Global Copper-Oxychloride Market Size, Share, And Business Benefits By Form (Liquid, Powder, Granule, Others), By Purity (Below 99%, Above 99%), By End-Use (Agriculture (Fungicide, Bactericide, Soil Amendment, Soil Amendment, Others), Chemical, Pigment Production, Catalysis, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152363

- Number of Pages: 251

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

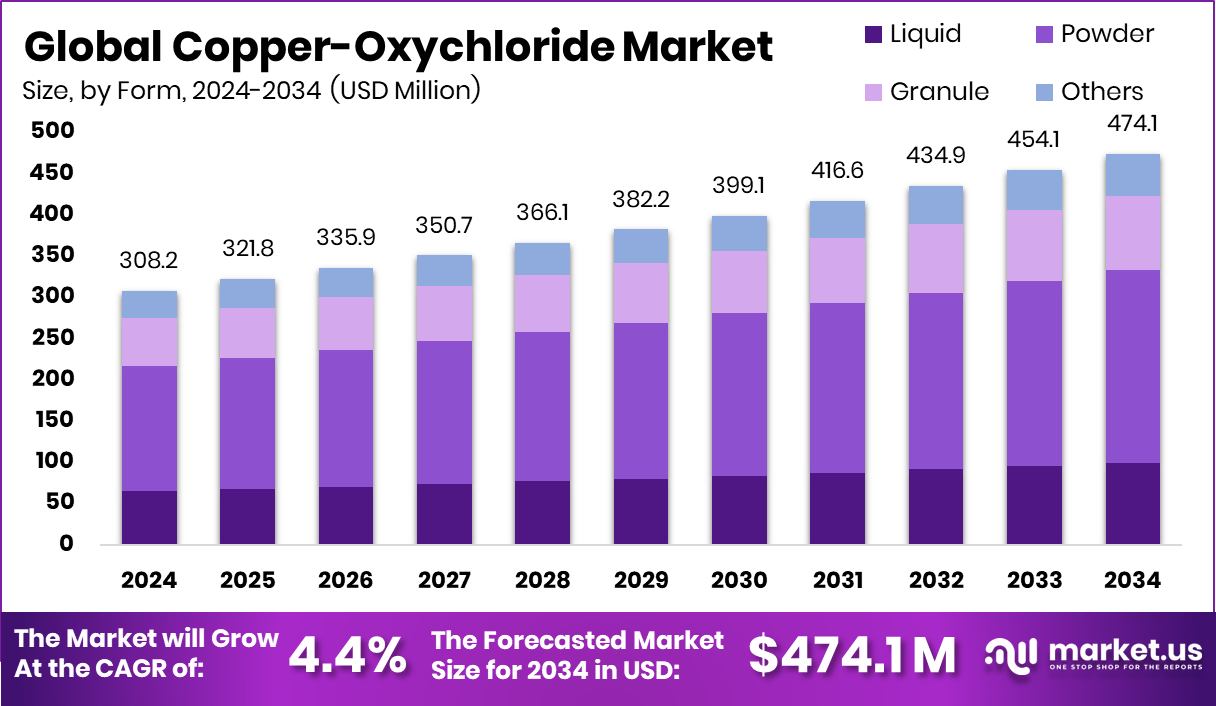

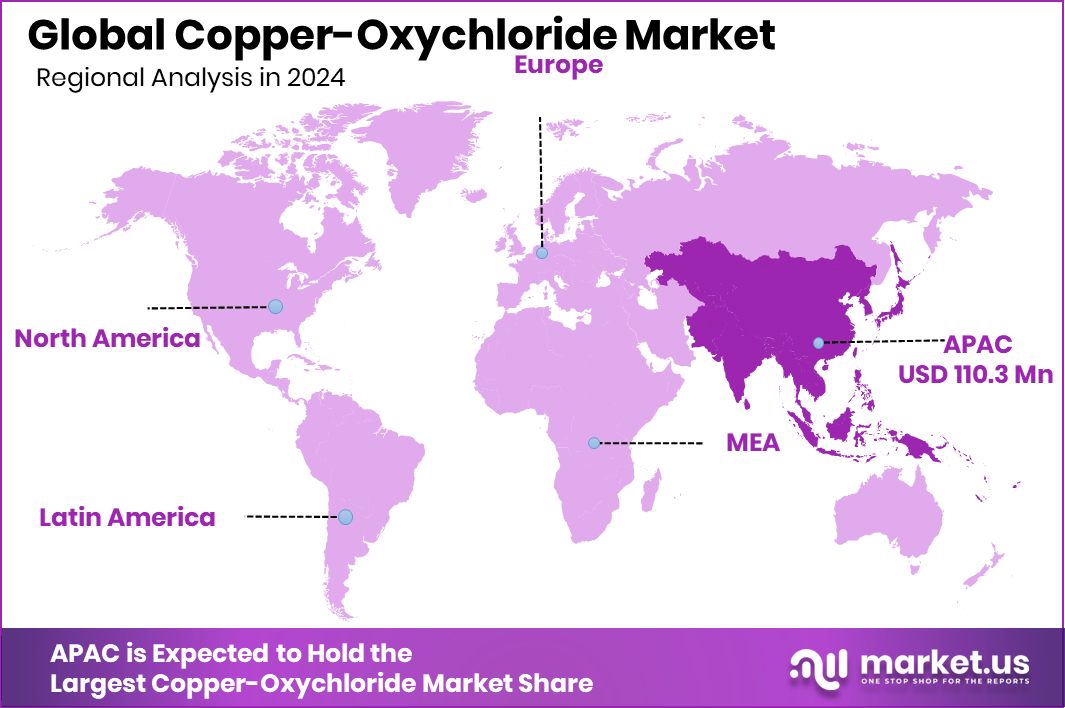

Global Copper-Oxychloride Market is expected to be worth around USD 474.1 million by 2034, up from USD 308.2 million in 2024, and grow at a CAGR of 4.4% from 2025 to 2034. Growing agricultural needs in Asia-Pacific drove Copper-Oxychloride demand to USD 110.3 million.

Copper-Oxychloride is an inorganic compound primarily used as a fungicide in agriculture. It is composed of copper, oxygen, and chlorine, typically appearing as a greenish powder. Its effectiveness in controlling fungal and bacterial diseases makes it widely used in protecting crops like fruits, vegetables, tea, coffee, and ornamental plants. It works by inhibiting the enzymatic activity in pathogens, thereby stopping the spread of infection.

The Copper-Oxychloride market revolves around the production, distribution, and application of this chemical in agriculture, forestry, and public health. Demand is primarily driven by its role in disease management for high-value crops and the growing emphasis on sustainable crop protection. The market also includes industrial uses such as wood preservation and pigments, although these applications remain secondary compared to agriculture.

According to an industry report, Granular Energy has raised €7.5 million to enhance data transparency and traceability within the green energy sector. The funding will support the development of tools to validate and certify clean energy sourcing. Granular, based in Paris, has secured €2 million to accelerate its mission of powering the global transition to renewable energy. The capital will be used to expand its platform for real-time clean energy tracking. Granular has raised £1.7 million to launch an innovative system for issuing hourly energy certificates. This funding aims to provide granular-level verification of clean energy usage throughout the day.

Key Takeaways

- Global Copper-Oxychloride Market is expected to be worth around USD 474.1 million by 2034, up from USD 308.2 million in 2024, and grow at a CAGR of 4.4% from 2025 to 2034.

- Powder form dominates the copper oxychloride market, holding a 49.3% share due to application convenience.

- Below 99% purity grade leads the market with a 74.5% share, preferred for cost-effective crop treatments.

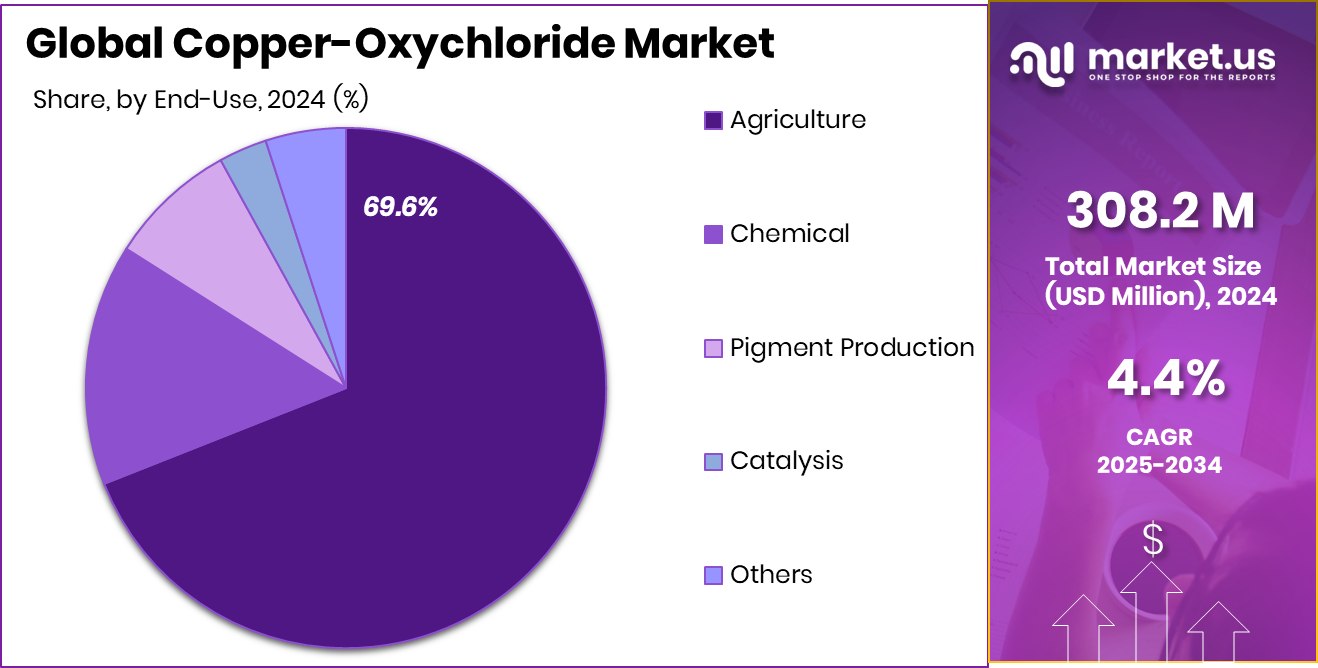

- The agriculture sector remains the largest end-use, accounting for 69.6% of total copper oxychloride market consumption globally.

- Asia-Pacific dominated globally with a 35.8% market share during the year 2024.

By Form Analysis

Powder form dominates the Copper-Oxychloride market with a 49.3% share globally.

In 2024, Powder held a dominant market position in the ‘By Form’ segment of the Copper-Oxychloride Market, accounting for a 49.3% share. This form continues to be widely preferred due to its ease of application, longer shelf life, and effectiveness in adhering to plant surfaces.

Its granular consistency allows for uniform dispersion when mixed with water, making it particularly suitable for large-scale agricultural spraying. The powder form is also favored in traditional and smallholder farming systems where simple and low-cost solutions are essential.

Farmers and agricultural professionals often rely on the powder variant for its consistent performance in disease prevention, especially in crops vulnerable to fungal attacks such as grapes, tomatoes, and citrus. Its compatibility with standard spraying equipment and lower risk of clogging compared to some liquid alternatives also enhance its usability in the field.

Furthermore, the powder form’s stability under varying climatic conditions has made it a reliable choice in tropical and subtropical regions where fungal diseases are more prevalent. The sustained dominance of the powder form in the market reflects its practical advantages, affordability, and wide acceptance among users across both developed and emerging agricultural economies.

By Purity Analysis

Copper-Oxychloride with below 99% purity holds a 74.5% market share.

In 2024, Below 99% held a dominant market position in the ‘By Purity’ segment of the Copper-Oxychloride Market, capturing a significant 74.5% share. This segment continues to be the most widely used due to its cost-effectiveness and sufficient efficacy for a wide range of agricultural applications.

Copper-oxychloride with a purity below 99% is commonly employed in crop protection as it meets the functional requirements for disease control without the added cost associated with higher purity levels.

Farmers and agrochemical applicators often prefer this grade as it provides reliable fungicidal performance while keeping input costs manageable, particularly in price-sensitive markets. The widespread use of below 99% purity formulations also aligns with the requirements of large-scale farming operations, where affordability and ease of handling are key considerations.

Additionally, the physical and chemical properties at this purity level allow for stable formulations in powder and suspension forms, making it a practical option for distribution and application.

By End-Use Analysis

The agriculture sector drives copper oxychloride demand, accounting for 69.6% of usage share.

In 2024, Agriculture held a dominant market position in the ‘By End-Use’ segment of the Copper-Oxychloride Market, accounting for a 69.6% share. This significant lead is primarily attributed to the widespread application of copper oxychloride as a fungicide and bactericide in crop protection.

Its effectiveness against a broad spectrum of plant diseases, including downy mildew, leaf spots, and blights, has made it a preferred choice among farmers cultivating fruits, vegetables, pulses, and plantation crops.

The agricultural sector relies heavily on copper-oxychloride for both preventive and curative treatments, particularly in regions with high humidity where fungal infections are prevalent. Its role in safeguarding crop yield and quality has become increasingly critical as growers aim to enhance productivity amid challenges posed by climate variability and disease outbreaks.

Moreover, the product’s compatibility with organic farming practices, where copper-based fungicides are among the few allowed treatments, further reinforces its relevance in the agricultural space.

Key Market Segments

By Form

- Liquid

- Powder

- Granule

- Others

By Purity

- Below 99%

- Above 99%

By End-Use

- Agriculture

- Fungicide

- Bactericide

- Soil Amendment

- Soil Amendment

- Others

- Chemical

- Pigment Production

- Catalysis

- Others

Driving Factors

Rising Crop Diseases Boost Demand for Protection Products

One of the main factors driving the growth of the copper-oxychloride market is the increasing spread of crop diseases caused by fungi and bacteria. Farmers around the world are facing more frequent outbreaks due to changing weather conditions, increased humidity, and shifting agricultural practices. These diseases affect important crops like tomatoes, grapes, potatoes, and citrus fruits, leading to major yield losses.

Copper-oxychloride is widely used because it helps prevent and control these infections effectively and affordably. Its long-lasting protective layer makes it ideal for farmers who need consistent results. As food demand continues to grow and crop safety becomes more important, the need for reliable fungicides like copper-oxychloride is expected to increase steadily.

Restraining Factors

Environmental Concerns Limit Copper-Based Fungicide Usage

One of the major restraining factors for the copper-oxychloride market is the growing concern over its environmental impact. Excessive or continuous use of copper-based fungicides can lead to copper buildup in soil, which may harm soil health and beneficial microorganisms.

In some regions, regulatory authorities are imposing strict limits on copper usage in agriculture to prevent long-term environmental damage. These restrictions are especially strong in countries promoting sustainable farming practices.

As a result, some farmers are shifting toward alternative, eco-friendly solutions. This growing awareness and tightening regulations are slowing down the expansion of copper-oxychloride use, particularly in developed countries.

Growth Opportunity

Emerging Markets Offer High Growth Potential

As developing countries expand their agricultural sectors, a significant growth opportunity emerges for copper-oxychloride. In regions of Africa, Southeast Asia, and Latin America, farmers are increasingly cultivating high-value crops such as fruits, vegetables, and plantation produce. These growers require effective disease-control solutions to protect their investments and ensure stable yields.

Copper-oxychloride, with its proven ability to prevent fungal and bacterial infections, offers a practical and relatively affordable option suited to these markets. Moreover, as awareness of food safety and export quality grows, demand for certified and safe plant protection products is expected to rise.

This expanding need, coupled with increasing support for modern farming methods, creates a favorable environment for the broad adoption of copper-oxychloride in emerging agricultural economies.

Latest Trends

Shift Toward Nano-Formulated Copper-Oxychloride in Agriculture

A recent trend gaining traction is the development and adoption of nano-formulated copper-oxychloride products. In these formulations, copper particles are reduced to a nanometer size, which increases their surface area and enhances their effectiveness at lower application rates.

Farmers benefit from improved disease control, as the nano-sized particles better adhere to plant surfaces and penetrate fungal cells more efficiently. Additionally, these formulations often result in reduced environmental impact due to lower copper usage overall. This innovative method aligns with the growing focus on precision farming and sustainability.

Regional Analysis

In Asia-Pacific, Copper-Oxychloride market reached USD 110.3 million in 2024.

In 2024, the Asia-Pacific region emerged as the leading market for Copper-Oxychloride, capturing the largest share of 35.8%, which is equivalent to USD 110.3 million. This dominance is primarily driven by the region’s expanding agricultural activities, particularly in countries like India, China, and Southeast Asian nations, where the demand for effective and economical fungicides remains strong. Favorable climatic conditions for crop diseases and the high dependency on agriculture as a livelihood continue to support sustained demand for copper-oxychloride across this region.

In North America and Europe, the market remains stable, with usage focused on specialty crops and regulated farming practices. However, growth is comparatively moderate due to strict environmental controls and growing interest in alternative bio-based fungicides. Latin America is witnessing a gradual uptake, supported by the region’s growing fruit and vegetable exports, where crop protection is critical for meeting export quality standards.

The Middle East & Africa region, although smaller in volume, presents steady growth potential owing to the rise in horticultural farming and government support for modern agriculture. The Asia-Pacific region’s large-scale farming needs and climate-driven disease pressure firmly position it as the top consumer of copper-oxychloride in the global market landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Bayer CropScience maintains its position through extensive distribution networks and rigorous quality standards. As an established agricultural input provider, the company leverages its global presence to ensure consistent supply and regulatory compliance. Its emphasis on integrated pest management allows for optimized usage of copper-oxychloride within combination programs, thus reinforcing trust among large-scale and commercial farmers.

FMC Corporation focuses on product innovation and tailoring solutions to meet specific regional demands. Through localized production and technical support, FMC ensures that copper-oxychloride formulations match soil and climate characteristics, particularly in emerging markets. The corporation’s research-driven approach enhances product efficacy and formulates mixtures to address complex fungal challenges.

Greenriver Industry Co., Ltd., as a regional specialist, demonstrates agility in cost efficiency and rapid market responsiveness. Greenriver’s success is attributed to its streamlined manufacturing processes and focus on affordability, making it a preferred supplier for smallholder farmers in Asia and Latin America. Its competitive positioning rests on delivering cost-effective copper-oxychloride in bulk powder form.

Top Key Players in the Market

- Albaugh, LLC

- Arysta LifeScience

- BASF

- Bayer Cropscience

- FMC Corporation

- Greenriver Industry Co., Ltd.

- IQV Agro

- Isagro S.P.A

- Killicks Pharma

- Manica S.p.A.

- Nufarm

- Syngenta

- UPL

- Vimal Crop Care Pvt. Ltd

Recent Developments

- In April 2025, Arysta LifeScience completed five acquisitions across the crop-tech and chemical-tech sectors, including Etec Crop Solutions, Verios, and Laboratories. These deals were designed to expand the company’s portfolio in crop protection technologies and formulations.

- In February 2025, Bayer CropScience introduced Nativo Plus at Brazil’s Show Rural Coopavel fair. This new fungicide–bactericide blend combines tebuconazole, trifloxystrobin, and copper-oxychloride. It is designed for preventive use in soybeans and corn before disease symptoms appear.

Report Scope

Report Features Description Market Value (2024) USD 308.2 Million Forecast Revenue (2034) USD 474.1 Million CAGR (2025-2034) 4.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Liquid, Powder, Granule, Others), By Purity (Below 99%, Above 99%), By End-Use (Agriculture (Fungicide, Bactericide, Soil Amendment, Soil Amendment, Others), Chemical, Pigment Production, Catalysis, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Albaugh, LLC, Arysta LifeScience, BASF, Bayer Cropscience, FMC Corporation, Greenriver Industry Co., Ltd., IQV Agro, Isagro S.P.A, Killicks Pharma, Manica S.p.A., Nufarm, Syngenta, UPL, Vimal Crop Care Pvt. Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Albaugh, LLC

- Arysta LifeScience

- BASF

- Bayer Cropscience

- FMC Corporation

- Greenriver Industry Co., Ltd.

- IQV Agro

- Isagro S.P.A

- Killicks Pharma

- Manica S.p.A.

- Nufarm

- Syngenta

- UPL

- Vimal Crop Care Pvt. Ltd