Global Cooking Oil Market Size, Share, And Business Benefits By Type (Palm Oil, Soyoil, Rapeseed/Canola Oil, Sunflower Oil, Corn Oil, Peanut Oil, Others), By Nature (Organic, Conventional), By Category (Refined, Unrefined), By Application (Food Service Outlets, Household, Food Processing), By Sales Channel (Hypermarkets and Supermarkets, Departmental Stores, Discount Stores, Online Stores, Convenience Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153193

- Number of Pages: 277

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

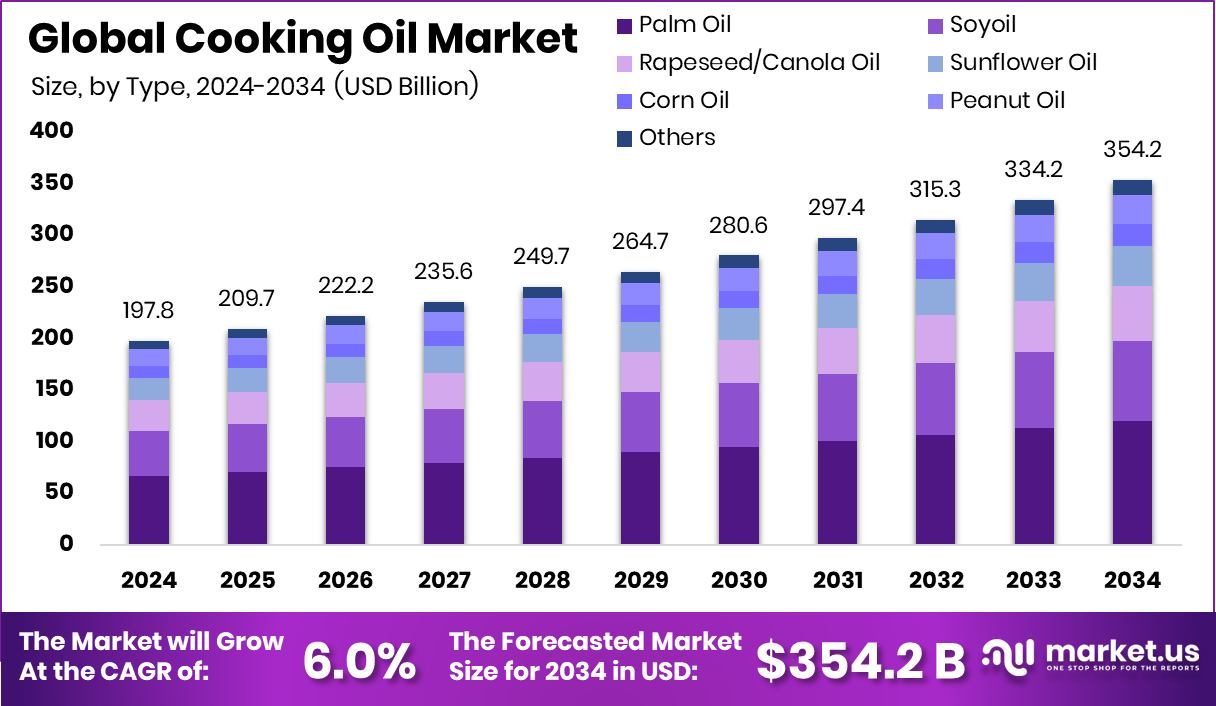

Global Cooking Oil Market is expected to be worth around USD 354.2 billion by 2034, up from USD 197.8 billion in 2024, and grow at a CAGR of 6.0% from 2025 to 2034. High consumption in households and food outlets supports North America’s USD 73.7 billion value.

Cooking oil is a type of edible oil derived from plant sources such as seeds, nuts, or fruits and is used primarily for frying, baking, sautéing, and other food preparation methods. Common types include sunflower oil, soybean oil, canola oil, and olive oil, each offering different flavor profiles and nutritional values. Cooking oils are not only essential for taste and texture but also serve as a medium for heat transfer and contribute to the overall nutritional quality of meals, often supplying necessary fatty acids and fat-soluble vitamins.

The cooking oil market refers to the global trade, production, and consumption of various edible oils used for culinary purposes. It includes refined, unrefined, blended, and fortified oils, catering to both household and commercial foodservice sectors. The market encompasses packaged retail products, bulk supply for industries, and specialty oils used for specific dietary or cultural needs. India’s edible oil import costs are projected to rise by $2 billion, further highlighting the strategic importance of domestic and alternative oil production.

One of the primary growth factors for the cooking oil market is the increasing demand for processed and ready-to-cook food products. Urbanization and the rise in dual-income households have boosted the consumption of packaged food, leading to greater use of cooking oil in manufacturing and home kitchens.

The growing awareness of health and wellness is also influencing the cooking oil industry. Consumers are actively seeking oils that are low in saturated fats and rich in nutrients such as omega-3 and vitamin E. This shift in dietary preferences has opened opportunities for producers to introduce healthier and functional oil varieties. In line with this, NoPalm Ingredients has secured €5 million in seed funding to expand its palm oil alternative operations, reflecting a strong industry move toward healthier, sustainable innovations.

Opportunities in the cooking oil market also lie in product innovation and sustainable sourcing. As environmental concerns rise, there is a growing push toward oils produced through eco-friendly practices and sustainable farming. Additionally, innovations in oil blends that cater to both taste and nutritional balance are attracting consumer interest. GrainCorp’s venture capital division has invested in a synthetic palm oil startup’s $1.2 million pre-seed funding round, showcasing the growing support for sustainable oil alternatives within the investment community.

Key Takeaways

- Global Cooking Oil Market is expected to be worth around USD 354.2 billion by 2034, up from USD 197.8 billion in 2024, and grow at a CAGR of 6.0% from 2025 to 2034.

- In the cooking oil market, palm oil dominates with a 33.8% share due to affordability.

- Conventional oils hold a strong 91.2% share, reflecting widespread preference in mass-market cooking.

- Refined oils lead the cooking oil market with 86.3%, favored for clarity, stability, and shelf life.

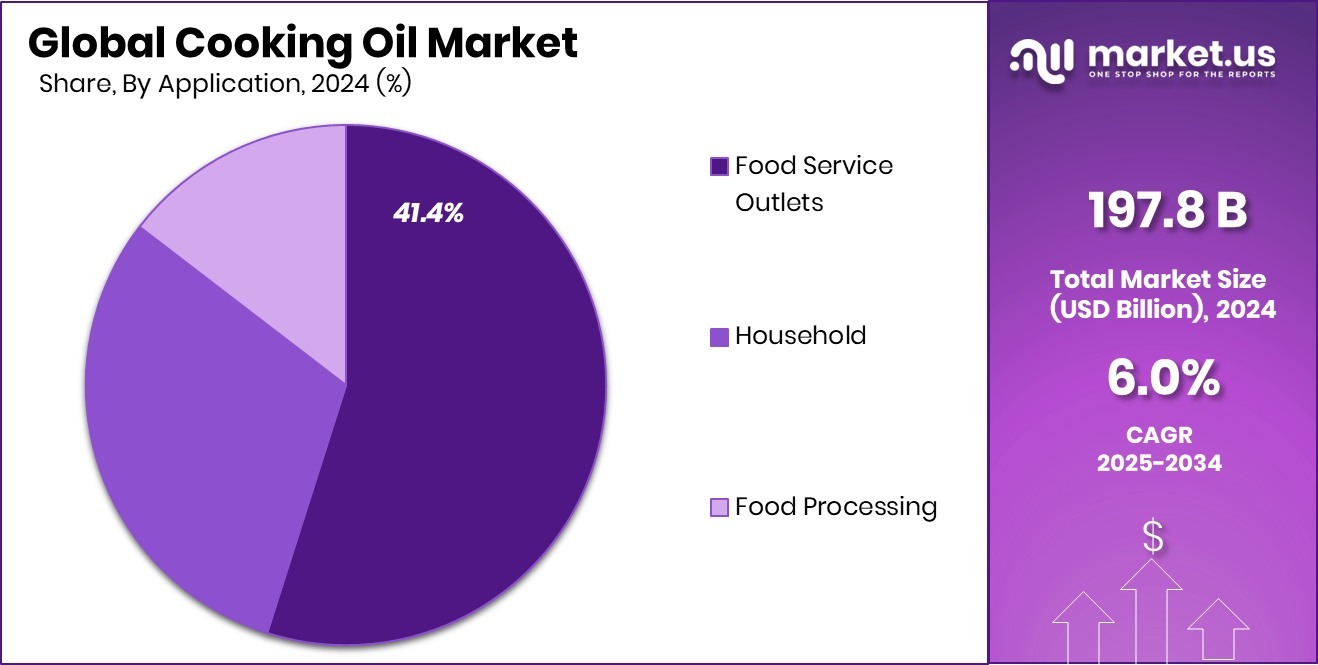

- Food service outlets drive 41.4% of cooking oil demand, fueled by growing commercial food consumption.

- Hypermarkets and supermarkets account for 38.1% share, offering broad accessibility and competitive pricing.

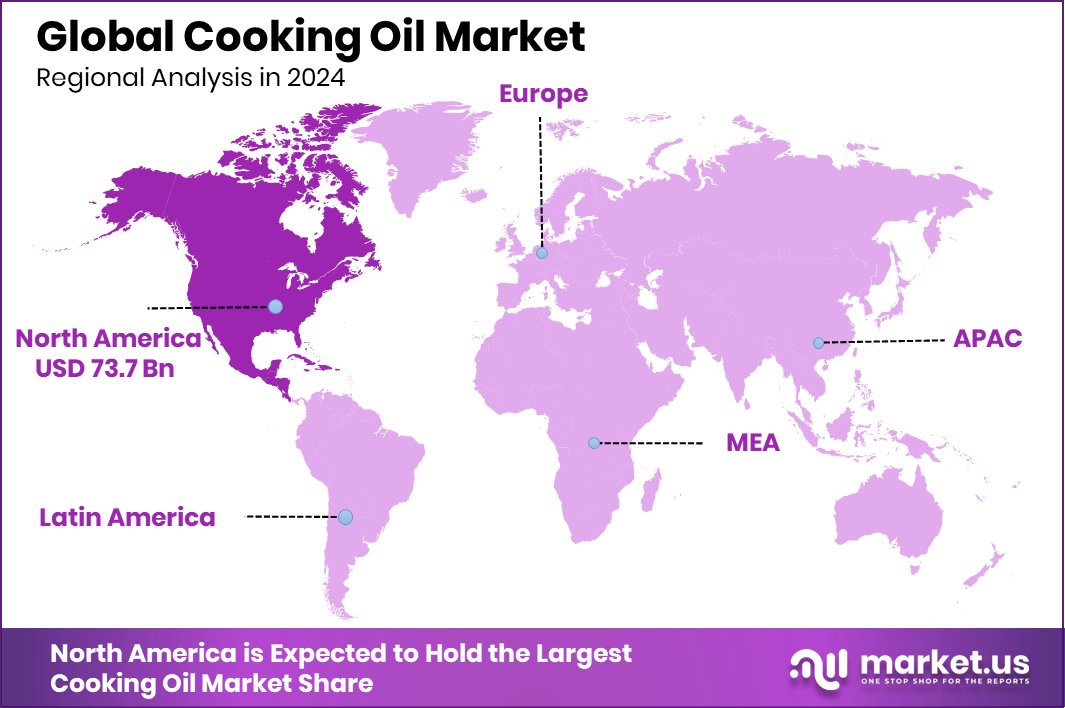

- The North American value reached USD 73.7 billion, reflecting strong and stable demand.

By Type Analysis

Palm oil dominates the Cooking Oil Market with a 33.8% share.

In 2024, Palm Oil held a dominant market position in the By Type segment of the Cooking Oil Market, with a 33.8% share. This strong performance can be attributed to palm oil’s widespread availability, cost-effectiveness, and versatility across multiple culinary applications.

Its high oxidative stability and neutral flavor profile make it suitable for frying, baking, and as an ingredient in various processed foods, which supports its dominance in both household and industrial usage. Palm oil’s adaptability to large-scale food processing and its extended shelf life further enhance its appeal, especially in regions where affordability and volume efficiency are key considerations.

Additionally, palm oil benefits from an established global supply chain, allowing producers to meet high-volume demand across diverse geographic markets. In emerging economies, particularly where price sensitivity influences consumer choices, palm oil continues to gain traction due to its low price point and consistent quality. Its role in everyday cooking and food manufacturing remains significant, especially in areas where traditional recipes rely heavily on this oil.

By Nature Analysis

Conventional oils lead the market at 91.2% share.

In 2024, Conventional held a dominant market position in the By Nature segment of the Cooking Oil Market, with a commanding 91.2% share. This overwhelming market share is primarily driven by the widespread availability, lower production cost, and established consumer preference for conventionally produced cooking oils. Conventional oils are typically produced using traditional agricultural practices, which allow for large-scale cultivation and processing, resulting in more competitive pricing across global markets.

The dominance of conventional cooking oil is also sustained by its deep-rooted presence in both household and commercial kitchens. Consumers in many regions continue to rely on familiar, accessible cooking oil options that align with cultural food practices and daily culinary needs. Additionally, foodservice providers and manufacturers often prefer conventional oils for their consistency, cost efficiency, and high-volume supply chain capabilities.

Retailers and distributors benefit from the steady demand and supply chain infrastructure supporting conventional oils, ensuring widespread penetration across urban and rural markets alike.

By Category Analysis

Refined oils account for 86.3% of global consumption.

In 2024, Refined held a dominant market position in the By Category segment of the Cooking Oil Market, with a substantial 86.3% share. The widespread adoption of refined cooking oil is largely due to its neutral taste, extended shelf life, and improved cooking performance, making it a preferred choice for both domestic and industrial use.

The refining process removes impurities, odors, and free fatty acids, resulting in a clear, stable product suitable for high-temperature cooking applications such as frying and sautéing.

Refined cooking oils are also favored for their consistent quality and safety standards, which meet the expectations of health-conscious consumers and regulatory bodies alike. Their ability to blend seamlessly with different cuisines and cooking styles has further strengthened their market presence.

Additionally, the uniform texture and enhanced visual appeal of refined oils make them a practical option for packaged food products and restaurant chains seeking quality control and flavor neutrality.

By Application Analysis

Food service outlets drive demand with a 41.4% share.

In 2024, Food Service Outlets held a dominant market position in the By Application segment of the Cooking Oil Market, with a 41.4% share. This leading position is driven by the high-volume consumption of cooking oil across restaurants, quick-service chains, hotels, and institutional kitchens.

Food service outlets typically require oils that can withstand high-temperature cooking, offer extended frying life, and maintain consistent taste across batches—qualities that make them substantial contributors to overall cooking oil demand.

The operational scale of food service establishments, especially in urban and semi-urban regions, leads to continuous and bulk procurement of cooking oil, reinforcing their share in the market. Large-format kitchens and commercial caterers often rely on stable oil supplies to meet daily cooking needs for a wide range of cuisines and high-frequency food preparation.

By Sales Channel Analysis

Hypermarkets and supermarkets hold 38.1% market share.

In 2024, Hypermarkets and Supermarkets held a dominant market position in the By Sales Channel segment of the Cooking Oil Market, with a 38.1% share. This leading share is primarily driven by the convenience, variety, and pricing benefits that these retail formats offer to consumers.

Hypermarkets and supermarkets serve as one-stop destinations where a wide range of cooking oil brands, pack sizes, and product types are readily available, allowing consumers to compare and choose based on preferences and budgets.

The strong presence of these outlets in both urban and suburban areas has played a significant role in increasing the accessibility of cooking oil to a broad consumer base. Their ability to offer promotional discounts, bundled deals, and loyalty programs further encourages frequent purchases, contributing to higher sales volumes.

Additionally, the organized layout and informative labeling in supermarkets help consumers make informed decisions, enhancing the overall shopping experience.

Key Market Segments

By Type

- Palm Oil

- Soyoil

- Rapeseed/Canola Oil

- Sunflower Oil

- Corn Oil

- Peanut Oil

- Others

By Nature

- Organic

- Conventional

By Category

- Refined

- Unrefined

By Application

- Food Service Outlets

- Household

- Food Processing

By Sales Channel

- Hypermarkets and Supermarkets

- Departmental Stores

- Discount Stores

- Online Stores

- Convenience Stores

- Others

Driving Factors

Rising Processed Food Demand Boosts Oil Use

One of the main driving factors in the cooking oil market is the increasing demand for processed and ready-to-eat food. As urban lifestyles become faster and more convenience-focused, more people are choosing packaged and quick meals.

These food items often require significant amounts of cooking oil during preparation and manufacturing, especially in frying, sautéing, and preservation processes. The growing number of fast-food chains, restaurants, and food delivery services also adds to this demand.

As a result, the need for cooking oils has increased not only in homes but also in the commercial food sector. This shift toward convenience-based eating habits is expected to keep pushing the market for cooking oil forward in both developed and developing regions.

Restraining Factors

Health Concerns Over Excess Oil Consumption

One of the key restraining factors in the cooking oil market is the growing concern about the negative health effects linked to excessive oil consumption. Rising awareness about lifestyle-related diseases such as obesity, heart disease, and high cholesterol has led many consumers to reduce their intake of fried and oily foods.

Health experts and nutritionists often advise limiting the use of certain oils high in saturated or trans fats, which has impacted consumer behavior, especially in urban and health-conscious segments.

This shift in eating habits is prompting people to seek healthier alternatives or reduce overall oil use. As a result, this trend may slow down market growth, particularly in regions where wellness awareness is increasing rapidly.

Growth Opportunity

Rising Demand for Healthier Oil Choices

One of the top growth opportunities in the cooking oil market lies in meeting the increasing demand for healthier and specialized oil products. As more consumers become mindful of health and nutrition, there is a noticeable shift toward oils with better fat profiles, such as those low in saturated fats and high in omega-3, omega-6, or antioxidant-rich content.

Oils labeled as organic, cold-pressed, non‑GMO, or fortified with vitamins are gaining popularity, appealing to individuals seeking both taste and wellness benefits. Manufacturers have the chance to innovate by developing blends or single-source oils that deliver functional advantages like improved heart health or immune support.

By tapping into this health-driven trend, producers can open new market segments, command premium pricing, and strengthen brand loyalty, thus fueling growth in a sector increasingly focused on nutrition and well‑being.

Latest Trends

Shift Toward Cold-Pressed and Natural Oils

One of the latest trends in the cooking oil market is the growing popularity of cold-pressed and natural oils. Consumers today are paying more attention to what they eat, and many are choosing oils that are made without high heat or chemical refining. Cold-pressed oils keep more nutrients, flavor, and aroma compared to refined oils, making them a preferred choice for health-conscious buyers.

These oils are often seen as more “natural” and are commonly used in salads, dressings, and low-heat cooking. As awareness about clean-label and minimally processed foods increases, cold-pressed oil varieties such as sesame, sunflower, and coconut oil are gaining attention in both retail and culinary spaces, creating new demand within the market.

Regional Analysis

In 2024, North America dominated the cooking oil market with a 37.3% share.

In 2024, North America emerged as the dominant region in the global cooking oil market, accounting for a significant 37.3% share, which equated to a market value of USD 73.7 billion. This leadership is supported by strong consumption across households and commercial foodservice sectors, where refined and processed cooking oils are extensively used in daily meal preparation and industrial food manufacturing.

The region benefits from a well-established retail infrastructure and widespread access to a variety of cooking oil types, contributing to consistent demand.

Europe, Asia Pacific, the Middle East & Africa, and Latin America also form essential parts of the global cooking oil market. While specific figures for these regions were not provided, their contribution is driven by varying culinary habits, population sizes, and levels of industrialization.

Europe is marked by steady consumption due to mature food industries, while Asia Pacific holds vast potential due to high population density and evolving dietary patterns. Meanwhile, the Middle East & Africa and Latin America represent growing markets, where urbanization and rising disposable incomes are gradually increasing the demand for cooking oils.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Archer Daniels Midland (ADM) continues to play a pivotal role in cooking oil production through its extensive global supply chain and processing operations. Leveraging its expansive network of oilseed crushers and refineries, ADM benefits from secured feedstock access and cost efficiencies. The company’s focus on operational excellence and scale enables it to supply a wide range of refined oils, meeting both retail and industrial demand.

Associated British Foods (ABF) holds a strategic position in the cooking oil sector by integrating high-value food ingredients with its branded consumer goods. Though not a primary oil processor, ABF’s downstream presence offers differentiated access to retail markets through established brands. In 2024, its engagement in fortification and fortified oil blends supported consumer demand for enhanced nutritional profiles.

Bunge Limited commands influence through its global origination, processing, and distribution capabilities. In 2024, Bunge’s investment in refining and storage infrastructure across key regions allowed it to capitalize on consistent volumes of crops like sunflower and soy. The company’s focus on improving processing yields and reducing supply chain costs helped maintain competitive pricing in refined oil products.

Cargill retained its leadership in the cooking oil market through diversified operations spanning palms, soybeans, and specialty oils. In 2024, its vertical integration—from agricultural sourcing to food processing—enabled robust portfolio offerings and market responsiveness. Cargill’s emphasis on sustainability initiatives and traceability helped meet evolving regulatory and consumer expectations.

Top Key Players in the Market

- Archer Daniels Midland Company

- Associated British Foods Plc

- Bunge Limited

- Cargill, Incorporated

- CJ Cheiljedang Corporation

- ConAgra Brands, Inc.

- Fuji Oil Company, Ltd.

- George Weston Foods Limited

- IFFCO Group

- Nutiva

- Olam International Limited

- Ottogi Co. Ltd.

- Sime Darby Plantation

- Wilmar International Limited

Recent Developments

- In April 2025, ABF’s 50 % joint venture, Stratas Foods, completed the acquisition of a foodservice facility in New Jersey along with its associated oil-based dressings and sauces brands. This move enhances ABF’s cooking oil and related products presence in the U.S. foodservice and retail markets.

- In March 2024, Bunge began expanding its refinery in Avondale, Louisiana. This $225 million project will add a new vegetable oil processing line to the recently acquired specialty oils plant, tripling the site’s capacity. Once operational by the end of 2025, it will become North America’s largest palm and specialty oil processing facility.

Report Scope

Report Features Description Market Value (2024) USD 197.8 Billion Forecast Revenue (2034) USD 354.2 Billion CAGR (2025-2034) 6.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Palm Oil, Soyoil, Rapeseed/Canola Oil, Sunflower Oil, Corn Oil, Peanut Oil, Others), By Nature (Organic, Conventional), By Category (Refined, Unrefined), By Application (Food Service Outlets, Household, Food Processing), By Sales Channel (Hypermarkets and Supermarkets, Departmental Stores, Discount Stores, Online Stores, Convenience Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Archer Daniels Midland Company, Associated British Foods Plc, Bunge Limited, Cargill, Incorporated, CJ Cheiljedang Corporation, ConAgra Brands, Inc., Fuji Oil Company, Ltd., George Weston Foods Limited, IFFCO Group, Nutiva, Olam International Limited, Ottogi Co. Ltd., Sime Darby Plantation, Wilmar International Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Archer Daniels Midland Company

- Associated British Foods Plc

- Bunge Limited

- Cargill, Incorporated

- CJ Cheiljedang Corporation

- ConAgra Brands, Inc.

- Fuji Oil Company, Ltd.

- George Weston Foods Limited

- IFFCO Group

- Nutiva

- Olam International Limited

- Ottogi Co. Ltd.

- Sime Darby Plantation

- Wilmar International Limited