Corneal Topographers Market By Product Type (Placido Disc System, Scanning Slit System, and Scheimpflug Systems), By Application (Refractive Surgery Evaluation, Cataract Surgery Evaluation, Corneal Disorder Diagnosis, Contact Lens Fitting, and Others), By End-user (Hospitals, Ambulatory Surgery Centers, and Ophthalmic Clinics), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153835

- Number of Pages: 242

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

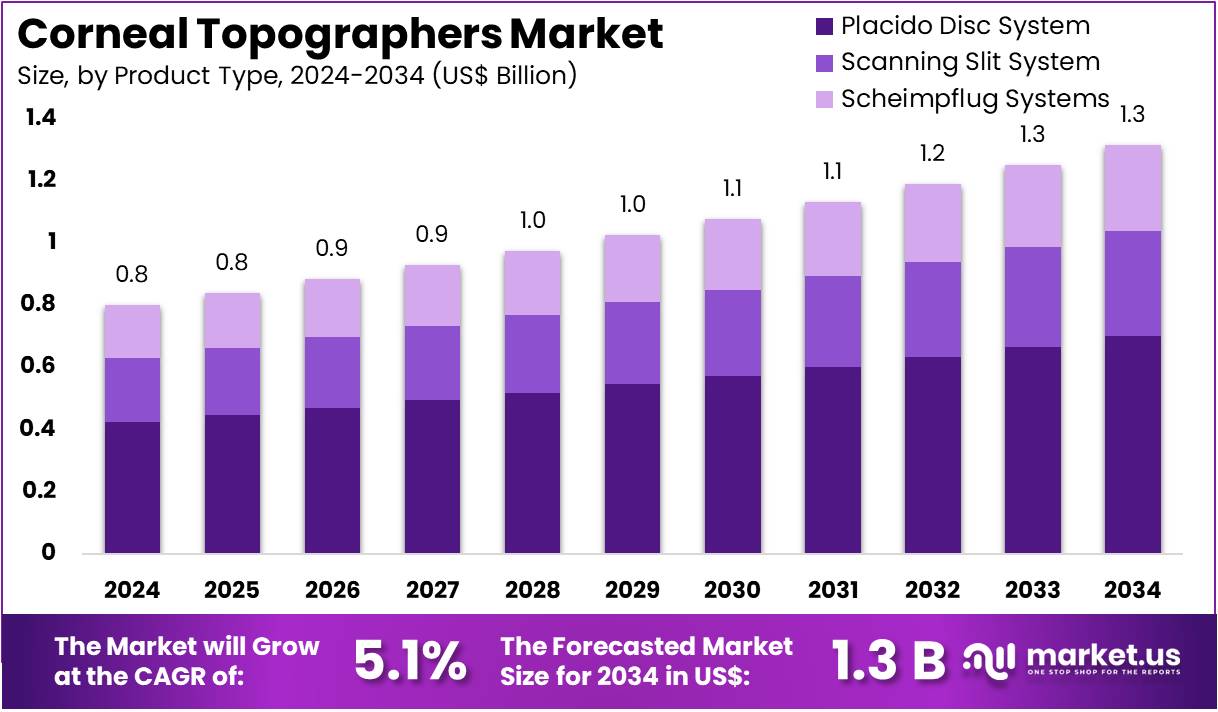

The Corneal Topographers Market Size is expected to be worth around US$ 1.3 billion by 2034 from US$ 0.8 billion in 2024, growing at a CAGR of 5.1% during the forecast period 2025 to 2034.

Increasing prevalence of eye disorders and the growing demand for precise and early diagnosis of corneal conditions are driving the expansion of the corneal topographers market. Corneal topographers are advanced diagnostic tools that provide detailed mapping of the cornea, aiding in the diagnosis and management of conditions such as keratoconus, astigmatism, and corneal ectasia.

As the global population ages, the need for accurate eye care solutions increases, particularly for individuals suffering from refractive errors and other corneal issues. Corneal topography plays a critical role in preoperative assessments for cataract and refractive surgeries, enabling healthcare professionals to assess corneal curvature, thickness, and overall surface structure to optimize treatment plans.

The rise in demand for customized vision correction methods, such as LASIK and other surgical interventions, further drives the adoption of corneal topographers. In March 2023, Haag-Streit launched a new display for the Eyestar 900 OCT analyzer designed for corneal ectasia. This display provides advanced features like surface topography, pachymetry mapping, Belin ABCD grading, and other key parameters. It is aimed at helping specialists identify early signs of keratoconus and other ectatic conditions with high-quality imaging for in-depth assessments of the anterior chamber.

The integration of OCT (optical coherence tomography) with corneal topography is becoming a significant trend, offering deeper insights into corneal health and improving diagnostic accuracy. Recent advancements in AI and machine learning algorithms are also enhancing the capabilities of corneal topographers, enabling faster and more precise analysis of corneal surfaces. As the market continues to evolve, opportunities abound for innovations that improve patient outcomes and offer more efficient, non-invasive diagnostic solutions.

Key Takeaways

- In 2024, the market for corneal topographers generated a revenue of US$ 0.8 billion, with a CAGR of 5.1%, and is expected to reach US$ 1.3 billion by the year 2034.

- The product type segment is divided into placido disc system, scanning slit system, and scheimpflug systems, with placido disc system taking the lead in 2023 with a market share of 53.2%.

- Considering application, the market is divided into refractive surgery evaluation, cataract surgery evaluation, corneal disorder diagnosis, contact lens fitting, and others. Among these, refractive surgery evaluation held a significant share of 45.6%.

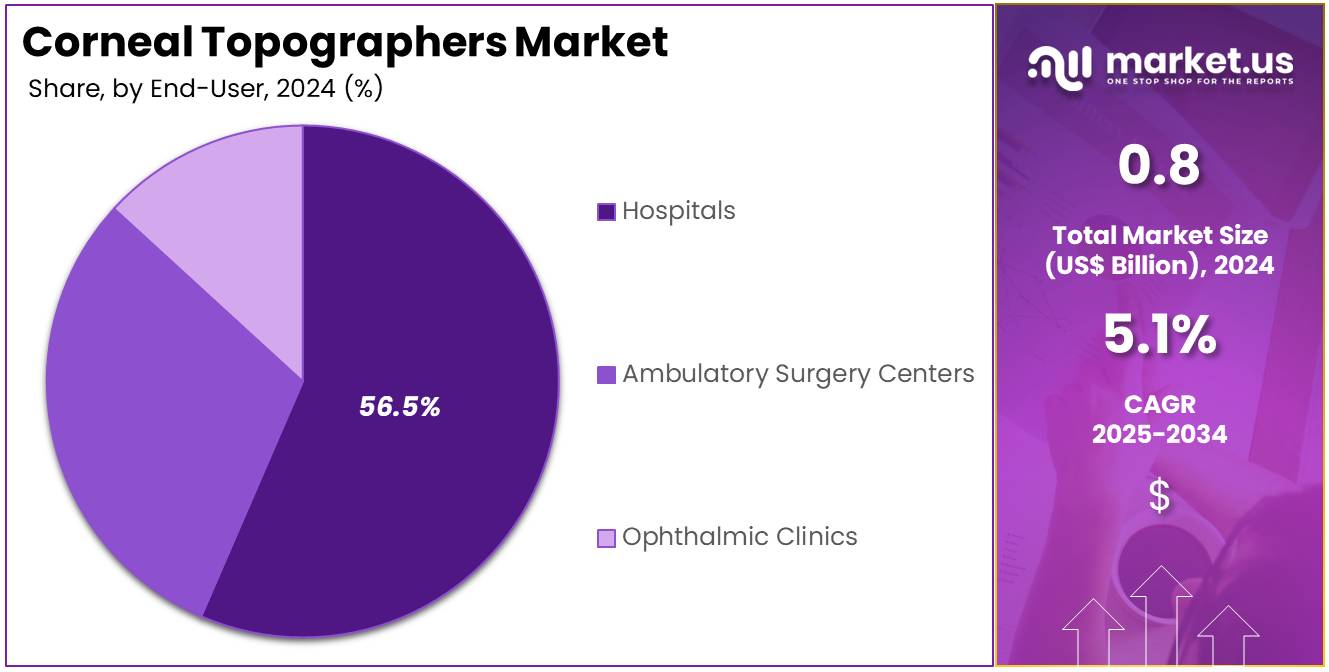

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, ambulatory surgery centers, and ophthalmic clinics. The hospitals sector stands out as the dominant player, holding the largest revenue share of 56.5% in the corneal topographers market.

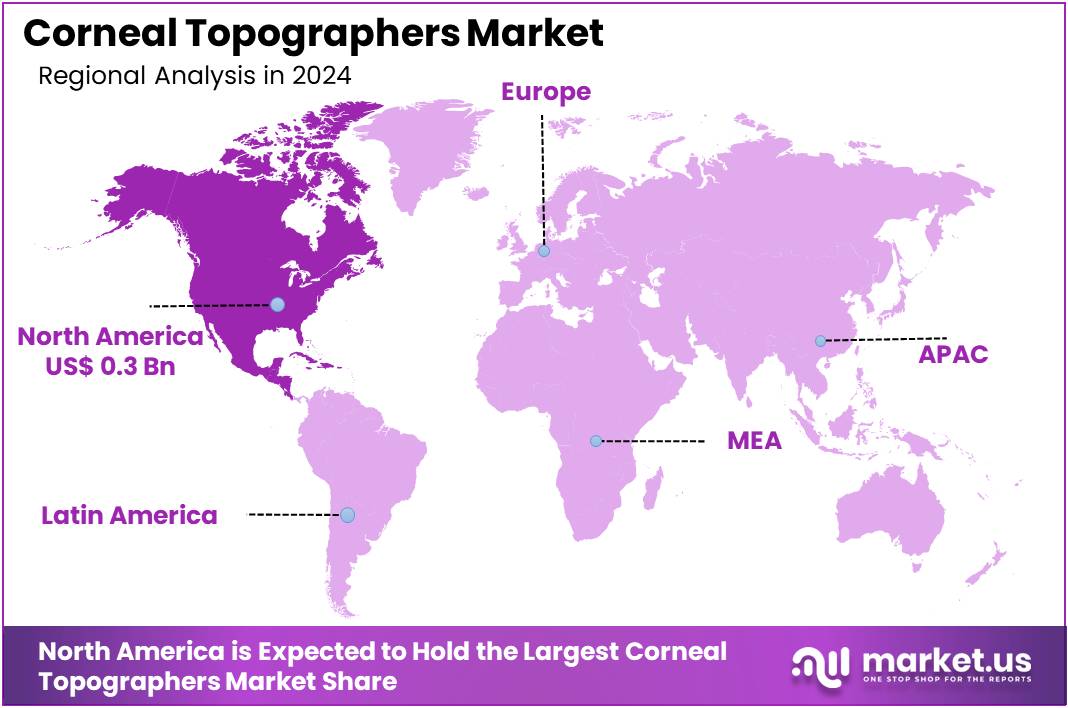

- North America led the market by securing a market share of 41.4% in 2023.

Product Type Analysis

The Placido disc system holds the largest share of 53.2% in the corneal topographers market. This growth is expected to continue as the Placido disc system remains the most widely used technology for corneal topography due to its accuracy and efficiency in mapping the surface of the cornea. The system utilizes concentric rings projected onto the cornea to measure the shape and curvature, making it particularly effective in diagnosing corneal diseases and assessing refractive errors.

The increasing demand for precise diagnostic tools in ophthalmology, especially for procedures such as refractive surgeries and contact lens fittings, is likely to fuel further adoption of Placido disc systems. Additionally, as the prevalence of vision-related disorders increases globally, the need for diagnostic systems that offer non-invasive and detailed corneal mapping is expected to drive continued growth in this segment. The affordability and ease of use of Placido disc systems also make them a popular choice in both developed and developing healthcare markets, contributing to their market dominance.

Application Analysis

Refractive surgery evaluation holds the largest share of 45.6% in the application segment of the corneal topographers market. This growth is driven by the increasing number of individuals undergoing refractive surgeries such as LASIK (Laser-Assisted in Situ Keratomileusis) and PRK (Photorefractive Keratectomy) to correct vision problems like myopia, hyperopia, and astigmatism. Corneal topography is critical for evaluating candidates for refractive surgery, as it helps surgeons assess corneal shape, thickness, and overall health.

The rising awareness about refractive surgery as a safe and effective alternative to glasses and contact lenses is anticipated to boost the demand for corneal topographers in refractive surgery evaluation. As refractive surgery technology advances and becomes more widely available, particularly in emerging markets, the need for precise corneal measurements will continue to drive growth in this segment. Additionally, the increased focus on personalized eye care and the desire for better visual outcomes will further contribute to the demand for corneal topographers in this application.

End-User Analysis

Hospitals represent the largest end-user segment, holding 56.5% of the market share in the corneal topographers market. This growth is expected to continue as hospitals are the primary centers for diagnostic and surgical procedures involving the eyes, including corneal evaluations and refractive surgeries. Hospitals invest significantly in advanced diagnostic technologies to improve patient outcomes, and corneal topography plays a critical role in pre-operative evaluations, particularly for refractive surgery and cataract surgery.

The increasing prevalence of eye disorders, including cataracts and refractive errors, is driving hospitals to adopt cutting-edge technologies for diagnosis and treatment. The integration of corneal topographers with other ophthalmic devices, such as slit lamps and optical coherence tomography (OCT) systems, is also anticipated to increase the efficiency and accuracy of ocular assessments in hospitals. As hospitals continue to focus on expanding their ophthalmology departments and offering advanced eye care services, the demand for corneal topographers in hospital settings is projected to grow, ensuring this segment remains the dominant end-user in the market.

Key Market Segments

By Product Type

- Placido Disc System

- Scanning Slit System

- Scheimpflug Systems

By Application

- Refractive Surgery Evaluation

- Cataract Surgery Evaluation

- Corneal Disorder Diagnosis

- Contact Lens Fitting

- Others

By End-user

- Hospitals

- Ambulatory Surgery Centers

- Ophthalmic Clinics

Drivers

Rising Incidence of Corneal Disorders and Refractive Errors is Driving the Market

The increasing global prevalence of corneal disorders, such as keratoconus, and a growing number of individuals seeking vision correction for refractive errors, are significant drivers propelling the corneal topographers market. These devices are essential for precisely mapping the curvature and shape of the cornea, enabling accurate diagnosis, monitoring disease progression, and meticulous pre- and post-operative planning for various ophthalmic procedures. Conditions like irregular astigmatism, post-surgical ectasia, and dry eye syndrome also necessitate detailed corneal analysis for effective management.

The World Health Organization (WHO) highlights the global burden of vision impairment; its “Eye care, vision impairment and blindness” report (most recently updated May 2025) emphasizes that refractive errors and corneal opacities are among the leading causes of vision impairment and blindness worldwide. While specific global incidence rates for keratoconus in 2022-2024 are difficult to obtain from government sources, the overall trend of increasing eye disorders demanding precise diagnostics continues.

The need for high-resolution corneal mapping is particularly critical in personalized refractive surgeries, such as LASIK and PRK, where even subtle irregularities can impact visual outcomes. The continuous rise in patient demand for both therapeutic and elective vision correction procedures directly fuels the adoption of advanced diagnostic tools.

Restraints

High Cost of Devices and Limited Reimbursement Policies are Restraining the Market

The substantial initial capital investment required for purchasing advanced corneal topographers, coupled with complex and sometimes limited reimbursement policies for the diagnostic procedures performed using them, represents a considerable restraint on the market. These sophisticated ophthalmic diagnostic devices incorporate precision optics, advanced imaging sensors, and complex software, leading to high manufacturing costs that are passed on to eye care practices and hospitals.

Smaller clinics or those in developing regions often face significant financial hurdles in acquiring these essential tools. The American Hospital Association (AHA) in its “2024 Costs of Caring” report highlighted that overall medical equipment prices remain a significant component of healthcare costs. While specific figures for corneal topographers are not disaggregated, the general upward trend in capital equipment expenditure places a burden on healthcare providers.

Furthermore, the Centers for Medicare & Medicaid Services (CMS) issues specific Current Procedural Terminology (CPT) codes for corneal topography (e.g., 92025). The national average Medicare payment for CPT code 92025 in a physician’s office setting in 2024 was around US$26.07, according to the CMS Physician Fee Schedule. Such reimbursement rates, while contributing to coverage, may not fully offset the high acquisition and operational costs of the device, creating financial pressure for widespread adoption.

Opportunities

Integration with Refractive Surgery Planning and Tele-ophthalmology is Creating Growth Opportunities

The increasing integration of corneal topographers with advanced refractive surgery planning platforms and the growing adoption of tele-ophthalmology solutions are creating significant growth opportunities in the market. Topographers are becoming indispensable for femtosecond laser-assisted surgeries and personalized ablations, offering seamless data transfer and sophisticated analysis for optimal surgical outcomes.

Furthermore, the expansion of tele-ophthalmology allows specialists to interpret corneal topography data remotely, enhancing accessibility to expert diagnoses and improving patient care in underserved areas. The US Food and Drug Administration (FDA) continues to clear and approve devices that integrate diagnostic capabilities with surgical planning software, reflecting this synergy. For instance, new software updates for existing topographers frequently include enhanced interfaces for excimer and femtosecond laser systems, indicating ongoing development in this area.

A study published in “Frontiers in Ophthalmology” in January 2025 on tele-ophthalmology as an effective triaging tool, while broadly discussing virtual eye care, emphasizes the role of digital imaging, which includes topography, in remote diagnostics. The study notes that utilization of synchronous telemedicine platforms increased during the study period, with 63.4% of patients new to the clinic engaging in rapid virtual eye care, showcasing the growing comfort and adoption of remote diagnostic services. This technological convergence and expanded reach through virtual care models are positioning corneal topography as a central component of modern ophthalmic practice.

Impact of Macroeconomic / Geopolitical Factors

Global macroeconomic conditions, including inflation and the overall investment in healthcare infrastructure, significantly influence the corneal topographers market by affecting capital expenditure budgets of ophthalmology practices and hospitals. Inflation can increase the costs for manufacturing these highly precise optical and electronic devices, from specialized lenses and sensors to advanced software, potentially leading to higher prices for the topographers themselves. This might strain the budgets of eye care providers, especially in economies experiencing downturns.

However, governments and private healthcare providers globally increasingly prioritize eye health and visual impairment prevention, recognizing its impact on quality of life and productivity. The World Health Organization (WHO) reported in May 2025 that global expenditure on health continued to rise, with many high-income countries consistently allocating a significant portion of their Gross Domestic Product (GDP) to health. For instance, Germany’s health expenditure was 12.86% of GDP in 2023, and Japan’s was 11.45% in 2023, showcasing robust national commitments that support investments in advanced diagnostic tools like corneal topographers.

Geopolitical stability also plays a crucial role in maintaining predictable supply chains for the complex components and ensuring stable international trade for these specialized medical instruments. Despite economic fluctuations, the fundamental imperative to provide high-quality eye care and address prevalent corneal conditions ensures sustained investment in advanced diagnostic technologies, fostering resilience and continued growth for the market.

Evolving US trade policies, including the imposition of tariffs on imported optical components, precision electronics, and high-quality lenses, are shaping the corneal topographers market by directly influencing manufacturing costs and recalibrating supply chain strategies for major players. Manufacturers of corneal topographers often rely on intricate global supply chains for highly specialized parts, such as high-resolution cameras, LED light sources, and sophisticated image processing units, many of which are sourced from international suppliers.

Tariffs on these specific imports directly increase the input costs for companies that either manufacture within the US or import finished devices for distribution, potentially leading to higher prices for the final topographers sold to ophthalmology clinics. The US Department of Commerce reported that US imports of “Optical, photographic, cinematographic, measuring, checking, precision, medical or surgical instruments and apparatus; parts and accessories thereof” (HTS Chapter 90, which includes topographers) amounted to approximately US$ 115.8 billion in 2023.

This substantial import value highlights the extensive reliance on global supply chains for components and finished products within this sector. While not all of this value is directly tariffed, the overall trade policy landscape, including specific duties on originating countries or product categories, directly impacts the cost structure and sourcing decisions for companies in this market. These policies, while sometimes aimed at bolstering domestic manufacturing capabilities, primarily create a more expensive and intricate operational environment for companies.

The critical need for precise corneal diagnostics, however, motivates manufacturers to strategically manage their supply chains and absorb some costs, ensuring continued access to essential ophthalmic imaging technologies in the US market.

Latest Trends

Growing Emphasis on Early Detection and Progression Monitoring of Keratoconus is a Recent Trend

A prominent recent trend shaping the corneal topographers market in 2024 and continuing into 2025 is the escalating emphasis on early detection and meticulous progression monitoring of keratoconus, a progressive eye disease characterized by the thinning and bulging of the cornea. Early and accurate diagnosis of keratoconus is crucial for initiating timely interventions, such as corneal collagen cross-linking, which can halt disease progression and preserve vision.

Advanced corneal topographers provide high-resolution maps that can identify subtle changes in corneal shape, even in subclinical cases, enabling earlier therapeutic intervention. The National Institutes of Health (NIH), through its National Eye Institute (NEI), continues to fund research into keratoconus and other corneal diseases, underscoring the importance of early detection and monitoring.

While specific direct 2024 statistics on early keratoconus diagnoses from government bodies are not commonly released, the ongoing development and clinical adoption of highly sensitive topographers, such as Scheimpflug imaging systems, highlight this trend. Oculus Optikgeräte GmbH, a key player, has continued to advance its Pentacam systems, which are widely used for keratoconus detection and progression monitoring, with updates in their software for enhanced analysis. This heightened clinical focus on proactive management of corneal ectatic disorders drives the demand for the most sophisticated and accurate mapping technologies available.

Regional Analysis

North America is leading the Corneal Topographers Market

The corneal topographers market in North America, holding a significant 41.4% share, experienced robust growth in 2024. This expansion was primarily driven by the increasing prevalence of corneal disorders such as keratoconus and astigmatism, a rising demand for advanced diagnostic tools in refractive surgery, and continuous technological innovations in ophthalmic imaging.

While the precise prevalence of keratoconus varies, a study published in Optometry Times in May 2024 indicated that the prevalence of keratoconus in a US-based pediatric population was higher than previously reported, highlighting the importance of early screening and diagnosis. The growing popularity of refractive surgeries like LASIK and PRK further fuels the demand for precise corneal mapping devices, as these procedures rely heavily on accurate topographical data for optimal outcomes.

The American Academy of Ophthalmology reported that refractive surgery continues to be a widely adopted procedure, reflecting a sustained patient interest in vision correction and necessitating advanced diagnostic support. Leading ophthalmic equipment manufacturers have reported strong performance in their diagnostic segments.

Carl Zeiss Meditec’s Ophthalmology Strategic Business Unit reported revenue of €1,589.2 million (US$1,859.36 million) in fiscal year 2023/24, demonstrating consistent demand for its ophthalmic solutions, including topographers. Johnson & Johnson Vision, another key player, continues to innovate in the vision care space, contributing to the overall market expansion through its comprehensive portfolio of diagnostic and surgical technologies.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The corneal topographers market in Asia Pacific is expected to grow considerably during the forecast period. This anticipated expansion is fueled by a large and aging population experiencing a rising incidence of refractive errors and corneal diseases, coupled with significant investments in upgrading healthcare infrastructure and increasing access to specialized eye care. The global prevalence of myopia is estimated to reach 4.758 billion individuals by 2050, with China contributing significantly to these figures due to its high prevalence of refractive errors, according to a study on global trends in refractive disorders.

Governments across the region are actively implementing eye health programs and initiatives to address the growing burden of visual impairment and blindness. For example, the World Health Organization (WHO) has various initiatives promoting eye care, including the development of tools like the “Competency-based refractive error teams” in May 2025, aimed at strengthening eye care services. This increased focus on eye health is likely to drive the adoption of advanced diagnostic equipment.

Major ophthalmic companies are strategically expanding their presence and distribution networks in Asia Pacific to meet this escalating demand. Carl Zeiss Meditec’s APAC region, despite a slight decline in revenue in fiscal year 2023/24 due to specific market conditions, is a crucial growth area for the company, indicating long-term investment and potential. Topcon Healthcare and Nidek are also actively introducing their advanced diagnostic devices to cater to the evolving needs of the Asian market. These factors collectively indicate a robust and expanding market for these diagnostic instruments across Asia Pacific.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the corneal topography market employ several strategies to drive growth. These include investing in research and development to create innovative products, such as advanced imaging systems and modular wall solutions, enhancing surgical efficiency. Strategic mergers and acquisitions enable companies to expand their product portfolios and enter new markets.

Collaborations with healthcare providers and research institutions facilitate the development of cutting-edge technologies and broaden market reach. Geographic expansion into emerging markets allows companies to tap into new customer bases and increase revenue streams. Adherence to regulatory standards ensures product safety and efficacy, building trust with healthcare professionals and patients. Additionally, companies focus on marketing and educational initiatives to raise awareness about the benefits of integrated operating room systems, thereby driving demand.

Carl Zeiss Meditec AG, a leading company in this sector, specializes in providing medical devices for various procedures, including corneal topography. The company offers a comprehensive range of products designed to enhance surgical environments, such as modular wall systems and advanced imaging technologies. With a strong focus on expanding its product portfolio and leveraging advanced technologies, Carl Zeiss Meditec aims to improve surgical outcomes and reduce healthcare costs. Through continuous innovation and strategic acquisitions, the company strengthens its position in the corneal topography market, meeting the growing demand for reliable and effective surgical solutions.

Top Key Players in the Corneal Topographers Market

- Visionix

- Tracey Technologies

- Topcon Corporation

- Tomey Corporation

- Optos plc

- OCULUS Optikgerate GmbH

- Nidek Co., Ltd

- Medmont International Pty Ltd

- Haag-Streit Diagnostics

- EyeSys Vision

- Cassini Technologies

- Carl Zeiss AG

Recent Developments

- In August 2023, KeraLink International (KLI) introduced three initiatives focused on eliminating corneal blindness in developing regions. These initiatives are centered around advancing corneal regeneration, improving treatment and prevention strategies globally, and addressing infectious keratitis. After being the largest provider of ocular tissue worldwide, KLI has shifted its focus exclusively toward combating corneal blindness in low- and middle-income countries.

- In 2022, OCULUS expanded its operations by establishing a new office in India to meet the growing demand for ophthalmic diagnostic equipment, especially corneal topographers. Furthermore, the company strengthened its distribution network across Latin America, improving product availability and eye health awareness in countries like Brazil and Mexico.

Report Scope

Report Features Description Market Value (2024) US$ 0.8 billion Forecast Revenue (2034) US$ 1.3 billion CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Placido Disc System, Scanning Slit System, and Scheimpflug Systems), By Application (Refractive Surgery Evaluation, Cataract Surgery Evaluation, Corneal Disorder Diagnosis, Contact Lens Fitting, and Others), By End-user (Hospitals, Ambulatory Surgery Centers, and Ophthalmic Clinics) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Visionix, Tracey Technologies, Topcon Corporation, Tomey Corporation, Optos plc, OCULUS Optikgerate GmbH, Nidek Co., Ltd, Medmont International Pty Ltd, Haag-Streit Diagnostics, EyeSys Vision, Cassini Technologies, Carl Zeiss AG. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Corneal Topographers MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Corneal Topographers MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Visionix

- Tracey Technologies

- Topcon Corporation

- Tomey Corporation

- Optos plc

- OCULUS Optikgerate GmbH

- Nidek Co., Ltd

- Medmont International Pty Ltd

- Haag-Streit Diagnostics

- EyeSys Vision

- Cassini Technologies

- Carl Zeiss AG