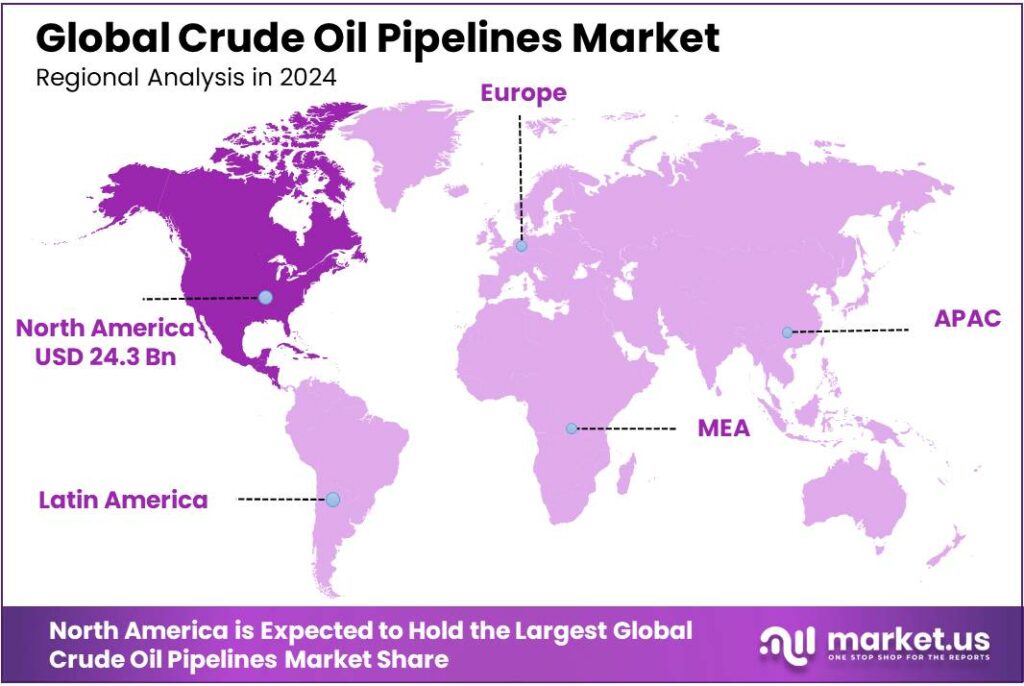

The Global Crude Oil Pipelines Market size is expected to be worth around USD 134.1 Billion by 2034, from USD 66.3 Billion in 2024, growing at a CAGR of 7.3% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 36.8% share, holding USD 24.3 Billion in revenue.

Crude oil pipelines are the backbone of the upstream-to-refining logistics system, moving large volumes of crude from production basins to refineries, storage hubs, and export terminals with high reliability and comparatively low unit transport cost. In the U.S. alone, federal pipeline statistics show 228,553 miles of hazardous liquid pipeline systems reported for 2024, including 83,243 miles categorized as crude oil pipelines—an indicator of how critical this asset base is for day-to-day energy supply continuity and price stability.

From an industrial scenario perspective, pipeline networks are expanding and being modernized where production growth and trade flows create bottlenecks. In the United States, upstream output remains structurally high—EIA reports U.S. crude oil production averaged about 13.2 million b/d in 2024, and it set a monthly record of 13.4 million b/d in August 2024. That scale requires resilient takeaway and long-haul connectivity to refineries and terminals. Safety and integrity oversight is equally central to the operating model: PHMSA’s annual reporting shows 228,553 miles of hazardous liquid/CO₂ pipeline systems in 2024, including 83,243 miles categorized as crude oil systems.

Key driving factors for crude oil pipeline activity include: growing (or shifting) upstream production that requires takeaway capacity; refinery crude slate optimization that changes which grades flow where; and export competitiveness that rewards reliable links to ports and storage. Inventory behavior matters too: the IEA reported global observed inventories at 8,030 mb in October (a four-year high), with “oil on water” playing a major role—conditions that can intensify the value of flexible pipeline connectivity into storage hubs and terminals.

- Government initiatives and regulation are increasingly steering investment toward safety, integrity, and monitoring. In the U.S., PHMSA announced $86 million in grants to support state pipeline safety programs and said these efforts help states inspect more than 85% of the nation’s 3.3-million-mile pipeline network. PHMSA also documented $1.5 million in FY 2024 Pipeline Safety State Damage Prevention grants—targeted at reducing excavation-related risks, a major incident driver for both liquids and gas systems.

Key Takeaways

- Crude Oil Pipelines Market size is expected to be worth around USD 134.1 Billion by 2034, from USD 66.3 Billion in 2024, growing at a CAGR of 7.3%.

- Carbon Steel Tubing held a dominant market position, capturing more than a 68.9% share in the crude oil pipelines market.

- Crude Oil Pipelines held a dominant market position, capturing more than a 63.4% share in the overall crude oil pipelines market.

- Transportation held a dominant market position, capturing more than a 57.3% share in the crude oil pipelines market.

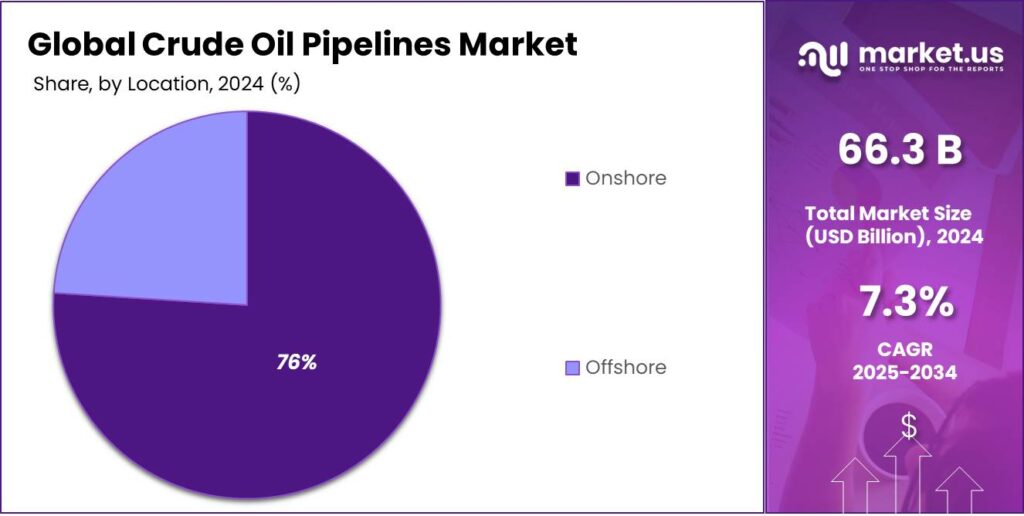

- Onshore held a dominant market position, capturing more than a 76.1% share in the crude oil pipelines market.

- North America held a dominant position in the crude oil pipelines market, capturing 36.8% of regional share and generating approximately US$24.3 billion.

By Type Analysis

Carbon Steel Tubing leads with 68.9% share due to strength, cost efficiency, and long service life

In 2024, Carbon Steel Tubing held a dominant market position, capturing more than a 68.9% share in the crude oil pipelines market, supported by its wide use in long-distance and high-pressure oil transportation projects. This dominance was mainly driven by the material’s high tensile strength, strong resistance to mechanical stress, and proven ability to handle large crude oil volumes over extended periods. Carbon steel tubing continued to be preferred in onshore pipeline networks where durability and cost control remained critical decision factors.

In 2024, pipeline operators increasingly selected carbon steel due to its lower installation cost compared to alloy alternatives and its compatibility with existing pipeline infrastructure. Moving into 2025, steady investments in pipeline replacement, network expansion, and cross-border crude oil transport supported continued demand for carbon steel tubing. Its ease of welding, availability in large diameters, and adaptability to protective coatings further improved operational reliability and corrosion management.

By Product Type Analysis

Crude Oil Pipelines dominate with 63.4% share due to rising long-distance oil transport needs

In 2024, Crude Oil Pipelines held a dominant market position, capturing more than a 63.4% share in the overall crude oil pipelines market, driven by the continued reliance on pipelines as the safest and most economical mode for transporting unrefined oil. This strong position was supported by increasing crude production from onshore and offshore fields, where direct pipeline connectivity to refineries and export terminals remained essential.

In 2024, operators focused on expanding and upgrading crude oil pipeline networks to improve flow efficiency, reduce transport losses, and meet strict environmental safety standards. Crude oil pipelines were widely used for cross-border and regional transport, especially in areas with stable long-term supply contracts. Looking ahead to 2025, steady investments in pipeline integrity.

By Application Analysis

Transportation leads the market with a 57.3% share, supported by large-scale crude movement needs

In 2024, Transportation held a dominant market position, capturing more than a 57.3% share in the crude oil pipelines market, as pipelines continued to be the backbone of crude oil movement from production sites to refineries, storage hubs, and export terminals. This dominance was mainly driven by the need for continuous, high-volume oil flow with lower operating risk compared to road and rail transport. In 2024, pipeline-based transportation was widely preferred due to its ability to reduce handling losses, improve cost efficiency per barrel, and ensure stable long-distance delivery across regions.

Energy operators invested in maintaining and expanding transportation pipeline networks to support rising crude output and changing trade routes. Moving into 2025, the transportation segment is expected to remain strong, supported by pipeline modernization projects, enhanced monitoring systems, and long-term supply agreements that favor reliable and uninterrupted crude oil transport.

By Location Analysis

Onshore pipelines dominate with a 76.1% share due to easier access and lower installation cost

In 2024, Onshore held a dominant market position, capturing more than a 76.1% share in the crude oil pipelines market, as onshore networks continued to be the primary mode for moving crude oil across producing and consuming regions. This strong position was mainly supported by lower construction and maintenance costs compared to offshore pipelines, along with easier inspection and repair activities.

In 2024, most pipeline expansions were concentrated on land-based routes connecting oil fields to refineries, storage terminals, and export points. Onshore pipelines also benefited from faster project execution timelines and wider regulatory familiarity across major oil-producing countries. Moving into 2025, the onshore segment is expected to maintain its lead, supported by capacity upgrades, replacement of aging pipelines, and steady investments aimed at improving safety and flow efficiency across existing crude transportation corridors.

Key Market Segments

By Type

- Carbon Steel Tubing

- Oil-resistant Rubber Hose

By Product Type

- Crude Oil Pipelines

- Refined Product Pipelines

- Others

By Application

- Transportation

- Storage

- Distribution

- Others

By Location

- Onshore

- Offshore

Emerging Trends

Smart Pipelines with Faster Leak Response

A major latest trend in crude oil pipelines is the shift from “run-and-fix” operations to continuous monitoring plus faster isolation—often described as building smarter pipelines. The idea is practical: detect abnormal conditions earlier, confirm them faster, and limit spill size by isolating the affected section quickly. This trend is picking up because pipeline systems are huge, and small delays in detection or shut-in can turn into large impacts. In the U.S. alone, PHMSA’s annual report mileage data for 2024 shows 228,553 miles of hazardous liquid/CO₂ pipeline, including 83,243 miles classified as crude oil systems.

On the safety and technology side, a clear sign of this trend is the regulatory focus on rupture-mitigation valves (RMVs) and equivalent technologies. PHMSA’s valve rule fact sheet explains that where RMVs (or equivalents) are required, operators must identify ruptures and close valves to isolate the ruptured segment as soon as practicable, and not to exceed 30 minutes from rupture identification.

A second force accelerating “smart pipeline” adoption is measurement and reporting pressure, especially linked to methane and broader environmental scrutiny across the oil and gas value chain. In the EU, Regulation (EU) 2024/1787 explicitly sets rules for accurate measurement, monitoring, reporting and verification of methane emissions, and it also includes requirements around leak detection and repair surveys, restrictions on venting and flaring, and transparency tools—including obligations tied to imports of fossil energy (including crude oil) into the Union.

- The European Commission’s methane policy page adds practical timelines: companies must survey equipment to detect leaks, and if leaks are found they need to be repaired quickly—“mostly within 5 or 15 working days”—and then monitored to confirm repairs worked.

This reporting and measurement push also shows up in how operators are asked to organize data. PHMSA’s notice on calendar year 2024 annual reports highlights that operators may need to change internal systems for collecting excavation damage data for reports due in 2025. That kind of “data plumbing” work is not flashy, but it’s a real trend: better structured data supports better risk ranking, better inspections, and better proof of performance when permits, communities, or insurers demand evidence.

Drivers

Growing Oil Volumes Need Reliable, High-Capacity Transport

This demand-and-flow pressure is still visible in the latest outlooks from trusted energy institutions. The International Energy Agency (IEA) expects global oil demand to rise by 830 kb/d in 2025, and it upgraded its 2026 year-on-year growth forecast to 860 kb/d. When demand is climbing, even modestly, it keeps base pipeline utilization strong—especially on routes feeding large refinery centers or export terminals. At the same time, growth is not evenly distributed across products and regions, which increases the need for flexible routing into storage and blending hubs.

- The U.S. Energy Information Administration (EIA) also points to continued expansion in global liquids use. In its Short-Term Energy Outlook, EIA says forecast global liquid fuels consumption increases by 1.1 million b/d in 2025 and 1.2 million b/d in 2026, with growth driven almost entirely by non-OECD countries. For pipeline operators, this matters because global demand growth tends to pull more crude toward major refining and export systems, raising the value of dependable midstream capacity and well-connected infrastructure.

In the United States, the sheer scale of pipeline infrastructure underlines why it stays central to crude logistics. PHMSA’s hazardous liquid annual report mileage summary shows 2024 hazardous liquid/CO₂ pipeline mileage of 228,553 miles, including 83,243 miles categorized as crude oil systems. Networks of this size are not “nice to have”—they are part of how the crude market functions day to day, because they reduce repeated loading/unloading steps and help stabilize refinery feed availability.

Government action is also reinforcing this driver, mainly through safety and inspection capacity—because a safer pipeline system can run more reliably and earn easier shipper confidence. In September 2025, PHMSA announced $86 million in grants to enhance states’ pipeline safety programs, stating the funding will help state partners inspect more than 85% of the nation’s 3.3-million-mile pipeline network. This matters commercially as well as socially: inspection coverage and integrity work support higher uptime, better risk management, and fewer unplanned outages that can disrupt crude flows.

Restraints

Frequent Pipeline Incidents and Safety Risks

One of the biggest challenges that holds back the growth and reliability of crude oil pipelines is the high frequency of pipeline incidents and the safety risks they pose to people, the environment, and business operations. In everyday language, this means pipelines sometimes leak, rupture, or fail, and those events have far-reaching effects — from local communities and farmland to environmental damage and cost burdens. Because these risks are real and documented, they act as a major restraint on further pipeline construction and expansion in many regions.

According to data compiled from the U.S. Pipeline and Hazardous Materials Safety Administration (PHMSA), pipeline incidents — including leaks, ruptures, and leaks of hazardous liquids — occur frequently enough that they average around 1.45 incidents per day in 2024, based on available reporting. Over the longer term, this trend goes back years, with historical reporting showing an average of around 1.7 incidents per day since 2010. These numbers show that pipeline incidents are not rare one-off events but recurring operational challenges that operators must manage constantly.

Government regulation and oversight have responded to these safety concerns with stricter rules and monitoring requirements. In the U.S., PHMSA tightened safety standards with new rules on leak detection and repair that apply to many pipeline categories, aiming to reduce undetected leaks and the severity of incidents. These regulatory actions reflect public and political pressure for safer infrastructure, but they also add compliance costs and technical complexity for operators, which can slow construction or delay approval of new projects until safety concerns are fully addressed.

Beyond compliance requirements, another restraining aspect is community and environmental scrutiny. Local groups and environmental advocates often push back against new pipeline projects due to fear of spills and ecological disruption. This public opposition can lead to legal challenges and permit delays, especially when pipelines cross sensitive land, water bodies, or agricultural regions. Although these voices reflect genuine safety and environmental concerns, they can also slow decision-making and raise the cost of developing pipeline projects.

Opportunity

Expansion of Crude Oil Pipeline Capacity to Meet Rising Production and Global Trade

One of the clearest growth opportunities for crude oil pipelines today lies in their expansion to handle increasing crude production and global oil trade flows, especially as major producers boost output and as refineries and export hubs seek stable, high-volume feedstock transport. In simple terms, more oil being produced around the world creates real business cases for new pipelines or for upgrading existing lines so that crude can get where it’s needed — safely, cheaply, and reliably.

The International Energy Agency (IEA) projects that world oil production capacity could grow by about 5.1 million barrels per day (mb/d) by 2030, with leading producers like Saudi Arabia and the United States driving much of that increase. This rising capacity figure strongly suggests that more infrastructure — including pipelines — will be required to move increased crude volumes from wells to processing and export locations. The logic is straightforward: higher production means bigger takeaway needs, and pipelines, compared to rail or truck, are the most cost-effective and safest large-scale option for long distance crude transport.

In regions like North America, pipelines are already being expanded to handle new production dynamics. For example, Enbridge’s recent approval of a $1.4 billion expansion of its Mainline and Flanagan South pipelines will add an extra 250,000 barrels per day (150,000 bpd on Mainline and 100,000 bpd on Flanagan South) to carry heavy Canadian crude to key U.S. refining markets when it comes online in 2027. This isn’t a small change — half-a-million barrels per day shifts how market flows work, and it shows that companies are investing in pipelines because they see long-term transport demand growth.

Government policy and regulatory support can further unlock pipeline opportunity. While safety and environmental review add time and costs, federal agencies in major producing countries have been pushing to streamline approvals and emphasize infrastructure reliability, recognizing that energy systems depend on strong logistics. In the United States, for example, recent legislative moves seek to modernize and speed up federal permitting processes for energy infrastructure projects, including pipelines, by improving interagency coordination and reducing redundant bureaucratic delays. Such reforms can help shorten approval times for new construction or expansions.

Regional Insights

North America leads with 36.8% share and US$24.3 Bn in 2024, underpinned by extensive pipeline infrastructure and production growth

In 2024, North America held a dominant position in the crude oil pipelines market, capturing 36.8% of regional share and generating approximately US$24.3 billion in value, supported by its expansive and highly developed pipeline networks across the United States and Canada. The region’s dominance was rooted in its extensive crude oil production, particularly from shale formations in Texas, North Dakota, and the Gulf Coast, which required robust midstream infrastructure to efficiently move oil from inland production sites to refineries and export terminals.

In the United States alone, more than 190,000 miles of liquid petroleum pipelines operate to facilitate continuous crude flows across states, connecting high-output fields with major processing hubs and coastal ports.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, integrated activities under ShellTechnip-style collaborations supported large pipeline engineering and subsea pipeline systems for global energy clients. TechnipFMC reported USD 10.8 billion in revenue, with multiple joint offshore pipeline projects valued over USD 1 billion each, enhancing deepwater pipeline delivery and subsea tie-backs.

In 2024, the Caspian Pipeline Consortium (CPC) operated one of the region’s largest export crude oil pipelines from Kazakhstan to the Black Sea. The system transported over 1.4 million barrels per day (bpd) and generated throughput revenues exceeding USD 2.1 billion, cementing its strategic role in Eurasian oil logistics and export infrastructure.

In 2024, Kinder Morgan was one of North America’s largest energy infrastructure companies, operating >85,000 miles of pipelines transporting crude oil, refined products, and natural gas. The company reported USD 12.9 billion in total revenue, with a significant portion from crude oil pipeline throughput and storage services, reflecting stable long-term transport demand.

Top Key Players Outlook

- GE Oil & Gas

- Saipem

- Kinder Morgan

- ShellTechnip

- Caspian Pipeline Consortium

- ABB

- Bharat Petroleum

- Cairn

Recent Industry Developments

In 2024, Saipem recorded revenue of €6,418 million and adjusted EBITDA of €565 million, underlining consistent project delivery and financial discipline.

In 2024, Kinder Morgan reported that it owns or operates approximately 79,000 miles of pipelines and 139 terminals, which include crude, refined products, and liquids handling facilities that support midstream transport and storage needs of oil markets.

Report Scope

Report Features Description Market Value (2024) USD 66.3 Bn Forecast Revenue (2034) USD 134.1 Bn CAGR (2025-2034) 7.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Carbon Steel Tubing, Oil-resistant Rubber Hose), By Product Type (Crude Oil Pipelines, Refined Product Pipelines, Others), By Application ( Transportation, Storage, Distribution, Others), By Location (Onshore, Offshore) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape GE Oil & Gas, Saipem, Kinder Morgan, ShellTechnip, Caspian Pipeline Consortium, ABB, Bharat Petroleum, Cairn Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- GE Oil & Gas

- Saipem

- Kinder Morgan

- ShellTechnip

- Caspian Pipeline Consortium

- ABB

- Bharat Petroleum

- Cairn