Global Creatine Supplements Market By Form (Powder, Liquid, Capsules/Tablets, and Others), By Product (Creatine Monohydrate, Creatine Ethyl Ester, Buffered Creatine, and Others), By End Use (Athletes and Bodybuilders, Fitness Enthusiasts, and Clinical and Therapeutic Use), By Distribution Channel (Hypermarkets And Supermarkets, Pharmacy And Drug Stores, Online, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155938

- Number of Pages: 293

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

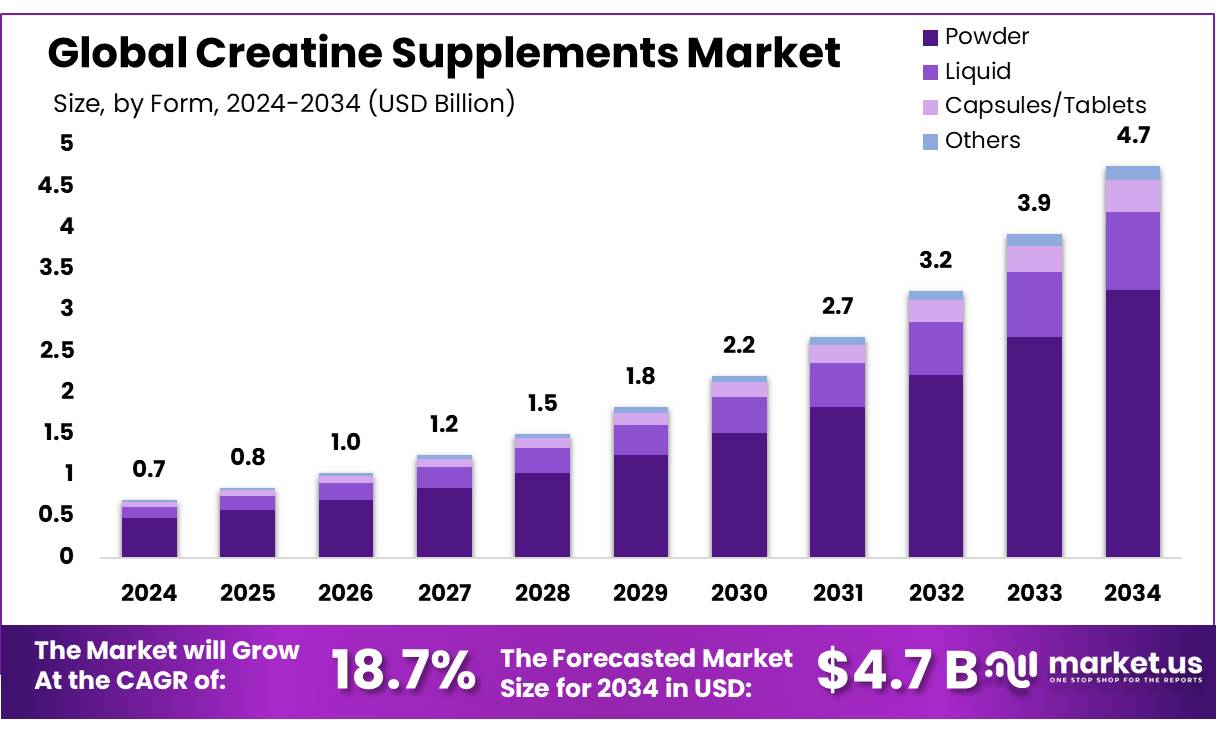

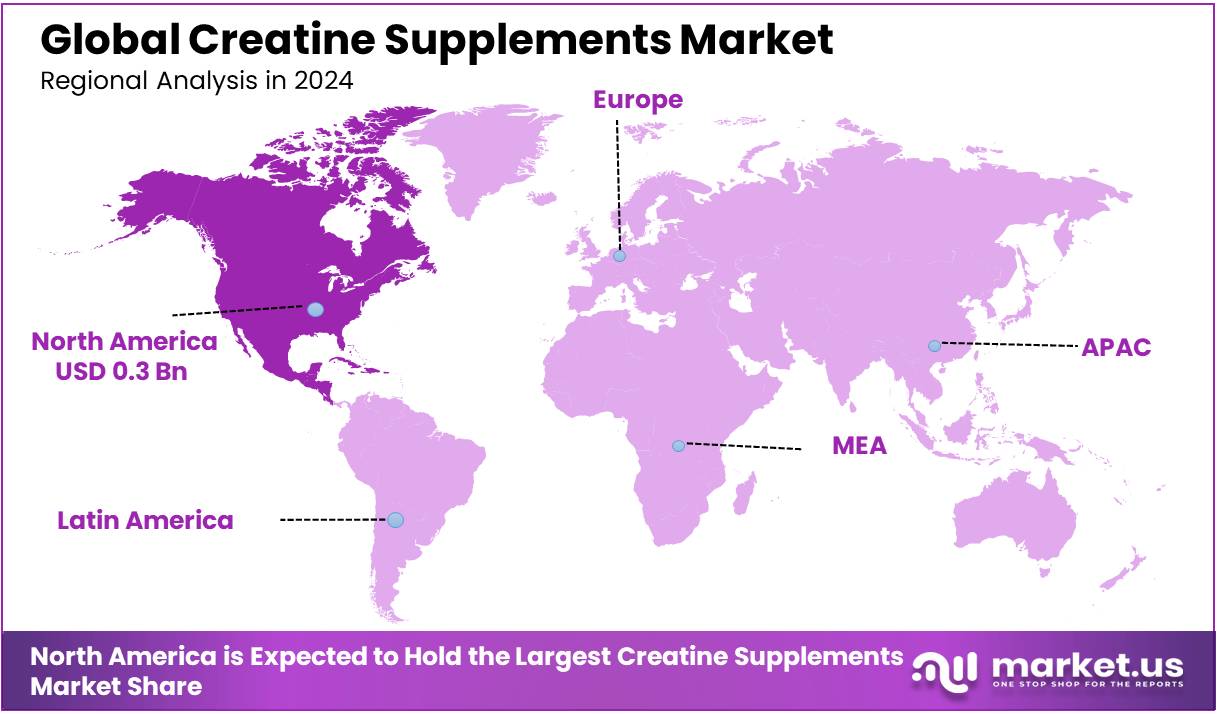

The Global Creatine Supplements Market size is expected to be worth around USD 4.7 Billion by 2034, from USD 0.7 Billion in 2024, growing at a CAGR of 18.7% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 48.4% share, holding USD 0.3 Billion revenue.

Creatine is a substance found naturally in human muscle cells and is a popular supplement used to improve athletic performance, increase muscle mass, and potentially enhance cognitive function. Creatine monohydrate is the most common and well-researched form of creatine supplement and is widely available in powder or capsule form. Increasing health awareness and the growing demand for sports nutrition are major forces driving the creatine supplements market.

In recent years, it has gained popularity beyond sports and among female consumers. As consumer preference for convenience is growing, several players have introduced multi-functional products such as beverages and gummies. Despite the advantages of the product that are backed by several studies, the market may face challenges from potential side effects.

- Approximately annually, 4 million kilograms (kg) or nearly 9 million pounds (lbs) of creatine is consumed in the United States of America alone.

Key Takeaways

- The global creatine supplements market was valued at USD 0.7 Billion in 2024.

- The global creatine supplements market is projected to grow at a CAGR of 18.7% and is estimated to reach USD 4.7 Billion by 2034.

- On the basis of product type, creatine monohydrate dominated the market with a 71.3% share of the total global market in 2024.

- Based on forms in which creatine supplements are available, in 2024, powder form led the creatine supplements market with a substantial market share of 68.4%.

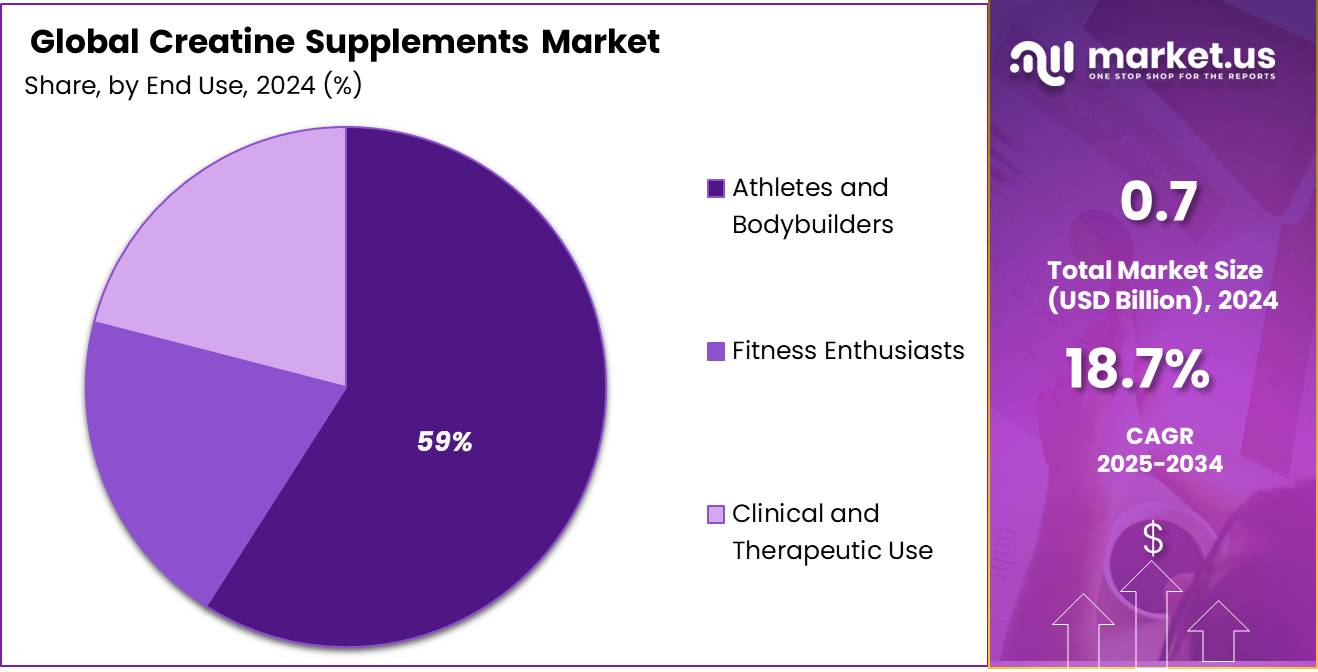

- Based on end-use, in 2024, athletes and bodybuilders led the creatine supplements market with a market share of 59.1%.

- Among the distribution channels, hypermarkets & supermarkets were at the forefront of the creatine supplements market with a market share of 35.8% in 2024.

- North America was the biggest market for the creatine supplements in 2024, with a market share of 48.4%.

Form Analysis

Creatine Supplements in Powder Form Led the Creatine Supplements Market Due to Convenient Production.

On the basis of forms, it is segmented into powder, liquid, capsules/tablets, and others. In 2024, powdered creatine supplements dominated the market with 68.4% share of the total global market. It is generally favored over liquid or gummy forms due to its cost-effectiveness, customizable dosage, and versatility in mixing. Powdered creatine is generally considered the gold standard for creatine supplementation due to its versatility and cost-effectiveness. While gummies offer convenience and taste, they can be more expensive and may contain added sugars or fillers.

Powder is typically the most cost-effective option, providing more servings per dollar. Additionally, powdered creatine allows for precise dosage control, making it easy to adjust the amount based on individual needs and goals. Furthermore, powder creatine can have a neutral or easily masked taste, and it generally contains fewer additives.

Product Type Analysis

Creatine Monohydrate Dominated the Creatine Supplements Market Due to its Physiochemical Properties.

Based on the product type, the creatine supplements market is divided into creatine monohydrate, creatine ethyl ester, buffered creatine, and others. Creatine monohydrate dominated the creatine supplements market in 2024 with a 71.3% market share in 2024. It is considered the gold standard to compare other purported sources of creatine because of its well-known physiochemical properties, high bioavailability, stability, low cost, and a large number of studies that have demonstrated efficacy and safety.

It is formed by crystallization with water, forming monoclinic prisms that hold one molecule of water per molecule of creatine. This provides a powder containing 87.9% creatine that readily dissociates into creatine and water upon oral ingestion. In addition, it has the most extensive research backing its effectiveness and safety in enhancing athletic performance and muscle growth. Some other forms, such as creatine ethyl ester, have shown lower bioavailability and efficacy compared to monohydrate. While creatine hydrochloride (HCl) may be more soluble, there’s not enough evidence to suggest it is safer to use.

End-Use Analysis

Athletes and Bodybuilders Dominated the Creatine Supplements Market.

Based on the end-use, the creatine supplements market is divided into athletes and bodybuilders, fitness enthusiasts, and clinical and therapeutic use. Athletes and bodybuilders led the creatine supplements market with a substantial market share of 59.1%. This dominance is largely attributed to the well-established use of creatine in strength training, muscle building, and high-intensity sports performance. Creatine monohydrate is shown to enhance muscular strength, power output, and recovery, making it a staple in the routines of athletes.

Additionally, the rise of social media fitness influencers and online coaching platforms has popularized creatine among younger demographics striving for visible muscular results. College athletes, especially in the U.S., often receive creatine as part of their training protocols, and the supplement is approved by organizations like the NCAA. Moreover, the shift toward evidence-based supplementation has made creatine a go-to option for athletes seeking legal, non-steroidal performance aids.

Distribution Channel Analysis

Hypermarkets and Supermarkets Dominated the Creatine Supplements Market.

The creatine supplements market is segmented into hypermarkets & supermarkets, pharmacy & drug stores, online, and others. Hypermarkets and supermarkets dominated the creatine supplements market with around 35.8% of the total market. This significant share is driven by the growing consumer preference for one-stop shopping experiences where dietary supplements are easily accessible alongside groceries and personal care products. Major retail chains such as Walmart, Target, Tesco, and Carrefour have expanded their health and wellness sections, offering a wide range of creatine products, including powders, capsules, and flavored blends.

These retailers benefit from high foot traffic, convenient locations, and the trust consumers place in established brands, which enhances product visibility and purchasing confidence. Additionally, the increasing focus on fitness among mainstream consumers has led to a rise in casual, over-the-counter supplement purchases during routine shopping. This accessibility and convenience make hypermarkets and supermarkets the most dominant channel.

Key Market Segments

By Form

- Powder

- Liquid

- Capsules/Tablets

- Others

By Product

- Creatine Monohydrate

- Creatine Ethyl Ester

- Buffered Creatine

- Others

By End Use

- Athletes and Bodybuilders

- Fitness Enthusiasts

- Clinical and Therapeutic Use

By Distribution Channel

- Hypermarkets & Supermarkets

- Pharmacy & Drug Stores

- Online

- Others

Drivers

Increasing Health Awareness and Demand for Sports Nutrition Drives the Creatine Supplements Market.

Increasing health awareness and the growing demand for sports nutrition are major forces driving the creatine supplements market. As more people prioritize fitness, performance, and overall wellness, creatine is becoming a staple supplement for a broader consumer base, including recreational gym-goers and college students.

- According to data from the National Center for Health Statistics, over 24% of U.S. adults met the physical activity guidelines for both aerobic and muscle-strengthening activity, a significant rise from pre-pandemic levels.

This growing fitness culture is closely tied to the rising use of performance-enhancing, recovery-supportive supplements, with creatine leading the charge due to its well-documented effects on strength, endurance, and muscle recovery. Furthermore, creatine’s role in cellular energy production (ATP) and its emerging benefits for cognitive function have expanded its appeal. Gym chains, college sports programs, and even high school athletes are incorporating creatine supplementation into training routines.

Restraints

Potential Side Effects Caused by Creatine Supplements Might Pose a Challenge to the Market.

The potential side effects that can be caused by creatine supplements might pose a challenge to the market. Creatine supplements help the body store energy and aid in muscle development, which becomes essential for athletes during training and competitions. However, creatine intake can cause weight gain due to muscle development and the amount of water intake.

Additionally, muscle cramping, nausea, and headaches are common side effects of creatine. In addition, in October 2023, New York passed a law that came into effect in April 2024, restricting the sale of dietary supplements to minors. Online retailers that ship products to New York must also use a method of shipping that requires a person over eighteen to sign for the package and provide proof of age to the mail carrier. This presents a unique challenge to online retailers as several mail carriers either do not offer age-gating for eighteen or charge a premium for these services. All these factors together might restrain the creatine supplements market from growing.

Opportunity

Creatine Supplements’ Growing Role Beyond Sport Propels the Market.

Creatine supplements are increasingly gaining recognition beyond their traditional use in sports and bodybuilding, creating new opportunities in the broader health and wellness market. Emerging research suggests that creatine plays a crucial role in brain function, cellular energy metabolism, and muscle preservation. Studies have shown that creatine supplementation may improve cognitive performance, especially in tasks involving short-term memory and quick thinking, making it appealing to students, professionals, and older adults.

This shift in application is fueling demand among non-athletic demographics, including seniors and vegetarians who typically have lower natural creatine stores. Additionally, the growing interest in nootropics and brain health supplements has opened doors for creatine to be included in cognitive-enhancing blends. As creatine becomes associated with holistic well-being, leveraging the trend, companies can present themselves as research-focused in the wellness market.

Trends

Growing Popularity of Creatine Beverages and Gummies.

The growing popularity of creatine beverages and gummies represents a significant trend in the evolving creatine supplement market, driven by consumer demand for convenience, flavor, and lifestyle-friendly formats. Traditional creatine powders often require mixing and can have a gritty texture or bland taste, which some users find unappealing.

Several brands are innovating with ready-to-drink creatine-infused beverages and flavored gummies that offer the same benefits in a more enjoyable and portable form. For instance, creatine energy drinks, often combined with electrolytes or caffeine, have become popular pre-workout options, especially among younger consumers seeking quick, on-the-go nutrition. Creatine gummies, often dosed at 1-3 grams per serving, appeal to consumers.

Geopolitical Impact Analysis

Geopolitical Tensions Disrupt the Supply Chains, Leading to Increased Prices of Supplements and Raw Materials.

Geopolitical tensions have a significant impact on the creatine supplements market, particularly due to the industry’s reliance on international trade and raw material sourcing. A substantial portion of global creatine monohydrate production is concentrated in China, which supplies raw ingredients to supplement manufacturers worldwide. Disruptions in diplomatic relations or trade policies between China and Western countries, such as the United States, are leading to supply chain instability, increased tariffs, and stricter import regulations.

For instance, during periods of heightened U.S.-China trade tensions, importers faced delays and increased costs for key ingredients, including creatine. These complications resulted in product shortages and price hikes for consumers and retailers in affected regions. Furthermore, geopolitical instability in key shipping regions, such as the South China Sea or the Middle East, disrupts global logistics, delaying shipments of raw materials and finished products. Sanctions, export bans, or changes in regulatory environments due to international conflicts can further limit accessibility and affordability.

Regional Analysis

North America Held the Largest Share of the Global Creatine Supplements Market.

North America was in the vanguard of the Global Creatine Supplements Market, holding about 48.4%. The dominance of the region is attributed to a combination of several factors, such as high consumer awareness, widespread fitness culture, and the strong presence of sports nutrition brands. In countries like the United States and Canada, creatine is one of the most commonly used supplements among athletes and bodybuilders.

- According to the National Institutes of Health (NIH), the National Study of Substance Use Habits of College Student Athletes survey by the National Collegiate Athletic Association (NCAA) reported that 14% of athletes used creatine, making it a mainstream part of sports nutrition routines. Professional sports leagues and collegiate sports programs often incorporate creatine into athlete nutrition plans due to its scientifically backed benefits in improving strength, power output, and muscle recovery.

In addition, the supplement is FDA-compliant and widely available across pharmacies, health stores, and e-commerce platforms, which boosts accessibility. Similarly, the strong fitness influencer culture and social media marketing strategies in the region play a major role in promoting creatine products to younger demographics.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

NutraBio, The Hut Group (Myprotein), GAT WHP, Weider Global Nutrition, Allmax Nutrition, Nutrex, and Ultimate Nutrition are the key players in the global creatine supplements market. As the creatine supplements market is very competitive, many players try to gain a competitive edge by engaging in strategic activities, such as product development, mergers, partnerships, and investments.

For instance, in January 2025, Vitamin Shoppe, an omni-channel specialty retailer of nutritional products, and Specnova, a research-driven biotech innovation company, announced the launch of BodyTech Elite Creatine Beadlets, the first product formulated with Specnova’s NovaQSpheres delivery technology for dietary supplements.

NutraBio offers creatine supplements, specifically creatine monohydrate, which are designed to enhance muscle strength, power, and endurance. These supplements are known for their purity, with a focus on providing a clean formula free of fillers and additives, aligning with consumer preference for quality products.

TSI Group aims to redefine consumer expectations for creatine supplements with OptiCreatine, making it cleaner, smoother, and easier to enjoy.

Myprotein, a brand of THG nutrition, offers a range of creatine supplements and benefits from robust online distribution of the Hut Group.

GAT WHP is a company that manufactures and distributes a variety of sports nutrition supplements, including creatine. It emphasizes holistic performance solutions and a global community of athletes, emphasizing their commitment to quality and efficacy.

Weider Global Nutrition is a sports nutrition company with a long history and profound consumer trust. They are known for their high-quality dietary supplements, including creatine, and their commitment to using scientific research and innovation to support athletes and fitness enthusiasts.

The Major Players in the Industry

- NutraBio

- TSI Group

- The Hut Group (Myprotein)

- GAT WHP

- Weider Global Nutrition

- Allmax Nutrition

- Nutrex

- Glanbia PLC

- MuscleTech

- Ultimate Nutrition

- EFX Sports

- Other Key Players

Key Development

- In September 2024, US-based creatine firm Create Wellness raised US$5 million in a Series A funding round led by Unilever Ventures. The investment accelerated Create’s mission to bring creatine supplementation to a wider audience.

- In May 2025, TSI Group launched OptiCreatine, a novel creatine processing technology to improve the solubility of creatine, convenience, and versatility of flavors across product formats. Creatine monohydrate powder is often gritty, precipitates in solutions, or is insoluble, and is associated with bloating. OptiCreatine creates clear, stable, and sediment-free solutions in 30 to 60 seconds.

Report Scope

Report Features Description Market Value (2024) US$ 0.7 Bn Forecast Revenue (2034) US$ 4.7 Bn CAGR (2025-2034) 18.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Powder, Liquid, Capsules/Tablets, and Others), By Product (Creatine Monohydrate, Creatine Ethyl Ester, Buffered Creatine, and Others), By End Use (Athletes and Bodybuilders, Fitness Enthusiasts, and Clinical and Therapeutic Use), By Distribution Channel (Hypermarkets & Supermarkets, Pharmacy & Drug Stores, Online, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape NutraBio, TSI Group, The Hut Group (Myprotein), GAT WHP, WEIDER GLOBAL NUTRITION, Allmax Nutrition, Nutrex, Glanbia PLC, MuscleTech, Ultimate Nutrition, EFX Sports, Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Creatine Supplements MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Creatine Supplements MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- NutraBio

- TSI Group

- The Hut Group (Myprotein)

- GAT WHP

- Weider Global Nutrition

- Allmax Nutrition

- Nutrex

- Glanbia PLC

- MuscleTech

- Ultimate Nutrition

- EFX Sports

- Other Key Players